- Home

- »

- Next Generation Technologies

- »

-

Mobile Satellite Services Market Size & Share Report, 2030GVR Report cover

![Mobile Satellite Services Market Size, Share, & Trends Report]()

Mobile Satellite Services Market (2023 - 2030) Size, Share, & Trends Analysis Report By Service (Voice, Data), By Application (Land Mobile, Maritime, M2M Services), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-071-4

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Satellite Services Market Summary

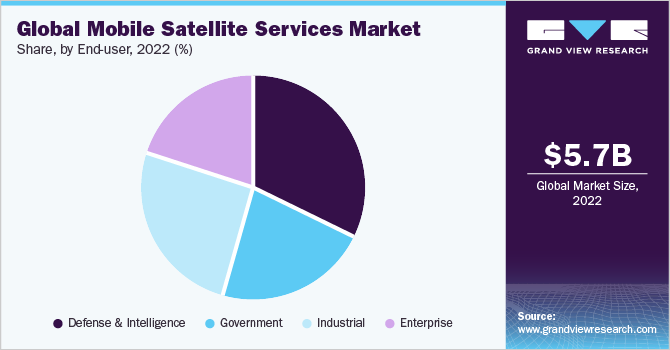

The global mobile satellite services market size was estimated at USD 5.74 billion in 2022 and is projected to reach USD 9.65 billion by 2030, growing at a CAGR of 6.8% from 2023 to 2030. Mobile satellite services (MSS) utilize satellite technology to offer voice and data communication services to mobile users across the globe, regardless of their location on land, sea, or air.

Key Market Trends & Insights

- The North America dominated the mobile satellite services market in 2022 and accounted for a revenue share of over 31.0%.

- The Asia Pacific region is experiencing the highest growth in the mobile satellite services market, driven by several factors.

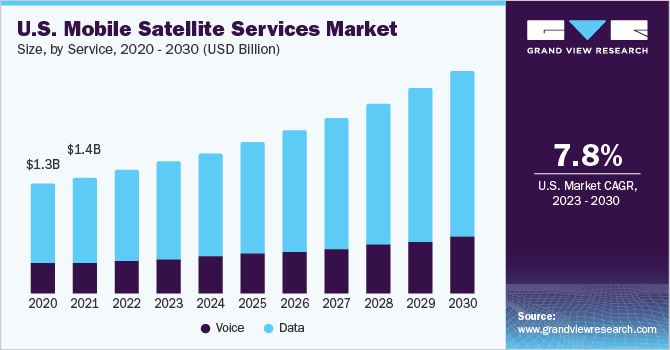

- Based on service, the data segment dominated the market in 2022 and accounted for a revenue share of more than 74.0%.

- Based on application, the land mobile segment dominated the market in 2022 and accounted for a revenue share of over 34.0%.

- Based on end-user, the defense & intelligence segment dominated the market in 2022 and accounted for a revenue share of more than 32.0%.

Market Size & Forecast

- 2022 Market Size: USD 5.74 Billion

- 2030 Projected Market USD 9.65 Billion

- CAGR (2023-2030): 6.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Mobile satellite services are witnessing significant growth owing to the increasing need for global connectivity, particularly in remote and rural areas where terrestrial infrastructure is insufficient. The market is expected to continue its growth trajectory in the coming years, primarily driven by the surging usage of mobile data and the growing adoption of satellite-based Internet of Things (IoT) applications.

Mobile satellite services are a means of providing communication services to mobile devices using satellite technology. Mobile satellite services are witnessing significant growth due to the increasing demand for connectivity solutions in remote, underserved, and rural areas where traditional terrestrial networks are either not functional or unavailable. One of the trends in this market is the usage of mobile satellite services during emergencies and natural disasters.

According to the Emergency Events Database EM-DAT, 2022 witnessed more than 387 natural disasters and hazards worldwide, resulting in the loss of 30,704 lives and affecting 185 million individuals. Moreover, the economic losses caused by these natural disasters reached around USD 223.8 billion. The considerable damages resulting from natural disasters have created a pressing need for solutions that can alert and connect people stuck in such hazardous situations. In this context, mobile satellite services prove to be highly beneficial as they are resilient to disaster damage.

Telecom operators and mobile satellite service providers are joining forces to tackle the issue of inadequate network coverage in remote areas. The main objective of these partnerships is to offer network connectivity in regions where the existing terrestrial network falls short. These efforts are anticipated to close the network gap and propel the expansion of the mobile satellite services industry in the foreseeable future. In addition to personal or consumer-level network connectivity, business operations in remote locations, such as the marine, mining, oil and gas, and defense sectors, face multiple challenges due to minimal access to terrestrial networks. As a result, these industries are increasingly turning to satellite-based connectivity, which is fueling the growth of mobile satellite services.

