- Home

- »

- Advanced Interior Materials

- »

-

Middle East Graphene Market Size, Industry Report, 2033GVR Report cover

![Middle East Graphene Market Size, Share & Trends Report]()

Middle East Graphene Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Graphene Nanoplatelets, Graphene Oxide, Reduced Graphene Oxide), By Application (Paints & Coatings, Electronic Components), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-732-1

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Graphene Market Summary

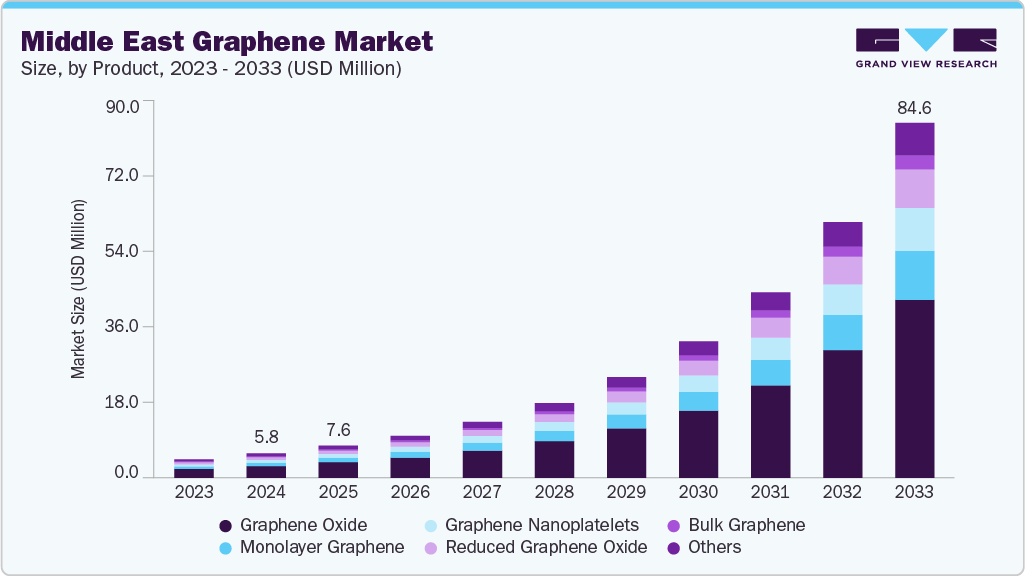

The Middle East graphene market size was estimated at USD 5.8 million in 2024 and is projected to reach USD 84.6 million by 2033, growing at a CAGR of 35.2% from 2025 to 2033, driven by growing investment in research and development of advanced materials. Countries such as the United Arab Emirates and Saudi Arabia are actively funding scientific innovation to diversify their economies beyond oil dependence.

Key Market Trends & Insights

- Egypt graphene industry is expected to grow at the fastest CAGR of 35.9% over the forecast period.

- By product, the graphene oxide segment is expected to grow at the fastest CAGR of 35.9% over the forecast period.

- By application, the composites segment is expected to grow at the fastest CAGR of 35.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5.8 Million

- 2033 Projected Market Size: USD 84.6 Million

- CAGR (2025-2033): 35.2%

As graphene is seen as a transformative material due to its strength, conductivity, and flexibility, it has become a focal point of interest for research institutions and universities across the region. These investments are facilitating new applications in sectors such as electronics, aerospace, and energy storage. Graphene’s potential in enhancing energy efficiency has aligned well with the Middle East's strategic push towards sustainable development. Governments across the region are pursuing ambitious renewable energy targets, and graphene-based technologies-particularly in batteries, solar panels, and water desalination-are seen as promising tools to achieve these goals. The material’s properties make it an ideal candidate for improving energy storage capacity and reducing system losses, making it highly relevant in a region with abundant solar resources.

The establishment of nanotechnology research centers in countries such as Qatar, the UAE, and Saudi Arabia has created a favorable environment for the development and commercialization of graphene-based products. These hubs provide infrastructure, funding, and technical expertise to startups and multinational companies alike. The clustering of talent and resources around nanotechnology is fostering innovation and accelerating the integration of graphene in industries ranging from automotive to construction.

