- Home

- »

- Communications Infrastructure

- »

-

Maritime Satellite Communication Market Size Report, 2033GVR Report cover

![Maritime Satellite Communication Market Size, Share & Trends Report]()

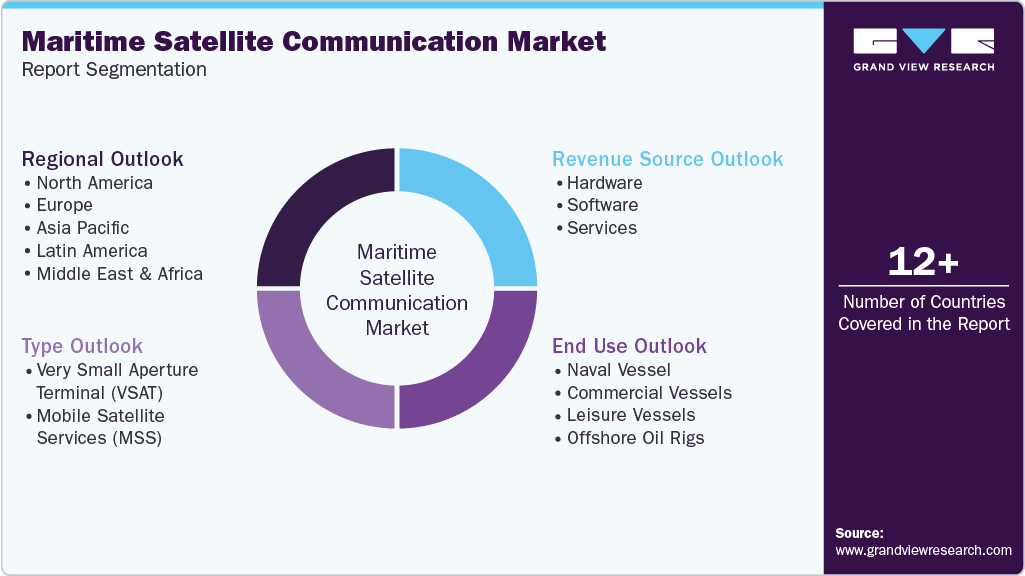

Maritime Satellite Communication Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Very Small Aperture Terminal (VSAT), Mobile Satellite Services (MSS)), By Revenue Source (Hardware, Software, Services), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-049-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Maritime Satellite Communication Market Summary

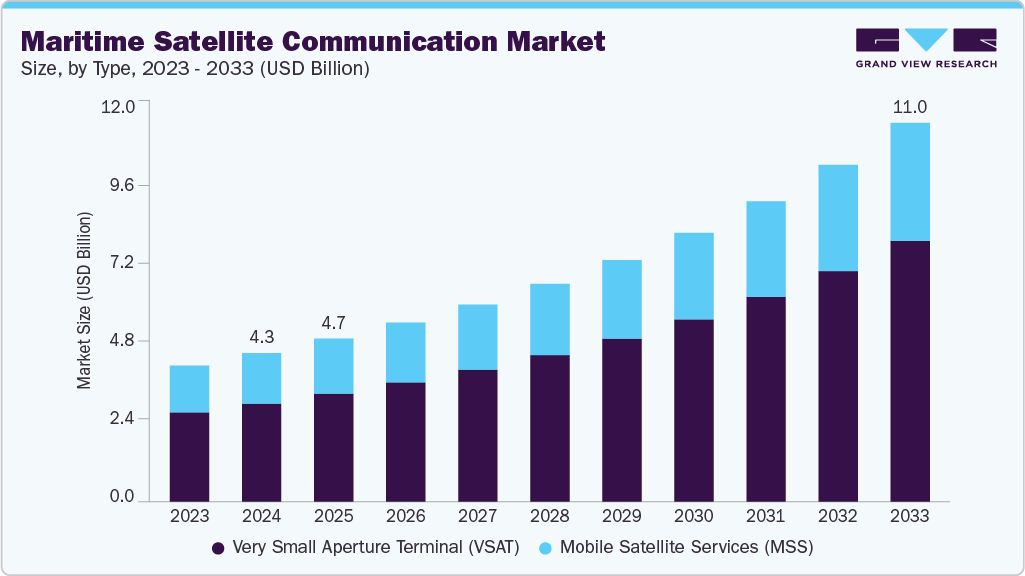

The global maritime satellite communication market size was estimated at USD 4.33 billion in 2024, and is projected to reach USD 11.03 billion by 2033, growing at a CAGR of 11.1% from 2025 to 2033. The rising need for reliable and cost-effective communication services at sea is driving growth.

Key Market Trends & Insights

- Asia Pacific maritime satellite communication market accounted for a 34.6% share of the overall market in 2024.

- The maritime satellite communication industry in the China held a dominant position in 2024.

