- Home

- »

- Renewable Energy

- »

-

Middle East Solar PV Market Size, Industry Report, 2033GVR Report cover

![Middle East Solar PV Market Size, Share & Trends Report]()

Middle East Solar PV Market (2025 - 2033) Size, Share & Trends Analysis Report By Connectivity (On Grid, Off Grid), By Mounting (Ground Mounted, Roof Top), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-719-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Solar PV Market Summary

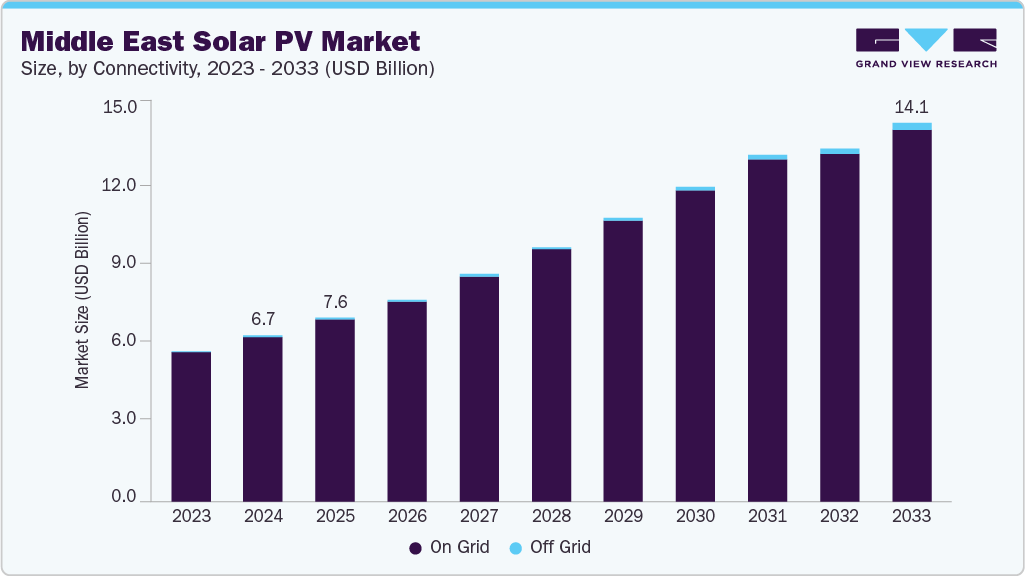

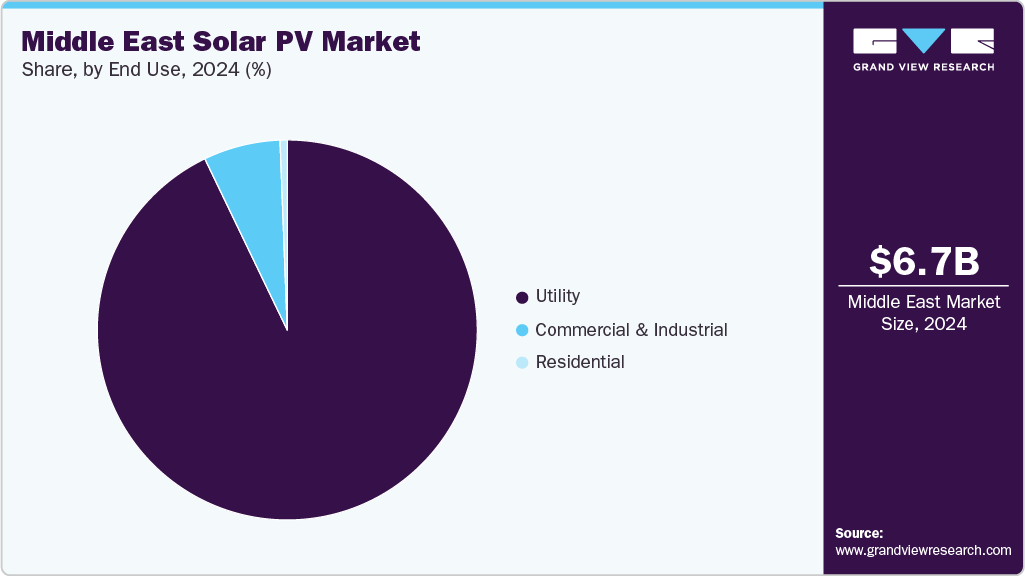

The Middle East solar PV market size was estimated at USD 6.73 billion in 2024 and is projected to reach USD 14.11 billion by 2033, growing at a CAGR of 8.1% from 2025 to 2033. Solar PV deployment in the region spans utility-scale, commercial & industrial (C&I), and residential segments, enabling grid-connected and off-grid applications across diverse end users.

Key Market Trends & Insights

- Saudi Arabia solar PV market held the largest share of 38.74% of the Middle East market in 2024.

- The solar PV market in the Middle East is expected to grow significantly over the forecast period.

- By connectivity, On Grid held the highest market share of 99.15% in 2024.

- Based on mounting, Ground Mounted segment held the highest market share in 2024.

- Based on end use, Utility segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.73 Billion

- 2033 Projected Market Size: USD 14.11 Billion

- CAGR (2025-2033): 8.1%

National strategies such as Saudi Vision 2030, the UAE’s Energy Strategy 2050, and Egypt’s Integrated Sustainable Energy Strategy 2035 catalyze large-scale PV investments to diversify energy sources, cut emissions, and strengthen long-term energy security. Countries across the Gulf Cooperation Council (GCC), Turkey, Jordan, and Israel are expanding solar PV capacity to serve industrial complexes, desalination plants, urban centers, and rural communities while enhancing resilience to rising demand and climate-driven challenges.

Market growth is driven by the region’s abundant solar resources, falling technology costs, and favorable financing models such as PPAs and PPPs. Utility-scale projects dominate installations, while distributed rooftop PV adoption is gaining momentum in urban centers supported by net-metering policies and smart grid integration. Hybrid systems pairing PV with battery energy storage systems (BESS) are increasingly being adopted to ensure round-the-clock reliability and