- Home

- »

- Advanced Interior Materials

- »

-

Middle East Graphite Market Size, Industry Report, 2033GVR Report cover

![Middle East Graphite Market Size, Share & Trends Report]()

Middle East Graphite Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Natural Graphite, Synthetic Graphite), By End Use (Electrodes, Refractories, Lubricants, Battery Production), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-708-6

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Graphite Market Summary

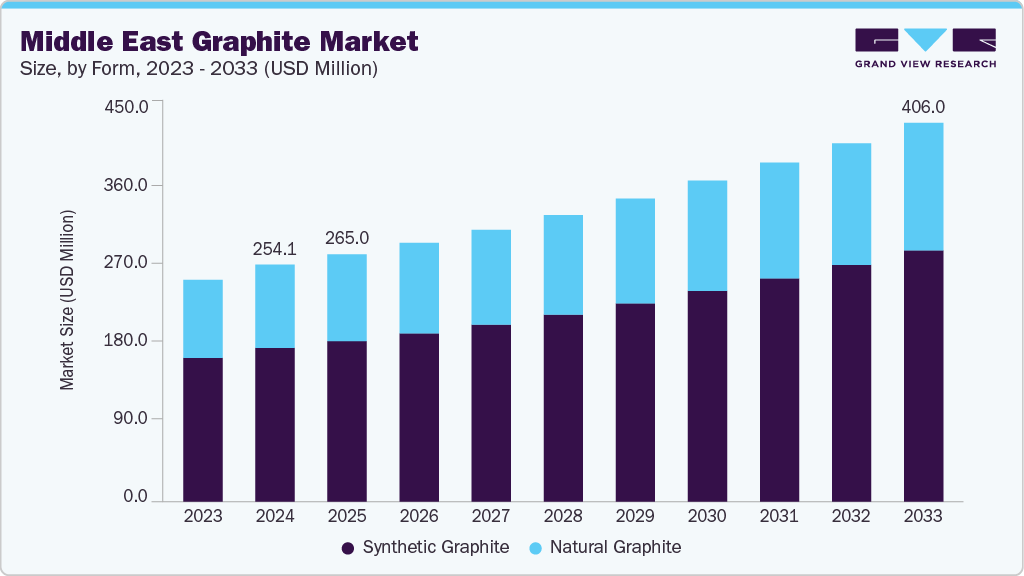

The Middle East graphite market size was estimated at USD 254.1 million in 2024 and is projected to reach USD 406.0 million by 2033, growing at a CAGR of 8.9% between 2025 and 2033. The market is driven by increasing demand from the steelmaking and foundry industries, supported by ongoing infrastructure and industrial projects.

Key Market Trends & Insights

- The graphite market in the Middle East is expected to grow at a substantial CAGR of 8.9% from 2025 to 2033.

- By form, synthetic graphite dominated the market with a revenue share of over 64.0% in 2024.

