- Home

- »

- Advanced Interior Materials

- »

-

Military Actuators Market Size, Share, Industry Report, 2030GVR Report cover

![Military Actuators Market Size, Share & Trends Report]()

Military Actuators Market (2020 - 2027) Size, Share & Trends Analysis Report By Component (Servo Valves, Cylinders), By System (Hydraulic, Electrical), By Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-047-3

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Actuators Market Summary

The global military actuators market size was estimated at USD 1.1 billion in 2019 and is projected to reach USD 1.7 billion by 2027, growing at a CAGR of 5.2% from 2020 to 2027. Military and defense applications require high force in a limited space with precision control for force, position, and speed.

Key Market Trends & Insights

- The North America accounted for the largest share of 33.7% in 2019 owing to the rising demand for advanced protection solutions in the defense and military sector.

- The Asia Pacific is projected to expand at the fastest CAGR of 6.1% from 2020 to 2027.

- Based on system, the hydraulic actuators segment dominated the market with a share of 24.5% in 2019.

- The rotary actuator type segment held the largest share of 32.5% in 2019.

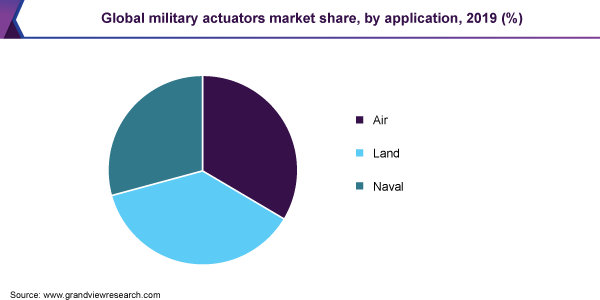

- The land application segment dominated the market with a share of 37.1% in 2019

Market Size & Forecast

- 2019 Market Size: USD 1.1 Billion

- 2027 Projected Market USD 1.7 Billion

- CAGR (2020-2027): 5.2%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

Actuators fulfill all the desired requirements of these military and defense applications, which is projected to fuel the market growth. The rise in terrorist activities around the world, security concerns, political unrest, and the adoption of modern military programs are some of the factors that are likely to propel the demand for military actuators over the forecast period. Technological innovation encourages manufacturers to opt for high-performance products used in various military applications.

The U.S. witnesses growth avenues for military actuators on account of the adoption of advanced technologies, growing R&D initiatives to encourage new product launches, the presence of multinational companies manufacturing actuators, and highly developed industries. The presence of a significant number of multinational companies, such as Curtiss-Wright; Moog Inc.; Parker Hannifin; and Venture Mfg. Co., in the region, also tends to propel the market growth.

Increased insurgency on border tensions in the countries, like China-India, and India-Pakistan, and unrest within the countries, like Iran and Syria, encourage the respective government to integrate modern military programs and invest in personal protection solution. In addition, the adoption of armored vehicles, tanks, and other offshore patrol vehicles, along with various naval and aircraft platforms, has triggered the demand for military actuators.

The rise in demand for actuators from military aircraft is one of the crucial factors favoring the growth of the market. The countries with significant military spending fuel the demand for military actuators, which is projected to continue over the forecast period. However, stringent government regulations on vibration control, motion control noise, and leakage issues are some of the factors restraining market growth.

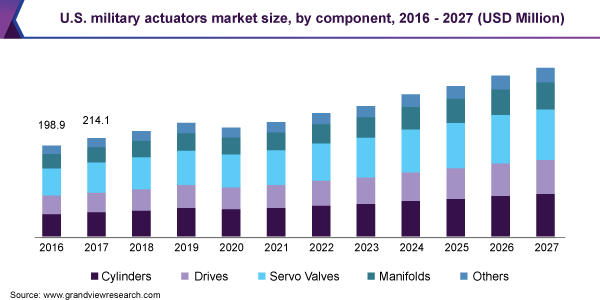

The U.S. is one of the highest military spending countries in the world, which favors the demand for military actuators. The servo valves segment dominated the component category and accounted for 30.16% share of the total revenue in the U.S. market in 2019. The cylinders segment is projected to gain traction over the forecast period.

Component Insights

The global market can be segmented based on component into cylinders, drives, servo valves, manifolds, and others. Servo valves dominated the market with a share of 27.4% in 2019. Components are crucial parts of every actuator as they offer desired characteristics to a product. The need for a specific component in the actuators depends on its use in specific applications for motion control and precision. The components used by the manufacturer may differ based on requirements and the area of application. The rise in the use of direction control valves and electrically modulated valves fuel the growth of servo valves.