Market Concentration & Characteristics

The Middle East graphene industry is moderately fragmented, with a mix of regional players and international companies operating within emerging industrial hubs. Innovation remains a key characteristic of this market, driven by both public and private sector investment in nanotechnology and advanced materials. Research institutions and specialized technology zones are fostering early-stage development across multiple applications, particularly in energy storage, electronics, and water treatment. While full-scale mergers and acquisitions are not yet common, joint ventures and partnerships are steadily increasing as firms seek to scale production and improve technological capabilities. Regulatory frameworks across the region are still evolving, with some countries offering clear support for advanced materials while others lag in establishing standards. The absence of unified guidelines continues to create uncertainty for manufacturers and investors, potentially slowing commercial adoption.

Although graphene holds immense promise, it still competes with conventional materials such as copper, silicon, and carbon fiber in various industrial applications. In cases where performance benefits do not yet outweigh costs, traditional alternatives remain dominant, especially in price-sensitive sectors. However, application concentration in the Middle East is notable, particularly in aerospace, energy, and high-performance electronics, where demand for advanced materials is steadily rising. These industries are increasingly integrating graphene-based solutions to enhance efficiency, durability, and sustainability. While current demand is somewhat concentrated, emerging applications in construction, automotive, and environmental technologies are beginning to diversify the market landscape. This gradual broadening of use cases suggests a long-term shift toward a more balanced and resilient demand base across multiple sectors.

Product Insights

The graphene oxide segment dominated the market and accounted for the largest revenue share of 47.9% in 2024, driven by its rising demand in water purification, coatings, and biomedical research. Its hydrophilic nature and large surface area make it ideal for filtration membranes and antibacterial applications. Countries like Saudi Arabia and the UAE are investing heavily in water treatment technologies due to freshwater scarcity, boosting adoption. In addition, academic institutions across the region are exploring graphene oxide for biosensors and drug delivery systems. Its ease of dispersion in solvents also supports its use in conductive inks and paints. These factors make it a versatile and increasingly utilized material in innovation-focused sectors.

The reduced graphene oxide segment is expected to grow significantly at a CAGR of 35.6% over the forecast period, driven by its superior electrical conductivity, which makes it suitable for energy storage and flexible electronics. Its low-cost synthesis compared to pristine graphene makes it attractive for commercial-scale production. Growing investments in renewable energy and battery technologies, particularly in the Gulf states, are accelerating demand. The material is being explored for supercapacitors, smart coatings, and sensors, contributing to the energy and electronics value chain. Furthermore, its compatibility with various substrates enhances its utility in printed electronics. As industrial R&D expands, reduced graphene oxide is positioned for broader application.