The adoption of mobile satellite services is significantly threatened by unique cybersecurity challenges. The mobile satellite services rely on a combination of ground-based technologies and satellite operations, which provide cybercriminals with ample opportunities for hacking through ground contact points. A key vulnerability that all satellite systems face is the need for uplinks and downlinks to go through the security protocols of telecom networks, which can be easily accessed by cybercriminals. This poses a major obstacle to the growth of mobile satellite services. However, satellite operators are implementing technological advancements and robust security measures to provide cutting-edge security to the mobile satellite services industry. This is expected to address cybersecurity concerns and mitigate its impact on market growth.

COVID-19 Impact Analysis

The COVID-19 pandemic had a widespread impact on various industries, including the mobile satellite services sector. Although mobile satellite communications proved beneficial in facilitating uninterrupted communication in remote areas during the pandemic, global supply chain disruptions caused delays in new product and component deliveries. In addition, workforce shortages negatively affected mobile satellite services. To curb the spread of the virus, governments across the globe implemented measures such as travel and material movement restrictions, which significantly impacted industries such as marine and aviation. These industries are among the primary consumers of mobile satellite services for maritime and in-flight connectivity. Consequently, reduced demand from these sectors harmed the growth of mobile satellite services. However, as the market recovers from the pandemic's adversities, it is expected to grow over the forecast period.

Service Insights

The data segment dominated the market in 2022 and accounted for a revenue share of more than 74.0%. The segment is anticipated to grow at the fastest growth rate during the forecast period. One of the primary factors driving the growth of the segment is the increasing demand from industries like aviation, marine, emergency response, and oil and gas, for high-capacity and high-speed data services in challenging and remote locations. These sectors require reliable and secure communication of data for various applications such as asset tracking, video surveillance, and remote monitoring. Furthermore, the need for a consistent and dependable connection is driving growth in this market segment, especially in urban and suburban areas where terrestrial infrastructure is available.

The services segment is anticipated to register substantial growth over the forecast period. The growth in this market segment can be attributed to the rising demand for dependable and secure communication services in remote areas and regions affected by disasters, where terrestrial infrastructure may not be available or damaged. This demand is driven by various industries, including maritime, oil and gas, emergency response, and aviation, where reliable voice communication is essential for operational safety and efficiency. Additionally, the adoption of 5G technology and High-Throughput Satellite (HTS) systems is fueling the growth of voice services in the mobile satellite services industry. 5G technology provides higher bandwidth and faster data rates, while HTS systems offer increased capacity and more efficient utilization of satellite resources, allowing mobile satellite service providers to offer advanced voice services, such as high-definition voice and video calls. Furthermore, the use of Software Defined Radios (SDRs) is enabling MSS providers to offer more scalable and flexible voice services, as SDRs can adapt to different network configurations and frequency bands.

Application Insights

The land mobile segment dominated the market in 2022 and accounted for a revenue share of over 34.0%. The segment is estimated to grow at the highest CAGR during the forecast period. The growth of the segment is attributed to its extensive usage of mobile satellite services in land mobile applications that require reliable and secure connectivity in remote locations where terrestrial infrastructure is not feasible. For instance, in mining operations, MSS can be utilized for remote monitoring purposes like equipment monitoring, asset tracking, and safety monitoring, enhancing productivity and safety while reducing costs.

In emergency response scenarios, such as natural disasters or accidents, where terrestrial communication infrastructure may be damaged or disrupted, MSS can serve as a dependable means of communication and data connectivity for first responders and emergency management organizations. By utilizing mobile satellite services, organizations can effectively coordinate their efforts and communicate with each other, which increases the adoption of MSS for land mobile applications.

The M2M segment is anticipated to witness significant growth through the forecast period. The ability of MSS to offer secure connectivity for M2M services operating in inaccessible areas, where terrestrial networks may not be available or reliable, is a major factor contributing to the segment growth. M2M services involve the exchange of data between two or more devices without human intervention, and MSS capabilities are increasingly being integrated into these devices. This allows companies to track and monitor the movement, location, and condition of assets such as containers, vehicles, and other equipment. MSS is also being used for remote monitoring and control of equipment and systems in various industries, including utilities, agriculture, and environmental monitoring. Such factors bode well for the growth of the segment over the forecast period.

End-user Insights

The defense & intelligence segment dominated the market in 2022 and accounted for a revenue share of more than 32.0%. The defense and intelligence sector has witnessed an increase in the adoption of mobile satellite services due to the growing demand for reliable and secure communication in remote and challenging environments. These services are employed in unmanned aerial vehicles to offer real-time Intelligence, Surveillance, and Reconnaissance (ISR) capabilities. Furthermore, the growing utilization of these services for secure data and voice communication in tactical environments enables troops to communicate effectively in areas where terrestrial networks are not feasible or dependable, which is driving the growth of this segment.

The industrial segment is expected to witness the highest growth rate during the forecast period. The increased use of machine learning and IoT technologies in industrial settings is driving the adoption of MSS for remote monitoring and data transfer of devices and sensors. This enables businesses to make data-driven decisions and improve their operational efficiency.

