- Home

- »

- Healthcare IT

- »

-

Medical Smart Rings Market Size And Share Report, 2030GVR Report cover

![Medical Smart Rings Market Size, Share & Trends Report]()

Medical Smart Rings Market Size, Share & Trends Analysis Report By Product (Health Monitoring Rings, Diagnostic Rings), By Application, By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-463-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Smart Rings Market Size & Trends

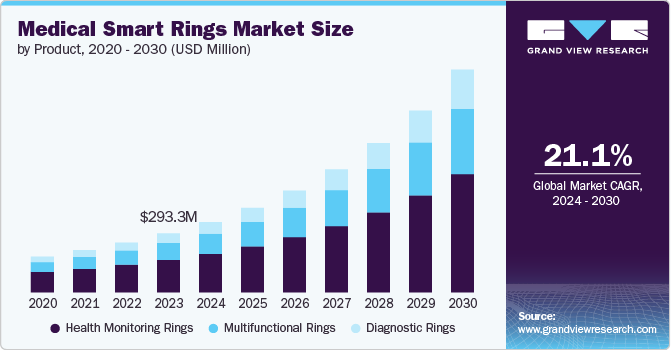

The global medical smart rings market size was estimated at USD 292.3 million in 2023 and is projected to grow at a CAGR of 21.1% from 2024 to 2030. This is driven by the increasing awareness and focus on health and wellness, the demand for non-intrusive, continuous health monitoring devices, and the advancement in wearable technology. These rings offer convenience, portability, and real-time data tracking of vital health metrics such as heart rate, sleep patterns, and body temperature, appealing to health-conscious individuals.

In addition, integrating IoT and AI capabilities has enhanced the functionality and accuracy of these devices, making them more attractive to consumers and healthcare providers. For instance, in July 2024, Samsung launched its first smart ring, the Galaxy Ring, which features AI-powered health and fitness tracking capabilities, including sleep analysis, cycle tracking, heart rate monitoring, and workout detection, all in a compact titanium body with up to seven days of battery life.

The increasing focus on personal health and fitness is a primary driver for the rise in popularity of smart rings. Consumers are becoming more health-conscious, seeking devices that monitor vital health metrics such as heart rate, sleep patterns, and physical activity levels. Smart rings offer advanced biometric tracking capabilities, making them essential tools for health and fitness enthusiasts. This trend is further driven by the rising prevalence of chronic diseases, which necessitates continuous health monitoring. For instance, according to the U.S. Pain Foundation, nearly 21% of the population in the U.S., or 51.6 million adults, experience chronic pain. Among these individuals, approximately 17.1 million experience high-impact chronic pain, significantly hindering their ability to engage in work or daily life activities.

Advancements in technology, particularly in miniaturization and sensor integration, have made smart rings more functional and appealing. These devices now incorporate NFC for contactless payments, Bluetooth connectivity, and sophisticated health monitoring sensors. Such innovations allow smart rings to perform traditionally associated with larger devices such as smartwatches but in a more discreet and stylish form. For instance, in July 2024, VezoPay launched the first smart ring in Africa for contactless payment methods throughout the region.

The shift towards telemedicine and remote care, accelerated by the COVID-19 pandemic, has created a strong need for devices that allow continuous health tracking from home. Medical smart rings offer non-invasive ways to monitor real-time vital signs like heart rate, blood oxygen levels, and temperature. These devices are particularly valuable in managing patients with chronic diseases or those recovering post-surgery, as they enable physicians to monitor health trends and intervene early when abnormal readings are detected, reducing hospital visits.

Market Concentration & Characteristics

The market is marked by significant innovation, driven by advancements in sensor technology and miniaturization. Companies are developing smart rings capable of monitoring a range of health metrics, from heart rate and blood oxygen levels to sleep patterns and stress indicators. This innovation is enhancing the accuracy and functionality of health monitoring, making these devices valuable tools for both preventive and ongoing health management. For instance, in July 2024, boAt introduced the Smart Ring Active in India. This budget-friendly device combines advanced health tracking features with a sleek, fashionable design, making it both functional and stylish. Its affordability makes it accessible to a broad range of consumers, offering a balance between technology and aesthetic appeal.

