- Home

- »

- Next Generation Technologies

- »

-

Military Wearables Market Size, Share, Industry Report, 2030GVR Report cover

![Military Wearables Market Size, Share & Trends Report]()

Military Wearables Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Headgear, Smart Eyewear, Wrist Devices, Headset, Bodywear), By Technology (Communication), By End-user (Land Forces, Naval Forces, Air Forces), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-528-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Wearables Market Size & Trends

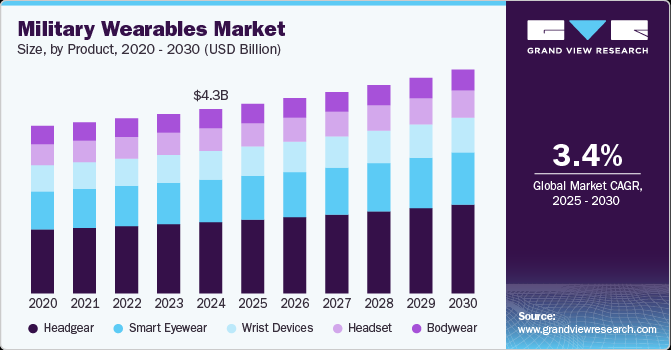

The global military wearables market size was estimated at USD 4,358.3 million in 2024 and projected to grow at a CAGR of 3.4% from 2025 to 2030. The market growth is driven by the increasing adoption of sophisticated military wearables that enhance safety, performance, and efficiency in defense missions. Advanced wearables such as smart helmets, exoskeletons, sensor-integrated body armor, and communication systems are being integrated into modern military strategies to improve situational awareness, real-time communication, and health monitoring for personnel.

The military wearables market is driven by emerging trends such as the increasing use of artificial intelligence (AI) and machine learning (ML) for predictive health monitoring, augmented reality (AR) to enhance battlefield awareness, and smart textiles with integrated sensors for tracking soldier performance. Additionally, there is a growing focus on wearable exoskeletons and sensor-enabled body armor to improve soldier resilience and operational effectiveness. With rising defense expenditures globally, particularly in North America, Europe, and Asia-Pacific, demand for military wearables is expected to grow steadily, creating lucrative opportunities for technology providers and manufacturers.

The market is dominated by key players such as Lockheed Martin, Boeing, Raytheon Technologies, and Thales Group, which heavily invest in research and development to introduce innovative wearable solutions for defense applications. These companies are focusing on developing advanced wearable systems that enhance soldier capabilities, communication, health monitoring, and mission success on the battlefield. Additionally, cybersecurity integration in military wearables is becoming a priority to safeguard sensitive defense data.

Furthermore, the military wearables industry is projected to witness significant growth, powered by ongoing improvements in AI, sensor technologies, and data protection. The demand for wearable solutions is projected to increase as defense forces increasingly turn to these technologies to enhance soldier performance, decrease operational risks, and enhance decision-making capabilities. With an emphasis on mission preparedness and the delivery of real-time intelligence, military wearables will be an essential component to the success of future defense efforts, defining the future of warfare well into 2030.

Product Insights

The Headgear segment accounted for the largest market share of over 37% in 2024. The tactical helmet segment is experiencing the fastest growth, driven by the increasing adoption of advanced technologies to enhance soldier safety and environmental awareness. Modern tactical helmets now incorporate augmented reality (AR) displays, built-in communication systems, and health sensors, enabling soldiers to access real-time battlefield data, maintain seamless communication, and remain operational in high-stress conditions. The growing emphasis on soldier protection, along with technological advancements in lightweight and durable materials, is fueling the widespread adoption of tactical helmets, making them an essential piece of equipment for military units worldwide. As technology continues to evolve, next-generation helmets will feature even more sophisticated capabilities, further reinforcing their importance in modern warfare.

By product type, the smart eyewear segment is the second-fastest growing category in the military wearables industry. Demand for AR goggles and smart glasses has surged as military forces seek to enhance operational effectiveness. These devices provide soldiers with critical real-time information, such as maps, target tracking, and data overlays, directly within their field of vision, making them a key component of future warfare strategies. The rising need for enhanced situational awareness, combined with advancements in AR technology, is accelerating the growth of this segment. Smart vision equipment improves decision-making, navigation, and target accuracy, making it indispensable for troops operating in complex environments. As technology continues to evolve, becoming smaller, more efficient, and more powerful, demand for smart eyewear is expected to see sustained growth in the coming years.

