- Home

- »

- Medical Devices

- »

-

Mexico Compounding Pharmacies Market Size Report, 2030GVR Report cover

![Mexico Compounding Pharmacies Market Size, Share & Trends Report]()

Mexico Compounding Pharmacies Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapeutic Area, By Age Cohort (Pediatric, Geriatric), By Compounding Type (Pharmaceutical Ingredient Alteration (PIA)), By Sterility, And Segment Forecasts

- Report ID: GVR-4-68040-519-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

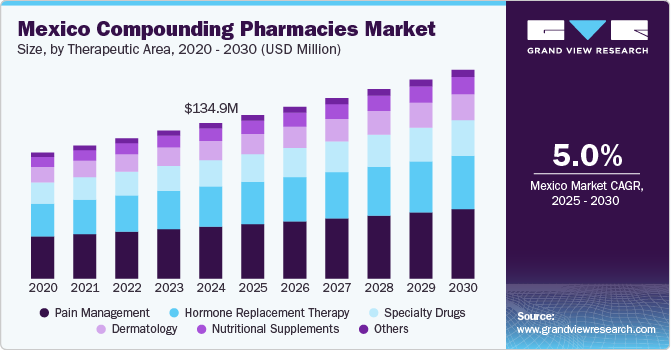

The Mexico compounding pharmacies market size was estimated at USD 134.89 million in 2024 and is expected to grow at a CAGR of 5.02% from 2025 to 2030. The rising demand for personalized medicine to enhance treatment, safety and efficacy is one of the major factors driving the market's growth. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and neurological conditions is fueling the need for customized formulations. In addition, compounding pharmacies plays an important role in improving medication adherence by helping address patient-specific needs, including allergies, taste preferences, and dosage modifications.

Personalized medicine aims to enhance the safety and effectiveness of medications by tailoring them to meet each patient's unique needs. Patients may have specific requirements, such as allergies or intolerances to certain substances, or may need medications for rare or orphan diseases, which necessitate compounded medications customized to their conditions. The increasing prevalence of chronic conditions such as cancer, diabetes, neurological diseases, cardiovascular disorders, and autoimmune diseases highlights the need for customized medication formulations. This can involve adjusting dosages, combining different drugs, or creating entirely new products to achieve better treatment outcomes. For instance, according to research published in the Diabetes Care Journal in December 2022, diabetes is the second leading cause of death in the country, with an estimated prevalence of 15.2% of the total population.

Moreover, the growing availability of genetic testing and molecular profiling nationwide enables healthcare providers to prescribe effective medications based on the patient’s genetic profile. For instance, according to an article published in the World Journal of Oncology in July 2021 titled “Personalized Medicine in Ovarian Cancer: A Perspective from Mexico,” scientists were able to discover molecular components involved in OC pathogenesis, enabling patients to gain access to individualized diagnosis and helping care providers to predict effective treatment for the diseases, leading to optimization of time, costs, safety and efficacy of health care.

Moreover, healthcare providers prescribe compounded medications that patients are anticipated to obtain from pharmacies. In addition, clinics and hospitals acquire large quantities of specific compounded medications, referred to as "office stock," directly from compounding pharmacies for on-site administration as needed. For instance, MXPharmacy (Edge Pharma) provides a comprehensive range of pharmaceutical services tailored to the needs of patients, healthcare providers, and medical institutions.

The increasing prevalence of chronic and infectious diseases significantly influence the Mexico compounding pharmacies industry. Chronic diseases, such as diabetes, hypertension, cardiovascular diseases, and arthritis require long-term medication management. Patients with chronic conditions are expected to require medication combinations or adjusted dosages that are not available in standard drug formulations. Compounding services create these tailored formulations, improving medication efficacy and patient adherence For instance, according to WHO report published in July 2022, musculoskeletal disorders (MSD) were identified to be the leading cause of years lived with disability (YLD) in 2021. The six main categories of MSDs include osteoarthritis, rheumatoid arthritis, gout, neck pain, low back pain, and others.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, and impact of regulations, level of partnerships & collaborations activities, and geographic expansion. For instance, the Mexico compounding pharmacies industry is fragmented, with many small players entering the market and launching new innovative services. The degree of innovation is medium, the level of merger & acquisition activities is low, the impact of regulations on the market is high, and the regional expansion of the market is low.

