- Home

- »

- Medical Devices

- »

-

Mental Health Clinical Trials Market Size And Share ReportGVR Report cover

![Mental Health Clinical Trials Market Size, Share & Trends Report]()

Mental Health Clinical Trials Market (2023 - 2030) Size, Share & Trends Analysis Report By Phase, By Study Design (Interventional, Observational), By Sponsor, By Disorder (Anxiety Disorders, Depression, Schizophrenia), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-062-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mental Health Clinical Trials Market Summary

The global mental health clinical trials market size was estimated at USD 2.73 billion in 2022 and is expected to reach USD 5.10 billion by 2030, growing at a CAGR of 8.3% from 2023 to 2030. This growth can be attributed to several factors, including the increasing prevalence of mental health disorders, growing awareness about the importance of mental health, and the rising demand for effective treatments.

Key Market Trends & Insights

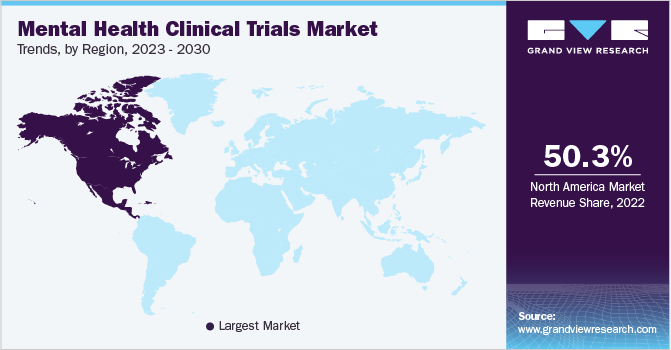

- North America is the most dominating market in the mental health clinical trials industry with a revenue share of 50.3% in 2022.

- Asia Pacific will have the highest CAGR of 8.8% during the analysis period.

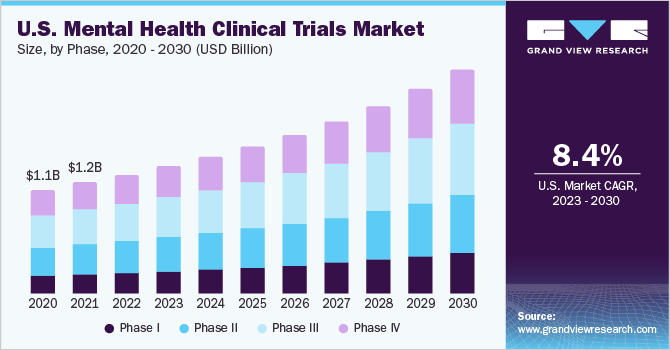

- By phase, the phase I segment is anticipated to witness the fastest CAGR of 8.7% during the analysis period.

- By study design, the study design segment has the highest revenue share of 64.2% in 2022.

- By disorder, the anxiety disorder segment accounted for highest CAGR of 8.8% from 2023 to 2030.

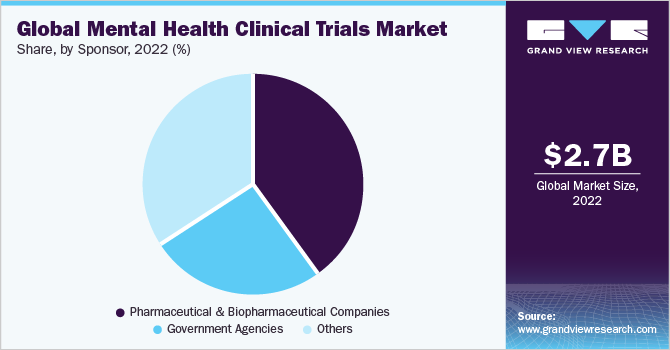

- By sponsor, the pharmaceutical and biopharmaceutical firms dominated the market in 2022 with a revenue share of 39.6%.

Market Size & Forecast

- 2022 Market Size: USD 2.73 Billion

- 2030 Projected Market Size: USD 5.10 Billion

- CAGR (2023-2030): 8.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Throughout the past few years, the market for mental health clinical trials has expanded at an outstanding rate, and this trend is anticipated to continue in the years to come. The rising prevalence of mental health illnesses worldwide is one of the major factors causing this growth. Recent data indicates that one in five adults in the United States suffers from mental illness each year. Also, the COVID-19 pandemic has made mental health issues worse, which has increased the demand for clinical studies to test out novel medicines.The expansion of financing for mental health research is a crucial element fueling the market for clinical trials in mental health. Governments and corporate organizations have been making significant investments in research and the creation of novel treatments as a result of their recognition of the urgent need to address mental health challenges. For instance, the National Institutes of Health (NIH) allocated USD 945 million under the NIH HEAL Initiative in September 2019 to promote research addressing the country's opioid issue. The funding will finance studies into, among other things, overdose prevention, addiction therapy, and pain management. To combat the ongoing opioid crisis in the US, the effort is anticipated to bring together researchers, healthcare professionals, and community organizations.

