- Home

- »

- Medical Devices

- »

-

Medical Device Design And Development Services Market 2033GVR Report cover

![Medical Device Design and Development Services Market Size, Share & Trends Report]()

Medical Device Design and Development Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Services, By Medical Devices, By Therapeutic Area (Cardiovascular, Diagnostic), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-195-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Design and Development Services Market Summary

The global medical device design and development services market size was valued at USD 12.79 billion in 2025 and is projected to reach USD 36.25 billion by 2033, growing at a CAGR of 14.42% from 2026 to 2033. The growth of the market is mainly due to the rising adoption of outsourcing services due to associated benefits such as cost-effectiveness, and access to specialized expertise.

Key Market Trends & Insights

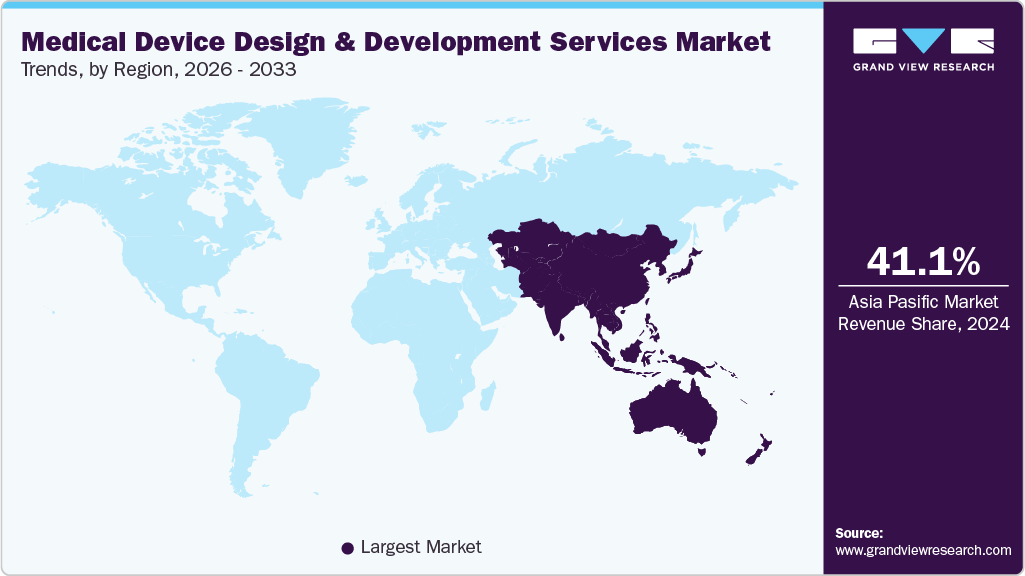

- Asia Pacific medical device design and development services market held the largest share of 41.13% of the global market in 2025.

- The medical device design and development services market in China is expected to grow significantly over the forecast period.

- Based on service, the designing & engineering segment held the largest market share of 38.98% in 2025.

- Based on medical devices, the drug delivery devices segment held the highest market share in 2025.

- Based on therapeutic area, the others segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 12.79 Billion

- 2033 Projected Market Size: USD 36.25 Billion

- CAGR (2026-2033): 14.42%

- Asia Pacific: Largest market in 2025

The changing landscape of the medical device industry drives the medical device design and development market. Furthermore, increasing complexity and miniaturization of medical devices are significantly accelerating the growth of the global medical device design and development services market. As devices become more compact, multifunctional, and embedded with advanced digital capabilities, original equipment manufacturers (OEMs) increasingly turn to specialized design and engineering service providers to overcome technical, regulatory, and manufacturing challenges. For instance, wearable and implantable medical devices such as Abbott’s FreeStyle Libre continuous glucose monitor and Medtronic’s Micra leadless pacemaker demonstrate the trend toward extreme miniaturization. Such devices require highly specialized design expertise in microelectronics, biocompatibility, and low-power wireless communication. Traditional in-house R&D teams often lack the multidisciplinary capabilities to develop such sophisticated devices, thereby accelerating demand toward outsourcing service providers with expertise in microfluidics, micro-electromechanical systems (MEMS), and nanomaterials.