- By type, the very small aperture terminal segment accounted for the largest share of 65.9% in 2024.

- By revenue source, the hardware segment held the largest market share in 2024.

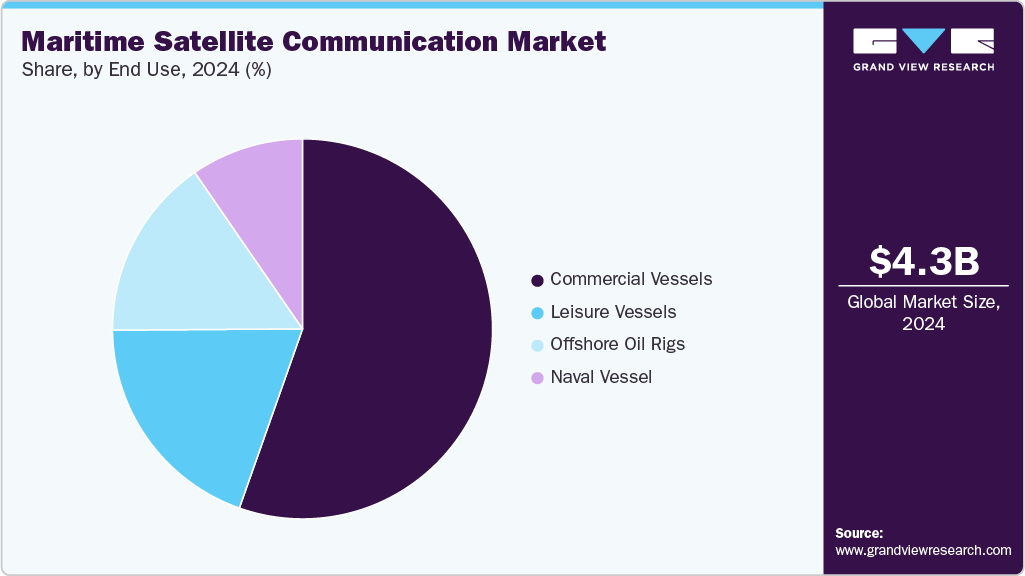

- By end use, the commercial vessels segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.33 Billion

- 2033 Projected Market Size: USD 11.03 Billion

- CAGR (2025-2033): 11.1%

- Asia Pacific: Largest market in 2024

Maritime telecommunication equipment has become the standard for short as well as long-term voyaging. Reliable communication has become an indispensable part of maritime transport, whether it's recreational boats, mega yachts, commercial fishing, or other naval transport. Cellular services are only available within the offshore areas and have a limited range wherein they function properly. A satellite network is used as a solution to mitigate communication issues and offer services that have a competitive advantage over land-based communications.

In the past, satellite network was used for communication between ships to shore and with other marine vessels. Now, the role of satellite communication has transformed from voice calls to additional user-oriented data services, such as entertainment, tracking, and monitoring services. These equipment have become ubiquitous owing to its diverse applications, such as DTH broadcasting, disaster management, voice calls, weather forecasting, and navigation, among others.

Receiver, transmitter/transponder, transceiver, antenna, modem/router, and satellite phone are the prominent communication equipment deployed on marine vessels. This equipment also finds application in air and marine navigation and meteorological monitoring. Although marine satellite communications are becoming ever more crucial, the solutions that work on land do not typically operate at sea. Continuous R&D in the field is leading to minimizing the size of antennas and increasing the rate of data transfer to reduce the time lag. This factor is positively influencing the growth of the market.

Marine satellite communication equipment used for naval defense forces helps deal with aerial monitoring, sending and receiving a distress call, and navigational requirements. Moreover, growing investment across various regions to upgrade legacy systems in the naval fleet is likely to propel demand over the forecast period. The defense and security sector has to maintain communications with zero time lag to evade challenges, such as pirate activities, inter-country conflicts, and border infiltrations, among others. Thereby, marine satellite communication is gaining attention among coast guards, naval forces, and other security organizations.

Type Insights

The very small aperture terminal (VSAT) segment accounted for the largest share of 65.9% in 2024. This growth is attributed to the advantages of VSAT over Mobile Satellite Services (MSS), such as reduced time lag, global coverage, and others. A Broadband VSAT network is used for establishing onboard VPN networks that cover fleets and connect ships to shore. This connectivity supports critical business applications, carries VoIP traffic, and increases ships’ access to information. VSAT provides regular access to the Internet for email, file sharing, and instant messaging, among others.

The mobile satellite services (MSS) segment is expected to grow at a significant CAGR during the forecast period. The rising need for constant connectivity across commercial shipping, passenger vessels, offshore platforms, and naval fleets. Maritime operators are increasingly adopting MSS to enable real-time communication for navigation, weather updates, crew welfare, remote diagnostics, and cargo tracking. As maritime routes become more digitally integrated, MSS ensures uninterrupted service where VSAT systems may be impractical due to size, cost, or operational constraints.

