- Home

- »

- Advanced Interior Materials

- »

-

Middle East Copper Scrap Market, Industry Report, 2033GVR Report cover

![Middle East Copper Scrap Market Size, Share & Trends Report]()

Middle East Copper Scrap Market (2025 - 2033) Size, Share & Trends Analysis Report By Feed Material (Old Scrap, New Scrap), By Scrap Grade (#1 Copper Scrap, #2 Copper Scrap), By Application (Wire Rod Mills, Brass Mills), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-714-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Copper Scrap Market Summary

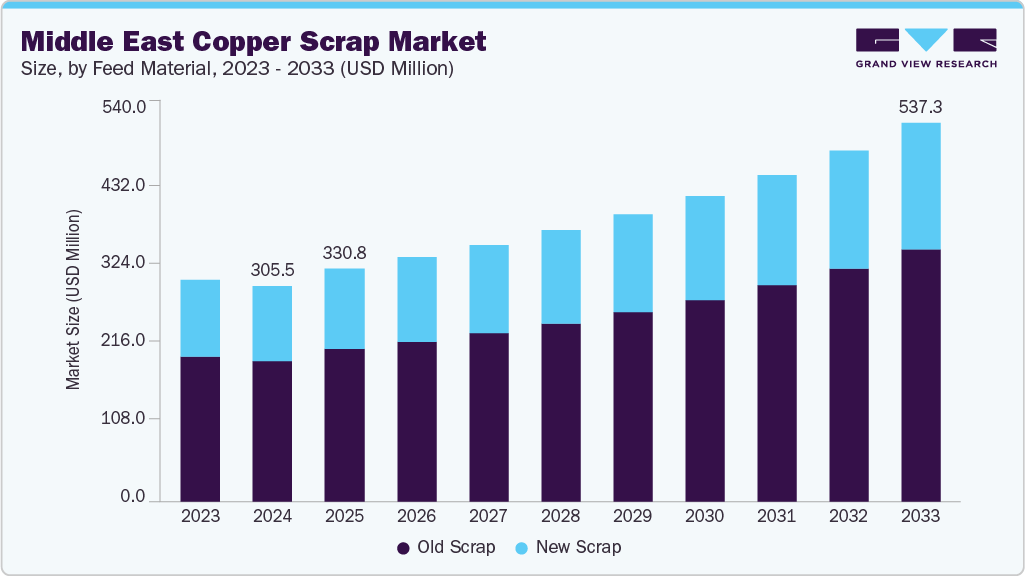

The Middle East copper scrap market size was estimated at USD 305.5 million in 2024 and is projected to reach USD 537.3 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. Strong infrastructure and construction pipelines across the Gulf lift demand for copper-containing products in power distribution, building services, and transport.

Key Market Trends & Insights

- The copper scrap market in the Middle East is expected to grow at a substantial CAGR of 6.3% from 2025 to 2033.

- By feed material, old scrap held the revenue share of 36.6% in 2024.

- By scrap grade, #2 scrap copper held the revenue share of 31.5% in 2024.

