- Home

- »

- Sensors & Controls

- »

-

Switchgear Market Size And Share, Industry Report, 2030GVR Report cover

![Switchgear Market Size, Share & Trends Report]()

Switchgear Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage Type (Low Voltage, Medium Voltage, High Voltage), By Insulation (Air, Gas), By Installation, By End-use (T & D Utilities, Commercial & Residential, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-115-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Switchgear Market Size & Trends

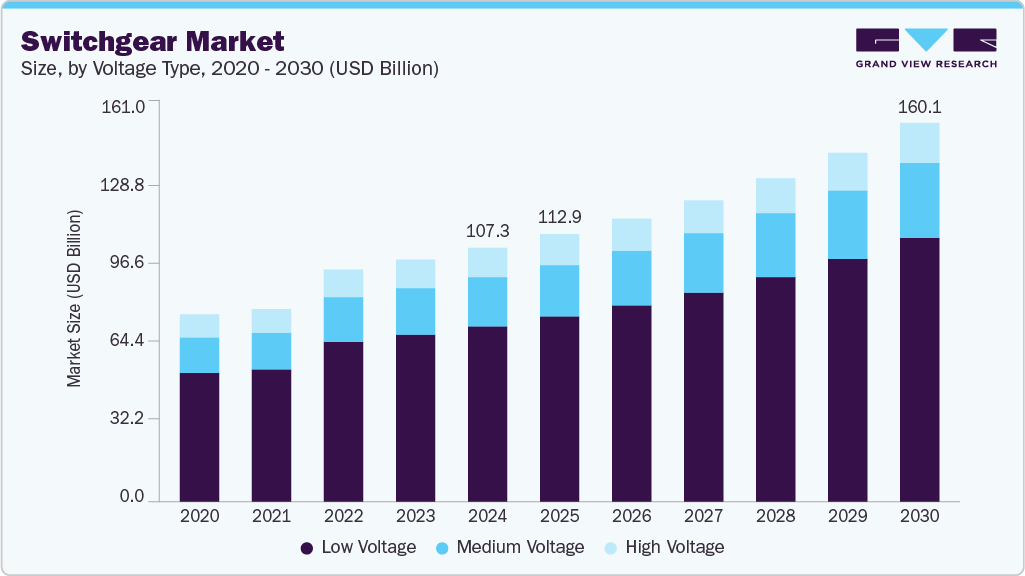

The global switchgear market size was estimated at USD 107.33 billion in 2024 and is projected to reach USD 160.07 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. A major factor expected to drive the global switchgear industry is the increasing emphasis on developing smart grid infrastructure.

Key Market Trends & Insights

- North America dominated the global switchgear market with a revenue share of 37.9% in 2024

- The U.S. switchgear market held a dominant position in the North America region in 2024.

- By voltage type, the low voltage segment accounted for the largest share of 69.2% in 2024.

- By insulation, the others segment held the largest share of the switchgear industry in 2024.

