- Home

- »

- Clinical Diagnostics

- »

-

Predictive Biomarkers Market Size, Industry Report, 2030GVR Report cover

![Predictive Biomarkers Market Size, Share & Trends Report]()

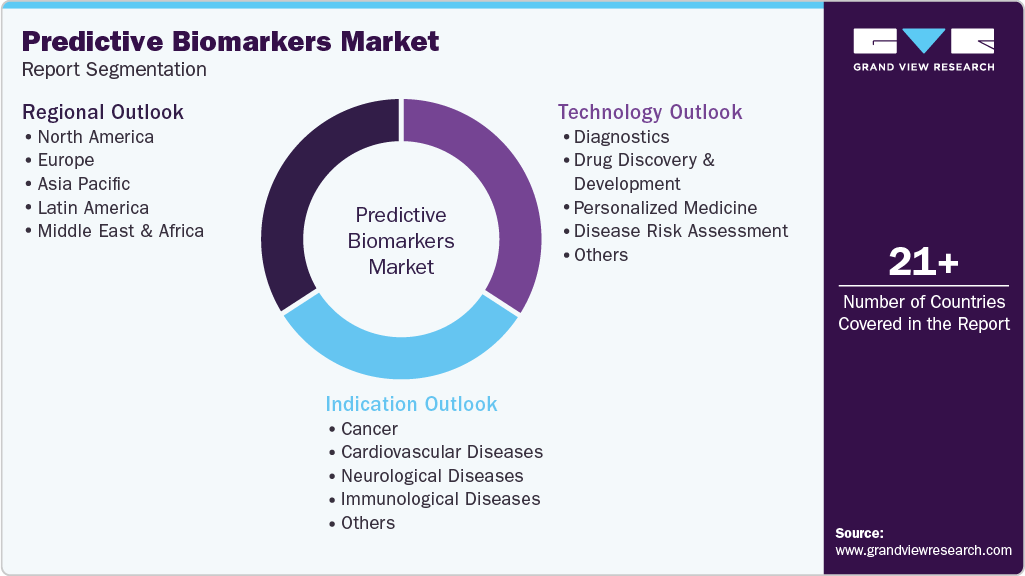

Predictive Biomarkers Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication, By Technology (Diagnostics, Drug Discovery & Development, Personalized Medicine, Disease Risk Assessment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-593-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Predictive Biomarkers Market Summary

