- Home

- »

- Plastics, Polymers & Resins

- »

-

Mexico Thermoplastic Elastomer Market Size Report, 2033GVR Report cover

![Mexico Thermoplastic Elastomer Market Size, Share & Trends Report]()

Mexico Thermoplastic Elastomer Market (2025 - 2033) Size, Share & Trends Analysis Report By Grade (Styrenic Block Copolymers, Thermoplastic Polyolefins, Thermoplastic Vulcanizates), By Material (Poly Styrenes, Poly Olefins), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-669-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mexico Thermoplastic Elastomer Market Summary

The Mexico thermoplastic elastomer market size was valued at USD 428.05 million in 2024 and is expected to reach USD 871.65 million by 2033, growing at a CAGR of 8.4% from 2025 to 2033. The rise in demand for various end-products of industries such as consumer goods, electrical and electronics, medical, and automotive in North America is driving the demand for TPEs in the country.

Key Market Trends & Insights

- Thermoplastic Polyolefin dominated the grade segment with the largest revenue share of 31.37% in 2024.

- Thermoplastic Vulcanizates are expected to grow at the fastest CAGR of 9.9% from 2025 to 2033.

- By material, the Poly Urethanes segment is expected to grow at the fastest CAGR of 10.8% from 2025 to 2033 in terms of revenue.

- By applications, the automotive segment dominated the grade segment with the largest revenue share of 37.71% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 428.05 Million

- 2033 Projected Market Size: USD 871.65 Million

- CAGR (2025-2033): 8.4%

The thermoplastic elastomers (TPE) market in Mexico is projected to experience consistent growth, fueled by increasing demand from major sectors including automotive, construction, consumer goods, and electronics. TPEs provide a distinctive blend of flexibility, durability, and recyclability, making them suitable for lightweight vehicle parts, ergonomic consumer products, and adaptable seals in infrastructure applications. The country’s growing manufacturing sector, enhanced trade ties with the U.S., and a rising inclination towards sustainable and cost-effective materials further contribute to this growth. Changes in regulations and sustainability goals set by original equipment manufacturers (OEMs) are driving the adoption of recyclable and halogen-free TPE formulations across various industries.

Moreover, the swift growth of urban areas, investments in infrastructure, and the rise in production of vehicles and appliances are driving the use of thermoplastic elastomers in Mexico. As industries that utilize these materials place more importance on performance, design versatility, and adherence to environmental standards, TPEs are becoming more favorable compared to conventional materials. With continuous improvements in processing technologies and an increasing awareness of circular economy concepts, the market is set for steady growth in the coming years.

Drivers, Opportunities & Restraints

The thermoplastic elastomers (TPE) sector in Mexico is expected to experience continuous growth, driven by increasing demand in the automotive, construction, consumer products, and electronics industries. TPEs merge the characteristics of rubber with the processing benefits of plastics, making them suitable for lightweight vehicle parts, flexible seals, soft-touch grips, and over-molded components. Their applications are broadening to include wire and cable insulation, medical equipment, and household items because of their recyclability, durability, and compliance with safety standards. The growth is further supported by rising investments in healthcare, the manufacturing of domestic appliances, and nearshoring trends that enhance Mexico’s role in regional supply chains.

New possibilities are arising in the Mexican thermoplastic elastomers (TPE) sector as the movement towards sustainability and circular economy objectives gathers pace. The emergence of recyclable, bio-based, and halogen-free TPE variants is increasingly noticeable, in line with global environmental criteria and the material requirements of original equipment manufacturers (OEMs). Furthermore, the swift rise in electric vehicle manufacturing, enhancements in infrastructure, and growth in e-commerce activities are broadening the applications for TPE, especially in lightweight automotive components, flexible packaging, and robust building materials. These developments are anticipated to reveal innovative applications of TPEs across a broader array of high-performance and environmentally conscious uses.

Limited domestic high-performance TPE production is a significant constraint on the growth of Mexico's TPE market. Government data from Mexico’s Secretariat of Economy indicates that the plastics and rubber products sector, which includes TPEs, contracted by approximately 3.3 % in the first quarter of 2024 in real terms. This decline reflects insufficient investment in advanced polymer processing facilities equipped for specialty TPEs. As a result, converters and OEMs must fill the gap with imports, primarily from the U.S., China, Canada, and Brazil. Relying on these imports leads to longer lead times, elevated freight, and customs costs, and added complexity in managing inventory buffers for production continuity.