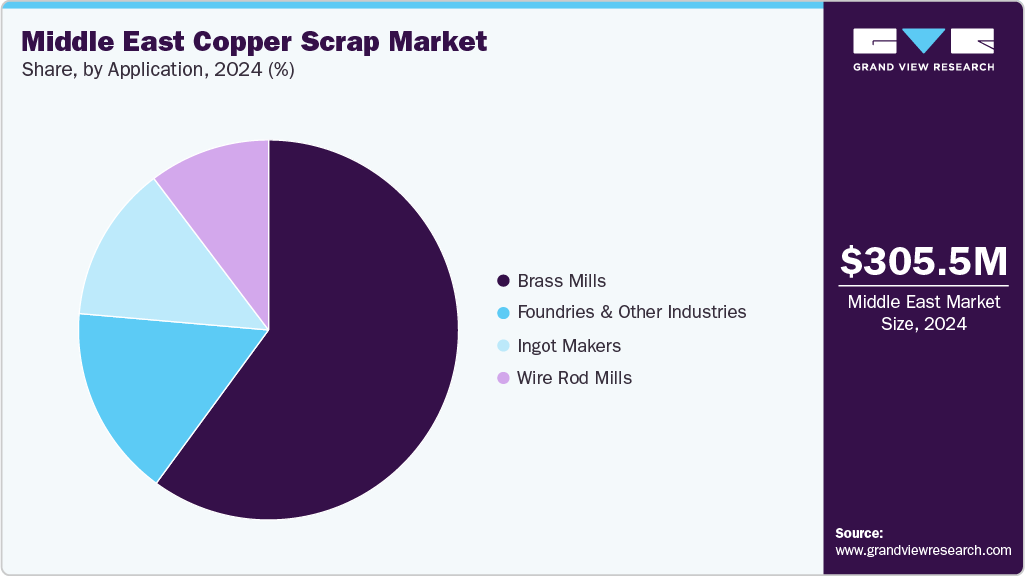

- By application, the brass mills segment held the revenue share of 62.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 305.5 Million

- 2033 Projected Market Size: USD 537.3 Million

- CAGR (2025-2033): 6.3%

As landmark real estate and industrial cities progress, contractors and utilities seek cost-efficient copper inputs for wiring, cabling, plumbing tubes, and HVAC components. Scrap availability from demolition, refurbishment, and offcuts rises parallel, creating a reliable local feedstock. The economics of substituting secondary copper where specifications allow is compelling when project schedules are tight and primary cathode premiums are high.Large-scale solar and wind rollouts, grid interconnections, and high-capacity data centers require heavy copper use in cables, busbars, transformers, and switchgear. Secondary copper helps ease material bottlenecks and moderates budget volatility for EPC players. Utilities and renewable developers are increasingly open to certified recycled content, provided metallurgical quality and traceability are demonstrated, encouraging investments in collection and upgrading.

Manufacturing diversification across the region is expanding a steady scrap generation and consumption base. Cable makers, air conditioning and refrigeration producers, and electrical equipment assemblers generate prompt scrap that can be quickly recycled into feed for rods and billets. Special economic zones and logistics hubs streamline cross-border flows, while proximity to major remelt centers in Türkiye and South Asia gives traders liquid outlets. This combination shortens working capital cycles and incentivizes better sorting and purity.

Policy, ESG, and corporate circularity commitments are strengthening the case for scrap. Governments are advancing waste recovery targets and producer responsibility frameworks that improve collection from end-of-life appliances, vehicles, and building systems. Large developers and sovereign-linked entities are embedding recycled content and emissions intensity criteria in procurement. Since secondary copper typically carries a materially lower carbon footprint per ton than primary production, meeting these requirements pushes buyers toward higher scrap ratios.

Regional yards are deploying better dismantling practices, such as eddy current separators, optical sorters, and granulation lines to increase recovery and reduce contamination. Smelters and refineries in nearby markets offer tolling and clean return options, which reward quality. Digital tracking and certification platforms improve trust between generators, traders, and consumers. Together, these improvements increase the value capture within the Middle East and support a deeper, more resilient copper scrap ecosystem.

Drivers, Opportunities & Restraints

The primary drivers of the Middle East copper scrap industry stem from the region’s rapid industrialization and infrastructure development. Large-scale construction projects, renewable energy installations, and growing electrical and electronics production create substantial demand for copper in wiring, cabling, and industrial components. Scrap generated from demolition, refurbishments, and manufacturing offcuts provides a cost-efficient source of raw material to meet this demand. At the same time, supportive government policies promoting recycling, sustainability, and resource efficiency further encourage the adoption of copper scrap in the value chain.

Opportunities are emerging as circular economy initiatives gain momentum. With global copper prices remaining volatile, industries in the Middle East are looking at scrap as a strategic hedge against supply disruptions and high costs of primary copper. Investments in advanced recycling technologies, sorting facilities, and cross-border trade networks enable higher-quality scrap recovery and improved export competitiveness. Growing emphasis on lowering carbon emissions across the manufacturing and construction sectors creates space for scrap-based copper, since it carries a significantly smaller environmental footprint than virgin production.