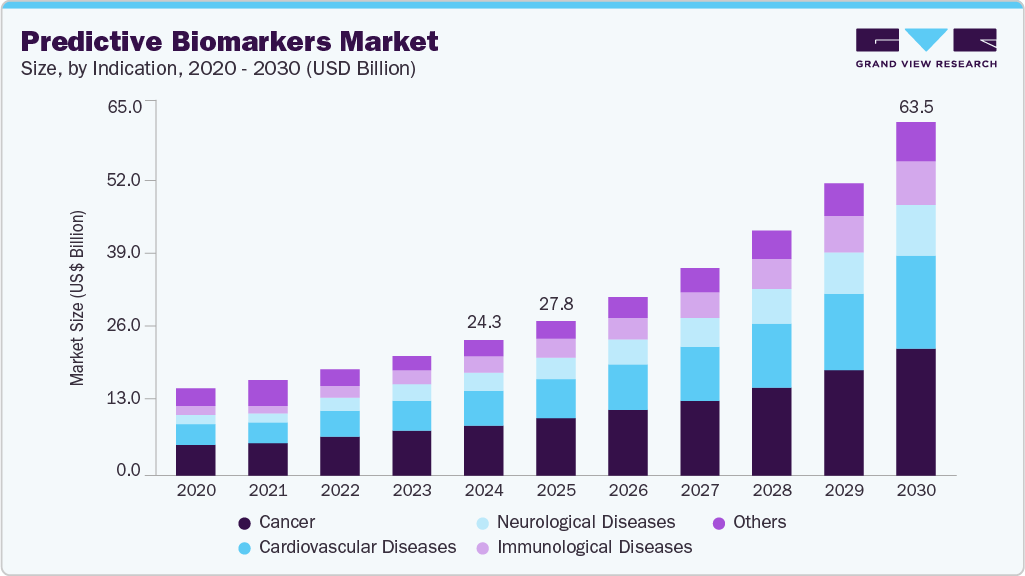

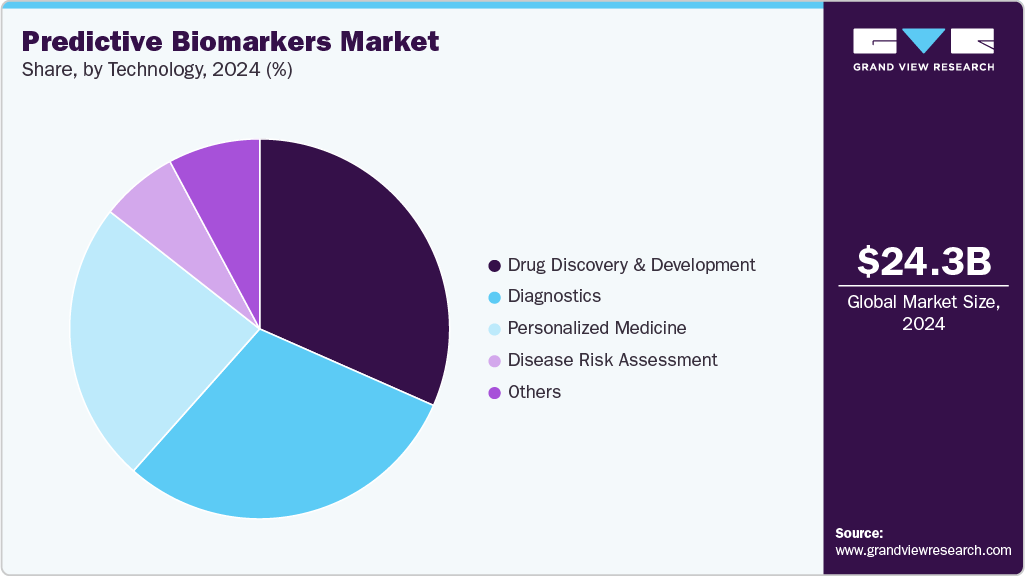

The global predictive biomarkers market size was estimated at USD 24.30 billion in 2024 and is projected to reach USD 63.54 billion by 2030, growing at a CAGR of 18.02% from 2025 to 2030. The market is experiencing significant growth driven by several factors such as advancements in genomics and precision medicines, increased investment in research and development and rising demand for early detection and personalized treatments.

Key Market Trends & Insights

- The North American predictive biomarker market held a revenue share of 43.83% in 2024.

- The U.S. predictive biomarker market, is experiencing significant growth.

- By technology, drug discovery and development segment is the largest segment in the predictive biomarker market accounting for 31.60% share in 2024.

- By indication, the cancer segment dominated the market accounting for largest share of revenue with 37.19% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.30 Billion

- 2030 Projected Market Size: USD 63.54 Billion

- CAGR (2025-2030): 18.02%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Research and development (R&D) is a major driver of growth in the predictive biomarkers market, fueling innovation and the discovery of new biomarker candidates. Genomics and precision medicine are at the forefront of medical technology, offering the potential for more targeted and effective treatments. Predictive biomarkers for the effects of interventions can reflect an individual's biological constituents ("host characteristics") or traits associated with the disease process or other medical conditions. The NHS and the government are making significant investments in these technologies, including the launch of the NHS Genomic Medicine Service. This service is dedicated to advancements in genomics to benefit patients by implementing genome sequencing, providing molecular diagnostics and genetic testing for cancer patients, and enhancing data integration to facilitate more effective treatments. Moreover, expertise in technology and data analytics with proficiency in developing new sequencing technologies, is achieved through collaborations that drive innovation and advance precision medicine for instance, in April 2025, Illumnia collaborated with Tempus AI to accelerate adoption of next generation sequencing tests for patients.

