- Home

- »

- Biotechnology

- »

-

Middle East Microfluidics Market Size, Industry Report, 2033GVR Report cover

![Middle East Microfluidics Market Size, Share & Trends Report]()

Middle East Microfluidics Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Lab-on-a-chip, Organ-on-a-chip), By Material (Silicon, Glass), By Application (Medical, Non-Medical), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-808-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Microfluidics Market Summary

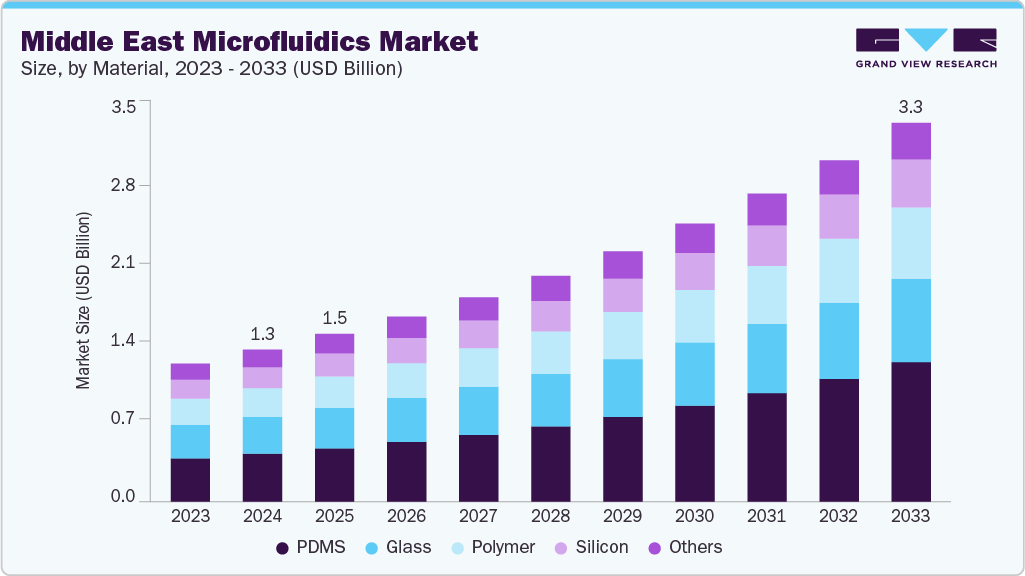

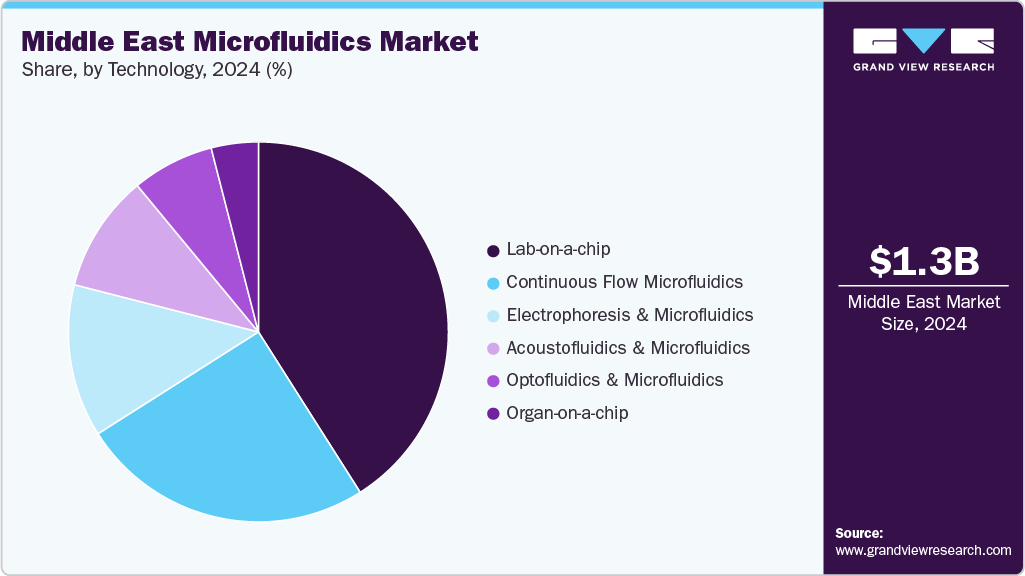

The Middle East microfluidics market size was estimated at USD 1.33 billion in 2024 and is projected to reach USD 3.32 billion by 2033, growing at a CAGR of 10.73% from 2025 to 2033. The Middle East microfluidics industry is gaining momentum as countries like Saudi Arabia and the UAE channel heavy investments into healthcare innovation and diagnostics modernization. Rising demand for point-of-care testing (POCT) and lab-on-chip devices, especially for infectious disease detection, chronic condition monitoring, and rapid testing, has positioned microfluidic technologies as a key enabler of faster, more efficient diagnostics. Large-scale healthcare digitalization projects, such as Saudi Vision 2030 and the UAE’s National Strategy for Advanced Innovation, have also prioritized biotechnology and medical device development, creating a fertile environment for microfluidic adoption.

