- Home

- »

- Medical Devices

- »

-

Medical Device Third-party Logistics Market Report, 2030GVR Report cover

![Medical Device Third-party Logistics Market Size, Share & Trends Report]()

Medical Device Third-party Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Transportation, Warehousing And Storage), By Class, By Type, By Device Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-565-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

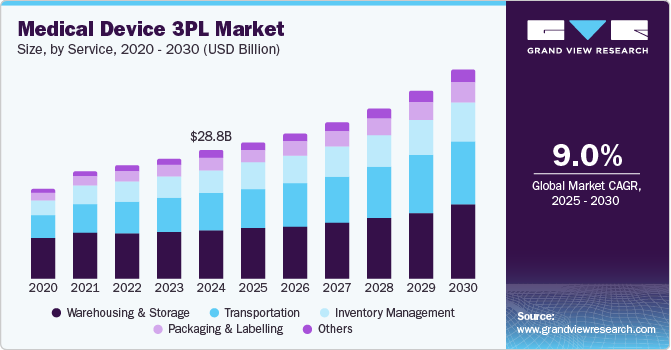

The global medical device third-party logistics market size was estimated at USD 28.76 billion in 2024 and is projected to grow at a CAGR of 9.00% from 2025 to 2030. The market growth is driven by the increasing complexity of medical device storage, the growing focus on compliance, and the demand for efficient handling and distribution. Besides, stringent regulatory requirements, optimized and improved inventory management, and streamlined shipping processes are anticipated to drive the market growth. These medical device third-party logistics (3PL) services allow medical device manufacturers and distributors to focus on innovation and patient care.

In addition, the market growth is driven by rising demand for cost-efficient medical devices, increasing requirements for stable logistics, and the growing trend of outsourcing among OEMs. Besides, the increasing need for product traceability is anticipated to drive the market over the estimated timeline. Furthermore, the medical device 3PL strengthens supply chains for medical devices, further supporting the medical device companies to focus on their core business, such as end-to-end supply chain, inventory management, and logistics with enhanced visibility and control. The services include decontamination, kitting, compliance management, and reverse logistics. It further facilitates adherence to regulations in international markets, saving time and costs for sales representatives collaborating with procurement teams and physicians.

Moreover, third party logistics providers assist medical device companies in managing a diverse range of inventories. These services offer advanced technologies and best practices to ensure efficient handling and prompt delivery of these essential healthcare products. The expertise of 3PLs in navigating the complex regulatory landscape of medical device logistics further enhances the guarantee of compliance and reduces risk.

Third-party logistics providers increasingly adopt artificial intelligence (AI), machine learning, and predictive analytics, positively impacting market growth. This shift enhances efficiency, promotes automation, lowers labor costs, and optimizes inventory management. Furthermore, the 3PL providers invest in data encryption, real-time threat detection, and enhanced vendor compliance protocols to protect critical supply chain infrastructure and reduce service disruptions. Thus, the market is witnessing the emergence of new solutions that address unique requirements such as temperature-controlled transportation for urgent delivery. The expansion of 3PL services enhances competitive differentiation in the industry.

Opportunity Analysis

The medical device third-party logistics industry presents significant growth opportunities driven by shifting trends towards outsourcing non-core activities, increasing complexity of medical device distribution, and emerging regulatory demands. The advancement of high-value and temperature-sensitive medical devices, such as implants, diagnostic kits, and surgical instruments, highlights the need for traceability and drives the demand for effective cold storage temperature monitoring and GDP-compliant transportation, enhancing competitive advantage.

Moreover, growing advances in medical devices 3PL services, such as enhancing warehouse management systems and increasing focus on tracking and managing medical devices' inventory in real-time, are expected to drive the market over the estimated time. In addition, several medical 3PLs offer automated and on-demand inventory reports to enhance the healthcare organization's focus on its core competencies while targeting its logistics requirements. Furthermore, the rising need for direct-to-patient logistics, particularly in the home healthcare and remote monitoring sectors, has increased the need for a range of 3PL services. This trend allows 3PL providers to enhance their delivery capabilities and offer additional services, such as device setup and handling of returns. In addition, rising e-commerce channels for medical devices further present new growth opportunities for specialized fulfillment and real-time inventory management.

