- Home

- »

- Advanced Interior Materials

- »

-

Modular Chillers Market Size & Share, Industry Report, 2033GVR Report cover

![Modular Chillers Market Size, Share & Trends Report]()

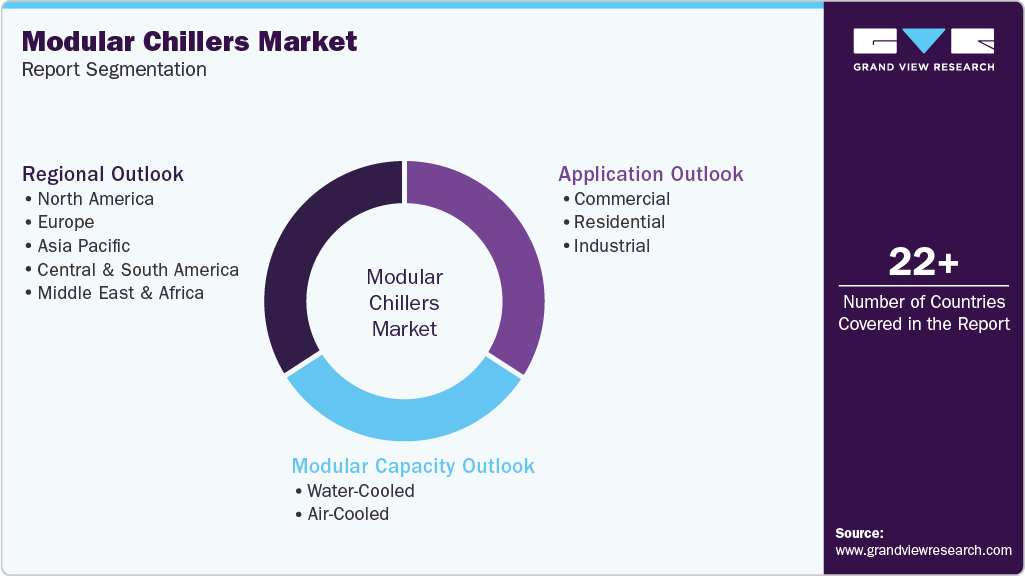

Modular Chillers Market (2025 - 2033) Size, Share & Trends Analysis Report By Modular Capacity (Water-Cooled, Air-Cooled), By Application (Commercial, Residential, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-901-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Modular Chillers Market Summary

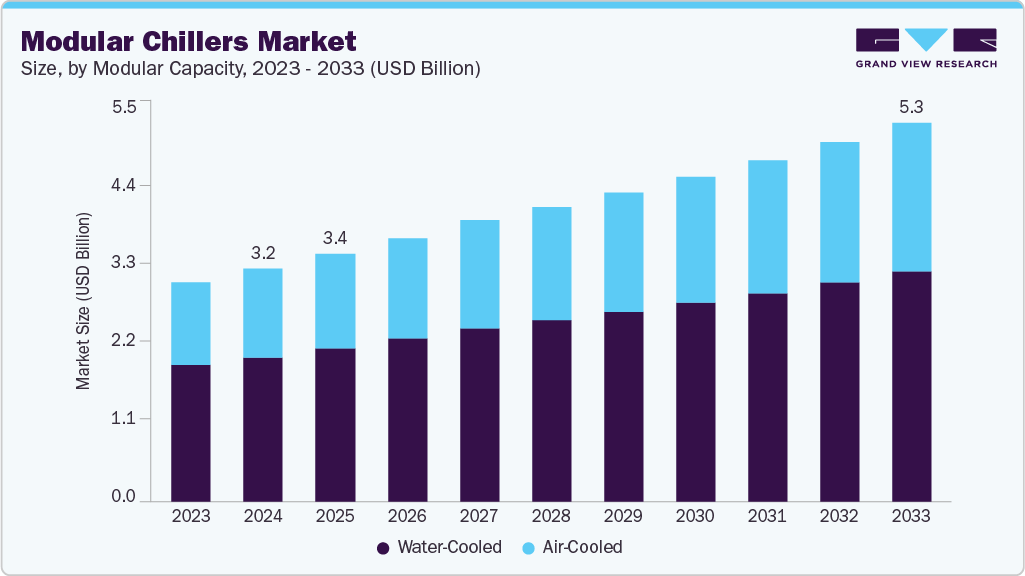

The global modular chillers market size was estimated at USD 3,247.5 million in 2024 and is projected to reach USD 5,280.8 million by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The growing demand for energy-efficient buildings, driven by increasing awareness of environmental degradation and strict government regulations, is expected to boost the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the modular chillers market with the largest revenue share of 45.9% in 2024.

