- Home

- »

- Medical Devices

- »

-

Middle East Electrosurgical Generators Market Report, 2033GVR Report cover

![Middle East Electrosurgical Generators Market Size, Share & Trends Report]()

Middle East Electrosurgical Generators Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Monopolar, Bipolar, Hybrid), By Product (Radiofrequency, Ultrasonic, Argon Plasma), By Application, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-723-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Electrosurgical Generators Market Summary

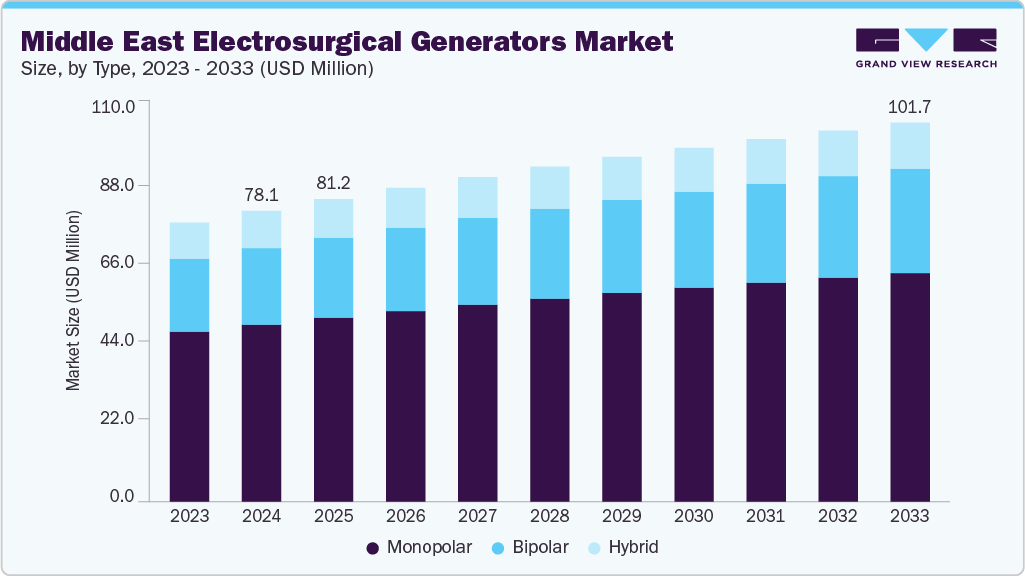

The Middle East electrosurgical generators market size was valued at USD 78.09 million in 2024 and is projected to reach USD 101.71 million by 2033, growing at a CAGR of 2.86% from 2025 to 2033. The industry is driven by the increasing prevalence of chronic diseases, rising surgical procedures, growing healthcare infrastructure investments, and the expansion of hospitals and surgical centers.

Key Market Trends & Insights

- Kuwait electrosurgical generators market is expected to witness the fastest growth over the forecast period.

- By type, the monopolar segment led the market with the largest revenue share in 2024.

- By product, the radiofrequency electrosurgery generators segment led the market with the largest revenue share in 2024.

- By application, general surgery segment led the market with the largest revenue share in 2024.

