- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Flexible Packaging Market, Industry Report, 2033GVR Report cover

![Medical Flexible Packaging Market Size, Share & Trends Report]()

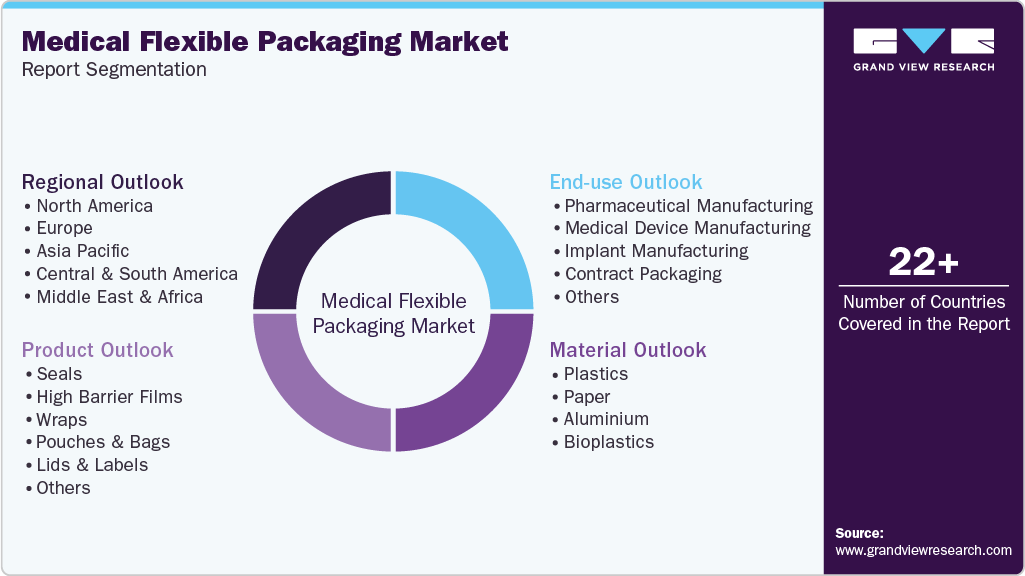

Medical Flexible Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Plastic, Paper, Aluminum, Bioplastics), By Product (High Barrier Films, Pouches & Bags), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-893-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Flexible Packaging Market Summary

