- Home

- »

- Advanced Interior Materials

- »

-

Metering Pump Market Size, Share & Trends Report, 2030GVR Report cover

![Metering Pump Market Size, Share & Trends Report]()

Metering Pump Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Peristaltic Pumps, Diaphragm Pumps), By End-Use (Pharmaceutical, Oil & Gas, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-161-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metering Pump Market Summary

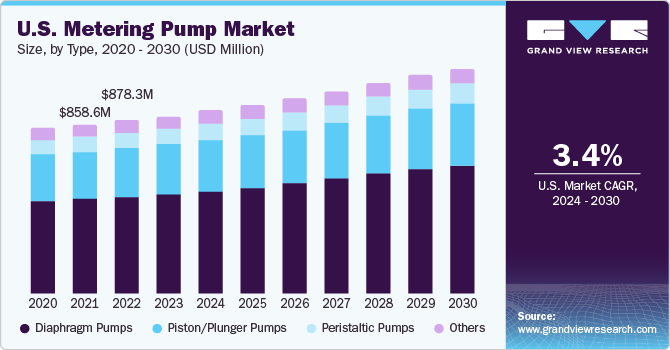

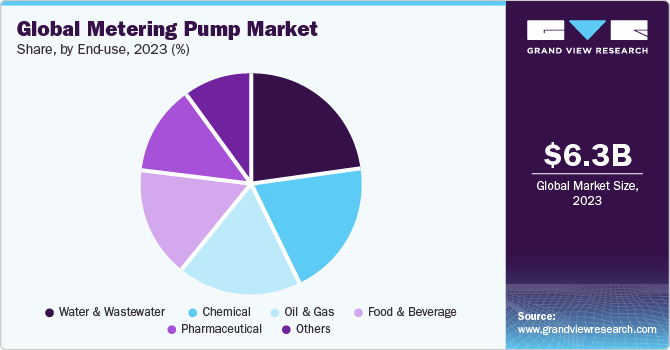

The global metering pump market size was estimated at USD 6.3 billion in 2023 and is projected to reach USD 8.9 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. Technological developments and growing end-use industries such as water & wastewater treatment, chemical, and pharmaceutical are likely to drive market growth.

Key Market Trends & Insights

- The Asia Pacific region held the largest revenue share of 41.4% in 2023.

- The Middle East and Africa region is expected to grow significantly with the second highest CAGR of 5.4% over the forecast period.

- By type, the Diaphragm pump segment held the largest revenue share of 55.5% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2030.

- By end-use, the water & wastewater segment held the largest revenue share of 23.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.3 Billion

- 2030 Projected Market Size: USD 8.9 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

Furthermore, growing need for precise chemical dosing across industries for quality manufacturing and growing emphasis on process improvement is anticipated to drive market growth.

Metering pumps are positive displacement pumps that displace a fixed amount of fluid under pressure. These pumps are also capable of handling a wide range of viscosities and pressure. They transfer a predetermined precise quantity of fluid in a specified time frame. They are designed to achieve a constant fluid flow rate which is often required in applications where precision is critical. They are used to transfer gases and liquids across commercial and industrial applications. Due to these characteristics, they are used to cater to the unique needs of various end-use industries such as chemical and water & wastewater treatment industries. Hence with the growth in these industries globally, the demand for metering pumps is expected to rise.

Growth in water & wastewater treatment industry in the U.S. is a key factor contributing to the rise in demand for metering pumps. Metering pumps are significantly used in water & wastewater treatment industry for precise chemical dosing to purify water by removing harmful contaminants, microorganisms, and impurities in water. Furthermore, with development of chemical processing industries such as petrochemicals and food processing industries in the U.S., market for metering pumps is likely to grow significantly over the forecast period.

Rising importance of energy efficiency & sustainability showcases future trends in the market. To cater to these needs, key market players are developing more energy-efficient pumps with less carbon footprint presence. These newly designed pumps have variable frequency drivers (VFDs) to enable better pump speed and flow control. In addition, newly launched metering pumps are integrated with the Industrial Internet of Things (IIoT) and have a digital control system to increase their effectiveness.

