- Home

- »

- Pharmaceuticals

- »

-

Middle East & Africa Parenteral Nutrition Market, Report 2030GVR Report cover

![Middle East & Africa Parenteral Nutrition Market Size, Share & Trends Report]()

Middle East & Africa Parenteral Nutrition Market (2024 - 2030) Size, Share & Trends Analysis Report By Nutrient Type (Carbohydrates, Parenteral Lipid Emulsion), By Stage Type, By Indication, By Sales Channel, And Segment Forecasts

- Report ID: GVR-1-68038-838-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

MEA Parenteral Nutrition Market Trends

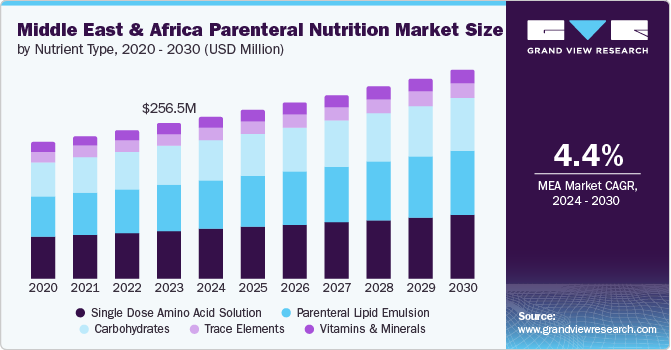

The Middle East & Africa parenteral nutrition market size was valued at USD 256.5 million in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The increase in the geriatric population and the growing prevalence of chronic diseases and gastrointestinal disorders are the major factors contributing to the growth of the market. In addition, increasing natality rate, rising number of premature births, risk of malnutrition, and rising awareness about the importance of proper nutritional support have further boosted the demand for parenteral nutrition, thereby boosting the market growth positively.

The rise in the natality rate impacts the market growth due to the increased demand for parenteral nutrition solutions for infants and children, thereby acting as a driver for the market. For instance, according to the World Bank Group, the value of birth rate (per 1000) is 20 from the year 2022 in the Middle East and Africa.

Premature infants often have an immature gastrointestinal system that is unable to tolerate adequate enteral (through the digestive tract) nutrition in the early stages after birth. Parenteral nutrition provides essential nutrients directly into the bloodstream, bypassing the digestive system. Early and appropriate parenteral nutrition has been shown to improve growth, reduce complications, and potentially enhance long-term neurodevelopmental outcomes in premature infants and improve their chances for survival. This application of premature infants is expected to drive market growth in the MEA region.

Malnutrition can occur due to various factors such as inadequate dietary intake, chronic diseases, and aging populations, which can be addressed through parenteral nutrition Initiatives such as policies aimed at reducing the impact of malnutrition, leading to increased demand for intravenous feeding products. For instance, in August 2023, the regional directors of various international organizations including the Food and Agriculture Organization of the United Nations (FAO), the World Food Programme (WFP), the United Nations Children's Fund (UNICEF) and the World Health Organization (WHO) launched a framework for regional United Nations nutrition collaboration to address the pressing issue of malnutrition.

Nutrient Type Insights

Single-dose amino acid solutions dominated the market and accounted for a market share of 30.8% in 2023. It can be attributed to an increase in the influx of regulatory-approved amino acid solutions. Moreover, advancements in formulations and medical technology have led to the development of more effective amino acid products, catering to a wider range of patient needs. For instance, Baxter offers a wide range of amino acid options to patients, such as Travasol 10% (amino acids) injection to treat nitrogen balance in patients, and Premasol 10% sulfite-free (amino acid) injection for pediatric patients.

The parental lipid emulsion segment is expected to grow at a significant CAGR over the forecast period. Lipid emulsions of concentrations 10%, 20%, or 30% (wt:vol) of concentrations 10%, 20%, or 30% of triacylglycerol, constituting the main source of fatty acids (FAs) and fuel calories, are used in parenteral nutrition formulations. Parenteral lipid emulsions have potential benefits as a drug delivery vehicle and are mainly used to administer drugs that reduce irritation & pain and prevent thrombophlebitis. Thereby, the benefits of lipid emulsions as a drug delivery vehicle, the development of hybrid formulations, and the increasing demand from specific patient populations such as pregnant women and preterm neonates help in the segmental growth.

