- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Compostable Packaging Market Report, 2033GVR Report cover

![Middle East Compostable Packaging Market Size, Share & Trends Report]()

Middle East Compostable Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Starch Blends, Cellulose Films & Others), By Application (Food & Beverage Packaging, Consumer Goods & E-commerce Packaging), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-719-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Compostable Packaging Market Summary

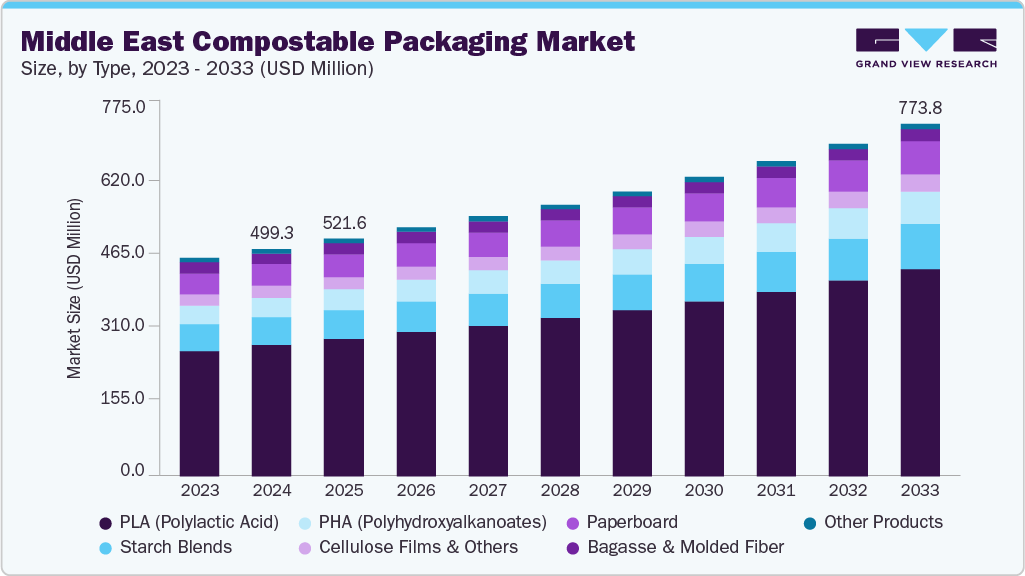

The Middle East compostable packaging market size was estimated at USD 499.3 million in 2024 and is projected to reach USD 773.8 million by 2033, growing at a CAGR of 5.1% from 2025 to 2033. Growing demand for lightweight vehicle components across the Middle East is driving automakers to favor thinner glazing solutions, like compostable-grade polyvinyl butyral (PVB), that reduce vehicular weight without sacrificing strength or safety.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East compostable packaging industry with the largest revenue share of 35.67% in 2024.

- The market in the UAE is expected to grow at a substantial CAGR of 5.4% from 2025 to 2033.

- By product, the PHA (Polyhydroxyalkanoates) segment is expected to grow at the fastest CAGR of 6.3% from 2025 to 2033.

- By application, the consumer goods and e-commerce packaging segment is expected to grow at the fastest CAGR of 5.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 499.3 Million

- 2033 Projected Market Size: USD 773.8 Million

- CAGR (2025-2033): 5.1%

- Saudia Arabia: Largest market in 2024

Concurrently, a surge in high-end architectural development, especially in booming urban centers, is fueling the need for noise-reducing laminated glass, where PVB interlayers enhance acoustic insulation and durability. These parallel dynamics are catalyzing robust growth in the Middle East compostable packaging market, with applications spanning automotive, construction, and beyond.

The compostable packaging industry in the Middle East is witnessing steady growth, fueled by rising regulatory support and consumer demand for sustainable alternatives to conventional plastics. Foodservice operators, retailers, and e-commerce platforms are increasingly adopting compostable films, trays, and bags to align with regional waste-management goals and circular economy initiatives. Advancements in bio-resin formulations are improving barrier properties and durability, making compostable solutions more competitive in high-performance packaging applications. With governments emphasizing plastic reduction targets and brands positioning sustainability as a value driver, compostable packaging is emerging as a key enabler of eco-friendly consumption patterns across the region.

Drivers, Opportunities & Restraints

Regulatory pressure to curb single-use plastics and rising sustainability mandates across the Middle East are key catalysts for compostable packaging adoption. Governments in the region are introducing bans and levies on conventional plastics, driving foodservice providers, retailers, and e-commerce operators to shift toward compostable alternatives. This regulatory momentum is further supported by national circular economy roadmaps that encourage bio-based and biodegradable packaging integration. In addition, hospitality and tourism hubs are increasingly prioritizing eco-friendly packaging solutions to align with international sustainability standards and enhance their environmental brand image.

