- Home

- »

- Micro Molding & Microspheres

- »

-

Medical Injection Molding Machine Market Size Report, 2033GVR Report cover

![Medical Injection Molding Machine Market Size, Share & Trends Report]()

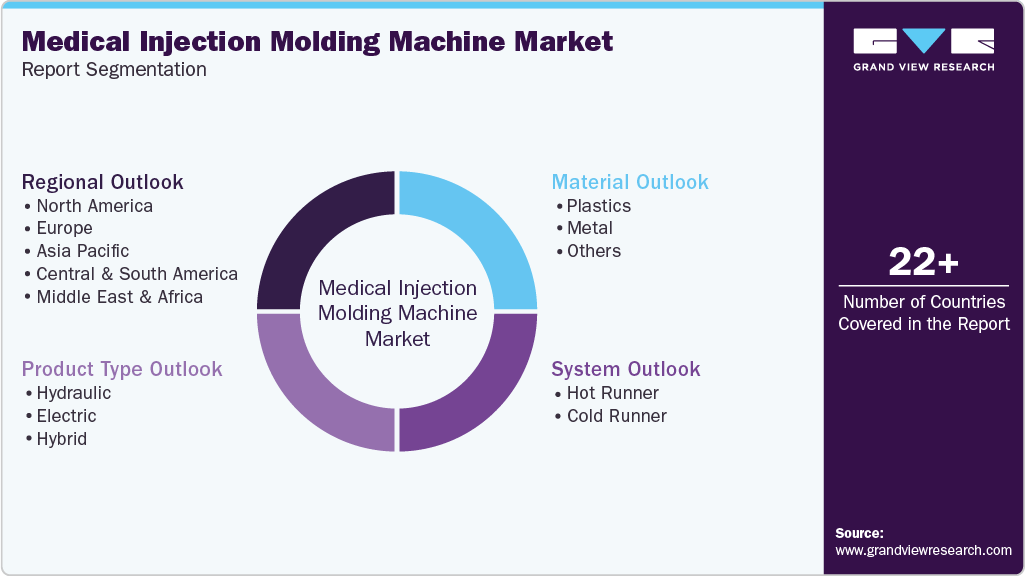

Medical Injection Molding Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Metal), By System (Hot Runner, Cold Runner), By Product Type (Hydraulic, Electric, Hybrid), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-920-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Injection Molding Machine Market Summary