Stage Type Insights

Adults dominated the market and accounted for 85.9% in 2023. The compromised gastrointestinal function, prolonged malnutrition, and increased malnutrition in adults drive the segmental growth. These issues can impair the body’s ability to absorb nutrients through oral or enteral routes. For instance, in August 2022, according to the Digestive Diseases and Sciences journal, Africa exhibited a larger proportion of Crohn’s disease compared to ulcerative colitis than in Asia. Thereby, the demand for parenteral nutrition has increased with the rise in various gut-related diseases helping the market grow positively.

The pediatric segment is expected to grow at a significant CAGR over the forecast period. It can be attributed to issues such as rising cases of children and infants gut unable to absorb enough nutrition for normal growth and development. The poverty in the Middle East and African region has caused children in the region to be deprived of basic food requirements, leading to malnutrition and various other health complications. For instance, according to a report by UNICEF published in June 2024, around 34 million children under five years of age have been experiencing child food poverty in the Middle East and North African region. Therefore, increasing malnutrition in pediatrics would lead to the requirement for parenteral nutrition, which is likely to help the market grow positively.

Indication Insights

Cancer care dominated the market and accounted for a market share of 16.9% in 2023. It can be attributed to the rising cancer cases in the Middle East and African region. For instance, according to the study published by Frontiers Media S.A. in April 2022, cancer was the fifth largest cause of death in Africa. The study also projected the rise in cancer burden in Africa from 1.1 million cases in 2020 to 2.1 million cases in 2040 in Africa. Parenteral nutrition helps meet cancer patients increased caloric and nutrient requirements, especially when oral or enteral nutrition is not feasible or sufficient. These benefits of parenteral nutrition are likely to help drive market growth in the region.

Dysphagia is expected to grow at the fastest CAGR over the forecast period. It is a disease that causes complications in adequate oral intake, putting patients at high risk of dehydration and malnutrition. Parenteral nutrition can provide the necessary calories, nutrients, and fluids to prevent these complications, which is expected to boost their demand over the forecast period and drive segmental growth.

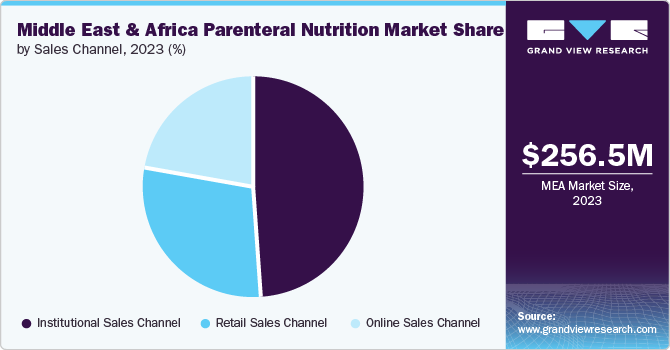

Sales Channel Insights

Institutional sales channels dominated the market and accounted for a market share of 49.2% in 2023. The large share of the segment can be attributed to the increasing allowance for the adoption of technologically advanced medical devices and parenteral nutrition solutions in settings such as hospitals and clinics. Hospitals and clinics have the necessary infrastructure, trained medical staff, and the capacity to handle intravenous parenteral nutrition therapies effectively. In addition, there has been significant investment in research and development of parenteral nutrition products by private entities, government agencies, and collaborations in the healthcare sector, which is driving growth in the market.

The online sales segment is expected to grow at the fastest CAGR of 4.9% over the forecast period. It can be attributed to the convenience and easy accessibility to procure essential parenteral nutrition products quickly and efficiently. This reduces the need for physical visits to healthcare facilities, which was particularly beneficial during the COVID-19 pandemic. Online sales platforms often provide a wider range of product options, competitive pricing, and the ability to compare brands and features also helps in driving the market.

