- Home

- »

- Advanced Interior Materials

- »

-

Middle East Passive Fire Protection Market Size Report, 2033GVR Report cover

![Middle East Passive Fire Protection Market Size, Share & Trends Report]()

Middle East Passive Fire Protection Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Intumescent Coatings, Fireproofing Cladding), By Application (Industrial Plants, Warehousing), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-742-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Passive Fire Protection Market Summary

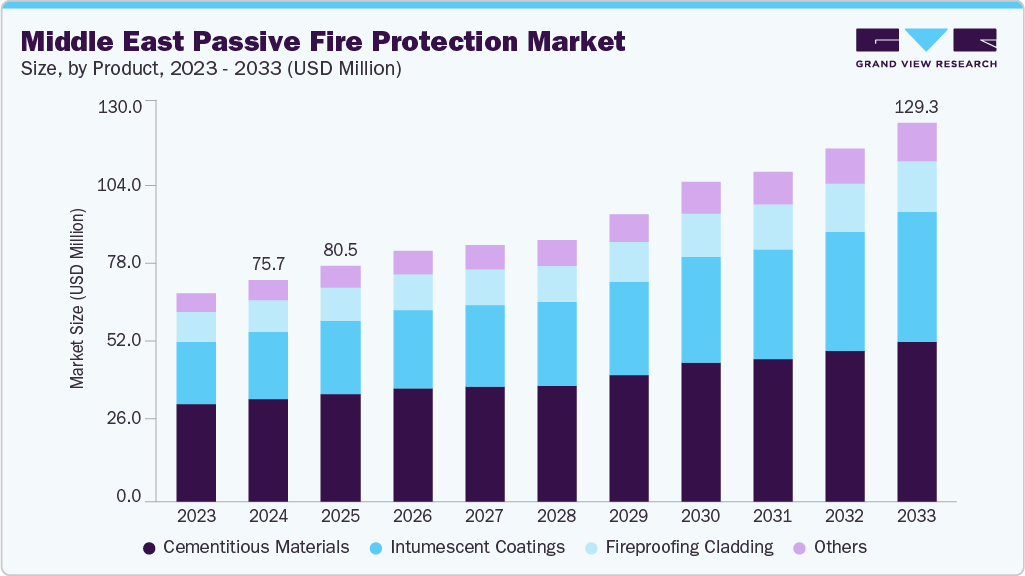

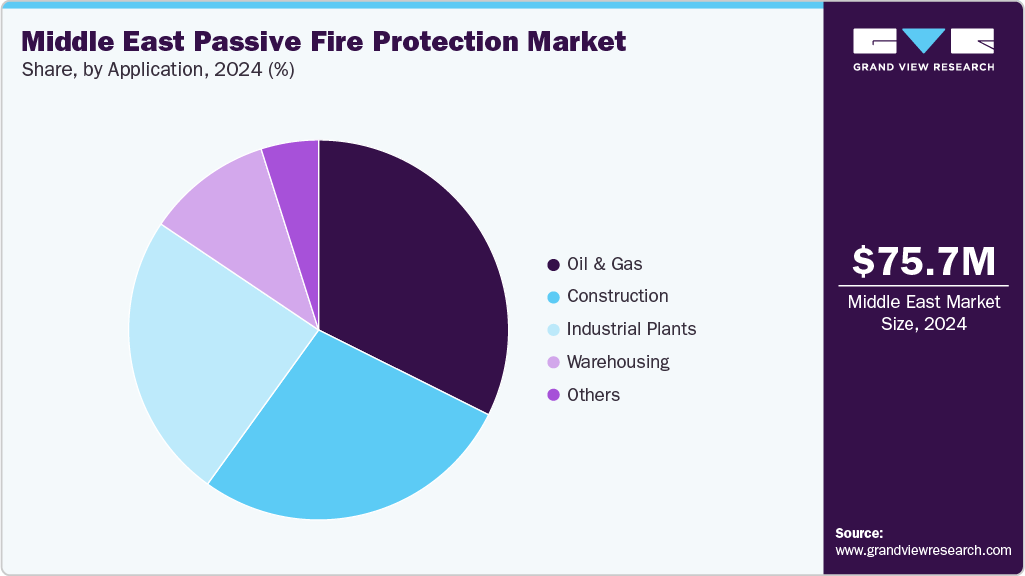

The Middle East passive fire protection market size was estimated at USD 75.7 million in 2024 and is projected to reach USD 129.3 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033, driven by increasing investments in construction, infrastructure, and industrial development. Countries like Saudi Arabia and the UAE are leading this growth, fueled by large-scale projects in urban development, oil and gas, and transportation. Stricter building codes and fire safety regulations encourage the adoption of advanced fire protection materials and systems.