The growing investment in research and development (R&D) is a key driver of the predictive biomarkers market. Pharmaceutical companies, biotech firms, and academic institutions are dedicating significant resources to discovering new biomarkers and advancing diagnostic technologies. One prominent application for biomarker identification is next-generation sequencing (NGS), which can rapidly detect millions of DNA copies within a gene. This technology enables comprehensive profiling of multiple genes and mutations in a short amount of time. For example, Illumina’s NovaSeq X platform offers high-throughput sequencing for analyzing large sequences of data and diagnose the condition of disease. The increasing funding and collaborative efforts in biomarker discovery lead to the development of more effective and accurate predictive tests. This, in turn, is accelerating the growth of the predictive biomarkers market, supporting the next generation of healthcare innovations.

There is an increasing demand for early disease detection and personalized treatments, which is one of the key driver in predictive biomarkers market. Biomarkers provide valuable insights into an individual's health, helping identify diseases in their early stages before symptoms appear. Early detection enables more effective interventions, improving patient outcomes and reducing treatment costs. An important application of predictive biomarkers is in oncology, which demonstrates resistance to treatment that continues to be a leading cause of mortality in breast cancer patients, driving the need for the development of predictive biomarkers.

Innovative approaches, such as omics technologies and artificial intelligence, are being explored to identify highly accurate molecular or imaging biomarkers, with the potential to enhance treatment outcomes. Biomarkers are even gaining popularity incorporation into clinical trials for safety and efficacy tests. Predictive biomarkers may also become a part of these trials tailoring of medicines according to patient needs. As healthcare systems shift toward individualized medicine, predictive biomarkers play a crucial role in optimizing treatment regimens and ensuring the right therapy for each patient.

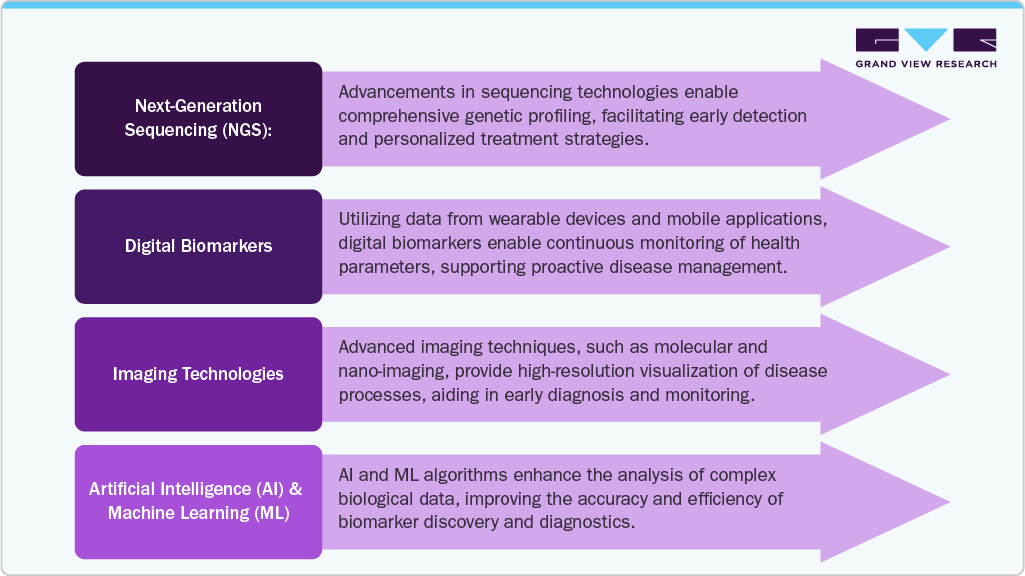

Technological drivers for predictive biomarkers in market

Technological drivers enhance the discovery, validation, and application of biomarkers by enabling faster, more accurate diagnostics and personalized treatments, accelerating the shift toward precision medicine and improving healthcare outcomes. Here are some key technological drivers in the market:

