- Home

- »

- Distribution & Utilities

- »

-

Microgrid As A Service Market Size, Industry Report, 2030GVR Report cover

![Microgrid As A Service Market Size, Share & Trends Report]()

Microgrid As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Software As A Service, Monitoring & Control Service, Operation & Maintenance Service), By Grid Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-598-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microgrid As A Service Market Summary

The global microgrid as a service market size was estimated at USD 2.87 billion in 2024 and is projected to reach USD 6.56 billion by 2030, growing at a CAGR of 14.8% from 2025 to 2030. The microgrid as a service (MaaS) industry is experiencing significant growth, driven by the increasing demand for reliable and resilient energy solutions.

Key Market Trends & Insights

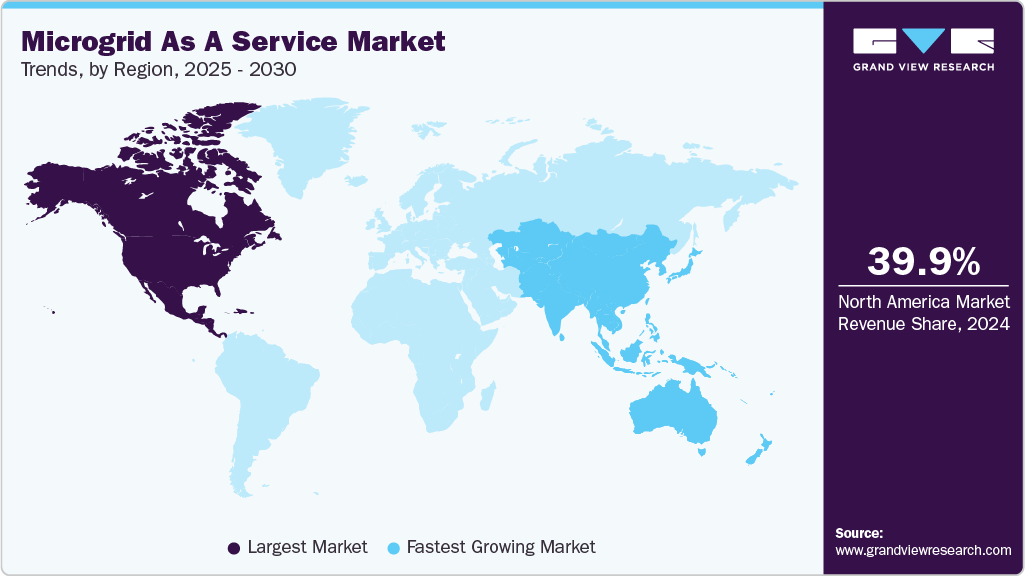

- North America held 39.87% revenue share of the global Microgrid as a Service market.

- Technological advancements are enhancing the efficiency and management of microgrids in the U.S.

- By service type, Operation & Maintenance (O&M) service held the largest market revenue share of over 39.21% in 2024.

- By grid type, grid-connected segment held the revenue share of 69.98% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.87 Billion

- 2030 Projected Market Size: USD 6.56 Billion

- CAGR (2025-2030): 14.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Factors such as the integration of renewable energy sources, advancements in energy storage technologies, and the adoption of smart grid solutions are propelling the market forward. Additionally, supportive government policies and incentives are encouraging the deployment of microgrids, particularly in regions with aging infrastructure or those prone to natural disasters. Technological innovations, including the use of artificial intelligence and the Internet of Things (IoT), are enhancing the efficiency and management of microgrids. These advancements allow for real-time monitoring and optimization of energy usage, contributing to cost savings and improved energy reliability. Furthermore, the shift towards decentralized energy systems aligns with global sustainability goals, making MaaS an attractive option for both urban and remote areas seeking energy independence and reduced carbon emissions.

The commercial and industrial sectors are increasingly adopting MaaS solutions to ensure uninterrupted power supply and to meet sustainability targets. The flexibility of MaaS models, which often involve subscription-based or pay-as-you-go arrangements, reduces the need for significant upfront capital investment, making it an attractive option for businesses. This trend is particularly evident in regions like Asia Pacific, where rapid industrialization and urbanization are driving energy demand.

Despite the positive outlook, challenges such as high initial investment costs, regulatory complexities, and cybersecurity concerns persist. However, ongoing advancements in technology and increasing awareness of the benefits of microgrids are expected to mitigate these issues over time. As the energy landscape continues to evolve, MaaS is poised to play a crucial role in providing sustainable, reliable, and cost-effective energy solutions worldwide.

