- Home

- »

- Next Generation Technologies

- »

-

Internet of Medical Things Market, Industry Report, 2030GVR Report cover

![Internet of Medical Things Market Size, Share & Trends Report]()

Internet of Medical Things Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (On-premise, Cloud), By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-109-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Internet of Medical Things Market Trends

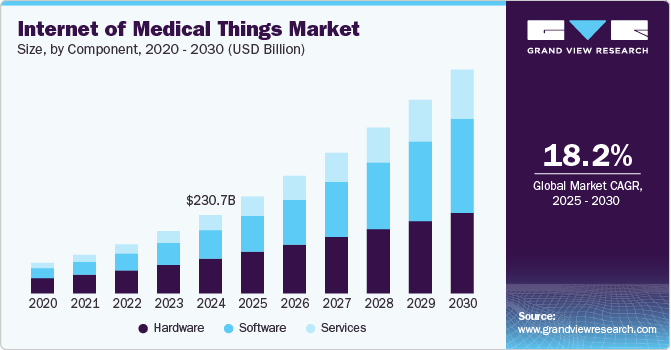

The global internet of medical things market size was estimated at USD 230.69 billion in 2024 and is projected to grow at a CAGR of 18.2% from 2025 to 2030. The market is experiencing rapid growth driven by the rising demand for remote patient monitoring, increased adoption of wearable technologies, and the integration of telehealth services. Furthermore, the emergence of big data in healthcare and improved device accuracy and connectivity is expected to drive the Internet of Medical Things industry growth in the coming years.

The Internet of Medical Things industry is also witnessing the evolution of high-speed networking technologies and increasing penetration of mobile platforms in healthcare. Artificial Intelligence (AI) and Machine Learning (ML) are pivotal in IoMT advancements, with AI algorithms used for analyzing vast amounts of data generated by IoMT devices and providing actionable insights for personalized healthcare interventions. The proliferation of wearable health technology is a prominent trend in the IoMT market, with devices such as smartwatches, fitness trackers, and portable health monitors gaining immense popularity across all age groups globally. These devices enable individuals to monitor vital signs, activity levels, and health metrics in real-time, promoting a shift toward preventive healthcare and personalized medicine.

In addition, the growing need for cost containment in healthcare delivery is another key factor driving the market growth. IoMT devices enable healthcare providers to remotely monitor patients’ health status, reducing hospital admissions and enhancing patient outcomes by enabling proactive healthcare management. This trend has been accelerated by the COVID-19 pandemic, which saw a notable increase in the adoption and acceptance of telemedicine as a mainstream healthcare service, thereby driving the Internet of Medical Things industry expansion.

Furthermore, advancements in sensor technology are driving the popularity of wearable devices in the IoMT ecosystem. Sensors used in wearable devices have become more sophisticated, accurate, and miniaturized, allowing for seamless integration into compact and comfortable form factors. These sensors can track a wide range of health parameters, including heart rate, blood pressure, oxygen levels, sleep patterns, and physical activity, providing a comprehensive view of an individual's health status. This trend is expected to further boost the Internet of Medical Things industry in the coming years.

Moreover, the rising demand for wearable devices is also creating opportunities for innovation in the IoMT market. Manufacturers are developing advanced features and functionalities such as Electrocardiogram (ECG) monitoring, fall detection, and medication adherence tracking to differentiate their products and meet the evolving needs of consumers. Thus, the advancements in sensor technology, improved user experience, growing awareness and adoption, and opportunities for innovation are all contributing to the increasing popularity of wearable devices, which is further driving the expansion of the Internet of Medical Things industry.

Component Insights

The hardware segment accounted for the largest market share of over 44% in 2024. The growth can be attributed to the increased adoption of IoT-enabled medical equipment, advancements in wireless communication technologies, technological innovations, integration with software components, and the demand for remote monitoring solutions. Hardware components are designed to support various connectivity options, including Bluetooth, Wi-Fi, cellular, and Low-Power Wide-Area Networks (LPWAN), enabling seamless data transmission to healthcare systems and mobile applications. The expansion of wireless communication technologies such as Wi-Fi, Bluetooth, and LPWAN has improved connectivity options for stationary IoT devices, making it easier to integrate them into existing networks.

The software segment is expected to register the fastest CAGR from 2025 to 2030, driven by the increasing adoption of connected medical devices, the growing need for real-time patient monitoring, and the rising demand for improved healthcare outcomes. Healthcare providers are increasingly turning to real-time patient monitoring solutions to enhance the quality of care and improve patient outcomes. Software applications that enable continuous monitoring of vital signs, medication adherence, and disease progression play a crucial role in the early detection of health issues, timely intervention, and personalized treatment plans. Moreover, AI-powered software solutions are revolutionizing healthcare by enabling predictive analytics, image recognition, natural language processing, and other advanced capabilities.