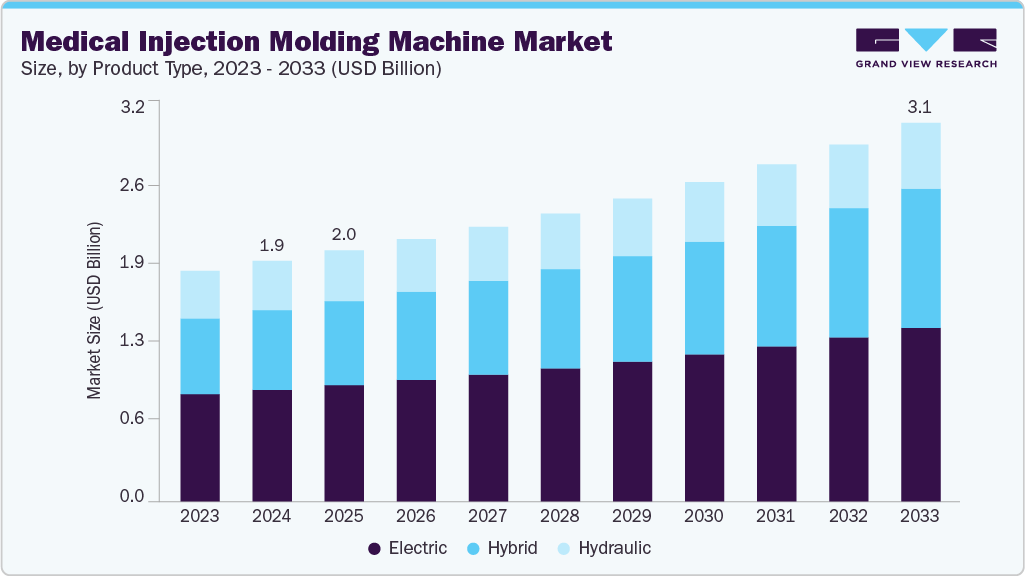

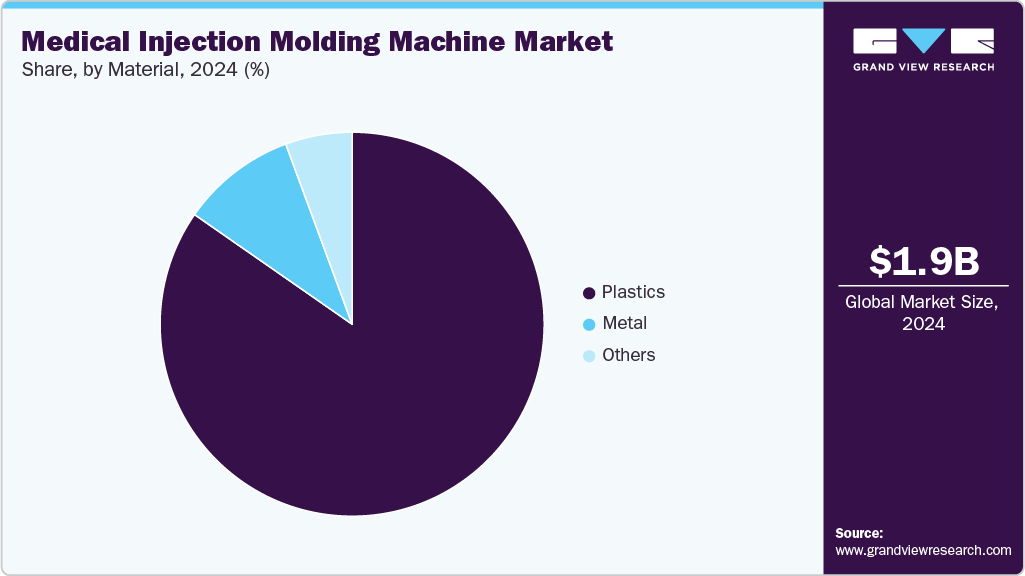

The global medical injection molding machine market size was estimated at USD 1,968.7 million in 2024 and is projected to reach USD 3,100.5 million by 2033, growing at a CAGR of 5.27% from 2025 to 2033. The increasing production of precision medical components, including syringes, catheters, and diagnostic parts, drives the market growth.

