- Home

- »

- Next Generation Technologies

- »

-

Mainframe Modernization Market Size, Industry Report, 2033GVR Report cover

![Mainframe Modernization Market Size, Share & Trends Report]()

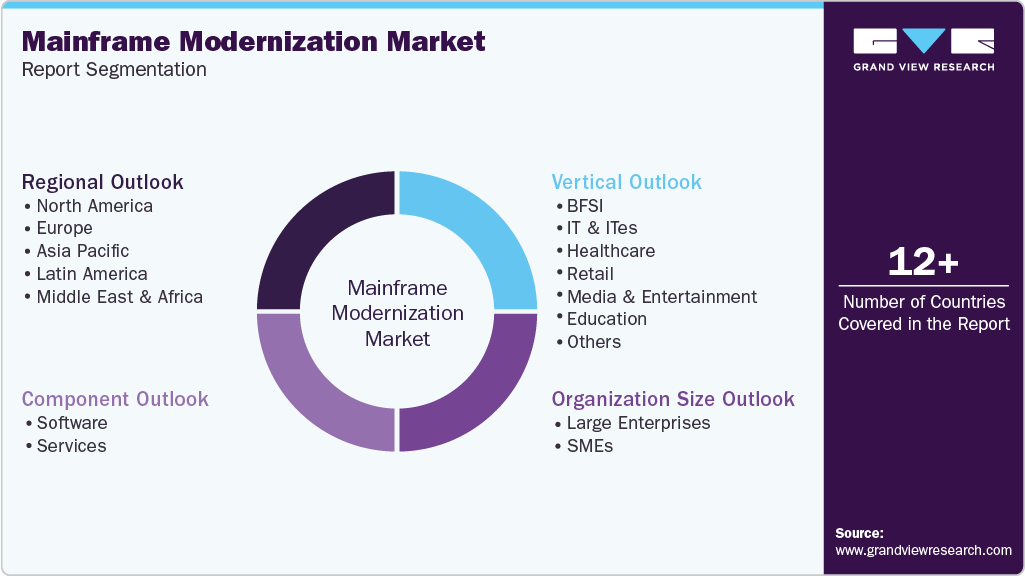

Mainframe Modernization Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Organization Size (Large Enterprises & SMEs), By Vertical (BFSI, IT & Healthcare, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-767-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mainframe Modernization Market Summary

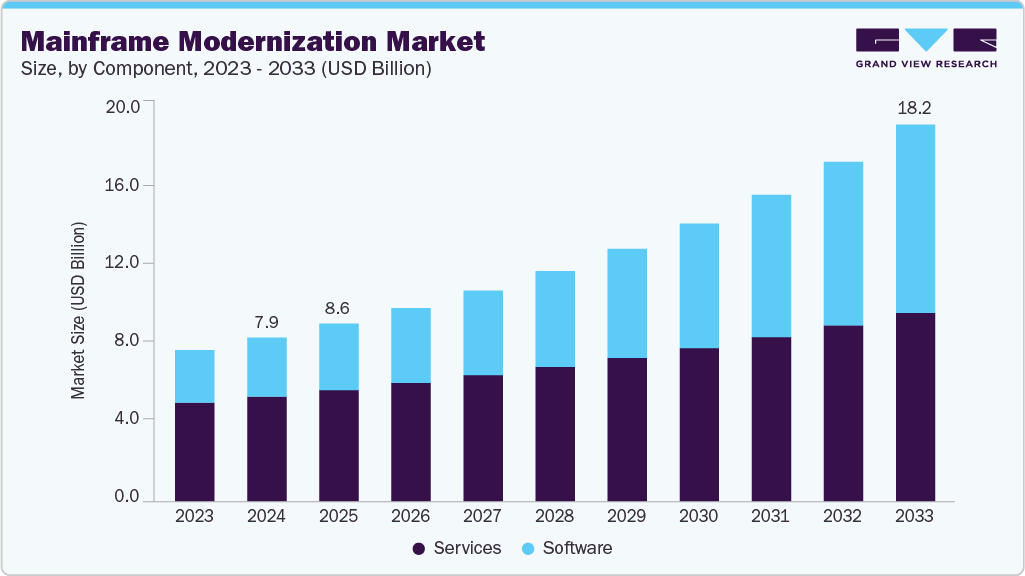

The global mainframe modernization market size was valued at USD 7.91 billion in 2024 and is projected to reach USD 18.19 billion by 2033, growing at a CAGR of 9.8% from 2025 to 2033. The mainstream modernization market is primarily driven by the growing need for digital transformation, legacy system upgrades, and enhanced operational efficiency.

