- Home

- »

- Clinical Diagnostics

- »

-

MEA Biomarker-based Immunoassays Market Report, 2033GVR Report cover

![Middle East & Africa Biomarker-based Immunoassays Market Size, Share & Trends Report]()

Middle East & Africa Biomarker-based Immunoassays Market (2025 - 2033) Size, Share & Trends Analysis Report By Sample (Blood, Saliva) By Product (Reagents & Kits, Consumables), By Biomarker, By Diseases, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-724-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

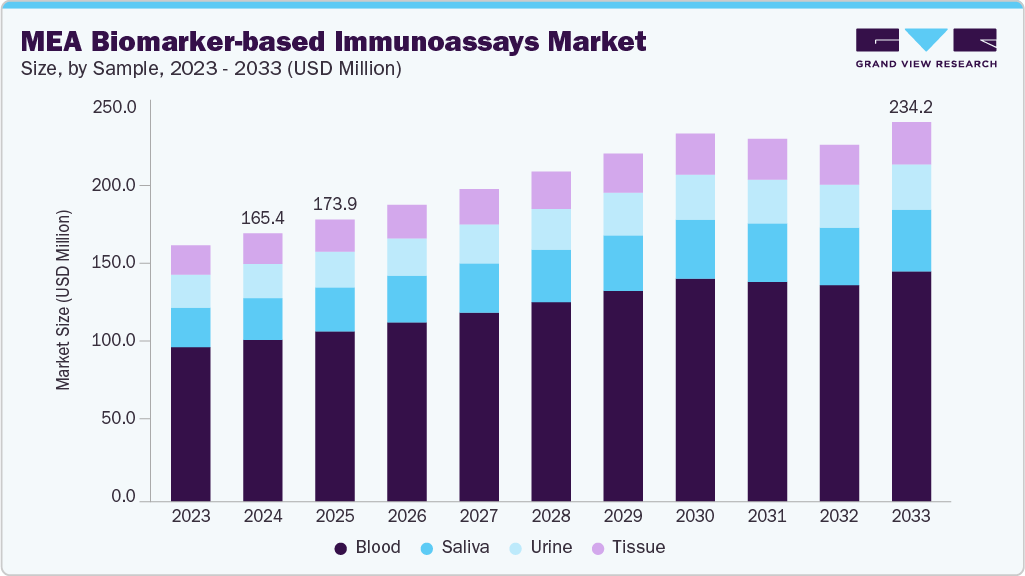

The Middle East and Africa biomarker-based immunoassays market size was estimated at USD 165.4 million in 2024 and is projected to reach USD 234.2 million by 2033, growing at a CAGR of 3.8% from 2025 to 2033. The market growth is fueled by the rising global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which require precise and early diagnostic tools. Increasing demand for personalized medicine has driven clinicians and pharmaceutical companies to adopt biomarker-guided strategies, where immunoassays play a central role in both disease detection and therapeutic monitoring. Countries like Saudi Arabia, the UAE, and South Africa are at the forefront, investing heavily in diagnostic infrastructure and adopting international best practices.

A key trend shaping the market is the growing collaboration between global diagnostic leaders and regional healthcare providers. For instance, in January 2025, Diatech Pharmacogenetics expanded its collaboration with Merck to extend access to RAS biomarker testing for colorectal cancer patients in MEA, underscoring the region’s rising focus on personalized cancer care. Such partnerships not only expand the availability of advanced biomarker assays but also accelerate technology transfer and capacity building across the region. This trend indicates that international companies view MEA as a critical growth frontier for precision diagnostics.

The MEA region offers untapped potential for biomarker-based immunoassays due to its expanding healthcare infrastructure and growing demand for precision medicine. Governments across Saudi Arabia, the UAE, and South Africa are investing heavily in advanced diagnostics to reduce dependence on overseas testing, which creates a strong opening for localized manufacturing and technology transfer. In addition, the rising prevalence of lifestyle-related diseases, combined with an increasing focus on early detection and personalized treatment, is driving adoption of biomarker assays in oncology, cardiology, and neurology. The growing emphasis on value-based care also positions biomarker testing as a cost-efficient solution, supporting earlier interventions and better patient outcomes.

Strategic collaborations are playing a critical role in shaping the MEA biomarker ecosystem. In 2025, Diatech Pharmacogenetics expanded its partnership with Merck to improve colorectal cancer care in the region through RAS biomarker testing, highlighting the momentum in companion diagnostics. Similarly, partnerships between diagnostic technology providers like IBL International and Grifols are advancing biomarker panels that could see uptake in MEA’s expanding clinical research networks. Meanwhile, local institutions, such as King Faisal Specialist Hospital in Saudi Arabia, are launching advanced biomarker testing programs that integrate with global standards, underscoring the region’s commitment to becoming a hub for innovation in precision diagnostics.