In addition, expansion into emerging markets such as North America, Europe, and Latin America is expected to fuel the requirements for 3PL services and drive the demand for regulatory-compliant logistics partners. OEMs increasingly seek integrated logistics solutions as they focus on cost efficiency and supply chain resilience. This shift creates opportunities for long-term partnerships with 3PL providers with digital capabilities, compliance expertise, and scalable infrastructure, which are expected to drive the market further in the forthcoming years.

Impact of U.S. Tariffs on the Global Medical Device Third-party Logistics Market

The implementation of U.S. tariffs on imported medical devices and their components has resulted in increased costs and operational challenges throughout the medical device supply chain, including third-party logistics providers. Though these tariffs do not directly target logistics services, the impact moderately influences service providers. In addition, the increased import costs drive the manufacturers to reassess their sourcing strategies, leading to changes in distribution networks and a growing preference for U.S.-based or tariff-exempt suppliers. Moreover, several other factors affecting market growth are pressures on volume and cost that strain existing warehouses and customs clearance operations.

On the other hand, the demand for logistics providers is rising as they offer expertise in tariffs, trade compliance consulting, and flexible rerouting solutions, contributing to an increase in foreign-trade zone services to comply with or reduce duty obligations. Besides, the shifting tariff landscape is accelerating the trends toward regionalization, with many OEMs moving away from traditional U.S. and China distribution routes. This shift led to increased investment in North America logistics hubs, particularly in Mexico and Canada, as companies seek to mitigate tariff impacts while remaining close to market demands. Thus, the overall effect of U.S. tariffs on medical device third-party logistics has been moderate.

Technological Advancements

Technological innovations in medical device third-party logistics are enhancing the need for improved visibility, compliance, and operational efficiency. Technologies such as GPS, RFID, and IoT sensors have become essential for monitoring high-value and temperature-sensitive medical devices throughout the supply chain. These technologies enable real-time visibility, allowing proactive management of delays, condition deviations, and route change elements specifically for devices with strict handling requirements. In addition, cloud-based platforms have become essential for inventory management, order processing, and documentation, allowing seamless data sharing between 3PL providers and manufacturers.

In addition, artificial intelligence and predictive analytics are leveraged to enhance route planning, forecast demand, and minimize instances of stockouts or overstocking. Besides, blockchain technology is increasingly gaining traction to improve data security, ensuring tamper-proof documentation and improving traceability to comply with regulations such as UDI and EU MDR. Furthermore, warehouse automation technologies, including robotics, automated guided vehicles, and intelligent sorting systems, enhance throughput and minimize human error. Likewise, digital twin technology is being studied for its potential in scenario planning and optimizing processes. These advancements allow 3PLs to evolve from traditional logistics roles to becoming strategic partners, offering value-added services that meet the standards of the medical device industry.

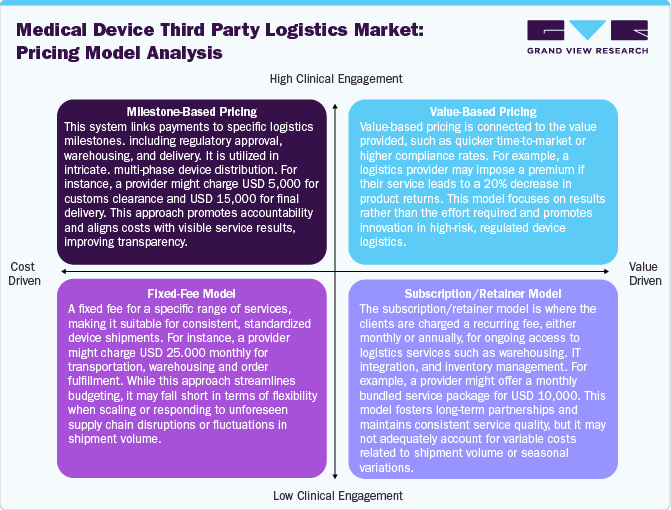

Pricing Model Analysis

In the medical device third party logistics (3PL) industry, the pricing model is evolving with the changing complexity and regulatory demand of the industry. The milestone-based pricing, where fees are tied to service benchmarks such as USD 3,000 for regulatory document verification or USD 10,000 for international delivery. This model is preferred for its transparency and performance in customs, cold chain management, and multi-modal transport projects. In addition, the value-based pricing is based on measuring outcomes such as enhanced order accuracy or reducing medical device recalls. For instance, a provider might apply a 10% premium if their logistics services result in a 15% reduction in delivery time, making this model highly suitable for high-value and time-sensitive medical devices.