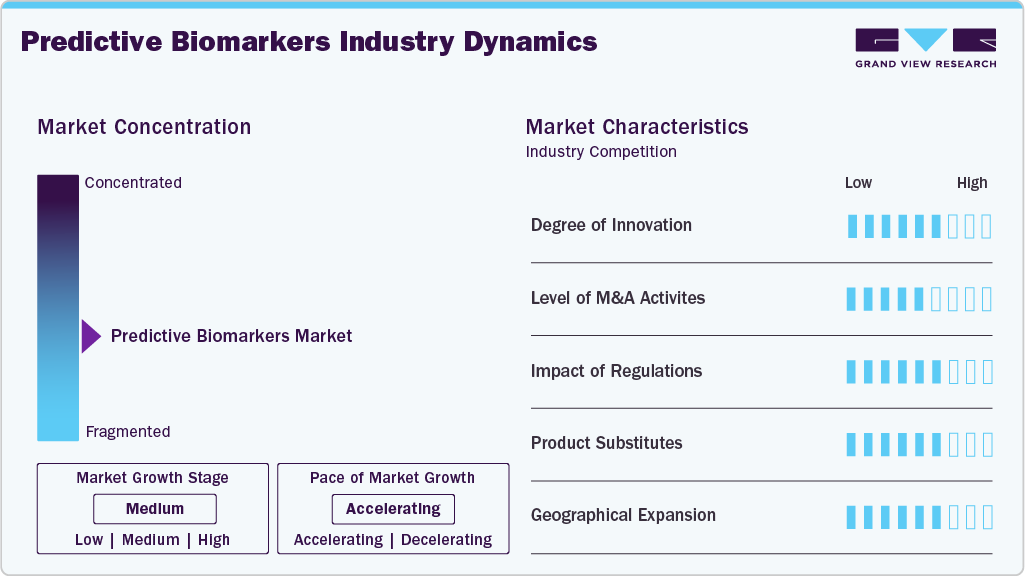

Market Concentration & Characteristics

The predictive biomarkers market is experiencing a surge in innovation, driven by advancements in genomics, proteomics, and artificial intelligence. These technologies enable the development of more accurate and personalized diagnostic tools, enhancing early disease detection and treatment efficacy. Collaborations between biotech firms and academic institutions are accelerating the discovery of novel biomarkers, particularly in oncology and neurology.

The predictive biomarkers sector is moderate increase in mergers and acquisitions, as companies seek to consolidate resources and expand their technological capabilities. Strategic partnerships and acquisitions enable firms to integrate complementary expertise, access proprietary biomarker platforms, and enhance their R&D pipelines. For instance, collaborations between pharmaceutical giants and AI-driven biotech startups are fostering the development of advanced diagnostic tools.

Regulatory frameworks play a pivotal role in shaping the predictive biomarkers market by ensuring the safety, efficacy, and ethical application of biomarker-based diagnostics. While stringent regulations can pose challenges, they also establish standardized protocols that facilitate market acceptance and reimbursement. Regulatory bodies are increasingly recognizing the importance of biomarkers in precision medicine, leading to the development of more streamlined approval processes. However, disparities in regulatory standards across regions can impact the global harmonization of biomarker applications, necessitating ongoing dialogue between stakeholders to align policies and promote international collaboration.

The emergence of alternative diagnostic modalities poses a challenge to the predictive biomarkers market. Technologies such as liquid biopsies, imaging techniques, and wearable health monitors offer non-invasive or minimally invasive options for disease detection and monitoring. These substitutes can complement or, in some cases, replace traditional biomarker tests, depending on the clinical context. While they provide additional tools for healthcare providers, they also intensify competition in the diagnostic space. Consequently, companies in the predictive biomarkers market must innovate continuously to maintain their competitive edge and demonstrate the unique value of their offerings.