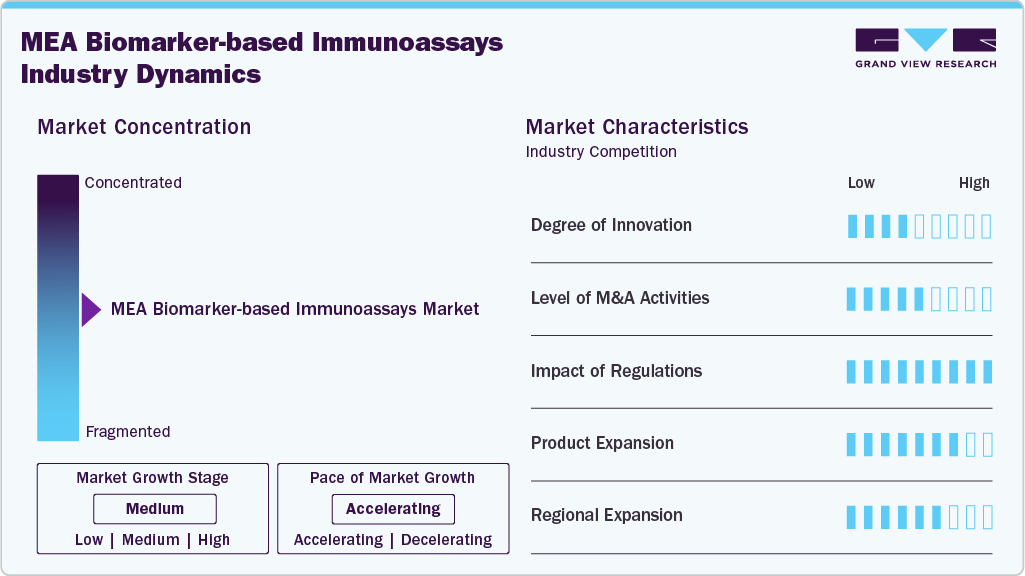

Market Concentration & Characteristics

The MEA biomarker-based immunoassays industry reflects a medium degree of innovation, with global players introducing advanced blood and saliva-based assays while local firms focus on distribution and adaptation rather than in-house R&D. Most product innovation is import-led, with multinational IVD companies introducing updated reagents/kits and analyzers that fit existing CE-IVD/ISO frameworks. Local innovation concentrates on service delivery: decentralized sample collection, hub-and-spoke logistics, connectivity to LIS/HIS, and verification/validation of global assays for local populations.

The MEA biomarker-based immunoassays industry has experienced a moderate level of merger and acquisition activity, with companies aiming to broaden their product portfolios and strengthen technological capabilities. Private hospital groups and insurance-backed providers in the GCC continue to integrate diagnostics to control turnaround time and cost, often via joint ventures or management agreements rather than outright acquisitions

Many MEA biomarker-based immunoassays industry accept CE-IVD marking and ISO 13485 as baseline evidence, with additional local registration at national authorities (e.g., SFDA in Saudi Arabia, MOHAP/DOH in the UAE, SAHPRA in South Africa, and national drug/device authorities in Egypt, Morocco, Kenya). GCC unified procurement and Saudi’s NUPCO frameworks influence platform selection by tying reimbursement and supply to approved vendor lists and performance criteria.

Product expansion in the MEA biomarker-based immunoassays industry has been largely import-driven, with multinational IVD companies introducing expanded reagent kits and analyzers tailored to oncology, infectious disease, and neurology. Cancer biomarker menus-particularly for breast, lung, and colorectal cancers-have gained traction in tertiary hospitals and specialized centers across Saudi Arabia, the UAE, Egypt, and South Africa, where screening initiatives are expanding. Infectious disease remains a critical driver, with companies continuing to introduce immunoassay products for HIV, hepatitis, and tuberculosis, often supported by global health programs.

Regional expansion in MEA is driven by rising demand for accessible and timely diagnostics, especially as healthcare infrastructure develops outside capital cities. In the GCC, expansion strategies focus on integrating advanced immunoassay platforms into new hospital projects and diagnostic networks, particularly in Saudi Arabia’s Vision 2030 healthcare transformation and the UAE’s private hospital growth. In North Africa, multinational companies are expanding through distribution partnerships in Egypt and Morocco, while local diagnostic chains are scaling reference labs to serve broader public and private markets.