The level of mergers and acquisitions (M&A) in the market is relatively high, reflecting the industry's rapid growth and consolidation. Major technology firms and healthcare companies are acquiring smaller startups to integrate advanced wearable technologies and expand their product portfolios. This trend is accelerating the development of innovative solutions and fostering partnerships that drive market expansion. For instance, in April 2022, Ultrahuman, a metabolic fitness platform, acquired LazyCo, the creators of the Aina smart ring, an AI-powered wearable ring. This acquisition aims to integrate LazyCo's expertise to expand Ultrahuman’s capabilities in metabolic health tracking, enhancing insights on glucose biomarkers to optimize users' fitness and health routines.

Regulations play a crucial role in shaping the market, as companies must navigate stringent guidelines for medical device approval and data privacy. Regulatory bodies, such as the FDA and EMA, impose rigorous standards to ensure device safety, efficacy, and data security. Compliance with these regulations is essential for market entry and maintaining consumer trust, influencing product development and market dynamics.

Product expansion in the market is driven by a growing demand for multifunctional health monitoring devices. Companies are expanding their product lines to include features such as real-time glucose monitoring, ECG capabilities, and advanced sleep tracking. This expansion is aimed at addressing a wider range of health needs and improving user engagement, thereby enhancing market appeal and competitive positioning. For instance, in September 2023, an Indian start-up Bonatra launched a new wearable smart ring, aimed at providing real-time health tracking through advanced sensors. The device is designed to monitor key health metrics such as heart rate, sleep patterns, and physical activity, catering to the growing demand for affordable, wearable health technology in India.

Product Insights

The healthcare monitoring rings segment dominated the market in 2023 and accounted for the largest revenue share of 55.2%. The benefits associated with these rings such as monitoring & tracking of various health metrics such as heart rates, sleep patterns, blood oxygen levels, and temperature are boosting adoption. Some of the leading products & market players in this segment are Oura Ring and Motiv Ring. Increasing consumer awareness coupled with growing consumer demand for wearable health technologies and preventive care solutions is positively impacting the market growth. Rising global concerns pertaining to chronic disease prevalence burden is driving the adoption of wearable devices that provides real-time health data. For instance, in the U.S., six in ten adults have at least one chronic disease, with heart disease and diabetes being leading causes of death and disability. The CDC reports that chronic diseases drive USD 4.1 trillion in annual healthcare costs. Rapid advancements and technological integrations such as AI/ML in wearables, enhances the accuracy and efficiency of smart rings.

The diagnostic rings segment is anticipated to register the fastest growth over the forecast period. Diagnostic rings are being widely used for specific medical diagnostics, providing vital data for clinical use or serves in assisting diagnosis. Some of the most common applications of diagnostic rings available are continuous glucose monitoring or detecting arrhythmias. With the increasing demand for remote patient monitoring, is driving the adoption of diagnostic rings. Furthermore, favorable government support and regulatory approvals, increasing credibility and adoption amongst the consumers. The shift from consumer devices to clinically validated tools, the adoption rate is anticipated to grow significantly. For instance, in March 2022, Oura Ring received CE Mark approval for its temperature sensing capabilities, thereby allowing the integration of Oura Ring vitals monitoring solution with Natural Cycles birth control app.

Application Insights

The fitness and wellness segment dominated the market in 2023 and accounted for the largest revenue share of 39.4%. This growth is largely driven by the increasing awareness of the importance of maintaining a healthy lifestyle and the growing inclination towards adopting fitness and wellness routines. As consumers become more health-conscious, the demand for wearables that offer continuous, seamless health monitoring has seen a significant surge. Many smart rings are now integrated with fitness apps that allow users to track their health metrics over time, set fitness goals, and receive personalized health recommendations. This trend enhances user engagement and encourages continuous usage.