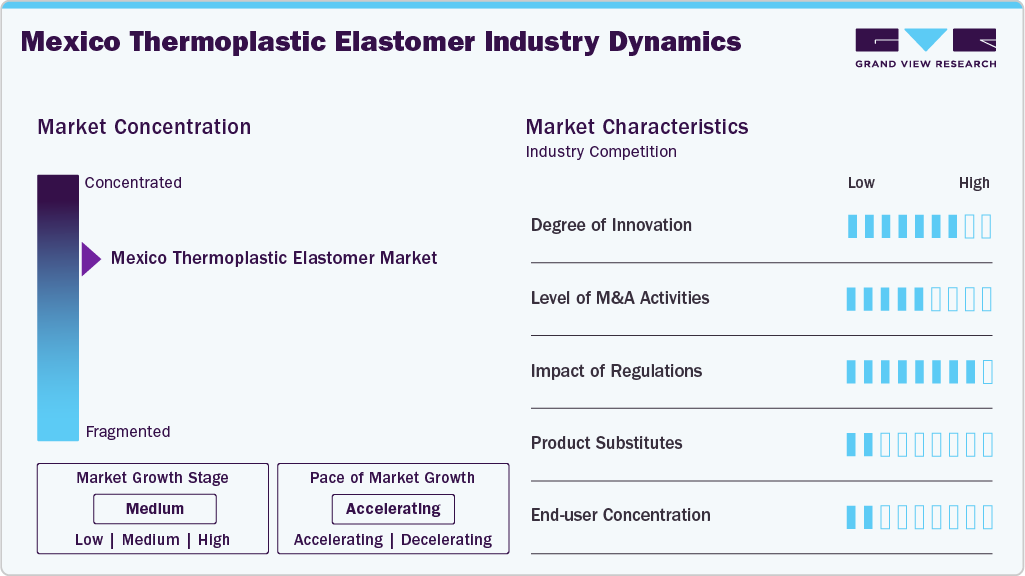

Market Concentration & Characteristics

The thermoplastic elastomers (TPE) sector in Mexico is currently experiencing moderate growth with an optimistic forecast, driven by increasing industrial demand and greater integration into high-performance applications. Although the market is still somewhat fragmented, major global and regional companies significantly influence its competitive environment. Industry leaders such as ExxonMobil Chemical, Hexpol TPE, Mitsui Chemicals, Teknor Apex, and Lubrizol Advanced Materials, among others, are spearheading innovation by creating advanced, recyclable, and specialty-grade TPEs designed to comply with changing regulatory standards and customer needs. Their targeted investments in research and development and local manufacturing capabilities are facilitating the quicker adoption of TPEs in automotive, electronics, medical, and construction sectors throughout Mexico.

Mergers and acquisitions are actively influencing the thermoplastic elastomers (TPE) market in Mexico, as leading players pursue strategic deals to expand their regional footprint, diversify product portfolios, and strengthen supply chain resilience. These consolidations are accelerating the development of sustainable TPE solutions, driven by growing environmental regulations and customer demand for safer, recyclable materials. In line with regulatory frameworks across North America and Europe, manufacturers are prioritizing low-VOC, halogen-free, and recyclable TPE grades. Compliance-related costs and shifting material standards are prompting increased investments in advanced compounding technologies and reformulation efforts to align with circular economy and low-emission goals.

The market for thermoplastic elastomers (TPE) in Mexico encounters moderate rivalry from alternative materials like PVC, thermoset rubbers, and engineered plastics, especially in the automotive, construction, and consumer sectors. Nonetheless, TPEs maintain a strong presence due to their lightweight nature, flexibility, ease of processing, and recyclability. The market demonstrates significant end-user concentration, particularly in the automotive and appliance manufacturing industries, where major OEMs and Tier 1 suppliers have considerable power over the selection and procurement of materials.

Grade Insights & Trends

Thermoplastic Polyolefins dominated the grade segment in terms of revenue, accounting for a market share of 31.37% in 2024. Thermoplastic Polyolefins are gaining ground in Mexico, especially in automotive and construction applications. TPOs are typically blends of polypropylene (PP) with rubber phases like ethylene-propylene rubber (EPR or EPDM), giving them a unique combination of rigidity and elasticity. Their lightweight, cost-effectiveness, UV resistance, and recyclability make them well-suited for Mexico’s growing automotive OEM base, particularly for bumpers, instrument panels, and exterior trims. TPOs are increasingly chosen over traditional materials due to their compliance with lightweighting trends driven by fuel efficiency and emission norms.

Styrenic Block Copolymers are the most widely consumed type of TPE in Mexico due to their versatile processing characteristics, cost efficiency, and applicability across key end-user industries like automotive, packaging, construction, and consumer goods. These materials are formed by combining polystyrene with elastomeric midblocks (typically butadiene or isoprene), offering a balance of softness, strength, and clarity. In Mexico, SBCs are prominently used in adhesive applications, footwear components, and flexible packaging due to their excellent elastic recovery, transparency, and ease of extrusion or molding.