The integration of advanced technologies presents a substantial opportunity for compounding pharmacies to improve operational efficiency and product quality. Automation and robotic systems help enhance precision in medication preparation, reduce human error, and streamline production processes. Moreover, Advancements in automated compounding systems (ACS) have significantly improved the precision, efficiency, and safety of preparing compounded medications. These innovations help transform the landscape of pharmacy practice in areas such as sterile and non-sterile compounding, personalized medicine, and the ability to handle complex formulations.

Players such as Magistral Pharmacies, FarmaLife, Pharma Tycsa, and others are the emerging players in the market. These players are adopting mergers & acquisitions strategies to stay competitive. Several companies are acquiring the major companies to expand their service portfolios and launch combined emergency rooms and urgent care services to enhance the revenue model.

The impact of regulations on the market is high. The Federal Commission for Protection against Sanitary Risk (COFEPRIS) oversees the compliance and enforcement of these regulations, ensuring that compounded medications meet safety and quality standards. In addition, NOM-249-SSA1-20 is a Mexican Official Standard that specifies the requirements for preparing, controlling, and ensuring the quality of sterile mixtures in healthcare settings.

Government initiatives and regulatory support for pediatric healthcare, along with advancements in pharmaceutical compounding techniques, are also contributing to market expansion. As more healthcare providers recognize the limitations of standard formulations for pediatric patients, the demand for compounded medications is expected to grow, driving significant development in Mexico’s compounding pharmacy market.

Therapeutic Area Insights

The pain management segment held the largest revenue share of 33.36% in 2024. Patients frequently use multiple medications for pain management, which are expected to be complicated and may result in compliance challenges. Compounding pharmacies provide alternative delivery methods, for instance, Fagron (Brands and Essentials) provides patients with high-quality, USP-grade Baclofen in powdered form. However, this is often compounded into creams or capsules to assist with pain management.

The nutritional supplements segment is expected to grow at the fastest CAGR of 5.54% over the forecast period. Its growth is attributed to the increasing shift toward dietary supplements that provide essential vitamins, minerals, and other nutrients, and is supported by the growing inclination toward maintaining overall health, with an increased demand for nutritional supplements that support immunity, energy levels, mental clarity, or skin health. Moreover, this shift is supported by various public health campaigns and educational initiatives that emphasize the role of nutrition in preventing chronic diseases.

Age Cohort Insights

The adult segment held the largest revenue share of 44.45% in 2024. The growth of the segment is owed to the rising shift from reactive to preventive medicine, a significant trend driven by the rising prevalence of chronic diseases. This approach aims to reduce the burden on the healthcare system while improving patient outcomes. The increasing focus on preventive care is particularly relevant for adults with unique sensitivities or specific dosage needs that mass-produced medications cannot fulfill.

The pediatric segment is expected to grow at the fastest CAGR of 5.11% over the forecast period. Its growth is attributed to the increasing awareness among healthcare providers and parents about the benefits of personalized medicine has fueled demand for customized pediatric medications. Many commercially available drugs are not suitable for children due to factors such as inappropriate dosage forms, unsuitable strengths, or the presence of allergens such as gluten and lactose.

Compounding Type Insights

The Pharmaceutical Ingredient Alteration (PIA) segment held the largest revenue share of 37.68% in 2024. This growth is due to its significant role in the growth of compounding pharmacies in Mexico by enabling these establishments to tailor medications to meet specific patient needs not addressed by commercially available drugs. PIA allows compounding pharmacies to respond quickly to shortages of certain medicines by reformulating available ingredients into effective alternatives. In addition, the government’s price controls, and tendering processes have created an environment where companies must optimize their production costs to participate in the market. This has led to altering pharmaceutical ingredients to cheaper alternatives while maintaining the required efficacy and safety standards.

The Pharmaceutical Dosage Alteration (PDA) segment is expected to grow at a lucrative CAGR of 5.14% during the forecast period. Its growth is attributed to the increasing aging population, the prevalence of polypharmacy, and the challenges related to dysphagia in older adults are driving the growth of the Pharmaceutical Dosage Alteration (PDA) in geriatric patients in Mexico. As the demographic landscape shifts with a significant rise in individuals 65 and older, healthcare providers must adapt medication regimens to account for age-related physiological changes and swallowing difficulties.