Key Market Trends & Insights

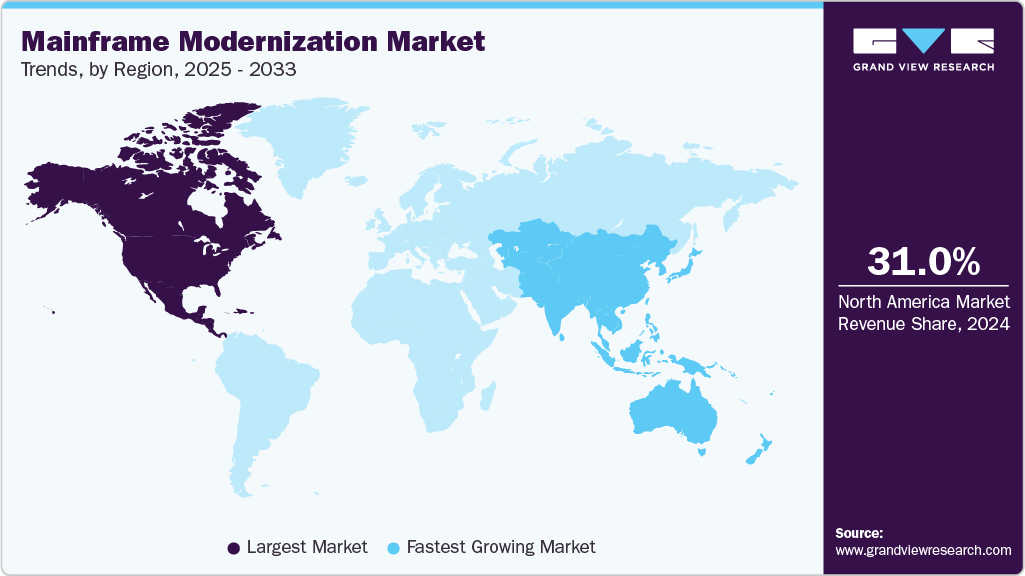

- North America dominated the global mainframe modernization market with the largest revenue share of 31.0% in 2024.

- The mainframe modernization market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, services led the market, holding the largest revenue share of 64.0% in 2024.

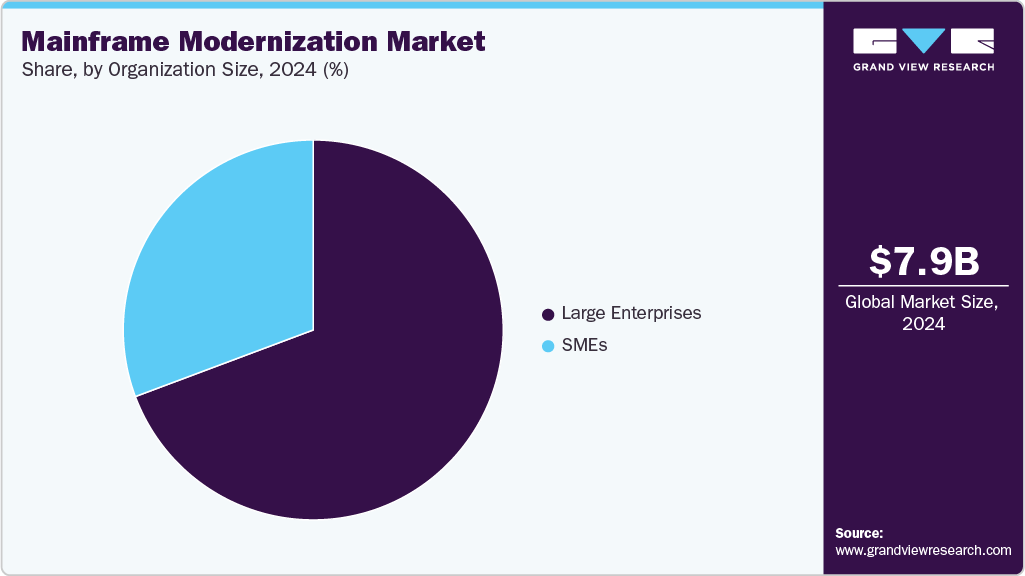

- By organization size, the large enterprises segment held the dominant position in the market.