The accelerating growth of the food delivery and online retail sectors is opening new opportunities for compostable packaging adoption in the Middle East. As meal delivery platforms, supermarkets, and e-commerce players scale operations, the demand is increasing for packaging that ensures product safety while minimizing environmental impact. Compostable films, containers, and mailers offer performance advantages such as breathability and strength, making them suitable replacements for conventional plastics in high-volume applications. Strategic collaborations between packaging producers, foodservice operators, and logistics providers are expected to drive innovation in bio-based materials tailored to the region’s dynamic consumption and sustainability needs.

Limited availability and high costs of bio-based resins present a significant challenge for compostable packaging producers in the Middle East. Key inputs such as polylactic acid (PLA), starch blends, and polyhydroxyalkanoates (PHA) are heavily import-dependent and vulnerable to global supply chain fluctuations. These constraints often translate into higher production costs compared to conventional plastics, pressuring manufacturers’ margins and making compostable products less price-competitive in cost-sensitive markets.

Market Concentration & Characteristics

The growth stage of the Middle East compostable packaging industry is medium, with the pace steadily accelerating. The industry shows moderate concentration, with a mix of global leaders and regional players shaping the competitive landscape. Key companies such as BASF SE, Novamont S.p.A., NatureWorks LLC, Tipa Corp, and BioBag International, along with emerging local producers, play a pivotal role in advancing market dynamics. These players are actively investing in product innovation, bio-resin development, and region-specific applications to address the rising demand for sustainable packaging solutions across foodservice, retail, and e-commerce sectors.

The industry is witnessing a wave of material breakthroughs that extend beyond traditional safety interlayers. Manufacturers are formulating next‑generation PVB grades with built‑in UV filtering and noise‑dampening additives to meet evolving consumer demands. Research partnerships between resin producers and glass fabricators are yielding low‑temperature lamination processes that cut energy consumption on the production floor. Concurrent advances in bio‑based feedstocks are also positioning PVB as a more sustainable choice without sacrificing performance. These innovations are reshaping how laminated glass products are designed and manufactured.

The industry is experiencing a wave of material innovations that move beyond basic biodegradable solutions. Producers are developing next-generation compostable films and rigid formats with enhanced barrier properties, heat resistance, and durability to meet the performance needs of foodservice, retail, and e-commerce applications. Collaborative efforts between resin developers and packaging converters are leading to cost-efficient processing technologies that improve scalability and reduce production energy intensity. At the same time, advancements in bio-based feedstocks such as PLA, PHA, and starch blends are strengthening the market’s sustainability credentials while ensuring functionality. These breakthroughs are redefining how packaging solutions are engineered for both environmental impact and end-use performance.

Product Insights

PLA (Polylactic Acid) dominated the industry, accounting for a revenue share of 57.76% in 2024, and is forecasted to grow at a 5.3% CAGR from 2025 to 2033. Rising investments in sustainable foodservice, retail, and e-commerce packaging are fueling demand for PLA-based products. Brand owners and distributors value PLA for its ability to deliver clarity, strength, and composability, making it a preferred choice for cups, trays, and flexible films. As regional regulations emphasize plastic reduction and consumers increasingly seek eco-friendly alternatives, manufacturers are scaling production of PLA packaging that balances performance with environmental responsibility. This sustained uptake positions PLA as the cornerstone of the compostable packaging industry in the Middle East.

The PHA (Polyhydroxyalkanoates) segment is anticipated to grow at the fastest CAGR of 6.3% through the forecast period. Growing emphasis on marine biodegradability and home-compostable solutions is driving demand for PHA-based packaging in the Middle East. PHA offers a unique advantage over other bio-based polymers by breaking down naturally in soil and aquatic environments, making it highly suitable for single-use items such as cutlery, straws, and flexible films. With governments and sustainability-focused brands prioritizing alternatives that address plastic leakage into ecosystems, investment in PHA production and applications is accelerating. This positions PHA as a high-potential segment within the compostable packaging market, catering to both regulatory goals and consumer expectations.