Thermoplastic vulcanizates are projected to experience steady growth over the forecast period at a CAGR of 9.9%. Thermoplastic vulcanizates, known for their high resilience, heat resistance, and rubber-like feel, are a premium TPE segment in Mexico. TPVs are formed through dynamic vulcanization, typically involving finely dispersed cross-linked EPDM rubber particles within a thermoplastic matrix, usually polypropylene.

Material Insights & Trends

Polyolefins led the market in terms of revenue, accounting for a share of 58.72% in 2024. Polyolefin is primarily used in packaging, automotive, and construction applications due to its flexibility and ability to withstand harsh environmental conditions. The growing demand for packaging films in Mexico, owing to the augmentation of the flourishing global e-commerce industry, due to the increased penetration of smart devices and Internet services, is fueling the demand for polyolefin in the packaging industry. This is leading to the development of novel sustainable products by the market players.

Polyurethanes are projected to grow at the fastest CAGR of 10.8% throughout the forecast period. Polyurethane-based TPEs are known for their elasticity and robust mechanical properties. They stand out for their versatility and are, hence, used in various industries. These elastomers exhibit excellent abrasion resistance, which makes them perfect for applications where flexibility and toughness are essential.

Application Insights & Trends

Automotive applications led the market in terms of revenue, accounting for a share of 37.71% in 2024. The automotive industry is expected to maintain its dominance over the forecast period. The growing per capita income in developing and developed countries is spurring the demand for automobiles for personal and commercial needs. Additionally, the surge in the adoption of electric vehicles (EVs) to reduce the reliance on fossil fuels due to the rising concerns about global warming and climate change is further expected to boost the TPE market over the coming years.

The medical industry is projected to grow at the fastest CAGR of 10.2% throughout the forecast period. Mexico’s medical device industry is a cornerstone of its TPE market, driven by near-shoring of global OEMs and government support for high-tech manufacturing. TPEs, especially medical-grade SEBS and TPU, are increasingly specified for catheters, tubing, gaskets, and flexible connectors due to their biocompatibility, sterilization resistance, and precise molding characteristics.

In Mexico’s TPE market, industrial applications represent a substantial and diverse segment, driven by the country’s robust manufacturing and infrastructure development. TPEs are increasingly used for seals, gaskets, hoses, and vibration-damping mounts across industries such as automotive assembly plants, heavy machinery fabrication, and oil & gas equipment. These components benefit from TPE’s combination of elastomeric flexibility and thermoplastic processability, allowing manufacturers to injection-mold or extrude parts with tight tolerances, rapid cycle times, and minimal post-processing.

Key Mexico Thermoplastic Elastomer Companies Insights

Key players operating in the Mexico thermoplastic elastomer market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Mexico Thermoplastic Elastomer Companies:

- ExxonMobil Chemical

- Hexpol TPE

- Mitsui Chemicals

- Teknor Apex

- Lubrizol Advanced Materials

- Celanese Corporation

- DIC Corporation

- BASF SE

- DSM Engineering Materials (DSM-Firmenich)

- KRAIBURG TPE GmbH & Co. KG

Recent Developments

-

In March 2025, KRAIBURG TPE GmbH & Co. KG showcased its latest TPE innovations at PLASTIMAGEN 2025, held from March 11 to 14 at the Citibanamex Center in Mexico City. The company presented new products, including the Thermolast M Supersoft compounds designed for medical and consumer markets, flame-retardant Thermolast K TPEs, and sustainable Thermolast R solutions with recycled content. These advances aimed to meet growing demands in the US and Latin American markets for ultra-soft, versatile, and sustainable TPE materials.s

-

In November 2024, GEON Performance Solutions expanded its TPE production by starting a new manufacturing line at its Ramos Arizpe, Mexico facility.

Mexico Thermoplastic Elastomer Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 871.65 million

Growth rate

CAGR of 8.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, material, applications

Key companies profiled

ExxonMobil Chemical; Hexpol TPE; Mitsui Chemicals; Teknor Apex; Lubrizol Advanced Materials; Celanese Corporation; DIC Corporation; BASF SE; DSM Engineering Materials (DSM-Firmenich); KRAIBURG TPE GmbH & Co. KG

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Thermoplastic Elastomer Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Mexico thermoplastic elastomer market report on the basis of grade, material, and applications:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Styrenic Block Copolymers

-

Thermoplastic Polyolefins

-

Thermoplastic Vulcanizates

-

Thermoplastic Polyurethanes

-

Thermoplastic Copolyester Elastomers

-

Thermoplastic Polyamides

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polystyrenes

-

Poly Olefins

-

Poly Ether Imides

-

Polyurethanes

-

Poly Esters

-

Polyamides

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Medical

-

Consumer Goods

-

Other Applications

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.