Application Insights

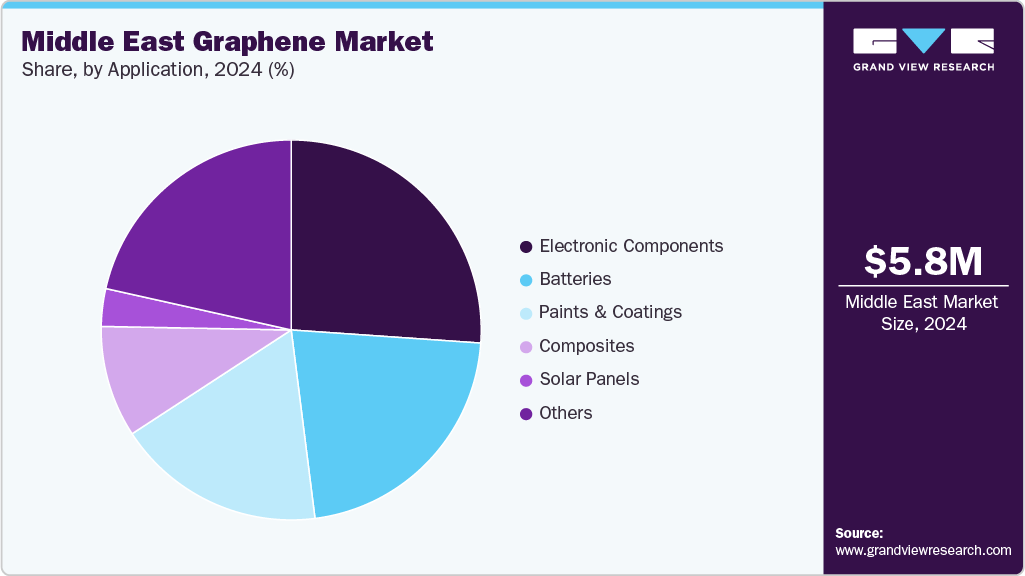

The electronic components segment dominated the market and accounted for the largest revenue share of 26.1% in 2024, driven by the region’s growing focus on smart infrastructure, IoT integration, and advanced semiconductor development. Graphene's exceptional electrical and thermal properties support its use in transistors, conductive films, and thermal management materials. Governments across the Middle East are launching digital transformation agendas, increasing demand for efficient, miniaturized, and durable electronics. Graphene-enabled components help improve device speed, flexibility, and power efficiency-making them suitable for wearable tech and communication systems. Regional partnerships with international tech firms further stimulate innovation in this segment. This positions graphene as a key enabler of next-generation electronics.

The composites segment is expected to grow significantly at a CAGR of 35.9% over the forecast period, driven by increased use of graphene-reinforced materials in construction, aerospace, and automotive sectors across the Middle East. Graphene’s high strength-to-weight ratio enhances mechanical properties when integrated into polymers, metals, and ceramics. With infrastructure projects surging under initiatives like Saudi Vision 2030, demand for stronger and lighter materials is growing. These composites offer benefitssuch as corrosion resistance, thermal stability, and improved durability-especially valuable in the region’s harsh climate. Industries are also leveraging graphene composites for 3D printing and protective coatings. Their adaptability across sectors makes this one of the most commercially promising graphene applications.

Country Insights

Saudi Arabia Graphene Market Trends

Saudi Arabia’s graphene industry is primarily driven by its Vision 2030 agenda, which emphasizes economic diversification and investment in high-tech industries. The country is channeling significant resources into advanced materials research through partnerships with global technology firms and academic institutions. Graphene is seen as a strategic asset in modernizing key sectors such as petrochemicals, defense, and clean energy. Its use in energy storage and thermal coatings aligns with national priorities around renewable integration and infrastructure development. In addition, the establishment of innovation hubs and industrial cities is facilitating pilot projects and small-scale production. This environment positions Saudi Arabia as a regional leader in graphene innovation and commercialization.

UAE Graphene Market Trends

The UAE’s graphene industry is gaining momentum through its focus on smart cities, sustainability, and advanced manufacturing. The government is heavily investing in research centers and tech incubators that support nanotechnology applications. Graphene is particularly relevant in the development of flexible electronics, smart infrastructure, and next-generation energy systems. Its potential to enhance battery life and improve solar panel efficiency aligns with the country’s renewable energy goals. The UAE’s robust logistics and free-zone infrastructure also support the import, export, and prototyping of graphene-based materials. These factors collectively make the UAE a dynamic hub for graphene deployment and innovation.

Egypt Graphene Market Trends

Egypt’s graphene industry is being propelled by its growing manufacturing sector and push toward technological self-sufficiency. As the country modernizes its industrial base, graphene is gaining interest for its use in lightweight composites, protective coatings, and low-cost energy storage. Academic institutions are playing a critical role in driving domestic research and small-scale production capabilities. Moreover, Egypt’s geographic position as a regional trade and logistics hub supports access to both African and Middle Eastern markets. Government-backed industrial zones are also starting to explore graphene integration in construction and electronics. These developments indicate a steady foundation for long-term market growth.

Qatar Graphene Market Trends

Qatar’s graphene industry is largely driven by its investment in knowledge-based industries and material science innovation. As part of its national vision, the country is emphasizing R&D in areas that reduce reliance on hydrocarbons and promote sustainability. Graphene is being explored for its role in desalination, water purification, and corrosion-resistant infrastructure-sectors critical to Qatar’s long-term planning. Strong collaboration between government entities and academic institutions is facilitating early-stage research and pilot applications. With an advanced education system and financial backing, Qatar is well-positioned to emerge as a center for niche graphene technologies. This strategy aligns with its ambition to lead in high-performance, low-carbon technologies.