grid stability. Emerging opportunities include green hydrogen production powered by dedicated PV farms and regional interconnection projects such as the GCC grid expansion and the Saudi-Jordan-Egypt power link, which enhance cross-border electricity trade. With leading companies such as Masdar, ACWA Power, First Solar, JinkoSolar, and EDF Renewables spearheading gigawatt-scale projects, the market is positioned for sustained growth over the coming decade.

Drivers, Opportunities & Restraints

The Middle East solar PV industry is driven by abundant solar irradiation, national diversification strategies, and falling technology costs that have positioned the region as a global hub for utility-scale solar power. Countries such as Saudi Arabia, the UAE, and Egypt are implementing ambitious renewable energy visions to reduce reliance on hydrocarbons, cut carbon emissions, and meet soaring electricity demand from expanding urban centers and industrial growth. Large-scale tenders, attractive power purchase agreements (PPAs), and strong government backing through initiatives like Saudi Vision 2030 and the UAE Energy Strategy 2050 propel PV deployment across the GCC, Levant, and North Africa. Rapid population growth, water desalination needs, and electrification of transport further boost demand for solar PV capacity in grid-connected and off-grid applications.

Opportunities in the market include the integration of PV with battery energy storage systems (BESS) to provide round-the-clock reliability, the rise of distributed rooftop solar in commercial and residential sectors, and the expansion of green hydrogen projects powered by dedicated solar farms. Regional interconnection initiatives such as the GCC grid expansion and Saudi-Jordan-Egypt links enhance cross-border trade and open new avenues for solar power export. Moreover, international partnerships with technology leaders enable the development of next-generation PV modules, bifacial panels, and digital monitoring systems, improving efficiency and lowering operational costs. However, the market faces restraints such as high upfront investments for grid infrastructure upgrades, policy uncertainties in non-GCC countries, and grid integration challenges caused by variable renewable output under harsh desert climates. Financing hurdles for small-scale distributed projects and the need for advanced cooling technologies to sustain PV performance in extreme heat remain critical obstacles to faster adoption.