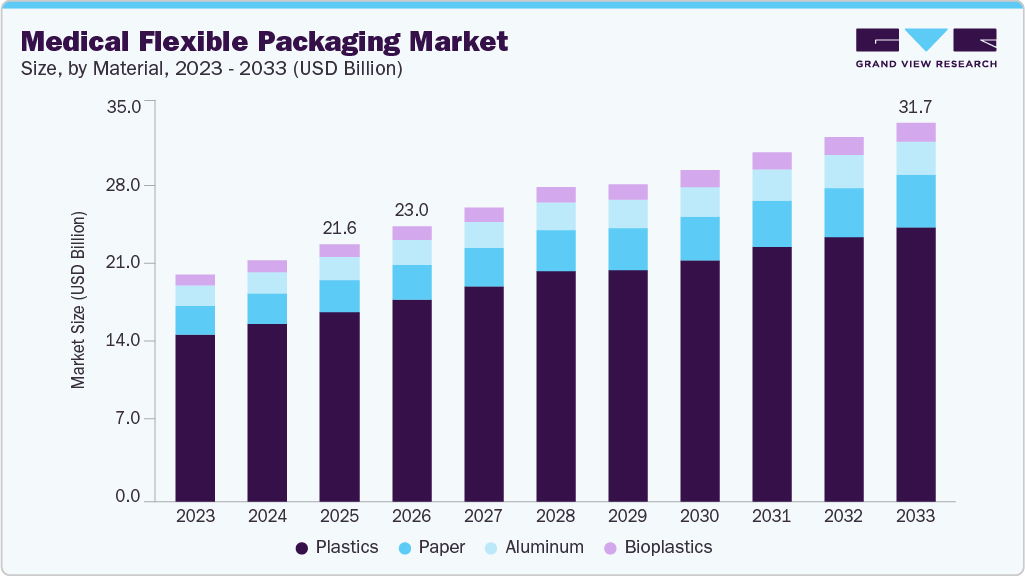

The global medical flexible packaging market size was estimated at USD 21.56 billion in 2025 and is projected to reach USD 31.75 billion by 2033, growing at a CAGR of 4.7% from 2026 to 2033. The growing pharmaceutical industry in emerging economies coupled with increasing demand for drug delivery devices and blister packaging is triggering the demand for medical flexible packaging solutions across the globe.

Key Market Trends & Insights

- Asia Pacific dominated the Medical Flexible packaging Market with the largest revenue share of over 58.53% in 2025.

- The Medical Flexible packaging Market in China is expected to grow at a substantial CAGR of 5.1% from 2026 to 2033.

- By material, the plastic segment accounted for the largest revenue share of 73.63% in 2025.

- By product, the pouches & bags segment was valued at a revenue share of 35.08% in 2025.

- By End-use, the contract packaging segment is expected to grow at a fastest CAGR of 5.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 21.56 Billion

- 2033 Projected Market Size: USD 31.75 Billion

- CAGR (2026-2033): 4.7%

- Asia Pacific: Largest market in 2025

The healthcare sector has witnessed a significant shift towards portability and convenience, fueling the demand for flexible packaging solutions. Flexible packaging offers lightweight and compact alternatives to traditional rigid packaging, making it easier for patients to carry and store medical products, such as inhalers, bandages, and injectable drugs. This convenience factor has become particularly important in today's fast-paced and mobile lifestyle, driving the adoption of flexible packaging in the medical field.The pharmaceutical and biotechnology industries are major contributors to the global market. The continued expansion of these industries and introduction of new drug formulations created the need for effective and reliable packaging solutions, thus driving the demand for flexible packaging solutions in medical applications. Flexible packaging materials, such as foils, films, and pouches, offer excellent barrier properties, protecting sensitive pharmaceutical products from moisture, oxygen, and other environmental factors that can compromise their efficacy and shelf life.

There is a growing emphasis on sustainability and reducing the environmental impact of packaging materials across various industries, including healthcare. Flexible packaging solutions often require less material and generate less waste compared to traditional rigid packaging options. Therefore, the manufacturers of medical flexible packaging solutions are striving to incorporate recycled material and offer sustainable and recyclable packaging solutions. For instance, in October 2023, Amcor Plc entered a Memorandum of Understanding (MOU) with SK geo-centric Co., Ltd., a prominent petrochemical company located in South Korea. As per the MOU, starting from 2025, Amcor will procure advanced recycled material primarily from SK in the Asia Pacific region. This strategic partnership is expected to enable Amcor to offer packaging solutions with recycled content to its food and healthcare customers in key markets across Asia Pacific and around the world.

Medical flexible packaging plays a crucial role in maintaining product safety and sterility, which are paramount concerns in the healthcare industry. Flexible packaging materials can be designed with advanced barrier properties, preventing contamination and ensuring the integrity of medical products during transportation and storage. Moreover, certain flexible packaging solutions can incorporate features such as tamper-evident seals, enhancing product security and patient safety.

Market Concentration & Characteristics

The global medical flexible packaging market is defined by its high-performance, risk-averse nature, where product safety and reliability outweigh cost sensitivity. Unlike consumer packaging, demand here is non-cyclical and closely tied to healthcare delivery volumes, making the market relatively resilient during economic slowdowns. Buyers-primarily pharmaceutical companies, medical device manufacturers, and diagnostic firms-prioritize consistency, regulatory compliance, and long-term supplier relationships over rapid supplier switching. This results in a market structure with high entry barriers, where established players with validated materials, clean-room manufacturing, and regulatory certifications maintain strong competitive positions. Product lifecycles are long, and qualification processes are rigorous, which slows commoditization and supports stable margins for compliant suppliers.