The remote patient monitoring segment is anticipated to register the fastest growth over the forecast period. The growing trend of telemedicine and the need for remote health management are driving the adoption of smart rings in healthcare settings. Smart rings enable physicians to track vital signs and patient health metrics in real time, facilitating timely interventions and better patient outcomes. Smart rings equipped with heart rate monitors, SpO2 sensors, and ECG tracking are becoming valuable tools for monitoring patients with chronic conditions like diabetes, heart disease, and hypertension. With the rising prevalence of chronic diseases, healthcare providers are increasingly adopting wearable devices to monitor patients continuously. Smart rings allow healthcare professionals to monitor vital signs remotely, helping in early diagnosis and preventive care. Regulatory approvals and the integration of smart rings into healthcare ecosystems are further driving the growth of this segment. Advancements in sensor technology, AI, and data analytics have enabled smart rings to offer accurate and reliable health insights.

End-use Insights

The consumers segment dominated the market in 2023 and accounted for the largest revenue share of 56.5%. Consumers are becoming more health-conscious and are actively seeking ways to monitor their health in real-time. This demand for self-care has significantly boosted the market for smart rings, which offer continuous monitoring. This is attributable to growing adoption of smart rings for fitness monitoring, personal health tracking, and wellness management. Growing consumer awareness towards benefits of real-time health insights and continuous monitoring of health, sleep quality, and physical activity levels. Shifting trends towards preventive healthcare amongst consumers is anticipated to bolster the market growth. Continuous improvements in sensor accuracy, data analysis, and battery life have made smart rings more reliable and attractive to a growing consumer base.

The healthcare providers segment is anticipated to register the fastest growth over the forecast period, owing to increasing need for remote patient monitoring and chronic disease management. Smart rings are being increasingly adopted by healthcare providers as tools for monitoring patients in real-time, enabling better management of conditions like cardiovascular disease, diabetes, and sleep disorders. With healthcare systems worldwide shifting towards preventive care and telemedicine, the role of smart rings in delivering continuous, real-time health data is becoming crucial. The adoption of telemedicine has grown significantly, and smart rings play a key role in enabling remote patient monitoring. Healthcare providers are utilizing these devices to continuously monitor patient health, reduce hospital visits, and manage chronic diseases more effectively.

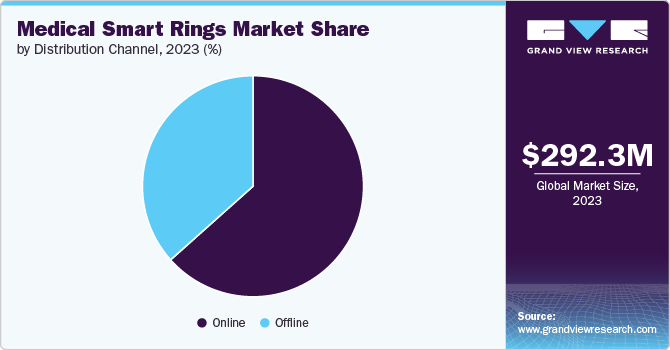

Distribution Channel Insights

The online segment dominated the market in 2023 and accounted for the largest revenue share and is anticipated to register the fastest growth with a CAGR of 21.7% over the forecast period. This is attributable to the growing preference for e-commerce platforms owing to the convenience offered, wide product selection, and easy accessibility. Key market players such as Motiv and Oura are devising their direct-to-consumer sales strategies to capitalize on the growing transitions towards online platforms. Some of the strategic initiatives being adopted by market players to enhance online sales are collaborations with fitness influencers, subscription based models, and targeted online ads. Furthermore, market players are offering exclusive online deals, which boosts customer attraction and drives online sales.

The offline distribution channel accounts for a significant market share, attributable to widespread presence of brick & mortar electronic stores and existing consumer behavior/preferences in physically examining wearables prior to purchase. In store purchases are boosted through in-store demonstrations coupled with immediate purchase options. Growing expertise of healthcare retailers are developing these facilities as vital offline distribution points. For instance, Walgreens and CVS HealthHUB have expanded their product offerings to include smart wearables such as medical rings targeted towards growing health-conscious consumers. Lastly, various health-tech companies utilize conferences and trade shows as an offline platform to distribute smart wearables. For example, Consumer Electronics Show (CES) and Health 2.0Conference have been key distribution platforms for companies such as Oura Health and Movano.

