- Home

- »

- Petrochemicals

- »

-

Middle East Lubricants Market Size, Industry Report, 2033GVR Report cover

![Middle East Lubricants Market Size, Share & Trends Report]()

Middle East Lubricants Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Product (Industrial, Automotive, Marine, Aerospace), By Country (Oman, Kuwait, Saudi Arabia, UAE, Qatar, Bahrain, Israel), And Segment Forecasts

- Report ID: GVR-4-68040-721-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Lubricants Market Summary

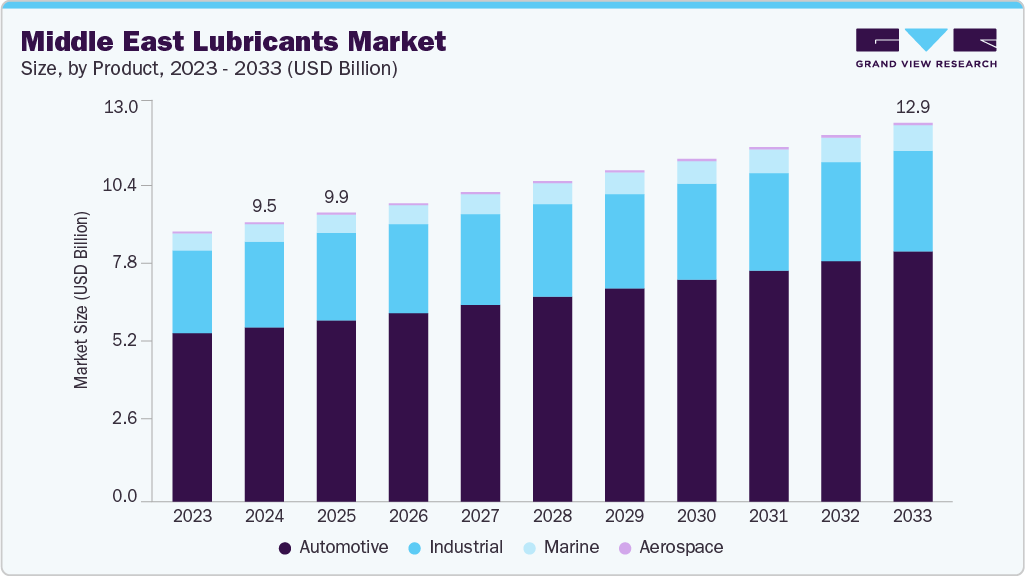

The Middle East lubricants market size was estimated at USD 9,544.9 million in 2024 and is projected to reach USD 12,945.4 million by 2033, growing at a CAGR of 3.4% from 2025 to 2033. The industry is driven by the region’s growing automotive fleet, rapid industrialization, and rising demand for high-performance vehicles.

Key Market Trends & Insights

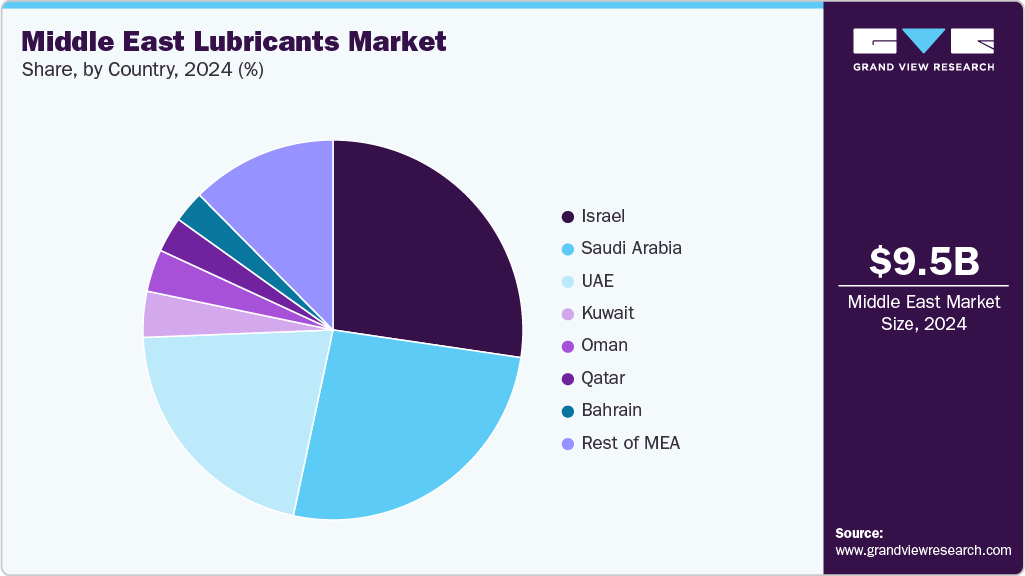

- Israel dominated the Middle East lubricants market with the largest revenue share of 27.3% in 2024.