Key Market Trends & Insights

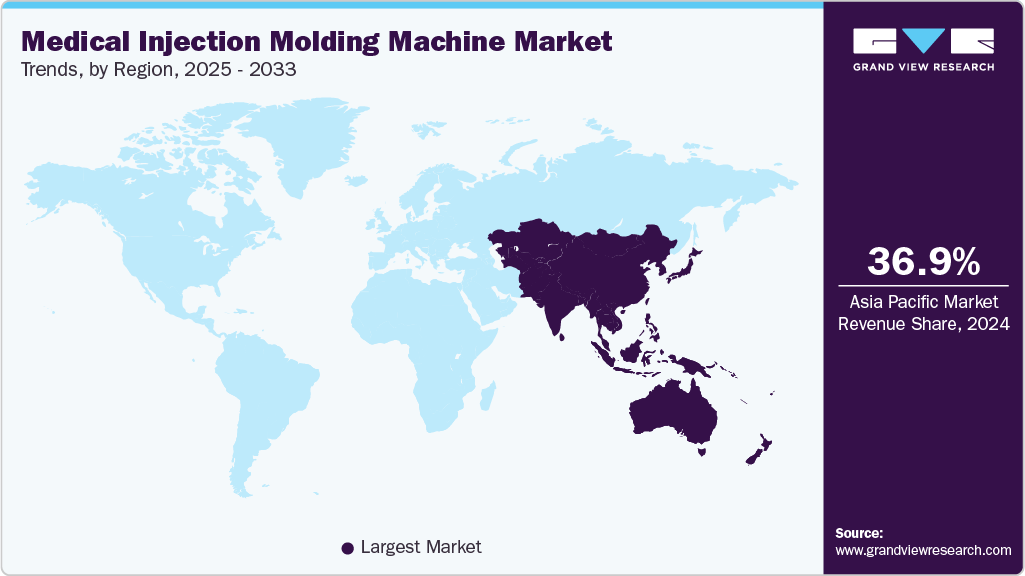

- Asia Pacific dominated the medical injection molding machine market with the largest revenue share of 36.9% in 2024.

- The China medical injection molding machine market dominates Asia Pacific, due to its massive medical device manufacturing ecosystem and large-scale adoption of automated injection molding systems.

- By material, the plastics segment dominated the medical injection molding machine industry, accounting for an 84.7% share in 2024.

- By product type, the electric injection molding machines segment dominated the medical market, accounting for a 46.4% share in 2024.

- By system, the hot runner systems segment dominated the medical injection molding machine industry, accounting for a 57.4% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,968.7 Million

- 2033 Projected Market Size: USD 3,100.5 Million

- CAGR (2025-2033): 5.27%

- Asia Pacific: Largest Market in 2024

Increasing demand for high-volume, contamination-free manufacturing is pushing hospitals and OEMs toward automated molding systems. The growth of minimally invasive procedures also boosts the need for complex, micro-molded parts.

Stringent regulatory standards for medical device safety are encouraging manufacturers to invest in machines that offer consistency and repeatability. Technological advancements such as all-electric molding systems improve energy efficiency and reduce operational costs. The rising preference for medical-grade plastics further elevates demand for specialized molding equipment. Additionally, expanding healthcare infrastructure in emerging markets fuels steady upgrades to equipment.

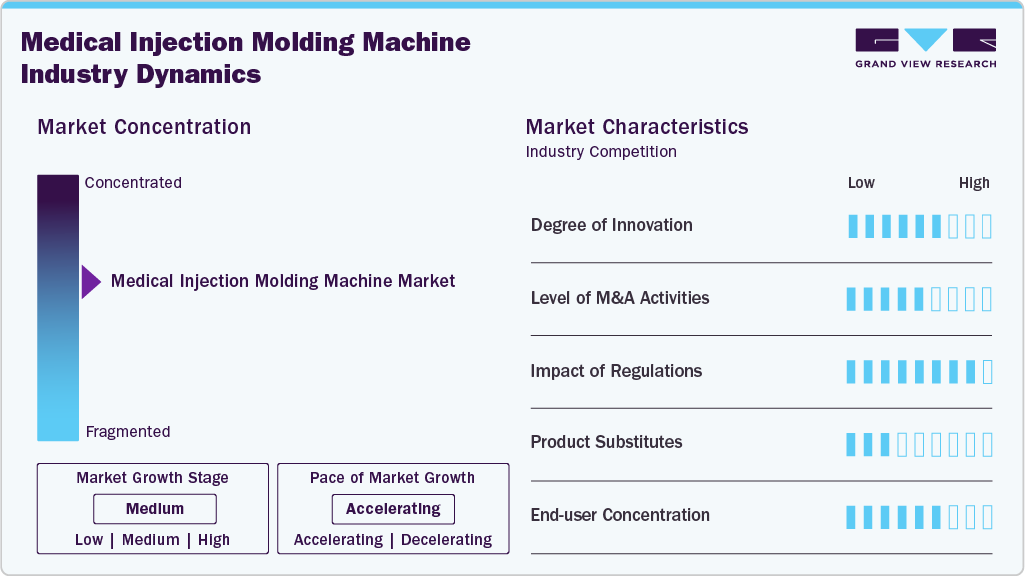

Market Concentration & Characteristics

The medical injection molding machine market remains moderately concentrated, with a few global players dominating high-precision and high-capacity segments. Leading manufacturers benefit from strong technological capabilities, regulatory expertise, and long-term supply relationships with top medical device companies. However, smaller regional producers continue to compete in niche applications such as low-volume specialty components. This blend of dominant innovators and emerging specialists keeps the market balanced but competitive, creating opportunities for innovation while maintaining pressure on pricing and quality standards.