However, the market also faces restraints that can limit its full potential. Informal collection practices, inconsistent quality standards, and limited traceability make it difficult for end users to rely on scrap as a consistent input. Regulatory variations between regional countries can create bottlenecks for smooth cross-border scrap trade. In addition, dependence on fluctuating international demand and pricing often exposes local players to margin volatility.

Feed Material Insights

Old scrap held the revenue share of 36.6% in 2024. Large-scale urban redevelopment, demolition of aging buildings, and modernization of electrical grids generate significant quantities of end-of-life copper cables, pipes, and wiring. Rapid adoption of renewable energy projects and replacing outdated equipment in oil and gas facilities adds to the flow of discarded copper components. This steady supply of old scrap provides recyclers with a valuable feedstock that can be processed to meet the region’s growing secondary copper demand.

The new scrap segment is gaining momentum due to the region's strong industrial activity and manufacturing growth. Industries such as electrical equipment, cable manufacturing, air conditioning, and plumbing generate substantial quantities of prompt scrap in trimmings, offcuts, and rejected products. These materials are typically clean and high in purity, making them easier to recycle and reintroduce into the production cycle with minimal processing. As industrial capacity expands in free zones and manufacturing hubs, the availability of new scrap continues to rise, supporting a reliable supply stream for recyclers.

Scrap Grade Insights

#2 scrap copper held the revenue share of 31.5% in 2024. The #2 scrap copper segment in the market is experiencing growth due to the rising availability of lower-grade scrap from construction demolitions, electrical upgrades, and discarded consumer appliances. This grade, typically copper with coatings, solder, or slight contamination, is widely generated across residential and commercial refurbishments and from end-of-life machinery. The expanding pace of infrastructure replacement and ongoing industrial modernization in the region ensures a consistent supply of #2 copper scrap, making it an important contributor to overall market volumes.

The bare bright copper scrap segment is expanding strongly, representing the market's highest quality and most sought-after grade. It primarily consists of clean, unalloyed, and uncoated copper wire free from impurities, making it a direct feedstock for smelters and refiners. Growing demand for premium quality copper inputs across electrical, construction, and renewable energy applications drives recyclers and traders to source barer bright scrap. Its high conductivity and minimal processing requirements make it especially attractive in a region where industrial projects often demand consistent and reliable raw materials.

Application Insights

Brass mills held the revenue share of over 62.4% in 2024. Brass mills rely heavily on copper scrap as a primary feedstock to produce rods, sheets, and other semi-finished products later used in fittings, valves, fasteners, and decorative items. With large-scale infrastructure projects, growing residential developments, and expanding industrial manufacturing in the region, the requirement for brass-based components is steadily increasing. This directly fuels the consumption of copper scrap by brass mills, making the segment a key driver in the overall market.

The brass mills segment is growing as demand for brass products in plumbing, automotive, and industrial applications continues to rise. Brass mills rely heavily on copper scrap as a primary feedstock to produce rods, sheets, and other semi-finished products later used in fittings, valves, fasteners, and decorative items. With large-scale infrastructure projects, growing residential developments, and expanding industrial manufacturing in the region, the requirement for brass-based components is steadily increasing.

Country Insights

Saudi Arabia held 28.1% revenue share of the Middle East copper scrap market. Saudi Arabia’s Vision 2030 economic transformation is driving strong growth in copper scrap recycling. Large-scale urban projects such as Neom, the Red Sea Resort, and logistics cities require vast amounts of copper for infrastructure, electrical systems, and renewable energy installations. As older structures are demolished or upgraded, end-of-life materials provide a rising scrap supply. This creates a steady feedstock pipeline for recyclers and supports the country’s goal of reducing dependence on imported primary copper while promoting sustainability.