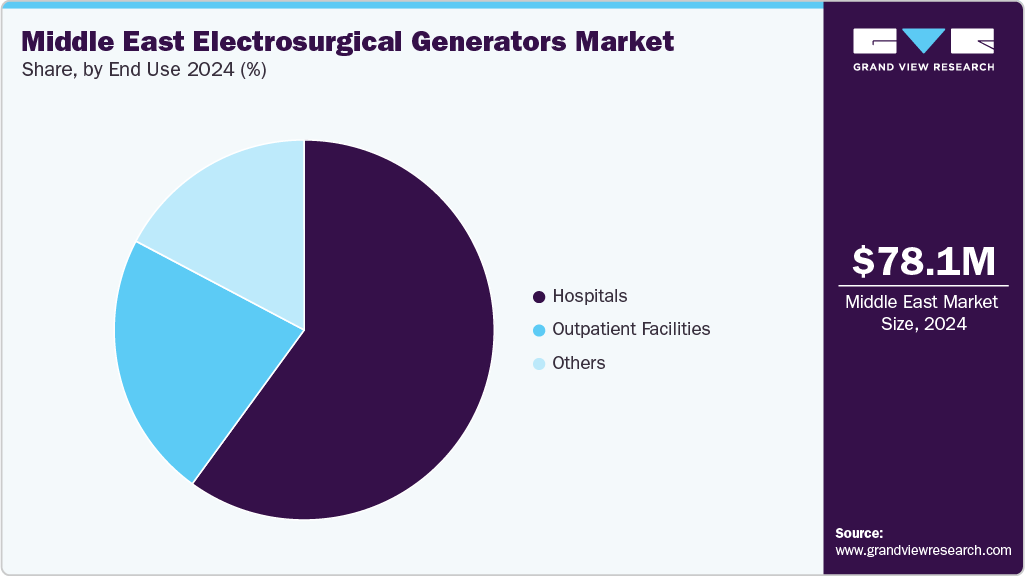

- By end use, hospitals & clinics segment led the market with the largest revenue share of 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 78.09 Million

- 2033 Projected Market Size: USD 101.71 Million

- CAGR (2025-2033): 2.86%

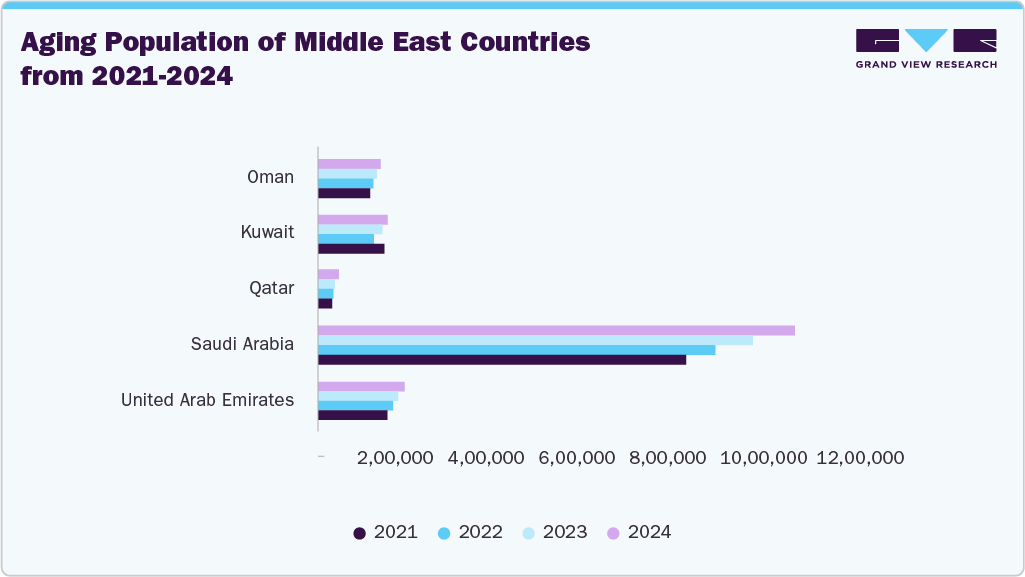

Government initiatives to improve healthcare facilities and increase funding positively impact market growth. Technological advancements in electrosurgical devices, such as improved safety features and multifunctionality, further stimulate demand. The growing geriatric population, prone to various health conditions requiring surgery, adds to the increasing need for efficient surgical equipment. In addition, the increasing number of trained surgeons and healthcare professionals proficient in using electrosurgical generators supports market expansion in the Middle East. The aging population is a key driver of the electrosurgical generator market in the Middle East. As the region’s population grows older, the incidence of age-related diseases such as cardiovascular conditions, cancer, diabetes, neurological disorders, and musculoskeletal problems is increasing, leading to higher demand for surgical interventions. Electrosurgical generators are essential in these procedures, offering precise, safe, and minimally invasive solutions for cutting, coagulation, and tissue ablation. The rising prevalence of chronic diseases among older adults in the Middle East is fueling the need for advanced electrosurgical equipment to improve treatment outcomes. According to WHO projections, by 2030, one in six people worldwide will be aged 60 or above, a trend that is also impacting the healthcare demands of Middle Eastern countries.

