- Home

- »

- Advanced Interior Materials

- »

-

Mine Hoisting System Market Size, Industry Report, 2033GVR Report cover

![Mine Hoisting System Market Size, Share & Trends Report]()

Mine Hoisting System Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Friction Hoists, Drum Hoists, Blair Multi-rope Hoists), By End-use (Underground Mining, Surface Mining), By Mining Type, By Power Source, By Region And Segment Forecasts

- Report ID: GVR-4-68040-792-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mine Hoisting System Market Summary

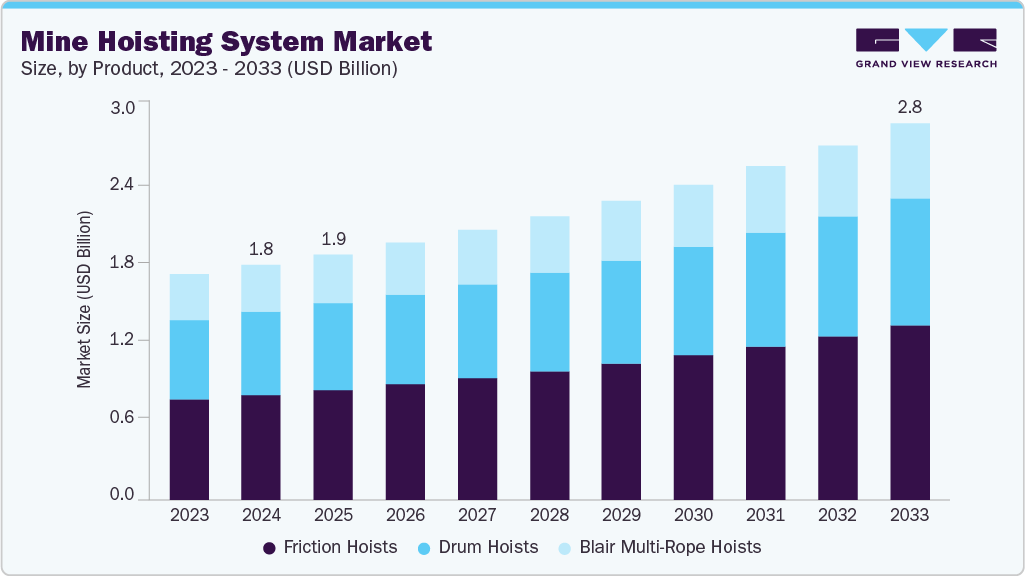

The global mine hoisting system market size was estimated at USD 1,781.7 million in 2024 and is projected to reach USD 2,849.9 million by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The industry is driven by the growing demand for efficient and safe underground mining operations.