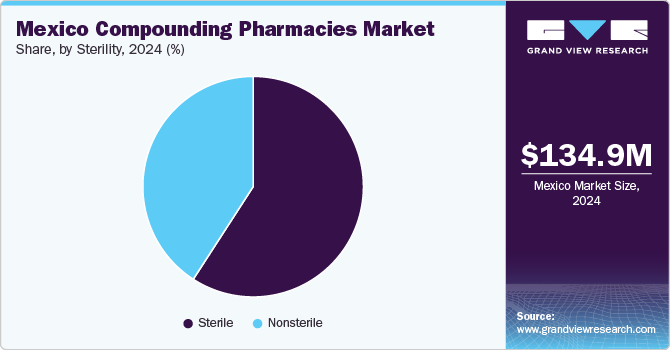

Sterility Insights

The sterile segment held the largest revenue share of 59.14% in 2024. Sterile compounding involves preparing medications free from viable microorganisms, which is critical for patients with compromised immune systems or those requiring injections. As healthcare providers and patients become more aware of the benefits of customized medications tailored to individual needs, the market for sterile compounding has expanded significantly. For instance, the rise in chronic diseases, healthcare and the aging population have led to a greater need for specialized treatments that sterile compounding pharmacies can provide.

The non-sterile segment is expected to grow at a lucrative rate with a CAGR of 4.81% over the forecast period, the rising demand for customized medications, which allows pharmacists to tailor formulations to meet individual patient requirements. This trend is particularly evident in areas such as pain management and hormone replacement therapy, where patients often seek specific dosages or combinations that are not available in standard commercial products.

Key Mexico Compounding Pharmacies Company Insights

Some of the notable companies in the market are Invacare Corporation; Fagron (Brands & Essentials); Omicronlab; Magistral Pharmacies; BIOH; FarmaLife; Farmacias el Globo; DermiCo; and others. The strategies of key players to strengthen their market presence include new product launches, partnership & collaborations, mergers & acquisitions, and geographical expansion. For instance, in May 2019, Fagron announced its agreement to acquire Central de Drogas, S.A. de C.V. (Cedrosa). This acquisition is significant as Cedrosa is recognized as a leading supplier of raw materials, specifically Essentials, to compounding pharmacies and the broader pharmaceutical industry in Mexico.

Key Mexico Compounding Pharmacies Companies:

- Fagron (Brands & Essentials)

- Omicronlab

- Magistral Pharmacies

- BIOH

- FarmaLife

- Farmacia México

- Pharma Tycsa

- Compounding Wholesalers de México

- MXPharmacy (Edge Pharma)

- Farmacias el Globo

- DermiCo

- Bionorusso

- Hervanario

Mexico Compounding Pharmacies Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 181.12 million

Growth rate

CAGR of 5.02% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic area, age cohort, type, sterility

Key companies profiled

Fagron (Brands and Essentials); Magistral Pharmacies; BIOH; FarmaLife; Farmacia México; Pharma Tycsa; Compounding Wholesalers de México; MXPharmacy (Edge Pharma); Farmacias el Globo; DermiCo; Bionorusso; OmicronLab; Hervanario

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Compounding Pharmacies Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico compounding pharmacies market report based on therapeutic area, age cohort, type and sterility.

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormone replacement therapy

-

Pain management

-

Specialty drugs

-

Dermatology

-

Nutritional Supplements

-

Others

-

-

Age Cohort Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Ingredient Alteration (PIA)

-

Currently Unavailable Pharmaceutical Manufacturing (CUPM)

-

Pharmaceutical Dosage Alteration (PDA)

-

Others

-

-

Sterility Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile

-

Non sterile

-

Frequently Asked Questions About This Report

b. The Mexico compounding pharmacies market size was established at USD 134.89 million in 2024 and is expected to reach USD 141.78 million in 2025.

b. The Mexico compounding pharmacies market is expected to grow at a compound annual growth rate of 5.02% from 2025 to 2030 to reach USD 181.12 million by 2030.

b. The pain management segment held the largest revenue share of 33.36% in 2024. Patients frequently use multiple medications for pain management, which are expected to be complicated and may result in compliance challenges. Compounding pharmacies provide alternative delivery methods, for instance, Fagron (Brands and Essentials) provides patients with high-quality, USP-grade Baclofen in powdered form. However, this is often compounded into creams or capsules to assist with pain management.

b. Some key players operating in the Mexico compounding pharmacies market include Fagron (Brands and Essentials); Magistral Pharmacies; BIOH; FarmaLife; Farmacia México; Pharma Tycsa; Compounding Wholesalers de México; MXPharmacy (Edge Pharma); Farmacias el Globo; DermiCo; Bionorusso; OmicronLab; and Hervanario

b. Key factors driving market growth include the rising demand for personalized medicine to enhance treatment, safety, and efficacy is one of the major factors driving the market's growth. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and neurological conditions is fueling the need for customized formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.