- Home

- »

- Next Generation Technologies

- »

-

Malaysia Contact Center Software Market Size Report, 2033GVR Report cover

![Malaysia Contact Center Software Market Size, Share & Trends Report]()

Malaysia Contact Center Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution, By Service (Integration & Deployment, Support & Maintenance), By Deployment (Hosted, On-premise), By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-741-2

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

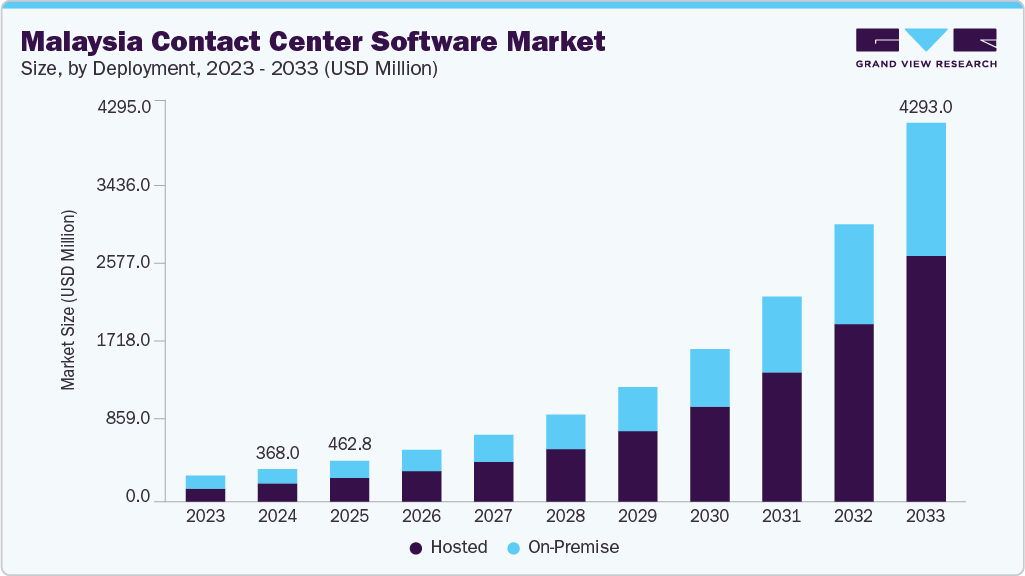

The Malaysia contact center software market size was estimated at USD 368.0 million in 2024 and is expected to reach USD 4,293.0 million by 2033, registering a CAGR of 32.1% from 2025 to 2033. The market is experiencing robust growth, driven by factors such as digital transformation initiatives, rising customer service expectations, and increasing demand for omnichannel engagement. The growth is further propelled by the rapid adoption of intelligent contact center solutions, which offer enhanced scalability, flexibility, and cost-effectiveness, particularly appealing to businesses seeking to reduce infrastructure needs and maintenance costs. In addition, Malaysia's national digital transformation initiatives, including the MyDIGITAL blueprint, are also fueling this expansion by promoting cloud adoption and strengthening the country's digital infrastructure, thereby creating a conducive environment for the growth of advanced contact center solutions.

The Malaysian contact center software industry is experiencing rapid expansion, fueled by emerging technological trends. The industry is being transformed by the widespread adoption of cloud-native platforms, artificial intelligence (AI), machine learning, and robotic process automation (RPA). These innovations support advanced capabilities such as omnichannel engagement, sentiment analysis, predictive call routing, and real-time analytics, enhancing both agent efficiency and the overall customer experience. In addition, cloud-based contact center solutions are becoming increasingly popular due to their scalability, cost-effectiveness, and ability to support remote and hybrid work models.

With digital transformation rapidly advancing across Malaysia, businesses are facing immense pressure to provide faster, smarter, and more personalized customer service. As online transactions, mobile connectivity, and expectations for real-time interaction continue to rise, traditional call centers are finding it difficult to keep up. In response, intelligent contact centers have become increasingly vital to enhance customer satisfaction and to improve operational efficiency, support flexible workforce models, and ensure regulatory compliance. Malaysian businesses across various industries are increasingly using intelligent contact center solutions, driven by several key factors contributing to enhanced customer engagement and operational performance. Thus, growing demand for an intelligent contact center is expected to contribute to market growth.

Rapid growth of the contact center outsourcing industry is further propelling the demand for contact center software solutions. As the country emerges as a major hub in Southeast Asia, fueled by multilingual talent, strategic location, and supportive government incentives, businesses are increasingly turning to cloud-based and AI-enabled platforms to enhance service delivery and operational efficiency. Malaysia’s multicultural and highly educated workforce enables seamless support across global markets, making centralized, omnichannel software solutions essential for managing diverse customer interactions. With rising investments in hybrid service models and regulatory frameworks that support innovation and data protection, the expanding outsourcing sector is accelerating the adoption of sophisticated contact center technologies to meet growing client expectations and scale operations effectively.