Deployment Insights

The on-premise segment held the largest market share in 2024. On-premise deployment is experiencing increased demand owing to the advantages it offers, such as low latency, high security, and better control over data, which are crucial for healthcare organizations to comply with strict regulations and data privacy requirements. On-premise IoMT solutions offer direct control over infrastructure, ensuring compliance with regulatory standards and safeguarding sensitive medical data, making them the preferred choice in healthcare settings, especially for critical applications in hospitals and clinics where real-time data processing and uninterrupted connectivity are paramount for patient monitoring and care delivery.

The cloud segment is expected to register the fastest CAGR from 2025 to 2030. The segment growth can be attributed to its cost-effectiveness, scalability, flexibility, and secure data management capabilities, which are crucial for effective and cost-efficient healthcare delivery in the face of growing data volumes from connected medical devices. Cloud management is essential for accumulating, storing, analyzing, and managing the large volumes of healthcare data generated by various IoMT devices and sensors, and cloud deployment allows for secure data storage, real-time monitoring, analytics, and seamless integration of IoMT devices into healthcare workflows. In addition, cloud-based IoMT platforms leverage advanced analytics and AI algorithms to derive actionable insights from vast amounts of healthcare data.

End Use Insights

The hospitals segment dominated the market in 2024. This segment growth can be attributed to the increasing adoption of IoMT solutions in hospitals to enhance patient care, streamline operations, and improve overall efficiency. These technologies enable real-time monitoring of patients, remote health management, predictive maintenance of medical equipment, and data-driven decision-making. In addition, the integration of IoMT devices with electronic health records (EHR) systems is facilitating seamless data exchange and interoperability within hospital settings.

The research institutes & academics segment is expected to register the fastest CAGR from 2025 to 2030. Research institutions, academia, and industry players collaborate to develop innovative IoMT solutions. This collaboration fosters cross-disciplinary research efforts, leading to the development of advanced medical devices, remote patient monitoring systems, and personalized healthcare technologies. Moreover, the growing emphasis on data-driven healthcare is prompting research institutes and academics to leverage IoMT technologies for collecting, analyzing, and interpreting vast amounts of health data in real-time. This trend is driving the adoption of wearable devices, smart sensors, and connected medical equipment in research settings to enhance patient care outcomes, optimize treatment strategies, and facilitate early disease detection.

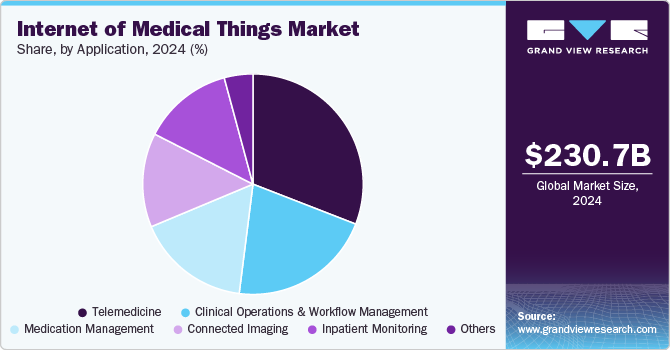

Application Insights

The telemedicine segment accounted for the largest market share in 2024. The telemedicine segment is experiencing significant growth within the market owing to rapid advancements in technology, such as improved connectivity, wearable devices, and remote monitoring tools. These technological innovations have made it easier for healthcare professionals to monitor patients’ health conditions and provide timely interventions remotely. In addition, telemedicine offers a cost-effective solution for both healthcare providers and patients. Telemedicine helps lower healthcare costs and improve patient outcomes by reducing the need for in-person visits and hospitalizations. This cost-effectiveness is a significant driver for the adoption of telemedicine within the Internet of Medical Things industry.

The inpatient monitoring segment is expected to register the fastest CAGR from 2025 to 2030. Inpatient monitoring helps enhance patient care within hospital settings, and it involves continuous tracking of vital signs, such as heart rate, blood pressure, oxygen levels, and other physiological parameters. This real-time data collection enables healthcare providers to monitor patients closely, promptly detect any abnormalities, and intervene when necessary. Furthermore, regulatory initiatives promoting interoperability standards, data security protocols, and privacy regulations are significantly influencing the development and adoption of IoMT solutions for inpatient monitoring.