- The Middle East lubricants market is projected to grow at a CAGR of 3.4% from 2025 to 2033.

- By product, automotive lubricants dominated the Middle East lubricants market with a revenue share of 62.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,544.9 Million

- 2033 Projected Market Size: USD 12,945.4 Million

- CAGR (2025-2033): 3.4%

These lubricants reduce friction, wear, and heat between moving parts, ensuring engine efficiency, smooth operation, and extended vehicle life. Demand is further strengthened by greater consumer awareness of vehicle maintenance, alongside stricter emission norms and fuel-efficiency regulations across the GCC.In the Middle East, automotive lubricants are applied across passenger cars, commercial vehicles, and heavy-duty machinery, designed to withstand harsh climatic conditions such as high temperatures, dust, and humidity. Engine oils dominate the segment, supported by rising vehicle ownership, fleet expansion in logistics, and the growing preference for synthetic and high-mileage formulations. Transmission fluids are gaining traction with the increased adoption of automatic vehicles, while gear oils remain critical for heavy-duty vehicles used in construction, mining, and transport. Greases and specialty additives also play a key role, offering durability and performance under extreme conditions.

The industry is steadily driven by growing maritime trade, expanding shipping and logistics activities, and the region's position as a global energy hub. Marine lubricants are essential for reducing friction, preventing corrosion, and ensuring reliable engine performance under harsh heat, humidity, and salinity conditions. Key applications include engine oils for cargo ships and tankers, two- and four-stroke oils for recreational and commercial vessels, gear oils for transmissions and sterndrives, and hydraulic oils for cranes, winches, and steering systems. Rising environmental regulations by the IMO are pushing demand for high-grade, synthetic, and eco-friendly lubricants that improve efficiency and reduce emissions. Increasing offshore exploration and stricter sustainability goals further support the region's shift toward advanced marine lubricants.

However, the industry faces restraints from stringent environmental and regulatory pressures, particularly around emissions and sustainability standards. To address this, companies are investing in R&D to develop eco-friendly, synthetic, and biodegradable lubricants, while also expanding local blending facilities and OEM partnerships. These initiatives help them comply with regulations and meet the region’s rising demand for sustainable, high-performance lubricants.