Country Insights

MEA parenteral nutrition market is anticipated to witness significant growth in the parenteral nutrition market. It can be attributed to the growing prevalence of chronic diseases in this region. For instance, in June 2023, according to a report published in the Health Systems Reform series in the MENA region, people over 60 are more prone to chronic disease risk, currently ranging from 0.8% in the UAE to 10.6% in Turkey. In addition, around 461,000 new cancer cases and over 274,000 cancer-related deaths in the region were predicted in the year 2020. Moreover, demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, are also likely to contribute to the growing demand for parenteral nutrition, thereby increasing the market growth.

South Africa Parenteral Nutrition Market Trends

South Africa parenteral nutrition market dominated the MEA parenteral nutrition market with a significant market share in 2023. It has made significant advancements in healthcare infrastructure which supports the delivery of parenteral nutrition and other specialized medical treatments for various other gastrointestinal complications. Initiatives and various awareness programs by government bodies have helped grow the market positively. For instance, the South African Society for Parenteral and Enteral Nutrition (SASPEN) has been working to promote clinical nutrition in the country.

UAE Parenteral Nutrition Market Trends

UAE is expected to register the fastest CAGR during the forecast period. It can be attributed to the growing awareness and initiatives taken for the engagement, support and participation of people regarding parenteral nutrition. For instance, the Middle Eastern Alliance for Parenteral and Enteral Nutrition Congress (MEAPEN 2024) scheduled in 2025 in Dubai, is likely to help in market expansion. In addition, the growing prevalence of chronic diseases in the UAE is likely to drive further demand in the market. For instance, in May 2021, according to a report published in World Health Organization (WHO), around 4,800 people or about 55% die every year from four main NCDs in UAE.

Middle East & Africa Parenteral Nutrition Company Insights

Some of the key companies in the MEA parenteral nutrition market include B. Braun Melsungen AG, Baxter, Fresenius Kabi AG, and others. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

B. Braun Melsungen SE offers a comprehensive portfolio of products, services, and technological innovations to support safe and effective parenteral nutrition delivery in both hospital and home settings. B. Braun also collaborated with Central Admixture Pharmacy Services (CAPS) to provide a comprehensive "PN360" program that includes parenteral nutrition education, training, products, and services.

-

Baxter is a company which provides an extensive portfolio of devices and solutions that help to overcome parenteral nutrition complexity. It offers various programs such as iCAN, Channel ONE and SMART PN which is designed to help measure, mix and nourish for effective parenteral nutrition.

Key Middle East & Africa Parenteral Nutrition Companies:

- B. Braun Melsungen SE

- Baxter

- Fresenius Kabi AG

- Qatar Pharma Factory

- Hospira (now part of Pfizer Inc.)

- Evonik

Recent Developments

-

In May 2024, Baxter secured FDA approval for Clinolipid, which is a lipid injectable emulsion) for neonatal and pediatric patients. It is used to provide essential fatty acids and calories in parenteral nutrition when oral or enteral nutrition is not possible.

-

In October 2023, Evonik launched GMP-quality plant-based squalene PhytoSquene for use in adjuvants in parenteral dosage forms.

Middle East & Africa Parenteral Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 267.5 million

Revenue forecast in 2030

USD 346.0 million

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nutrient type, stage type, indication, sales channel, country

Regional scope

MEA

Country scope

KSA, UAE, South Africa, Kuwait

Key companies profiled

B. Braun Melsungen AG, Baxter, Fresenius Kabi AG, Qatar Pharma Factory, Hospira (now part of Pfizer Inc.), Evonik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East & Africa Parenteral Nutrition Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East & Africa parenteral nutrition market report based on nutrient type, stage type, indication, sales channel, and country:

-

Nutrient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrates

-

Parenteral Lipid Emulsion

-

Single Dose Amino Acid Solution

-

Trace Elements

-

Vitamins & Minerals

-

-

Stage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Indication

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales Channel

-

Retail Sales Channel

-

Institutional Sales Channel

-

-

Country Outlook (Revenue, USD Million; 2018 - 2030)

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.