- Home

- »

- Automotive & Transportation

- »

-

Middle East Cold Storage Market Size, Industry Report 2033GVR Report cover

![Middle East Cold Storage Market Size, Share & Trends Report]()

Middle East Cold Storage Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Facilities/Services, Equipment), By Temperature Range (Chilled, Frozen, Deep-frozen), By Application (Food & Beverages, Pharmaceuticals), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-848-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Cold Storage Market Summary

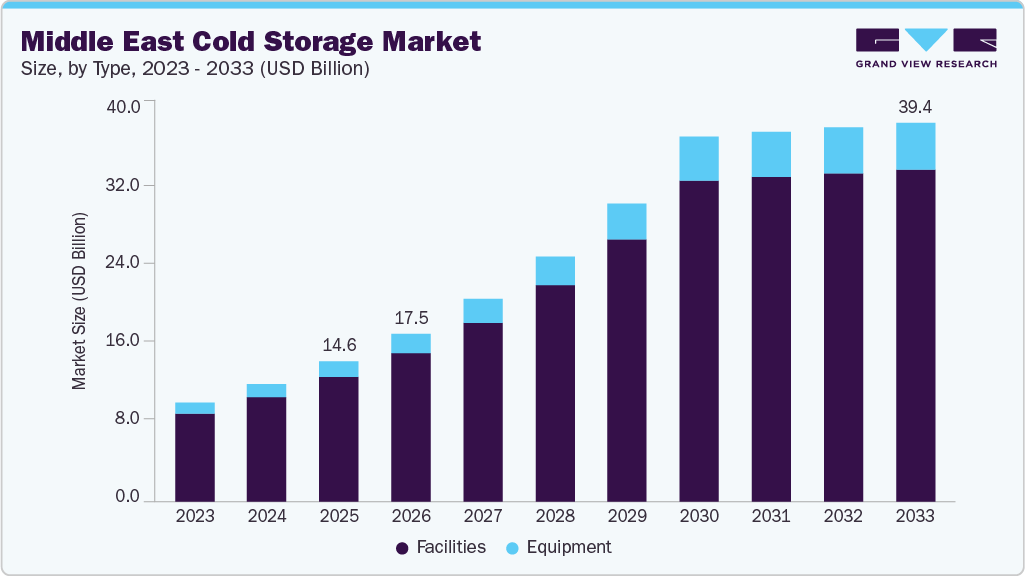

The Middle East cold storage market size was estimated at USD 14.61 billion in 2025 and is projected to reach USD 39.42 billion by 2033, growing at a CAGR of 12.3% from 2026 to 2033. The Middle East’s cold storage industry is growing at a rapid pace, supported by changing consumer preferences, increasing food imports, and the rising need for pharmaceutical and healthcare services.

Key Market Trends & Insights

- UAE dominated the Middle East cold storage industry and accounted for a share of 21.6% in 2025.

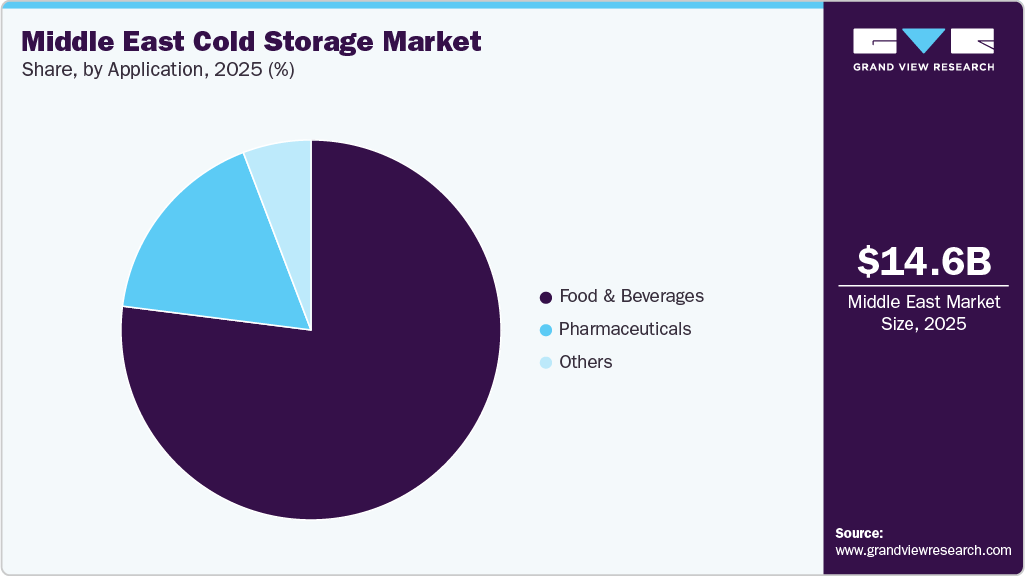

- By type, the facilities segment dominated the market in 2025 and accounted for the largest share of 88.6%.

- By temperature range, the frozen (-18°C to -25°C) segment held the largest market in 2025.