- The modular chillers industry in the U.S. is expected to grow at a substantial CAGR of 5.8% from 2025 to 2033.

- By modular capacity, the air-cooled segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,247.5 Million

- 2033 Projected Market Size: USD 5,280.8 Million

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest Growing Region

Rising recognition of the benefits of energy-efficient systems and the negative impacts of fossil fuel use, along with advancements in energy-saving technologies, will support product adoption. The development of privately-owned construction firms in the UAE, India, and China is anticipated to augment the spending in the construction industry over the forecast period. According to IBEF, India’s real estate sector is projected to grow significantly, reaching a market size of USD 1 trillion by 2030, up from USD 200 billion in 2021. This expansion is expected to contribute around 13% to the country’s GDP, driven by urbanization, infrastructure development, and increased housing and commercial demand.

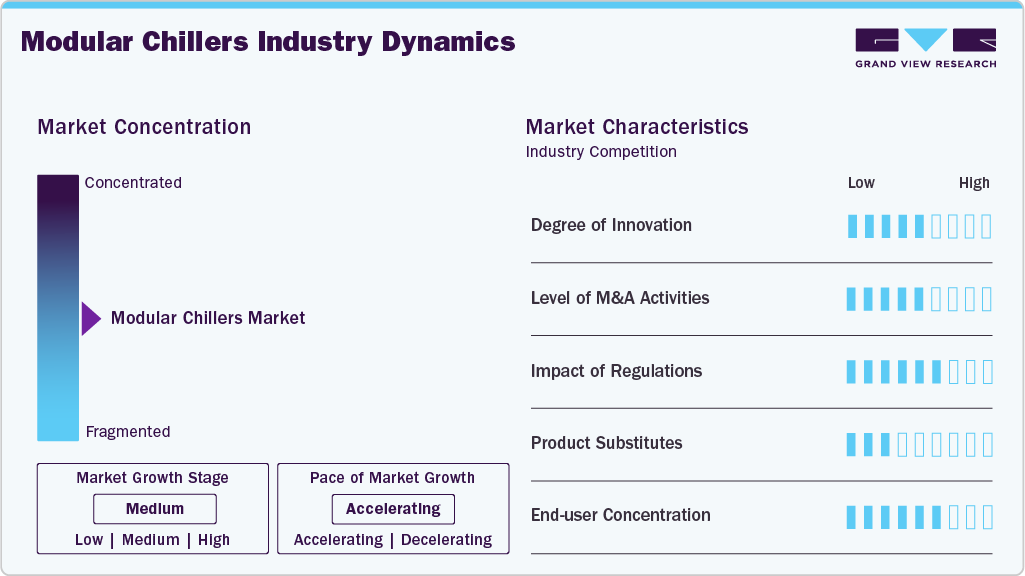

Market Concentration & Characteristics

The global modular chillers market is moderately fragmented, with a mix of global and regional players offering a variety of products. While established companies dominate with broad portfolios and extensive distribution networks, several mid-sized and local manufacturers compete by offering customized solutions, energy-efficient designs, or lower pricing. This competitive environment creates innovation and price variation but limits any single player’s dominance. The market’s moderate fragmentation also reflects varying regional demands, regulatory standards, and applications across commercial, industrial, and institutional sectors.

The global modular chillers industry exhibits a high degree of innovation, focused on energy efficiency, smart controls, low-GWP refrigerants, and compact design. Manufacturers are integrating IoT-enabled monitoring, variable-speed compressors, and modular scalability to meet changing building demands. Environmental goals also drive innovation, as companies develop solutions that align with evolving energy standards and building performance requirements.

Merger and acquisition activities are driven by the need to expand geographic reach, enhance product portfolios, and access advanced technologies. Larger players are acquiring regional manufacturers to strengthen local presence, while others seek partnerships for R&D capabilities. For instance,in July 2023, MODINE MANUFACTURING COMPANY made a significant announcement regarding the acquisition of Napps Technology. As part of this acquisition, MODINE acquired the Jetson product line from Napps Technology. The Jetson product line includes a wide range of cooling solutions, such as water-cooled condensing units, modular air-cooled and water-cooled chillers, air-cooled chillers, and packaged air-cooled chillers split systems.