Geographical expansion is a key strategy for growth in the predictive biomarkers market, as companies aim to tap into emerging markets with increasing healthcare demands. Regions such as Asia Pacific and Latin America present significant opportunities due to their large patient populations and evolving healthcare infrastructures. Establishing a presence in these areas allows companies to leverage local partnerships, adapt to regional healthcare needs, and navigate regulatory landscapes effectively. Moreover, expanding into diverse markets facilitates the collection of varied clinical data, enhancing the robustness and applicability of biomarker-based diagnostics across different populations.

New applications and innovations of predictive biomarkers market

New applications and innovations in the predictive biomarkers market are expanding rapidly, particularly in personalized medicine, cancer detection, and chronic disease management. Some notable developments include:

-

Multi-Omics Integration: Combining genomics, proteomics, transcriptomics, and metabolomics data allows for a more comprehensive understanding of disease mechanisms, improving biomarker discovery and enabling precision diagnostics.

-

Immunotherapy Biomarkers: In oncology, predictive biomarkers are being developed to assess the effectiveness of immunotherapies, helping identify patients most likely to benefit from treatments such as checkpoint inhibitors.

-

Genomic and Proteomic Profiling: Advances in sequencing technologies allow for deeper analysis of individual genomes and proteins, offering insights into complex diseases such as Alzheimer's and cancer, and enabling tailored treatments.

-

CRISPR and Gene Editing Technologies: The use of CRISPR technology is enabling precise gene editing to investigate disease-causing mutations. This not only aids in identifying predictive biomarkers for genetic disorders but also supports personalized treatment strategies by targeting specific genetic alterations.

-

Exosome and Circulating RNA Biomarkers: The exploration of exosomes and circulating RNA as biomarkers is opening new pathways for detecting diseases such as cancer and neurological disorders at early stages. These extracellular vesicles carry genetic information that can serve as indicators of disease.

- Nanotechnology in Biomarker Detection: Nanotechnology is being employed to enhance the sensitivity and accuracy of biomarker detection methods. Nanomaterials, such as nanoparticles, are used to improve the capture and analysis of biomarkers, leading to faster and more precise diagnostics, especially for cancer and infectious diseases.

These advancements represent the forefront of the predictive biomarkers market, with the potential to revolutionize how diseases are diagnosed, treated, and managed, further enhancing the move toward personalized medicine.

Indication Insights

The cancer segment dominated the market accounting for largest share of revenue with 37.19% in 2024, driven by the growing demand for early diagnosis, personalized treatment, and monitoring of treatment responses. The ability to identify specific genetic mutations, protein expressions, and other molecular alterations in cancer cells has transformed oncology, allowing for targeted therapies and improved patient outcomes. For instance, in September 2024, Phase III trial TROPION-Lung01, a new computational pathology-based biomarker TROP2 for datopotamab deruxtecan was predictive of clinical outcomes in patients with non-small cell lung cancer (NSCLC). This innovative biomarker assessment underscores the potential of computational pathology in enhancing personalized treatment strategies for NSCLC.The increasing adoption of immunotherapies and the need for companion diagnostics to predict patient responses further fuel the growth of the predictive biomarker market in oncology, solidifying cancer as the largest and most dynamic segment in this space.

Immunological diseases segment was found to be the fastest growing segment amongst all over the forecast period. Conditions such as rheumatoid arthritis, multiple sclerosis, and lupus benefit significantly from predictive biomarkers that can identify disease onset, predict flare-ups, and monitor treatment responses. Biomarkers such as anti-citrullinated protein antibodies (ACPA) in rheumatoid arthritis and serum cytokines in autoimmune disorders help in diagnosing and stratifying patients for specific therapies, such as biologics. For example, in July 2024, Scipher Medicine, introduced an innovative method for biomarker development with the release of its novel, patent-pending framework, PRoBeNet (Predictive Response Biomarkers using Network Medicine) for autoimmune treatments. Advancements in genomic and proteomic profiling are improving the understanding of immunological disease mechanisms and enabling the development of personalized treatments, which are more effective and have fewer side effects. Combining rise of biologic therapies and precision medicine, immunological diseases are becoming a major focus area for biomarker development, further expanding the market's growth potential.