Connectivity Insights

The on-grid segment held the largest revenue share of 99.15% in 2024, underscoring the region's strong focus on utility-scale and grid-connected solar projects. This dominance is driven by large-scale tenders, attractive power purchase agreements (PPAs), and government-backed initiatives prioritizing solar as a cornerstone of energy diversification strategies. Countries such as Saudi Arabia, the UAE, Egypt, and Jordan lead capacity additions through record-breaking solar auctions and mega-projects like the Mohammed bin Rashid Al Maktoum Solar Park (UAE) and Sakaka PV plant (Saudi Arabia). With expanding national grids and rising electricity demand from industrial hubs, desalination plants, and rapidly growing cities, on-grid solar PV has emerged as the preferred choice for delivering cost-competitive, clean power at scale.

Supportive policies, including feed-in tariffs, competitive bidding programs, and long-term renewable targets, further accelerate on-grid adoption. Integrating battery energy storage systems (BESS) and advanced grid management solutions enhances solar output's flexibility, enabling better peak load management and reducing curtailment risks. In addition, cross-border interconnection projects across the GCC and North Africa open opportunities for solar power trade, reinforcing the strategic importance of grid-connected PV. While the off-grid segment accounts for a much smaller share, it continues to serve niche applications in remote communities, oil & gas operations, and mining sites. However, the overwhelming dominance of on-grid solar PV highlights the Middle East's commitment to large-scale deployment, positioning the region as a global leader in harnessing solar resources for national and regional energy security.

Mounting Insights

The ground mounted segment accounted for a dominant revenue share of 95.89% in 2024 and is expected to maintain its lead over the forecast period. This segment benefits from the region’s abundance of flat, arid land, which makes it highly suitable for utility-scale solar farms. Countries such as Saudi Arabia, the UAE, and Egypt spearhead massive ground-mounted solar projects, including record-breaking capacity additions like the Mohammed bin Rashid Al Maktoum Solar Park and the Benban Solar Park. These installations contribute to national renewable energy goals and supply low-cost, clean electricity to industries, desalination facilities, and growing urban populations. The scale of these projects enables economies of scale, reduces the levelized cost of electricity (LCOE), and ensures reliable integration with national grids, strengthening the segment’s dominance.

The expansion of the ground mounted solar PV market is further supported by government-led competitive bidding programs, declining module and EPC costs, and strong public-private partnerships. Increasing adoption of tracking systems, bifacial modules, and hybrid setups with battery energy storage systems (BESS) further enhances efficiency and output. While rooftop and other mounting configurations are steadily gaining traction in commercial and residential settings, their share remains minimal compared to large-scale ground installations. With ambitious solar deployment targets across the Middle East and a pipeline of multi-gigawatt solar tenders, ground-mounted PV will continue to act as the backbone of the region’s solar expansion, driving energy security and long-term decarbonization objectives.

End Use Insights

The utility segment accounted for a dominant revenue share of 95.62% in 2024 and is projected to maintain its leadership position throughout the forecast period. Large-scale utility projects continue to shape the region’s solar expansion, driven by ambitious national visions and renewable energy programs across Saudi Arabia, the UAE, Egypt, and Morocco. Flagship projects such as the Mohammed bin Rashid Al Maktoum Solar Park in Dubai and the Benban Solar Park in Egypt showcase the scale and cost competitiveness of utility-scale installations, with governments awarding multi-gigawatt tenders to meet rising electricity demand and diversify their energy mix. These projects strengthen grid stability and deliver some of the world’s lowest solar tariffs, reinforcing the dominance of the utility segment.

The utility segment’s growth is further propelled by supportive policies, public-private partnerships, and international investments that enable deployment of solar PV at unprecedented scales. Integrating bifacial panels, single-axis trackers, and hybrid systems with battery storage enhances energy yield and grid reliability, making utility-scale projects central to long-term energy security and decarbonization strategies. While commercial and residential solar adoption is gaining traction in select countries, its contribution remains limited compared to utility projects. With a robust pipeline of solar tenders across the GCC and North Africa and declining levelized electricity costs (LCOE), the utility segment will remain the backbone of solar PV deployment in the Middle East, ensuring sustainable, affordable, and secure power generation for decades.

