- Home

- »

- Advanced Interior Materials

- »

-

Marine Construction Market Size, Industry Report, 2030GVR Report cover

![Marine Construction Market Size, Share & Trends Report]()

Marine Construction Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Steel, Concrete, Wood, Composite), By Region (North America, Asia Pacific, Europe, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-529-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Construction Market Summary

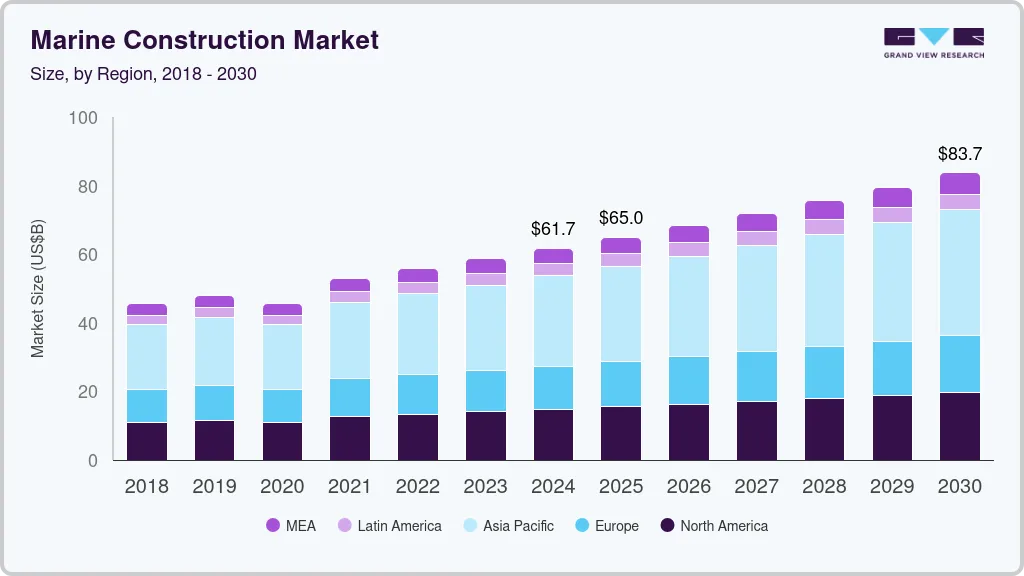

The global marine construction market size was estimated at USD 61.74 billion in 2024 and is projected to reach USD 83.70 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The increase in climate change-related concerns, such as rising sea levels and extreme weather conditions, is driving the market.

Key Market Trends & Insights

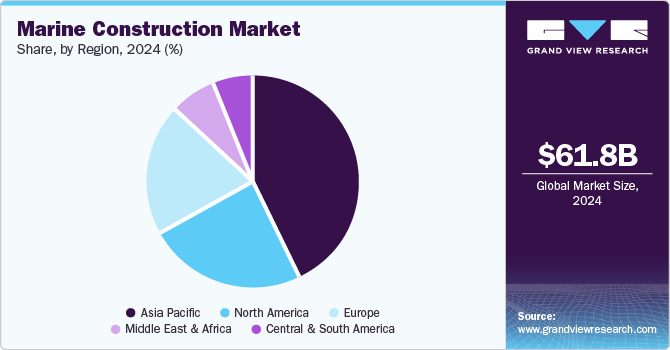

- Asia Pacific dominated the market and accounted for the largest revenue share of 42.6% in 2024.

- China is expected to register significant CAGR from 2025 to 2030.

- By material, concrete segment dominated the market and accounted for the largest revenue share of 35.31% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 61.74 Billion

- 2030 Projected Market Size: USD 83.70 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

This has led to the need for resilient infrastructure, including coastal protection systems, seawalls, and flood barriers to mitigate the impacts of climate change. Governments and private sectors are investing in the construction of these protective structures to safeguard coastal communities and critical infrastructure from the growing threat of environmental hazards.