Technology Insights

Drug discovery and development segment is the largest segment in the predictive biomarker market accounting for 31.60% share in 2024, fueled by the need to enhance the efficiency and success rates of clinical trials. Predictive biomarkers enable pharmaceutical companies to identify patient subgroups most likely to respond to new therapies, reducing trial failures and accelerating regulatory approvals. These biomarkers also help in optimizing drug dosing and monitoring safety, leading to more personalized and effective treatments. Advances in genomics, proteomics, and bioinformatics are driving biomarker discovery, allowing for more precise targeting of diseases. As personalized medicine becomes the standard, the integration of predictive biomarkers into drug development pipelines is rapidly expanding, making this segment a key growth driver.

The diagnostics segment is the fastest growing segment within the predictive biomarker market, driven by the increasing demand for early detection, accurate disease diagnosis, and personalized treatment plans. Predictive biomarkers are essential in identifying disease risk, guiding therapeutic decisions, and monitoring treatment response. The growing adoption of non-invasive diagnostic methods, including liquid biopsies and genomic testing, further fuels the market by offering precise, rapid, and cost-effective diagnostic solutions. With advancements in technology and an increasing focus on personalized medicine, the diagnostic application of predictive biomarkers continues to drive market growth, positioning it as the dominant segment.

Regional Insights

The North American predictive biomarker market held a revenue share of 43.83% in 2024, driven by rising chronic disease prevalence, increased demand for personalized medicine, and advancements in non-invasive diagnostic technologies. Research is accelerating the market growth with continuous clinical trials for various medicinal indications such as, in November 2022, Phase 4 REFINE-ALS study aimed to identify predictive biomarkers to evaluate the effects of RADICAVA (edaravone) in individuals with amyotrophic lateral sclerosis (ALS) which was conducted in collaboration with the Neurological Clinical Research Institute (NCRI) at Massachusetts General Hospital (MGH), REFINE-ALS is a prospective, observational, multi-center study involving ALS patients in the U.S. and Canada who have started treatment with RADICAVA. Innovations leveraging artificial intelligence for biomarker discovery and treatment response prediction are accelerating market growth, alongside strong government support and substantial R&D investments in healthcare infrastructure.

U.S. Predictive Biomarkers Market Trends

The U.S. predictive biomarker market, is experiencing significant growth driven by the rising prevalence of chronic diseases, increasing demand for personalized medicine, advanced healthcare infrastructure, and strong government and private investments in R&D. Major players lead the market through collaborations among companies for instance, in January 2024, Genialis, and Debiopharm have collaborated to identify and discover biomarkers utilizing Genialis’ biology-first, machine learning-powered ResponderID platform to develop predictive biomarkers related to DNA Damage Repair (DDR) biology . Advancements in AI and machine learning enhance biomarker discovery, treatment response prediction, and non-invasive diagnostic technologies, fueling market expansion.

Europe Predictive Biomarkers Market Trends

The predictive biomarker market in Europe is moderately expanding driven by rising demand for precision therapies, especially in oncology and genetic disorders, increased adoption of non-invasive liquid biopsy technologies, and strong policy support and research funding. Major players such as Thermo Fisher Scientific, Hoffmann-La Roche, Illumina, and Bio-Rad Laboratories lead the market. Advances in AI, next-generation sequencing, and liquid biopsies are enhancing biomarker discovery and personalized medicine adoption across the region.

The UK predictive biomarker market is steadily growing, driven by rising cancer and chronic disease prevalence, increasing adoption of precision medicine, and expanding healthcare infrastructure. Government support, growing investments in biomarker-based diagnostics, and collaborations between academia and industry further fuel growth. Advancements such non-invasive testing, single-cell sequencing, and digital health tools are enhancing biomarker discovery and personalized treatment, ensuring improved patient outcomes and healthcare sustainability.

