- Home

- »

- Medical Devices

- »

-

Medical Adhesive Tapes Market Size & Share Report, 2030GVR Report cover

![Medical Adhesive Tapes Market Size, Share & Trends Report]()

Medical Adhesive Tapes Market Size, Share & Trends Analysis Report By Type (Acrylic, Silicone), By Adhesion, By Application (Surgery, Wound Dressing), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-026-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Adhesive Tapes Market Trends

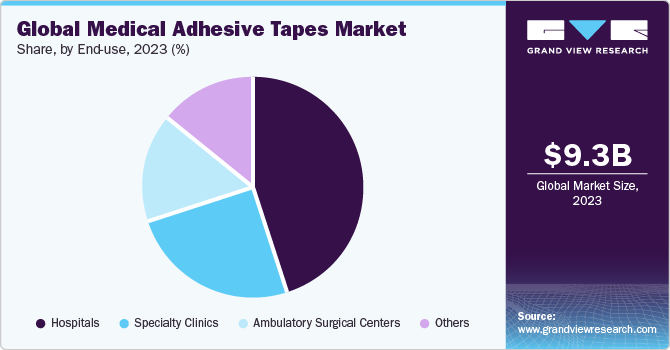

The global medical adhesive tapes market size was estimated at USD 9.30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.14% from 2024 to 2030. The growing incidence of chronic conditions, including venous leg ulcers, diabetic ulcers, and traumatic wounds, is a primary driver for the increased utilization of medical adhesive tapes. As an illustration, WHO data indicates that annually, approximately 1.2 million individuals succumb to fatalities resulting from vehicle crashes, with an additional 20 to 50 million people sustaining non-fatal injuries.

Surgical interventions necessitate the placement of infusions, IV lines, and catheters, all of which rely on medical adhesive tapes for secure adhesion. Medical adhesive tapes play a crucial role in ensuring the stability and correct placement of catheters and IV lines. The growing prevalence of surgical procedures is expected to fuel the demand for these tapes. For instance, as reported published in 2023 by the Mass General Brigham, around 900,000 open heart surgeries are conducted every year in the U.S. In addition, AHA Journals report that roughly 40,000 children undergo congenital heart surgery annually in the U.S. These surgeries require a considerable healing period, during which wound dressing products play a crucial role in facilitating prompt recovery. Therefore, the preference for wound dressing post-surgery is expected to propel the utilization of medical adhesive tapes throughout the forecast period.

There is a rising trend in global road accidents and other catastrophic events. For instance, according to a 2023 WHO report , approximately 28% of worldwide road traffic fatalities took place in the WHO South-East Asia Region, followed by 25% in the Western Pacific Region, 19% in the African Region, 12% in the Region of the Americas, 11% in the Eastern Mediterranean Region, and 5% in the European Region. The majority of these deaths, about nine in ten, occurred in low- and middle-income countries, where the fatality rates are notably higher relative to the number of vehicles and road infrastructure.

Market Concentration & Characteristics

The market is witnessing a moderate degree of innovation, with companies introducing improved products with enhanced adhesion, easy removal, and reduced skin irritation. These innovations aim to enhance patient comfort, promote better wound healing, and provide healthcare professionals with more efficient and reliable adhesive solutions.

Several market players such as Cardinal Health, 3M, and Smith & Nephew are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations in the market have a significant impact, with changes necessitating manufacturers to adjust their products or processes accordingly. These can include regulations that promote the production of eco-friendly and sustainable medical adhesive tapes, or those that require changes in manufacturing technologies to reduce the emissions of volatile organic compounds (VOCs)

Potential product substitutes in the market include staples and sutures in wound closure and surgical procedures. Advanced wound dressings like hydrocolloids, foam dressings, and alginate dressings further serve as substitutes, particularly in wound care. Market players are expanding regionally to capitalize on growing healthcare demands, with a focus on enhancing product accessibility and addressing specific regional healthcare needs.

Type Insights

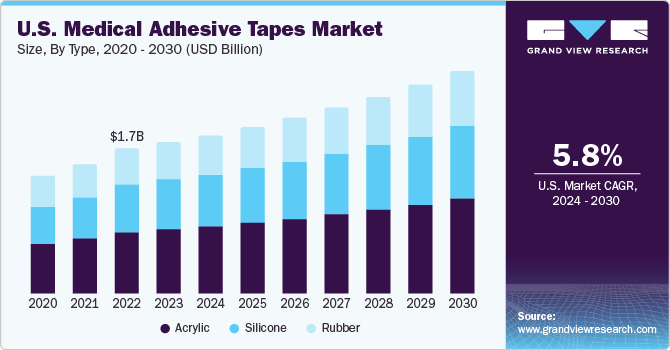

Based on type, the acrylic segment held the market with the largest revenue share of 42.2% in 2023. The prevalence of acrylic medical adhesive tape can be attributed to the benefits it offers. Specifically, this tape provides a robust initial tack, exhibits low skin sensitivity, and leaves no residue on the skin upon removal. In addition, it showcases resistance to humidity and heat, is latex-free, and can be laminated onto various surfaces, including foams and film dressings. Notably, the tape maintains its integrity throughout the wound dressing process.