Technology Insights

The communication segment accounted for the largest market share in the military wearables market, driven by the critical need for secure and efficient communication in defense operations. As military forces become increasingly dependent on real-time information sharing, integrated communication systems within wearables-such as tactical helmets and wrist devices-have become indispensable. These systems ensure uninterrupted connectivity in harsh environments, where traditional communication methods may be ineffective. Additionally, the adoption of 5G technology, enhanced encryption techniques, and satellite communication is further fueling the demand for advanced military communication solutions. The ability to securely transmit large volumes of data in real-time remains a top priority, solidifying this segment's leading position in the market.

The network and connectivity segment is projected to be the fastest-growing in terms of CAGR between 2025 and 2030. The rising demand for reliable, high-speed connectivity across a wide range of military wearables is a key growth driver. As armed forces deploy advanced wearables in complex operational environments, the supporting infrastructure must be equally sophisticated to handle high data transfer rates and seamless integration. Innovations in networking technologies, such as mesh networks and secure communication grids, are essential for maintaining connectivity among dispersed troops. Furthermore, the push for interoperability between wearable devices and broader military systems will significantly contribute to this segment’s expansion. In the coming years, advanced connectivity solutions will play a pivotal role in real-time data processing, situational awareness, and overall mission success.

End-user Insights

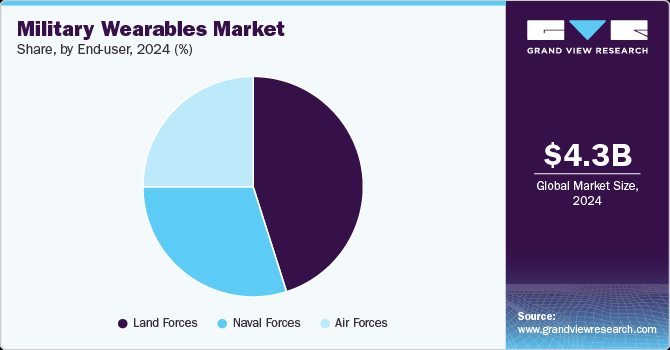

The Land Forces segment is expected to grow at the fastest CAGR between 2025 and 2030, primarily driven by the rising adoption of wearable technology to enhance soldier performance, safety, and combat communication. Advanced wearables such as tactical helmets, intelligent vision equipment, and sensor-integrated body armor are significantly improving operational capabilities, real-time information delivery, and situational awareness. As warfare tactics evolve, land-based troops are at the forefront of integrating next-generation wearable technologies to gain tactical superiority, enhance mobility, and safeguard troop health in various combat environments. This segment is also benefiting from increased defense technology investments and continuous upgrades of troop equipment to meet modern battlefield requirements.

The Naval Forces segment holds the second-largest market share, driven by the growing demand for advanced communication, situational awareness, and health monitoring solutions for seafarers and submariners. Wearable technologies such as communication headsets, tactical headgear, and health monitoring systems are increasingly being used to enhance coordination, crew safety, and operational efficiency in maritime missions. As naval operations become more complex, wearable devices are playing a crucial role in navigation, environmental monitoring, and secure communication. The continuous demand for rugged and technologically advanced wearables, coupled with improvements in their durability for marine environments, positions this segment for steady growth in the coming years.

Regional Insights

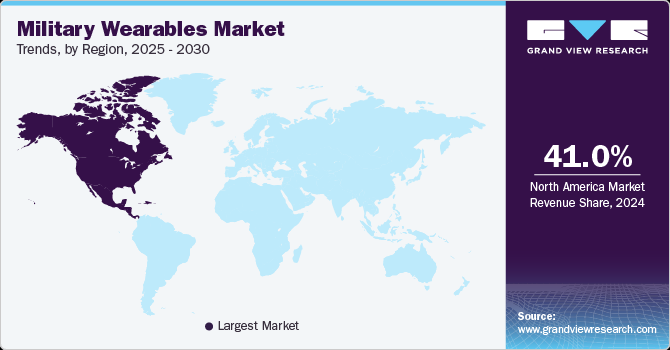

North America military wearables market dominates the global industry, accounting for over 41% of total market revenue. The United States, the world’s largest defense spender, is the primary driver of this growth due to continuous investments in military technology. The U.S. military is rapidly adopting wearables to enhance soldier efficiency, enable real-time communication, and improve health monitoring. Additionally, the integration of Artificial Intelligence (AI), machine learning (ML), and cybersecurity features into military wearables is further accelerating market expansion. With ongoing modernization efforts and a strong focus on technological advancement, North America is expected to maintain its market dominance from 2025 to 2030.