- By vertical, BFSI held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 7.91 Billion

- 2033 Projected Market Size: USD 18.19 Billion

- CAGR (2025-2033): 9.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing cloud adoption, rising demand for cost optimization, and integration of AI and automation technologies further accelerate modernization initiatives, enabling enterprises to remain competitive and agile in a rapidly evolving business landscape.The mainstream modernization market is witnessing significant growth as enterprises increasingly prioritize digital transformation to remain competitive. One of the major driving factors is the growing need to replace outdated legacy systems, which often hinder agility, scalability, and cost efficiency. Organizations are adopting modernization strategies to streamline workflows, reduce maintenance costs, and ensure compatibility with next-generation applications, making it easier to respond to market changes and customer expectations. Additionally, modernization enables better alignment between IT infrastructure and business goals, empowering organizations to innovate rapidly. As customer demands evolve and competitors embrace advanced technologies, companies are compelled to modernize to stay relevant, achieve faster time-to-market, and strengthen long-term growth.

The rapid adoption of cloud-based platforms and services is also driving the growth of the mainframe modernization market. Businesses are migrating core operations to hybrid and multi-cloud environments to enhance flexibility, security, and data accessibility. Cloud integration supports real-time decision-making and enables cost optimization and scalability, critical for managing growing workloads and distributed teams. Moreover, cloud modernization allows enterprises to integrate advanced analytics, automation, and AI-driven solutions seamlessly, providing deeper insights and improved operational agility. The ability to scale infrastructure on-demand, ensure business continuity, and reduce capital expenses is further fueling modernization initiatives, as organizations seek to maintain resilience and future readiness.

In addition, technological advancements such as artificial intelligence, machine learning, and automation are accelerating modernization initiatives. Enterprises are leveraging these innovations to improve data analytics, enhance user experiences, and drive operational efficiency. With increasing regulatory compliance needs and security concerns, organizations are investing heavily in modernization solutions to future-proof operations and maintain resilience in an evolving business landscape. Furthermore, advanced modernization frameworks enable businesses to enhance collaboration, reduce manual intervention, and ensure higher levels of transparency. The growing need to mitigate risks, improve decision-making, and strengthen cybersecurity is also encouraging enterprises to embrace modernization as a strategic priority, creating long-term value across industries.

Component Insights

The services segment dominated the market with a share of 64.0% in 2024. Enterprises are increasingly adopting cloud computing and big data technologies to enhance scalability and performance, driving demand for modernization services. Additionally, the rise in remote working culture necessitates the upgrade of legacy applications and systems to ensure seamless operations. Regulatory compliance requirements, such as GDPR and PSD2, compel organizations to modernize their systems to meet stringent data security standards. The need for improved customer experiences through applications further accelerates the adoption of modernization services. These factors contribute to the significant growth of the mainframe modernization services market.

The software segment is expected to register a significant CAGR over the forecast period. The software component segment of the mainframe modernization market is experiencing robust growth, driven by several key factors. Enterprises are increasingly adopting AI-powered tools and automation to streamline the application development lifecycle, enhance code quality, and accelerate modernization processes. This shift is particularly evident in industries such as banking, insurance, and government, where legacy systems are being transformed into agile, cloud-native platforms. Additionally, the rising demand for hybrid cloud environments and stringent regulatory compliance requirements are prompting organizations to modernize their mainframe applications to ensure scalability, security, and compliance.

Organization Size Insights

The large enterprises segment dominated the market in 2024, propelled by the need to enhance operational efficiency, ensure regulatory compliance, and integrate emerging technologies. These organizations are increasingly adopting hybrid IT strategies, combining the reliability of mainframes with the scalability of cloud platforms. Security remains a key priority; enterprises consider regulatory compliance in their modernization decisions. Additionally, the integration of generative AI into mainframe environments is gaining momentum, as enterprises plan to deploy AI tools on their mainframes, aiming to streamline operations and reduce costs. This shift addresses the challenges of legacy systems and positions enterprises for future growth and innovation.