Sample Insights

The blood segment led the market with the largest revenue share of 60.34% in 2024. Blood-based assays are widely adopted for oncology, infectious diseases, and cardiovascular testing due to their high accuracy, established clinical workflows, and integration into hospital and reference laboratory settings. In the GCC, particularly Saudi Arabia and the UAE, demand for advanced blood-based biomarker tests is supported by large-scale cancer screening programs and government-led precision medicine initiatives. For instance, Saudi Arabia’s Ministry of Health has been actively expanding national cancer screening campaigns under Vision 2030, which emphasizes early detection through advanced diagnostics.

The saliva segment is anticipated to grow at the fastest CAGR of 4.3% over the forecast period. Saliva-based assays are increasingly being recognized in wellness testing, infectious disease diagnostics, and preventive healthcare programs, particularly in urban centers of the GCC where consumer-driven health monitoring is gaining popularity. Countries like the UAE are seeing early adoption of saliva-based biomarker platforms in corporate wellness initiatives and personalized health services, reflecting growing awareness of preventive diagnostics. In Africa, saliva testing holds strong potential for infectious disease detection due to its ease of collection in low-resource and rural settings where blood sampling may not be feasible.

Product Insights

The reagents & kits segment led the market with the largest revenue share of 42.81% in 2024. Reagents and kits form the core of biomarker-based immunoassay activity across the Middle East & Africa, and they lead the market because they are the practical engine of clinical testing. Hospitals, public reference laboratories, and private diagnostic chains depend on validated, automation-ready kits that integrate smoothly with existing analyzers and quality systems. In GCC countries, ministries of health and large private providers prioritize platforms with stable reagent supply, traceable lot control, and strong vendor service levels. This favors standardized reagent menus for oncology (e.g., tumor markers), infectious disease (HIV, hepatitis, TB-related serology), cardiometabolic risk (troponin, BNP, HbA1c immunoassay formats), and women’s health.

The instruments/analyzers segment is anticipated to grow at the fastest CAGR of 6.1% over the forecast period. Instruments and analyzers are growing fastest as MEA countries upgrade laboratory infrastructure. GCC hospitals are replacing legacy platforms with high-throughput analyzers offering better connectivity, automation, and uptime. In North Africa, tenders favor analyzers with cost efficiency, reliability, and LIS integration. South Africa and regional hubs adopt standardized analyzers to support “hub-and-spoke” models, centralizing complex testing. Analyzer adoption is also rising as labs expand menus to include cancer and neurological biomarkers, reducing the need for overseas referrals. Vendors are driving growth with training centers, financing options, and local service support. Overall, demand for modernized platforms that deliver speed, accuracy, and scalability is making analyzers the fastest-growing product segment in MEA.

Biomarker Insights

The efficacy & pharmacodynamic biomarkers segment led the market with the largest revenue share of 35.08% in 2024. Hospitals and specialty centers in GCC states rely on these biomarkers to guide precision oncology and chronic disease management, while in North Africa, their use is growing through clinical trial collaborations and government-backed cancer programs. In South Africa, private laboratories increasingly employ these biomarkers to support individualized therapies and improve patient outcomes.

The predictive & prognostic biomarkers segment is expected to grow at the fastest CAGR of 5.6% over the forecast period. Private labs increasingly invest in prognostic testing to support preventive healthcare and reduce long-term treatment costs. Partnerships between global companies and regional research institutes are further accelerating adoption, particularly in neurology and oncology. As health systems shift toward proactive care, prognostic and predictive biomarkers are positioned for the fastest growth in MEA.

Diseases Insights

The cancer segment led the market with the largest revenue share of 38.97% in 2024. In the GCC, cancer programs receive strong government funding, with hospitals investing heavily in biomarker testing for breast, lung, and colorectal cancers. South Africa’s private sector has become a key driver, offering advanced biomarker panels to support personalized therapies and targeted treatments. International collaborations also play a major role, with pharma companies conducting clinical trials in the region that rely on cancer biomarker testing. With the rising cancer burden and government commitment to early detection, oncology continues to be the largest disease area for biomarker-based immunoassays in MEA.

The neurological segment is expected to grow at the fastest CAGR during the forecast period. Neurological disorders represent the fastest-growing segment as MEA countries face rising cases of Alzheimer’s, Parkinson’s, and other cognitive conditions linked to aging populations and lifestyle factors. In the GCC, hospitals are adopting blood-based and CSF biomarker tests for early Alzheimer’s diagnosis, supported by international partnerships. South African research institutions are increasingly participating in neurology-related clinical trials, expanding access to biomarker technologies. South Africa is seeing growing demand from private healthcare providers offering advanced diagnostics for neurodegenerative diseases, often in collaboration with multinational diagnostic firms.