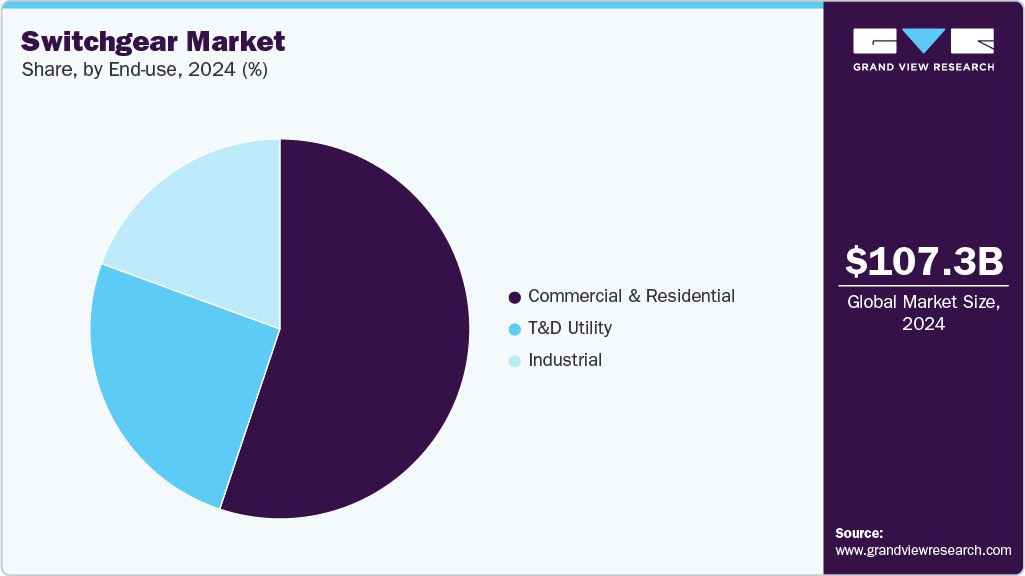

- By end-use, the commercial & residential segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 107.33 Billion

- 2030 Projected Market Size: USD 160.07 Billion

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Governments of developed and emerging economies are focused on upgrading the present electric grid infrastructure to ensure an efficient electricity supply and reduce electric component failure during power transmission. Switchgear aids in lowering the damage to the components that are connected to the power supply during the event of a power surge by interrupting the power flow.Due to rapid urbanization and industrialization, the increasing demand for power from emerging economies has led to a high emphasis on developing efficient power transmission and distribution networks, ultimately increasing demand for switches, fuses, and circuit breakers. This high demand for products from the power sector is expected to drive the growth of the global switchgear market. In addition, the rise of new factories, commercial buildings, and residential complexes is further driving demand for robust electrical distribution and protection systems. Medium-voltage switchgear is experiencing rapid adoption in these sectors. Supportive government policies, infrastructure development programs, and foreign direct investment (FDI) inflows are further strengthening the market.

Aging power infrastructure and rising electricity consumption are prompting large-scale investments in grid modernization, particularly in developed markets. Switchgear plays a pivotal role in enabling intelligent grid operations by protecting electrical circuits and supporting automation and real-time control. The growing adoption of digital switchgear equipped with IoT sensors, remote monitoring, and predictive maintenance capabilities is enhancing operational efficiency and reducing downtime. Utilities and transmission operators are increasingly upgrading to smart switchgear systems as part of broader grid digitalization strategies, fueling switchgear industry growth.

Significant strides in switchgear technologies, including gas-insulated switchgear (GIS) and solid-state switchgear, have revolutionized the landscape of electrical infrastructure. The seamless integration of digital technologies, such as the Internet of Things (IoT) and advanced analytics, has ushered in a new era of switchgear management. These rapid advancements in switchgear technologies, coupled with the integration of digital solutions, have spurred substantial growth in the switchgear industry. Benefits such as improved operational efficiency, reduced maintenance costs, and increased system reliability have made the adoption of these technologies highly desirable for industries across the board. As a result, such factors provide lucrative opportunities for the growth of the switchgear market in the coming years.

Switchgear systems typically involve high initial capital expenditure, which can deter potential adopters and constrain market expansion. The significant costs associated with the procurement, installation, and maintenance of these systems pose a particular challenge in developing regions, where financial constraints are prevalent. These upfront financial requirements represent a substantial barrier, especially for cost-sensitive sectors that prioritize short-term affordability over long-term infrastructure investment. The total expenditure includes the purchase of switchgear components, integration, commissioning, and ongoing servicing, all of which contribute to increased overall costs. Thus, these financial demands remain a key restraint on the broader adoption and growth of the switchgear industry.

Voltage Type Insights

The low voltage segment dominated the market in 2024 and accounted for the largest revenue share of 69.2%. The segment provides a link between power sources and end-users, ensuring the safe and efficient distribution of electricity. The rising focus on renewable energy sources and the integration of decentralized power generation has necessitated a demand for flexible and smart switchgear systems that can accommodate these evolving energy landscapes. The growing emphasis on energy efficiency and the need to reduce carbon emissions has led to the implementation of energy management systems that leverage low-voltage switchgear to optimize power distribution and minimize energy wastage. Hence, these drivers are fueling segment growth.

