- Home

- »

- Pharmaceuticals

- »

-

Mexico Medical Cannabis Market Size & Share Report, 2030GVR Report cover

![Mexico Medical Cannabis Market Size, Share & Trends Report]()

Mexico Medical Cannabis Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Flowers, Oil & Tinctures), By Application (Cancer, Chronic Pain, Depression & Anxiety, Arthritis), And Segment Forecasts

- Report ID: GVR-3-68038-115-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

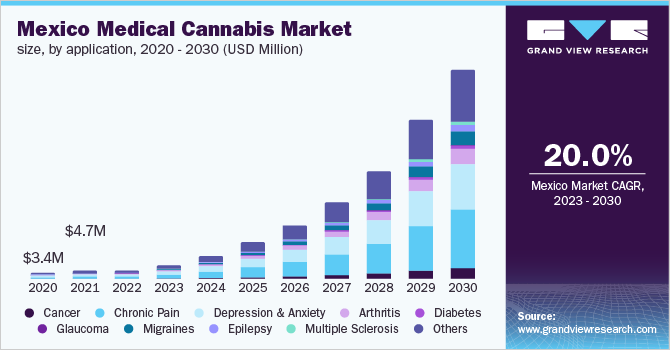

The Mexico medical cannabis market size was valued at USD 4.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20% from 2023 to 2030. Various countries have begun to liberalize marijuana and hemp regulations, which is expected to stimulate market growth. Legalizing it for adult use will assist to create new jobs and bring in billions of dollars to the economy. Tourism, food, and transportation are just a few of the industries that will benefit from legalization. The anticipated increase in the acceptance of cannabis for medicinal purposes is projected to increase demand for medical cannabis, eroding the illegal market in the process.

As of January 2021, Mexico’s health ministry published rules that will regulate the use of medical cannabis. As per the regulations, cannabis will be cultivated specifically for research purposes as well as for manufacturing pharmaceutical products, applicable to both private as well as public research, including measures regarding quality control and good manufacturing practices for products containing cannabis. Since the regulations have been put in place, medical tourism is expected to increase, bringing in extra income for the government, and furthering the growth of the market.

One of the variables projected to drive the Mexican industry is the high prevalence of cancer. According to the American Cancer Society, around 11,030 new cancer patients will be diagnosed with cancer in Mexico in 2022. Numerous researches have confirmed cannabis's anti-cancer properties, resulting in its increased use in cancer treatment. Over the projected period, rising illness burdens and increased usage of cannabis for medical purposes are expected to drive product demand.

The country's health licenses for cannabis growth, harvesting, and manufacture are solely for medical and research purposes. In Mexico, cannabis regulations are not well-regulated, and it is subject to secondary control by the Federal Commission for the Protection Against Health Risks. It can only be brought into Mexico for medicinal or scientific research objectives.

Marijuana is only permitted to be consumed with a physician's prescription, and its distribution is regulated by the government. The cultivation, manufacturing, and consumption of medical cannabis having less than 1% tetrahydrocannabinol (THC) were as allowed in Mexico in 2017. The government established a unique law that offered people the right to use CBD products in their daily lives.

The projected legalization of recreational cannabis will put an end to criminal drug trafficking and shift the business to legal cannabis entrepreneurs. It will allow for better planning, regulation, and implementation of plans, hence increasing the growth potential of the market. The government would also be able to profit from taxes paid on legal cannabis sales.

As a result of the impending legalization of cannabis, numerous huge corporations, such as Aurora Cannabis, have begun to acquire smaller businesses in the country. Aurora Cannabis purchased Farmacias Magistrales S.A., giving the company a first-mover advantage and exclusive access to the expanding the growth of the market.

Coronavirus (COVID-19) has wreaked havoc on the economy as well as the healthcare system. The COVID-19 pandemic has strained the global healthcare system, with developed countries facing an economic downturn. From March 2020, the pandemic negatively influenced the healthcare system, resulting in a 50% to 70% decline in revenue.

Several small hospitals, clinics, and care facilities have had to close their doors. Because of social estrangement, elective surgical treatments have been postponed, which has resulted in localized curfews. Furthermore, visa cancellations have halted medical tourism, which may hinder the growth of the industry.

Application Insights

Chronic pain is expected to be the most lucrative category and it held a revenue share of 26.3% in 2022. Neurogenic pain, cancer pain, lower back pain, arthritis, neck pain, headaches, cancer pain, and facial discomfort, are all examples of chronic pain. Furthermore, it is linked to a variety of other medical disorders, which is expected to increase the total use of cannabis for pain relief, driving the growth. The aged, in particular, are more vulnerable to both chronic and acute pain, increasing the demand for pain management medications.

According to the World Health Organization (WHO), Mexico's population of people aged 65 and more will increase by 277% by 2050. As per the World Data Atlas, the population of people aged 65 years and above in Mexico was 7.8%. In addition, studies show that medical cannabis helps older individuals with chronic pain. As a result, the market for chronic pain management is projected to be driven by rising knowledge of cannabis' medical benefits and an aging population.