The market for mental health clinical trials has expanded as a result of technological developments, including the use of telemedicine and digital therapies. Researchers have been able to conduct clinical studies remotely, which has dramatically expanded the breadth and efficiency of these trials due to the broad acceptance of virtual care during the epidemic.

Overall, the market for mental health clinical trials is expected to expand significantly over the next several years as a result of rising financing for research, the rising prevalence of mental health illnesses, and technological developments. Millions of people who battle mental illness have a wonderful chance to live better lives as new, cutting-edge therapies and treatments are created through clinical trials.

Phase Segment Insights

The phase I segment is anticipated to witness the fastest CAGR of 8.7% during the analysis period. Phase I studies evaluates the pharmacokinetics and tolerability of molecules along with assessing the safety of a drug/biologic. It determines the effect of a drug on humans, including how it is absorbed, metabolized, and excreted. It also studies the side effects of a drug compound in case of amplified dosage levels. Phase I includes 20-100 healthy people or volunteers with the disease. Increasing number of companies focusing on investing in mental health research is one of the major factors supporting the lucrative CAGR of the segment.

The phase 3 clinical trials segment is the most dominating phase in the market with a revenue share 31.0% in 2022 as it involves testing a treatment on a large patient population in multiple centers to determine its effectiveness, safety, and side effects. For a new medicine to be approved and made available commercially, Phase 3 trial findings are essential. For instance, the U.S. FDA recently approved the medication Brexanolone after a recent Phase 3 clinical research shown that it was helpful in treating postpartum depression in women. The success of a treatment on the market is greatly influenced by the outcomes of phase 3 clinical trials, which also require a sizeable time and financial investment.

Study Design Segment Insights

Since there is a demand for efficient interventions for mental health illnesses, the study design segment has the highest revenue share of 64.2% in 2022. This segment of the mental health clinical trials market analysis is an important consideration when conducting research. Interventional studies involve an active intervention, such as administering a drug or therapy, to assess its effectiveness. For instance, the US FDA recently approved the medication Esketamine. After recent interventional research it was showed to be beneficial in treating depression that has resisted treatment.

On the other side, observational studies are intended to observe and gather data without any kind of intervention. New targets for intervention can also be found through observational studies. For instance, a recent observational study identified a link between childhood trauma and a higher risk of depression and anxiety disorders in adulthood. This discovery can guide the creation of therapies that will either prevent or treat certain illnesses. The segment is anticipated to register the fastest CAGR of 8.6% during the analysis period.

Disorder Segment Insights

The anxiety disorder segment accounted for highest CAGR of 8.8% from 2023 to 2030. Clinical trials for anxiety disorders often evaluate new medications or therapies to lessen symptoms, including excessive worry, fear, and panic attacks. For instance, a recent clinical trial by Sage Therapeutics to evaluate the efficacy of SAGE-217, a novel medication, in treating individuals with generalized anxiety disorder showed encouraging results.

Depression holds the highest percent share owing to factors such as the increasing prevalence of the condition in the past few years, growing awareness about the condition in developing economies and increasing research and development activities with an aim to develop novel therapeutics in treating the ailment. For instance, the US FDA recently approved the antidepressant medicine Esketamine after a recent clinical trial by Johnson & Johnson's subsidiary, Janssen Pharmaceuticals, which examined its efficacy in treating patients with depression who had failed to respond to other treatments.

Generally, mental health diseases such as anxiety disorders and depression are common and need for effective treatments. With clinical trials evaluating the efficacy of novel medications and therapies, the market for mental health clinical trials is essential in the development of new treatments for these conditions. It is believed that as research into mental health issues progresses, new treatments may appear that can enhance the lives of the millions of individuals affected by these conditions.

Sponsor Segment Insights

The pharmaceutical and biopharmaceutical firms dominated the market in 2022 with a revenue share of 39.6%, due to their significant investments in the creation of novel medicines for mental health diseases. These businesses are equipped to carry out extensive clinical research and launch novel medications. For instance, Janssen Pharmaceuticals, a division of Johnson & Johnson, carried out numerous clinical trials to create the antidepressant medication Esketamine, which received U.S. FDA approval in 2019.