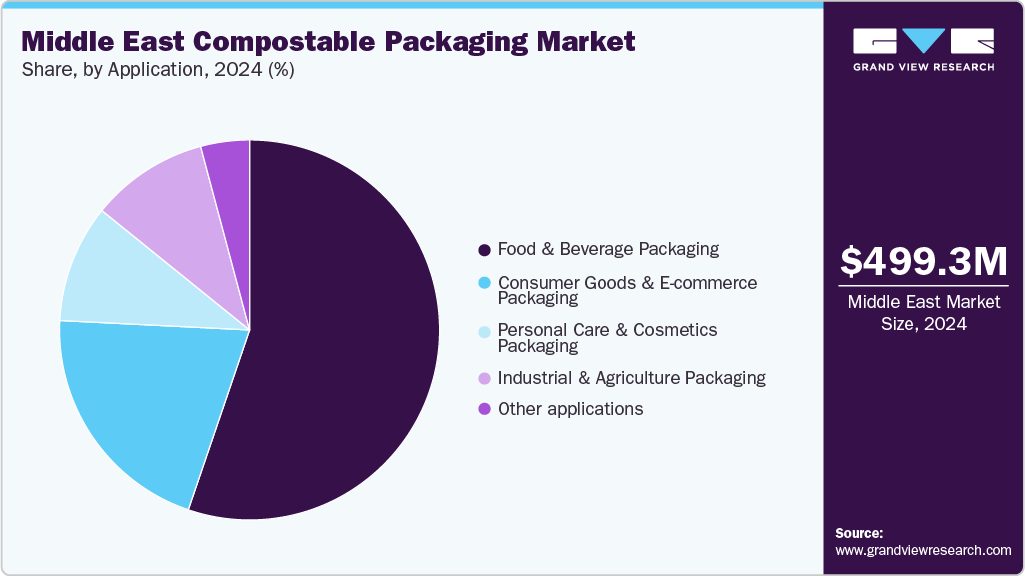

Application Insights

Food & Beverage packaging led the market and held a share of 55.23% in 2024. The food and beverage industry is one of the main drivers of demand for compostable packaging in the Middle East. Quick-service restaurants, cafes, and food delivery services are increasingly using compostable cups, trays, cutlery, and flexible films to reduce their dependence on traditional plastics. Growing consumer preference for eco-friendly dining and takeaway options, along with regulations on single-use plastics, is fueling this shift. As international food brands grow their presence in the region, compostable packaging is becoming essential for sustainable branding and meeting local waste management goals.

The consumer goods & e-commerce packaging segment is anticipated to grow at a significant CAGR of 5.9% through the forecast period. The rapid expansion of consumer goods and e-commerce platforms in the Middle East is creating strong momentum for compostable packaging solutions. Online retailers and logistics providers are increasingly adopting compostable mailers, pouches, and protective films to minimize plastic waste and align with regional sustainability targets. With cross-border e-commerce and last-mile delivery services surging, demand is rising for durable yet eco-friendly packaging formats that balance product protection with environmental responsibility. This trend positions compostable packaging as a vital component in building greener supply chains and enhancing consumer trust in sustainable shopping experiences.

The personal care & cosmetics packaging segment is expected to expand at a substantial CAGR of 5.6% through the forecast period. The personal care and cosmetics sector in the Middle East is increasingly adopting compostable packaging as brands respond to rising consumer awareness around sustainability and premium, eco-friendly products. Compostable jars, tubes, and flexible pouches made from PLA, PHA, and starch blends are being introduced to replace conventional plastics in skincare, haircare, and beauty packaging. With global and regional cosmetic brands positioning sustainability as a differentiator, demand for compostable solutions that combine aesthetic appeal with biodegradability is growing. This shift is reinforcing compostable packaging’s role in aligning luxury and mass-market cosmetics with evolving environmental expectations.

Country Insights

The Middle East compostable packaging market is expected to witness strong growth over the coming years, supported by rising regulatory emphasis on reducing single-use plastics and the region’s broader sustainability agendas. Increasing investments in foodservice, retail, and e-commerce are expected to fuel the adoption of compostable alternatives that align with consumer demand for eco-friendly products. With governments introducing plastic reduction initiatives and global brands strengthening their regional presence, the market is expected to evolve rapidly, creating opportunities for both international leaders and local manufacturers.

Saudi Arabia Compostable Packaging Market Trends

Saudi Arabia held the largest share of 35.67% in terms of revenue in 2024. Saudi Arabia is emerging as a leading market for compostable packaging in the Middle East, driven by strong government initiatives to reduce plastic waste under the Saudi Green Initiative and Vision 2030 framework. Regulations restricting single-use plastics in retail and foodservice sectors are creating a favorable environment for bio-based and compostable alternatives. The rapid expansion of food delivery, modern retail, and e-commerce is further boosting demand for sustainable packaging solutions that align with consumer expectations and national sustainability targets. With growing investments in local manufacturing and partnerships with global players, Saudi Arabia is positioning itself as a key hub for compostable packaging adoption in the region.

UAE Compostable Packaging Market Trends

The UAE compostable packaging market is experiencing strong momentum as regulatory measures, sustainability targets, and changing consumer preferences converge to drive adoption. The government’s initiatives to ban single-use plastics and accelerate the circular economy are encouraging businesses across foodservice, retail, and e-commerce to shift toward compostable alternatives. Material innovation is also shaping the market, with advanced PLA and PHA blends offering improved durability, barrier properties, and compatibility with existing packaging formats. The food and beverage sector remains a key adopter, as brands integrate eco-friendly packaging to align with consumer demand for sustainable dining and delivery experiences. Despite challenges such as high production costs and limited composting infrastructure, ongoing awareness campaigns, technological progress, and partnerships between global suppliers and local players are supporting long-term growth prospects in the UAE market.