Drivers, Opportunities & Restraints

Increasing incidences of grid failures due to extreme weather events, cyberattacks, and aging infrastructure have made energy resilience a top priority. Microgrids offer a reliable and localized energy solution that can operate independently from the main grid during disruptions. This makes MaaS particularly attractive for critical infrastructure like hospitals, data centers, and military bases.

Opportunities in the market are expanding due to technological advancements and shifting energy consumption patterns. Emerging technologies like IoT, AI, and advanced energy storage systems are making microgrids smarter, more efficient, and easier to manage remotely. There is a significant opportunity in remote, off-grid regions and developing economies where microgrids can offer affordable and reliable power. Moreover, commercial and industrial users are adopting MaaS to meet sustainability goals, reduce energy costs, and ensure uninterrupted operations, particularly in areas with unreliable utility grids or high peak demand charges.

Despite its promising growth, the microgrid as a service market faces several restraints. High initial setup and operational costs for service providers, especially in customized or large-scale deployments, remain a major challenge. Regulatory inconsistencies and a lack of standardization across regions complicate implementation and grid integration. Additionally, as microgrids become more digitized, concerns around cybersecurity, data privacy, and system reliability in the face of potential cyber threats are growing. Addressing these barriers will be essential for the long-term scalability and success of the MaaS model.

Service Type Insights

Operation & Maintenance (O&M) Service held the largest market revenue share of over 39.21% in 2024. The Operation & Maintenance (O&M) service segment plays a crucial role in the microgrid as a service industry by ensuring optimal performance, reliability, and longevity of microgrid systems. This segment encompasses real-time monitoring, system diagnostics, preventive maintenance, and rapid fault response, all of which are vital for minimizing downtime and maximizing energy efficiency. As microgrids become more complex with the integration of distributed energy resources, advanced controls, and digital technologies, the demand for specialized O&M services is increasing. Moreover, O&M contracts often form a recurring revenue stream for MaaS providers, making them a key component of the business model, especially in commercial, industrial, and remote installations where uptime is critical.

Software as a Service (SaaS) is a key segment within the microgrid as a service market, enabling intelligent, real-time management of distributed energy resources. SaaS platforms provide advanced analytics, predictive maintenance, energy forecasting, and automated control capabilities, allowing microgrid operators to optimize performance, reduce operational costs, and enhance grid reliability.

Grid Type Insights

Grid-connected segment held the revenue share of 69.98% in 2024. The grid-connected segment is experiencing significant growth, driven by its ability to enhance energy reliability, integrate renewable sources, and reduce operational costs. These systems operate in tandem with the main grid, allowing for seamless energy exchange and improved stability. Their compatibility with existing infrastructure simplifies integration and lowers deployment costs. Furthermore, grid-connected microgrids enable the sale of surplus energy back to the grid, creating additional revenue streams for operators. Government incentives and policies supporting clean energy adoption further bolster the demand for these systems, making them a pivotal component in the transition toward a more resilient and sustainable energy landscape.

The islanded segment is a key driver in the microgrid as a service (MaaS) market due to its ability to operate independently from the main grid, offering critical energy resilience and reliability in remote, disaster-prone, or infrastructure-deficient regions. This capability is especially valuable for military bases, islands, rural communities, and industrial facilities that require an uninterrupted power supply regardless of grid conditions. The MaaS model further enhances the appeal of islanded microgrids by lowering capital barriers and providing turnkey solutions, including design, installation, and operation, making it easier for users to access resilient energy without the burden of ownership or technical expertise.

Regional Insights

North America held 39.87% revenue share of the global Microgrid as a Service market. The North America microgrid as a service market is experiencing robust growth, driven by increasing demand for resilient and decentralized energy solutions, rising grid instability due to extreme weather events, and supportive government policies promoting renewable energy integration. Key trends include the adoption of AI-driven energy management systems, expansion of renewable-powered microgrids (especially solar + storage), and growing interest from commercial & industrial (C&I) sectors seeking cost savings and energy independence. Additionally, utilities and tech providers are leveraging subscription-based MaaS models to reduce upfront costs, while cybersecurity and grid modernization initiatives further propel market expansion. The U.S. dominates the region, but Canada is also seeing growth due to remote community electrification projects.

U.S. Microgrid As A Service Market Trends

Technological advancements are enhancing the efficiency and management of microgrids in the U.S. The integration of artificial intelligence (AI), Internet of Things (IoT), and advanced energy storage systems is transforming microgrid operations, enabling real-time monitoring, predictive maintenance, and automated demand-side management. These innovations contribute to increased efficiency and resilience in microgrid operations, making them more attractive to commercial and industrial sectors seeking uninterrupted power supply and sustainability.