Regional Insights

North America dominated the market in 2023 and accounted for a significant revenue share of 27.0%. The growing acceptance of advanced technologies and the quick availability of new products are the key driving factors within the region. Health-promoting devices, which support preventative care and assist in managing existing health issues, are in greater demand in the region. For instance, according to the National Library of Medicine, in the U.S., 30% of individuals use wearable medical technology.

U.S. Medical Smart Rings Market Trends

The medical smart ring market in the U.S. held the largest share of 92.6% in 2023. Moreover, rising health issues related to sedentary lifestyles, the advent of innovative products by key market players, and growing investments by market players fuel the market growth. For instance, in April 2024, Ultrahuman, a U.S.-based company, launched a manufacturing facility to manufacture medical smart rings.

Europe Medical Smart Rings Market Trends

The medical smart ring market in Europe is anticipated to register a significant growth rate during the forecast period. The region's strong focus on research and development fosters continuous innovation in wearable technologies, enhancing product efficacy and patient outcomes. Moreover, the strong presence of major technology companies focusing on introducing innovative solutions to meet changing customer demands favors the regional market's growth.

UK medical smart ring market is anticipated to register a considerable growth rate during the forecast period. Growth in the market can be attributed to the government backing and equal adoption of digital health technology by the National Health Services (NHS) & small physicians to improve access to healthcare. In addition, various technology companies are actively working with academic institutes, clinicians, & policymakers to develop solutions in line with patient and clinician needs. For instance, in July 2024, Samsung introduced the Galaxy Ring, a fitness and health-tracking technology. The England men's football team recently used it, which made headlines.

The medical smart ring market in Sweden is anticipated to register a considerable growth rate during the forecast period. The increasing adoption of wearable technology, rise in fitness awareness among the population, and growing investment by market players and the government have contributed to the market growth in Sweden. For instance, Sweden invests approximately USD 1.22 billion annually in healthcare IT.

Asia Pacific Medical Smart Rings Market Trends

The medical smart ring market in Asia Pacific is anticipated to register a fastest growth rate during the forecast period. The Asia Pacific market is anticipated to register the fastest growth rate during the forecast period, owing to the growing adoption of fitness trackers and increasing awareness regarding overall health and fitness among the working-class population. For instance, in August 2023, Bonatra, a health tech startup, introduced Smart Rings to monitor various health parameters to promote longer and healthier lives.

India medical smart ring market is anticipated to register a considerable growth rate during the forecast period. Several companies are adopting various strategies, such as new product launches, mergers and acquisitions, partnerships, and collaborations, to expand their market position in this region. For instance, in July 2024, boAt, an Indian company, introduced the stainless-steel boAt Smart Ring Active to track health and fitness.

Latin America Medical Smart Rings Market Trends

The medical smart ring market in Latin America is anticipated to register a significant growth rate during the forecast period. The demand for smart rings is anticipated to increase due to the growing popularity of connected devices, the Internet of Things (IoT), and the rapidly expanding worldwide population of technologically knowledgeable individuals.

Brazil medical smart ring market is anticipated to register a considerable growth rate during the forecast period. Favorable government initiatives and increasing public and private investments in promoting technologically advanced solutions are expected to propel market growth. For instance, the Ministry of Health and the Ministry of Science and Technology signed an agreement to develop technological solutions in the healthcare sector.

Middle East and Africa Medical Smart Rings Market Trends

The medical smart ring market in Middle East and Africa is anticipated to register a lucrative growth rate during the forecast period. Wearable devices and the incorporation of artificial intelligence (AI) and machine learning (ML) are the significant trends revolutionizing healthcare accessibility. Furthermore, launching new products and growing investments in this region boosts market growth. For instance, in June 2023, the Health Finance Coalition (HFC) established the Transform Health Fund, a USD 50 million pan-African initiative to support high-impact African health innovators. This fund provided flexible capital to early-stage health startups developing innovative solutions to healthcare challenges in Sub-Saharan Africa.