Expanding precision medicine and research ecosystem

The rapid expansion of precision medicine and biomedical research across the Middle East has become a major catalyst for the growth of the market. Governments and healthcare institutions in countries such as Saudi Arabia, the UAE, and Qatar are actively funding genomics, proteomics, and biomarker discovery initiatives to strengthen their precision medicine infrastructure. Microfluidic technologies-known for enabling miniaturized, high-throughput sample analysis-are increasingly being integrated into these programs to improve diagnostic accuracy and reduce testing time. As national health strategies emphasize personalized treatment approaches, demand for compact, efficient platforms that can analyze genetic and molecular data continues to rise.

In addition, the region’s expanding network of research universities, biotech incubators, and clinical laboratories is fostering collaboration with technology providers. These partnerships are driving innovation in microfluidic chip design for applications such as liquid biopsy, single-cell sequencing, and organ-on-chip studies. With growing government support for translational research and R&D commercialization, microfluidics is emerging as a foundational technology bridging basic science and clinical practice, ultimately enhancing the Middle East’s capacity to deliver precision healthcare solutions tailored to its diverse population.

Growing government support for local manufacturing and medical innovation

Government-backed initiatives across the Middle East are significantly accelerating the adoption of microfluidic technologies through strong support for local manufacturing and medical innovation. Countries such as Saudi Arabia and the UAE are prioritizing the development of domestic medical device capabilities under national transformation programs like Saudi Vision 2030 and the UAE Industrial Strategy “Operation 300bn.” These efforts aim to reduce import dependency, foster technology transfer, and create a sustainable ecosystem for high-value healthcare manufacturing. As part of this, governments are offering funding, regulatory fast-tracking, and incentives for companies engaged in producing diagnostic and microfluidic components locally, driving both cost efficiency and supply chain resilience.

Parallel to these manufacturing goals, regional authorities are investing heavily in innovation hubs, biotech parks, and research accelerators to nurture startups and collaborations in medical device design. Initiatives such as the King Abdullah University of Science and Technology (KAUST) innovation clusters and the Dubai Science Park are bringing together academia, investors, and industry players to advance homegrown R&D in areas like lab-on-chip devices and biosensors. This coordinated push for local innovation, supported by favorable policies and infrastructure, is positioning the Middle East as an emerging center for microfluidic research, design, and production, ultimately strengthening its competitiveness in the medical technology landscape.

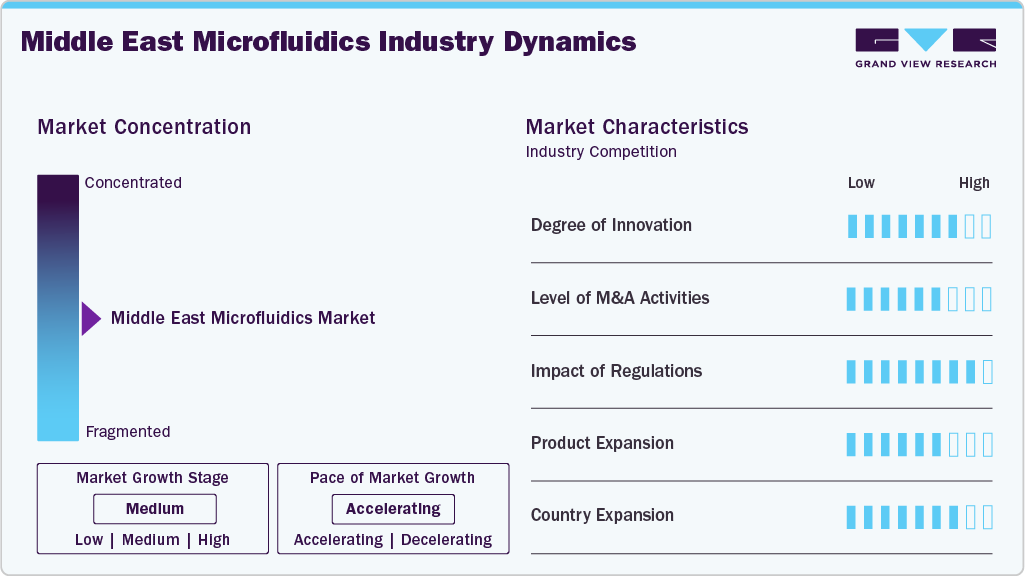

Market Concentration & Characteristics

The Middle East shows moderate-to-accelerating innovation in microfluidics, regional universities, research centers, and a growing startup base that is adopting lab-on-chip and PoC platforms for genomics, single-cell assays, and infectious-disease testing, while international vendors are partnering locally to co-develop solutions, a pattern consistent with industry trends toward higher R&D intensity in microfluidic components and applications.