Functionality and regulatory compliance shape nearly every market characteristic. Medical flexible packaging must perform multiple roles simultaneously: protect against contamination, maintain sterility, withstand sterilization methods, and support traceability across complex supply chains. As a result, innovation in this market is incremental and validation-driven rather than disruptive. Material choices are conservative, favoring proven multilayer films and laminates that balance barrier performance with seal integrity. Regulations do not merely influence demand; they actively shape product design, production processes, and even geographic sourcing decisions. This regulatory intensity creates a market where operational discipline, documentation capability, and quality control infrastructure are as important as material science expertise.

Demand patterns reflect long-term healthcare trends rather than short-term consumer behavior. Growth is closely linked to rising medical procedure volumes, expansion of pharmaceutical manufacturing, increasing use of single-use medical products, and the shift toward home-based and self-administered care. Sustainability is emerging as an important qualitative shift, but adoption remains cautious; environmental considerations are secondary to patient safety and regulatory acceptance. As a result, the market is evolving toward ‘safe sustainability,’ where recyclable or downgauged solutions are adopted only when they meet stringent medical standards. Overall, the medical flexible packaging market is characterized by stability, technical depth, and gradual evolution, with innovation guided by risk mitigation and compliance rather than speed or cost disruption.

Material Insights

Based on material, the market has been segmented into plastics, paper, aluminium, and bioplastics. The plastic segment recorded the largest market revenue share of 73.63% in 2025. Plastic dominates the medical flexible packaging material segment primarily because it offers the most reliable balance of sterility, barrier protection, processability, and regulatory acceptance. Medical-grade plastics can be engineered into multi-layer structures that provide strong resistance to moisture, oxygen, chemicals, and microbial contamination while remaining lightweight and durable across transport and storage.

Crucially, plastics are compatible with common sterilization methods such as ethylene oxide, gamma irradiation, and steam, without compromising seal integrity or material performance. They also enable precise forming, sealing, and customization for pouches, bags, wraps, and blister formats, which is essential for medical and pharmaceutical applications. Compared to alternatives like paper or bio-based materials, plastics have a longer validation history and lower risk of performance failure, making them the preferred choice in a market where patient safety, regulatory compliance, and consistency are non-negotiable.

The paper material segment is expected to witness at the fastest CAGR of 5.8% over the forecast period. The demand for this material-based packaging is driven by its lightweight property and its availability in various shapes and sizes. The temperature resistance exhibited by this material-based packaging is expected to drive the demand for this packaging material over the forecast period.

Product Insights

The market is segmented into seals, high barrier films, wraps, pouches & bags, lids & labels, and other products. The pouches & bags segment led the market with the largest revenue share of over 35.08% in 2025. Pouches and bags offer a convenient packaging solution for hospitals, clinics, and other healthcare facilities. They are easy to open, dispense, and dispose of, which simplifies the handling and usage of medical products, especially in critical care environments.

The high barrier films segment is expected to witness at the fastest CAGR of 5.5% during the forecast period. High barrier films act as effective microbial barriers, preventing the ingress of microorganisms, bacteria, and other contaminants that could compromise the sterility of medical products.

End-use Insights

Based on end use, the market is segmented into pharmaceutical manufacturing, medical device manufacturing, implant manufacturing, contract packaging, and others. The pharmaceutical manufacturing segment led the market with the largest revenue share of over 28.92% in 2025. The global pharmaceutical industry is continuously expanding, driven by factors such as an aging population, increasing prevalence of chronic diseases, and the development of new drugs and therapies. This growth in pharmaceutical production directly translates into a higher demand for flexible packaging solutions to ensure the safe and effective delivery of these products.

