- Home

- »

- Disinfectants & Preservatives

- »

-

Magnesium Oxide Market Size, Share, Industry Report, 2033GVR Report cover

![Magnesium Oxide Market Size, Share & Trends Report]()

Magnesium Oxide Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Dead Burned Magnesia (DBM), Caustic Calcined Magnesia (CCM)), By Application (Agriculture, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Magnesium Oxide Market Summary

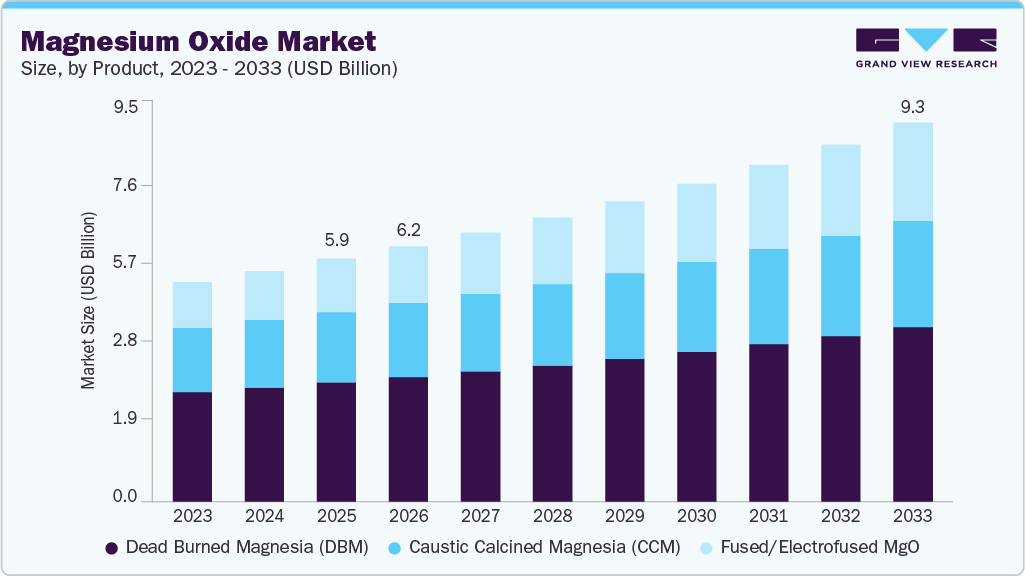

The global magnesium oxide market size was estimated at USD 5,926.4 million in 2025 and is projected to reach USD 9,252.8 million by 2033, growing at a CAGR of 5.8% from 2026 to 2033. This growth is driven by the increasing/growing demand of the steel, cement, and ceramics sectors, particularly in emerging economies, which continue to drive magnesium oxide (MgO) consumption through its use in high-temperature refractory linings.

Key Market Trends & Insights

- Asia Pacific dominated the magnesium oxide market with the largest revenue share of 52.6% in 2025.

- The China magnesium oxide industry is expected to grow at the fastest CAGR of 5.0% from 2026 to 2033.

- By product, the fused/ electrofused MgO segment is expected to grow at the fastest CAGR of 8.1% from 2026 to 2033 in terms of revenue.