The predictive biomarker market in Germany is experiencing steady growth, driven by increasing R&D investments, expanding healthcare infrastructure, and rising incidence of cancer and genetic disorders. Strong collaborations between academic institutions, pharmaceutical companies, and contract research organizations (CROs) further fuel innovation. Key players include Thermo Fisher Scientific, Hoffmann-La Roche, Qiagen, Illumina, Merck KGaA, and Siemens Healthineers accelerate market growth. Research and development are gaining momentum for instance, in May 2025, NeutroFlow, had been awarded a USD 2.83 million grant from the EIC Transition Programme to advance the development of a predictive biomarker test for immunotherapy response.

Asia Pacific Predictive Biomarkers Market Trends

Asia Pacific predictive biomarkers market is anticipated to witness the fastest growth of 19.75% CAGR over the forecast period driven by rising chronic and non-communicable diseases, expanding precision medicine adoption, and advancements in genomics and digital health technologies. Government funding and increased R&D investments in countries such as China, Japan, India, South Korea, and Australia fuel innovation and market expansion. Technological progress in next-generation sequencing, AI-driven biomarker analysis, and non-invasive diagnostics are enhancing early disease detection and personalized treatment, positioning the region as the fastest-growing market globally.

The China predictive biomarker market is rapidly growing, driven by increasing cancer prevalence, government support for precision medicine, and rising healthcare investments. Key drivers include advancements in genomic technologies and growing demand for personalized therapies. Continuous advancements in AI and NGS (Next-Generation Sequencing) technologies further enhance predictive accuracy, fueling the competitive landscape in China’s biomarker market. Continuous advancements in AI and NGS (Next-Generation Sequencing) technologies further enhance predictive accuracy, fueling the competitive landscape in China’s biomarker market.

Japan predictive biomarker market is experiencing significant growth, driven by an aging population, rising cancer incidence, and advancements in genomics and molecular biology. Government initiatives such as the Cancer Genome Screening Project and collaborations between academia and industry are accelerating biomarker adoption in oncology. Innovations in analytical technologies, such as next-generation sequencing, AI-driven biomarker analysis, and non-invasive diagnostics, are enhancing early disease detection and personalized medicine, strengthening Japan’s position as a leader in biomarker development and precision healthcare

Latin America Predictive Biomarkers Market Trends

Latin America predictive biomarkers market is anticipated to grow at a substantial growth rate over the forecast period. Growth is driven by increasing prevalence of chronic diseases, rising adoption of personalized medicine, expanding digital health technologies, and government support for healthcare modernization. Key players include Thermo Fisher Scientific, Hoffmann-La Roche, Qiagen, Bio-Rad Laboratories, and Danaher Corporation. Advancements in AI, machine learning, wearable devices, and non-invasive diagnostics are accelerating biomarker discovery and improving disease management across the region.

The predictive biomarker market in Brazil is rapidly expanding, with the biomarker discovery outsourcing services segment. Growth is driven by rising demand for minimally invasive diagnostics, increasing prevalence of chronic diseases, expanding precision medicine adoption, and advancements in molecular diagnostics and bioinformatics. Innovations in AI-powered biomarker analysis, next-generation sequencing, and digital health technologies are rapidly advancing biomarker discovery and enabling more personalized treatments in Brazil.

Middle East and Africa Predictive Biomarkers Market Trends

The predictive biomarker market in the Middle East and Africa (MEA) is growing robustly, rising prevalence of chronic diseases such as cancer and cardiovascular conditions, advancements in genomics and molecular diagnostics, and increasing adoption of personalized medicine. Government initiatives, rising healthcare expenditure, and collaborations between research institutions and industry are further fueling market growth. Notable players in the region include Bio-Rad Laboratories, Qiagen N.V., and Merck & Co., Inc. Technological advancements like artificial intelligence and machine learning are enhancing biomarker discovery and analysis, facilitating more accurate diagnostics and treatment strategies

Saudi Arabia predictive biomarker market is expanding rapidly, driven by increasing cancer prevalence, particularly breast cancer, and advancements in genomics and molecular diagnostics. Key drivers include government healthcare initiatives, rising awareness, and investments in precision medicine. Leading players in the market include Fujirebio, Roche, Bio-Rad, Cepheid, and Randox. Technological advancements such as next-generation sequencing (NGS) and liquid biopsy are enhancing diagnostic accuracy and treatment personalization.