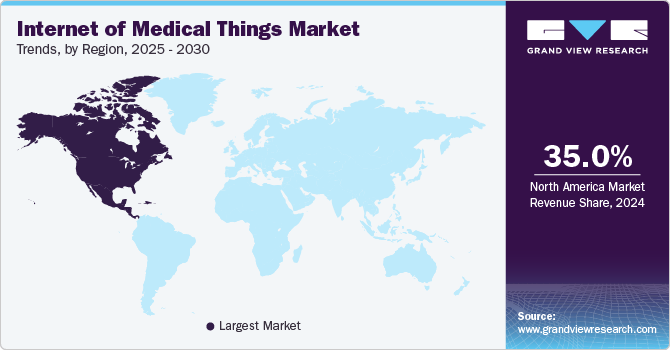

Regional Insights

North America Internet of Medical Things (IoMT) market dominated globally in 2024 with a revenue share of over 35%. The transition to value-based care models in the region is driving the adoption of IoMT technologies to improve patient outcomes and reduce healthcare costs. IoMT devices provide real-time data on patient health, enabling healthcare providers to make more informed decisions and deliver personalized care; this shift to value-based care models has boosted the market growth of the Internet of Medical Things industry in North America.

U.S. Internet of Medical Things Market Trends

The U.S. Internet of Medical Things (IoMT) market held a dominant position in 2024 in the North America region. The U.S. government has launched several initiatives aimed at promoting telehealth services, including reimbursement for telehealth services, which is driving the market growth in the U.S., thereby driving the internet of medical things industry.

Europe Internet of Medical Things Market Trends

Europe Internet of Medical Things (IoMT) market is expected to grow at a considerable CAGR of over 16% from 2025 to 2030. Europe has a well-developed healthcare system with modern facilities and advanced medical technologies. This infrastructure provides a strong foundation for the integration of IoMT devices, enabling seamless data exchange and remote patient monitoring. Moreover, European healthcare providers have been quick to embrace Electronic Health Records (EHRs), which store patient data electronically, consequently driving the adoption of IoMT devices across the region.

The UK Internet of Medical Things (IoMT) market is expected to grow rapidly in the coming years. The market is driven by increasing awareness of the benefits of connected health technologies and the need for more efficient healthcare services. The shift toward patient-centered care in the UK healthcare system has propelled the adoption of IoMT technologies. Patients are partaking in managing their health, and IoMT devices facilitate this by offering personalized monitoring solutions, promoting adherence to treatment plans, and fostering proactive health management.

The Germany internet of Medical Things (IoMT) market held a substantial market share in 2024, driven by the country’s strong focus on digital health initiatives and innovative healthcare solutions accelerating market growth.

Asia-Pacific Internet of Medical Things Market Trends

The Internet of Medical Things (IoMT) market in the Asia Pacific region is expected to grow at the fastest CAGR of over 21% from 2025 to 2030. The development of high-speed networking technologies and the increasing availability of cloud-based platforms are enabling the growth of the IoMT market. In addition, in rural areas of Asia-Pacific, where access to healthcare facilities is limited, telehealth platforms are becoming increasingly popular. IoMT devices enable healthcare providers to deliver care remotely, improving access to healthcare services for underserved populations.

The Japan Internet of Medical Things (IoMT) market is expected to grow rapidly in the coming years. The country’s growing focus on precision medicine and personalized healthcare interventions is driving the market expansion in Japan. In addition, Japan’s strong emphasis on R&D in life sciences has led to the development of sophisticated medical devices that leverage IoT capabilities to deliver tailored treatment plans based on individual health data. These factors are contributing to the Internet of Medical Things industry expansion in Japan.

The China Internet of Medical Things (IoMT) market held a substantial market share in 2024. The growth is attributed to the government’s focus on 5G infrastructure and military modernization. With heavy investments in secure communication technology, SDRs are essential for both civilian and defense applications. China’s emphasis on IoT in smart cities and public safety networks also supports SDR growth as these radios facilitate flexible, multi-standard communications.

Key Internet of Medical Things Company Insights

Some of the key players operating in the market include Cisco Systems, Inc. and GE Healthcare Technologies, Inc., among others.

-

Cisco Systems, Inc. is a technology company specializing in networking hardware, software, and telecommunications equipment. The company is also known for its innovative enterprise networking, security, and IoT solutions. The company caters to diverse industries and industry verticals, including cities and communities, manufacturing, smart buildings, education, mining, financial services, mining, oil & gas, healthcare, transportation, and retail, among others.

-

GE HealthCare Technologies Inc. is a medical technology, digital innovation, and pharmaceutical diagnostics company. The company develops, manufactures, and markets a broad portfolio of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients. The company operates its business through four segments, namely ultrasound, imaging, patient care solutions, and pharmaceutical diagnostics.