Regulations focusing on energy efficiency, emissions reduction, and refrigerant phase-outs are significantly shaping the modular chillers market. Governments worldwide are enforcing stricter building codes and environmental standards, prompting manufacturers to redesign systems with eco-friendly refrigerants and higher efficiency ratings. Compliance requirements are pushing innovation and influencing purchasing decisions, especially in commercial and institutional construction and renovation projects.

Drivers, Opportunities & Restraints

The growing demand for energy-efficient HVAC systems in commercial and institutional buildings is a major driver for the modular chillers market. Modular chillers offer scalability, flexibility, and reduced energy consumption, making them ideal for green buildings. Their ease of installation and ability to operate under partial loads align with sustainability goals and rising environmental awareness among building owners.

An emerging opportunity in the modular chillers industry lies in smart building integration. As demand for IoT-enabled HVAC systems grows, modular chillers can be equipped with advanced monitoring, diagnostics, and remote control features. This supports predictive maintenance, energy optimization, and enhanced occupant comfort, creating strong growth potential in modern infrastructure projects and intelligent building management systems.

High initial cost compared to traditional systems creates a significant barrier to modular chillers. Although long-term energy savings are significant, the upfront investment can be a barrier, especially in cost-sensitive regions. Additionally, the need for skilled labor for system integration and maintenance may hinder adoption in areas lacking technical expertise or adequate training resources.

Modular Capacity Insights

Water-cooled dominated the modular chillers market in 2024, with the highest revenue share of 58.0% due to its higher energy efficiency and suitability for large-scale commercial and industrial applications. Water-cooled chillers offer better heat transfer and lower operational costs, making them preferred in regions with access to reliable water sources. Increasing adoption in data centers, hospitals, and manufacturing facilities, along with growing emphasis on sustainability, will drive demand for water-cooled modular chillers.

The air-cooled segment of modular chillers is anticipated to expand rapidly due to its easier installation, lower upfront costs, and suitability for small to medium-sized applications. Air-cooled systems are favored in areas with limited water availability or strict water usage regulations. Their flexibility and lower maintenance requirements make them ideal for retrofit projects and decentralized cooling needs, contributing to growth across commercial buildings and urban infrastructure development.

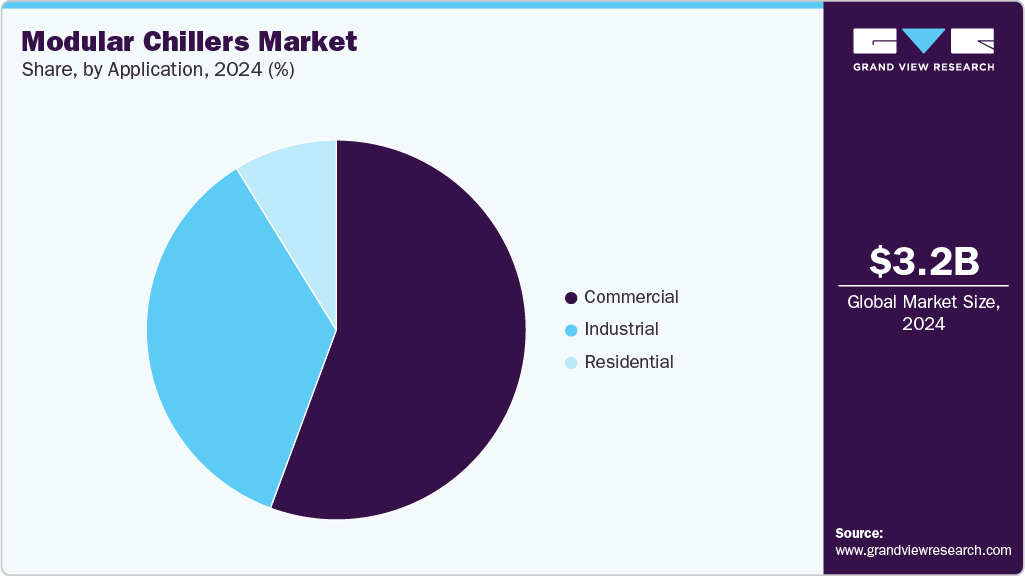

Application Insights

The commercial segment dominated the modular chillers industry in 2024, with the largest revenue share of 44.9%, driven by increasing demand from office buildings, shopping malls, hotels, and hospitals. The need for reliable, scalable cooling solutions that support energy efficiency and comply with green building standards is rising. Modular chillers offer flexibility and ease of maintenance, making them ideal for commercial applications with variable cooling loads and expanding infrastructure.