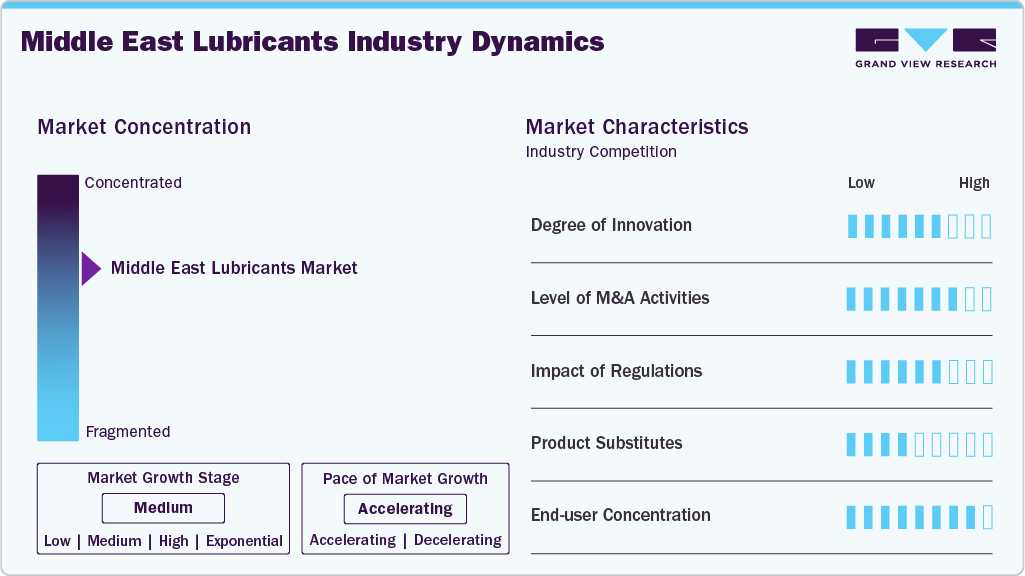

Market Concentration & Characteristics

The industry is moderately fragmented, with several leading players holding significant market share due to their expansive operations, integrated capabilities, and strong regional presence. Companies leverage their value chain integration, from base oil sourcing and advanced formulation development to distribution and after-sales services, to achieve cost efficiencies, ensure consistent product quality, and maintain a reliable supply. Their robust distribution networks, partnerships with original equipment manufacturers (OEMs), and technological expertise enable them to effectively serve diverse industries, including automotive, industrial machinery, marine, and energy.

Furthermore, with increasing emphasis on sustainability, companies are introducing low-emission, fuel-efficient, and bio-based lubricants in line with evolving regulatory frameworks across the GCC and broader MEA region. Continuous investments in research and development, digitalization, and regional production facilities further strengthen their market positioning, allowing them to address the rising demand for high-performance, eco-friendly lubricants while contributing to the Middle East’s broader goals of industrial modernization, energy diversification, and environmental sustainability.

One of the major restraints in the Middle East lubricants market is the volatility in raw material and energy prices, which directly impacts manufacturers' production costs and profit margins. The region's heavy dependence on imported base oils and additives exposes companies to fluctuations in global crude oil markets and supply chain uncertainties, making pricing strategies and long-term planning increasingly complex. However, companies are adopting more efficient sourcing, production, and distribution strategies to remain competitive in the Middle East lubricants market.

Product Insights

The automotive segment dominated the market and accounted for the largest revenue share of 62.3% in 2024, driven by rising vehicle ownership, logistics expansion, and infrastructure development. Harsh climatic conditions increase the need for high-performance lubricants that reduce friction, dissipate heat, and enhance fuel efficiency. Demand is shifting toward advanced synthetic oils with longer drain intervals and OEM compliance. Heavy-duty machinery uses in construction and industry further boosts consumption, while eco-friendly formulations gain momentum amid regional sustainability goals. Global and regional players continue to invest in R&D and partnerships, reinforcing market growth. For instance, in June 2025, ENOC Group is strengthening its position in the Middle East lubricants market by launching Elektra, a new range of fluids for electric and hybrid vehicles, during its 9th Global Distributors Meet in Thailand (June 2025). With exports to 60+ countries and two UAE plants producing over 300,000 tons annually, ENOC is aligning with the region’s shift toward EV adoption and global expansion.

The marine lubricants market is expected to grow fastest with a CAGR of 4.3% from 2025 to 2033 during the forecast period. This growth is driven by the region’s strategic geographical location, serving as a global maritime hub connecting Asia, Europe, and Africa. Rising investments in port infrastructure, offshore oil and gas exploration, and expanding shipping activities are boosting lubricant demand. Additionally, increasing adoption of advanced vessels and stricter environmental regulations are fueling the need for high-performance, eco-friendly lubricants. The Middle East’s growing energy exports and trade volumes further strengthen lubricant consumption, supporting sustained market expansion across commercial and industrial marine operations.

Country Insights

The lubricants market in Israel held 27.3% of the total revenue share in 2024, strongly driven by rising vehicle ownership, rapid urbanization, expanding logistics, and the growing need for fuel efficiency and engine protection. Lubricants such as engine oils, transmission fluids, gear oils, greases, and additives play a critical role in reducing friction, minimizing wear, dissipating heat, and ensuring vehicle longevity. Increasing demand for synthetic and high-performance oils is fueled by stricter emission regulations, advanced engine technologies, and consumer preference for extended drain intervals and better performance.

Heavy-duty vehicles in logistics and construction further boost the need for durable gear oils and greases, while additives are in demand to enhance protection and fluid life in modern engines and transmissions. Additionally, the shift toward eco-friendly formulations and sustainability initiatives is shaping future growth, making automotive lubricants indispensable for both passenger and commercial vehicles in evolving markets.