Key Predictive Biomarkers Company Insights

Some of the key players operating in the market include Myriad Genetics, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Bio-Rad Laboratories, Qiagen NV and Merck KGaA. Innovations in artificial intelligence, next-generation sequencing, and liquid biopsy are enhancing the accuracy and efficiency of predictive biomarker diagnostics. These developments underscore the dynamic nature of the predictive biomarker market, with established companies and emerging technologies shaping its future trajectory.

Key Predictive Biomarkers Companies:

The following are the leading companies in the predictive biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Qiagen

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc

- Illumina Inc.

- Merck KGaA

- Bio-Techne

- Siemens Healthineers AG

- PerkinElmer

- Myriad Genetics, Inc.

- Becton Dickinson

- Danaher Corporation

- Genomic Health, Inc.

- PacBio

Recent Developments

-

In August 2024, Illumina, Inc. announced FDA approval for its in vitro diagnostic (IVD) TruSight Oncology (TSO) Comprehensive test along with two companion diagnostic (CDx) indications. This approval underscores Illumina’s pivotal role in predictive biomarker development by enabling precise genomic profiling of tumors.

-

In March 2024, Volastra Therapeutics, announced collaborations with Microsoft, Function Oncology, and Tailor Bio. These partnerships aim to expand the potential of Volastra’s evolving therapeutics pipeline across various tumor types by leveraging the identification of predictive biomarkers.

-

In November 2023, OncoHost has successfully developed a proteomics-based predictive biomarker to identify immune-related adverse events (irAEs) in patients with non-small cell lung cancer (NSCLC). OncoHost’s biomarker aids clinicians in personalizing treatment plans and mitigating risks associated with immune checkpoint inhibitors, marking a significant step forward in precision oncology for NSCLC.

Predictive Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.75 billion

Revenue forecast in 2030

USD 63.54 billion

Growth rate

CAGR of 18.02% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Qiagen; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc; Agilent Technologies, Inc.; Illumina Inc.; Merck KGaA; Bio-Techne; Siemens Healthineers AG; PerkinElmer; Myriad Genetics, Inc.; Becton Dickinson; Danaher Corporation; Genomic Health, Inc.; PacBio

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Predictive Biomarkers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global predictive biomarkers market report on the basis of indication, technology and region.

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Cardiovascular Diseases

-

Neurological Diseases

-

Immunological Diseases

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Drug Discovery & Development

-

Personalized Medicine

-

Disease Risk Assessment

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global predictive biomarkers market size was estimated at USD 24.30 billion in 2024 and is expected to reach USD 27.76 billion in 2025.

b. The global predictive biomarkers market is expected to witness a compound annual growth rate of 18.02% from 2025 to 2030 to reach USD 63.54 billion by 2030.

b. The cancer segment dominated the market accounting for largest share of revenue with 37.19% in 2024, driven by the growing demand for early diagnosis, personalized treatment, and monitoring of treatment responses. The ability to identify specific genetic mutations, protein expressions, and other molecular alterations in cancer cells has transformed oncology, allowing for targeted therapies and improved patient outcomes

b. Some key players of this market include Thermo Fisher Scientific Inc., Qiagen, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc, Agilent Technologies, Inc., Illumina Inc., Merck KGaA, Bio-Techne, Siemens Healthineers AG, PerkinElmer, Myriad Genetics, Inc., Becton Dickinson, Danaher Corporation, Genomic Health, Inc., PacBio.

b. The market is experiencing significant growth driven by several factors such as advancements in genomics and precision medicines, increased investment in research and development and rising demand for early detection and personalized treatments. Research and development (R&D) is a major driver of growth in the predictive biomarkers market, fueling innovation and the discovery of new biomarker candidates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.