The electrosurgical generators industry in the Middle East is experiencing significant growth, driven by several key factors. A major catalyst is the increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer, which necessitate surgical interventions where electrosurgical equipment is essential. Additionally, the rising geriatric population in countries like Saudi Arabia, the UAE, and Qatar contributes to a higher demand for surgical procedures, further boosting the need for electrosurgical devices. Advancements in medical technology have led to the development of more efficient and safer electrosurgical generators, enhancing their adoption across various surgical specialties. Moreover, the growing trend of medical tourism in the region has increased the number of elective surgeries, thereby driving the demand for advanced surgical equipment. Government initiatives to improve healthcare infrastructure and expand access to modern medical technologies also play a crucial role in propelling market growth. These combined factors are expected to continue fueling the expansion of the electrosurgical generators market in the Middle East in the coming years.

Market Concentration & Characteristics

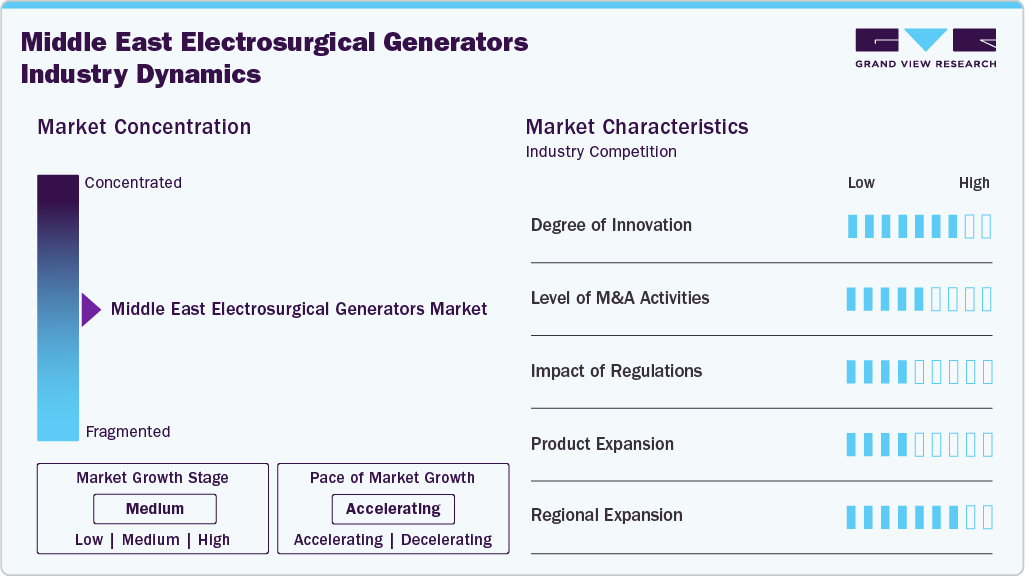

The electrosurgical generators industry in the Middle East is in a high-growth stage, driven by rising surgical procedures, stricter infection control regulations, and healthcare infrastructure investments. Countries like the UAE and Saudi Arabia lead this expansion, with increasing demand for reliable sterilization validation.