Key Market Trends & Insights

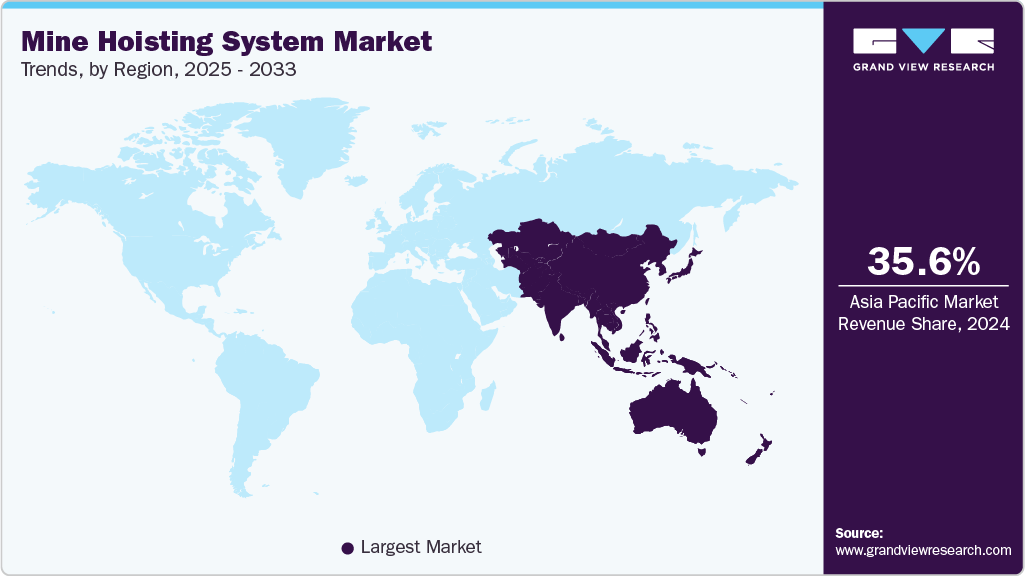

- Asia Pacific dominated the mine hoisting system market with the largest revenue share of 35.6% in 2024.

- The mine hoisting system market in the U.S. is expected to grow at a substantial CAGR of 4.0% from 2025 to 2033.

- By product, the friction hoists segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

- By mining type, the metal mining segment is expected to grow at a significant CAGR of 7.0% from 2025 to 2033 in terms of revenue.

- By end use, the underground mining segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,781.7 Million

- 2033 Projected Market Size: USD 2,849.9 Million

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

Increasing mineral extraction activities, particularly in developing economies, are encouraging the adoption of advanced hoisting technologies. Another major driver is the rising investment in deep mining projects for precious metals, coal, and rare earth minerals. The demand for high-capacity and energy-efficient hoisting systems has surged as mines extend deeper underground. Governments and private players are also focusing on sustainable mining practices, prompting the use of electric and hybrid hoist systems. Furthermore, advancements in material strength and motor technologies are enhancing system reliability and lifespan, further boosting market expansion.

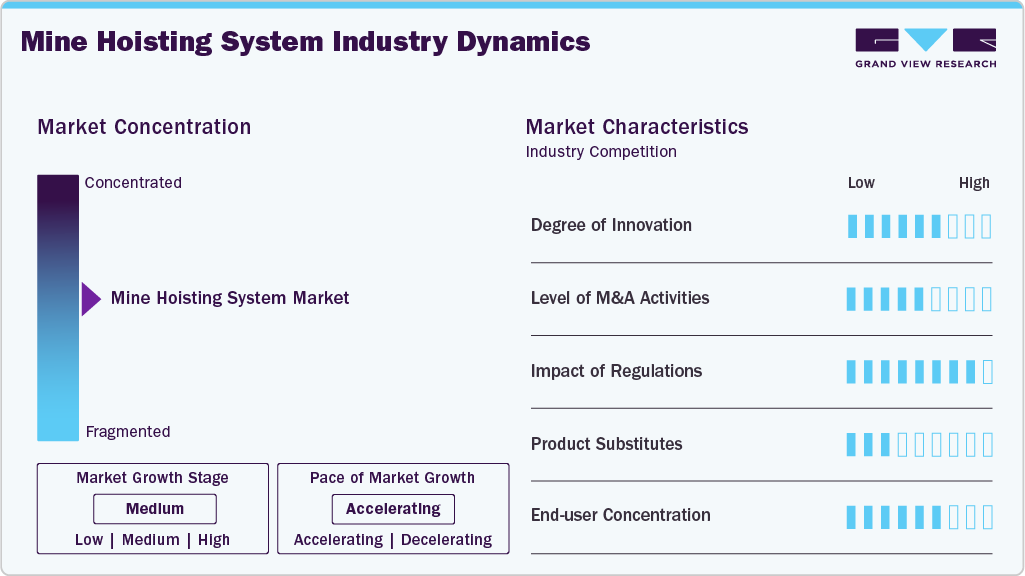

Market Concentration & Characteristics

The industry is moderately concentrated, with a few major players holding a significant share due to their strong technological expertise and established client networks. Companies such as ABB Ltd., FLSmidth & Co. A/S, and SIEMAG TECBERG Group dominate the market through continuous innovation and large-scale project capabilities. However, regional manufacturers are emerging rapidly, offering cost-effective and customized solutions tailored to local mining needs. This balance between global leaders and regional players creates healthy competition, driving advancements in performance, automation, and energy efficiency.