The medium voltage segment is expected to witness the fastest CAGR over the forecast period. With increasing urbanization, industrialization, and the rapid expansion of renewable energy sources, there is a rising demand for efficient and reliable electrical distribution systems. Medium-voltage ensures safe and efficient power distribution, protection, and control in medium-voltage-type networks. Moreover, upgrading aging electrical infrastructure, particularly in emerging economies, presents substantial market potential. In addition, the increasing focus on grid resilience, smart grid technologies, and the integration of advanced digital solutions are driving the demand for innovative medium-voltage products and solutions.

Insulation Insights

The others segment held the largest share of the switchgear industry in 2024. This segment includes vacuum and oil. They offer superior insulation properties and enhanced safety features, making them suitable for accommodating the complexities of renewable energy systems. Furthermore, the aging infrastructure in many regions is propelling the replacement and upgrade of outdated switchgear with modern, more efficient alternatives. The development of smart grids and the proliferation of electric vehicles also contribute to the demand for oil and vacuum, as these technologies necessitate reliable and high-performance electrical systems.

The gas segment is expected to register a moderate CAGR of 7.1% during the forecast period. The growing demand for reliable and efficient power distribution infrastructure, particularly in developing economies, is fueling the expansion of the gas segment. These advanced switchgear systems offer numerous advantages, including enhanced safety features, compact size, and superior environmental performance. In addition, the increasing focus on renewable energy sources and the integration of smart grid technologies are driving the adoption of gas insulation, as they provide seamless integration with renewable power generation and enable efficient monitoring and control of electricity networks.

Installation Insights

The outdoor segment dominated the market in 2024. The increasing demand for reliable and efficient power distribution systems in various industries and utility sectors has fueled the need for robust outdoor installations. These installations provide enhanced protection against harsh environmental conditions, such as extreme temperatures, moisture, and dust, ensuring an uninterrupted power supply. The rapid expansion of renewable energy generation adoption, including solar and wind power, has necessitated outdoor deployment to connect these decentralized energy sources to the grid efficiently. In addition, the growing focus on electrification and the modernization of existing infrastructure in emerging economies has led to the adoption of outdoor switchgear solutions for distribution networks in urban and rural areas.

The indoor segment is expected to witness the fastest CAGR over the forecast period. The growing emphasis on safety and reliability in electrical systems has led to an increased demand for indoor installations, as they offer enhanced protection against environmental elements and unauthorized access. The rising adoption of smart grid technologies and the integration of renewable energy sources has spurred the need for advanced indoor solutions capable of efficiently managing power distribution and accommodating complex grid configurations. In addition, the ongoing urbanization and expansion of infrastructure in developing economies have fueled the demand for indoor switchgear installations, as they provide space-saving benefits and can be easily integrated into compact urban environments.

End-use Insights

The commercial & residential segment dominated the market in 2024. Rapid urbanization and industrialization in the segment are key factors driving the demand for switchgear, as they require efficient electrical distribution and protection systems. In addition, the expansion of data centers, the adoption of smart grids, and the growing emphasis on renewable energy sources contribute to market growth. In the residential sector, factors such as increasing disposable incomes, rising urban population, and the need for enhanced safety measures propel the demand for switchgear. Moreover, the ongoing digitalization and home automation trends, coupled with the growing demand for electric vehicles and energy-efficient solutions, further boost the market demand, as residential consumers seek reliable electrical infrastructure and advanced control systems.

The transmission & distribution utilities (T&D utility) segment is expected to register a notable CAGR over the forecast period. The increasing demand for reliable and uninterrupted power supply drives the need for efficient switchgear to manage and control electrical power distribution. In addition, expanding renewable energy sources and integrating smart grid technologies require advanced switchgear systems to accommodate complex power flows and ensure grid stability. Moreover, the need to upgrade the aging infrastructure and replace outdated switchgear with more efficient and environmentally friendly alternatives is a significant market growth driver. The rising focus on enhancing grid resilience and mitigating the risks of power outages and electrical faults drives the adoption of advanced switchgear technologies with enhanced safety features.