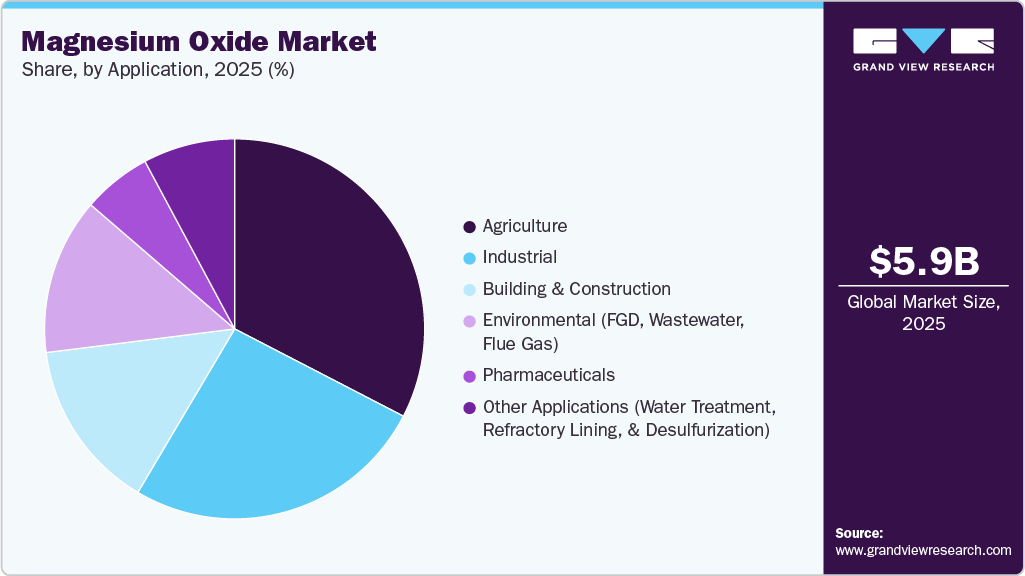

- By application, the agriculture segment held the largest revenue share of 32.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5,926.4 Million

- 2033 Projected Market Size: USD 9,252.8 Million

- CAGR (2026-2033): 5.8%

- Asia Pacific: Largest Market in 2025

- North America: Fastest growing market

Moreover, the global shift toward sustainable manufacturing, environmental protection, and agricultural productivity elevated the demand for reactive and high-purity MgO in water treatment, emissions control, and soil enhancement. Furthermore, increasing innovation in pharmaceuticals, specialty chemicals, and advanced materials is expanding its functional scope. Backed by continuous technological advancement, process optimization, and vertical integration, magnesium oxide remains a strategically vital material enabling durability, efficiency, and sustainability across global value chains.

Key opportunities in the magnesium oxide industry are increasing due to demand across various end-use industries, including environmental, construction, agriculture, and healthcare. With the increasing global emphasis on sustainable materials, MgO’s eco-friendly profile plays a significant role in carbon capture, wastewater treatment, and soil enhancement, presenting major growth opportunities. The construction industry’s shift toward fire-resistant and energy-efficient materials further fuels the adoption of MgO boards and cement. Additionally, its use in animal feed, fertilizers, and pharmaceuticals benefits from the growing focus on nutrition and health. Technological advancements in production efficiency and the development of high-purity, reactive grades also open new possibilities in electronics, refractories, and specialty chemicals, making MgO a key material in the transition toward greener and high-performance applications.

The global MgO market continues to face a range of structural and operational challenges that influence its long-term growth trajectory. A key concern is the volatility in magnesite prices, which directly impacts production economics and pricing stability. Stringent environmental regulations governing mining and calcination processes have increased compliance costs and restricted supply in several regions. Persistent quality inconsistencies among producers, particularly in developing markets, affected product performance and end-user confidence. Moreover, competition from alternative materials such as calcium oxide and other refractory substitutes presents an ongoing threat to market share.

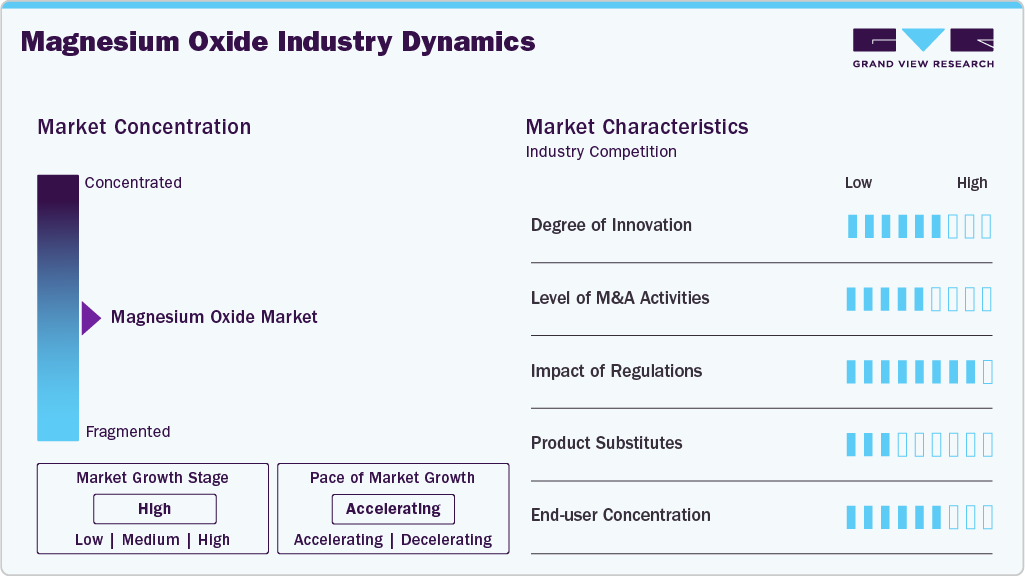

Market Concentration & Characteristics

The presence of several multinational chemical companies with well-established production, distribution, and purification capabilities characterizes the global magnesium oxide market. Leading players, such as Israel Chemical Ltd. (ICL), Martin Marietta Magnesia Specialties, Premier Magnesia, and Grecian Magnesite, dominate the market through their extensive product portfolios, diverse magnesia offerings, and global supply networks. These companies leverage advanced technologies and regulatory compliance expertise to cater to the demand.