Stringent regulatory and compliance requirements are a critical growth driver in the global medical device design and development services market. With rising complexities in device technologies and increasing patient safety concerns, regulatory bodies worldwide are imposing rigorous standards to enhance device efficacy and safety. This stringent regulatory environment forces manufacturers to partner with specialized design and development service providers capable of managing the complex compliance requirements, thereby driving market growth. For instance, the U.S. Food and Drug Administration (FDA) implements comprehensive regulations such as the Quality System Regulation (QSR) under 21 CFR Part 820, which mandates stringent design controls, risk management, and validation protocols throughout the product lifecycle. Compliance with these requirements requires advanced design capabilities and thorough documentation, driving demand for expert external design and development partners.

Opportunity Analysis

The global medical device design and development landscape is undergoing a seismic shift driven by the convergence of engineering innovation, clinical demand, and demographic necessity. With over 1 billion people globally projected to be aged 60 or older by 2030 (WHO), there is surging demand for devices tailored to aging-related conditions like cardiovascular disease, osteoarthritis, and diabetes. Similarly, the proliferation of connected devices through the Internet of Medical Things (IoMT) is pushing design firms to integrate wireless modules, embedded systems, and secure firmware from the early design phase. Regulatory frameworks such as IEC 62366 and ISO 14971 are now mandating usability engineering and formal risk management, creating a niche for specialized outsourced design services. Technological enablers like 3D printing and AI-driven design optimization are no longer optional, they are expected. This confluence is creating a multi-dimensional opportunity for service providers who can offer not just prototyping and CAD services, but also regulatory documentation, simulation testing, and human factor validation aligned with clinical practice.

Impact of U.S. Tariffs on Medical Device Design and Development Services Market

The market witnesses increased U.S. tariffs on imported medical devices, components, and electronic subassemblies, raising production expenses and altering the landscape of the medical device design and development services industry. The hike in input costs is prompting manufacturers to reevaluate their supply chains, move sourcing to tariff-exempt areas, and invest in domestic production and research partnerships. In addition, smaller and mid-sized MedTech companies are experiencing tighter profit margins, leading them to outsource design, prototyping, and regulatory services to specialized providers who can deliver cost savings. Moreover, tariffs are also hindering innovation timelines for businesses that rely heavily on imported technology. In conclusion, the market faces both challenges and opportunities as companies adjust to a protectionist trade landscape.