Oman Compostable Packaging Market Trends

The Oman compostable packaging market is gaining momentum as environmental awareness, government policies, and innovative production converge to reshape the industry. National efforts to phase out single-use plastics are encouraging businesses and consumers to explore compostable options, especially in foodservice and retail. Manufacturers and startups are meeting this demand by introducing eco-friendly materials and building local supply networks, despite challenges in waste segregation and infrastructure. These ventures are laying the groundwork for circular economy practices, as they address environmental concerns and foster new collaborations across sectors, from packaging producers to service providers and regulatory bodies.

Kuwait Compostable Packaging Market Trends

The Kuwait compostable packaging market is steadily developing as sustainability begins to influence consumer preferences and business practices. Government initiatives to curb single-use plastics are encouraging the introduction of compostable alternatives, particularly in foodservice and retail. Local and regional suppliers are expanding the availability of plant-based packaging products such as cups, containers, and shopping bags to meet rising interest. However, the market continues to face challenges including limited consumer awareness, higher production costs compared to conventional plastics, and a lack of large-scale composting infrastructure. Despite these barriers, growing regulatory support, innovation by entrepreneurs, and gradual awareness-building efforts are expected to strengthen demand and position compostable packaging as an important part of Kuwait’s shift toward sustainable practices.

Key Middle East Compostable Packaging Companies Insights

Key players operating in the Middle East compostable packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Compostable Packaging Companies:

- Hotpack Global

- INDEVCO Group

- BioPak Middle East

- GreenGood Manufacturing

- Avani Eco

- Ecoway Biopolymers LLC

- Ecolife Bioplastics

- Napco National

- Taghleef Industries

- Gulf Manufacturing Co.

Recent Developments

-

In August 2025, Cortec Corporation introduced Eco Works 100, a packaging film that is completely biobased and compostable in industrial settings, made solely from renewable materials. This product has received certification from TÜV Austria and is acknowledged by the USDA for its entirely biobased composition, setting it apart as a top-tier, sustainable option compared to conventional plastics. It is designed for use in industrial composting environments such as shopping bags, waste liners, and commercial packaging, providing both efficacy and environmental benefits.

-

In May 2025, Metpack, located in Turkey, collaborated with BASF to introduce Ezycompost, a type of home-compostable coated paper tailored for food packaging uses. This groundbreaking material utilizes BASF’s ecovio 70 PS14H6, which provides outstanding barrier properties against liquids, fats, grease, and oils, along with high-temperature durability (able to withstand boiling water) and improved coating speeds with a thinner layer compared to PLA coatings. It holds certifications for home composting in accordance with DIN EN 13432 and AS 5810 standards and has received FDA approval for use in food contact applications.

Middle East Compostable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 521.6 million

Revenue forecast in 2033

USD 773.8 million

Growth rate

CAGR of 5.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, applications, country

Country scope

Saudi Arabia; UAE; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

Hotpack Global; INDEVCO Group; BioPak Middle East; GreenGood Manufacturing; Avani Eco; Ecoway Biopolymers LLC; Ecolife Bioplastics; Napco National; Taghleef Industries; Gulf Manufacturing Co.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Compostable Packaging Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East compostable packaging market report on the basis of product, applications, and country.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

PLA (Polylactic Acid)

-

Starch Blends

-

PHA (Polyhydroxyalkanoates)

-

Cellulose Films & Others

-

Paperboard

-

Bagasse & Molded Fiber

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage Packaging

-

Consumer Goods & E-commerce Packaging

-

Personal Care & Cosmetics Packaging

-

Industrial & Agriculture Packaging

-

Other applications

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global Middle East compostable packaging market size was estimated at USD 499.3 million in 2024 and is expected to reach USD 521.6 million in 2025.

b. The global Middle East compostable packaging market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 773.8 million by 2033.

b. Food & Beverage Packaging dominated the Middle East compostable packaging market with a share of 55.2% in 2024 on account of growing use of quick-service restaurants, cafes, and food delivery services are increasingly using compostable cups, trays, cutlery, and flexible films to reduce their dependence on traditional plastics.

b. Some of the major players operating in the Middle East compostable packaging market include Smurfit Kappa; WestRock; Graphic Packaging International, LLC; Mayr-Melnhof Karton AG; Seaboard Folding Box Company, Inc.; Quad; Huhtamaki; Amcor plc; KapStone Paper and Packaging Corporation; and Georgia-Pacific

b. The Middle East compostable packaging market is witnessing steady growth, fueled by rising regulatory support and consumer demand for sustainable alternatives to conventional plastics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.