Asia Pacific Microgrid As A Service Market Trends

The Asia Pacific microgrid as a service industry is experiencing rapid growth, driven by escalating energy demands, a strong push for renewable energy integration, and government-led electrification initiatives. The growth is fuelled by the need to provide reliable and sustainable energy solutions, particularly in remote and underserved regions. Countries like India and China are leading the charge, with India implementing the Microgrid Initiative for Campus and Rural Opportunities to support 10,000 microgrids, and China launching the National Renewable Energy Microgrid Demonstration Program to enhance energy access in rural areas. Technological advancements, including the integration of AI and IoT in microgrid operations, are further enhancing efficiency and reliability, making MaaS an increasingly attractive solution across the region.

Europe Microgrid As A Service Market Trends

The Europe microgrid as a service industry is growing steadily, driven by the EU’s push for energy transition, grid decentralization, and resilience against geopolitical energy risks. Renewable energy mandates and funding programs like the Clean Energy Package are accelerating deployments, particularly in Germany, France, and the Nordics, where industrial and municipal sectors adopt MaaS for cost efficiency and carbon reduction. Key trends include hybrid microgrids (solar-wind-storage), blockchain-enabled peer-to-peer energy trading, and increased private-sector partnerships to overcome high upfront costs.

Latin America Microgrid As A Service Market Trends

The Latin America microgrid as a service industry is gaining traction due to unreliable grid infrastructure, rising energy costs, and government efforts to expand electricity access in remote areas. Countries like Brazil, Chile, and Mexico lead adoption, driven by renewable energy potential (particularly solar and hydro) and demand from mining, agriculture, and off-grid communities.

Middle East & Africa Microgrid As A Service Market Trends

The Middle East and Africa microgrid as a service industry is being propelled by several key drivers. Foremost among these is the escalating demand for reliable and sustainable energy solutions, particularly in remote and underserved regions where traditional grid infrastructure is lacking or unreliable. Countries like Saudi Arabia and the United Arab Emirates are leading initiatives to diversify their energy portfolios, with Saudi Arabia aiming to generate 58.7 GW of renewable energy by 2030 as part of its Vision 2030 program. Similarly, the UAE's Energy Strategy 2050 targets meeting half of its energy demand through renewable sources by mid-century.

Key Microgrid As A Service Company Insights

Some of the key players operating in the market include Eaton, ABB, GE, Younicos, and Green Energy Corp.

-

In April 2024, Duke Energy, a major U.S. electric power and natural gas company, launched one of the country’s most advanced green microgrids in Hot Springs, Madison County. The project includes a 2-megawatt solar power facility and a 4.4-megawatt lithium battery storage system, designed to provide clean, reliable energy to the community.

-

In March 2024, the U.S. Department of Energy (DOE) announced plans to invest more than USD 366 million in 17 clean energy projects across rural and remote areas in the U.S. These projects include a variety of clean energy technologies such as battery energy storage systems (BESS), solar power, microgrids, and electric vehicle charging stations.

Key Microgrid As A Service Companies:

The following are the leading companies in the microgrid as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton

- ABB

- GE

- Younicos

- Green Energy Corp

- NRG Energy

- EnSync Energy

- Spirae

- PowerSecure

- Ameresco

- Schneider Electric

- ENGIE

Microgrid As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.28 billion

Revenue forecast in 2030

USD 6.56 billion

Growth rate

CAGR of 14.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Service type, grid type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Eaton; ABB; GE; Younicos; Green Energy Corp; NRG Energy; EnSync Energy; Spirae; PowerSecure; Ameresco; Schneider Electric; ENGIE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microgrid As A Service Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microgrid as a service market report based on service type, grid type, and region:

-

Service Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Software As A Service

-

Monitoring & Control Service

-

Operation & Maintenance (O&M) Service

-

-

Grid Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Islanded

-

Grid Type

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global microgrid as a service market size was estimated at USD 2.87 billion in 2024 and is expected to reach USD 3.28 billion in 2025.

b. The global microgrid as a service market is expected to grow at a compound annual growth rate of 14.8% from 2025 to 2030 to reach USD 6.56 billion by 2030.

b. The Operation & Maintenance (O&M) Service segment dominated the market with a revenue share of over 39.21% in 2024. Regular O&M helps prevent downtime, optimizes energy output, and extends the lifespan of equipment, making it essential for customers looking to maximize their investment.

b. Some of the key vendors of the global Microgrid as a Service market are Eaton; ABB; GE; Younicos ; Green Energy Corp ; NRG Energy; EnSync Energy ; Spirae ; PowerSecure ; Ameresco ; Schneider Electric ; ENGIE.

b. The key factor that is driving the growth of the global Microgrid as a Service market is the increasing grid disruptions from natural disasters, cyberattacks, and aging infrastructure are pushing organizations to adopt microgrids for reliable, uninterrupted power supply.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.