The need for extreme precision, micro-molding capability, and contamination-free production shapes innovation in the medical injection molding machine industry. Manufacturers are increasingly integrating all-electric systems, real-time quality monitoring, and automation to support the production of complex medical components. Advanced materials and digital process controls are accelerating design flexibility and production consistency. As healthcare demands evolve, innovation remains a core competitive lever for machine vendors.

Regulation fundamentally drives equipment design, validation protocols, and manufacturing workflows in medical molding. Stringent standards for biocompatibility, sterility, and traceability require investment in machines that ensure consistent, verifiable output. Meeting FDA, EU MDR, and ISO directives demands high-accuracy, low-defect systems, making equipment quality a direct outcome of regulatory pressure. This intensifies entry barriers for new manufacturers.

End-user concentration is influenced by the dominance of large medical device manufacturers that rely on high-volume, automated molding solutions. These major buyers often secure long-term partnerships, creating stable but highly competitive supplier dynamics. Smaller clinics and specialty device producers contribute additional demand but represent a lower share of machine purchases. This concentration around leading OEMs strengthens pricing discipline and drives continuous performance upgrades from machine suppliers.

Drivers, Opportunities & Restraints

The market growth is driven by rising demand for precision-molded medical components used in diagnostics, drug delivery, and minimally invasive procedures. The growing preference for high-performance medical-grade plastics is driving manufacturers to upgrade to advanced molding technologies. Automation and all-electric machines are gaining traction due to their accuracy, cleanliness, and reduced scrap generation. Increasing healthcare expenditure worldwide further accelerates the adoption of equipment across large device manufacturers.

Expanding production of personalized medical devices creates significant opportunities for customized and micro-molding systems. Emerging markets are investing in healthcare manufacturing infrastructure, opening new avenues for machine suppliers. Integration of AI-based process monitoring and Industry 4.0 connectivity offers value-added differentiation. The demand for sustainable materials and energy-efficient equipment also presents growth opportunities for innovators.

High upfront investment and maintenance costs remain key restraints for smaller manufacturers considering equipment upgrades. Strict regulatory requirements increase validation expenses, slowing adoption for companies with limited compliance resources. Volatility in the availability of medical-grade resins can create production bottlenecks and impact machine utilization. Additionally, a lack of skilled technicians in some regions hinders the implementation of advanced molding technologies.

System Insights

The hot runner systems segment dominated the medical injection molding machine industry, accounting for a 57.4% share in 2024. This can be attributed to their ability to deliver consistent melt flow and minimize material waste. They support high-speed, multi-cavity production, which is crucial for large-volume medical consumables such as syringes and IV components. Their superior precision and reduced cycle times make them ideal for meeting the strict standards of healthcare manufacturing. As medical OEMs pursue efficiency and repeatability, hot runners remain the preferred system choice.

Cold runner segment is expected to grow at a significant CAGR of 4.1% from 2025 to 2033 in terms of revenue. The cold runner systems segment is experiencing significant growth as smaller manufacturers and specialty device producers opt for cost-effective molding solutions. Their simpler design reduces upfront equipment investment, making them attractive for low- to medium-production volumes. Cold runners also offer flexibility for frequent material changes, which benefits companies that produce a diverse range of medical components. This balanced cost-performance profile is driving steady adoption across emerging and mid-sized healthcare markets.