The magnesium oxide industry demonstrates limited price elasticity, as production costs are closely tied to raw material and energy inputs. Product standardization is moderate, with differentiation largely based on purity, reactivity, and end-use specialization. Regional markets often operate in supply clusters near resource bases, leading to localized competition and logistical interdependence. Overall, the industry combines high capital intensity, resource dependency, and technological specialization, creating a structure that favors scale efficiency and long-term contractual relationships over short-term price competition.

Product Insights

The dead burned magnesia dominated the global magnesium oxide industry, accounting for the largest revenue share of 49.1% in 2025. This is primarily due to its exceptional thermal stability, density, and resistance to chemical attack, which make it indispensable for refractory applications such as steelmaking, cement production, and glass manufacturing. Unlike caustic or fused magnesia, DBM is produced by calcining magnesite at very high temperatures (typically above 1,800 °C), resulting in a highly sintered, inert, and low-reactivity material that can withstand extreme conditions inside furnaces and kilns. Its superior structural integrity at high temperatures ensures longer refractory lining life, reduced maintenance downtime, and lower operational costs, key economic drivers for industries dependent on high-temperature processes.

The fused/electrofused MgO segment is expected to grow at the fastest CAGR of 8.1% during the forecast period, driven by its superior purity, density, and performance characteristics compared to other MgO grades. The increasing demand for advanced refractories to support high-temperature industrial processes, coupled with the ongoing modernization of steel manufacturing facilities and stricter quality standards, is accelerating adoption. Additionally, the shift toward energy-efficient furnaces and longer-lasting refractory linings positions electrofused MgO as a preferred material, ensuring both operational efficiency and reduced maintenance costs. This combination of technological advantages and industrial demand resilience underpins its strong future growth trajectory.

Application Insights

The agriculture segment dominated the global magnesium oxide market, accounting for the largest revenue share of 32.6% in 2025. Agriculture is the largest application segment for magnesium oxide, due to its critical dual role in both crop and livestock production. In farming, MgO serves as an effective soil amendment, improving acidic soils by raising the pH and supplying essential magnesium, a key element in chlorophyll production and photosynthesis. Its high reactivity and neutralizing value make it particularly valuable in regions facing soil magnesium depletion, such as parts of Asia, Latin America, and sub-Saharan Africa. Additionally, the global shift toward sustainable agriculture and precision nutrition has driven up demand for consistent, high-quality magnesium inputs-making MgO an indispensable part of modern agricultural systems.

The pharmaceuticals segment is expected to grow at the fastest CAGR of 8.2% during the forecast period, driven by its increasing use in antacids, dietary supplements, and mineral fortification products. Rising awareness of digestive health and the growing prevalence of gastrointestinal disorders are fueling demand for magnesium oxide-based formulations. Additionally, its role in cardiovascular health and bone-strengthening supplements has expanded its adoption across both prescription and over-the-counter medications. This trend is further reinforced by the aging population and the rising focus on preventive healthcare, positioning magnesium oxide as a critical ingredient in pharmaceutical innovation.

Regional Insights

Asia Pacific dominated the global magnesium oxide market with a 52.6% revenue share in 2025 due to its strong resource base, massive industrial demand, and rapid economic development. The region, particularly China, holds the world’s largest magnesite reserves and production capacity, giving it a structural advantage in both raw material availability and cost competitiveness. Additionally, Asia-Pacific’s large agricultural sector, especially in China, India, and Southeast Asia, drives significant demand for MgO in fertilizers, soil conditioners, and animal feed.

The China magnesium oxide market dominated Asia Pacific with a revenue share of 37.8% in 2025. This growth can be attributed to the country’s abundant magnesite reserves, large-scale production capacity, and deeply integrated industrial base. It serves as both the world’s significant producer and consumer, driven by strong demand from its steel, cement, glass, and agriculture sectors. With government support for domestic mining and processing, China benefits from cost advantages, established supply chains, and export strength, making it the central hub of global MgO supply and pricing influence.