Revenue Source Insights

The hardware segment held the largest market share of 61.3% in 2024. Hardware components are utilized in large volumes, and the cost associated with them is very high. This high cost is likely to positively impact revenue generation over the forecast period. A rise in the installation of VSAT broadband equipment in new as well as existing marine vessel fleets is anticipated to fuel the market growth further. Technological innovations, such as the reduced size of the dish and cost of data usage, are expected to drive the demand for the installation of new VSAT services over MSS services.

The software segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the accessibility of a wide range of application-specific software that suits the interests and requirements of marine vessels. For instance, satellite tracking and prediction, simulations and graphical interfaces, radio tuning with automatic Doppler correction, antenna steering through popular interfaces, and navigational and entertainment software. Increasing adoption of marine satellite communication equipment in defense vessels, cruise ships, luxury yachts, and others is anticipated to drive the segment further.

End Use Insights

The commercial vessels segment dominated the market in 2024. The growth of the segment is attributed to the rising trade activities using commercial vessels in key emerging countries such as China, Brazil, and India, among others. The international shipping industry carries approximately 90% of global trade. Maritime trade continues to expand, bringing benefits for consumers across the globe through competitive logistics costs. With rising manufacturing and global trade, there has been a rise in the number of marine vessels added to the existing fleet. An increase in the number of ships and naval vessels is expected to fuel the market over the forecast period.

The naval vessel segment is projected to grow at the fastest CAGR of 12.0% over the forecast period. The growing need for real-time situational awareness and secure communications during defense and military operations fuels the growth of the market. Naval vessels often operate in remote and high-risk environments where terrestrial networks are unavailable. Satellite communication (SATCOM) ensures seamless and continuous connectivity with command centers, allied forces, and other units. This enables mission-critical applications such as secure voice and video communication, encrypted data exchange, and live tracking of threats or assets, crucial for effective maritime defense strategy and coordination.

Regional Insights

The North America maritime satellite communication industry held a significant share in 2024. The growth in the region is fueled by high maritime traffic, advanced naval operations, and the rapid adoption of digital technologies in commercial shipping and offshore industries. The region benefits from a well-established satellite infrastructure and early adoption of high-throughput satellites (HTS) and LEO-based communication networks.

U.S. Maritime Satellite Communication Market Trends

The U.S. maritime satellite communication industry held a dominant position in 2024 due to dominant naval capabilities, a vast commercial fleet, and offshore oil and gas activities. The U.S. Navy and Coast Guard continue to invest heavily in secure and resilient SATCOM systems for real-time data sharing and mission-critical operations.

Europe Maritime Satellite Communication Market Trends

The Europe maritime satellite communication industry was identified as a lucrative region in 2024. Europe represents a mature and technologically advanced market for maritime satellite communication, with high demand from commercial shipping, naval defense, and offshore wind energy sectors. The region is witnessing increased deployment of VSAT systems and integration with IoT platforms to support efficient vessel operations and compliance with the EU’s digital maritime regulations.

The UK maritime satellite communication industry is expected to grow rapidly in the coming years. The growth in the country is supported by the country’s strategic maritime location, strong naval capabilities, and international shipping activity through key ports such as London and Southampton. The UK Royal Navy’s focus on digital transformation and autonomous naval platforms is boosting investment in advanced SATCOM technologies.

The Germany maritime satellite communication industry held a substantial market share in 2024. Germany plays a key role in the European SATCOM market, especially through its shipbuilding industry and North Sea operations. The German Navy is integrating modern SATCOM solutions to improve situational awareness and multi-domain connectivity. German shipping companies are increasingly deploying satellite-based broadband services to support digital operations, environmental monitoring, and crew welfare.

Asia Pacific Maritime Satellite Communication Market Trends

Asia Pacific maritime satellite communication market accounted for a 34.6% share of the overall market in 2024. Asia Pacific maritime satellite communication industry is anticipated to grow at a CAGR of 13.5% during the forecast period. The expansion of seaborne trade, port infrastructure development, and regional maritime security concerns drive the growth in the region. Countries in the region are rapidly investing in high-speed satellite connectivity to enhance vessel tracking, navigation, and digital maritime services.

The Japan maritime satellite communication industry is expected to grow rapidly in the coming years due to the country’s focus on maritime safety, environmental compliance, and technological innovation. Japanese shipping lines and coast guard fleets are actively adopting SATCOM systems to improve fleet management, real-time monitoring, and emergency response.

The China maritime satellite communication industry held a substantial market share in 2024. China is rapidly expanding its maritime satellite communication capabilities as part of its broader maritime and digital infrastructure strategies. The country is investing in national satellite constellations, including BeiDou and other broadband LEO systems, to support its large commercial and military fleets.