The contact center software market in Malaysia is growing rapidly, driven by digital transformation and rising customer experience demands. However, several challenges hinder its full potential, including high implementation costs, legacy system dependencies, and regulatory complexities. Deploying advanced contact center solutions, especially cloud-based omnichannel platforms, requires significant investment in licensing, infrastructure, and integration. Small and medium enterprises (SMEs) often struggle with upfront costs, while ongoing expenses such as AI-powered analytics, CRM integrations, and cybersecurity measures add to the financial burden.

Solution Insights

The automatic call distribution segment dominated the market in 2024 with a share of 20.8%. In Malaysia, automatic call distribution systems (ACD) are widely used by contact centers to streamline inbound call handling. ACD ensures that incoming calls are routed to the most appropriate agent based on predefined criteria such as skill set, availability, or priority. With Malaysia’s multilingual workforce, ACD systems are increasingly being integrated with language detection and skill-based routing to enhance customer satisfaction and minimize wait times. In addition, ACD helps Malaysian businesses manage high inbound call volumes effectively by ensuring customers are directed to the most suitable agents. This is especially critical for multilingual support, where routing calls based on language preference enhances first-contact resolution and customer satisfaction.

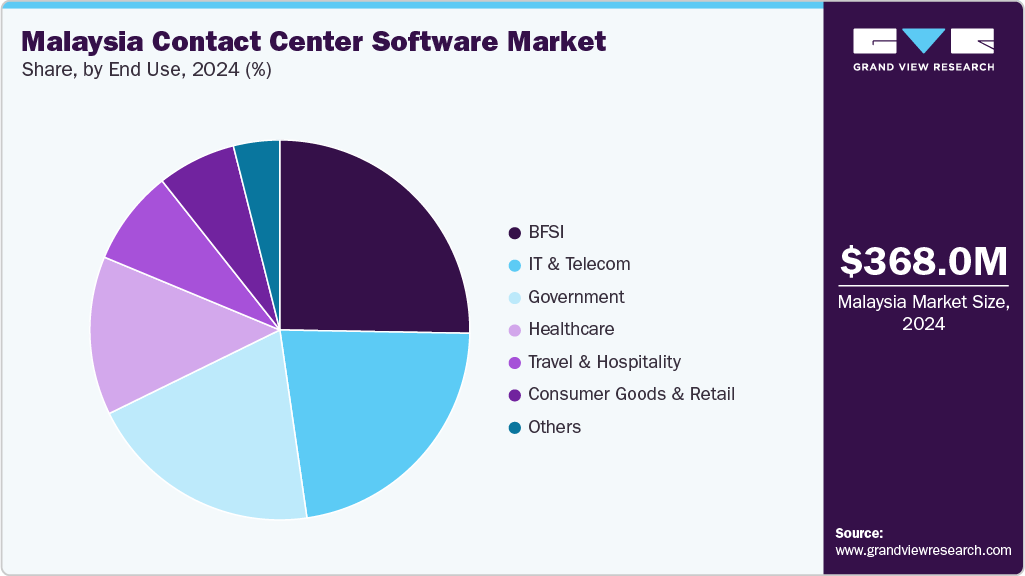

The customer collaboration segment is expected to witness the fastest CAGR of 37.2% over the forecast period. Malaysian consumers are increasingly using digital channels such as messenger applications. As a result, customer collaboration tools that unify these platforms into a single dashboard are in high demand. Customer collaboration tools allow Malaysian contact centers to engage with customers on their preferred digital platforms. In addition, industries such as travel and hospitality leverage these tools to boost engagement and handle customer queries in real time, thereby driving the segment’s growth.

Service Insights

The integration & deployment segment dominated the market in 2024 with a share of 42.4%. Integration and deployment services play a critical role in helping businesses transition from legacy on-premise systems to modern, cloud-based contact center platforms. With the country's growing digital adoption, this shift is becoming increasingly important. Enterprises and BPO providers are now seeking seamless integration of contact center software with CRM systems, payment gateways, AI tools, and communication platforms, which in turn drive demand for integration and deployment services.

The managed services segment is expected to witness the fastest CAGR over the forecast period. Rising demand for cost optimization and operational efficiency is prompting mid-sized and large enterprises to outsource contact center operations to specialized service providers. Managed services allow businesses to avoid significant upfront investments in infrastructure and technology while ensuring access to the latest innovations, including AI, analytics, and cloud capabilities. In addition, the shortage of in-house IT expertise and the complexity of integrating multiple communication channels have further increased reliance on managed service providers.

Deployment Insights

The hosted segment dominated the market in 2024. In Malaysia, hostel deployment model is gaining strong traction, particularly among SMEs and growing service providers. Its demand can be attributed to its minimal setup requirements, faster deployment timelines, and a reduced need for internal IT resources. This makes it especially attractive to businesses seeking scalability and simplified system upgrades.

The on-premise segment is expected to witness notable growth over the forecast period.Despite the surge in hosted deployment adoption, on-premise deployment remains relevant in Malaysia, especially for organizations prioritizing data control, security, and compliance. Many businesses still prefer on-premise solutions to maintain full ownership of their systems and data. In addition, organizations operating under specific geographic, jurisdictional, or industry regulations often find on-premise contact center solutions either mandatory or more suitable due to compliance, data sovereignty, or security requirements.