Advancements in marine construction technology have further propelled the market by improving the efficiency, safety, and sustainability of projects. Innovations such as robotics, automation, and advanced materials are enhancing the construction process, reducing costs, and minimizing environmental impacts. These technologies allow for more complex and large-scale marine projects to be executed more effectively, which in turn fuels market growth.

Another major driver is the growing emphasis on renewable energy, particularly offshore wind farms and tidal energy projects. Governments worldwide are investing heavily in green energy initiatives, and marine construction plays a vital role in the development and installation of offshore wind turbines, energy generation platforms, and other renewable energy structures. As nations strive to meet their carbon reduction targets, the marine construction industry benefits from these environmentally sustainable projects.

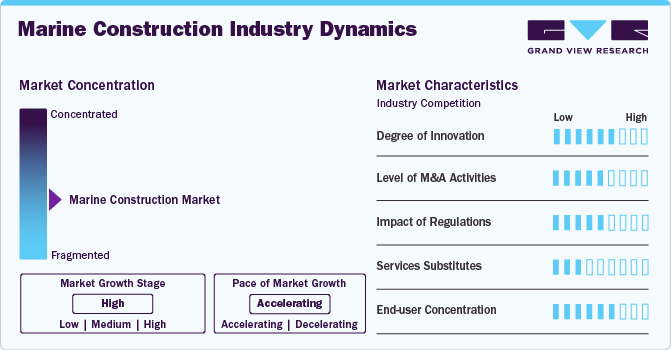

Market Concentration & Characteristics

The marine construction industry is characterized by a moderate to high degree of concentration, with key players often dominating the global landscape. These leading companies typically have significant resources, extensive project portfolios, and established relationships with government and private stakeholders, allowing them to secure large-scale projects. However, the market also includes a number of smaller, specialized firms focusing on niche services such as underwater construction, dredging, or marine infrastructure for specific regions. The degree of innovation within the sector is moderate, with companies continually adopting advancements in materials, construction techniques, and technology to enhance the durability, efficiency, and safety of marine structures. Innovations such as sustainable construction practices, automation, and improved design software are reshaping the market, allowing firms to meet increasingly complex demands and environmental considerations.

Regulations play a critical role in shaping the market, particularly given the environmental, safety, and legal implications of projects in marine and coastal areas. Strict regulations related to environmental protection, such as emissions controls, waste management, and the preservation of marine ecosystems, often require significant investments in compliance and sustainable construction methods. The market is also influenced by the availability of substitutes for traditional marine construction services, such as alternative materials or offshore technologies that can reduce costs and improve efficiency. In terms of end-use concentration, the market is typically divided between large infrastructure projects (ports, bridges, harbours) and specialized applications (coastal protection, renewable energy installations like offshore wind farms). While infrastructure projects represent a significant share, demand from renewable energy sectors is increasing, providing new growth opportunities for the market.

Material Insights

The concrete segment dominated the market and accounted for the largest revenue share of 35.31% in 2024. The growing demand for coastal development and the expansion of ports and harbors, particularly in emerging economies, has significantly increased the need for concrete in marine construction. As international trade continues to rise, ports and harbors are expanding to accommodate larger vessels and growing shipping traffic. Concrete is often the preferred material for constructing large-scale infrastructure projects due to its ability to support heavy loads and provide stability. The increasing focus on urbanization and infrastructure development along coastlines and waterfronts has also propelled the demand for concrete in the marine construction sector.

Composite segment is expected to grow at fastest CAGR of 5.6% over the forecast period. Technological advancements in composite manufacturing have played a crucial role in driving market growth. Innovations such as advanced molding techniques and the development of new, more cost-effective composite materials have enhanced the overall quality and affordability of composite products in marine construction. These advancements have expanded the range of applications for composites, from recreational boats to large commercial vessels, and have made them more accessible to a broader range of manufacturers and operators.