- By application, the food & beverages segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 14.61 Billion

- 2033 Projected Market Size: USD 39.42 Billion

- CAGR (2026-2033): 12.3%

As Middle Eastern countries prioritize food security and economic diversification, investment in cold chain infrastructure has become a major focus. Key trends such as rising food imports and re-exports, the rapid growth of e-commerce and online grocery platforms, and strong government food security initiatives are shaping the development of the region’s cold storage industry. The Middle East depends heavily on imported food, which directly increases the need for large-scale cold storage facilities at ports, airports, and inland logistics hubs. Governments are investing in food security programs to ensure stable supplies of meat, dairy, fruits, and frozen products. These programs require reliable temperature-controlled storage to reduce spoilage and maintain quality. As a result, public and private investment in modern cold warehouses is accelerating.

The expansion of supermarkets, hypermarkets, and online grocery platforms is reshaping food distribution in the region. These channels require consistent cold storage for fresh, frozen, and ready-to-eat products. Same-day and next-day delivery models are pushing companies to build smaller, strategically located cold facilities near cities. This trend is creating strong demand for both large distribution hubs and urban cold storage units.

Healthcare spending is increasing across the Middle East, driven by population growth and higher standards of medical care. Vaccines, biologics, and temperature-sensitive medicines require strict cold storage conditions. Governments and private healthcare providers are building specialized pharmaceutical cold warehouses. This is driving growth in high-specification cold storage with advanced monitoring and compliance systems.

Middle Eastern governments are increasing investments in food security through initiatives that support the development of local cold storage facilities by cold room service providers. Programs such as the UAE’s National Food Security Strategy 2051 encourage public-private partnerships and strengthen the resilience of food supply chains. In addition, urban lifestyles and busy work patterns are increasing demand for frozen and processed foods. Local food processing plants need cold storage for raw materials and finished products. International food brands are also setting up regional distribution centers to serve the Middle East market. This is expanding demand for both blast freezing and long-term cold storage facilities.

One of the major restraints in the Middle East cold storage market is the high cost of setting up and operating temperature-controlled facilities. Building cold warehouses requires heavy capital investment in refrigeration systems, insulation, power backup, and monitoring technologies. In addition, high electricity consumption and rising energy prices increase operating expenses, especially in countries with extreme climates. These cost pressures make it difficult for small and mid-sized players to enter the market and can slow down expansion plans.

Type Insights

The facilities segment dominated the market in 2025 and accounted for the largest share of 88.6%. The segment is expanding rapidly due to the surge in demand for temperature-controlled storage of perishable goods across food & beverage, pharmaceuticals, and retail sectors, making it the largest revenue contributor in the region. Increasing urbanization and rising consumption of fresh and frozen products are prompting investments in large-scale refrigerated warehouses and bulk storage hubs. Strategic location advantages at major ports and free zones are accelerating facility development to support imports, exports, and regional distribution networks. In addition, government regulations aimed at enhancing food safety and reducing spoilage are driving both public and private investments in compliant cold storage infrastructure.

The equipment segment is expected to grow at the fastest CAGR over the forecast period. The segment is one of the most lucrative growth areas due to rapid adoption of advanced refrigeration and freezing technologies that improve operational efficiency and energy performance. Rising demand for sophisticated systems, such as blast freezers, chillers, walk-in coolers, and IoT-enabled temperature monitoring, supports better product quality and compliance with international standards. Growth in sectors such as pharmaceuticals and e-commerce cold logistics further boosts demand for flexible, modular, and high-precision equipment solutions. Technological improvements and increasing investments in automation are also enabling operators to optimize storage capacity and reduce wastage across the cold chain.

Temperature Range Insights

The frozen (-18°C to -25°C) segment held the largest market in 2025. The segment is growing rapidly in the Middle East due to rising consumption of frozen meat, seafood, and ready-to-eat meals suited to busy urban lifestyles. Increasing imports of frozen foods and the need for ultra-low temperature storage for pharmaceuticals and vaccines are boosting demand for advanced freezing infrastructure. Retailers and hypermarkets are expanding freezer space to meet consumer demand for convenience and product variety. As a result, frozen storage is one of the fastest-growing temperature segments in the regional cold storage market.

The chilled (0°C to 15°C) segment is anticipated to grow at a considerable CAGR from 2026 to 2033. The chilled segment holds a considerable share of the Middle East cold storage market as many perishable products, such as dairy, fruits, vegetables, and pharmaceuticals, require storage between 0 °C and 8 °C. Demand for fresh and minimally processed foods is increasing due to urbanization, higher incomes, and changing dietary habits. Strong growth in retail, food service, and healthcare is further driving the need for reliable chilled storage. As a result, chilled storage remains a core part of the region’s cold chain infrastructure.