Baxter International, Inc. and Boston Scientific Corporation are some of the emerging participants in the Internet of Medical Things industry.

-

Baxter International, Inc. is a medical products and services company known for its innovative healthcare solutions that enhance patient care. With a strong emphasis on renal care, hospital products, and advanced surgical technology, the company is committed to saving and sustaining lives while focusing on sustainability and social responsibility.

-

Boston Scientific Corporation operates in the medical technology field, creating, producing, and marketing devices for various interventional medical specialties. The company caters to diverse medical specialties, including critical care, electrophysiology, gastroenterology, gastrointestinal surgery, interventional cardiology, and interventional oncology, among others.

Key Internet of Medical Things Companies:

The following are the leading companies in the Internet of medical things market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- Cisco Systems, Inc.

- GE HealthCare Technologies Inc.

- Honeywell International Inc.

- IBM Corporation

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Lenovo Group Ltd.

- Medtronic plc

- Microsoft Corporation

- SAP SE

- Siemens AG

- Baxter International, Inc.

View a comprehensive list of companies in the Internet of Medical Things Market

Recent Developments

-

In June 2024, Apple Inc. previewed iOS 18 for the iPhone, making the device more capable, secure, and intelligent. In the latest update to the Health App, the Medical ID feature has been overhauled to streamline access to critical information for first responders during emergencies. The app has also been integrated with enhanced functionality to support individuals during pregnancy, offering personalized insights and suggestions based on changes in both physical and mental health conditions.

-

In May 2024, GE HealthCare Technologies Inc. and Tampa General Hospital (TGH), an academic health system, agreed to deploy GE HealthCare Technologies Inc.’s Imaging and Ultrasound technology solutions for the benefit of clinicians and patients in TGH Imaging’s outpatient facilities across the U.S. state of Florida.

-

In September 2023, Microsoft Corporation and Mercy, a healthcare system based in the U.S., announced a long-term collaboration to use digital technologies, including generative AI, to improve patient experiences by allowing advanced practice providers, physicians, and nurses to give more time to care for patients. Plans envisaged Mercy utilizing Microsoft Corporation's Azure OpenAI Service to enhance care by enabling more informed health discussions between clinicians and patients through AI-assisted conversations.

Internet of Medical Things Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 284.90 billion

Revenue forecast in 2030

USD 658.57 billion

Growth Rate

CAGR of 18.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Australia, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, U.A.E.

Key companies profiled

Apple Inc.; Boston Scientific Corporation; BIOTRONIK SE & Co. KG; Cisco Systems, Inc.; GE HealthCare Technologies Inc.; Honeywell International Inc.; IBM Corporation; Johnson & Johnson Services, Inc.; Koninklijke Philips N.V.; Lenovo Group Ltd.; Medtronic plc; Microsoft Corporation; SAP SE; Siemens AG; Baxter International, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internet of Medical Things Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Internet of Medical Things (IoMT) Market report based on component, deployment, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Wearable Devices

-

Stationary Devices

-

Implantable Devices

-

Others

-

-

Software

-

Device Management

-

Application Management

-

Cloud Management

-

Data Analytics

-

Others

-

-

Services

-

Integration & Deployment

-

Consulting

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telemedicine

-

Clinical Operations & Workflow Management

-

Connected Imaging

-

Medication Management

-

Inpatient Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Homecare

-

Clinics

-

Hospitals

-

Research Institutes & Academics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global internet of medical things market size was estimated at USD 230.69 billion in 2024 and is expected to reach USD 284.90 billion in 2025.

b. The global internet of medical things market is expected to grow at a compound annual growth rate of 18.2% from 2025 to 2030 to reach USD 658.57 billion by 2030.

b. Based on component, the hardware segment dominated the market in 2024 with a share of over 44%, owing to the increased adoption of IoT-enabled medical equipment, advancements in wireless communication technologies, technological innovations, integration with software components, and the demand for remote monitoring solutions.

b. Some of the key players in the global internet of medical things market include Apple Inc., Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Cisco Systems, Inc., GE HealthCare Technologies Inc., Honeywell International Inc., IBM Corporation, Johnson & Johnson Services, Inc., Koninklijke Philips N.V., Lenovo Group Ltd., Medtronic plc, Microsoft Corporation, SAP SE, Siemens AG, and Baxter International, Inc.

b. Key factors that are driving the internet of medical things market growth include the rising penetration of connected devices, the growing need for cost reduction in medicinal delivery, and the increasing adoption of IoT devices and technologies in the healthcare industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."