Regional Insights

North American marine construction market is driven by the emphasis on environmental sustainability. As the region becomes more environmentally conscious, there is a growing demand for eco-friendly construction materials and methods. This has led to the adoption of green technologies in marine construction, such as the use of recycled materials, sustainable design practices, and the development of renewable energy infrastructure, like offshore wind farms. Regulatory pressures and the need to comply with stringent environmental regulations have also encouraged industry to shift toward more sustainable and energy-efficient construction practices, promoting market growth.

U.S. Marine Construction Market Trends

The increasing focus on technological advancements in marine construction is major factor driving market growth. The use of high-performance composite materials, automated construction techniques, and digital modeling tools is enhancing the durability and efficiency of marine structures. These innovations help reduce long-term maintenance costs and improve project execution, making marine construction more cost-effective and sustainable. As the U.S. continues to prioritize maritime infrastructure development, the marine construction industry is expected to witness steady growth, supported by strong investments, regulatory backing, and technological progress.

Asia Pacific Marine Construction Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 42.6% in 2024, driven by rise in maritime trade and shipping activities in the Asia Pacific region. The region is home to some of the busiest shipping lanes in the world, and the continuous growth in trade volumes is prompting the development of larger, more sophisticated ports and terminals. This surge in maritime traffic requires the construction of deep-water ports, advanced docking facilities, and specialized infrastructure capable of handling large volumes of cargo. The increasing need for modern, high-capacity port infrastructure is thus driving investments in marine construction. Additionally, the Asia Pacific region's emphasis on offshore energy exploration, particularly in oil and gas, has contributed to the expansion of marine construction projects. Offshore platforms, rigs, and renewable energy installations, such as offshore wind farms, require specialized construction and installation services.

China’s growing focus on offshore energy exploration and production is driving the market growth. With vast offshore oil and gas reserves, the country has heavily invested in marine construction for the development of offshore platforms, rigs, and renewable energy infrastructure, such as offshore wind farms. The rising demand for clean energy and China's commitment to reducing its carbon footprint have further driven the need for renewable energy projects, especially in offshore wind energy. The government's focus on energy security and its push for sustainable energy sources are vital contributors to the expansion of marine construction in the offshore energy sector.

Europe Marine Construction Market Trends

The Europe marine construction market is driven by a combination of increasing investments in coastal infrastructure, rising demand for sustainable maritime solutions, and advancements in marine engineering technologies. With a strong emphasis on port modernization and expansion, European governments and private stakeholders are investing in large-scale marine infrastructure projects to accommodate growing trade volumes and enhance connectivity across the region. The European Union’s Blue Economy initiative, which promotes sustainable ocean-related industries, is further driving investments in ports, harbors, offshore wind farms, and coastal protection structures, reinforcing the growth of the market.

The increasing investments in coastal protection and climate resilience projects are propelling market growth. As climate change poses rising threats such as rising sea levels and extreme weather events, Germany is focusing on strengthening its coastal infrastructure through seawalls, flood barriers, and advanced drainage systems. Government-funded initiatives aimed at protecting coastal cities and industrial zones further drive demand for innovative marine construction solutions, solidifying Germany’s position as a key player in the global market.

Latin America Marine Construction Market Trends

The Latin America marine construction market is driven by a combination of economic growth, increasing maritime trade, and rising investments in port infrastructure development. As global trade routes expand and the demand for efficient logistics increases, Latin American countries are prioritizing the modernization and expansion of their ports and coastal infrastructure. Governments and private stakeholders are investing in dredging projects, terminal expansions, and new port constructions to accommodate larger vessels and improve cargo handling efficiency. This growing focus on enhancing trade connectivity is a key driver for the marine construction sector in the region.

Middle East & Africa Marine Construction Market Trends

Rising offshore oil and gas exploration activities in the region is a significant driver. The Middle East is a global leader in oil production, and African nations, particularly Nigeria and Angola, have significant offshore oil reserves. The expansion of offshore drilling platforms, subsea pipelines, and floating production storage and offloading (FPSO) units requires robust marine construction capabilities, further fueling market growth. As energy companies invest in new offshore fields and upgrade existing infrastructure to meet global energy demands, the demand for durable and corrosion-resistant marine construction materials and solutions continues to rise.

