- Home

- »

- Next Generation Technologies

- »

-

Mobile Video Surveillance Market Size, Industry Report, 2030GVR Report cover

![Mobile Video Surveillance Market Size, Share & Trend Report]()

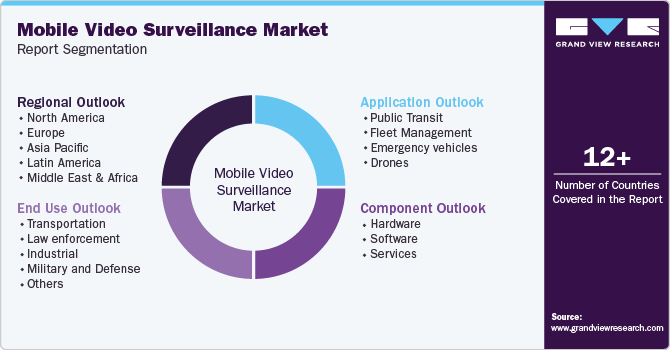

Mobile Video Surveillance Market (2025 - 2030) Size, Share & Trend Analysis Report By Component (Hardware, Software, Services), By Application (Public Transit, Fleet Management, Emergency vehicles, Drones), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-575-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Video Surveillance Market Summary

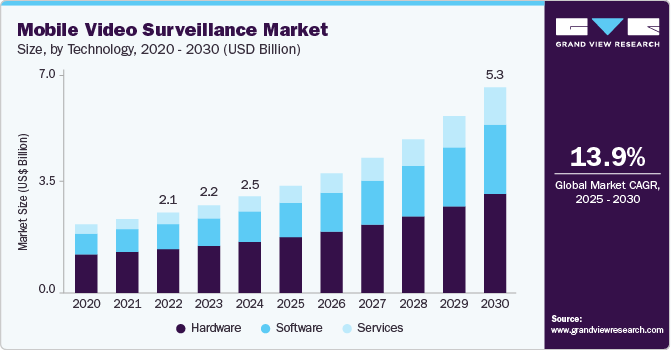

The global mobile video surveillance market size was estimated at USD 2468.0 million in 2024 and is projected to reach USD 5257.1 million by 2030, growing at a CAGR of 13.9% from 2025 to 2030. The market growth is driven by rising demand for enhanced security across industries such as military, defense, emergency vehicles, and fleet management.

Key Market Trends & Insights

- North America mobile video surveillance market dominated the global market and accounted for a 36% share in 2024.

- The mobile video surveillance market in the U.S. is experiencing rapid growth.

- In terms of component, the hardware segment accounted for the largest revenue share of 53.0% in 2024.

- In terms of application, the fleet management segment accounted for the largest market revenue share in 2024.

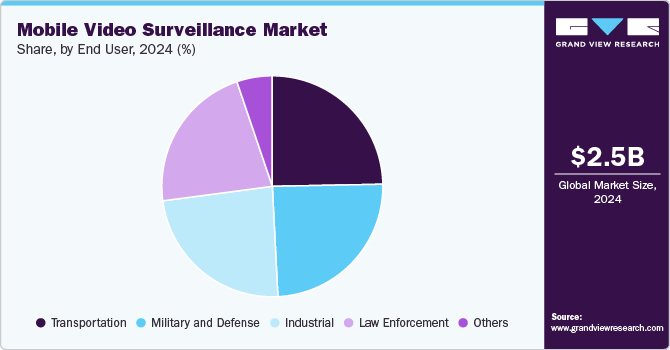

- In terms of end user, the transportation segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2468.0 Million

- 2030 Projected Market Size: USD 5257.1 Million

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

The increasing adoption of mobile video surveillance for monitoring and recording events in motion, enhanced accountability, and cost saving is a major contributor to the market expansion. Additionally, advancements in mobile video surveillance designs, such as camera technologies, video analytics, artificial intelligence, and connectivity, are making these solutions more accessible for broader industrial use.

Mobile video surveillance, specifically offers various factors such as flexibility, scalability, rapid deployment in specific areas, cost effective, and the ability to monitor different environments in the specific areas. It helps in crime prevention by detecting the potential crimes, thus reducing the number of incidents. These advantages make mobile video surveillance more valuable in fields such as transportation, law enforcement, defense, and emergency response. It offers unique feature of changing according to security needs, basically going beyond the limitations of fixed cameras.

The market for mobile video surveillance is witnessing strong growth, driven by increasing demand across both commercial and military sectors. Mobile video surveillance apps such as Ivideon and AlfredCamera let users access live video feeds from security cameras, DVRs, and NVRs directly on their smartphones or tablets. These applications typically offer functions like live monitoring, video recording, and cloud-based storage, allowing users to keep track of activities at their surveillance locations remotely.