The mine hoisting system industry is characterized by continuous technological innovation, driven by the need for higher efficiency and safety in underground operations. Companies are increasingly integrating automation, IoT-based monitoring, and predictive maintenance into their systems. Advanced materials and energy-efficient motors are also being developed to improve reliability and reduce operational costs. This focus on innovation helps players differentiate themselves and meet the evolving demands of modern mining.

Regulatory frameworks play a critical role in the market, emphasizing worker safety and environmental compliance. Stricter safety standards and mandatory inspections drive companies to adopt advanced, certified hoisting solutions. Environmental regulations also encourage the use of energy-efficient and low-emission technologies. Compliance with these regulations increases operational costs but simultaneously promotes safer and more sustainable mining practices.

The industry exhibits moderate end-user concentration, with large mining companies dominating demand for advanced hoisting systems. These key players prefer customized, high-capacity solutions to support extensive underground operations. At the same time, small and mid-sized mining firms are gradually adopting modern hoists to enhance productivity. This mix of large and smaller end-users encourages suppliers to offer flexible, scalable, and cost-effective systems across different mining scales.

Drivers, Opportunities & Restraints

The mine hoisting system market is primarily driven by the increasing demand for efficient and safe underground mining operations. Growing extraction of minerals and deep mining projects necessitate high-capacity and reliable hoisting solutions. Automation and digitalization in hoist systems further enhance productivity and reduce operational risks. Additionally, the modernization of aging mining infrastructure supports continuous market expansion.

Rising investments in deep and complex mining projects offer significant growth opportunities for advanced hoisting solutions. Technological advancements, such as energy-efficient motors and IoT-enabled monitoring systems, allow companies to provide innovative and customized solutions. Expanding mining activities in emerging economies create untapped regional markets. Strategic partnerships and collaborations also present opportunities for global players to strengthen their presence and service offerings.

High initial capital investment and maintenance costs limit the adoption of advanced hoisting systems, particularly among smaller mining companies. Regulatory compliance and stringent safety standards increase operational complexity and cost. Market growth can also be hindered by fluctuations in mineral demand and mining project delays. Furthermore, the scarcity of skilled labor to operate and maintain sophisticated hoist systems poses a significant challenge.

Product Insights

Friction hoists continue to dominate the market and accounted for a share of 44.8% in 2024 due to their proven reliability and ability to handle heavy loads over long vertical distances. Their widespread adoption in both deep and medium-depth mines ensures stable market demand. The technology’s low maintenance requirements and compatibility with existing mining infrastructure make it a preferred choice for large-scale operations. Moreover, advancements in motor efficiency and control systems have further strengthened their market position.

Blair multi-rope hoists segment is expected to grow at a significant CAGR of 5.3% from 2025 to 2033 in terms of revenue, owing to their capacity for ultra-deep mining applications and higher safety performance. These systems offer greater energy efficiency and smoother operation compared to traditional hoists, attracting deep mining projects. The rising need for automation and precision in mineral extraction has accelerated their adoption. Increasing investment in high-capacity, long-life hoists supports the rapid expansion of this segment.

Mining Type Insights

The non-metallic mineral mining segment dominates the market, as it accounted for a share of 41.7% in 2024 and will continue to grow due to the extensive extraction of materials such as coal, limestone, and phosphate. These operations typically involve large-scale underground mines that require reliable and high-capacity hoisting solutions. The steady global demand for construction and industrial minerals sustains consistent system deployment. Additionally, well-established mining practices and infrastructure in this sector support the continued preference for traditional hoist technologies.