Moreover, the fixed-fee model involves a set of monthly or per-project rates for defined logistics services, such as USD 20,000 per month for distribution, warehousing, and inventory management. This model is well-suited for stable, recurring supply chains. Furthermore, the subscription models provide access to a bundle of services for a recurring fee, typically ranging from USD 8,000 to USD 12,000 monthly. This model promotes long-term partnerships and is particularly advantageous for companies seeking scalable and integrated logistics support over time.

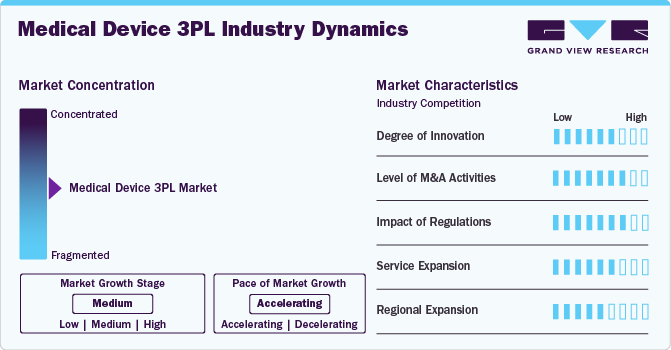

Market Characteristics and Concentration

The market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, product expansion, and regional expansion.

The medical device third-party logistics industry is witnessing significant innovation, fueled by advancements in digital technology and the implementation of real-time tracking systems. Besides, the service providers are increasingly investing in AI-driven solutions, IoT-enabled cold chain monitoring, cloud logistics platforms, and blockchain technology to enhance supply chain transparency. In addition, the growing focus on the automation of warehouse operations and the integration of robotic systems is boosting efficiency and boosting market growth.

Regulatory frameworks such as the FDA’s UDI program, EU MDR, and ISO play a crucial role in the operations of 3PL providers. In addition, the non-compliance can lead to risks such as product holds, recalls, and financial penalties. As regulatory oversight intensifies, 3PL providers must implement advanced compliance tools and adhere to Good Distribution Practice (GDP). Moreover, the regulatory environment is increasingly required for licensing, documentation, and validated storage and transportation protocols for high-risk medical devices.

The competition among market players is due to growing activity in the medical device third-party logistics to enhance capabilities in temperature-controlled logistics, regulatory compliance, and last-mile delivery. Furthermore, the growing demand for integrated services and expansion into new regions is expected to drive market growth. The diversification of service offerings and a broader global footprint are also key contributors to this growth.

The market remains moderately fragmented due to the presence of an emerging number of 3PL service providers, expanding regional presence, and rising demand for innovative medical device products. In addition, the large players dominate the market while the smaller and emerging companies increasingly provide customized services that adhere to local regulations. This fragmentation creates variation in pricing and quality of service, particularly in regions with limited regulatory frameworks.

Regional expansion is increasing with the growing medical device consumption. In addition, medical device 3PLs are establishing new cold-chain facilities and bonded warehouses to fulfill local compliance requirements. Factors such as the increasing volume of surgical procedures, an aging population, and the efforts of original equipment manufacturers (OEMs) to decentralize supply chains beyond North America and Western Europe are contributing to the market growth.

Services Insights

Based on service, the market is segmented intotransportation, warehousing and storage, inventory management, packaging & labelling, and others. The warehousing and storage segment dominated the market with the largest revenue share of 37.17% in 2024. The segment growth is driven by increasing demand for secure, compliant storage facilities for temperature-sensitive medical devices and a rising need to optimize the storage and distribution of these devices throughout facility networks.

Furthermore, the warehousing facilities are mostly equipped with specialized cold storage capabilities to maintain the quality of medical devices. This further supports the cost savings associated with storing and distributing the products. It further enhances the quality of care by safeguarding devices against damage, corrosion, and other environmental threats. In addition, warehousing & storage support minimize the risk of accidents, protecting equipment from corrosion and other environmental factors while saving time and cost. Moreover, warehousing and storage ensure that medical devices are adequately protected from theft and damage, playing a vital role in the timely and effective distribution of medical devices, enhancing healthcare quality, and patient outcomes.