Component Insights

The hardware segment accounted for the largest revenue share of 53.0% in 2024, driven by their increasing security concerns, advancements in technology and the need for smarter and efficient surveillance systems. The growing shift toward urban living has increased the demand for public safety solutions, including mobile video surveillance. Rising concerns about crime and overall security are further increasing the need for effective surveillance systems. Additionally, smart city initiatives frequently prefer mobile video surveillance to improve both safety and operational efficiency. A key driver of market expansion is the increasing need for real-time access to surveillance data, enabling quicker response and better situational awareness. The growing demand of mobile video surveillance systems across different industries is driving the increased demand for hardware components such as cameras, monitors, and storage devices.

The services segment registered a CAGR of 17.1% from 2025 to 2030. Mobile video surveillance services offer solutions designed to capture, manage, and analyze video data on mobile from permanent or temporary locations. These services typically include system installation and integration, ongoing maintenance and technical support, real-time video monitoring and management, as well as advanced analytics and reporting capabilities. The growing demand for these services is largely driven by their wide-ranging applications across sectors such as security, transportation, law enforcement, and emergency response. Installation and integration ensure seamless deployment and compatibility with existing systems, while maintenance and support guarantee consistent performance. Real-time monitoring enables effective oversight and incident response, and analytics help extract valuable insights from video data.

Application Insights

The fleet management segment accounted for the largest market revenue share in 2024. The segment is driven due to its role in enhancing safety, monitoring driver behavior, and providing critical evidence in the event of accidents or disputes. Moreover, rising security concerns, urbanization, and the growing demand for real-time monitoring and cloud-based solutions is significantly driving the market growth. Integration with systems like access control and alarms, as well as applications in law enforcement, further supports its growth. Video monitoring improves safety by tracking driving patterns and alerting for risky behaviors, while video telematics enables fleet managers to check driver performance, such as hard braking or swerving. Recorded footage also serves as evidence for resolving incidents quickly and fairly.

Drones segment is projected to grow significantly over the forecast period. The segment growth is driven by increasing security concerns, the need for heightened situational awareness, and the adoption of advanced technologies such as AI and edge computing. Drones offer unbeaten mobility and flexibility, making them ideal for monitoring rapidly changing environments and hard-to-reach locations across various sectors. Their ability to capture and transmit real-time video and data enables faster response times and better decision-making in security operations. As global concerns around terrorism, crime, and public safety intensify, organizations are turning to drone-based surveillance for efficient, real-time monitoring. Technological advancements have further improved drone capabilities, allowing for autonomous operation, advanced data analytics, and threat detection through AI and IoT integration.

End User Insights

The transportation segment accounted for the largest market revenue share in 2024. The rising need for real-time situational awareness and stronger security measures drives this segment. This demand is especially leading in public transportation and commercial fleets, where ensuring passenger safety and monitoring vehicle operations are top priorities. Smart city initiatives are also contributing, as cities increasingly use surveillance systems to improve traffic management, public safety, and the efficient use of resources. Technological advancements in camera systems, video analytics, and connectivity-such as 5G and cloud-based platforms-have significantly enhanced the capabilities and accessibility of mobile surveillance. These solutions offer a cost-effective way to monitor driver behavior, vehicle performance, and cargo shipment security, helping to optimize operations and reduce expenses.

The industrial segment is projected to grow significantly over the forecast period. This segment is driven by urbanization, demand for remote access and monitoring real-time actions, and rising security concerns. For instance, in April 2024, LiveView Technologies (LVT), a key player in customizable mobile surveillance, has announced integration with the Immix security management platform and the launch of two new cameras at ISC West. This partnership enables Immix users to seamlessly control LVT’s advanced mobile surveillance units alongside other security products, streamlining alert management and enhancing situational awareness. The new long-range thermal and panoramic cameras expand coverage capabilities, allowing organizations to secure larger industrial and commercial environments with fewer units.

Regional Insights

North America mobile video surveillance market dominated the global market and accounted for a 36% share in 2024. Driven by technological advancements and rising demand across various industries. Military and defense applications are key drivers of this growth, driven by the increasing demand for advanced surveillance technologies, particularly within the military and defense sectors in the United States and Canada. A significant contributor to this growth is the heightened use of surveillance systems along regional and international borders to combat terrorism and criminal activities.

U.S. Mobile Video Surveillance Market Trends

The mobile video surveillance market in the U.S. is experiencing rapid growth, driven by factors such as technological advancements-particularly in artificial intelligence, the Internet of Things (IoT), and cloud computing, which are enabling more intelligent, real-time video analytics and seamless remote access. Government support through funding and policy initiatives is further boosting the market, and the number of surveillance camera installations are increasing across the country. Key trends include the use of AI-powered analytics to detect and respond to suspicious behavior, cloud-based platforms that enhance accessibility and scalability, and the integration of mobile surveillance with other security systems like access control and alarms to create strong, multi-layered security infrastructures.

Europe Mobile Video Surveillance Market Trends

The European mobile video surveillance market is witnessing steady growth, driven by the shift toward cloud-based solutions for greater flexibility and scalability, increased integration with technologies like AI and IoT, and a rising focus on environmentally sustainable surveillance practices. Mobile video surveillance solutions are becoming more integral to operations as industries undergo digital transformation to enhance efficiency and competitiveness. Heightened security concerns across sectors such as public transportation, construction, and manufacturing are also driving demand, further supported by government regulations mandating surveillance in certain areas. Market players like Axis Communications, Motorola Solutions, and Calipsa are leveraging strategic partnerships to strengthen their positions and boost profitability.