Product Type Insights

The electric injection molding machines segment dominated the medical market, accounting for a 46.4% share in 2024, due to their high precision, clean operation, and superior energy efficiency. They are ideal for producing contamination-sensitive components used in diagnostics and drug-delivery systems. Consistent clamp control and repeatable accuracy support strict regulatory compliance in medical manufacturing. These advantages make electric machines the preferred choice for large-scale, high-precision production.

The hybrid machines segment is expected to grow at the fastest CAGR of 5.8% over the forecast period. Hybrid machines combine the power of hydraulics with the efficiency of electric drives. This balance supports complex medical components that require both force and precision. Their reduced energy consumption and improved cycle flexibility attract mid-to-large-scale manufacturers. The growing demand for cost-effective yet high-performance systems is accelerating the adoption of hybrids.

Material Insights

The plastics segment dominated the medical injection molding machine industry, accounting for an 84.7% share in 2024, primarily due to their versatility, biocompatibility, and capacity for mass production. This dominance is further supported by rising demand for disposable devices, which has accelerated the use of plastic-molded components in hospitals and diagnostic centers. Additionally, the lightweight, sterile, and economical qualities of plastics make them essential for syringes, housings, and various types of drug-delivery products. As manufacturers continue to emphasize efficiency and safety, plastics remain the preferred material for many applications.

The metal segment is expected to grow at the fastest CAGR of 6.3% over the forecast period, driven by rising demand for durable, high-strength components in surgical and orthopedic devices. Precision metal molding enables the creation of complex geometries and tight tolerances required in critical medical applications. Advancements in metal injection molding technology are improving cost efficiency and production scalability. This momentum is accelerating adoption among manufacturers seeking robust, performance-centric medical parts.

Regional Insights

Asia Pacific accounted for the largest market share of 36.9% in 2024, owing to strong medical device manufacturing bases in China, Japan, South Korea, and India. The region benefits from lower production costs, rapid industrialization, and increasing investment in automated molding technologies. The expansion of healthcare infrastructure drives high-volume demand for disposable medical components. Government initiatives supporting medical export capabilities further reinforce the region’s leadership.

The China medical injection molding machine marketdominates Asia Pacific, due to its massive medical device manufacturing ecosystem and large-scale adoption of automated injection molding systems. Strong government support for healthcare production and export competitiveness fuels continuous equipment upgrades. High-volume demand for syringes, diagnostic consumables, and device housings drives significant machine utilization. Rapid advancements in smart manufacturing further solidify China’s leading position.

The medical injection molding machine market in India is experiencing rapid growth as local medical device production expands under initiatives promoting domestic manufacturing and reducing imports. Rising demand for affordable medical consumables encourages investment in efficient, mid-range molding machines. Improvements in healthcare infrastructure are widening opportunities for precision-molded diagnostic and patient-care product types. Increasing interest from global OEMs in Indian manufacturing partnerships strengthens the country’s upward market trajectory.

North America Medical Injection Molding Machine Market Trends

The North America medical injection molding machine market is growing steadily at a CAGR of 4.2%, as medical OEMs adopt advanced, energy-efficient injection molding machines to meet strict regulatory standards. The region’s focus on high-precision surgical and diagnostic devices drives demand for sophisticated molding capabilities. Strong R&D ecosystems encourage the adoption of all-electric and automated machine systems. Increasing preference for domestically manufactured medical product types also supports market expansion.

U.S. Medical Injection Molding Machine Market Trends

The U.S. dominates the North America medical injection molding machine industry due to its large medical device manufacturing base and strong adoption of high-precision molding technologies. Strict FDA regulations drive demand for machines that ensure consistent, validated production quality. Major OEMs are investing in automation and all-electric systems to improve output efficiency. Continued innovation in diagnostics, wearables, and minimally invasive devices further strengthens U.S. leadership.