Key Market Trends & Insights

- The passive fire protection market in Saudi Arabia is expected to grow at a substantial CAGR of 6.7% from 2025 to 2033.

- By product, the intumescent coatings segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By application, the warehousing segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 75.7 Million

- 2033 Projected Market Size: USD 129.3 Million

- CAGR (2025-2033): 6.1%

In addition, growing awareness of fire risks and the need to enhance safety in high-rise buildings and industrial facilities contribute to higher demand for passive solutions such as fire-resistant coatings, barriers, and structural protection. While the market faces challenges like high installation costs and uneven regulatory enforcement, ongoing modernization efforts and government initiatives create strong opportunities.

Market Concentration & Characteristics

The passive fire protection industry in the Middle East is moderately fragmented, with a mix of regional and international players competing across various segments. No single company dominates the market, as numerous firms offer specialized products like fire-resistant coatings, cladding, and sealants. Local manufacturers cater to price-sensitive projects, while global brands focus on premium offerings and compliance with international standards.

The Middle East passive fire protection industry is witnessing growing innovation, especially in advanced materials such as intumescent and ceramic-based coatings. New technologies aim to enhance fire resistance, reduce weight, improve corrosion protection, and allow for faster installation. There's also a strong focus on sustainability, environmental safety, and developing solutions for high-risk industrial and energy sectors.

Mergers and acquisitions in the Middle East passive fire protection industry are limited, but companies are actively forming partnerships and expanding through local manufacturing facilities and distribution networks. These strategic moves aim to enhance market presence, reduce costs, and improve delivery timelines. Growth is primarily driven by collaboration, regional expansion, and localization rather than major acquisitions.

Fire safety regulations significantly shape the Middle East market by enforcing stricter standards for buildings and industrial projects. Regulatory bodies require certified fire protection systems, proper installation practices, and adherence to international safety codes. This pushes stakeholders to prioritize compliance, invest in quality solutions, and adopt advanced materials that meet increasingly stringent fire resistance criteria.

Drivers, Opportunities & Restraints

Rapid infrastructure growth across the Middle East, particularly in high-rise buildings, airports, and energy facilities, is a major driver. Governments are investing heavily in construction and industrial expansion, which increases the demand for passive fire protection systems to ensure safety, meet regulatory requirements, and protect valuable assets in critical sectors like oil, gas, and urban development.

A significant opportunity exists to retrofit older buildings and industrial sites with modern passive fire protection systems. Many existing structures lack updated fire safety measures, and growing awareness alongside stricter regulations creates demand for compliant, certified solutions. This opens up new markets for suppliers offering tailored, cost-effective, and easily applicable fire-resistant materials and coatings.

Inconsistent enforcement of fire safety regulations across different countries and regions is a significant challenge in the market. While some nations have advanced codes and strict compliance, others lag, leading to uneven market demand and quality standards. This creates barriers for manufacturers and service providers to scale regionally while maintaining uniform product certification and reliability.

Product Insights

The cementitious materials segment dominated the market in 2024 by accounting for a share of 46.1% due to their robustness, proven performance, and cost‑effectiveness. They are widely used to protect structural steel, concrete surfaces, and commercial, industrial, and energy infrastructure. Their high fire resistance, durability under harsh climates, and relative ease of supply make them well‑suited for large projects like oil & gas plants and heavy industrial facilities.

Intumescent coatings are expected to grow moderately in the Middle East market, driven by demand for thinner, lighter fire protection that doesn’t compromise aesthetics. Their ability to expand when heat exposure protects steel and other structural elements while blending with architectural design. Rising infrastructure development, especially high‑rise buildings, transport hubs, energy facilities, and stricter fire safety regulations, are pushing demand.

Application Insights

The oil & gas segment dominated the market in 2024 by accounting for a share of 32.4% due to the high fire risk associated with extraction, processing, and storage operations. Expanding infrastructure, including refineries, LNG plants, and petrochemical facilities, is increasing demand for fireproofing systems. Strict regulatory requirements mandate the use of certified fire-resistant materials.