Cylinders are projected to witness significant growth in the forecast period owing to their use for storing, transporting, and dispensing gases in defense and military vehicles. Demand for drives is projected to be moderate throughout the forecast period because of their increased use to control the motor speed to reduce shock hazards.

Manifolds are used in surface warships and submarines. Technological development and increasing demand for advanced and upgraded protection equipment from the defense industry encourage the manufacturer to integrate these different components into a system.

System Insights

The global market is segmented based on the system into hydraulic, electric, pneumatic, electromechanical, electrohydraulic, and others. The hydraulic actuators segment dominated the market with a share of 24.5% in 2019. Hydraulic actuators are powered by hydraulic fluids and are most suitable in armor plate and gun positioning applications. Hydraulic systems are projected to be a market leader in the aerospace and defense industry on account of their high power density and low cost. However, issues with their weight, high maintenance, and leakage may hamper the segment growth over the forecast period.

The electrical actuator systems are replacing hydraulic systems. The electrical actuators are anticipated to expand at the fastest CAGR of 5.8% from 2020 to 2027 owing to their improved performance, low maintenance cost, improved security, and lightweight. Electrical actuator systems are widely used in flight control systems, thus witnessing increased demand from the aviation sector.

Electromechanical and electrohydraulic actuators are prominently used in various crucial military applications. These systems produce power on demand and are more efficient than other systems that run continuously to maintain the pressure. Electromechanical actuator systems are used in military ground vehicles and naval applications too.

Type Insights

The type segment is bifurcated into rotary actuators, linear actuators, multi-axis positioning actuators, and semi-rotary actuators. The rotary actuator type segment held the largest share of 32.5% in 2019. Rotary actuators are traditionally being used in valves and gates and precision control applications in the aviation and defense industries.

The linear actuator type is projected to expand at the fastest CAGR of 5.6% from 2020 to 2027. Linear actuator transforms rotary motion to linear one and controls linear motion. Screw-driven,belt-driven, and rod-driven linear actuators are widely used in various military applications. Screw-driven types are used in servo motors and control hardware. Belt-driven linear actuators are used to enhance the operational efficiency of numerous defense weapons and rod-driven actuators are used in the aerospace and defense industry, thus favoring the demand for linear actuators over the forecast period.

Application Insights

The global market can be segmented based on application into air, land, and naval applications. The land application segment dominated the market with a share of 37.1% in 2019 and is expected to maintain its lead over the forecast period. This is attributed to the demand for advanced protection equipment, rising homeland security concerns, and government initiatives that have fueled the demand for military actuators.

The need to emphasize on enhancing the personal protection of armed forces, advancement in the equipment, and its upgraded performances altogether favor the market growth. The regions spend magnificently in the military equipment and related program in order to prove their strength in the military and defense industry, thus fueling the demand for military actuators over the forecast period.

In the application segment, the market is further bifurcated into individual platforms and its actuators. Based on air applications, the market is segmented into the air platform and actuators. Air platform deals with fighter aircraft and helicopters where active vibration control, flight control, weapon bay door drives, engine controls, and utility actuation are used. In terms of land application, it is segregated into a land platform and its actuators.

Similarly, in the naval platform, the market deals with frigates, corvettes, destroyers, and offshore patrolling vehicles in which linear actuators for naval rotary hinge actuators, weapons robots, and other actuators, including electromechanical steam turbine and valve actuators, are used.

Moreover, the government standards of defense are followed rigorously by a number of companies engaged in the development of military associated products. Stringent implementation of regulatory norms, issues related to noise, vibration, and leakage, along with associated maintenance cost of military actuators, are some of the factors that may restrain the market growth in the forecast period.

Regional Insights

North America accounted for the largest share of 33.7% in 2019 owing to the rising demand for advanced protection solutions in the defense and military sector. The U.S., being the top military spender in the world, is occupied with the most advanced and large number of defense equipment, thus contributing significantly to the growth of the market in North America.

Advancements in the technology, large R&D facilities, prominent warfare tactics, and rising investment by the government in the military and defense industry have encouraged various countries to upgrade their armed forces with high protection solutions and advanced ammunition products, thus augmenting the market growth.

Asia Pacific is projected to expand at the fastest CAGR of 6.1% from 2020 to 2027 owing to the prominence of China, India, and other Asian countries. Internal conflicts, homeland security issues, and on-border tensions between neighboring countries, like India-Pakistan, are some of the major factors fueling market growth.