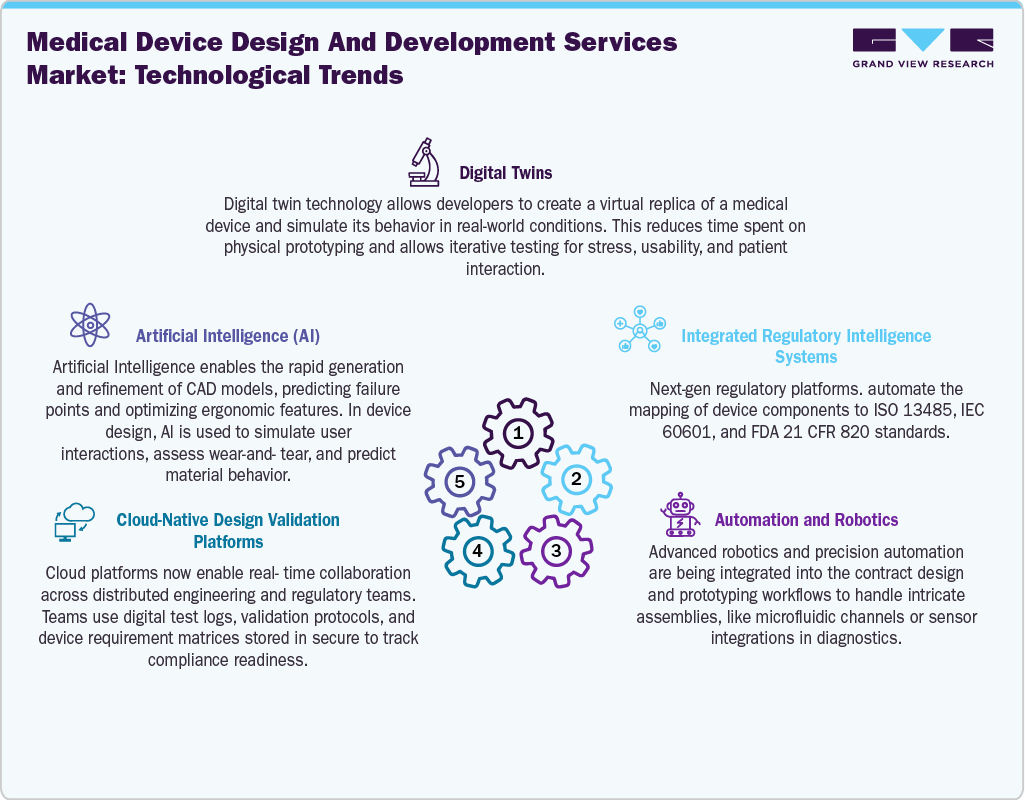

Technological Advancements

The medical device design and development landscape is undergoing a significant transformation driven by emerging technologies such as artificial intelligence (AI), the Internet of Medical Things (IoMT), additive manufacturing (3D printing), and advanced materials. AI is enabling predictive modeling and faster prototyping by using machine learning algorithms to simulate product performance and optimize device parameters.

This reduces time-to-market and improves design precision, especially for complex diagnostic or therapeutic devices. Moreover, AI-powered image analysis and real-time patient monitoring features are becoming core elements in device functionality, particularly in radiology and cardiology.

Pricing Model Analysis

Pricing in the medical device design and development services market is highly variable and influenced by the complexity of the device, regulatory pathway, scope of services, geographic location of the development firm, and stage of the development cycle. Design services are typically structured around milestones such as concept development, human factors engineering, prototyping, verification & validation (V&V), and regulatory documentation.

Costs can range from USD 50,000 to USD 500,000+ per phase, depending on whether the project involves simple disposables (e.g., catheters, syringes) or high-risk devices like implantable or smart diagnostics.

Market Concentration & Characteristics

The medical device design and development services industry growth stage is high, and growth is accelerating. The market is characterized by the level of merger & acquisition activities, the degree of innovation, the regulatory impact, the product expansion, and the regional expansions.

The market is fueled by rapid advancements in digital health, compact electronics, AI-enhanced diagnostics, and innovative materials. The providers are incorporating simulation, digital twins, rapid prototyping, and user-focused design to expedite product development timelines. Besides this, as original equipment manufacturers (OEMs) seek more intelligent, connected, and patient-friendly devices, outsourcing partners with advanced R&D capabilities witness a significant competitive edge.

The evolving global regulatory landscape, highlighted by updates to FDA Quality System Regulations, the EU Medical Device Regulation (MDR), and In Vitro Diagnostic Regulation (IVDR), along with heightened post-market surveillance standards, is transforming the approaches to device design and validation. Manufacturers depend on specialized service providers for compliance, managing risk documentation, and ensuring thorough verification, validation, and quality system integration. Thus, as regulatory challenges escalate, there is an increasing need for expert-driven design, testing, and documentation services among start-ups and established medtech companies.

Merger and acquisition activities in this sector are on the rise as firms consolidate their strengths in design engineering, prototyping, regulatory compliance, and contract manufacturing. Some of the major MedTech companies and service providers are acquiring specialized engineering firms, software developers, and regulatory consultants to broaden their end-to-end service offerings. For instance, in March 2025, NVIDIA and GE HealthCare collaborated to use the new Isaac for Healthcare simulation platform to accelerate autonomous imaging development, enabling virtual training and validation of AI-driven X-ray and ultrasound systems.

Service providers are broadening their range of offerings throughout the entire device lifecycle, from initial concept design and human factors engineering to verification, validation, regulatory assistance, and post-market revisions. Besides this, areas witnessing growth include the development of digital health products, engineering for connected devices, user experience/user interface (UX/UI) design, software as a medical device (SaMD), and manufacturing transfer.

Global medtech firms and design service providers expand regionally to meet the rising demand in Asia-Pacific, the Middle East, and Latin America. By creating local innovation centers, engineering hubs, and regulatory support teams, companies are better equipped to comply with regional standards, capitalize on cost benefits, and access skilled labor. This geographic diversification enhances global delivery models, speeds up project turnaround, and provides clients with wider market access.

Service Insights

On the basis of service, the designing and engineering segment held the largest market share of over 38.98% in 2025. Design and engineering firms have proved their abilities by meeting stringent regulatory requirements, even when the project is highly complex, diverse, and demanding. Moreover, the pressure to reduce costs, increasing competition, rising demand from emerging economies, and technological advancements are prompting device makers to consider outsourcing design and engineering operations. Such factors are anticipated to drive the segment.