M&A activity affecting medical technologies (including microfluidics-related diagnostics and components) is increasing regionally, driven by strategic buyers, sovereign wealth investors, and cross-border deal flows that target capabilities and distribution in the GCC; expect bolt-on acquisitions and minority growth investments (rather than frequent megadeals) as the dominant transaction types for microfluidics players.

Regulatory frameworks across the Gulf and wider Middle East are tightening and maturing, with authorities like Saudi’s SFDA formalizing device registration and import controls and other national MOHs moving toward EU/FDA-aligned pathways, which raises market-entry barriers but improves long-term market clarity and reimbursement-readiness for certified microfluidic products.

Product expansion is focusing on point-of-care diagnostics, lab-on-chip platforms, and modular microfluidic components that shorten time-to-result and reduce cost-per-test; suppliers are scaling component portfolios (chips, cartridges, integrated sensors) and launching turnkey PoC systems to capture demand from hospitals, diagnostics labs, and decentralized testing programs.

Middle East microfluidics industry expansion is concentrated in Saudi Arabia and the UAE (largest commercial uptake and government support), with targeted expansion strategies into Kuwait, Qatar and selected Levant markets via distributors, local partnerships and pilot clinical deployments; broader ME expansion is pragmatic, prioritizing high-GDP Gulf buyers first, then larger population markets with established lab infrastructure.

Product Insights

The microfluidic components segment held the largest revenue share of the market in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to their critical role in enabling precise fluid control and integration across various microfluidic devices. Components such as pumps, valves, chips, and sensors are essential for diagnostics, drug delivery, and analytical instrumentation applications. The rising demand for point-of-care testing, lab-on-a-chip platforms, and personalized medicine has significantly increased the need for reliable and scalable microfluidic components. Moreover, advancements in fabrication technologies, including soft lithography and 3D printing, have reduced production costs and improved performance, further driving adoption. The presence of key manufacturers and increased investment in biomedical research and development (R&D) have also contributed to segment growth.

The microfluidic-based devices segment is expected to grow significantly throughout the forecast period due to their expanding applications in diagnostics, drug delivery, and life sciences research. These devices offer advantages such as reduced sample volume, faster analysis, and enhanced sensitivity, making them ideal for point-of-care testing and personalized medicine. Increasing demand for rapid diagnostic solutions, especially in infectious diseases and cancer, further fuels adoption.

Application Insights

The medical segment held the largest revenue share of the market in 2024. Microfluidics is a significant technology in biological analysis, chemical synthesis, and information technology. The miniaturization of conventional laboratory equipment and technologies through microfluidics has led to several advancements, including minimal usage of reagents and maximum information derived from small sample sizes, short and simple assay protocols, improved parallel processing of samples and screening approaches, and accurate spatiotemporal control of cell microenvironments.

The non-medical segment is expected to register significant CAGR throughout the forecast period. Microfluidics technology is emerging as a key driver in this sector, revolutionizing industries such as oil extraction, food production, and material science.

Material Insights

The polydimethylsiloxane (PDMS) segment held the largest market share of 31.53% in 2024. PDMS is a widely used polymer in microfluidics owing to several advantages offered by the material. Some of the benefits of PDMS are nontoxicity, robustness, optical transparency, permeability to gas and oxygen, biocompatibility, elastomeric features, low cost, and complex designs of microfluidic devices by stacking multiple layers.

The polymers segment is expected to experience significant growth during the forecast period. This growth is driven by the increasing demand for cost-effective, customizable, and flexible materials in microfluidic device fabrication. Polymers offer advantages like ease of production, versatility in design, and compatibility with various applications, including diagnostics, drug delivery, and environmental monitoring, making them a preferred choice for manufacturers aiming to innovate and meet market demands.

Technology Insights

The lab-on-a-chip segment held the largest market share of 40.69% in 2024. Lab-on-a-chip research has recently shown potential in cell biology. These systems validate the capability to regulate cells at the single-cell level while quickly dealing with a huge volume of cells. For instance, in March 2024, a review published in Lab-on-a-Chip explored the future directions of microfluidic lab-on-a-chip (LOC) technologies in translational medicine. The research highlighted the importance of improved accessibility, usability, and manufacturability to help connect lab work to clinical practice. The authors provided strategies to help facilitate the transition of microfluidic devices to the clinics to realize their full potential in diagnostics and personalized medicine.