Asia Pacific Mobile Video Surveillance Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. As cities across the region expand, the demand for effective and scalable security solutions, including mobile video surveillance, continues to rise to manage urban development and ensure public safety. Growing crime rates and a heightened awareness of security needs are further rising the adoption across both governmental and industrial sectors. The expansion of transportation infrastructure, such as public transit systems and road networks, requires strong monitoring solutions to safeguard these assets. Additionally, increased security awareness and supportive government policies aimed at strengthening public safety are contributing to the market's upward reach throughout the region.

Key Mobile Video Surveillance Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Hikvision, is a global player in integrated security and AI-powered digitalization solutions, serving a wide range of industries with advanced technologies. The company specializes in scenario-based security, offering innovative products that leverage the AIoT (Artificial Intelligence of Things) to enhance monitoring, automation, and overall safety. In the field of mobile video surveillance, Hikvision provides a comprehensive portfolio, including mobile cameras designed for on-board monitoring with anti-vibration and fire-proof features to ensure reliability in demanding environments. These cameras come in various formats such as CVBS, TVI, and AHD, delivering high-quality images and smart functionality for analog systems.

-

Dahua Technology Co., Ltd founded in 2001 in Hangzhou, China, and is a globally recognized provider of video-centric AIoT solutions and services. The company delivers a broad range of security products, such as surveillance cameras, recording devices, and AI-powered analytics, all built on an open integration platform. Serving diverse industries including transportation, retail, banking, and government, Dahua focuses on innovation and high-quality solutions. With a presence in more than 180 countries, the company operates through a vast network of international offices and partners.

Key Mobile Video Surveillance Companies:

The following are the leading companies in the mobile video surveillance market. These companies collectively hold the largest market share and dictate industry trends.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd

- Axis Communications AB.

- Hanwha Vision Co., Ltd.

- Hi-Focus

- Bosch Sicherheitssysteme GmbH

- Avigilon (Motorola Solutions, Inc.)

- Honeywell International Inc.

- Panasonic Holdings Corporation

- CP PLUS International.

- Teledyne FLIR LLC

Recent Developments

-

In March 2025, Hi-Focus announces the launch of its advanced AI-powered CCTV solutions for public transport, designed to enhance passenger safety, prevent crime, and boost operational efficiency. Featuring real-time monitoring, HD night vision, and instant alerts, these systems help deter criminal activity, optimize routes, and ensure swift incident response. By instilling greater confidence among commuters, Hi-Focus CCTV technology is transforming public transport into a safer and more efficient experience for all.

-

In September 2024, Panasonic Marketing Middle East & Africa (PMMAF) has introduced a new range of CCTV products, including eight network cameras and two network video recorders, to modify small and medium-sized businesses as well as residential users. This delivers high-quality imaging, advanced security capabilities, and a dedicated mobile application compatible with iOS and Android for viewing live and recorded footage. The system features high-definition recording, intelligent video analytics, and strong privacy measures, offering reliable protection for homes, retail stores, and office environments.

Mobile Video Surveillance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2737.2 million

Revenue forecast in 2030

USD 5257.1 million

Growth rate

CAGR of 13.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end user and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Hangzhou Hikvision Digital Technology Co., Ltd.;

Dahua Technology Co., Ltd; Axis Communications AB.;

Hanwha Vision Co., Ltd.; Hi-Focus; Bosch Sicherheitssysteme GmbH; Avigilon (Motorola Solutions, Inc.); Honeywell International Inc.; Panasonic Holdings Corporation; CP PLUS International; Teledyne FLIR LLC;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Video Surveillance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile video surveillance market report based on component, application, end use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Transit

-

Fleet Management

-

Emergency vehicles

-

Drones

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Law enforcement

-

Industrial

-

Military and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile video surveillance market size was estimated at USD 2,468.0 million in 2024 and is expected to reach USD 2,737.2 million in 2025.

b. The global mobile video surveillance market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2030 to reach USD 5,257.1 million by 2030.

b. North America dominated the mobile video surveillance market with a share of 36.0 in 2024. Driven by technological advancements and rising demand across various industries. Military and defense applications are key drivers of this growth, by the increasing demand for advanced surveillance technologies, particularly within the military and defense sectors in the United States and Canada.

b. Some key players operating in the mobile video surveillance market include Hangzhou Hikvision Digital Technology Co., Ltd.; Dahua Technology Co., Ltd; Axis Communications AB.; Hanwha Vision Co., Ltd.; Hi-Focus; Bosch Sicherheitssysteme GmbH; Avigilon (Motorola Solutions, Inc.); Honeywell International Inc.; Panasonic Holdings Corporation; CP PLUS International.; Teledyne FLIR LLC

b. Key factors that are driving the market growth specifically offers various factors such as flexibility, scalability, rapid deployment at specific areas, cost effective, and the ability to monitor different environments in the specific areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.