Oman Lubricants Market Trends

The lubricants market in Oman is expected to grow at the fastest CAGR of 4.8% from 2025 to 2033, due to the increasing demand for reliable lubrication solutions is a key driver of the industrial lubricants market. Proper lubrication is essential to ensure seamless machinery performance, minimize friction, reduce wear and tear, and extend equipment life. Industrial lubricants, including mineral oils, synthetic lubricants, greases, and bio-based alternatives, are specifically formulated to meet the diverse needs of industries such as manufacturing, power generation, mining, and construction. Their ability to improve energy efficiency, provide corrosion protection, dissipate heat, and enhance operational reliability makes them indispensable across heavy-duty and precision applications. As industries continue to push for higher productivity, reduced downtime, and compliance with environmental standards, the need for advanced industrial lubricants grows stronger. Leading players like Castrol are at the forefront of this demand, delivering high-performance solutions that not only optimize equipment efficiency but also align with sustainability requirements, further fueling market growth.

Key Middle East Lubricants Company Insights

Key players operating in the Middle East lubricants market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Lubricants Companies:

- TotalEnergies

- Petromin

- Aljomaih and Shell Lubricating Oil Company (JOSLOC)

- behranoil.co

- CASTROL LIMITED

- AMSOIL INC.

- FUCHS

- Chevron Overseas Limited

- ExxonMobil Corporation

- Eurol

- Emarat

- Gulf Oil International Ltd

Recent Developments

-

In January 2025, TotalEnergies Lubrifiants announced the acquisition of fire-resistant, low-VOC hydraulic fluid product lines from German manufacturer Fluid Competence, expanding its portfolio of mineral oil-free specialty fluids. The deal includes the Corsave (HFA, water-based) and Lubesave (HFC-E, water glycol-based) product lines, which are designed for safety-critical applications in industries such as steel, mining, and tunneling.

-

In November 2024, Eurol introduced Lube PL-S Spray, a new-generation multifunctional dry lubricant built on its SYNGIS Technology. Designed for both heavy-duty and broader commercial or household use, the product offers strong penetration, anti-corrosion performance, and comes in a 400 ml aerosol can with an upgraded nozzle for ease of application. Notably, it is PTFE-free, aligning with regulatory changes restricting PTFE use in lubricants, and serves as a sustainable alternative to traditional water-repellent sprays and penetrating oils, highlighting the industry’s shift toward eco-friendly, regulation-compliant lubrication solutions.

Middle East Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,873.5 million

Revenue forecast in 2033

USD 12,945.4 million

Growth rate

CAGR of 3.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel, RoME

Key companies profiled

TotalEnergies; Petromin; Aljomaih and Shell Lubricating Oil Company (JOSLOC); behranoil.co; CASTROL LIMITED; AMSOIL INC.; FUCHS; Chevron Overseas Limited; ExxonMobil Corporation; Eurol; Emarat; Gulf Oil International Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Lubricants Market Report Segmentation

This report forecasts volume & revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East lubricants market report based on product and country

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Industrial

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Greases

-

Others

-

-

Automotive

-

Engine Oil

-

0W-20

-

0W-30

-

0W-40

-

5W-20

-

5W-30

-

5W-40

-

10W-60

-

10W-40

-

15W-40

-

Other

-

-

Gear Oil

-

Transmission Fluids

-

Brake Fluids

-

Coolants

-

Greases

-

-

Marine

-

Engine oil

-

Hydraulic oil

-

Gear oil

-

Turbine oil

-

Greases

-

Others

-

-

Aerospace

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Middle East

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

RoME

-

-

Frequently Asked Questions About This Report

b. The Middle East lubricants market size was estimated at USD 9,544.9 million in 2024 and is expected to reach USD 9,873.5 million in 2025.

b. The Middle East lubricants market is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033, reaching USD 12,945.4 million by 2033.

b. The automotive segment held the largest revenue share in 2024, driven by rising vehicle sales, increased fleet maintenance, growing consumer awareness, and demand for high-performance lubricants.

b. Some of the key players operating in the Middle East lubricants market include TotalEnergies, Petromin, Aljomaih and Shell Lubricating Oil Company (JOSLOC), behranoil.co, CASTROL LIMITED, AMSOIL INC., FUCHS, Chevron Overseas Limited, ExxonMobil Corporation, Eurol, Emarat, Gulf Oil International Ltd.

b. The Middle East lubricants market is expanding due to increasing vehicle production, industrial development, growing fleet maintenance needs, government infrastructure initiatives, rising demand for advanced lubricants, technological innovations, and heightened focus on engine efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.