Enterprise Size

The large enterprise segment dominated the market in 2024. Large enterprises typically handle high volumes of customer interactions across multiple channels, requiring scalable, secure, and feature-rich platforms. These platforms support omnichannel engagement, real-time analytics, and workforce optimization to meet complex operational demands. As a result, large enterprises rely on contact center software to streamline interactions, boost efficiency, and enhance overall customer experience.

The small & medium enterprise (SME) segment is expected to witness the fastest growth over the forecast period.SMEs in Malaysia are increasingly adopting contact center software to enhance customer engagement, streamline operations, and remain competitive with larger firms. These solutions equip SMEs with the necessary tools to manage customer interactions efficiently and professionally across various channels. In addition, many vendors offer flexible, hosted deployment models that minimize the need for significant IT infrastructure or upfront capital investment, making them particularly appealing to budget-conscious businesses.

End Use Insights

The BFSI segment dominated the market in 2024. The growth of this segment is driven by the increasing need to engage customers and deliver seamless, high-quality experiences. In Malaysia, BFSI organizations utilize contact center software for a wide range of applications, including processing loan and mortgage applications, offering investment advisory services, managing insurance claims, and detecting and preventing fraud. The sector is also undergoing rapid digital transformation, fueled by rising customer expectations for 24/7 access to banking services and smooth, digitally enabled interactions.

The consumer goods & retail segment is expected to witness the fastest growth over the forecast period in the Malaysia contact center software market. In the consumer goods and retail sectors, contact center software is used for efficient order management and tracking, as well as processing returns and exchanges. It also plays a key role in handling product inquiries, offering personalized recommendations, and delivering comprehensive e-commerce customer support. The surge in e-commerce and omnichannel retailing has significantly driven the demand for unified customer support across channels such as phone, email, chat, and social media.

Key Malaysia Contact Center Software Company Insights

Some of the key players operating in the Malaysia contact center software market include Zendesk, Genesys, and Cisco Systems, Inc., among others. These players offer unified contact center platforms that support voice, chat, email, social, and messaging under one interface to meet omnichannel service demands. These vendors focus on AI integration (e.g., predictive routing, speech analytics) and strategic partnerships with local BPOs and telcos to drive adoption.

-

Genesys is a global leader in customer experience and contact center solutions, serving enterprises across various sectors. In Malaysia, the company works with regional system integrators to provide cloud-based platforms that manage customer interactions over voice, messaging, and digital channels.

-

Cisco Systems, Inc. is a multinational technology company known for networking, security, and communication infrastructure. In Malaysia, Cisco supports customer service operations across government, healthcare, and financial sectors. Its contact center platforms are integrated with enterprise systems to handle voice and digital communication securely and efficiently.

Key Malaysia Contact Center Software Companies:

- Genesys

- Avaya LLC

- Cisco Systems, Inc.

- Five9, Inc.

- NiCE

- Talkdesk

- 8x8, Inc.

- Ameyo

- Zendesk

- Freshworks

Recent Developments

-

In December 2024, Cisco’s Webex Contact Center cloud service became available to Malaysian enterprises via its Asia-Pacific (Singapore) regional cloud. This deployment allows Malaysian organizations to host contact center instances in Singapore, enabling data residency compliance and improved voice performance by reducing latency. It supports local businesses looking to modernize their customer experience infrastructure through a reliable and secure CCaaS (Contact Center as a Service) solution.

Malaysia Contact Center Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 462.8 million

Revenue forecast in 2033

USD 4,293.0 million

Growth rate

CAGR of 32.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end use

Key companies profiled

Genesys; Avaya LLC; Cisco Systems Inc.; Five9 Inc.; NiCE; Talkdesk; 8x8 Inc.; Ameyo; Zendesk; Freshworks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Malaysia Contact Center Software Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Malaysia contact center software market report based on solution, service, deployment, enterprise size, and end use:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic Call Distribution (ACD)

-

Call Recording

-

Computer Telephony Integration (CTI)

-

Customer Collaboration

-

Dialer

-

Interactive Voice Responses (IVR)

-

Reporting & Analytics

-

Workforce Optimization

-

Others

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Hosted

-

On-premise

-

-

Enterprise-size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travelling & Hospitality

-

Others

-

Frequently Asked Questions About This Report

b. The Malaysia contact center software market size was estimated at USD 368.0 million in 2024 and is expected to reach USD 462.8 million in 2025.

b. The Malaysia contact center software market is expected to grow at a compound annual growth rate of 32.1% from 2025 to 2033 to reach USD 4,293.0 million by 2033.

b. The automatic call distribution segment dominated the market in 2024 with a share of 20.8%.

b. Some key players operating in the Malaysia contact center software market include Genesys, Avaya LLC, Cisco Systems, Inc., Five9, Inc., NiCE, Talkdesk, 8x8, Inc., Ameyo, Zendesk, and Freshworks.

b. The Malaysia contact center software market is experiencing robust growth, driven by factors such as digital transformation initiatives, rising customer service expectations, and increasing demand for omnichannel engagement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.