Metal mining is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue, driven by increasing demand for precious and base metals in electronics, construction, and renewable energy sectors. Deep and complex metal mines require advanced hoisting systems like multi-rope and automated hoists for safe and efficient material handling. Technological innovations and high-capacity solutions are being adopted to meet operational challenges. Expanding mining activities in emerging economies further accelerate growth in this segment.

Power Source Insights

Electric-powered hoisting systems dominate the market and accounted for a share of 61.1% in 2024 due to their efficiency, reliability, and suitability for a wide range of mining applications. They offer precise speed control, lower operational costs, and compatibility with automated and digital monitoring systems. Established mining operations prefer electric hoists for their long service life and minimal maintenance requirements. Continuous technological improvements in electric motors and control systems further reinforce their market leadership.

Hydraulic hoists segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue, driven by their ability to provide smooth operation and high torque in deep and complex mining environments. They are particularly suitable for applications requiring frequent starts and stops or variable load handling. Increasing adoption in new mining projects is fueled by advancements in hydraulic efficiency and safety features. Their flexibility, compact design, and energy-saving potential support rapid market growth.

End-use Insights

Underground mining accounted for a share of 65.1% in 2024 due to the critical need for efficient vertical transport of personnel, equipment, and extracted minerals. High-capacity hoists are essential for deep shafts, ensuring operational safety and productivity. Long-established mines continue to upgrade hoisting systems to incorporate automation and monitoring technologies. The reliance on reliable, continuous operations reinforces underground mining as the primary end-use segment.

Surface mining segment is expected to grow at a significant CAGR of 4.8% from 2025 to 2033 in terms of revenue, driven by expanding open-pit and strip mining operations worldwide. The increasing demand for bulk materials, including coal, iron ore, and non-ferrous metals, requires scalable and efficient hoisting solutions. Adoption of modern hoists with energy-efficient and automated features supports faster and safer material handling. Growth in emerging economies and large-scale infrastructure projects further accelerates the demand for surface mining hoisting systems.

Regional Insights

The North America mine hoisting system market is poised to exhibit a CAGR of 4.4% over the forecast period, driven by modernization of aging mines and the adoption of automated hoisting solutions. Investments in safety and environmental compliance are encouraging the replacement of conventional systems with advanced hoists. The presence of well-established mining companies has accelerated the demand for reliable, high-performance equipment. Technological innovation and energy-efficient solutions further support market expansion.

U.S. Mine Hoisting System Market Trends

The mine hoisting system industry in the U.S. has gained ground due to its extensive and well-established mining industry. High demand for coal, metals, and industrial minerals drives investment in advanced hoisting solutions. Modernization of aging mines with automated and energy-efficient systems further strengthens market leadership. Strict safety and environmental regulations also encourage the adoption of reliable, high-performance hoists.

The Canada mine hoisting system industry is experiencing growth in the wake of increasing exploration and deep mining projects, particularly for metals and precious minerals. Investments in advanced hoisting technologies enhance operational efficiency and safety in underground mines. The adoption of automated and digitally monitored systems supports productivity in remote mining regions. Additionally, government incentives and sustainability initiatives boost the demand for modern hoisting solutions.

Europe Mine Hoisting System Market Trends

The mine hoisting system industry in Europe is growing steadily due to the focus on sustainable mining and the development of deep and underground metal mines. Stringent safety and environmental regulations promote the use of advanced, automated hoisting systems. Modernization of existing mining infrastructure is creating demand for high-capacity and reliable solutions. In addition, collaborations between mining companies and equipment manufacturers drive regional market growth.

The Germany mine hoisting system industry dominates the regional market with its strong mining infrastructure and focus on technological innovation. The country’s coal and metal mining sectors drive demand for high-capacity and automated hoisting solutions. Continuous modernization of existing mines ensures the adoption of advanced and energy-efficient systems. Strict safety and environmental regulations further reinforce the use of reliable, compliant hoists.