Country Insights

Saudi Arabia accounted for the largest share of the Middle East Solar PV market in 2024, holding over 38.74% revenue share, reflecting its position as the region's clean energy frontrunner. The Kingdom's ambitious Vision 2030 strategy places solar energy at the center of its diversification efforts, supported by utility-scale projects like the 300 MW Sakaka PV plant, the 1.5 GW Sudair Solar PV plant, and integrated renewable initiatives under NEOM. The Renewable Energy Project Development Office (REPDO) has streamlined transparent auction processes, encouraged competitive pricing, and attracted global developers to accelerate solar deployment.

Benefiting from one of the world's highest solar irradiance levels, Saudi Arabia has made solar PV the backbone of its energy transition. The Kingdom's large-scale projects, including the USD 8.4 billion NEOM Hydrogen plant, are increasingly linked with its green hydrogen ambitions, creating synergies between solar power and emerging clean fuels. With strong regulatory support, sovereign funding mechanisms, and international collaborations, Saudi Arabia is expected to maintain its regional market leadership position throughout the forecast period.

UAE Solar PV Market Trends

The solar PV market in the UAE is a leading hub for solar PV adoption in the Middle East, supported by progressive policy frameworks under the UAE Energy Strategy 2050, which targets 50% clean energy in the national mix by mid-century. Large-scale projects like the Mohammed bin Rashid Al Maktoum Solar Park, one of the world's largest single-site solar facilities, showcase the UAE's commitment to scaling capacity. Abu Dhabi and Dubai also lead in distributed solar installations through programs such as Shams Dubai and initiatives by the Abu Dhabi Department of Energy, driving rapid adoption across residential, commercial, and industrial sectors.

Alongside utility-scale solar PV, the UAE actively explores integrating concentrated solar power (CSP) and coupling solar with green hydrogen initiatives. Favorable financing, an open foreign investment environment, and world-class infrastructure further strengthen its solar market outlook. With ongoing expansion phases of existing solar parks and new cross-sector energy transition initiatives, the UAE remains a critical market growth engine for the Middle East.

Israel Solar PV Market Trends

The solar PV market in Israel is steadily growing, driven by rising energy demand, supportive government policies, and a strategic shift toward renewable energy independence. Under the government's Integrated Sustainable Energy Strategy (ISES), Israel targets 30% renewables in its energy mix by 2030, with solar PV expected to account for the majority share. The country is advancing utility-scale and distributed solar projects, investing in battery storage integration to address grid reliability and intermittency.

Innovative technology adoption and increasing participation from Independent Power Producers (IPPs) reinforce Israel's solar potential. Cross-border grid interconnection plans with Europe and neighboring regions are expected to enhance the scalability of its solar PV capacity. With robust regulatory frameworks and international financing support, Israel is positioning itself as a rising player.

Oman Solar PV Market Trends

The solar PV market in Oman is emerging as promising in the Middle East, aligned with Oman Vision 2040, which targets 30% of power generation from renewables by 2030. Vast desert landscapes offer significant potential for large-scale solar deployment, with flagship projects like the 500 MW Ibri II Solar Plant already operational and setting benchmarks for further development. Ongoing investments are also linked to Oman's green hydrogen ambitions, led by Hydrogen Oman (Hydrom), where solar PV is the primary input for renewable hydrogen production.

The government is implementing regulatory reforms to attract foreign investors while supporting pilot projects in distributed solar and hybrid systems. While grid integration challenges persist, Oman's strong wind-solar complementarity and rising regional demand for clean power make it an attractive long-term market. With international consortia actively participating in its renewable sector, Oman is expected to strengthen its role in regional solar PV growth.