North America Magnesium Oxide Market Trends

The North America magnesium oxide industry is expected to grow at the fastest CAGR of 7.1% during the forecast period, due to tightening environmental regulations, renewal ofinfrastructure, and the expanding focus on sustainable agriculture. The region’s industrial base, especially in the steel, cement, and environmental sectors, continues to rely heavily on MgO for refractory linings, flue-gas sulfurization, and wastewater treatment due to its superior thermal resistance and neutralizing capacity. However, the agriculture sector has emerged as the dominant application, largely because of the growing emphasis on soil health, pH correction, and magnesium enrichment in crop production.

U.S. Magnesium Oxide Market Trends

The U.S. magnesium oxide industry dominated North America, accounting for the largest revenue share of 79.7% in 2025. This growth is supported by the rising demand from both the agricultural and industrial sectors. Agriculture remains the dominant application, driven by the country’s large livestock industry and the increasing need for soil enhancement in magnesium-deficient farmlands. Farmers and feed manufacturers rely on MgO for its efficiency in correcting soil acidity and preventing metabolic disorders, such as grass tetany, in cattle.

Europe Magnesium Oxide Market Trends

The Europemagnesium oxide industry accounted for a global revenue share of 18.9% in 2025. The regional market is expanding due to strong demand from the steel, cement, and glass industries, as well as the region’s focus on sustainable and energy-efficient manufacturing. The rising use of MgO in environmental applications, such as wastewater treatment and emissions control, aligns with the stringent EU sustainability directives. Additionally, growth in agriculture, pharmaceuticals, and advanced materials is driving diversification beyond traditional refractories. Continuous R&D investments and innovation in high-purity and reactive MgO grades further enhance product performance. Europe’s emphasis on quality, circular economy practices, and domestic supply security firmly supports the market’s steady upward trajectory.

The Germany magnesium oxide market is growing steadily, fueled by the country’s advanced industrial landscape, strong environmental policies, and commitment to sustainable manufacturing. Industrial applications clearly dominate, with MgO being a critical material in the production of high-quality refractories used in Germany’s steel, cement, and glass industries. The country’s push toward energy efficiency and carbon reduction has intensified the demand for durable, heat-resistant materials that extend furnace life and improve operational performance roles that MgO fulfills exceptionally well.

Middle East & Africa Magnesium Oxide Market Trends

In the Middle East, the magnesium oxide industry is growing gradually but with strong long-term potential, supported by the region’s expanding industrial base and increasing focus on environmental sustainability. Industrial applications are the dominant segment, particularly in steel, cement, and desalination industries-sectors that form the backbone of regional infrastructure development.

Latin America Magnesium Oxide Market Trends

In Latin America, the magnesium oxide industry is expanding steadily, driven mainly by growth in agriculture and construction. Agriculture is the dominant application, as countries like Brazil, Argentina, and Chile rely heavily on MgO for soil correction and as a magnesium supplement in animal feed. The region’s widespread soil acidity and nutrient depletion make MgO an essential input for improving crop yields and livestock health.

Key Magnesium Oxide Company Insights

The global magnesium oxide market is led by a few vertically integrated producers, including Premier Magnesia, Israel Chemical Ltd. (ICL), Martin Marietta Magnesia Specialties, and Grecian Magnesite.

Premier Magnesia is one of the few companies with full ownership of its magnesia ore source and downstream manufacturing chain. Based in Gabbs, Nevada, U.S., the company has operated its magnesia mine and processing plant for over 50 years, marketing high-purity calcined magnesium oxide (MgO) and magnesium hydroxide products under the MAGOX brand.

Key Magnesium Oxide Companies:

The following are the leading companies in the magnesium oxide market. These companies collectively hold the largest market share and dictate industry trends.

- Israel Chemical Ltd. (ICL)

- Martin Marietta Magnesia Specialties

- Premier Magnesia

- Grecian Magnesite

- NEDMAG B.V.

- Magnezit Group

- Haicheng Guangling Refractory Manufacturing Co. LTD

- YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD

- Bhavani Chemicals

- Ube Material Industries Ltd

Recent Developments

-

On October 22, 2025, Canada Nickel Company Inc. expanded its collaboration with NetCarb to explore low‑carbon industrial clusters that can produce magnesium products (by‑products of carbon sequestration processes), signaling innovation in sustainable magnesium supply chains.