The mine hoisting system industry in France is experiencing growth on the back of expanding metal and mineral mining projects. Investments in automation and digital monitoring technologies enhance operational efficiency and safety. Modernization of older mines encourages the adoption of advanced hoisting systems. Government support for sustainable mining practices further stimulates market development.

Asia Pacific Mine Hoisting System Market Trends

The mine hoisting system industry in the Asia Pacific exhibited dominance with a share of 35.6% in 2024, fueled by rapid industrialization, expanding mining activities, and abundant mineral reserves in countries such as China, India, and Australia. The region sees heavy investments in modernizing mining infrastructure and adopting advanced hoisting technologies. Large-scale coal and metal mining projects drive consistent demand for high-capacity systems. Government support and increasing foreign investments further strengthen the market position in this region.

The China mine hoisting system industry dominates the regional landscape due to its extensive coal and metal mining operations and large-scale infrastructure projects. High demand for efficient and reliable hoisting solutions drives continuous investment in advanced technologies. Modernization of aging mines and adoption of automation further strengthen market leadership. Government policies supporting industrial growth and safety standards also boost the regional market.

The mine hoisting system industry in India is witnessing significant growth fueled by expanding coal and mineral extraction projects. Investments in deep mining operations and modern hoisting technologies enhance productivity and safety. The adoption of energy-efficient and automated systems is increasing to meet rising industrial demand. Furthermore, government initiatives to promote mining efficiency and infrastructure development support market expansion.

Middle East & Africa Mine Hoisting System Market Trends

The mine hoisting system industry in the Middle East and Africa is witnessing growth due to expanding mining operations and rising demand for coal, minerals, and metals. New mining projects and modernization of existing mines are driving investments in advanced hoisting solutions. The adoption of energy-efficient and automated systems is increasing in line with global mining standards. Regional infrastructure development and foreign partnerships further boost market expansion.

The Saudi Arabia mine hoisting system industry is witnessing growth against the backdrop of increasing investments in mining projects, particularly for minerals and industrial metals. Modernization of existing mines and the adoption of automated hoisting solutions enhance operational efficiency and safety. The demand for energy-efficient and high-capacity systems is rising with large-scale extraction activities. Government support for mining infrastructure development further drives market expansion in the region.

Latin America Mine Hoisting System Market Trends

The mine hoisting system industry in Latin America is emerging as a key market, fueled by increasing exploration and extraction of metals and minerals. Large-scale mining projects in countries like Brazil and Chile drive the adoption of advanced hoists. Investments in mechanization and safety enhancements support market growth. The region also benefits from government initiatives promoting mining efficiency and productivity.

The Brazil mine hoisting system industry is experiencing growth, driven by its expanding metal and mineral mining sector. Large-scale mining projects require high-capacity and reliable hoisting solutions to improve efficiency and safety. Adoption of automated and energy-efficient systems supports productivity in deep and surface mines. Besides, government initiatives promoting mining investment and infrastructure development further boost market demand.

Key Mine Hoisting System Company Insights

Some of the key players operating in the market include ABB Ltd., FLSmidth & Co. A/S, CITIC Heavy Industries Co., Ltd.

-

ABB Ltd. is a leading provider of advanced mine hoisting solutions, specializing in high-capacity electric hoists and automation systems for underground and surface mining operations. The company focuses on integrating digital monitoring, predictive maintenance, and energy-efficient motor technologies into its hoisting equipment. ABB’s solutions are designed to optimize operational productivity while ensuring worker safety in challenging mining environments. Their global presence allows for a rapid deployment of customized systems tailored to regional mining requirements. Continuous R&D investment enables ABB to stay at the forefront of innovative hoist technologies.

-

FLSmidth & Co. A/S delivers specialized mine hoisting systems engineered for heavy-duty mining applications, including deep-shaft and large-scale metal and coal projects. The company emphasizes automation, high-capacity multi-rope hoists, and reliability under extreme operational conditions. FLSmidth integrates energy-saving technologies and real-time monitoring to enhance efficiency and reduce downtime. Its engineering solutions are tailored to meet specific mine layouts and material handling requirements. Strong project management and technical support ensure optimal performance and long-term system sustainability.