The warehousing segment is anticipated to grow significantly, as logistics and e-commerce industries expand, more warehouses are being built or upgraded to meet safety standards. Fire safety is critical to protect stored goods and maintain operational continuity. Steel structures, wide layouts, and tall racking systems increase fire risks, prompting the use of fire-resistant coatings and materials to prevent structural collapse and contain fire spread effectively.

Country Insights

Saudi Arabia Passive Fire Protection Market Trends

Saudi Arabia dominated the passive fire protection market over the forecast period, accounting for 60.5% of the market share in 2024, driven by major infrastructure and industrial projects under Vision 2030. The country is investing heavily in smart cities, energy facilities, and transport infrastructure, all of which require advanced fire safety systems. Regulatory enforcement is becoming stricter, encouraging wider adoption of certified materials.

UAE Passive Fire Protection Market Trends

The UAE passive fire protection market is expected to grow at a CAGR of 5.9% from 2025 to 2033 due to rapid urban development, high-rise construction, and infrastructure expansion. Stricter fire safety regulations boost demand for high-quality, certified products in new builds and retrofit projects. The country’s focus on sustainability and innovation also drives the adoption of advanced materials, especially intumescent coatings.

Key Middle East Passive Fire Protection Company Insights

Some key players operating in the market include Hempel A/S, HILTI, and Carboline.

-

Hempel A/S is a U.S.-based manufacturer specializing in explosion protection, pressure relief, and fire suppression solutions. In the Middle East, Fike is recognized for its advanced passive fire protection, including clean agent, water mist, and industrial fire protection technologies. The company serves critical sectors such as oil & gas, power, pharmaceuticals, and data centers, offering high-performance systems designed to minimize downtime and protect high-value assets.

-

HILTI is a global group of life-saving technology companies headquartered in the UK. Its subsidiaries, such as FirePro and Apollo Fire Detectors, have a strong presence in the Middle East fire suppression market. Halma offers environmentally sustainable passive fire protection and advanced fire detection technologies for industrial, commercial, and residential applications.

Key Middle East Passive Fire Protection Companies:

- Hempel A/S

- HILTI

- Carboline

- Isolatek International

- 3M

- PPG Industries, Inc.

- Etex Group

- The Sherwin-Williams Company

- Jotun Group

- Pyrotech

Recent Developments

-

In March 2025, Hempel launched Hempafire Extreme 550, a state-of-the-art epoxy passive fire protection (PFP) coating offering up to four hours of fire resistance against cellulosic fires. The product is designed for harsh environments and reduces paint consumption by up to 40%, improving efficiency. It is solvent-free, has low VOCs, and meets high corrosion standards. Faster application and curing times help speed up construction while ensuring structural protection.

-

In April 2025, Siderise began manufacturing high-performance passive fire protection products in the UAE, marking a significant step in its regional expansion. The move enhances local availability, reduces lead times, and supports growing demand in Middle East construction and infrastructure projects.

Middle East Passive Fire Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80.5 million

Revenue forecast in 2033

USD 129.3 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Saudi Arabia; UAE; Oman ;Qatar; Kuwait; Israel

Key companies profiled

Hempel A/S; HILTI; Carboline; Isolatek International; 3M; PPG Industries, Inc.; Etex Group; The Sherwin-Williams Company; Jotun Group; Pyrotech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Passive Fire Protection Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East passive fire protection market based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cementitious Materials

-

Intumescent Coatings

-

Fireproofing Cladding

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Construction

-

Industrial Plants

-

Warehousing

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Kuwait

-

Israel

-

Frequently Asked Questions About This Report

b. The Middle East passive fire protection market size was estimated at USD 75.7 million in 2024 and is expected to reach USD 80.5 million in 2025.

b. The Middle East passive fire protection market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033, reaching USD 129.3 million by 2033.

b. The cementitious materials segment dominated the market in 2024 by accounting for a share of 46.1% due to their robustness, proven performance, and cost‑effectiveness. Their high fire resistance, durability under harsh climates, and relative ease of supply make them well‑suited for large projects like oil & gas plants and heavy industrial facilities.

b. Some of the key players operating in the Middle East passive fire protection market include Hempel A/S, HILTI, Carboline, Isolatek International, 3M, PPG Industries, Inc., Etex Group, The Sherwin-Williams Company, Jotun Group, and Pyrotech.

b. Key factors driving the Middle East passive fire protection market include rapid urbanization, large-scale infrastructure and industrial projects, and stricter fire safety regulations. Growing awareness of fire risks in high-rise buildings, oil and gas facilities, and transportation hubs boosts demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.