The inventory management segment is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by increasing medical device procurement for seamless and equal distribution to healthcare facilities. In addition, inventory management involves systematically overseeing and controlling medical equipment and supplies within healthcare facilities. Covering the entire lifecycle of devices, from procurement to usage and disposal, ensuring the availability, efficiency, and safety of essential medical tools. Such factors are expected to drive segment growth over the estimated period.

Class Insights

Based on class, the market is segmented into Class I, Class II, and Class III. The class I segment accounted for the largest market revenue share in 2024.The high segment share is due to growing demand for affordable and minimally risky Class I medical devices and rising e-commerce platforms with direct-to-consumer delivery models. Besides, these devices include items like surgical tools, stethoscopes, and examination gloves, which usually face less regulatory scrutiny, allowing for easier distribution. In addition, logistics providers are enhancing supply chains for class I devices by utilizing automation, advanced inventory management systems, and just-in-time delivery methods to meet the demand for medical devices in the market. Furthermore, hospitals, clinics, and retailers have increased the requirement for these devices, further contributing to the market revenue growth. With a global healthcare focus on preventive care and outpatient services, the volume and frequency of shipments for Class I medical devices are expected to witness new opportunities with high-volume, low complexity, further fueling the market growth.

The Class II segment is expected to grow at the fastest CAGR during the forecast period. Class II medical devices present a higher risk category and are more complicated than Class I devices. In addition, these devices require more regulatory controls to provide reasonable assurance of their safety and effectiveness, increasing the need for 3PL services for supply chain management. Furthermore, these include devices that come into contact with a patient's cardiovascular system or internal organs and diagnostic tools. For instance, according to the U.S. FDA, 43% of medical devices fall under this category. Aforementioned factors are anticipated to drive overall segmental growth.

Type Insights

Based on type, the market is segmented into cold chain logistics and non-cold chain logistics. The non-cold chain logistics segment accounted for the largest market revenue share in 2024.The high segment share is due to growing demand for efficient, scalable, and regulatory-compliant product distribution that does not require temperature-controlled logistics, such as surgical tools, diagnostic equipment, and durable medical devices. In addition, logistics offers various benefits, including reduced operational costs, scalability, and improved visibility across the supply chain. In addition, integration of digital technologies like RFID, GPS tracking, and AI-based route optimization to ensure real-time visibility and operational efficiency is anticipated to drive the market growth. Moreover, the pressure to reduce costs and the need for rapid scalability will likely promote quicker market access, cost optimization, and streamlined distribution of medical devices.

The cold chain logistics segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is due to rising demand for temperature-sensitive products, including in-vitro diagnostics, implantable devices, surgical instruments, and wearable sensors. In addition, cold chain logistics provides precise temperature control throughout the supply chain, encompassing production, storage, transportation, and delivery, ensuring the protection of medical devices. Furthermore, the increasing need for advanced diagnostics that require precise temperature control is expected to drive the market over the estimated period. Moreover, growing adoption of cold-chain logistics enhanced by integration of IoT-based temperature monitoring, GPS tracking, and automated data logging in both emerging and developed markets supports the market growth. These factors are expected to support market growth in the forthcoming years.

Device Type Insights

Based on device type, the market is segmented into diagnostic devices and therapeutic devices. The diagnostic devices segment accounted for the largest market revenue share in 2024. The segment growth is driven by rising demand for diagnostic devices, the number of surgeries, and the growing need for monitoring and decentralized testing. In addition, increasing adoption of point-of-care (POC) and at-home diagnostic devicesis likely to boost the requirement for 3PL services as it reduces shipping costs, further improving operations without compromising quality. Moreover, growing stringent timelines and regulatory requirements are anticipated to drive the market over the estimated period.

The therapeutic devices segment is expected to grow at the fastest CAGR during the forecast period. The segment is driven by the demand for biologics and pharmaceutical treatments, a rise in home-based healthcare and chronic disease management, and an increased focus on cold chain logistics. Besides, the rising need for 3PL services to manage products with diverse temperature requirements and stability considerations throughout their lifecycle is expected to drive segment growth. In addition, stringent regulatory compliance, growing complexity of devices, and the need for specialized handling of therapeutic devices contribute to market growth.