Key Marine Construction Company Insights

Some of the key players operating in market include China State Construction Engineering Corporation, Hyundai Engineering and Construction

-

China State Construction Engineering Corporation (CSCEC) is one of the largest construction companies globally, with a strong presence in infrastructure and marine construction. The company specializes in large-scale marine projects, including port construction, dredging, and coastal defense structures. CSCEC’s product offerings in the marine construction industry include breakwaters, seawalls, harbors, and offshore infrastructure, supporting the development of key maritime hubs across various regions

-

Hyundai Engineering and Construction is a leading South Korean construction firm known for its expertise in marine and offshore construction. The company has extensive experience in developing coastal infrastructure, port facilities, and offshore platforms. Its marine construction product offerings include offshore oil and gas structures, subsea pipelines, floating terminals, and breakwater systems. Hyundai Engineering and Construction leverages advanced engineering techniques and sustainable construction practices to ensure durability and efficiency in challenging marine environments.

Strabag, DEME are some of the emerging market participants in the global marine construction industry.

-

Strabag is an Austria-based construction company with a significant footprint in marine construction, focusing on coastal protection and port infrastructure. The company provides innovative solutions for dredging, harbor expansions, and offshore wind farm foundations. Its product offerings in the market include quay walls, locks, flood protection structures, and underwater tunnels.

-

DEME is a global operator in dredging, land reclamation, and marine infrastructure development, with a strong emphasis on sustainable and innovative construction solutions. The company specializes in offshore wind farm installations, port expansions, and subsea construction. Its marine construction product portfolio includes dredging vessels, subsea rock installation services, land reclamation solutions, and offshore energy infrastructure.

Key Marine Construction Companies:

The following are the leading companies in the marine construction market. These companies collectively hold the largest market share and dictate industry trends.

- China State Construction Engineering Construction

- Hyundai Engineering and Construction

- Strabag

- DEME

- Ningbo Zhoushan Port

- Boskalis

- Bechtel

- McCarthy Building

- China Merchants

Recent Developments

-

Marine Structures and JMC have announced a strategic collaboration to deliver world-class marine solutions in Western South Korea, strengthening their position in the region’s expanding market. Set for launch in February 2025, this partnership aims to enhance coastal infrastructure, port facilities, and offshore energy projects through innovative engineering and sustainable construction practices. By combining Marine Structures' expertise in marine engineering with JMC’s extensive experience in large-scale infrastructure projects, the alliance is expected to drive efficiency, cost-effectiveness, and environmental sustainability.

Marine Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 64.96 billion

Revenue forecast in 2030

USD 83.70 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Materials, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

China State Construction Engineering Construction; Hyundai Engineering and Construction; Strabag; DEME; Ningbo Zhoushan Port; Boskalis; Bechtel; McCarthy Building; China Merchants

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine construction market report based on materials and region.

-

Materials Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Concrete

-

Wood

-

Composite

-

Other Materials

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global marine construction market size was estimated at USD 61.75 billion in 2024 and is expected to reach USD 64.96 billion in 2025.

b. The marine construction market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 83.70 billion by 2030.

b. The concrete segment dominated the market and accounted for the largest revenue share of 35.31% in 2024. The growing demand for coastal development and the expansion of ports and harbors, particularly in emerging economies, has significantly increased the need for concrete in marine construction

b. Some of the key players operating in the marine construction market include China State Construction Engineering Construction, Hyundai Engineering and Construction, Strabag, DEME, Ningbo Zhoushan Port, Boskalis, Bechtel, McCarthy Building, China Merchants

b. The key factors that are driving the marine construction market include increasing investments in port infrastructure, offshore energy projects, and coastal protection initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.