Regional Insights

North America dominated the switchgear market with the revenue share of 37.9% in 2024 and is expected to register a notable CAGR from 2025 to 2030. The increasing demand for electricity, driven by population growth, industrialization, and urbanization, has amplified the need for efficient power distribution and transmission systems in the region. This has created a significant market for switchgear, which plays a crucial role in controlling, protecting, and isolating electrical equipment. Moreover, the aging infrastructure and the growing focus on grid modernization and renewable energy integration are further propelling the demand for advanced switchgear solutions in North America. In addition, the emergence of smart grids and the rapid adoption of digital technologies, such as IoT and cloud computing, present opportunities for integrating intelligent switchgear systems that enhance energy management and optimize operational efficiency.

U.S. Switchgear Market Trends

The U.S. switchgear industry held a dominant position in the region in 2024. Ongoing grid modernization efforts, a surge in renewable energy integration, and the development of resilient, intelligent infrastructure characterize the U.S. switchgear industry. Federal investments in energy storage, electric vehicle charging networks, and climate-resilient systems are expanding the need for advanced switchgear technologies. The presence of a mature utility sector and increasing demand from data centers and industrial automation continue to support market growth.

Europe Switchgear Market Trends

The Europe switchgear industry is expected to register a notable CAGR from 2025 to 2030. Aggressive decarbonization goals, widespread electrification, and the transition to renewable energy are driving the market growth. The European Union’s Green Deal and stringent environmental regulations are accelerating the adoption of digital and environmentally sustainable switchgear systems. Smart grid projects across countries such as Germany, the UK, France, and Italy are driving demand for high-performance, low-emission switchgear technologies.

The UK switchgear market is expected to grow at the fastest CAGR during the forecast period. The country’s commitment to achieving net-zero emissions by 2050 is fostering the adoption of low-loss and eco-friendly switchgear technologies. Urban infrastructure developments and the electrification of public transport networks are creating additional demand across residential, commercial, and utility segments.

The switchgear market in Germany held a substantial revenue share in 2024. The growth is driven by its advanced industrial base, smart energy transition policies, and a strong push toward a decentralized power system. Germany’s acceleration of its Energiewende strategy is driving increased demand for high-efficiency, digital switchgear to enable renewable integration and maintain grid stability.

Asia Pacific Switchgear Market Trends

The Asia Pacific switchgear industry is expected to grow at the fastest CAGR of 8.7% during the forecast period. Rapid industrialization and urbanization across the region are boosting the demand for electricity, thereby fueling the need for efficient and reliable switchgear solutions. The growing focus on renewable energy sources and the integration of smart grid technologies are leading to the adoption of advanced switchgear systems capable of handling complex power distribution networks. Moreover, the expansion of industries such as oil and gas, manufacturing, and construction, coupled with investments in infrastructure development projects, is further propelling the demand for switchgear products in the Asia Pacific region. The rising awareness about the importance of electrical safety and the need for uninterrupted power supply is creating opportunities for market growth, as end-users are prioritizing the installation of reliable switchgear systems to safeguard their operations and ensure uninterrupted power flow.

India’s switchgear market is expected to grow at the highest growth rate during the forecast period, owing to factors such as rapid urbanization, industrial expansion, and government-led initiatives such as Power for All and Smart Cities Mission. The increasing investments in grid modernization, rural electrification, and renewable energy projects are propelling demand for both low- and medium-voltage switchgear. In addition, Make in India policies are encouraging domestic manufacturing, creating opportunities for local and international players, thereby driving the demand for switchgear solutions.