The organ-on-a-chip segment is anticipated to grow considerably over the forecast period. Academic institutions and innovation hubs in Saudi Arabia, the UAE, and Qatar are investing in organ-on-a-chip technologies to reduce reliance on animal testing and improve preclinical modeling of human physiology. These initiatives align with national healthcare transformation programs that promote cutting-edge R&D and local biotech manufacturing. Growing collaborations between regional research centers and life science companies are further accelerating adoption, positioning organs-on-chips as a vital tool for translational research, toxicity screening, and personalized therapeutic development across the Middle East.

Country Insights

Saudi Arabia Microfluidics Market Trends

Saudi Arabia microfluidics industry dominated the Middle East market with a revenue share of 44.71% in 2024. The Saudi Arabian market is primarily driven by strong government support for healthcare innovation and biotechnology localization under initiatives like Saudi Vision 2030. The country is investing heavily in modernizing its diagnostic infrastructure, with growing demand for point-of-care testing, lab-on-chip devices, and precision medicine platforms in hospitals and research institutes. National funding programs and partnerships with medtech and academic players are fostering local R&D and manufacturing of microfluidic systems. This strategic focus on self-sufficiency, coupled with expanding clinical applications in genomics, drug discovery, and personalized healthcare, is propelling rapid market growth for microfluidics in Saudi Arabia.

UAE Microfluidics Market Trends

The UAE microfluidics industry is projected to drive the demand for microfluidics and grow considerably due to factors such as increasing healthcare investments, growing demand for personalized medicine, advancements in diagnostics, and the rising adoption of point-of-care testing. Moreover, the expansion of biotechnology research and development and supportive government initiatives are expected to further fuel the growth of microfluidic technologies in the region. Integrating microfluidics in applications such as drug delivery, diagnostics, and lab-on-a-chip devices is also anticipated to expand the Middle East microfluidics industry.

Kuwait Microfluidics Market Trends

Kuwait's microfluidics industry is projected to grow steadily, driven by new healthcare infrastructure, increasing demand for point-of-care testing, and government programs encouraging innovation in medical technologies. The increasing prevalence of chronic and infectious diseases is driving the need for rapid diagnostic solutions. This demand for efficient diagnostic solutions is also being fueled by the growth of pharmaceutical and biotechnology research in Kuwait. Emerging applications in drug delivery and wound care also provide momentum for the market, which is unique and newer than the Middle East microfluidics industry.

Key Middle East Microfluidics Company Insights

The Middle East microfluidics industry is characterized by several established players who dominate through strong product portfolios, strategic collaborations, and consistent R&D investments. Leading companies such as Thermo Fisher Scientific, Agilent Technologies, and F. Hoffmann-La Roche Ltd. have maintained significant market share due to their presence and integrated solutions spanning diagnostics, drug discovery, and genomics.

Firms like Bio-Rad Laboratories, Inc., Abbott and others are expanding their footprint by focusing on advanced microfluidic applications in molecular diagnostics, infectious disease testing, and personalized medicine. Through innovation, partnerships, and geographic expansion, these players continue to shape the competitive dynamics of the Middle East market.

Overall, the market is witnessing a blend of legacy strength and startup agility, with increased M&A activity, partnerships, and product innovations likely to intensify competition further. Companies that balance scientific validation with lifestyle relevance and ethical sourcing will be best positioned to capture long-term value in the evolving middle east microfluidics landscape.

Key Middle East Microfluidics Companies:

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd

- Revitty

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher

- Thermo Fisher Scientific, Inc.

- Abbott

- Standard BioTools Inc.

Recent Developments

-

In October 2025, Co-Diagnostics entered a definitive agreement with Arabian Eagle Manufacturing to form a Saudi‑based JV “CoMira Diagnostics” to research/manufacture/distribute Co‑Dx products across KSA and 18 other MENA countries.

-

In November 2024, Announced a new distributor agreement with CareTech International covering MENA countries including UAE, Qatar, Kuwait for its diagnostics consumables.

Middle East Microfluidics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.47 billion

Revenue forecast in 2033

USD 3.32 billion

Growth rate

CAGR of 10.73% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, material, application, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Illumina, Inc.; F. Hoffmann-La Roche Ltd; Revitty; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher; Thermo Fisher Scientific, Inc.; Abbott, Standard BioTools Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Microfluidics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the Middle East microfluidics market report based on product, technology, material, application, and countries:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Microfluidic-based Devices

-

Microfluidic Components

-

Chips

-

Micro-pumps

-

Sensors

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Lab-on-a-chip

-

Organ-on-a-chip

-

Continuous flow microfluidics

-

Optofluidics and microfluidics

-

Acoustofluidics and microfluidics

-

Electrophoresis and microfluidics

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicon

-

Glass

-

Polymer

-

PDMS

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical

-

Pharmaceuticals

-

Medical Devices

-

In-vitro Diagnostics

-

Others

-

-

Non-medical

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.