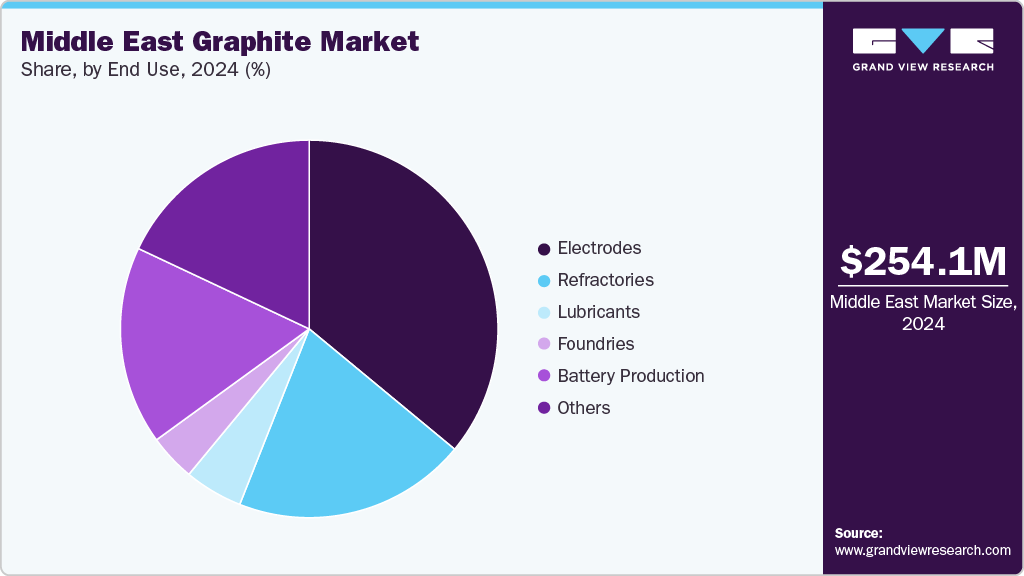

- The electrode segment held the largest share of over 35.0% of graphite revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 254.1 Million

- 2033 Projected Market Size: USD 406.0 Million

- CAGR (2025-2033): 8.9%

The rising adoption of graphite in energy storage applications, including lithium-ion batteries, further accelerates market growth. Graphite is gaining strategic importance in the Middle East’s shift toward clean energy, sustainable mobility, and advanced industrial sectors. Graphite plays a crucial role in high-performance applications with its exceptional electrical and thermal conductivity, superior lubricity, and chemical stability. Graphite demand is rising rapidly in the region’s growing energy storage market-particularly in lithium-ion batteries, which serve as the primary anode material. As Middle Eastern nations accelerate electric vehicle (EV) adoption, invest in renewable energy projects, and expand advanced manufacturing, graphite is emerging as a key enabler of the region’s energy transition and industrial diversification goals.

Sustainability initiatives and recycling are becoming central to the market outlook. Recovery of graphite from spent lithium-ion batteries is gaining traction as part of wider circular economy strategies aligned with national sustainability agendas. Regional industry stakeholders increasingly invest in R&D to develop cleaner production technologies, reduce carbon footprints, and establish resilient, low-emission supply chains. As Middle Eastern economies intensify their push toward electrification, renewable integration, and carbon neutrality targets, graphite will remain a pivotal material in innovation, resource security, and the region’s broader energy transition plans.

Drivers, Opportunities & Restraints

The Middle East graphite industry is poised for strong growth, driven by the rapid expansion of the electric vehicle (EV) sector and the parallel surge in lithium-ion battery production capacity. Graphite, which makes up more than 90% of the anode material in lithium-ion batteries, is valued for its superior conductivity, thermal stability, and consistent performance. Each EV battery pack contains approximately 50-100 kilograms of graphite, meaning that the accelerating global shift to EVs, underscored by more than 14 million units sold worldwide in 202,3, translates directly into robust demand for high-quality graphite. As Middle Eastern nations invest in EV infrastructure, sustainable transport policies, and renewable energy integration, regional graphite consumption is expected to climb steadily.

However, the market faces a significant cost barrier in producing battery-grade graphite, particularly coated spherical purified graphite (CSPG). CSPG is the most critical raw material for lithium-ion battery anodes and requires several high-cost processing stages, including purification, shaping, micronizing, and surface coating. This cost challenge underscores the importance of technological innovation and local value-added processing capabilities within the Middle East to reduce import dependency and strengthen supply resilience.

Beyond the EV sector, the region’s commitment to renewable energy fosters growth in utility-scale and residential energy storage projects, which rely on lithium-ion batteries. With graphite accounting for nearly 95% of the anode material in these batteries, demand is set to remain strong. This positions graphite as a strategic material for the Middle East’s broader clean energy transition, industrial diversification, and long-term energy security strategies.

Form Insights

The synthetic graphite segment accounted for the largest revenue share over 64.0% in 2024, driven by its vital role in lithium-ion battery anodes, electric arc furnace (EAF) electrodes, and advanced thermal management applications. The region’s expanding steel industry, particularly in Gulf Cooperation Council (GCC) countries, relies heavily on EAF technology, which depends on durable, high-conductivity electrodes for efficient production. Synthetic graphite’s high purity, uniform structure, and reliability under extreme temperature and load conditions make it the preferred choice for precision manufacturing and demanding industrial processes. In addition, its use in energy storage and EV-related projects is rising as Middle Eastern nations roll out clean mobility initiatives and invest in battery manufacturing capabilities.