-

In Dec 2024, RHI opened a new automatic plant to serve the booming electric-arc-furnace steel sector; this facility uses automation and sustainable processing (reducing any chromite in magnesia-chrome bricks)

-

In March 2024, RHI Magnesita (Austria), the significant refractory producer, announced an agreement to acquire Resco Group, a refractory manufacturer, for approximately USD 430 million. The deal significantly increases RHI’s North American production footprint, enabling ~50% of U.S. sales to be produced locally rather than imported.

Magnesium Oxide Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6,238.3 million

Revenue forecast in 2033

USD 9,252.8 million

Growth rate

CAGR of 5.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Israel Chemical Ltd. (ICL); Martin Marietta Magnesia Specialties; Premier Magnesia; Grecian Magnesite; NEDMAG B.V.; Magnezit Group; Haicheng Guangling Refractory; Yingkou Magnesite Chemical Industrial Group; Bhavani Chemicals; Ube Material Industries Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

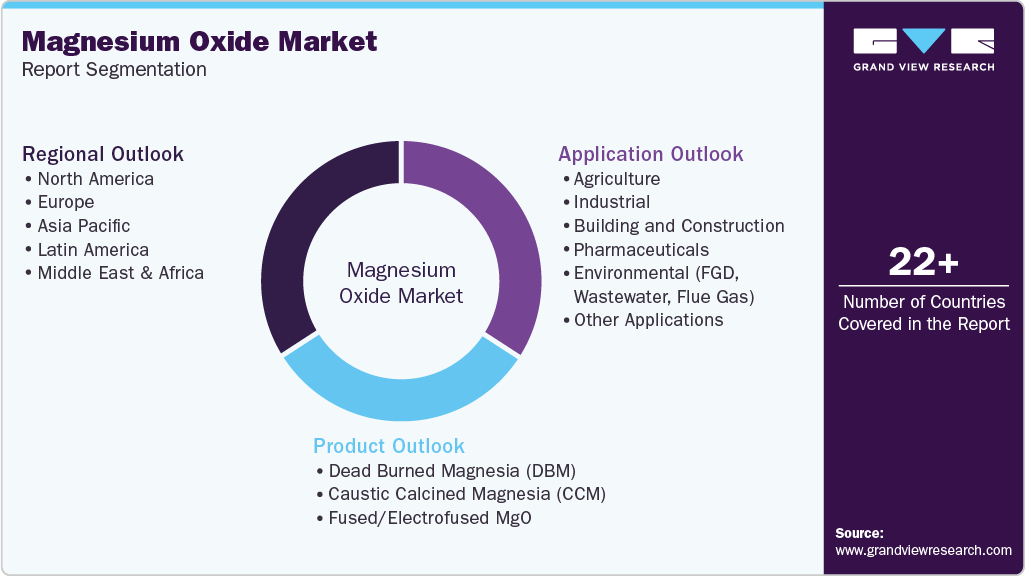

Global Magnesium Oxide Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global magnesium oxide market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Dead Burned Magnesia (DBM)

-

Caustic Calcined Magnesia (CCM)

-

Fused/Electrofused MgO

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Agriculture

-

Industrial

-

Building and Construction

-

Pharmaceuticals

-

Environmental (FGD, Wastewater, Flue Gas)

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The agriculture segment dominated the magnesium oxide market with a 32.6% revenue share in 2025, magnesium oxide market is being propelled by strong demand across refractory, steel, and construction sectors, reinforced by its expanding use in environmental, agricultural, and healthcare applications. Growing emphasis on high-performance materials, operational efficiency, and sustainable manufacturing continues to drive market momentum, while advances in high-purity and reactive MgO grades are unlocking new opportunities in advanced industrial and green technologies.

b. Some of the key players operating in the magnesium oxide market include Israel Chemical Ltd. (ICL), Martin Marietta Magnesia Specialties, Premier Magnesia, Grecian Magnesite, NEDMAG B.V.., Magnezit Group, Haicheng Guangling Refractory, Yingkou Magnesite Chemical Industrial Group, and Ube Material Industries

b. The magnesium oxide market is primarily driven by rising demand from refractory, steel, and construction industries, coupled with its growing use in environmental, agricultural, and healthcare applications. Increasing focus on high-performance materials, process efficiency, and sustainable manufacturing further accelerates MgO adoption across industrial value chains. Additionally, technological advancements in high-purity and reactive grades are expanding its role in next-generation industrial and green solutions.

b. The global magnesium oxide market size was estimated at USD 5,926.4 million in 2025 and is expected to reach USD 6,238.3 million in 2026.

b. The global magnesium oxide market is expected to grow at a compound annual growth rate of 5.8% from 2026 to 2033 to reach USD 9,252.8 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.