The Canada medical injection molding machine market is growing steadily as its healthcare manufacturing ecosystem expands to support the rising demand for domestically produced medical components. Government incentives for advanced manufacturing are increasing investments in modern molding equipment. The country’s focus on high-quality medical consumables and specialty devices drives the adoption of precise, energy-efficient systems. Enhanced cross-border supply partnerships with U.S. manufacturers also support Canada’s market growth.

Europe Medical Injection Molding Machine Market Trends

The Europe medical injection molding machine industry is experiencing notable growth, driven by technological innovation and strong compliance with stringent healthcare regulations. Manufacturers prioritize high-quality, contamination-controlled production, boosting demand for advanced molding systems. The region’s leadership in diagnostic and minimally invasive medical devices further fuels the adoption of equipment. Investments in sustainable and energy-efficient machine designs add momentum to market growth.

The Germany medical injection molding machine marketdominates Europe, due to its strong medical engineering capabilities and advanced manufacturing infrastructure. The country’s focus on precision molding for surgical instruments, diagnostic systems, and high-quality consumables drives demand for machines. German manufacturers adopt cutting-edge automation and digital monitoring to ensure regulatory compliance and production accuracy. Continuous investment in R&D and export-oriented device production further reinforces its leadership.

The medical injection molding machine market in France is experiencing steady growth as medical device producers expand their capacity to meet the rising domestic and EU healthcare needs. Increasing adoption of all-electric and energy-efficient molding systems supports the country’s sustainability goals and manufacturing standards. Demand for diagnostic and patient-care consumables boosts investment in mid-to-high precision molding equipment. Strengthening collaborations between research institutes and medical manufacturers accelerates market expansion in France.

Middle East & Africa Medical Injection Molding Machine Market Trends

The Middle East & Africa medical injection molding machine industry is witnessing gradual yet consistent growth, driven by the expansion of hospital networks and rising demand for essential medical supplies. Investments in localized manufacturing are encouraging the adoption of cost-effective molding systems. Governments are focusing on reducing healthcare import dependence and creating opportunities for regional production units. As healthcare modernization advances, the demand for reliable injection molding machines remains strong.

The Saudi Arabia medical injection molding machine market dominates Middle East & Africa, due to its strong investment in healthcare modernization and the expansion of local medical device manufacturing. Government-led initiatives to reduce import dependence are driving demand for advanced injection molding machines. High consumption of medical consumables across hospitals and diagnostic centers supports steady equipment deployment. Rising partnerships with global technology providers further strengthen the country’s leading regional position.

Central & South America Medical Injection Molding Machine Market Trends

The Central & South America market for medical injection molding machines is growing as countries like Brazil and Argentina expand local medical device production capabilities. Increasing government support for healthcare manufacturing attracts foreign investments in molding technologies. Rising demand for affordable medical consumables boosts installations of mid-range injection molding machines. Enhanced supply-chain integration with North American OEMs is also accelerating regional adoption.

The Brazil medical injection molding machine market dominates Central & South America, due to its expanding medical device production capacity and strong demand for essential healthcare consumables. Growing investments in modern manufacturing facilities are accelerating the adoption of efficient injection molding machines. The country’s large healthcare network drives a consistent need for high-volume molded components. Supportive industrial policies and rising collaborations with global medical manufacturers further reinforce Brazil’s leadership.

Key Medical Injection Molding Machine Company Insights

Some of the key players operating in the market include Arburg GmbH + Co KG, Haitian International Holdings Limited, and Milacron.

-

Arburg is recognized for its highly precise injection molding systems designed for regulated medical manufacturing environments. The company emphasizes repeatability and process control for producing micro and high-tolerance medical components. Its machines support clean-room production and are widely used for syringes, diagnostics, and pharmaceutical packaging. Arburg integrates advanced digital control systems to monitor molding stability and reduce defects. Strong focus on automation and smart manufacturing strengthens its position in high-end medical molding applications.