The contract packaging segment is projected to grow at the fastest CAGR of 5.2% over the forecast period. Contract packaging services offer cost advantages to medical device manufacturers and pharmaceutical companies. By outsourcing their packaging operations, these companies avoid the substantial capital investments required for setting up in-house packaging facilities and infrastructure. Contract packagers can leverage economies of scale and specialized expertise, resulting in cost savings.

Regional Insights

Asia Pacific dominated the medical flexible packaging market with the revenue share of over 58.53% in 2023. The Asia Pacific region has a massive population base, which translates into a large patient pool and increased demand for healthcare products and services, including medical flexible packaging solutions. Many countries in the Asia Pacific region, such as China, India, Japan, and South Korea, have experienced significant growth in their healthcare industries, driven by rising disposable incomes, increasing healthcare expenditure, and government initiatives to improve healthcare infrastructure, thus benefitting the market growth in the region.

The medical flexible packaging market in India is anticipated to grow at a fastest CAGR during the forecast period. The market growth is positively impacted by the establishment of new pharmaceutical companies and the expansion of existing production capabilities. For instance, in February 2021, the Punjab government announced plans to establish three pharma parks within the state. One of these parks, located in Bhatinda, is expected to span approximately 1,300 acres, and require an investment of around USD 245.58 million. These developments indicate a favorable outlook for the healthcare blister packaging market as it aligns with the expansion of the pharmaceutical industry in the country.

North America Medical Flexible Packaging Market Trends

The medical flexible packaging market in North America is anticipated to grow at a significant CAGR during the forecast period. The significant increase in the production of pharmaceuticals and their sales in North American countries, namely the U.S., Canada, and Mexico, is positively impacting the growth of the healthcare blister packaging market in the region. For instance, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America accounted for a share of 52.30% of global pharmaceutical sales, whereas Europe accounted for a share of 22.40% in 2022. In addition, according to EFPIA, 64.4% of sales of new medicines launched from 2017 to 2022 were in the U.S. market. Hence, the launch of new medicines in the form of tablets, capsules, and pills creates the need for reliable packaging solutions, which, in turn, is expected to drive the market growth over the forecast period.

U.S. Medical Flexible Packaging Market Trends

The U.S. medical flexible packaging market is growing due to an increase in the establishment of new chemical and biological companies in the country. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the country saw the introduction of 65 new chemical and biological entities between 2008 and 2012. This positive trend continued with the launch of an additional 100 new chemical and biological entities from 2013 to 2017, followed by 159 more entities from 2018 to 2022. These statistics indicate a promising future for pharmaceutical and healthcare industries, creating growth opportunities for healthcare packaging solutions, including medical flexible packaging, within the country.

Europe Medical Flexible Packaging Market Trends

The medical flexible packaging market in Europe held a substantial revenue share in 2025, owing to stringent regulations and standards. Europe has stringent regulations and standards for medical packaging, such as the EU's Medical Device Regulation (MDR) and Good Manufacturing Practices (GMP) guidelines. These regulations ensure the safety and quality of medical products, driving the demand for high-quality and compliant flexible packaging solutions.

The Germany medical flexible packaging marketis primarily driven by the increasing efforts made by the Government and flexible packaging solutions manufacturers to develop and offer sustainable packaging products in the healthcare industry. For instance, in February 2024, Graphic Packaging International launched a Centre of Excellence for Pharmaceutical Leaflets in Germany, enhancing its offerings in sustainable paperboard packaging solutions for pharmaceutical products. This move allows the company to provide a comprehensive range of leaflet solutions, including ousters, catering to the pharmaceutical and medical sectors. The Magdeburg site in Germany has been transformed into this Centre of Excellence, showcasing the company's commitment to delivering high-quality packaging solutions for its customers in the healthcare industry.