U.S. Military Wearables Market Trends

The U.S. military wearables industry is projected to grow at a CAGR of over 3.9% from 2025 to 2030, fueled by the Department of Defense’s increasing reliance on wearable technologies. The demand for tactical helmets, sensor-integrated body armor, and health monitoring devices is rising as the U.S. military seeks to enhance operational effectiveness, safety, and communication. The integration of real-time analytics, AI-driven decision-making tools, and advanced situational awareness systems is a key growth driver. Moreover, the shift toward individualized, data-driven soldier solutions, such as biometric tracking and fitness monitoring, is gaining traction. High defense spending and strategic collaborations between defense contractors and tech firms continue to drive innovation and adoption in this market.

Europe Military Wearables Market Trends

The European military wearables market is expected to grow at a CAGR of over 3.5% from 2025 to 2030, driven by increasing investments in wearable technologies aimed at enhancing soldier protection and performance. The integration of smart tactical helmets, sensor-equipped body armor, and medical monitoring systems into European defense forces is improving situational awareness, real-time data accessibility, and soldier health tracking. As defense budgets increase and NATO emphasizes technological interoperability, demand for military wearables is expected to rise across the region.

The UK military wearables market is set to witness significant growth, driven by modernization initiatives aimed at improving communication, health monitoring, and decision-making. Wearable devices that track vital signs and predict potential health risks are becoming central to the U.K. military’s strategy for maintaining soldier readiness and security. Additionally, the U.K. is leveraging AI and data analytics to customize wearable technologies to meet individual soldier demands.

The military wearables market in Germany is expanding due to ongoing defense modernization efforts. Germany is investing in smart helmets, performance-tracking wearables, and sensor-integrated uniforms to enhance soldier safety and mission success. These systems allow real-time monitoring of troop health and battlefield performance. Germany’s defense budget growth and commitment to NATO operations will continue driving military wearable adoption in the country.

Asia Pacific Military Wearables Market Trends

The Asia-Pacific military wearables market is projected to grow at the highest CAGR of over 3.2% in 2024, fueled by rising defense budgets, large-scale military modernization programs, and technological advancements. Countries such as China, Japan, and India are actively adopting wearable technologies to enhance soldier performance, improve operational safety, and optimize real-time battlefield decision-making. The increasing demand for smart helmets, health monitoring systems, and tactical wearables is driven by military efforts to enhance situational awareness and reduce risks in high-threat environments. Investments in defense infrastructure and advanced wearable technologies will continue to propel market expansion in the region.

The Japan Military Wearables Market is expanding as the nation is prioritizing the development of its defense capabilities by embracing advanced technology. The Japanese Self-Defense Forces are increasingly using wearable health monitoring systems, performance-tracking devices, and real-time communication tools to enhance troop safety and battlefield efficiency. Japan’s strategic partnerships with global defense forces, along with a strong focus on technological innovation, will sustain long-term market growth.

Military wearables market in china is growing aggressively owing to the nation's strong defense modernization initiative and growing emphasis on soldier technology. China is integrating health-tracking wearables, smart helmets, and sensor-enabled body armor into its military operations to improve situational awareness and mission effectiveness. The country’s advancements in AI, data analytics, and real-time intelligence capabilities are central to enhancing soldier performance and military readiness. With a vast military workforce and an aggressive focus on technology development, China’s market for military wearables is poised for continued expansion.

Key Military Wearables Company Insights

Some of the key players operating in the market are BAE Systems, Elbit Systems, among others.

-

BAE Systems is a defense and aerospace technology company with a broad portfolio of wearable solutions for soldiers. Their wearable military solutions include intelligent helmets, tactical headsets, communication devices, and health-monitoring wearables. BAE's wearable solutions are intended to deliver real-time information, enhance situational awareness, and promote soldier safety on the battlefield. The company also deals in wearable communication solutions that enable soldiers to remain connected in harsh environments. BAE is a dominant company in North America and Europe with a robust defense contracting presence.

-

Elbit Systems offers air, land, and naval technologies for the defense sector. Elbit Systems provides smart eyewear, headmount, and body-worn sensors in the military wearables business. The wearables are aimed at enhancing soldier health monitoring, situational awareness, and battlefield communications. Elbit products are used extensively across the Middle Eastern and European defense markets, where their wearable technology is built into broader defense systems to drive mission success and reduce soldier risk.

Thales Group and Rheinmetall are some of the emerging market participants in the Military Wearables Market.

-

Rheinmetall is specializes in the development of military technologies such as smart clothing, wearable sensors, and tactical vests with health and biometric monitoring. Their wearables enable soldiers to monitor vital signs, physical stress, and communication capabilities in real-time. Rheinmetall also specializes in developing systems that combine wearable technology with weapons systems and armored vehicles. Rheinmetall's wearable solutions are becoming popular in European and Asia-Pacific markets as an integral part of holistic defense solutions.