Cannabis has been used for the treatment of symptoms in various other medical conditions, like Alzheimer’s, Parkinson’s, and Tourette’s Syndrome. Tourette's is anticipated to register the fastest growth rate of 54.7%. Contrary to the expected effect of euphoria created by using cannabis, it was found to have reduced tics in some patients with Tourette’s. This is becoming an area of increased research since the current medical interventions for the treatment of Tourette’s syndrome are inadequate. This factor will be a key driving factor for the growth of this segment as well as for the market in Mexico.

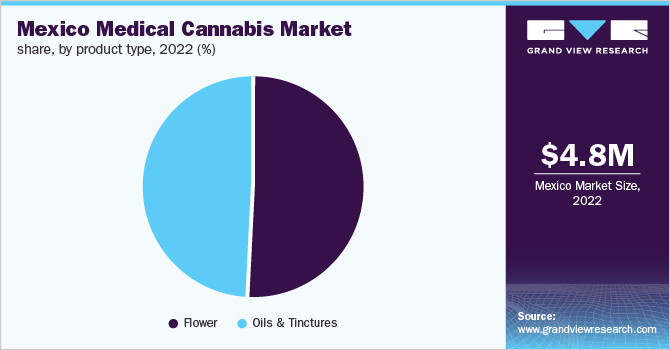

Product Insights

In 2022, oil and tinctures accounted for the largest revenue share of 50.8% and is anticipated to register the fastest growth rate of 49.5%. Tinctures are made by dissolving marijuana in alcohol and are intended to be taken sublingually. When compared to oils, they have a faster beginning effect. Oils and other kinds of cannabis treatments take 45 minutes to take effect, whilst tinctures take only 15 minutes. Waiting 15 minutes instead of 45 minutes is a possible alternative for those suffering from acute discomfort. The demand for tinctures is predicted to rise over the projection period due to this benefit, hence will be the key driving factor for the market.

CBD oil comes in a variety of forms, including edibles, vapes, topicals, and other items. With the rising societal stigma associated with cannabis smoking, demand is dwindling. Furthermore, doctors are wary of people smoking since it contains potentially dangerous components such as particulates, tar, and other substances. As a result, oil and tinctures adoption is expected to increase significantly.

The flower segment held the fastest-growing product category over the forecast period. It emerged as the most profitable segment because of the low price and easy availability of the product. However, with rising domestic production, increased availability, and lower prices, the oil & tinctures section is predicted to overtake the flower category as the fastest-expanding segment. CBD oil can be used to treat diseases and disorders like cancer and nausea, as well as to improve sleep and relieve stress and anxiety. It has been legalized in the country due to its strong potential for medical use.

Key Companies & Market Share Insights

Existing players face moderate competition, as just a few organizations have the technology, financial resources, technology, and legal approval to engage in large-scale cannabis cultivation. Furthermore, the availability of research money is critical in encouraging additional entrepreneurs to enter the Mexican market with innovative products. For instance, through the 100% takeover of D9C Mexico S.A. DE C.V., Ikänik Farms is now the first to claim "Hecho en Mexico" for hemp and cannabis in July 2020. Some prominent players in the Mexico medical cannabis market include:

-

Aurora Cannabis

-

CANOPY GROWTH CORPORATION

-

GW Pharmaceuticals, plc

-

Jazz Pharmaceuticals, Inc.

-

CBD Life

-

HempMeds

-

Isodiol International Inc.

-

PharmaCielo.com

-

Elixinol

-

ENDOCA

Mexico Medical Cannabis Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 7.8 million

The revenue forecast in 2030

USD 117.7 million

Growth rate

CAGR of 20% from 2023 to 2030

The base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product

Country scope

Mexico

Key companies profiled

Aurora Cannabis; CANOPY GROWTH CORPORATION; GW Pharmaceuticals, plc; Jazz Pharmaceuticals, Inc.; CBD Life; HempMeds; Isodiol International Inc.; PharmaCielo.com; Elixinol; ENDOCA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Medical Cannabis Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research, Inc. has segmented the Mexico medical cannabis market report based on application and product:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Flowers

-

Oils & Tinctures

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Cancer

-

Chronic Pain

-

Depression & Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s Disease

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson’s Disease

-

Tourette’s Syndrome

-

Others

-

Frequently Asked Questions About This Report

b. The Mexico medical cannabis market is expected to grow at a compound annual growth rate of 20.0% from 2023 to 2030 to reach USD 117.7 million by 2030.

b. Chronic pain dominated Mexico medical cannabis market with a share of 26.3% in 2022. This is attributable to the rapid adoption of marijuana for the treatment of chronic pain as an alternative to opioids and synthetic drugs.

b. Some key players operating in Mexico medical cannabis market include Aurora Cannabis; Canopy Growth Corporation; GW Pharmaceuticals, plc; CB Science, Inc.; HempMeds; CBD Life; and Isodiol International, Inc.

b. The Mexico medical cannabis market size was estimated at USD 4.8 million in 2022 and is expected to reach USD 7.8 million in 2023.

b. Key factors that are driving the market growth include the growing adoption of medical marijuana for the treatment of chronic conditions and the approval of CBD derivatives for medicinal use.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.