In addition, the machining segment is anticipated to witness lucrative growth over the forecast period. Growing demand for miniaturized and complex devices is a major growth driver for the segment. The ability to machine complex materials in compliance with regulatory specifications and technological advancements in medical machining, such as laser micromachining, computerized Numerical Control (CNC), and machining of micro-precision medical components, is expected to further fuel the machining market.

Medical Devices Insights

On the basis of the medical devices, the drug delivery devices segment held the largest share in 2025. The segment’s growth is driven by increasing demand for advanced drug delivery solutions, rising expectations for more effective and patient-friendly therapies, cost efficiencies for both individuals and healthcare systems, and the rapid pace of technological innovation in device development. Moreover, continuous innovation in novel drug delivery devices with ease-of-use, sustainability, and safety concerns for patients and healthcare providers across various treatments has fueled the segment's growth. As a result, devices such as autoinjectors, transdermal patches, and infusion pumps have grown strongly in the past few years.

In addition, the POC diagnostic equipment segment is expected to witness the fastest growth over the forecast period. A point-of-care (POC) device provides rapid, reliable, fit-for-purpose test results at the point of need and poses unique design challenges. Furthermore, POC diagnostic equipment design provides an accurate result while ensuring the integrity of the specimen sample. This has led to the increasing adoption of rapid diagnostic tests. In addition, stringent regulations and technological advancements are expected to boost the growth of POC diagnostic equipment within the medical device design and development services market.

Therapeutic Area Insights

On the basis of therapeutic area, the diagnostic segment captured a considerable share in 2025. Innovations in imaging technologies, point-of-care devices, and molecular diagnostics have driven significant investments in design and development. The increasing prevalence of chronic diseases and the need for early and accurate diagnosis continue to fuel growth. Companies are focusing on developing user-friendly, portable, and rapid diagnostic devices, further expanding the market.

In addition, the cardiovascular segment is expected to witness considerable growth over the forecast period. Cardiovascular devices contribute to advancements in treating heart failure, heart disease, arrhythmia, and other cardiac conditions. The growth of the segment is due to a rise in product pipelines and continuous upgradation of cardiovascular devices. Growing emphasis on high technology-oriented, price-sensitive, and quality competitive for new device approvals accelerates the demand for robust devices.

End Use Insights

On the basis of the end use, the medical device companies segment dominated the market in 2025. The growth of this segment can be attributed to the increasing demand for quality medical device products globally. Besides, the rising aging population and prevalence of diseases have surged research in medical device design & development. In addition, medical device development firms are leading innovations by adopting the latest technology trends such as miniaturization, portability, enhanced reliability, and connectivity. The overall outlook for design services is strong, owing to trends towards advanced manufacturing technologies, components, and automation techniques.

The biotechnology companies’ segment is expected to witness considerable growth over the forecast period. Recent trends have shown a vast migration in medical devices with significant advancements in diagnosis & treatment. Besides, the related and broad field of medical devices in biotechnology companies includes developing healthcare products & procedures that diagnose, treat, or prevent disease by adding pharmaceuticals or biologics. With the rich pipeline for medical devices and increased sales, the segment is expected to witness significant growth.

Regional Insights

The North America medical device design and development services market is expected to witness the fastest growth over the forecast period. This can be attributed to continuous growth due to the presence of established manufacturing companies and increasing innovation for high-quality products. In addition, many medical device companies, & biotechnology companies have shifted their focus to manufacturing service providers to efficiently handle the increasing volume of medical devices. This has led to rising demand for the medical device design & development services industry.

U.S. Medical Device Design and Development Services Market Trends

The medical device design and development services market in the U.S. is driven by well-established healthcare infrastructure, growing medical device outsourcing services and rising R&D investments.

Europe Medical Device Design and Development Services Market Trends

The medical device design and development services market in Europe is expected to grow significantly due to increasing advanced technologies and the need for services to enhance the performance, & safety of new as well as existing medical devices.

Germany medical device design and development services market is anticipated to grow over the forecast period owing to growing focus on owing to growing demand for medical device outsourcing and increased emphasis on quality is expected to further boost the demand for the market.

The medical device design and development services market in the UK is anticipated to grow over the forecast period. The high healthcare spending and rapidly evolving demand for medical devices contribute to the growing medical device design and development services in this region.