The industry is moderately innovative, with advanced hybrid systems, intelligent controls, and portable designs gaining traction mainly in top hospitals. Growing healthcare investments are driving wider adoption of these sophisticated technologies. For instance, in July 2025, an article on the Dualto Energy System highlighted its multi-modal platform combining monopolar, bipolar, and ultrasonic technologies. The system demonstrated improved safety, faster energy delivery, and adequate hemostasis, performing comparably to existing devices. Its modular design, ease of use, and potential cost savings suggest a move toward more efficient and versatile surgical energy solutions in the Middle East.

Regulatory authorities across the Middle East play a vital role in governing the electrosurgical generator market by ensuring device safety, effectiveness, and compliance. In Saudi Arabia, the Saudi Food and Drug Authority (SFDA) mandates registration through the Ghad portal, requiring local representation and comprehensive technical documentation. The UAE’s Ministry of Health, through its Registration and Drug Control Department, enforces regulations aligned with international standards, including post-market surveillance and adverse event reporting. In Kuwait, the Ministry of Health is gradually strengthening its regulatory framework, often referencing approvals from globally recognized authorities. While these regulations improve product quality and patient safety, they also create challenges related to approval timelines and compliance for manufacturers entering the regional market.

Merger and acquisition activity in the market is currently limited, with most transactions occurring as part of broader medical device industry deals. While consolidation occurs within the healthcare technology sector, focused acquisitions targeting electrosurgical generators remain minimal.

Regional expansion of the electrosurgical generator market in the Middle East is driven by growing healthcare investments, rising demand for minimally invasive surgeries, and advancements in medical technology, especially in countries like Saudi Arabia, the UAE, and Kuwait. Government initiatives and the expanding medical tourism sector further boost market growth. However, challenges like infrastructure gaps and the need for specialized training may affect adoption rates in some areas.

Type Insights

The monopolar type of electrosurgical generators held the largest market share in 2024 due to several advantages that make them the preferred choice in a wide range of surgical procedures. In the Middle East, monopolar electrosurgery is widely used across various specialties such as general surgery, gynecology, urology, and dermatology, due to its versatility in cutting, coagulation, and tissue removal. The simplicity and ease of use of monopolar generators make them a common choice among surgeons in the region, who are well-versed and comfortable with this technology. This familiarity has solidified monopolar devices as the dominant segment in the Middle Eastern electrosurgical generator market.

The bipolar segment is expected to grow due to its enhanced precision and safety over monopolar systems. By confining electrical current between two electrodes, bipolar electrosurgery minimizes thermal spread and reduces the risk of damage to surrounding tissues. This makes it ideal for delicate procedures in neurosurgery, gynecology, and minimally invasive surgeries, driving its adoption across the region's increasingly advanced surgical landscape. For instance, July 25, 2025 - Olympus Corporation (Olympus), a MedTech company committed to making people's lives healthier, safer, and more fulfilling, today announced the conclusion of an agreement with Revival Healthcare Capital (Revival) to drive advancements in endoluminal robotics. Olympus and Revival will co-find Swan Endo Surgical, a new company dedicated to developing a novel robotic system designed to revolutionize gastrointestinal (GI) patient care in the future.

Product Insights

Radiofrequency electrosurgery generators held the largest market share in the Middle East in 2024 due to their precision, versatility, and suitability for minimally invasive and robot-assisted surgeries. Widely used in specialties like general surgery, gynecology, ENT, and neurology, they offer enhanced safety through features like tissue impedance monitoring. Their compact design, energy efficiency, and ability to minimize tissue damage make them cost-effective and popular in routine and advanced surgical procedures across the region.

The ultrasonic electrosurgery generators segment is expected to grow at the fastest CAGR during the forecast period. In the Middle East, their rising adoption is driven by demand for high-precision, low-thermal damage solutions in delicate procedures such as oncology, head and neck, and laparoscopic surgeries. With better control and reduced patient trauma, ultrasonic systems are gaining traction across the region's advanced surgical fields like plastic and vascular surgery.

