- Home

- »

- Distribution & Utilities

- »

-

Molded Case Circuit Breakers Market Size Report, 2030GVR Report cover

![Molded Case Circuit Breakers Market Size, Share & Trends Report]()

Molded Case Circuit Breakers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Miniature, Molded Case), By Power Range (0-75A, 75-250A), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-379-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Molded Case Circuit Breakers Market Summary

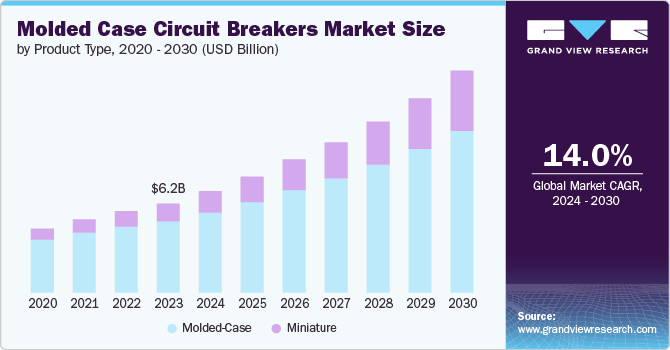

The global molded case circuit breakers market size was estimated at USD 6.23 billion in 2023 and is projected to reach USD 15.52 billion by 2030, growing at a CAGR of 14.0% from 2024 to 2030. Increasing investments in electricity generation and transmission is propelling market growth.

Key Market Trends & Insights

- The Asia Pacific dominated the industry, accounting for over 35.0% of the global market's revenue share in 2023.

- The China molded case circuit breakers market is expected to register lucrative growth amidst growing electricity generation.

- Based on product type, the molded case held a revenue share of around 80% of the global market in 2023.

- Based on power range, the 75-250A held the largest revenue share of 48% in 2023.

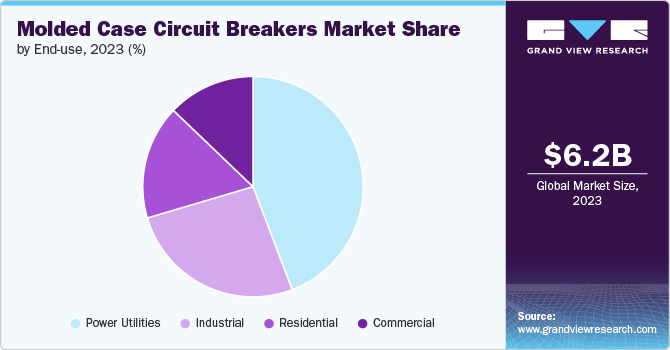

- Based on end-use, the residential is expected to register a CAGR of 14.3% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6.23 Billion

- 2030 Projected Market USD 15.52 Billion

- CAGR (2024-2030): 14.0%

- Asia Pacific: Largest market in 2023

A molded-case circuit breaker (MCCB) protects the electrical circuit from excessive current, which can cause overload or short circuits. Compared to a circuit breaker, an MCCB possesses a higher interrupting capacity and can thus handle larger loads. This ability makes it more suitable for commercial and industrial applications.

Drivers, Opportunities & Restraints

Rising electricity generation worldwide is the major growth driver for the market. According to Enerdata, world power generation increased by 2.6% in 2023 on a year-on-year (y-o-y) basis, maintaining a consistent growth of over 2.5% during the 2010-2019 period. A major growth of 6% was witnessed in BRICS, holding a 45% share of world power generation. Countries including China, India, and Brazil registered a y-o-y growth of 6.9%, 6.9%, and 4.8%, respectively.

Further, rising investments in data centers are anticipated to provide expansion opportunities for MCCBs. Data centers require a secure and dependable power infrastructure, and MCCBs become essential in such cases as they help maintain a continuous flow of operations against mishaps like electrical failures. Thus, an increase in data centers is expected to aid demand for MCCBs. For instance, in April 2024, Google announced an investment of USD 3 billion for building or expanding data center campuses in Virginia and Indiana.

The market growth faces hindrances due to the high cost of installing MCCB. Factors such as high ampere, a requirement for robust components, additional features like ground fault protection and remote monitoring capabilities, brand value, and labor costs add to the overall price of circuit breakers. The MCCBs are designed for applications that need high ampere, which makes them more expensive compared to standard circuit breakers.

Product Type Insights

“Molded case held a revenue share of around 80% of the global market in 2023.”

Miniature circuit breakers (MCB) and MCCB work similarly. The MCCB, however, can prevent short circuits and electrical overloads against high currents, whereas the MCB is an automatic electrical switch that works around low-voltage circuits. In terms of current ratings, MCCBs range up to 1600 A, whereas MCBs go up to 125A.

MCCBs have high interrupting capacity for demanding applications and also have remote operation options, which are not present for MCBs. However, MCBs have a faster turnaround time and are used in residential, commercial, and light industrial applications, which have lower current requirements.

Power Range Insights

“75-250A held the largest revenue share of 48% in 2023.”

The 75-250A power range dominates the market due to its versatility and widespread use in commercial and industrial sectors. This range is essential for protecting against overloads and short circuits, vital in construction, manufacturing, and infrastructure. Its reliability and efficiency make it the top choice for engineers and facility managers.

On the other hand, the segment above 250A is essential for large industrial and infrastructure projects, requiring robust power management systems. With the expansion of industries and the rising demand for power, both of these segments are poised for steady growth. This growth is fueled by technological advancements and stricter safety and reliability standards. For instance, in 2023, Schneider Electric, a leading global player in MCCB market, announced the launch of its new Masterpact MTZ3 MCCB series. This strategic initiative is aimed at addressing the growing demand for high-performance, energy-efficient, and digitally enabled circuit breakers across various industries.