-

Thales Group provides a diversified range of defense and security solutions with emphasis on communication systems, intelligent helmets, augmented reality (AR) glasses, and medical monitoring devices for soldiers. Thales' wearable technologies aim to enhance soldier efficiency, safety, and performance through essential information provision and situational awareness. These wearables enable real-time data gathering and communication, which is essential for effective military operations. The firm is a major player in the European and Asia-Pacific defense markets, with ongoing innovations to address contemporary soldier requirements.

Key Military Wearables Companies:

The following are the leading companies in the military wearables market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Elbit Systems

- Rheinmetall

- Saab

- Rheinmetall

- Aselsan

- General Dynamics

- Garmin

- Lockheed Martin

- Honeywell International Inc.

- L3harris Technologies Inc.

- Leonardo S.p.A.

Recent Developments

-

In December 2024, BAE Systems has signed a £133 million contract with the Eurofighter Typhoon consortium (Germany, Italy, Spain, and the UK) to continue developing its Striker II Helmet Mounted-Display (HMD). The helmet brings together cutting-edge technologies, such as digital night vision and a color display, to deliver mission-critical information to the pilot in real-time on their visor. The deal will concentrate on developing the capabilities of the helmet through flying trials and solidifying its leadership position in military wearables for flight.

-

In July 2024, Viasat launched the Secure Wireless Hub (SWH), a wearable tactical communications system for dismounted troops. Co-developed with U.S. Special Operations Command (USSOCOM), the system provides a light, single-unit tactical gateway that improves network connectivity and situational awareness for ground troops. Weighing less than one kilogram, the SWH minimizes size, weight, and power (SWaP), easily integrating with body armor. It gives interoperability between a range of devices and supplies secure VPN capability, allowing dependable connectivity and data sharing in near real-time while in combat mode

-

Thales Group partnered with the French Ministry of Armed Forces in February 2024 to provide next-generation integrated combat systems for wearable devices. This includes the creation of connected helmets, body-worn sensors, and intelligent communication systems for soldiers. These wearables are intended to enhance soldier survivability, health monitoring, and data transmission on the battlefield. The objective of the partnership is to keep the French military in the lead of wearable defense technology.

Military Wearables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.48 billion

Revenue forecast in 2030

USD 5.29 billion

Growth rate

CAGR of 3.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE.

Key companies profiled

BAE Systems; Elbit Systems; Rheinmetall; Thales Group; Saab; Aselsan; General Dynamics; Garmin; Lockheed Martin; Honeywell International Inc.; L3harris Technologies Inc.; Leonardo S.p.A.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Military Wearables Market Report Segmentation

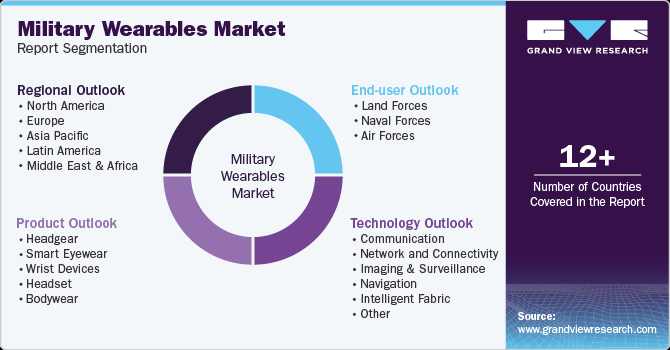

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global military wearables market report based on product, technology, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Headgear

-

Smart Eyewear

-

Wrist Devices

-

Headset

-

Bodywear

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Network and Connectivity

-

Imaging & Surveillance

-

Navigation

-

Intelligent Fabric

-

Other

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Land Forces

-

Naval Forces

-

Air Forces

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global military wearables market size was estimated at USD 4,358.3 million in 2024 and is expected to reach USD 4.48 billion in 2025.

b. The global military wearables market is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2030 to reach USD 5.29 billion by 2030.

b. North America dominates the military wearables industry, accounting for over 41% of total market revenue, owing to the continuous investments in military technology. The U.S. military is rapidly adopting wearables to enhance soldier efficiency, enable real-time communication, and improve health monitoring.

b. Some key players operating in the military wearables market include BAE Systems; Elbit Systems; Rheinmetall; Thales Group; Saab; Aselsan; General Dynamics; Garmin; Lockheed Martin; Honeywell International Inc.; L3harris Technologies Inc.; Leonardo S.p.A.

b. Key factors that are driving the military wearables market growth include the increasing adoption of sophisticated military wearables that enhance safety, performance, and efficiency in defense missions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.