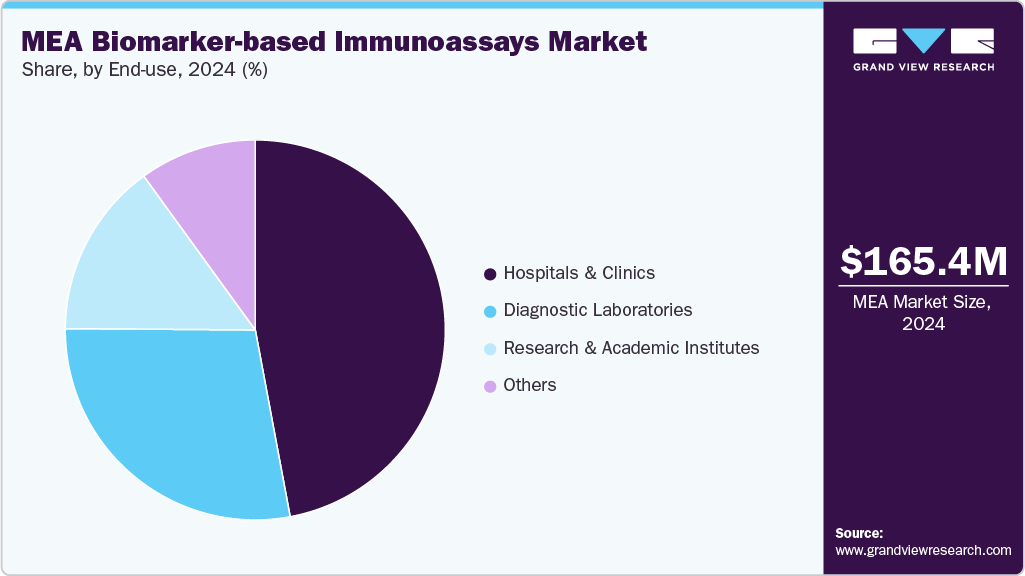

End-use Insights

The hospitals & clinics segment led the market with the largest revenue share of 47.06% in 2024. Hospitals and clinics often serve as the first point of care for patients, making them crucial centers for the adoption of biomarker-based immunoassays across disease areas such as oncology, cardiology, and neurology. Furthermore, the rising integration of immunoassay platforms within hospital diagnostic workflows enables physicians to implement more personalized treatment strategies, particularly as biomarker-driven therapies gain traction.

The diagnostic laboratories segment is expected to grow at the fastest CAGR of 3.7% over the forecast period. Hospitals, which primarily use immunoassays for immediate clinical needs, laboratories cater to large volumes of testing for clinical trials, public health programs, and specialized diagnostics, giving them a unique position in the ecosystem. The rising demand for outsourcing complex biomarker testing by pharmaceutical companies and smaller hospitals is further fueling growth in this segment.

Regional Insights

The biomarker-based immunoassays market in Middle East & Africa is expanding. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced diagnostic capabilities, with oncology and infectious diseases being primary areas of focus. In 2024, Siemens Healthineers partnered with healthcare providers in the UAE to deploy new immunoassay analyzers for cancer biomarker testing, reflecting growing regional demand. While adoption levels remain lower compared to developed markets, increasing collaborations with global diagnostic leaders are driving accessibility.

Saudi Arabia Biomarker-based Immunoassays Market Trends

The Saudi Arabia biomarker-based immunoassays market is growing, Saudi hospitals and research institutions are adopting biomarker-based immunoassays to address rising cancer and cardiovascular disease prevalence. In 2024, King Faisal Specialist Hospital and Research Centre launched a new biomarker testing program for oncology patients, highlighting the country’s commitment to advanced diagnostics. Partnerships with international diagnostic players are also expanding biomarker assay availability, making Saudi Arabia an important growth node in the region. the increasing prevalence of Cardiovascular Diseases (CVDs) and rising awareness about it is expected to drive the market.

According to ScienceDirect, by 2035, the prevalence of CVDs is estimated to reach 479,500. Similarly, according to the International Diabetes Atlas, in 2021, over 4.27 million people in the country had diabetes. In 2023, the nation is anticipated to witness a diagnosis of over 31,000 new cancer cases. Chronic diseases need constant support from diagnostics and immunoassays to make treatment possible, and thus, their growing prevalence is creating growth opportunities.