The industrial segment is projected to expand due to rising manufacturing activities and the need for precise temperature control in processes like pharmaceuticals, food processing, and chemicals. Modular chillers provide scalable cooling capacity, energy savings, and reduced downtime, which are critical for industrial operations. Increasing investments in automation and sustainability initiatives in industrial facilities further support the adoption of modular chillers to enhance operational efficiency and comply with environmental regulations.

Regional Insights

The North America modular chillers market is expected to grow at a 5.7% CAGR during the forecast period, due to increasing construction and renovation projects focused on energy savings and sustainability. Strict environmental regulations and government incentives encourage the adoption of efficient cooling systems. Technological improvements and growing awareness of operational cost reductions further drive demand across commercial and institutional sectors in the region.

U.S. Modular Chillers Market Trends

The modular chillers industry in the U.S. is expected to grow at a CAGR of 5.8% from 2025 to 2033. The U.S. is poised for strong growth with rising demand from offices, healthcare facilities, and data centers. Efforts to reduce carbon emissions and improve energy efficiency promote the use of modular cooling solutions. Supportive policies and advancements in smart technology also play key roles in increasing market adoption across various industries.

The Mexico modular chillers market is anticipated to experience growing demand due to urbanization and expanding industrial activities. Increased investment in commercial buildings and manufacturing plants drives demand for energy-saving cooling equipment. Government initiatives encouraging sustainability and efficiency help accelerate the adoption of modular chillers, supporting steady market growth across multiple sectors.

Europe Modular Chillers Market Trends

The Europe modular chillers industry is witnessing strong growth, driven by strong environmental regulations and a shift toward energy-efficient building solutions. The region’s focus on reducing carbon emissions and adopting sustainable technologies is encouraging the use of modular cooling systems. Increased investments in commercial and public infrastructure projects further support market expansion across multiple countries.

Germany’s modular chillers market is growing rapidly due to strict energy efficiency standards and strong government support for sustainable construction. Growing demand from commercial buildings, healthcare, and industrial sectors fuels adoption. Innovations in energy-saving technologies and the push for climate-neutral buildings make modular chillers a preferred solution in the country’s efforts to reduce environmental impact.

The modular chillers market in the UK isgrowing as construction and renovation projects increasingly focus on sustainability and energy efficiency. Government incentives and regulations promoting low-carbon buildings drive demand. The rise in commercial infrastructure and retrofit projects, combined with advancements in cooling technologies, supports steady growth in the adoption of modular chiller systems across the country.

Asia Pacific Modular Chillers Market Trends

Asia Pacific dominated the modular chillers industry with a revenue share of 45.9% in 2024, due to urbanization, industrial expansion, and increasing demand for energy-efficient cooling solutions. According toUN-Habitat, by 2050, Asia and the Pacific’s urban population is projected to increase by 50%, adding around 1.2 billion people. Rising investments in commercial buildings and infrastructure projects, along with government initiatives promoting sustainability, drive adoption. Technological advancements and growing environmental awareness support market growth across diverse countries in the region.

China leads the Asia Pacific modular chillers market, driven by rapid urban development and industrial growth. Strict government regulations on energy efficiency and carbon emissions encourage the use of advanced cooling technologies. Increasing construction of commercial complexes, data centers, and manufacturing facilities boosts demand, while local manufacturers innovate to meet evolving market needs.

The India modular chillers market is growing rapidlydue to accelerating infrastructure development and industrialization. Rising commercial construction and government initiatives promoting energy-efficient technologies support adoption. The demand for reliable, scalable cooling solutions in offices, hospitals, and manufacturing plants is increasing. Growing environmental awareness and modernization efforts are expected to further boost market expansion in India.

Middle East & Africa Modular Chillers Market Trends

Middle East & Africa is poised for steady growth in the modular chillers industry due to expanding commercial infrastructure and increasing focus on energy-efficient cooling solutions in hot climates. Government initiatives promoting sustainability and investments in smart city projects drive adoption. The region’s construction boom, particularly in commercial and industrial sectors, supports the steady growth of modular chillers.

The Saudi Arabia modular chillers market is anticipated to see strong growth during the forecast period, due to large-scale infrastructure projects, including commercial developments, hospitals, and industrial facilities. The government’s Vision 2030 plan emphasizes sustainability and energy efficiency, encouraging the use of modular chillers. Rising demand for reliable, scalable cooling solutions in harsh climates contributes to strong market growth.

Central & South America Modular Chillers Market Trends

The modular chillers industry in Central & South America is growing steadily, due to increasing urbanization and industrialization. Rising investments in commercial infrastructure and government initiatives promoting energy efficiency support market expansion. The demand for adaptable and efficient cooling solutions in retail, healthcare, and manufacturing sectors is driving growth across the region.

