- Home

- »

- Medical Devices

- »

-

Medical Cameras Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Cameras Market Size, Share & Trends Report]()

Medical Cameras Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Endoscopy, Dermatology, Ophthalmology), By Sensor (CMOS, CCD), By Resolution (HD), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-742-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Cameras Market Summary

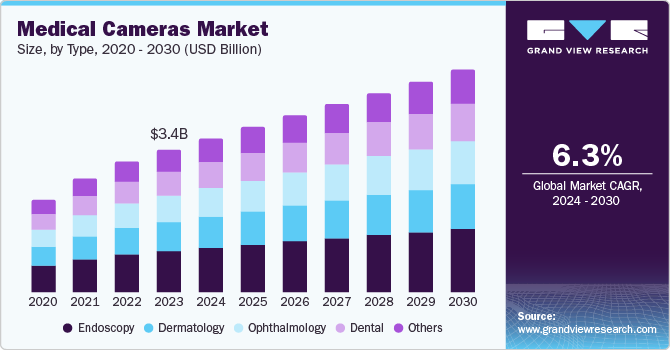

The global medical cameras market size was valued at USD 3.44 billion in 2023 and is projected to reach USD 5.36 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The market growth is projected to grow as medical cameras have become particularly essential for surgeries and diagnostic tests ensuring high accuracy throughout the procedure.

Key Market Trends & Insights

- The medical cameras market in North America dominated with 41.2% of the global share in 2023.

- The medical cameras market in the U.S. dominated with 76.9% in 2023.

- By type, endoscopy segment led the medical cameras market by securing almost 28.8% of the share in 2023.

- By resolution, HD medical cameras segment dominated the market with 73.8% of the share in 2023.

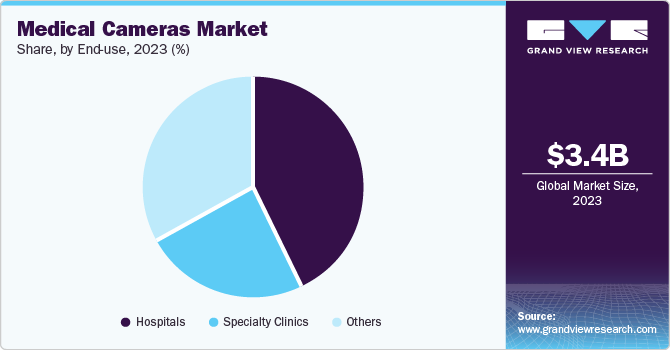

- By end use, the hospital segment dominated the market share with 43.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.44 Billion

- 2030 Projected Market Size: USD 5.36 Billion

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Visual study of patients captured with enhanced quality and accuracy has become crucial for medical documentation. The prevalence of chronic diseases along with lifestyle and age-related conditions has also contributed to the expansion of the medical cameras market. These conditions often require ongoing monitoring and complex procedures for accurate medications. In addition, the expansion of telemedicine and remote patient monitoring practices accelerated by the COVID-19 pandemic, has created a surge in demand for these cameras to facilitate the required services.

Another major driving factor is the growing trend of minimally invasive surgical techniques, which heavily rely on medical cameras to provide high-definition visuals without abrupt incisions. Additionally, several government policies and substantial investments in research and development have also encouraged innovation and adoption of advanced medical cameras across the global healthcare settings.

Type Insights

Endoscopy led the medical cameras market by securing almost 28.8% of the share in 2023 and is anticipated to grow lucratively during the forecast period. The segment has primarily dominated the market due to the increasing incidence of chronic diseases such as gastrointestinal disorders, cancer, and cardiovascular diseases. These conditions, which often require endoscopic procedures for diagnosis and treatment, have led to a surge in demand for endoscopic cameras. Patients are becoming inclined toward these endoscopy cameras for clear and accurate visuals of their conditions. The market growth has also been fueled on account of the rising popularity of minimally invasive surgical techniques as these are less traumatic for patients and offer quicker recovery in comparison to traditional surgeries.

The ophthalmology segment is anticipated to register as the fastest-growing segment during the forecast period. The rising prevalence of optical disorders including cataracts, glaucoma, vitreoretinal disorder, and diabetic retinopathy is projected to propel significant market growth. These conditions necessitate detailed visuals of intricate ocular structures for precise diagnostic intervention. Technological advancements in these cameras have significantly improved functionality and enabled efficient diagnosis and treatment outcomes. In addition, government initiatives aimed at increasing awareness about visual impairment and eye diseases have further contributed to the market growth.

Sensor Insights

The complementary metal-oxide-semiconductor (CMOS) led the medical cameras market with a 66.2% revenue share in 2023. This growth can be attributed to the rising demand for high-definition medical imaging. As medical research and healthcare sectors advanced, the market witnessed an increasing requirement for imaging solutions that offer high performance and superior image quality. Furthermore, technological developments in product design such as enhanced resolution, faster processing speeds, and improved sensitivity have also contributed to market growth. These advanced cameras integrated with WiFi and 5G networks, have expanded with real-time data transfer and remote diagnostics. Moreover, the portable sensors have gained momentum due to their low power consumption, compact size, and cost-effectiveness.

Charge coupled device (CCD) sensors in the medical cameras market are expected to grow considerably during the forecast period. These sensors are known for their excellent light-gathering capabilities which help them deliver the superior image quality, required for healthcare procedures. These sensors are particularly valued in applications including endoscopy, microscopy, and ophthalmology, where precise imaging is crucial. Although these sensors are relatively cost-prohibitive than CMOS sensors, they continue as a preferred choice in medical imaging applications due to their proven reliability and performance in capturing high-quality images for complex diagnostic and therapeutic procedures.