SMEs segment is expected to register a significant CAGR over the forecast period. Small and Medium Enterprises (SMEs) are increasingly driving demand due to the need for agile, scalable, and cost-effective IT infrastructure. SMEs often face limitations with legacy mainframe systems, including high maintenance costs, limited integration with modern applications, and slower time-to-market for new services. The growing adoption of cloud platforms, microservices, and DevOps practices encourages SMEs to modernize their mainframe environments to enhance operational efficiency and reduce technical debt. Additionally, competitive pressures and the need for digital transformation in areas such as analytics, customer experience, and regulatory compliance further propel SMEs toward modernizing their mainframe systems, creating significant market growth opportunities.

Vertical Insights

BFSI accounted for the largest revenue share due to its reliance on legacy systems for various operations, including core banking, transaction processing, and risk management. Rising customer expectations for faster digital and personalized services are pushing BFSI organizations to modernize applications to cloud-based and hybrid environments, enhancing agility and scalability. Regulatory compliance, data security, and real-time analytics requirements further incentivize the shift from traditional mainframes to modern platforms. Additionally, competitive pressure from fintech and digital-first banks is accelerating investment in modernization initiatives, enabling BFSI organizations to optimize costs, improve operational efficiency, and enhance customer experience.

The education segment is expected to register the highest CAGR over the forecast period. The education sector is increasingly driving demand for mainframe modernization as institutions seek scalable, secure, and efficient IT infrastructure to support digital learning, student management systems, and research databases. Legacy mainframes often limit integration with modern applications, cloud services, and analytics tools, creating inefficiencies in data processing and administrative workflows. Rising adoption of e-learning platforms, online course management, and remote access solutions has intensified the need for agile, cloud-ready mainframe environments. Additionally, educational institutions are under pressure to reduce operational costs while ensuring data security and regulatory compliance. These factors collectively accelerate investment in modernizing mainframes to enhance performance, flexibility, and digital transformation in the education sector.

Regional Insights

North America dominated the mainframe modernization industry with a revenue share of 31.0% in 2024. The North American mainframe modernization market is primarily driven by the need for increased operational efficiency, cost optimization, and enhanced scalability. Enterprises across banking, healthcare, and government sectors rely on legacy mainframes, which often hinder integration with modern cloud-based applications and analytics platforms. Growing demand for digital transformation, advanced data analytics, and real-time transaction processing is pushing organizations to modernize their mainframe environments. Additionally, stringent regulatory compliance requirements and the need for robust cybersecurity measures are prompting companies to adopt modern, secure infrastructures. The proliferation of hybrid cloud adoption and automation technologies further accelerates mainframe modernization initiatives across North America.

U.S. Mainframe Modernization Market Trends

The U.S. mainframe modernization industry is expected to grow significantly in 2024, driven by the growing need for digital transformation across industries, where legacy systems hinder agility, scalability, and integration with cloud and AI technologies. Enterprises are increasingly adopting modernization to improve operational efficiency, reduce maintenance costs, and enhance data security and compliance with stringent regulations such as GDPR and HIPAA. Rising demand for real-time analytics, automated workflows, and cloud-native applications is compelling organizations to modernize core systems.

Europe Mainframe Modernization Market Trends

The mainframe modernization market in Europe is expected to grow significantly over the forecast period, driven by the growing need for digital transformation across industries, rising adoption of cloud-based solutions, and the demand for cost-efficient, scalable IT infrastructure. Regulatory compliance, data security requirements, and the need to integrate legacy systems with modern applications further accelerate modernization. Additionally, increasing focus on AI, analytics, and automation compels organizations to upgrade mainframes to support advanced technologies and enhance operational efficiency.

Asia Pacific Mainframe Modernization Market Trends

The mainframe modernization industry in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period, driven by rapid digital transformation across industries, increasing adoption of cloud and AI technologies, and growing demand for real-time data processing. Organizations aim to improve operational efficiency, reduce legacy system costs, and enhance security and compliance. Additionally, government initiatives promoting digital infrastructure and the rise of fintech, healthcare, and education sectors further accelerate the adoption of modernized mainframe solutions in the region.