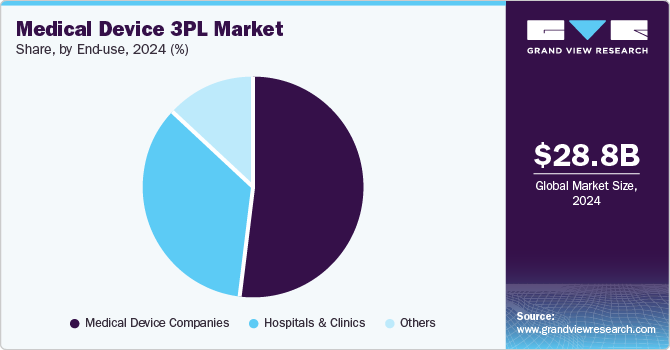

End Use Insights

Based on end use, the market is segmented into medical device companies, hospitals & clinics, and others. The medical device companies segment accounted for the largest market revenue share in 2024. The segment growth is driven by the shifting trend toward third-party logistics, the rising adoption of technology-enabled logistics solutions, and an increased focus on optimizing global distribution. In addition, growing focus on cost efficiency and stringent regulatory requirements contributes to segment growth. Besides, the real-time tracking, automation, and compliance with Good Distribution Practices (GDP) in warehousing boost market growth. In addition, the rising product complexity, demand for last-mile delivery, and expanding direct-to-consumer models have increased the requirement for third-party logistics providers. Such factors are anticipated to drive the segment growth over the estimated time period.

The hospitals & clinics segment is expected to grow at the fastest CAGR during the forecast period. This segment is driven by outsourcing end-to-end logistics services, rising usage of automated inventory systems, and increasing need for supply chain resilience. Besides, the 3PL services support hospitals & clinics to improve efficiency, minimize stockouts, and support their clinical operations. Such factors are expected to enhance reliability, traceability, and operational optimization, further contributing to market growth.

Regional Insights

North America dominated the medical device third-party logistics market with the largest revenue share of 39.53% in 2024. The regional growth is driven by factors such as the increasing reliance on transportation solutions for critical medical devices, the increasing focus on navigating the complexities of international shipping, and the growing demand for compliant storage and transportation solutions for various medical devices. In addition, strict regulatory requirements and the presence of established 3PL service providers are expected to drive the market over the estimated time.

Furthermore, established 3PL providers in the U.S., Canada, and Mexico support medical device manufacturers to reduce their overhead costs through effective outsourced logistics services, allowing them to concentrate on their core business while managing fulfillment efficiently. As a result, numerous medical device companies are turning to third-party logistics, offering significant advantages such as cost savings, access to advanced technologies, flexibility, regulatory compliance, and risk management, further contributing to market growth.

U.S. Medical Device Third-party Logistics Market Trends

The medical device third party logistics market in the U.S.accounted for the largest market revenue share in North America in 2024, due to the presence of established companies and a growing demand for complex medical devices. As medical devices play a critical role in patient care, efficient handling and storage are essential for enhancing their effectiveness. Besides, this approach reduces costs and improves overall operational efficiencies throughout the device lifecycle, from initial conception to end-of-life decommissioning.

In addition, several U.S. medical device companies opt to outsource logistics due to the country's advanced healthcare infrastructure, stringent regulatory requirements, and a high demand for specialized logistics solutions. In addition, increasing focus on core innovation and regulatory compliance drives the market growth. Moreover, the rising need for 3PL services that offer temperature-controlled logistics, real-time tracking, and efficient last-mile delivery is expected to boost the demand for surgical instruments, diagnostic devices, and home-use equipment. Furthermore, most U.S. manufacturers seek supply chain resilience and quicker market access, making 3PL providers offering integrated, technology-driven, and regulatory-compliant solutions well-positioned for market growth.

The Canada medical device third-party logistics marketis driven by the increasing need for comprehensive logistics solutions and the growing demands associated with critical medical device transportation services. Besides, the medical device 3PLs are equipped with advanced infrastructure and expertise, supporting the medical device manufacturer in lowering the operational expenses related to transportation and warehousing by optimizing delivery routes and shipments and using their extensive carrier networks. In addition, 3PL providers offer significant advantages for manufacturers by having established shipping centers, which enable them to negotiate more favorable shipping terms on behalf of the clients. In addition, the cost efficiency and flexible shipping options are expected to boost the market over the estimated time period.