Natural graphite is also gaining momentum, largely due to its critical role in producing spherical graphite for lithium-ion battery anodes. As EV adoption, renewable integration, and portable electronics manufacturing grow in the region, demand for high-quality flake graphite has increased. Governments and private players are exploring ways to diversify supply chains and reduce dependence on Chinese refining capacity by pursuing upstream sourcing partnerships and local processing facilities. With lower production costs and a smaller environmental footprint compared to synthetic graphite, natural graphite aligns well with the Middle East’s sustainability targets and the region’s broader push toward greener, more cost-efficient manufacturing.

End Use Insights

Electrodes accounted for over 35.0% of revenue in 2024, a share expected to remain dominant over the forecast period. Graphite electrodes are essential in the electric arc furnace (EAF) steelmaking process, increasingly adopted across the GCC and broader region due to their significantly lower carbon emissions and higher energy efficiency compared to traditional blast furnaces. As Middle Eastern economies expand construction, infrastructure, and manufacturing projects under national diversification programs, demand for EAF-produced steel is set to grow, directly supporting the consumption of graphite electrodes. In addition, regional investment in green steel initiatives aligns with the push of global decarbonization, further cementing electrodes as a cornerstone application for graphite in the Middle East.

As the global steel sector transitions toward lower-carbon technologies, the Middle East is also witnessing increased adoption of electric arc furnaces (EAFs), aligning with broader decarbonization goals. Countries in North America and Europe are leading this shift; nearly 93% of new steelmaking capacity underway in 2024 is EAF-based, according to industry reports, and Middle Eastern steel producers are following suit to meet environmental regulations and growing infrastructure needs. This trend is fueling steady demand for graphite electrodes in the region, as EAF technology depends on their durability, high conductivity, and performance in extreme temperatures.

Refractories represent another major end-use segment for graphite in the Middle East, particularly in steel, cement, and non-ferrous metal processing-industries central to the region’s industrial base. These applications require materials with exceptional thermal conductivity, chemical resistance, and structural stability at very high temperatures, all of which graphite delivers. The importance of secure, high-quality raw material sources is increasingly recognized, as seen in February 2025 when Sovereign Metals announced that coarse flake graphite from its Kasiya project in Malawi met strict refractory-grade specifications. For the Middle East, such developments open opportunities to diversify supply chains, reduce reliance on single-source suppliers, and strengthen resilience in serving the region’s second-largest end-use segment for natural graphite.

Regional Insights

Demand in the Middle East is projected to witness steady growth, supported by the region’s strategic shift toward industrial diversification, clean energy adoption, and sustainable infrastructure development. Momentum in key sectors-such as construction, steel production, automotive assembly, and advanced manufacturing-continues to drive graphite consumption. The transition toward electric arc furnace (EAF) steelmaking is boosting demand for graphite electrodes, while national initiatives for electrification, renewable integration, and energy storage are reinforcing graphite’s role in mobility and clean power applications across leading economies such as the UAE, Saudi Arabia, and Qatar.

Saudi Arabia Graphite Market Trends

The graphite market in Saudi Arabia is gaining momentum, fueled by the country’s Vision 2030 initiatives that prioritize industrial diversification, clean energy adoption, and sustainable infrastructure. Significant investments in electric mobility, renewable power generation, and green steel production drive the need for both graphite electrodes in electric arc furnace (EAF) steelmaking and high-purity graphite for battery applications. The kingdom’s growing focus on localizing advanced manufacturing and energy storage capabilities is expected to strengthen further its position as a key graphite consumer in the region.

Qatar Graphite Market Trends

The graphite market in Qatar is supported by its ongoing infrastructure modernization, expansion of advanced manufacturing, and commitment to sustainable energy solutions. The country’s push for cleaner steel production through EAF technology is a major driver of graphite electrode demand, while initiatives in renewable integration and electric mobility are increasing the need for battery-grade graphite. With its emphasis on high-performance industrial components and environmentally responsible technologies, Qatar is positioning itself as a niche but strategic consumer in the Middle East graphite supply chain.