Key Medical Flexible Packaging Company Insights

The competitive landscape of the global medical flexible packaging market is shaped by a mix of large multinational material and packaging firms alongside specialized regional players. Established corporations with extensive R&D, validated quality systems, and global manufacturing footprints, such as Amcor, Berry Global, Sealed Air, and Bemis/Winpak, dominate market share by offering broad product portfolios tailored to stringent medical standards. These leaders invest heavily in regulatory compliance infrastructure, clean-room production, and material innovation, enabling them to serve major pharmaceutical and medical device companies that demand long-term supply reliability, global consistency, and technical support. Their scale gives them cost and distribution advantages, while established brand reputations reduce qualification friction with cautious buyers.

At the same time, the competitive landscape features dynamic niche and regional players that differentiate through specialized capabilities and customer intimacy. Smaller firms often focus on high-value segments such as customized sterile barrier systems, complex pouch formats, or emerging markets where local responsiveness and flexible order volumes are priorities. These players compete by offering rapid development cycles, tailored solutions, and close collaboration with customers in regulated product launches. In recent years, competitive pressures have also shifted toward value-added services-such as regulatory consulting, serialization support, and sustainability initiatives-as buyers look for partners who can help navigate evolving compliance and environmental expectations. While pricing remains important, technical expertise, quality certifications, and the ability to support complex medical supply chains are the most critical competitive factors in this market.

-

In November 2023, Coveris launched a new recyclable thermoforming film packaging solution called MonoFlex Thermoform. This innovative product offers excellent puncture resistance and is designed to provide optimal protection for various applications, including medical devices. The MonoFlex Thermoform film is a sustainable option that aligns with Coveris' commitment to environmental responsibility

-

In August 2023, Amcor plc announced the acquisition of a scalable flexible packaging plant in the high-growth Indian market. This strategic move involves the acquisition of Phoenix Flexibles, expanding Amcor's capacity in India. The company already operates four flexible packaging plants in India. This acquisition aligns with Amcor's position as a global leader in developing sustainable packaging solutions

Key Medical Flexible Packaging Companies:

The following key companies have been profiled for this study on the medical flexible packaging market.

- Amcor plc

- AptarGroup, Inc.

- BD (Becton, Dickinson and Company)

- Berry Global Inc.

- WINPAK LTD.

- Sealed Air

- Mondi

- Huhtamaki Oyj

- Coveris

- WestRock Company

- Datwyler Holding Inc.

- Catalent, Inc.

- CCL Industries, Inc.

- Gerresheimer

- Bemis Company, Inc.

Medical Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 23.04 billion

Revenue forecast in 2033

USD 31.75 billion

Growth rate

CAGR of 4.7% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; the Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Amcor plc; AptarGroup, Inc.; BD (Becton, Dickinson and Company); Berry Global Inc.; WINPAK LTD.; Sealed Air; Mondi; Huhtamaki Oyj; Coveris; WestRock Company; Datwyler Holding Inc.; Catalent, Inc.; CCL Industries, Inc.; Gerresheimer; Bemis Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Flexible Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical flexible packaging market report based on material, product, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Paper

-

Aluminium

-

Bioplastics

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Seals

-

High Barrier Films

-

Wraps

-

Pouches & Bags

-

Lids & Labels

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Manufacturing

-

Medical Device Manufacturing

-

Implant Manufacturing

-

Contract Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Thepouches & bags segment recorded the largest market share of 35.08% in 2025

b. The global medical flexible packaging market was estimated at around USD 21.56 billion in the year 2025 and is expected to reach around USD 23.04 billion in 2026.

b. The global medical flexible packaging market is expected to grow at a compound annual growth rate of 4.7% from 2026 to 2033 to reach around USD 31.75 billion by 2033.

b. The pharma manufacturing segment recorded the largest market share of 28.9% in 2025 owing to the growing pharmaceutical industry worldwide

b. The growing pharmaceutical industry in emerging economies coupled with increasing demand for drug delivery devices and blister packaging is triggering the demand for medical flexible packaging solutions across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.