The switchgear market in China held a substantial market share in 2024, driven by its extensive investments in infrastructure, energy transmission, and smart grid development. The government’s focus on decarbonization and clean energy expansion, including ultra-high-voltage projects, continues to drive demand for high-voltage switchgear solutions. For instance, in May 2025, Hitachi Energy Ltd announced the delivery of the world’s first sulfur hexafluoride (SF₆)-free 550 kV gas-insulated switchgear (GIS) to the Central China Branch of the State Grid Corporation of China. This groundbreaking milestone represents a major advancement in efforts to decarbonize the power grid and supports China’s broader goal of achieving carbon neutrality by 2060.

Key Switchgear Company Insights

Some of the key companies in the switchgear industry include ABB Ltd., Eaton Corporation, General Electric, and Siemens AG. These companies focus on technological innovation, extensive product portfolios, and global distribution networks. The growth of these companies is driven by the need for advanced, eco-friendly, and digitally integrated switchgear solutions, particularly as utilities and industries modernize their electrical infrastructure.

-

ABB Ltd. is a key player in the switchgear industry, delivering advanced low- and medium-voltage systems designed for safety, reliability, and efficiency. The company has a strong global footprint and offers digital switchgear with integrated condition monitoring and predictive maintenance capabilities. The company’s focus on electrification, automation, and sustainable energy solutions has made it a preferred partner for utilities and large-scale industrial clients worldwide.

-

Siemens AG is a global technology powerhouse headquartered in Germany, known for its extensive portfolio in power transmission and distribution. The company offers a comprehensive range of switchgear solutions, including air-insulated, gas-insulated, and digital switchgear systems tailored for utilities, industrial operations, and infrastructure projects.

Key Switchgear Companies:

The following are the leading companies in the switchgear market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Eaton Corporation

- General Electric

- Hitachi Limited

- Bharat Heavy Electricals Limited (BHEL)

- Crompton Greaves

- Powell Industries

- Legrand

- Atlas Electric, Inc.

- Siemens AG

Recent Developments

-

In October 2024, Schneider Electric, a prominent company in the digital transformation of energy management and automation, announced the launch of its Ringmaster AirSeT in the UK. This next-generation medium-voltage switchgear is free of sulfur hexafluoride (SF₆) and plays a vital role in advancing smarter and more sustainable electrical grid infrastructure.

-

In August 2024, Hitachi Energy Ltd. introduced a switchgear technology aimed at reducing sulfur hexafluoride (SF₆) emissions, which account for 80% of such emissions in the power sector. In response, the company has unveiled the world’s highest-voltage SF₆-free solutions: the EconiQ 550 kV circuit breaker, compatible with both gas-insulated switchgear and the EconiQ 420 kV Live Tank Breaker and dead tank breakers, reinforcing its commitment to sustainable grid technologies.

Switchgear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 112.99 billion

Revenue forecast in 2030

USD 160.07 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage type, insulation, installation, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Argentina; KSA; UAE; South Africa

Key companies profiled

ABB Ltd.; Eaton Corporation; General Electric; Hitachi Limited; Bharat Heavy Electricals Limited (BHEL); Crompton Greaves; Powell Industries; Legrand; Atlas Electric, Inc.; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Switchgear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global switchgear market report based on voltage type, insulation, installation, end-use, and region:

-

Voltage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Insulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Air

-

Gas

-

Others

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

T & D Utilities

-

Commercial & Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global switchgear market size was estimated at USD 107.33 billion in 2024 and is expected to reach USD 112.99 billion in 2025.

b. The global switchgear market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 160.07 billion by 2030.

b. The low voltage segment dominated the market in 2024 and accounted for the largest share of 69.2%. The growing emphasis on energy efficiency and the need to reduce carbon emissions has led to the implementation of energy management systems that leverage low-voltage switchgear to optimize power distribution and minimize energy wastage.

b. Some key players operating in the switchgear market include ABB Ltd., Eaton Corporation, General Electric, Hitachi Limited, Bharat Heavy Electricals Limited (BHEL), Crompton Greaves, Powell Industries, Legrand, Atlas Electric, Inc., and Siemens AG.

b. Key factors that are driving the market growth include the growing renewable energy integration, increasing power generation & transmission Infrastructure, and increasing focus on grid modernization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.