South Africa Biomarker-based Immunoassays Market Trends

The biomarker-based immunoassays market in South Africa is growing rapidly. Major diagnostic labs are investing in consumables and reagents & kits to meet demand in oncology, HIV, and cardiometabolic monitoring programs. In late 2024, a leading private pathology group introduced a multiplex immunoassay panel for simultaneous cardiovascular and liver function markers, bolstering kit consumption. Instruments are being upgraded in urban referral centers to improve automation and throughput, while Services like assay validation and analytical support are expanding regionally. Companies are launching novel products to aid the adoption of immunoassays in the country. For instance, HealthPulse TestNow, a digital application, was launched by Audere in April 2023 to support immunoassay self-testers in interpretation and administration in South Africa.

UAE Biomarker-based Immunoassays Market Trends

The UAE biomarker-based immunoassays market is anticipated to grow at a significant CAGR during the forecast period. Being a high-income country, the UAE government aims to provide universal access to updated and advanced healthcare services. Due to its vast financial resources and adequate government funding, the UAE immunoassay market is growing at a steady pace. In addition, ongoing public-private initiatives to facilitate the diagnosis of chronic diseases in the country are expected to create a conducive environment for growth.

Kuwait Biomarker-based Immunoassays Market Trends

The biomarker-based immunoassays market in Kuwait is expected to grow at a substantial CAGR during the forecast period. Due to the pandemic, diagnostic device companies partnered with the market players to improve testing in Kuwait. For instance, in March 2023, Mylab Discovery Solutions partnered with AstraGene, a diagnostic company, to develop automated molecular diagnostics for Kuwait. Adoption of such strategies and the high burden of COVID-19 in the country are expected to improve the availability of immunoassays in the region. Kuwait has shown an increased emphasis on early diagnosis and screening for improving patient outcomes. Screening solutions have witnessed certain novel advancements, such as the adoption of immunoassays and precision diagnosis with biomarkers.

Key MEA Biomarker-based Immunoassays Company Insights

Key participants in the MEA biomarker-based immunoassays industry are focusing on developing innovative testing solutions and securing necessary certifications to broaden their offerings. In addition, companies are entering into partnerships, collaborations, mergers, and acquisitions to strengthen their presence in the sector. These players are heavily investing in advanced technology and infrastructure, allowing them to efficiently process & analyze a large volume of samples. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Key MEA Biomarker-based Immunoassays Companies:

- F. Hoffmann-La Roche AG

- Abbott

- Thermo Fisher Scientific Inc

- Erofins Scientific

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc.

Recent Developments

-

In January 2025, Diatech Pharmacogenetics announced an expanded partnership with Merck to improve access to RAS (KRAS and NRAS) biomarker testing for colorectal cancer across the Middle East and Africa, underlining Saudi Arabia’s role as a regional hub for personalized diagnostics.

MEA Biomarker-based Immunoassays Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 173.9 million

Revenue forecast in 2033

USD 234.2 million

Growth rate

CAGR of 3.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample, product, biomarkers, diseases, end-use, country

Regional scope

MEA

Key companies profiled

F. Hoffmann-La Roche AG.; Abbott.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Biomarker-based Immunoassays Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the Middle East & Africa biomarker-based immunoassays market report based on the sample, product, biomarkers, diseases, end-use, and country.

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood

-

Tissue

-

Urine

-

Saliva

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Instruments/Analyzers

-

Reagent & Kits

-

Services

-

-

Biomarker Outlook (Revenue, USD Million, 2021 - 2033)

-

Safety & toxicity biomarkers

-

Efficacy & Pharmacodynamic Biomarkers

-

Predictive & Prognostic Biomarkers

-

Surrogate/Exploratory Biomarkers

-

-

Diseases Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer

-

Cardiovascular Diseases

-

Neurological Diseases

-

Immunological Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The MEA biomarker-based immunoassays market size was estimated at USD 165.4 million in 2024 and is expected to reach USD 173.9 million in 2025.

b. The MEA biomarker-based immunoassays market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033 to reach USD 234.2 million by 2033.

b. The blood segment led the MEA biomarker-based immunoassays market in 2024 with a share of 60.33%. Blood has long been considered the gold standard for biomarker-based immunoassays because it offers direct access to systemic biomarkers that reflect disease progression and therapeutic response

b. Some key players operating in the market include F. Hoffmann-La Roche AG.; Abbott.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

b. Key factors that are driving the MEA biomarker-based immunoassays market growth include the rising global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which require precise and early diagnostic tools

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.