The silicone segment is expected to grow lucrative CAGR during the forecast period. The rising demand for silicone medical adhesive tapes can be attributed to several key factors. One significant reason is their repositionable nature, allowing for wound observation and examination without the necessity of replacing the dressing, thereby facilitating extended wear time. In addition, these tapes are atraumatic and easy to remove, reducing the risk of complications like secondary infections. Moreover, silicone tapes contribute to minimizing scarring and are internationally recognized as a recommended form for scar management. Consequently, the demand for silicone medical adhesive tapes is anticipated to grow in the forecast period due to these factors.

Backing Material Insights

Based on backing material, the paper segment led the market with largest revenue share in 2023. Paper-based tapes are widely used in medical applications because they provide a good balance of strength, flexibility, and breathability. The porosity of paper allows for better aeration and moisture absorption, making it suitable for applications where skin contact is involved. In addition, paper tapes are easily customizable, allowing manufacturers to produce a variety of widths and lengths to meet diverse medical requirements, thereby contributing to the overall segment growth.

The fabric segment is anticipated to witness the lucrative CAGR during the forecast period due to its unique combination of durability, flexibility, and excellent adhesive properties. Fabric-backed tapes are known for their high tensile strength and resistance to tearing, making them ideal for applications that require a secure and long-lasting bond. Furthermore, fabric tapes offer enhanced breathability compared to some other materials, promoting airflow and reducing the risk of skin irritation.

Adhesion Insights

Based on adhesion, the double coated segment led the market for the largest revenue share in 2023. The attribution of its market dominance can be ascribed to enhanced strength and superior dimensional versatility, rendering them highly adaptable for conversion. Furthermore, these tapes present breathable, hypoallergenic, and repositionable alternatives. They also offer a variety of thickness, adhesive strengths, and backing materials to cater to individual requirements, consolidating their stronghold in the market.

The single coated segment is estimated to register the fastest CAGR over the forecast period.Single-coated medical tapes comprise a substrate of foam, nonwoven, film, or metal coated with medical-grade pressure-sensitive adhesive on one side. These tapes, protected by a silicone release liner, are utilized in healthcare devices that require direct skin contact.

Application Insights

Based on application, the surgery segment dominated the market with the largest revenue share in 2023. The surge in the usage of medical adhesive tapes can be linked to the rise in the number of surgical procedures. For instance, an article published by 'Trauma of Major Surgery' indicates that approximately 310 million major surgeries are conducted annually. In addition, the growing trend of cosmetic surgeries has contributed to the increased utilization of medical adhesive tapes. In 2020, according to the Aesthetics Society, approximately 140,314 fat-reduction procedures were performed, further fueling the growth of this segment.

The wound dressing segment has been anticipated to show lucrative CAGR over the forecast period. The increase in the utilization of medical adhesive tapes can be attributed to the growing prevalence of wound dressing applications, particularly in the treatment of various chronic and acute wounds. The rising incidence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers is expected to drive the demand for these tapes. For instance, as per IDF Diabetes Atlas report published in 2021, around 537 million adults are living with diabetes disorder. Furthermore, diabeticfootonline.com report published in 2020, up to 34% of individuals with diabetes are at risk of developing diabetic foot ulcers. These factors contribute significantly to the expansion of the market.

End-use Insights

Based on end-use, the hospital segment dominated the market with the largest revenue share in 2023. The dominance of the hospital segment in the use of medical adhesive tapes can be ascribed to a surge in surgical procedures, an escalation in the number of hospitals, and a rise in accidental incidents across various countries. For instance, according to Philkotse, the number of traffic accidents rose from 63,072 in 2007 to 116,906 in 2018. This increase in accidents has led to a higher incidence of surgeries and, consequently, an elevated demand for medical adhesive tapes. Additionally, in the U.S. the National Highway Traffic Safety Administration projected that 42,795 individuals lost their lives in motor vehicle traffic crashes in the year 2022. Therefore, owing to these contributing factors, the hospital segment is anticipated to take a leading position in the end-use category.

The ambulatory surgical centers segment has been anticipated to witness lucrative CAGR over the forecast period. The growing incidence of chronic diseases is driving the demand for ambulatory surgical centers. Moreover, increased investments and various initiatives by public health organizations and governments, coupled with a changing preference among patients favoring ASCs over traditional hospitals, are anticipated to boost the demand for medical adhesive tapes in these ambulatory settings.