Kuwait Graphene Market Trends

The graphene industry in Kuwait is being influenced by the government’s desire to modernize its energy and industrial sectors. With rising interest in clean technologies, graphene is being evaluated for its use in thermal management systems and advanced sensors. The country’s investment in educational reforms and scientific research is gradually creating a foundation for nanotechnology applications. Local universities and innovation centers are beginning to collaborate with regional partners to explore material science advancements. Furthermore, Kuwait’s refining and petrochemical sectors present opportunities for graphene-enhanced components that increase efficiency and safety. These efforts signal a growing recognition of graphene’s value in national development plans.

Key Middle East Graphene Company Insights

Some of the key players operating in market include Graphene Manufacturing Group Ltd. and Nanowerk.

-

Graphene Manufacturing Group Ltd offers scalable production of graphene materials, including graphene powders and dispersions suited for industrial and technological applications. Its product portfolio supports uses in composites, electronics, and advanced coatings. Emphasis is placed on modifying material properties to enhance tensile strength, conductivity, and thermal performance.

-

Nanowerk provides graphene-based solutions tailored for research and commercial applications, including functional inks, coatings, and nanocomposites. Its offerings target sectors such as electronics, diagnostics, and energy storage, helping improve conductivity and durability. The company emphasizes quality control across nanoscale materials.

Medad Holding LLC and MSE Supplies Ltd are some of the emerging market participants in the market.

-

Medad Holding LLC offers graphene materials and composites aimed at advanced industrial applications-particularly in energy and manufacturing. Their portfolio includes graphene-enhanced films, coatings, and nanocomposites that enhance durability and conductivity. The company supports clients through prototyping and application development across sectors such as electronics and energy storage.

-

MSE Supplies Ltd delivers graphene additives and powders suited for research institutions and industrial clients. Their products enhance conductivity and mechanical properties across electronics and materials science applications. The company also provides customer-specific formulations and technical collaboration.

Key Middle East Graphene Companies:

- Graphene Manufacturing Group Ltd.

- Nanowerk

- Dexterous DMCC

- Medad Holding LLC

- MSE Supplies Ltd

- Directa Plus

- Haydale Graphene Industries plc

- Graphenea

- XG Sciences

Recent Development

-

In July 2025, Graphene Innovations Manchester unveiled a new facility at Sharjah Innovation Park to drive the development of graphene technologies in the Middle East. The move is intended to strengthen regional partnerships in research, innovation, and the commercial rollout of advanced materials.

Middle East Graphene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.6 million

Revenue forecast in 2033

USD 84.6 million

Growth rate

CAGR of 35.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Region scope

Middle East

Key companies profiled

Graphene Manufacturing Group Ltd.; Nanowerk; Dexterous DMCC; Medad Holding LLC; MSE Supplies Ltd; Directa Plus; Haydale Graphene Industries plc; Graphenea; XG Sciences

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Graphene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East graphene market report based on product, application, and country:.

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Graphene Nanoplatelets

-

Graphene Oxide

-

Reduced Graphene Oxide

-

Monolayer Graphene

-

Bulk Graphene

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Paints & Coatings

-

Electronic Components

-

Composites

-

Batteries

-

Solar Panels

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East graphene market size was estimated at USD 5.8 million in 2024 and is expected to reach USD 7.6 million in 2025.

b. The Middle East graphene market is expected to grow at a compound annual growth rate of 35.2% from 2025 to 2033 to reach USD 84.6 million by 2033.

b. Graphene oxide segment dominated the market and accounted for the largest revenue share of 47.9% in 2024, driven by its rising demand in water purification, coatings, and biomedical research

b. Some of the prominent companies in the Middle East graphene market include Graphene Manufacturing Group Ltd., Nanowerk, Dexterous DMCC, Medad Holding LLC, MSE Supplies Ltd, Directa Plus, Haydale Graphene Industries plc, Graphenea, and XG Sciences

b. Key factors driving the Middle East graphene market increasing investment in advanced materials, growing demand from electronics and energy sectors, and government initiatives supporting nanotechnology research and sustainable industrial development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.