Key Maritime Satellite Communication Company Insights

Some of the key companies in the maritime satellite communication industry include Inmarsat Global Limited, Iridium Communications Inc., Thuraya Telecommunications Company, ViaSat Inc., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Inmarsat Global Limited is a company specializing in mobile satellite communications, providing reliable voice and data services worldwide through a network of geostationary satellites. The company provides satellite connectivity for diverse sectors, including maritime, aviation, government, and enterprise customers operating in remote or challenging environments. The company’s services enable seamless communication anywhere on the globe, supporting critical applications such as crew welfare, operational efficiency, and safety.

-

Iridium Communications Inc. is a mobile satellite service provider offering truly global, pole-to-pole coverage through its constellation of 66 active low-Earth orbit (LEO) satellites and 14 in-orbit spares. The company delivers reliable voice and data communications services worldwide, serving a diverse customer base that includes commercial markets, the U.S. Department of Defense, international governments, non-governmental organizations, and consumers. Iridium’s offerings encompass satellite phones, broadband terminals, embedded devices, and IoT connectivity solutions tailored for sectors such as maritime, aviation, public safety, utilities, oil and gas, mining, forestry, and transportation.

Key Maritime Satellite Communication Companies:

The following are the leading companies in the maritime satellite communication market. These companies collectively hold the largest market share and dictate industry trends.

- Inmarsat Global Limited

- Iridium Communications Inc.

- Leonardo S.p.A.

- Thuraya Telecommunications Company

- ViaSat Inc.

- Orbcomm Inc.

- KVH Industries, Inc.

- Singapore Technologies Engineering Ltd

- EchoStar Corporation

- Kongsberg Maritime AS

Recent Developments

-

In June 2025, Alén Space placed its SATMAR nanosatellite into orbit, marking a significant milestone in advancing the digitalization of maritime communications. Launched on June 23, 2025, aboard a SpaceX Falcon 9 rocket from Vandenberg Space Force Base, SATMAR is a 6U nanosatellite developed entirely by Alén Space in collaboration with Egatel and the technology center Gradiant, funded by the Ports 4.0 initiative led by Puertos del Estado and the Spanish Port Authorities. The mission’s primary objective is to validate the new VHF Data Exchange System (VDES) standard in orbit, which is designed to replace the current Automatic Identification System (AIS) by enabling bidirectional satellite communications in the VHF band.

-

In February 2025, Space Norway commissioned a new geostationary satellite named Thor 8, set for launch in 2027, to provide Ka-band connectivity primarily for the maritime and offshore sectors across the Middle East, Europe, and Africa. Built by Thales Alenia Space, Thor 8 will feature three dedicated payloads operating on Ku and Ka bands and is designed for a lifespan exceeding 15 years. The satellite will deliver high-speed, reliable data communications to commercial maritime clients and national authorities, supporting Very Small Aperture Terminal (VSAT) services on ships.

Maritime Satellite Communication Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.74 billion

Revenue forecast in 2033

USD 11.03 billion

Growth rate

CAGR of 11.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report revenue source

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, revenue source, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Inmarsat Global Limited; Iridium Communications Inc.; Leonardo S.p.A.; Thuraya Telecommunications Company; ViaSat Inc.; Orbcomm Inc.; KVH Industries, Inc.; Singapore Technologies Engineering Ltd; EchoStar Corporation; Kongsberg Maritime AS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maritime Satellite Communication Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global maritime satellite communication market report based on type, revenue source, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Very Small Aperture Terminal (VSAT)

-

Ka-Band

-

C-Band

-

Others

-

-

Mobile Satellite Services (MSS)

-

-

Revenue Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Naval Vessel

-

Commercial Vessels

-

Leisure Vessels

-

Offshore Oil Rigs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global maritime satellite communication market size was estimated at USD 4.33 billion in 2024 and is expected to reach USD 4.74 billion in 2025.

b. The global maritime satellite communication market is expected to witness a compound annual growth rate of 11.1% from 2025 to 2033 to reach USD 11.03 billion by 2033.

b. Asia Pacific dominated the maritime satellite communication market with a share of 34.6% in 2024. This is attributable to the increasing adoption of VSAT technologies in merchant and cruise ships in the region.

b. Some key players operating in the maritime satellite communication market include Inmarsat Global Limited; Iridium Communications Inc.; Leonardo S.p.A.; Thuraya Telecommunications Company; ViaSat Inc.; Orbcomm Inc.; KVH Industries, Inc.; Singapore Technologies Engineering Ltd; EchoStar Corporation; Kongsberg Maritime AS.

b. Key factors that are driving the market growth include rising need for reliable and cost-effective communication services across waterways and investments by key maritime communication equipment manufacturers to introduce affordable variants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.