Europe Medical Device Third-party Logistics Market Trends

The medical device third-party logistics market in Europe is driven by a favorable regulatory framework across various European nations, an increasing number of 3PL providers, and a rising demand for supply chain logistics, increasing focus on cost-effective manufacturing to capitalize on broader opportunities within this market. In addition, outsourcing logistics supports companies to focus on developing and innovating their medical device offerings. These 3PL providers enhance companies' flexibility, infrastructure, and expertise in global logistics.

Moreover, countries like the UK, Germany, and France, which have well-established 3PL services, rapidly evolve with regulatory complexity, cross-border trade, and increasing demand for temperature-sensitive device distribution. Moreover, the implementation of the EU has increased the need for 3PL services in the medical device industry, creating new growth opportunities for the market. Furthermore, the manufacturers are turning to outsourcing logistics to manage cost pressures and focus on innovation, while 3PLs are investing in GDP-compliant warehousing, real-time tracking, and cold chain capabilities. Such factors are expected to drive the market over the estimated period.

The Germany medical device third-party logistics market accounted for the largest market revenue share in Europe in 2024. This growth can be attributed to the increasing prevalence of diseases, a stringent regulatory environment, and an increasing demand for various medical devices. In addition, trends such as the adoption of digital technologies, including real-time tracking systems, warehouse automation, and the integration of IoT devices for temperature-sensitive shipments, are expected to propel market growth during the forecast period. These innovations are expected to enhance operational efficiency, ensure regulatory compliance, and improve supply chain visibility.

The medical device third-party logistics market in the UK is anticipated to grow at a significant CAGR over the forecast period. The country's growth is driven by advanced knowledge, advanced medical technology, and a rising need for medical devices, including surgical instruments, patient monitoring systems, and insulin pumps. Besides, most medical device 3PL companies offering inventory storage services are expected to witness rising growth over the estimated period.

Asia Pacific Medical Device Third-party Logistics Market Trends

The medical device third-party logistics market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region’s growth is driven by various factors, including increasing demand for various medical devices, increased market competition, and a stronger focus on warehousing and advanced medical device technologies. In addition, the rising complexity of medical devices, stringent regulatory requirements, and the necessity for specialized handling and transportation are anticipated to drive the market over the estimated period.

Furthermore, 3PL services provide medical device manufacturers with low manufacturing costs, attracting numerous medical device companies across the globe, further contributing to the market growth. In addition, the growing use of digital technologies such as real-time tracking systems, automation in warehousing, and the integration of Internet of Things (IoT) devices for managing temperature-sensitive shipments is expected to drive the market over the estimated period.

The China medical device third-party logistics market is driven by a growing aging population, increasing prevalence of chronic diseases, increased healthcare spending, the growing number of clinics and hospitals, and stringent regulatory scenarios. In addition, increasing demand for temperature-controlled logistics solutions for medical devices, increasing focus on quality assurance, and growing specialized cold storage facilities are anticipated to drive the market over the estimated period. In addition, the growing number of distribution centers and the increasing number of transportation networks in the country are anticipated to fuel the market. Moreover, expansion of distribution centers and transportation further enhances the importance of medical devices within the country’s medical device sector, fueling the market growth. In addition, the increasing availability of medical devices for various diseases is expected to drive the market over the estimated period.

The medical device third-party logistics market in Japan is driven by access to advanced technologies that promote high-quality and innovative manufacturing practices. In addition, improvements in the supply chain and a rising demand for third-party logistics services are expected to contribute to market growth. Furthermore, Japan’s manufacturing landscape benefits from cost efficiency, shorter development timelines, well-established manufacturing processes, and a proactive approach to competitive manufacturing techniques, further supporting the medical device 3PL services. Moreover, outsourcing logistics offers various benefits, including effective warehouse management, transportation at distribution hubs, and enhanced quality assurance. These logistics supply chains feature fully integrated & digitalized warehouses and services for the supply of medical devices. Such factors are expected to drive market growth in Japan.

The India medical device 3PL market isdriven by the developing healthcare infrastructure, increasing innovation in medical devices, rising outsourcing trends, increased availability of industry experts, cost-effective manufacturing, and regulatory compliance. Furthermore, the demand for efficient logistics solutions, particularly for managing temperature-sensitive products, is expected to drive market growth.

Latin America Medical Device Third-party Logistics Market Trends

The medical device 3PL market in Latin America is driven by factors such as an aging population, increased healthcare investments, and a growing demand for efficient logistics solutions for medical devices. In addition, the rising number of manufacturing and logistics providers in the region is anticipated to drive the market over the estimated period.