-

Haitian International focuses on high-efficiency injection molding machines that support large-scale production of medical consumables. The company offers cost-optimized systems that strike a balance between speed, precision, and energy efficiency. Its equipment is widely adopted for the mass production of disposable medical products and basic device components. Haitian continues to expand its technological capabilities with servo-driven and hybrid machine platforms. This combination of scalability and affordability drives its strong presence in volume-focused medical manufacturing.

Key Medical Injection Molding Machine Companies:

The following are the leading companies in the medical injection molding machine market. These companies collectively hold the largest Market share and dictate industry trends.

- Arburg GmbH + Co KG

- Haitian International Holdings Limited

- Milacron

- Nissei Plastic Industrial Co., Limited.

- Engel Austria GmbH

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Chen Hsong Holdings Limited

- Toyo Machinery & Metal Co., Ltd

- Husky Injection Molding Systems Ltd

- Japan Steel Works Limited

- KraussMaffei Group

- UBE Machinery

- Shibaura Machine Co. Ltd.

- Wittmann Battenfeld

Recent Developments

-

In September 2025, Arburg introduced an advanced digital production cell tailored for medical technology applications. The system combines automated process control with intelligent monitoring to improve production accuracy and consistency. Its flexible design supports rapid adjustments for complex medical components and varying output needs. This development highlights Arburg’s commitment to intelligent, automated solutions for regulated medical manufacturing.

-

In September 2025, ENGEL demonstrated a virtual showcase of its advanced injection molding system to highlight smart manufacturing capabilities for precision medical production. The presentation emphasized high-accuracy molding suitable for complex medical components, as well as integrated process control technologies. This initiative reflects ENGEL’s commitment to driving innovation in automated, high-performance molding solutions for regulated healthcare applications.

-

In October 2024, Milacron introduced a new all-electric injection molding machine built for advanced manufacturing needs, including medical device production. This machine focuses on minimizing energy consumption, improving cycle consistency, and reducing maintenance demands. Its design aims to deliver higher precision and cleaner operations for molded medical components. By offering this technology, Milacron responds to rising demand for efficient, high-performance molding solutions in regulated industries.

Medical Injection Molding Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,055.2 million

Revenue forecast in 2033

USD 3,100.5 million

Growth rate

CAGR of 5.27% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, system, product type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Arburg GmbH + Co KG; Haitian International Holdings Limited; Milacron; Nissei Plastic Industrial Co., Limited; Engel Austria GmbH; Sumitomo (SHI) Demag Plastics Machinery GmbH; Chen Hsong Holdings Limited; Toyo Machinery & Metal Co., Ltd; Husky Injection Molding Systems Ltd; Japan Steel Works Limited; KraussMaffei Group; UBE Machinery; Shibaura Machine Co. Ltd.; Wittmann Battenfeld.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Injection Molding Machine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical injection molding machine market report based on material,system, product type, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Metal

-

Others

-

-

System Outlook (Revenue, USD Million, 2021 - 2033)

-

Hot Runner

-

Cold Runner

-

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hydraulic

-

Electric

-

Hybrid

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical injection molding machine market size was estimated at USD 1,968.7 million in 2024 and is expected to be USD 2,055.2 million in 2025.

b. The global medical injection molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 3,100.5 million by 2033.

b. Electric injection molding machines dominate the medical market accounting for a 46.4% share in 2024, due to their high precision, clean operation, and superior energy efficiency.

b. Some of the key players operating in the global medical injection molding machine market include Arburg GmbH + Co KG; Haitian International Holdings Limited; Milacron; Nissei Plastic Industrial Co., Limited; Engel Austria GmbH; Sumitomo (SHI) Demag Plastics Machinery GmbH; Chen Hsong Holdings Limited; Toyo Machinery & Metal Co., Ltd; Husky Injection Molding Systems Ltd; Japan Steel Works Limited; KraussMaffei Group; UBE Machinery; Shibaura Machine Co. Ltd.; Wittmann Battenfeld.

b. Increasing consumption of plastics in healthcare applications, technological advancements and rising demand for medical disposable products are the major factors driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.