France medical device design and development services market is anticipated to grow over the forecast period. Supportive government policies and funding programs encourage R&D activities, boosting demand for outsourced design and development services. Collaboration between research institutions and industry players also accelerates product innovation. Increasing chronic disease prevalence and aging demographics create a steady demand for advanced medical solutions.

Asia Pacific Medical Device Design and Development Services Market Trends

The medical device design and development services market in Asia Pacific accounted for the largest revenue share of around 41.13% in 2025. The region's high share is mainly due to the changing business model of medical device outsourcing and R&D activities. The region has a strong cost-efficiency offered by medical device design and development companies in countries such as India and China, contributing to its prominence in this field. Moreover, growing demand for various advanced medical devices, favorable pricing, and rising local manufacturing boost the market need, fostering innovation & technological expertise within the region. Furthermore, low-cost manufacturing, a wide spectrum of complex & evolving medical device regulatory requirements and developed manufacturing infrastructure for medical device design & development services drive the market.

China medical device design and development services market is expected to grow over the forecast period due to rapid technological advancements, growing demand for new & cost-effective medical devices, and high healthcare expenditure.

The medical device design and development services market in Japan is expected to grow over the forecast period due to the established healthcare infrastructure and increasing adoption of novel technologies that enhance the efficiency of medical devices.

India medical device design and development services market is anticipated to grow at the fastest CAGR over the forecast period owing to favorable government funding to accelerate new product development, and favored destinations for manufacturing services drive the market.

Latin America Medical Device Design and Development Services Market Trends

The medical device design and development services market in Latin America is projected to grow over the forecast period. The growth in the region is due by rising chronic disease prevalence, expanding medtech manufacturing, and increasing investment in nearshoring and innovation hubs. The regulatory landscape is strengthening, with ANVISA and COFEPRIS streamlining approvals and aligning with international quality and GMP standards to attract global OEM partnerships. In addition, competitively, the region witnesses growing activity from global players collaborating with local design firms, alongside emerging domestic engineering companies offering cost-efficient prototyping, testing, and product development solutions.

Brazil medical device design and development services market is expected to grow over the forecast period. The country is rapidly expanding due to a growing domestic medtech manufacturing base, government incentives & local production requirements, and expansion of digital health & connectivity solutions. The competitive landscape includes global players partnering with Brazilian firms alongside a growing base of domestic design studios.

Middle East and AfricaMedical Device Design and Development Services Market Trends

The medical device design and development services market in the Middle East & Africa is driven by the rapid expansion of medical free zones and innovation clusters, rising adoption of AI, robotics, and IoT-enabled devices, and growth in private healthcare investment. Besides this, competition is increasing as global CROs, design firms, and engineering specialists expand through partnerships with regional healthcare providers and innovation hubs in the UAE, Saudi Arabia, and South Africa.

The South Africa medical device design and development services market is witnessing growth due to growing demand for locally engineered devices and expanding investments in digital health and biodesign innovation. Besides this, regulatory oversight is shaped by SAHPRA’s evolving device classification, conformity assessment, and quality system requirements, pushing companies to strengthen compliance while accelerating innovation to meet regional healthcare needs.

UAE is emerging as a competitive hub in the medical device design and development services market, driven by high adoption of digital health & AI and rapid expansion of healthcare infrastructure. Some of the key players are strengthening the innovation ecosystem through R&D collaborations, AI-driven product design, clinical validation partnerships, and MedTech accelerator programs. Besides this, strategic initiatives such as the UAE’s National Strategy for Advanced Industries, local prototyping hubs, regulatory support from MoHAP, and free-zone innovation clusters (DHA, DHCC, ADGM) are boosting advanced device development.

Key Medical Device Design and Development Services Companies Insights

Key players operating in the medical device design and development services market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Medical Device Design and Development Services Companies:

The following are the leading companies in the medical device design and development services market. These companies collectively hold the largest market share and dictate industry trends.

- Ximedica

- DeviceLAb

- Jabil, Inc.

- Flex Ltd

- Plexus Corp

- Nordson Medical

- Celestica, Inc.