Application Insights

The food & beverages segment dominated the market in 2025, owing to rapid urbanization and higher disposable incomes are driving increased consumption of perishable products such as dairy, meat, seafood, fruits, and processed foods. Retail expansion, modern supermarkets, and e-commerce grocery delivery are further fueling demand for reliable cold storage to maintain freshness and safety from production to point of sale. Governments are also tightening food safety regulations, pushing businesses to adopt advanced cold chain solutions to comply with standards and reduce spoilage. This combination of consumer demand, retail growth, and regulatory focus is sustaining strong investments in cold storage infrastructure throughout the region.

The pharmaceuticals segment is expected to grow at the fastest CAGR during the forecast period. The segment is growing rapidly in the Middle East due to rising healthcare spending and higher imports of temperature-sensitive drugs and vaccines. Expansion of clinical trials, local manufacturing, and biologics is increasing the need for highly reliable cold storage. Government initiatives and healthcare infrastructure development are further supporting investments in specialized facilities. As a result, pharmaceutical cold storage is driving technology upgrades and capacity expansion across the region.

Country Insights

UAE Cold Storage Market Trends

UAE dominated the Middle East cold storage industry and accounted for a share of 21.6% in 2025. The growth can be attributed to its role as a major trade and logistics hub and rising imports of perishable goods. Expansion of e-commerce groceries and strong government focus on food security are driving investments in modern cold storage facilities.

Qatar Middle East Cold Storage Market Trends

The Qatar cold storage market is expected to grow at the fastest CAGR during the forecast period. Cold storage demand in Qatar is rising because it relies heavily on imported food and temperature-sensitive pharmaceuticals. Government food security programs and logistics investments are supporting steady expansion of cold chain infrastructure.

Key Middle East Cold Storage Share Insights

Some of the key companies in the Middle East cold storage industry include RSA Cold Chain, A.P. Moller - Maersk, and Global Star Group, among others. These players are focusing on expanding multi-temperature cold storage capacity and strengthening integrated logistics services across the Middle East. They are also investing in technology, automation, and compliance to improve efficiency, visibility, and reliability in cold chain operations.

-

A.P. Moller - Maersk is a global logistics and shipping company that has expanded its cold chain footprint in the Middle East, notably with a major cold storage facility in Dubai Industrial City. The company integrates end-to-end supply chain service, including sea, air, and land transport with advanced refrigerated warehousing to support perishable goods.

-

RSA Cold Chain is a prominent temperature-controlled logistics provider formed through a joint venture between UAE-based RSA Global and Americold, a global cold storage operator. It operates large-scale refrigerated warehouses with bonded and non-bonded facilities, serving food importers, retailers, and distributors across the GCC.

Key Middle East Cold Storage Companies:

- Global Star Group

- A.P. Moller - Maersk

- RSG GLOBAL COLD STORE

- Transworld Group

- Al-Futtaim Logistics

- RSA Cold Chain

- Snowland Cooling Systems LLC

- Clarion Shipping Services L.L.C

Recent Developments

-

In September 2025, RSA Cold Chain, a prominent cold chain operator in the region and a joint venture between UAE-based RSA Global and US-based Americold, announced the launch of its advanced cold storage facility at Jebel Ali Free Zone in Dubai. This development strengthens RSA Cold Chain’s position in modernizing food supply chains across the GCC by combining RSA Global’s digital supply chain capabilities with Americold’s global expertise in temperature-controlled logistics.

Middle East Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 17.50 billion

Revenue forecast in 2033

USD 39.42 billion

Growth rate

CAGR of 12.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, temperature range, application, country

Regional scope

Middle East

Country scope

KSA; UAE; Turkey; Qatar

Key companies profiled

Global Star Group; A.P. Moller - Maersk; RSG GLOBAL COLD STORE; Transworld Group; Al-Futtaim Logistics; RSA Cold Chain; Snowland Cooling Systems LLC; Clarion Shipping Services L.L.C

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Cold Storage Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East cold storage market report based on type, temperature range, application, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Facilities/Services

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

-

Cold Room

-

-

Equipment

-

Blast freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Temperature Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East (ME)

-

KSA

-

UAE

-

Turkey

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East cold storage market size was estimated at USD 14.61 billion in 2025 and is expected to reach USD 17.50 billion in 2026.

b. The Middle East cold storage market is expected to grow at a compound annual growth rate of 12.3% from 2026 to 2033 to reach USD 39.42 billion by 2033.

b. The facilities segment dominated the market in 2025 and accounted for the largest share of 88.6%. The facilities segment is expanding rapidly due to the surge in demand for temperature-controlled storage of perishable goods across food & beverage, pharmaceuticals, and retail sectors, making it the largest revenue contributor in the region.

b. Some key players operating in the Middle East cold storage market include Global Star Group, A.P. Moller - Maersk, RSG GLOBAL COLD STORE, Transworld Group, Al-Futtaim Logistics, RSA Cold Chain, Snowland Cooling Systems LLC, and Clarion Shipping Services L.L.C.

b. The Middle East’s cold storage industry is growing rapidly, driven by changing consumer preferences, rising food imports, and the growing demand for pharmaceutical and healthcare services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.