Qatar Solar PV Market Trends

The solar PV market in Qatar is gaining traction under the Qatar National Vision 2030, emphasizing carbon reduction and sustainable energy transition. The 800 MW Al Kharsaah Solar PV Plant, inaugurated in 2022, represents the country's largest renewable energy project and is a foundation for future solar expansions. The government is increasingly prioritizing solar integration to diversify its gas-heavy power sector and support climate commitments, including the goal of achieving carbon neutrality by 2050.

Beyond utility-scale developments, Qatar is exploring solar deployment for industrial facilities, smart cities, and desalination projects. Partnerships with international players, favorable regulatory frameworks, and growing renewable investment incentives are expected to drive the next wave of solar adoption. While fossil fuels remain dominant, solar PV is steadily rising as a complementary and strategic energy source in Qatar's diversification agenda.

Key Middle East Solar PV Company Insights

Some key players operating in the market include JinkoSolar Holding Co. Ltd., First Solar Inc., ACWA Power, Enerwhere Sustainable Energy DMCC, Alsa Solar Systems LLC, Canadian Solar Inc., Masdar (Abu Dhabi Future Energy Company), Yellow Door Energy, Trina Solar, and JA Solar Co. Ltd. These companies are actively engaged in developing and deploying large-scale solar PV projects, supplying advanced photovoltaic modules, and integrating clean energy technologies to accelerate renewable adoption and support the region’s transition toward sustainable energy systems.

Key Middle East Solar PV Companies:

- JinkoSolar Holding Co. Ltd.

- First Solar Inc.

- ACWA Power

- Enerwhere Sustainable Energy DMCC

- Alsa Solar Systems LLC

- Canadian Solar Inc.

- Masdar

- Yellow Door Energy

- Trina Solar

- JA Solar Co. Ltd.

Recent Developments

-

In February 2025, ACWA Power commenced construction of the 2,060 MW Al Shuaibah Solar PV Independent Power Project (IPP) in Saudi Arabia, one of the largest solar facilities in the Middle East. The project, developed in partnership with the Saudi Public Investment Fund (PIF), is expected to supply clean electricity to nearly 450,000 households annually while offsetting over 3 million tons of CO₂ emissions per year.

Middle East Solar PV Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.58 billion

Revenue forecast in 2033

USD 14.11 billion

Growth rate

CAGR of 8.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in MW, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Connectivity, connection type, end use, country

Country scope

UAE; Saudi Arabia; Israel; Oman; Qatar

Key companies profiled

JinkoSolar Holding Co. Ltd.; First Solar Inc.; ACWA Power; Enerwhere Sustainable Energy DMCC; Alsa Solar Systems LLC; Canadian Solar Inc.; Masdar; Yellow Door Energy; Trina Solar; JA Solar Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Solar PV Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East Solar PV market report based on connectivity, mounting, end use, and country:

-

Connectivity Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

On Grid

-

Off Grid

-

-

Mounting Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Ground Mounted

-

Roof Top

-

-

End Use Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial & Industrial

-

Utility

-

-

Country Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Israel

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East solar PV market size was estimated at USD 6.73 billion in 2024 and is expected to reach USD 7.58 billion in 2025.

b. The Middle East solar PV market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2033 to reach USD 14.11 billion by 2033.

b. Based on the end-use segment, the utility sector dominated the Middle East solar PV market in 2024, accounting for over 92.86% of the total revenue share. This dominance is primarily driven by the region’s strong focus on large-scale solar projects that align with national energy diversification strategies and carbon reduction commitments.

b. Some of the key vendors operating in the Middle East solar PV market include Masdar; ACWA Power International; EDF Renewables; Engie; Siemens Energy AG; JinkoSolar Holding Co. Ltd.; First Solar Inc.; Enerwhere Sustainable Energy DMCC; and Canadian Solar Inc., among others.

b. The key factors driving the Middle East solar PV market include ambitious renewable energy targets, favorable government policies, and the region’s abundant solar resources. Countries such as Saudi Arabia, the UAE, and Oman are accelerating solar adoption to diversify energy portfolios, reduce reliance on fossil fuels, and meet long-term carbon neutrality commitments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.