- Starfish Medical

- Planet Innovation

- Donatelle

- Cambridge Design Partnership

- Aran Biomedical

- Cirtec

Recent Developments

-

In September 2025, Tata Elxsi announced the expansion of a new Bayer radiology technology centre, accelerating advanced imaging device development through integrated engineering, reducing time-to-market, and boosting innovation capacity, significantly expanding demand for outsourced design, validation, and regulatory-compliant development services.

-

In March 2025, Archimedic launched the OpenQMS platform democratizes access to regulatory-ready quality systems, helping medtech firms meet FDA requirements efficiently, strengthening compliance, lowering development delays, and increasing reliance on digital design and regulatory support services.

-

In February 2025, BAAT Medical partnered with Medtech Incubator, streamlining end-to-end device development, offering startups seamless concept-to-commercialization support, driving higher innovation throughput, reducing development barriers, and accelerating growth in medical device design and development services.

Medical Device Design and Development Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14.37 billion

Revenue forecast in 2033

USD 36.25 billion

Growth rate

CAGR of 14.42% from 2026 to 2033

Historical Year

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, medical devices, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Ximedica; DeviceLAb; Jabil, Inc.; Flex Ltd; Plexus Corp; Nordson Medical; Celestica, Inc.; Starfish Medical; Planet Innovation; Donatelle; Cambridge Design Partnership; Aran Biomedical; Cirtec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Design and Development Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical device design and development services market report based on services, medical devices, therapeutic area, end use, and region.

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Designing & Engineering

-

Machining

-

Molding

-

Packaging

-

-

Medical Devices Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular devices

-

Ventricular Assist Devices

-

Total Artificial Hearts

-

Pacemakers

-

Implantable Cardioverter Defibrillators (ICDs)

-

Cardiac Loop Recorders

-

Holter Monitors

-

Event Monitors

-

ECMO Systems

-

Consumables

-

-

POC diagnostic equipment

-

Blood glucose monitor

-

Blood analyzer

-

Blood pressure monitor

-

Pregnancy test kit

-

Infectious diseases testing

-

Hb1Ac testing

-

Coagulation testing Kit

-

Cardiac markers test

-

Thyroid stimulating hormone test

-

Others

-

-

Drug delivery devices

-

Autoinjectors

-

Infusion Pumps

-

Prefilled Syringes

-

Inhalers

-

Nebulizers

-

Nasal Spray

-

Intrauterine Devices (IUDs)

-

Transdermal Patches

-

-

Orthopedic devices

-

Prosthetics

-

Orthopedic Navigation Systems

-

Others

-

-

Dental devices

-

Surgical devices

-

Surgical Robots

-

Others

-

-

Imagining devices

-

X-Ray

-

MRI Scanners

-

Ultrasound

-

CT Scanners

-

Nuclear Imaging Scanners

-

-

Sleep & respiratory devices

-

Positive Airway Pressure (PAP) Devices

-

Ventilators

-

Oxygen Concentrators

-

Others

-

-

Ophthalmology devices

-

Fundus Cameras

-

Slit Lamps

-

Optical Coherence Tomography

-

Corneal Topography Systems

-

Others

-

-

Endoscopy

-

Diabetes care

-

Cochlear implants

-

Bionic Ear

-

Bionic Eye

-

-

Neurostimulators

-

Spinal Cord Stimulators

-

Deep Brain Stimulators

-

Others

-

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular

-

Diagnostic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Device Companies

-

Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global medical device design and development services market size was estimated at USD 12.79 billion in 2025 and is expected to reach USD 14.37 billion in 2026.

b. The global medical device design and development services market is expected to grow at a compound annual growth rate of 14.42% from 2026 to 2033 to reach USD 36.25 billion by 2033.

Which segment accounted for the largest medical device design and development services market share?b. Asia Pacific dominated the medical device design and development services market with a share of around 41.13% in 2025. The rapid advancements in healthcare infrastructure, coupled with changing business model of medical device outsourcing and R&D activities are driving the region's prominence in the global medical device testing services market

b. Some key players operating in the medical device design and development services market include Ximedica, DeviceLAb, Jabil, Inc., Flex Ltd, Plexus Corp, Nordson Medical, Celestica, Inc., Starfish Medical, Planet Innovation, Donatelle, Cambridge Design Partnership, Aran Biomedical, Cirtec among others

b. Key factors that are driving the medical device design and development services market growth include the changing landscape of the medical device industry and advancement in medical device design supporting medical device usability are simultaneously the market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.