Resolution Insights

HD medical cameras dominated the market with 73.8% of the share in 2023 and are expected to continue their commanding presence during the forecast period. The key factor that notably propelled the market growth is the need for enhanced image clarity in diagnostic and surgical procedures. Since medical procedures have become nuanced, the requirement for precise and clear visual representation has become more critical. These cameras offer superior image quality enabling healthcare professionals to perform intricate surgeries with accurate diagnoses. Furthermore, innovations in imaging technologies, including 3D visualization and real-time image transfer are fueling the market growth. These advancements allow spatial orientation which is essential during surgical interventions and facilitates collaborative diagnostics and remote consultations. This further expands the reach of specialized medical care.

In addition, the ongoing digital transformation in the healthcare industry has created a demand for connected devices that can be seamlessly integrated into digital health record systems. HD medical cameras constitute an integral part of the modern healthcare ecosystem, enabling efficient documentation and data management.

End Use Insights

The hospital segment dominated the market share with 43.3% in 2023. Technological advancements in medical cameras, such as enhanced image quality, portability, and integration with other medical systems have witnessed market expansion within hospital settings. These innovations are improving the efficiency and effectiveness of medical procedures, leading to better patient care and treatment outcomes. Hospitals are increasingly investing in endoscopic facilities with CMOS sensors due to their increased usage of minimally invasive surgical techniques. Moreover, as the healthcare industry emphasizes incorporating the latest advancements in diagnostic and surgical technology, the uptake of these medical cameras is anticipated to surge.

Specialty clinics are expected to emerge as the fastest-growing segment in the medical cameras market during the forecast period. The driving factors for this segment include the introduction of technologically advanced medical equipment and a growing preference for minimally invasive surgical technologies. Speciality clinics have leveraged medical cameras to improve the precision of their procedures, particularly in areas such as dermatology, ophthalmology, and endoscopy. Advanced medical cameras that offer high-resolution image quality and facilitate ease of use, detailed examinations, and accurate diagnoses are being increasingly adopted in speciality clinics.

Regional Insights

The medical cameras market in North America dominated with 41.2% of the global share in 2023. The increasing number of surgical procedures that require high-quality imaging has primarily driven the market. The continuous improvements in camera technology, along with the region’s growing healthcare infrastructure and the patient population seeking advanced medical care have fueled the market growth. Furthermore, government initiatives have also aided in R&D activities which has further led the market growth with several companies dedicating substantial resources to innovate and improve medical camera technologies. In addition, new hospitals and specialty clinics are increasingly being equipped with the latest imaging technologies to ensure high standards of patient care.

U.S. Medical Cameras Market Trends

The medical cameras market in the U.S. dominated with 76.9% in 2023 owing to the advent of cutting-edge camera technology. Technical breakthroughs enhanced the functionality and reliability of medical cameras and broadened their application across various disciplines. The market experienced a notable demand for invasive surgical procedures which necessitated precise visual guidance.

Mexico Medical Cameras Market Trends

Mexico medical cameras market is anticipated to boost remarkably owing to the increasing prevalence of chronic diseases in the country. Moreover, the development of innovative camera designs that cater to diverse medical applications has also played a major factor in driving market growth.

Europe Medical Cameras Market Trends

The medical cameras market in Europe held a 23.4% share in 2023. The market was collectively augmented by the growing demand for medical procedures that utilize medical cameras, advancements in technology, and supportive government policies. Furthermore, significant R&D investments further stimulated innovation within the sector, leading to technical breakthroughs that enhanced the capabilities and applications of medical cameras.

Asia Pacific Medical Cameras Market Trends

The medical cameras market in the Asia Pacific (APAC) region registered a market share of 20.7% and emerged as the fastest-growing segment at a CAGR of 7.6% during the forecast period. Countries including China, India, and Japan leading the charge in adopting new and improved medical imaging technologies have significantly driven the market. The rapid adoption of advanced medical cameras was further supported by an increase in per capita healthcare spending which reflected a broader commitment to improving healthcare infrastructure. Government incentives and swelling private sector investment in R&D activities have spiked innovation in medical camera design and functionality, catering to various medical applications from endoscopy to surgery.

Key Medical Cameras Company Insights

Several prominent companies including Olympus Corporation, Stryker Corporation and more dominated the medical cameras market. These companies contributed to the market with their innovative products ranging from endoscopy cameras to surgical microscopy cameras. The collective efforts of these prominent companies shaped the competitive landscape with technological breakthroughs.

Key Medical Cameras Companies:

The following are the leading companies in the medical cameras market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- TOPCORN CORPORATION

- Richard Wolf Gmbh

- Canfiled Scientific, Inc

- Stryker Corporation

Recent Developments

-

In November 2023, Olympus Corporation launched its next-generation EVIS X1 endoscopy system in China to help physicians visualize abnormalities including Celiac disease, Crohn’s disease, ulcers, acid reflux, and colorectal cancer (CRC).

-

In September 2023, Stryker announced the launch of the next generation of minimally invasive medical cameras: the 1788 platform which is set to advance surgery across specialties.

Medical Cameras Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.71 billion

Revenue forecast in 2030

USD 5.36 billion

Growth Rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, sensor, resolution, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Olympus Corporation; TOPCORN CORPORATION; Richard Wolf Gmbh; Canfiled Scientific, Inc; Stryker Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Cameras Market Report Segmentation

This report forecasts revenue growth at global, regional, and country and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global medical cameras market report based on type, sensor, resolution, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Endoscopy

-

Dermatology

-

Ophthalmology

-

Dental

-

Others

-

-

Sensor Outlook (Revenue, USD Billion, 2018 - 2030)

-

CMOS

-

CCD

-

-

Resolution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Standard Definition (SD) Cameras

-

High Definition (HD) Cameras

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.