End-use Insights

Residential is expected to register a CAGR of 14.3% over the forecast period.”

The residential segment holds the largest revenue share in the MCCB market, driven by the increasing emphasis on safety and energy efficiency in home electrical systems. As more households adopt advanced electrical appliances and smart home technologies, the demand for reliable circuit protection has surged. Furthermore, growing concerns over electrical fires and outages have led homeowners and builders to prioritize high-quality circuit breakers, further solidifying the residential sector's dominant position in the market.

In the power utilities end use segment, MCCB plays a crucial role in ensuring the stability and reliability of electrical distribution networks. As utility companies invest in upgrading infrastructure and integrating renewable energy sources, the demand for robust circuit protection solutions has escalated. These circuit breakers are essential for managing power loads and safeguarding against faults in utility-scale operations, driving significant growth within this sector as utilities strive to maintain service continuity and meet regulatory standards.

Regional Insights

“China held nearly 60% revenue share of the overall Asia Pacific molded case circuit breakers market.”

North America molded case circuit breakers market is aided by the growth in renewable energy in the region. According to the U.S. Department of Energy, wind power is the fastest-growing and lowest-cost source of electricity in the country, as of August 2023. Wind energy held a 22% share of new electricity capacity installed in the country in 2022.

Asia Pacific Molded Case Circuit Breakers Market Trends

The molded case circuit breakers market of Asia Pacific dominated the industry, accounting for over 35.0% of the global market's revenue share in 2023. Growing electricity generation, data centers, and dependency on renewable energy in the region is aiding need for MCCBs in the region

China molded case circuit breakers market is expected to register lucrative growth amidst growing electricity generation. The country ranked first in terms of electricity generation in 2023, with 9,456 MW. Also, one of the country’s largest utilities commenced construction of a USD 3.9 billion project for electricity transmission across three provinces in March 2024.

Europe Molded Case Circuit Breakers Market Trends

The molded case circuit breakers market of Europe is driven by the growth in the electricity grid. For instance, in April 2024, the EU Commission launched an Action Plan for Grids to modernize the region’s electricity grid and prepare for renewables-based electrification of the energy system.

Key Molded Case Circuit Breakers Company Insights

Some of the key players operating in the market include Seiko Epson Corporation, and NIHON DEMPA KOGYO CO., LTD.

-

Seiko Epson Corporation was founded in May 1942 with headquarters in Nagano, Japan. The company is engaged in the development, production, sales, and providing services for products used in the following segments: manufacturing-related and wearables, visual communications, printing solutions, and others. It generated USD 8,682.71 million in revenue in FY 2023-24 and employed over 74,400 personnel.

-

NIHON DEMPA KOGYO CO., LTD was founded in April 1948 and is headquartered in Tokyo, Japan. As of March 31, 2024, the group has 2,366 employees and generated a revenue of ~USD 311.6 million. The company is engaged in the manufacturing and sales of crystal-related products including crystal devices, molded case circuit breakers, crystal blank, and ultrasonic transducers.

Key Molded Case Circuit Breakers Companies:

The following are the leading companies in the molded case circuit breakers market. These companies collectively hold the largest market share and dictate industry trends.

- AGC

- CoorsTek

- Daishinku Corporation (KDS)

- Heraeus Group

- Murata Manufacturing Co., Ltd.

- NIHON DEMPA KOGYO CO., LTD

- Seiko Epson Corporation

- Shin-Etsu Chemical Co., Ltd.

- Siward Crystal Technology Co. Ltd.

- Universal Quartz Inc.

Recent Developments

-

In June 2024, Nokia acquired Infinera for USD 2.3, with an aim to expand its optical networking business.

-

In May 2024, Polaris Semiconductor announced plans to expand its manufacturing facility in Minnesota, U.S. The company is expected to invest USD 525 million over a period of 2 years and this is expected to be supported by Minnesota State Incentives and Potential Federal Funding from the CHIPS and Science Act

Molded Case Circuit Breaker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.09 billion

Revenue forecast in 2030

USD 15.52 billion

Growth rate

CAGR of 14.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, power range, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

AGC; CoorsTek; Daishinku Corporation (KDS); Heraeus Group; Murata Manufacturing Co., Ltd.; NIHON DEMPA KOGYO CO., LTD; Seiko Epson Corporation; Shin-Etsu Chemical Co., Ltd.; Siward Crystal Technology Co. Ltd.; Universal Quartz Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molded Case Circuit Breakers Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global molded case circuit breakers market report on the basis of product type, power range, end-use, and region:

-

Product Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Miniature

-

Molded Case

-

-

Power Range Outlook (Revenue, USD Billion; 2018 - 2030)

-

0-75A

-

75-250A

-

250-800A

-

Above 800A

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Power Utilities

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global molded case circuit breakers market size was estimated at USD 6.23 billion in 2023 and is expected to reach USD 7.09 billion in 2024.

b. The global molded case circuit breakers market is expected to grow at a compound annual growth rate of 14.0% from 2024 to 2030 to reach USD 15.52 billion by 2030.

b. By end use, industrial dominated the market with a revenue share of over 26.0% in 2023.

b. Some of the key vendors of the global molded case circuit breakers market are AGC, CoorsTek, Daishinku Corporation (KDS), Heraeus Group, Murata Manufacturing Co., Ltd., NIHON DEMPA KOGYO CO., LTD, Seiko Epson Corporation, Shin-Etsu Chemical Co., Ltd., Siward Crystal Technology Co. Ltd., Universal Quartz Inc., among others.

b. The increasing investments towards electricity generation and transmission is the propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.