Key Middle East Graphite Company Insights

Some key players operating in the market include Al-Balagh Trading & Contracting Co., Al Refaey Group, Emirates Carbon LLC, and others.

-

Al-Balagh Trading & Contracting Co. is a Saudi Arabia-based industrial materials supplier focusing on carbon and graphite products. The company serves key sectors such as steel, manufacturing, and construction by providing high-quality graphite electrodes, refractory materials, and specialty carbon products. With its extensive regional distribution network, Al-Balagh supports the growing demand for graphite in the Kingdom’s industrial expansion and energy transition initiatives.

-

Al Refaey Group is a UAE-based supplier and distributor specializing in specialty industrial raw materials, including natural and synthetic graphite products. The group caters to diverse sectors such as steel production, energy storage, and manufacturing. Al Refaey’s strong regional presence and strategic partnerships allow it to meet the rising demand for graphite materials driven by the Gulf’s infrastructure and clean energy projects.

-

Emirates Carbon LLC operates out of the UAE as a distributor and processor of graphite electrodes and carbon materials, primarily serving the steelmaking and metallurgical industries. Emirates Carbon is a key player in supporting the Middle East’s steel industry transition towards Electric Arc Furnace (EAF) technology, facilitating access to high-quality electrodes and refractory-grade graphite products.

-

Saudi Refractories Company is a leading manufacturer and supplier of refractory materials in Saudi Arabia, including graphite-based refractories used in steel, cement, and non-ferrous metal industries. The company is critical in supporting local industrial growth by providing materials designed to withstand high temperatures and aggressive chemical environments. Saudi Refractories is aligned with Vision 2030 goals, emphasizing sustainable industrial development.

Key Middle East Graphite Companies:

- Al-Balagh Trading & Contracting Co.

- Al Refaey Group

- Middle East Carbon LLC

- Emirates Carbon LLC

- Fujairah Carbon Industries

- Saudi Refractories Company

- National Industrial Gases Company

- KSA Carbon & Chemicals

- Advanced Carbon Solutions

- Gulf Graphite Trading LLC

Recent Developments

-

During its Q1 2025 briefing, Emirates Carbon LLC announced an expansion of its graphite electrode inventory, including introducing ultra-high-power (UHP) electrodes designed to enhance Electric Arc Furnace (EAF) steelmaking efficiency and support regional decarbonization efforts.

-

In early 2025, Saudi Refractories Company launched a pilot program to develop eco-friendly graphite-based refractory materials that reduce carbon emissions during production, aligning with Saudi Arabia’s national sustainability initiatives.

Middle East Graphite Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 406.0 million

Growth rate

CAGR of 8.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, end use

Regional scope

Middle East

Country scope

Saudi Arabia; Qatar; Omar; UAE

Key companies profiled

Al-Balagh Trading & Contracting Co.; Al Refaey Group; Middle East Carbon LLC; Emirates Carbon LLC; Fujairah Carbon Industries; Saudi Refractories Company; National Industrial Gases Company; KSA Carbon & Chemicals; Advanced Carbon Solutions; Gulf Graphite Trading LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Graphite Market Report Segmentation

This report forecasts country and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Middle East graphite market report based on form and end use:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Natural Graphite

-

Synthetic Graphite

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrodes

-

Refractories

-

Lubricants

-

Foundries

-

Battery Production

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East graphite market size was estimated at USD 254.1 million in 2024 and is projected to reach USD 406.0 million by 2033.

b. The Middle East graphite market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2033 to reach USD 406.0 million by 2033.

b. By form, synthetic graphite dominated the market with a revenue share of over 64.0% in 2024.

b. Some of the key vendors of the Middle East graphite market are Al-Balagh Trading & Contracting Co.; Al Refaey Group; Middle East Carbon LLC; Emirates Carbon LLC; Fujairah Carbon Industries; Saudi Refractories Company; National Industrial Gases Company; KSA Carbon & Chemicals; Advanced Carbon Solutions; Gulf Graphite Trading LLC.

b. The key factor driving the growth of the Middle East graphite market is the surge in demand for electric vehicles and energy storage systems, which has been a significant driver for the graphite market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.