Key Medical Smart Rings Company Insights

Key players in the global market are more focused on product innovation and strategic partnerships with technology providers. Companies are investing in advanced technologies to enhance the functionality and accuracy of their products, such as integrating more sophisticated sensors, improving data analytics capabilities, and incorporating artificial intelligence for better health insights. Strategic collaborations with technology firms enable these companies to leverage advanced innovations, access new technologies, and enhance their product offerings.

Key Medical Smart Rings Companies:

The following are the leading companies in the medical smart ring market. These companies collectively hold the largest market share and dictate industry trends.

- Oura Health

- Circular

- Fitbit

- Motiv

- Go2Sleep

- Kring

- Nymi

- Nura

- Bellabeat

- Qardio

- Sapphire

- Hexoskin

Recent Developments

-

In August 2024, Ultrahuman, a company in wearable technology, announced the launch of its Ultrahuman Ring AIR at Verizon stores. This new addition to the Ultrahuman ecosystem complements existing products including the Ultrahuman M1 for continuous glucose monitoring, Blood Vision for preventive blood testing using the innovative UltraTrace technology, and Ultrahuman Home, a health device designed for home use.

-

In July 2024, Samsung introduced the Galaxy Ring, marking its debut in the smart rings market. The South Korean tech company aims to integrate this new product with its existing lineup of smartphones and wearables, offering health-tracking capabilities. The Galaxy Ring is designed to monitor a range of health metrics, including heart rate and sleep patterns.

-

In March 2024, Oura, a company offering smart ring that monitors the consumer health, announced that it will be selling its products on Amazon. This move marks a shift from its previous direct-to-consumer sales model to a broader retail presence.

-

In August 2023, India-based startup Bonatra, which focuses on longevity and health technology, introduced wearable smart rings designed to promote longer and healthier living through IOMT-enabled and doctor-guided lifestyle programs. The rings feature advanced capabilities, including tracking sleep scores and readiness scores, providing users with comprehensive health information.

Medical Smart Rings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 348.56 million

Revenue forecast in 2030

USD 1.10 billion

Growth rate

CAGR of 21.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ōura Health Oy; Wellue; Bodimetrics; Circular; Motiv Inc.;

Pi Ring; TheTouch X s.r.o.; SLEEPON; Vitality Watch; Sky Labs Inc.; Linktop; McLEAR; Fujitsu; Bellabeat; Sapphire; Hexoskin

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Smart Rings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global medical smart rings market report based on product, application, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Health Monitoring Rings

-

Diagnostic Rings

-

Multifunctional Rings

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Disease Management

-

Fitness and Wellness

-

Remote Patient Monitoring

-

Elderly Care

-

Women’s Health

-

Occupational Health

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumers

-

Healthcare Providers

-

Corporate Wellness Programs

-

Research Institutions

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Retail

-

Offline Retail

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical smart rings market size was estimated at USD 292.3 million in 2023 and is expected to reach USD 348.6 million in 2024.

b. The global medical smart rings market is expected to grow at a compound annual growth rate of 21.2% from 2024 to 2030 to reach USD 1.10 billion by 2030.

b. The fitness and wellness segment dominated the market in 2023 and accounted for the largest revenue share of 39.4%. This growth is largely driven by the increasing awareness of the importance of maintaining a healthy lifestyle and the growing inclination towards adopting fitness and wellness routines.

b. Some key players operating in the market include Ōura Health Oy; Wellue ; Bodimetrics; Circular; Motiv Inc.; Pi Ring; TheTouch X s.r.o.; SLEEPON; Vitality Watch; Sky Labs Inc.; Linktop; McLEAR; Fujitsu; Bellabeat; Sapphire; Hexoskin

b. The medical smart rings market is driven by the increasing awareness and focus on health and wellness, the demand for non-intrusive, continuous health monitoring devices, and the advancement in wearable technology.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."