UAE Copper Scrap Market Trends

The copper scrap market in the UAE is growing due to rapid urbanization and infrastructure development. Large-scale projects such as residential complexes, commercial towers, smart city initiatives, and transport networks generate significant scrap copper through construction offcuts, refurbishments, and demolition. This steady supply provides recyclers with a consistent stream of feedstock while helping meet rising demand for copper in power distribution, building services, and industrial systems.

Key Middle East Copper Scrap Company Insights

Some key players operating in the market include PGI Group and Planet Green Recycling LLC.

-

PGI Group is a well-established metal recycling and waste management company headquartered in Sharjah, UAE, with operations spread across the Middle East, Southeast Asia, the UK, Europe, and Africa. Founded in 1999, the company has expanded from a modest scrap yard into a global player with advanced facilities and an extensive trading network. PGI Group specializes in procuring, processing, and recycling wires, cables, brass, and mixed copper-bearing materials. Its advanced cable-granulation facility in Sharjah can handle large volumes of copper cables monthly, ensuring high recovery and purity levels.

-

Planet Green Recycling LLC is a Dubai-based recycling and waste management company established in 2019. Certified under ISO 9001:2015 and licensed by local authorities, the company delivers end-to-end recycling and destruction services. Its operations cover a wide variety of waste categories, including metals, e-waste, plastics, glass, cardboard, and other materials. Planet Green Recycling handles the collection, segregation, and processing of copper alongside other non-ferrous metals. The company ensures copper scrap's safe and efficient recovery from manufacturing waste, consumer goods, and industrial sources.

Key Middle East Copper Scrap Companies:

- PGI Group

- RA Scrap Trading

- WaterLink Corp

- H A Z Scrap Trading LLC

- Planet Green Recycling LLC

- Amkay Metals DMCC

- Milan Metal Scrap & Used Batteries TR LLC

- Shar Metal Scrap Co Ltd

- Lucky Recycling Limited

- Sayed Metal

Recent Development

-

In June 2025, the UAE announced new measures to strengthen its circular economy framework, focusing on scrap metal recycling, including copper. The Ministry of Climate Change and Environment introduced updated guidelines for industrial waste management, requiring manufacturers and contractors to adopt certified recycling channels. The initiative aims to reduce landfill pressure, enhance copper recovery rates, and align with the nation’s sustainability commitments under the UAE Net Zero 2050 strategy.

Middle East Copper Scrap Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 330.8 million

Revenue forecast in 2033

USD 537.3 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Feed material, scrap grade, application, region

Regional scope

Middle East

Country scope

Bahrain; Kuwait; Saudi Arabia; UAE; Omar; Qatar

Key companies profiled

PGI Group; RA Scrap Trading; WaterLink Corp; H A Z Scrap Trading LLC; Planet Green Recycling LLC; Amkay Metals DMCC; Milan Metal Scrap & Used Batteries TR LLC; Shar Metal Scrap Co Ltd; Lucky Recycling Limited; Sayed Metal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Copper Scrap Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East copper scrap market report based on feed material, scrap grade, application, and region:

-

Feed Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Old Scrap

-

New Scrap

-

-

Scrap Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bare Bright

-

#1 Copper Scrap

-

#2 Copper Scrap

-

Other Grades

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wire Rod Mills

-

Brass Mills

-

Ingot Makers

-

Foundries & Other Industries

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Bahrain

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East copper scrap market size was estimated at USD 305.5 million in 2024 and is expected to reach USD 330.8 million in 2025.

b. The Middle East copper scrap market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 537.3 million by 2033.

b. The old scrap segment dominated the market with a revenue share of 63.5% in 2024.

b. Some of the key players of the Middle East copper scrap market are PGI Group, RA Scrap Trading, WaterLink Corp, H A Z Scrap Trading LLC, Planet Green Recycling LLC, Amkay Metals DMCC, Milan Metal Scrap & Used Batteries TR LLC, Shar Metal Scrap Co Ltd, Lucky Recycling Limited, Sayed Metal, and others.

b. The key factor driving the growth of the Middle East copper scrap market is the rising demand for recycled copper in construction, electrical, and automotive applications across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.