Furthermore, industries such as chemical processing require specialized metering pumps to handle highly corrosive, viscous, and acidic fluids. Hence, manufacturers are offering customization options and expertise to cater to those demands. Moreover, most of the key market players have adopted a modular design approach while designing metering pumps. In addition, companies are placing significant emphasis on VFDs to optimize their performance.

The metering pump industry is highly competitive and concentrated with numerous players having expertise in product design and development. Companies in the global market are actively focusing on investing in research and development activities for diaphragm pumps and other types of pumps which enables them to retain their market share thereby further developing the market.

End-use Insights

The water & wastewater segment held the largest revenue share of 23.1% in 2023. Water treatment involves various processes where accurate dosing of specific chemicals is required to remove impurities. It involves an injection of chemicals such as chlorine and pH adjusters to make water safe and potable. With the growth in urbanization and industrialization, demand for potable and pH-stable water supply has been increasing significantly. Metering pumps are fundamentally used in water treatment operations to optimize drinking water quality by dosing exact required quantity of chemicals. With growth in urbanization, population, and food processing industries, demand for metering pumps is expected to rise significantly over the forecast period.

The chemical segment is anticipated to grow at the fastest CAGR of 5.8% over the forecast period. Metering pumps find extensive use in chemicals industry due to their ability to handle a wide range of chemicals with different pH levels. In chemical industry, acidic fluids cause corrosion to internal pump parts. To overcome this problem, diaphragm pumps are used to reduce corrosive effect of acidic fluids on inner components of pump. Further, these pumps maintain precise control over fluid discharge rates and operate reliably under various conditions.

Rising standards of living and a growing middle class in emerging markets are leading to a surge in end-users purchasing electronics, consumer goods, automobiles, and other products that require the use of chemicals and plastics. The quality of chemical processing often involves metering of chemicals for accurate dosing, so that product quality can be increased by controlling process variables such as discharge rates and pressure of fluid. In case of metering pumps, it is easy to control these process variables. Hence metering pumps are used to inject the catalyst with accurate quantity and create quality compounds in the chemical processing industry.

Type Insights

Diaphragm pump segment held the largest revenue share of 55.5% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2030. A diaphragm pump uses a diaphragm made up of flexible materials such as rubber or plastics instead of the piston to transfer fluids. Depending on end-use application pressure and flow rate requirements, diaphragm pumps are actuated either by mechanical means or by motors.

Key advantages of diaphragm pumps include their ability to handle a wide range of fluids, including viscous and abrasive fluid. Their versatility, reliability, and ability to handle challenging fluids make them a valuable choice for handling a wide range of fluids in water & wastewater treatment, pharmaceutical, and chemical processing industries.

The piston/plunger pump segment is anticipated to grow at the second-highest CAGR of 4.6% from 2024 to 2030. It is a type of positive displacement pump used to transfer fluids by reciprocating the motion of a piston inside a cylinder. These pumps are used to achieve precise and accurate flow rates due to their ability to work within predefined fixed stroke lengths.

Piston/plunger pumps are known for their ability to generate extremely high pressures. They are often used in applications that require very high pressure, such as high-pressure fluid flow inside a hydraulic system and pressure testing. Moreover, piston/plunger pumps can handle highly viscous fluids more effectively as compared to other metering pumps. Piston design is less susceptible to wear and damage when pumping fluids with solid particles or high viscosity, hence they are preferred in oil & gas extraction industries for upstream exploration and production (ExoPE).

Regional Insights

Asia Pacific region held the largest revenue share of 41.4% in 2023. Rapid industrialization and urbanization coupled with growing demand for fluid handling & safe drinking water in several countries, including China and India, are expected to boost market potential. Water & wastewater treatment, chemical, and food processing industries in Asia Pacific are witnessing significant growth on account of rising urbanization and per capita income.

Moreover, economies in the Asia Pacific region are likely to flourish over the forecast period because of rising investments by governments in pharmaceutical, food & beverage, and water & wastewater treatment industries. The continuous expansion of end-use industries like chemical and oil & gas exploration industry is likely to generate more demand for fluid handling equipment thereby driving market growth.