Government agencies are also important sponsors of mental health clinical trials. However, this segment is at a stable CAGR of 8.5% as government agencies face budget constraints and may have limited resources to invest in clinical trials. Nonetheless, government agencies play a crucial role in funding and conducting research on mental health disorders, which can lead to the development of new treatments and interventions. For example, the NIH is funding multiple clinical trials through it’s HEAL initiative to address the opioid epidemic in the United States. Governmental agencies also play a critical role in funding and carrying out research, even though pharmaceutical and biopharmaceutical companies are the main power in the market for mental health clinical trials. Collaboration between these institutions has the potential to enhance the lives of millions of people globally and pave the way for the creation of efficient therapies for mental health illnesses.

Regional Insight

Asia Pacific will have the highest CAGR of 8.8% during the analysis period, due to the region's quick rise in the frequency of mental health issues and rising investment in clinical research. The expansion of the mental health clinical trials market in this area is being fueled by the rising usage of cutting-edge technologies and the availability of a sizable patient pool. For instance, the Shanghai Mental Health Center recently investigated the efficacy of transcranial direct current stimulation (TDCS) in treating patients with major depressive disorder in China, and the results were encouraging.

North America is the most dominating market in the mental health clinical trials industry with a revenue share of 50.3% in 2022, as the region has a well-established healthcare infrastructure, favorable regulatory environment, and a high prevalence of mental health disorders. The presence of major pharmaceutical and biopharmaceutical companies in the region, such as Pfizer, Johnson & Johnson, and Eli Lilly, further drive the growth of the market. For example, a recent clinical trial conducted by Pfizer tested the effectiveness of a new drug called PF-06438179 in treating patients with schizophrenia, leading to promising results and paving the way for further development.

The market for clinical trials in the field of mental health is geographically diversified, with each location having certain traits and laws that affect the design and conduct of clinical trials. Although North America still dominates the market, the Asia Pacific area is expanding quickly and is anticipated to do so for the foreseeable future. Collaboration between academics, physicians, and organizations from all around the world is necessary to discover effective therapies for mental health illnesses.

Key Companies & Market Share Insights

Key market players are undertaking various strategic initiatives such as the signing of the new partnership agreement, collaborations, mergers and acquisitions, and geographic expansion, aiming to strengthen their services, thus providing a competitive advantage. Eli Lilly and Company is also active in the market, with a focus on developing treatments for depression and bipolar disorder. The company's product, Prozac, is a widely recognized antidepressant. Some of the prominent players in the global mental health clinical trials market include:

-

ICON Plc.

-

Eli Lilly Company

-

Caidya

-

Syneous Health

-

Novo Nordisk

-

Pharmaceutical Product Development, LLC

-

Parexel International Corporation

-

Corcept

-

Labcorp Drug Development

-

IQVIA

Mental Health Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.91 billion

Revenue forecast in 2030

USD 5.10 billion

Growth rate

CAGR of 8.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Phase, study design, sponsor, disorder, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

ICON Plc, Eli Lilly Company, Caidya, Syneous Health, Novo Nordisk, Pharmaceutical Product Development, LLC, Parexel International Corporation, Corcept, Labcorp Drug Development, and IQVIA.

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mental Health Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global mental health clinical trials market report on the basis of phase, study design, sponsor, disorder, and region:

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional

-

Observational

-

Others

-

-

Sponsor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Government Agencies

-

Others

-

-

Disorder Outlook (Revenue, USD Billion, 2018 - 2030)

-

Anxiety Disorders

-

Depression

-

Bipolar affective disorder

-

Dissociation and dissociative disorders

-

Schizophrenia

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mental health clinical trials market size was estimated at USD 2.73 billion in 2022 and is expected to reach USD 2.91 billion in 2023.

b. The global mental health clinical trials market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 5.10 billion by 2030.

b. By phase, the phase III segment dominated the market with a revenue share of 31.0% in 2022. The segment is driven by the high cost of phase III trials along with a significant volume of patient enrollment in this phase.

b. Some key players operating in the market include ICON Plc, Eli Lilly Company, Syneous Health, Pharmaceutical Product Development, LLC and a few others.

b. The increasing prevalence of mental health disorders, growing awareness about the importance of mental health, and the rising demand for effective treatments are a few factors augmenting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.