Application Insights

The general surgery segment held the largest market share in 2024. In the Middle East, this is driven by the high volume of procedures like appendectomies, hernia repairs, gallbladder removals, and colon resections. Electrosurgical generators are essential for precise cutting and hemostasis in open, laparoscopic, and robot-assisted surgeries. Their versatility in dissection, coagulation, and tissue sealing makes them vital tools in general surgery. The growing adoption of minimally invasive techniques, particularly laparoscopic surgeries, has further fueled demand for regional electrosurgical generators.

The neurological surgery segment is expected to grow at the fastest CAGR during the forecast period. In the Middle East, rising cases of brain tumors, spinal disorders, Parkinson’s disease, and other neurological conditions driven by aging populations and lifestyle changes are increasing the need for surgical interventions. This, in turn, boosts demand for electrosurgical generators used in procedures like tumor resections, spinal surgeries, and deep brain stimulation. For instance, a review published on September 30, 2024, by the National Library of Medicine highlights the growing importance of understanding electrosurgical generators in gynecologic surgery. These devices are now essential for cutting, coagulation, and tissue sealing across various procedures. Electrosurgery uses high-frequency alternating currents, with energy delivery guided by principles such as Ohm’s and Joule’s laws to generate precise tissue heat. Modern electrosurgical units feature advanced technologies like tissue impedance monitoring, voltage stabilization, and adaptive energy output to enhance safety and effectiveness. However, despite their widespread use, many gynecologic surgeons still lack comprehensive knowledge of critical concepts such as capacitive coupling, impedance, and waveform duty cycles. Misuse or poor understanding of these settings can lead to unintended tissue damage, especially in minimally invasive or delicate procedures. As the demand for precision and patient safety increases, deeper training and awareness are essential for optimal surgical outcomes.

End Use Insights

Hospitals held the largest market share in 2024, driven by high surgical volumes, advanced infrastructure, and diverse specialties in the Middle East. Key healthcare providers perform various procedures, including general, laparoscopic, gynecological, and oncological surgeries that rely on electrosurgical generators for precise cutting and coagulation. Well-equipped operating rooms, skilled personnel, and the financial ability to adopt advanced technologies further boost demand. The region's growing adoption of minimally invasive and robotic-assisted surgeries also supports increased use of high-end electrosurgical devices, aligning with hospitals' focus on safety, efficiency, and improved patient outcomes.

The outpatient facilities segment is expected to be the fastest-growing electrosurgical generators market in the Middle East. Growth is driven by rising demand for advanced, sterile surgical solutions and compliance with strict regulatory standards. As healthcare services expand and focus shifts to outpatient procedures, clinics are increasingly adopting high-quality electrosurgical generators. Investment in modern technologies and quality control further supports this trend.

Country Insights

UAE Electrosurgical Generators Market Trends

The UAE electrosurgical generators market is experiencing growth, driven by increasing surgical volumes, advanced healthcare infrastructure, and rising demand for minimally invasive procedures. Monopolar generators currently hold the largest market share due to their widespread use across various surgical specialties, while bipolar generators are gaining traction for their precision and safety in delicate procedures. Hospitals in the UAE are the primary end users, benefiting from high patient throughput, modern operating rooms, and substantial investments in surgical technologies. In addition, specialty clinics are rapidly growing as the healthcare system shifts toward outpatient and day-care surgeries. The country’s focus on adopting robotic-assisted and laparoscopic techniques, continued public and private sector investments, and a strong push for medical tourism are further propelling market expansion.