Key Mainframe Modernization Company Insights

Some key companies in the mainframe modernization industry areIBM Corporation, and Accenture.

-

IBM Corporation is a key player in the mainframe modernization market due to its mainframe expertise, comprehensive modernization portfolio, and strong global presence. With advanced hybrid cloud, AI, and automation solutions, IBM Corporation enables enterprises to optimize legacy systems, reduce costs, and accelerate digital transformation seamlessly.

-

Accenture is key player in the mainframe modernization market due to its deep consulting expertise, strong global presence, and strategic partnerships with cloud providers like AWS, Microsoft, and Google. Its end-to-end services, advanced automation, and industry-specific modernization frameworks enable enterprises to accelerate transformation, reduce costs, and drive agility.

Key Mainframe Modernization Companies:

The following are the leading companies in the mainframe modernization market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Accenture

- Amazon Web Services, Inc.

- TATA Consultancy Services Limited

- Capgemini

- Infosys Limited

- HCL Technologies Limited

- Wipro

- DXC Technology Company

- Open Text Corporation

Recent Developments

-

In July 2025, Kyndryl Inc., an information technology infrastructure services provider,introduced advisory & implementation services that leverage Amazon Web Services, Inc.’s agentic AI capabilities to help enterprises migrate or modernize mainframe applications more rapidly, with reduced timeline and risk. Kyndryl Inc. helps clients modernize mainframe applications on Amazon Web Services, Inc. by streamlining the software development lifecycle through its consulting expertise. By leveraging platform engineering, it enables rapid integration, provisioning, and deployment of applications.

-

In April 2025, IBM unveiled its z17 system, engineered for the AI landscape. It integrates accelerated AI infrastructure, such as, the Telum II processor and various tools such as, watsonx Code Assistant for Z and Test Accelerator for Z to boost developer productivity, simplify modernization, and support generative AI in mainframe environments.

-

In March 2025, Kyndryl Inc., an information technology infrastructure services provider, partner with Google LLC’S, technology company, Gemini models, to help clients assess, modernize, and migrate mainframe applications/data. Their “Mainframe Modernization with Gen AI Accelerator Program” combines Kyndryl Inc.’s deep mainframe expertise with Google Inc.’s AI tools to speed cloud-native modernization.

Mainframe Modernization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.58 billion

Revenue forecast in 2033

USD 18.19 billion

Growth rate

CAGR of 9.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

IBM Corporation; Accenture; Amazon Web Services, Inc.; TATA Consultancy Services Limited; Capgemini; Infosys Limited; HCL Technologies Limited; Wipro; DXC Technology Company; Open Text Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mainframe Modernization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global mainframe modernization market report based on component, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & ITes

-

Healthcare

-

Retail

-

Media & Entertainment

-

Education

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the mainframe modernization market with a share of 31.0% in 2024. This is attributable to the the need for increased operational efficiency, cost optimization, and enhanced scalability. Enterprises across banking, healthcare, and government sectors rely on legacy mainframes, which often hinder integration with modern cloud-based applications and analytics platforms. Growing demand for digital transformation, advanced data analytics, and real-time transaction processing is pushing organizations to modernize their mainframe environments.

b. Some key players operating in the mainframe modernization market include IBM Corporation; Accenture; Amazon Web Services, Inc.; TATA Consultancy Services Limited; Capgemini; Infosys Limited; HCL Technologies Limited; Wipro; DXC Technology Company; and Open Text Corporation.

b. Key factors that are driving the mainframe modernization market growth include the growing need for digital transformation, legacy system upgrades, and enhanced operational efficiency. Increasing cloud adoption, rising demand for cost optimization, and integration of AI and automation technologies further accelerate modernization initiatives, enabling enterprises to remain competitive and agile in a rapidly evolving business landscape.

b. The global mainframe modernization market size was estimated at USD 7.91 billion in 2024 and is expected to reach USD 8.58 billion in 2025.

b. The global mainframe modernization market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2033 to reach USD 18.19 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.