Regional Insights

The Asia Pacific region dominated the market with a revenue share of 48.0% in 2023 and is also expected to grow the fastest CAGR during the forecast period. The growing prevalence of diabetes in the region can be attributed to the increasing demand for medical adhesive tapes. For instance, according to the Down to Earth organization, India had an estimated 74.2 million diabetics between the ages of 20 and 79 as of December 2021, with projections indicating a rise to 124.8 million by 2045. In the Philippines, the International Diabetes Federation (IDF) reported that 3,993,300 people out of a total population of 536,600 had diabetes in 2021. The escalating number of diabetics raises the likelihood of diabetic foot ulcers, necessitating the use of wound dressings. This, coupled with an increase in surgical cases, is expected to drive the demand for medical adhesive tapes, thereby stimulating regional market growth over the forecast period.

The China held the largest revenue share of the market in the Asia Pacific region in 2023. The country's economy is one of the biggest in the world, which allows for substantial investment in the production of medical adhesive tapes. In addition, China's access to economical and readily available raw materials drives foreign investments, contributing to the growth of healthcare adhesive tapes production.

North America held a significant market share in the market in 2023. This market is driven by the advanced healthcare infrastructure, increasing public awareness, and the presence of significant industry players. Furthermore, the anticipated rise in surgical procedures in North America is expected to drive the demand for medical adhesive tapes. For instance, the Emory University Hospital estimated that approximately 441 open-heart operations were conducted in the U.S. in 2022 Similarly, according to AHA Journals, 40,000 children in the U.S. undergo congenital heart surgery annually. Given the recovery period for these surgeries, wound dressings are essential, necessitating the use of medical adhesive tapes and thereby propelling regional growth.

The U.S. accounted for the largest revenue share of the market in North America region in 2023. The U.S. boasts a robust and technologically advanced healthcare infrastructure, fostering increased adoption of medical adhesive tapes in various clinical applications. In addition, the presence of prominent market players and research institutions within the country contributes to the development and innovation of advanced adhesive technologies.

Key Medical Adhesive Tapes Company Insights

Some of the key players operating in the market include Cardinal Health, 3M and Smith Nephew. These players are continuously focusing on developing innovative medical adhesive tape products with advanced features, such as improved adhesion, breathability, and skin-friendly formulations, to meet evolving healthcare needs. Furthermore, they also focus on strategic partnerships, acquisitions, and global expansions to strengthen market presence and offer comprehensive solutions, ensuring they stay ahead in a competitive healthcare landscape.

Nitto Denko Corporation and Nichiban Co Ltd are some of the emerging market players in the market. These market players employ strategies such as technological innovation to introduce unique products, cost competitiveness to offer budget-friendly solutions, and strategic alliances for market expansion.

Key Medical Adhesive Tapes Companies:

The following are the leading companies in the medical adhesive tapes market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these medical adhesive tapes companies are analyzed to map the supply network.

- Smith & Nephew

- 3M

- Medline Industries, LP

- Paul Hartmann AG

- Cardinal Health

- Baxter

- Johnson & Johnson Services, Inc

- Nitto Denko Corporation

- Nichiban Co Ltd

- Lohmann Technologies

Recent Developments

-

In January 2023, introducing Swift Melt 1515-I, H.B. Fuller's first biocompatible product approved in the IMEA region. This product is tailored for clinical tape applications, specifically designed for adherence to the skin in challenging climates, such as the hot and humid conditions found in the Indian subcontinent

-

In February 2023, 3M launched a new medical adhesive formulated to securely adhere to the skin for an extended period, lasting up to 28 days. This adhesive is specifically designed for use with a wide variety of health monitors, sensors, and long-term medical wearables

-

In April 2022, 3M introduced a new adhesive tape designed for securing medical devices to a patient's skin, offering extended adhesion for up to 21 days

Medical Adhesive Tapes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.78 billion

Revenue forecast in 2030

USD 13.98 billion

Growth rate

CAGR of 6.14% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, backing material, adhesion, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K..; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Smith & Nephew; 3M; Medline Industries LP; Paul Hartmann AG; Cardinal Health; Baxter; Johnson & Johnson Services, Inc; Nitto Denko Corporation; Nichiban Co Ltd; Lohmann Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Adhesive Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global medical adhesive tapes market report based on type, backing material, adhesion, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Silicone

-

Rubber

-

-

Backing Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Fabric

-

Plastic

-

Others

-

-

Adhesion Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Coated

-

Double Coated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Wound Dressing

-

IV Lines

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical adhesive tapes market size was estimated at USD 9.30 billion in 2023 and is expected to reach USD 9.78 billion in 2024.

b. The global medical adhesive tapes market is expected to grow at a compound annual growth rate of 6.14% from 2024 to 2030, to reach USD 13.98 billion by 2030.

b. The acrylic medical adhesive tape falls under type segment that comprises commanding over 42.19% revenue share in 2023.

b. Some key players operating in the medical adhesive tapes include Smith & Nephew, 3M, Medline Industries LP, Paul Hartmann AG, Cardinal Health, Baxter International, Johnson & Johnson, Nitto Denko Corporation, Nichiban, Lohmann GmbH & Co. KG

b. Key factors that are driving the medical adhesive tapes market growth include chronic diseases, a rising geriatric population, an increasing number of road accidents, and trauma cases, and surge in surgical procedures

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."