Brazil’s modular chillers market is expanding with the growing construction of commercial buildings and industrial facilities. Government policies encouraging sustainable energy use and environmental conservation promote the adoption of energy-efficient cooling systems. Increasing urban development and modernization efforts, combined with technological advancements, are contributing to the steady market growth in Brazil.

Key Modular Chillers Company Insights

Some of the key players operating in the market include Trane Technologies plc, GREE ELECTRIC APPLIANCES INC., Carrier, FRIGEL FIRENZE S.p.A.

-

Trane Technologies plc is a global climate innovation company focused on developing sustainable solutions for buildings, homes, and transportation. Headquartered in Ireland, it operates under major brands such as Trane and Thermo King. The company designs and manufactures energy-efficient systems for heating, cooling, and ventilation, including modular chillers and building control technologies.

-

GREE Electric Appliances Inc., based in Zhuhai, China, manufactures residential and commercial air conditioning systems. The company produces a wide range of products, including modular chillers, VRF systems, and smart building solutions. GREE operates its own R&D centers and manufacturing facilities, ensuring full control over innovation and quality.

Key Modular Chillers Companies:

The following are the leading companies in the modular chillers market. These companies collectively hold the largest market share and dictate industry trends.

- Trane Technologies plc

- GREE ELECTRIC APPLIANCES, INC.

- Carrier

- FRIGEL FIRENZE S.p.A.

- Midea Group

- Multistack International Limited.

- Daikin

- Johnson Controls

- Haier Group

- Mitsubishi Electric Corporation

- Nanjing TICA climate solutions co., ltd

- Arctic Chiller Group

- LG Electronics

- Aermec S.p.A.

- Smardt

Recent Developments

-

In May 2025, Smardt launched the ECO AeroMod, a high-efficiency modular air-cooled chiller platform designed for scalable performance, energy savings, and operational flexibility across various commercial and industrial cooling applications.

-

In May 2024, Carrier India introduced the 30RB Air-Cooled Modular Scroll Chiller, manufactured in India to meet the specific demands of the local market. Engineered for enhanced cooling efficiency and operational reliability.

Modular Chillers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,453.4 million

Revenue forecast in 2033

USD 5,280.8 million

Growth rate

CAGR of 5.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modular capacity, application, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Trane Technologies plc; GREE ELECTRIC APPLIANCES, INC.; Carrier; FRIGEL FIRENZE S.p.A; Midea Group; Multistack International Limited; Daikin; Johnson Controls; Haier Group; Mitsubishi Electric Corporation; Nanjing TICA Climate Solutions Co., Ltd; Arctic Chiller Group; LG Electronics; Aermec S.p.A; Smardt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modular Chillers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global modular chillers market report based on modular capacity, application, and region:

-

Modular Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Water-Cooled

-

<50kW

-

51-100kW

-

101-200kW

-

201-300kW

-

>301kW

-

-

Air-Cooled

-

<50kW

-

51-100kW

-

101-200kW

-

201-300kW

-

>301kW

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Corporate Offices

-

Data Centers

-

Public Buildings

-

Mercantile & Service

-

Healthcare

-

Others

-

-

Residential

-

Industrial

-

Chemical

-

Food & Beverage

-

Metal Manufacturing & Machining

-

Medical & Pharmaceutical

-

Plastics

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global modular chillers market size was estimated at USD 3,247.5 million in 2024 and is expected to be USD 3,453.4 million in 2025.

b. The global modular chillers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 5,280.8 million by 2033.

b. Water-cooled dominated the market in 2024, accounting for the highest revenue share at 62.1% due to its higher energy efficiency and suitability for large-scale commercial and industrial applications. Water-cooled chillers offer better heat transfer and lower operational costs, making them preferred in regions with access to reliable water sources.

b. Some of the key players operating in the global modular chillers market include Trane Technologies plc, GREE ELECTRIC APPLIANCES INC., Carrier, FRIGEL FIRENZE S.p.A., Midea Group, Multistack International Limited, Daikin, Johnson Controls, Haier Group, Mitsubishi Electric Corporation, Nanjing TICA Climate Solutions Co., Ltd, Multistack LLC, LG Electronics, Aermec S.p.A., Smardt.

b. Key factors driving the global modular chillers market include increasing demand for energy-efficient cooling systems, rising construction of commercial buildings, growing focus on sustainability, government regulations promoting green technologies, and the need for flexible, scalable solutions in modern infrastructure projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.