The Middle East and Africa region is expected to grow significantly with the second highest CAGR of 5.4% over the forecast period due to high growth industries such as oil & gas and water & wastewater treatment industry. Middle East & Africa is the major hub for the production of oil & gas. Metering pumps are used during the crude oil transferring and refining process. Moreover, Middle Eastern countries have been investing heavily in desalination facilities that can generate potable water from saline water. Metering pumps are used during seawater intake, reverse osmosis, and brine disposal in the water desalination process.

Europe region held the second-largest revenue share in 2023. Growth in market in Europe is expected to be significantly driven due to its developed industrial sector. Metering pumps are used in various industrial processes to accurately dose fluids, especially liquids. They are used in processes such as paint & coating, hydraulic systems, and chemical dosing. With increasing demand for these processes, demand for pumps is expected to rise in this region.

Key Companies & Market Share Insights

Manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, and geographical expansions, to enhance market penetration and to cater to the changing requirements of various end-use industries.

Some of the major companies have been focusing on technological innovation and investing in research and development activities to further penetrate the market. In July 2023, Grundfos Holding A/S acquired Metasphere, a leading smart sewer solutions provider. This acquisition is expected to help the company improve its product offerings within pumps and hydraulic segment.

Key Metering Pump Companies:

- IDEX Corporation

- Ingersoll Rand

- Dover Corporation

- ProMinent

- Grundfos Holding A/S

- SEKO S.P.A.

- Milton Roy Company

- SPX Flow Technology Norderstedt GmbH

- Verder Group

- Yamada Corporation

- LEWA GmbH

- Moyno Inc.

- Nikkiso Co., Ltd.

- Swelore Engineering Pvt. Ltd.

- Wanner Engineering, Inc.

Metering Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.6 billion

Revenue forecast in 2030

USD 8.9 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

IDEX Corporation; Ingersoll Rand; Dover Corporation; ProMinent; Grundfos Holding A/S; SEKO S.P.A.; Milton Roy Company; SPX Flow Technology Norderstedt GmbH; Verder Group; Yamada Corporation; LEWA GmbH; Moyno Inc.; Nikkiso Co., Ltd.; Swelore Engineering Pvt. Ltd.; Wanner Engineering, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

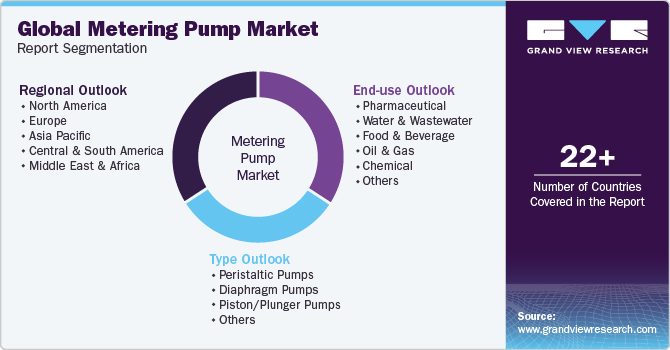

Global Metering Pump Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metering pump market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Peristaltic Pumps

-

Diaphragm Pumps

-

Piston/Plunger Pumps

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Water & Wastewater

-

Food & Beverage

-

Oil & Gas

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global metering pump market size was estimated at USD 6.3 billion in 2023 and is expected to reach USD 6.6 billion in 2024.

b. The global metering pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 and reach USD 8.9 billion by 2030.

b. Asia Pacific dominated the metering pump market in 2023 with a share of 41.4%, owing to the increasing investments in chemical, pharmaceutical and water treatment industries, to cater the growing urbanization needs.

b. Some of the key players operating in the metering pump market include, IDEX Corporation, Ingersoll Rand, Dover Corporation, ProMinent, Grundfos Holding A/S, SEKO S.P.A., Milton Roy Company, SPX Flow Technology Norderstedt GmbH, Verder Group, Yamada Corporation, LEWA GmbH, Moyno Inc., Nikkiso Co., Ltd., Swelore Engineering Pvt. Ltd., Wanner Engineering, Inc.

b. The increasing demand for fluid handling equipment in various industries such as water & wastewater treatment, oil & gas, pharmaceutical, and chemical industry has been propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.