Developing countries in the Asia Pacific including India and China are projected to contribute significantly to the market growth owing to rising political unrest and domestic conflicts. However, the COVID 19 pandemic has affected the overall market. The availability of raw materials used to manufacture military actuators, including metals such as steel and aluminum, has been severely affected by the pandemic, and thus affecting the market growth.

Key Companies & Market Share Insights

The global market is characterized by strong competition on account of the presence of prominent military actuators manufacturers serving major geographies across the globe. Armor manufacturers boost their sales through product innovation, investments, strong research and development facilities, and extended market reach. The market players are significantly investing in their R&D facilities and introducing innovative and advanced products in order to gain a competitive advantage and sustain in the market. Some of the prominent players in the military actuators market include:

-

Curtiss-Wright

-

Moog Inc.

-

Parker Hannifin

-

Triumph Group

-

Nook Industries

-

AMETEK

-

Ultra Motion

-

EME EleKTro-Metall

-

Whippany Actuation Systems

-

Beaver Aerospace & Defense

-

Arkwin Industries

-

Temis SRL

-

Honeywell International Inc.

-

Safran

-

Woodward Inc.

-

Kyntronics

Military Actuators Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.1 billion

Revenue forecast in 2027

USD 1.7 billion

Growth Rate

CAGR of 5.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 – 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, system, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; United Arab Emirates; South Africa

Key companies profiled

Curtiss-Wright; Moog Inc.; Parker Hannifin; Triumph Group; Nook Industries; AMETEK; Ultra Motion; EME EleKTro-Metall; Whippany Actuation Systems; Beaver Aerospace & Defense; Arkwin Industries; Temis SRL; Honeywell International Inc.; Safran; Woodward Inc.; Kyntronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global military actuators market report on the basis of component, system, type, application, and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2027)

-

Cylinders

-

Drives

-

Servo Valves

-

Manifolds

-

Others

-

-

System Outlook (Revenue, USD Million, 2016 - 2027)

-

Hydraulic Actuators

-

Electrical Actuators

-

Pneumatic Actuators

-

Electro-Mechanical Actuators

-

Electrohydraulic Actuators

-

Others

-

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Linear Actuators

-

Rotary Actuators

-

Multi-axis Positioning Actuators

-

Semi-rotary Actuators

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Air

-

Land

-

Naval

-

-

Air Application By Platform Outlook (Revenue, USD Million, 2016 - 2027)

-

Fighter Aircraft

-

Helicopters

-

-

Air Application By Actuators Outlook (Revenue, USD Million, 2016 - 2027)

-

Flight Controls

-

Engine Controls

-

Active Vibration Controls

-

Weapon Bay Door Drives

-

Utility Actuation

-

-

Land Application By Platform Outlook (Revenue, USD Million, 2016 - 2027)

-

Tanks

-

Armored Vehicles

-

Land-based Missiles

-

Others

-

-

Land Application By Actuators Outlook (Revenue, USD Million, 2016 - 2027)

-

Military Ground Vehicles Actuators

-

Electromechanical Gun Elevation Actuators

-

Elevation Actuators

-

Gun and Turret Drive Actuators

-

Traverse Actuators

-

Electromechanical Gun/Turret Drive Actuators

-

-

Naval Application By Platform Outlook (Revenue, USD Million, 2016 - 2027)

-

Frigates

-

Destroyers

-

Corvettes

-

Offshore Patrol Vehicles

-

-

Naval Application By Actuators Outlook (Revenue, USD Million, 2016 - 2027)

-

Linear Actuator for Weapons Robots

-

Naval Rotary Hinge Actuators

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global military actuators market size was estimated at USD 1,137.3 million in 2019 and is expected to reach USD 1091.1 million in 2020.

b. The global military actuators market is expected to grow at a compounded annual growth rate of 5.2% from 2020 to 2027 to reach USD 1,710.5 million in 2027.

b. North America dominated the military actuators market with a share of 33.7% in 2019. This can be attributed to the increasing military expenditure regarding the fortification of armored vehicles.

b. Some key players operating in the military actuators market include Curtiss Wright, Parker Hannifin Corporation, AMETEK, Moog, Inc., Nook Industries, and Temis Srl.

b. Key factors driving the military actuators market growth include the rapid militarization coupled with an increase in the number of moving parts in the armored vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.