Diabetes Statistics in the UAE (2024)

Total Adult Population

7,710,700

Prevalence of Diabetes in Adults

20.70%

Total Cases of Diabetes in Adults

1,274,200

Kuwait Electrosurgical Generators Market Trends

The electrosurgical generators market in Kuwait is witnessing significant growth, supported by the country’s ongoing healthcare modernization and increased demand for advanced surgical technologies. As Kuwait invests in upgrading hospital infrastructure and expanding specialized medical services, the use of electrosurgical generators in general surgery, gynecology, and minimally invasive interventions is rising. Public hospitals remain primary users, though private clinics and specialty centers increasingly adopt these devices to enhance surgical precision and patient outcomes. The growing prevalence of chronic diseases requiring surgical intervention, along with government initiatives to boost healthcare quality and reduce outbound medical travel, is further driving the adoption of electrosurgical generators in the Kuwait market. For instance, in September 2022, Kuwait's Ministry of Health introduced three new regulations to enhance the registration, distribution, and oversight of medical devices, health products, and prescriptions. One regulation focuses on aligning the classification and registration of medical devices with international standards, helping foreign companies, especially from the U.S, navigate the process more efficiently. Another addresses the circulation of health products, ensuring Kuwait's system keeps pace with global developments in pharmaceuticals and diagnostics. The third regulation standardizes medical prescriptions by requiring the use of scientific names to improve patient safety and reduce medication errors. These changes aim to increase transparency, streamline procedures, and support local and international healthcare providers operating in Kuwait.

Key Middle East Electrosurgical Generators Company Insights

Key players operating in the Middle East electrosurgical generators market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Electrosurgical Generators Systems Companies:

- Olympus Corporation

- Medtronic

- Volgo Care International LTD

- Atricure, Inc.

- CooperSurgical, Inc.

- KARL STORZ SE & Co. KG

- ACTEON Group

- PENTAX Europe GmbH

- Medzell

Recent Development

-

In February 2025, OBS Medical further strengthened its position in the Saudi market by securing MDMA certification for its electrosurgical generators and electrosurgical pencils, reinforcing its commitment to meeting the region’s regulatory and clinical requirements.

-

In December 2024, Saudi Arabia granted MDMA certification to OBS (Baisheng) Medical for its electrosurgical pads and defibrillation electrodes, marking a significant step in expanding its product access in the region. The MDMA (Medical Device Marketing Authorization) is the sole regulatory pathway for medical devices in the Kingdom, requiring strict compliance with safety, quality, and performance standards.

Middle East Electrosurgical Generators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 81.20 million

Revenue forecast in 2033

USD 101.71 million

Growth rate

CAGR of 2.86% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Olympus Corporation; Medtronic; Volgo Care International LTD; Atricure, Inc.; CooperSurgical, Inc.; KARL STORZ SE & Co. KG; ACTEON Group; PENTAX Europe GmbH; Medzell

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Middle East Electrosurgical Generators Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East electrosurgical generators market report based on type, products, application, end use, and countries.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Monopolar

-

Bipolar

-

Hybrid

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiofrequency Electrosurgery Generators

-

Ultrasonic Electrosurgery Generators

-

Molecular Resonance Electrosurgery Generators

-

Argon Plasma Electrosurgery Generators

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Gynecological Surgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Neurological Surgery

-

Urological Surgery

-

ENT Surgery

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

Frequently Asked Questions About This Report

b. The Middle East electrosurgical generators market size was estimated at USD 78.09 million in 2024.

b. The global Middle East electrosurgical generators market is expected to grow at a compound annual growth rate of 2.86% from 2025 to 2033 to reach USD 101.71 million by 2033.

b. By end use, the hospital segment dominated the Middle East electrosurgical generators market with a share of 60.00% in 2024, reflecting their high demand for advanced surgical equipment and large-scale surgical procedures.

b. Some key players operating in the Middle East electrosurgical generators market include Olympus Corporation, Medtronic, Volgo Care International LTD, Atricure, Inc., CooperSurgical, Inc., KARL STORZ SE & Co. KG, ACTEON Group, PENTAX Europe GmbH, and Medzell.

b. The Middle East electrosurgical generators market is growing due to the rising number of surgical procedures, technological advancements in electrosurgical devices, and significant investments in healthcare infrastructure. Increasing demand for minimally invasive surgeries and growing awareness of advanced surgical solutions drive market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.