Applications of mobile satellite services include remote asset management in the mining and oil & gas industries, where they enable companies to monitor and control equipment and facilities from afar. These services also provide reliable communication capabilities for workers in remote locations. Furthermore, the growing need for sustainable energy is boosting the use of MSS in the renewable energy sector, particularly for the remote monitoring and control of solar and wind farms.

Regional Insights

North America dominated the mobile satellite services market in 2022 and accounted for a revenue share of over 31.0%. The increasing adoption of mobile satellite services in North America is driven by the necessity for dependable and accessible connectivity in remote regions. Several regions in North America, particularly rural and isolated areas, lack access to conventional telecommunications infrastructure. Mobile satellite services serve as a viable substitute for traditional networks, allowing individuals in these areas to remain connected.

The Asia Pacific region is experiencing the highest growth in the mobile satellite services market, driven by several factors, including the growing proliferation of smartphones, the development of digital infrastructure, and efforts taken by regional governments to implement 5G networks. Advancements in digital infrastructure, such as high-speed internet networks, fiber-optic connectivity, and satellite communication systems, are rapidly taking place in the region. These developments are generating opportunities for mobile satellite service providers to offer dependable and high-quality communication services to underserved and remote regions, where traditional networks may be limited. The enhanced digital infrastructure is facilitating better connectivity, and mobile satellite services are being utilized to fill the gaps in coverage and provide connectivity in remote areas.

Key Companies & Market Share Insights

The mobile satellite services market can be described as a moderately consolidated market with a presence of established mobile network operators, technology providers, and startups, each with their own unique strengths and capabilities. Key market players are seeking partnership and collaboration opportunities to provide innovative solutions to their customers and gain a significant share in the mobile satellite services industry. In February 2023, Ligado Networks and Omnispace, a telecommunication and satellite company, announced that signed a Memorandum of Understanding (MOU) to merge their licensed mobile satellite services spectrum. This partnership is aimed at creating the most advanced space-based, direct-to-device solutions for global text, voice, and data connectivity.

Mobile network operators are focused on developing advanced solutions to compete with other players. For instance, in March 2023, the Saudi Telecommunication Company signed an agreement with AST SpaceMobile, Inc., a U.S.-based satellite communications company, to create cutting-edge telecom solutions and satellite-based digital services to increase access to mobile services. Moreover, some MSS providers also offer Broadcast Satellite Services (BSS) services, such as satellite TV programming, to expand their offerings and generate additional revenue streams. Some prominent players in the global mobile satellite services market include:

-

Viasat, Inc.

-

SES S.A.

-

Intelsat S.A.

-

Telesat Corporation

-

EchoStar Corporation

-

Thuraya Telecommunications Company

-

Iridium Communications Inc.

-

SKY Perfect JSAT Holdings Inc.

-

Vizocom

-

Speedcast

Mobile Satellite Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.07 billion

Revenue forecast in 2030

USD 9.65 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Service, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Viasat, Inc.; SES S.A.; Intelsat S.A.; Telesat Corporation; EchoStar Corporation; Thuraya Telecommunications Company; Iridium Communications Inc.; SKY Perfect JSAT Holdings Inc.; Vizocom; Speedcast

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

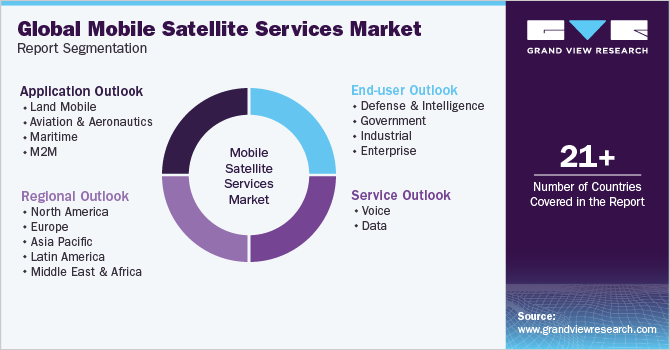

Global Mobile Satellite Services Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global mobile satellite services market report based on service, application, end-user, and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Voice

-

Data

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Land Mobile

-

Aviation & Aeronautics

-

Maritime

-

M2M

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Defense & Intelligence

-

Government

-

Industrial

-

Enterprise

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile satellite services market size was estimated at USD 5.74 billion in 2022 and is expected to reach USD 6.07 billion in 2023

b. The global mobile satellite services market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 9.65 billion by 2030.

b. North America dominated the mobile satellite services market with a share of 31.33%% in 2022. The increasing adoption of mobile satellite services in North America is driven by the necessity for dependable and accessible connectivity in remote regions.

b. Some key players operating in the mobile satellite services market include Viasat, Inc., SES S.A., Intelsat S.A., Telesat Corporation, EchoStar Corporation, Thuraya Telecommunications Company, Iridium Communications Inc., SKY Perfect JSAT Holdings Inc., Vizocom, Speedcast.

b. Key factors that are driving the mobile satellite services market growth include Growing demand for network coverage from individuals and businesses and increasing use of satellite communications in government & defense sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.