The Brazil medical device third-party logistics market is driven by innovation and the presence of international medical device companies. This growth is fueled by enhanced access to private healthcare, improved healthcare services, favorable regulatory scenarios, and the expansion of 3PL services. In addition, the increasing manufacturing capacity of medical device companies and the growing network of manufacturing partners enhancing their global supply chains are anticipated to boost market growth.

Middle East & Africa Medical Device Third-party Logistics Market Trends

The medical 3PL marketin the MEA region is anticipated to grow at a steady CAGR during the forecast period. The region offers modest performances in the logistics market, transportation sector, and medical device industry. Moreover, increasing government initiatives to improve the healthcare system in the region are one of the major factors driving market growth.

The South Africa medical device 3PL market isdriven by the growing need for medical devices and the rising presence of key players offering 3PL services for supplying medical devices. The country’s supply chain logistics have proven to offer the capacity to centralize the distribution of high-value, temperature-sensitive products, thereby reducing transportation time and costs. This centralization ensures that medical devices can reach even the most remote areas effectively, further supporting the market growth.

Key Medical Device Third-party Logistics Company Insights

The key players operating across the market are adopting inorganic strategic initiatives such as partnerships, mergers, acquisitions, service launches, partnerships & agreements, and expansions to gain a competitive edge in the market.

For instance, in May 2024, Kuehne+Nagel introduced a new service option for transporting medical technology devices in Europe's road freight services. While not subject to GxP requirements, this expanded offering provides logistics solutions while adhering to the safety and quality standards for handling high-value medical and diagnostic equipment. The service is available in the UK, Germany, France, the Netherlands, Spain, and Italy.

Key Medical Device Third-party Logistics Companies:

The following are the leading companies in the medical device 3PL market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- DHL International GmbH

- SF Express

- United Parcel Service of America, Inc.

- Cencora

- FedEx

- Warehousing and Fulfillment

- Plexus Corp.

Recent Developments

-

In March 2025, OrthoEx, a third-party logistics provider focused on medical device distribution expanded its services with tissue banking. This new capability will allow OrthoEx to facilitate the storage and distribution of human cells, tissues, as well as cellular and tissue-based products, further enhancing its logistics solutions for the healthcare sector.

-

In February 2024, GlobalMed Logistix expanded Atlanta campus in the U.S., which will increase its operational footprint by 200% and introduce new services. The expansion includes 65,000 square foot facility to meet the rising demand from healthcare companies seeking GMLx's expertise in medical device handling and third-party logistics solutions.

Medical Device Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.55 billion

Revenue forecast in 2030

USD 47.01 billion

Growth rate

CAGR of 9.00% from 2025 to 2030

Base year for estimation

2024

Historical period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, class, type, device type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cardinal Health; DHL International GmbH; SF Express; Kinesis Medical B.V.; United Parcel Service of America, Inc.; Cencora; FedEx; Warehousing and Fulfillment; and Plexus Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device 3PL market report based on service, class, type, device type, end use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Air Freight

-

Overland

-

Sea Freight

-

-

Warehousing and Storage

-

Inventory Management

-

Packaging & Labelling

-

Others

-

-

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Class I

-

Class II

-

Class III

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Chain Logistics

-

Non-cold Chain Logistics

-

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Therapeutic Devices

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Brazil

-

Argentina

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical device third-party logistics market size was estimated at USD 28.76 billion in 2024 and is expected to reach USD 30.55 billion in 2025.

b. The global medical device third party logistics market is expected to grow at a compound annual growth rate of 9.00% from 2025 to 2030 to reach USD 47.01 billion by 2030.

b. North America dominated the medical device 3PL market with a share of 39.53% in 2024. The regional growth is driven by increasing reliance on transportation solutions, growing demand for compliant storage and transportation solutions for various medical devices, and strict regulatory requirements.

b. Some key medical device third party logistics market players are Cardinal Health, DHL International GmbH, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., Cencora, FedEx, Warehousing and Fulfillment, Plexus Corp. among others.

b. Key factors that are driving the medical device third party logistics market growth include the increasing complexity of medical device storage, growing demand for efficient handling and distribution of medical devices, presence of established 3PL service providers and stringent regulatory requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.