Key Mine Hoisting System Companies:

The following are the leading companies in the mine hoisting system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- FLSmidth & Co. A/S

- CITIC Heavy Industries Co., Ltd.

- SIEMAG TECBERG group

- Sichuan Mining Machinery

- INCO engineering

- Hebi Wanfeng Mining Machinery Manufacturing Co., Ltd.

- Hepburn Engineering Inc.

- Konecranes Plc

- Frontier-Kemper Constructors, Inc.

- Timberland Equipment

- Zitrón

- J.D. Neuhaus

- Shengda Mining Equipment Co., Ltd.

- Columbus McKinnon Corporation

Recent Developments

-

In September 2025,Bluestone Mines Tasmania Joint Venture chose ABB to upgrade the primary hoist at Australia’s largest tin mine, the Renison Tin Mine. The modernization will improve safety, reliability, and performance for deep mining operations. ABB will install its SIL 3-certified Safety Plus hoist control system, along with a new DC converter, brake stands, hydraulic power system, and shaft communication setup. The project is scheduled for commissioning in 2026 after five years of joint engineering work.

-

In May 2025, Weir introduced the GEHO Hydraulic Ore Hoisting system, which uses hydraulic pressure to lift slurry, improving efficiency and reducing energy use compared to traditional hoists. Its design minimizes wear, lowers maintenance costs, and increases operational uptime. Tested rigorously, the system provides a sustainable and cost-effective solution for deep mining operations.

Mine Hoisting System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,861.8 million

Revenue forecast in 2033

USD 2,849.9 million

Growth rate

CAGR of 5.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mining type, power source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

ABB Ltd.; FLSmidth & Co. A/S; CITIC Heavy Industries Co., Ltd.; SIEMAG TECBERG Group; Sichuan Mining Machinery; INCO Engineering; Hebi Wanfeng Mining Machinery Manufacturing Co., Ltd.; Hepburn Engineering Inc.; Konecranes Plc; Frontier-Kemper Constructors, Inc.; Timberland Equipment; Zitrón; J.D. Neuhaus; Shengda Mining Equipment Co., Ltd.; Columbus McKinnon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mine Hoisting System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mine hoisting system market report based on product, mining type, power source, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Friction hoists

-

Drum hoists

-

Blair Multi-Rope hoists

-

-

Mining Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Coal mining

-

Metal mining

-

Non-metallic mineral mining

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Hydraulic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Underground mining

-

Surface mining

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mine hoisting system market size was estimated at USD 1,781.7 million in 2024 and is expected to be USD 1,861.8 million in 2025.

b. The global mine hoisting system market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 2,849.9 million by 2033.

b. Underground mining dominates the mine hoisting system market and accounted for a share of 65.1% in 2024 due to the critical need for efficient vertical transport of personnel, equipment, and extracted minerals. High-capacity hoists are essential for deep shafts, ensuring operational safety and productivity. Long-established mines continue to upgrade hoisting systems to incorporate automation and monitoring technologies.

b. Some of the key players operating in the global mine hoisting system market include ABB Ltd., FLSmidth & Co. A/S, CITIC Heavy Industries Co., Ltd., SIEMAG TECBERG Group, Sichuan Mining Machinery, INCO Engineering, Hebi Wanfeng Mining Machinery Manufacturing Co., Ltd., Hepburn Engineering Inc., Konecranes Plc, Frontier-Kemper Constructors, Inc., Timberland Equipment, Zitrón, J.D. Neuhaus, Shengda Mining Equipment Co., Ltd., and Columbus McKinnon Corporation.

b. The global mine hoisting system market is primarily driven by the increasing number of deep mining projects worldwide, which require high-capacity and reliable hoisting solutions for safe and efficient material and personnel transport.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.