- Home

- »

- Next Generation Technologies

- »

-

Monitoring Tools Market Size, Share & Growth Report, 2030GVR Report cover

![Monitoring Tools Market Size, Share & Trends Report]()

Monitoring Tools Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Type (Infrastructure Monitoring Tools, Security Monitoring Tools), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-124-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Monitoring Tools Market Summary

The global monitoring tools market size was estimated at USD 26.05 billion in 2022 and is projected to reach USD 96.85 billion by 2030, growing at a CAGR of 18.0% from 2023 to 2030. Monitoring tools are software applications designed to monitor and analyze the operational status, performance, and accessibility of various components within IT infrastructure.

Key Market Trends & Insights

- North America dominated the market in 2022, accounting for over 37% share of the global revenue.

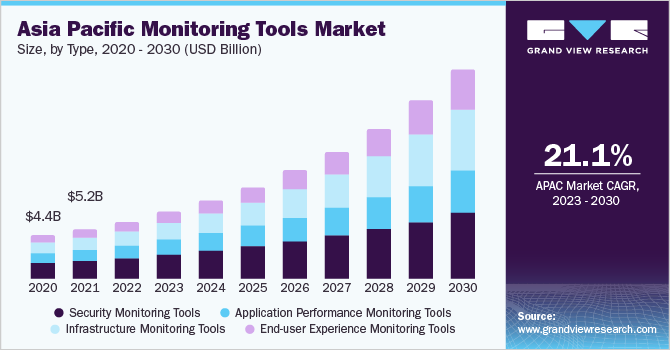

- Asia Pacific is anticipated to register the fastest CAGR over the forecast period.

- By component, the software segment led the market in 2022, accounting for over 76% share of the global revenue.

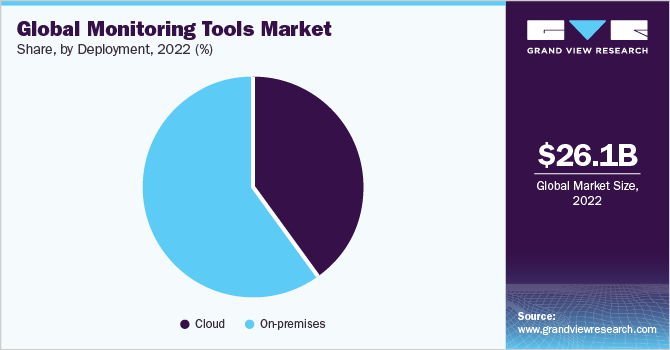

- By deployment, the on-premises segment led the market in 2022, accounting for over 59% share of the global revenue.

- By type, the security monitoring tools segment held the largest revenue share of over 37% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 26.05 Billion

- 2030 Projected Market Size: USD 96.85 Billion

- CAGR (2023-2030): 18.0%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

These tools encompass distinct capabilities such as network monitoring, server oversight, application performance tracking (APM), cloud system observation, log analysis, security surveillance, and capacity forecasting. By delivering up-to-the-minute data on metrics such as CPU utilization, network data flow, and response durations, these tools facilitate the detection of problems, troubleshooting processes, and enhancement efforts.

As growing economies in developing regions undergo swift economic expansion and technological progress, enterprises within these areas are progressively integrating digital solutions to propel their functions and enhance efficiency. This surge in digital adoption has generated a need for monitoring tools capable of safeguarding the efficiency and dependability of their digital infrastructure. Businesses often find themselves in the initial stages of digital transformation. This transition, often involving a shift from manual or conventional processes to digital frameworks, emphasizes the critical importance of robust monitoring tools.

Furthermore, developing regions often have unique market dynamics and regulatory environments. Monitoring tools equipped to accommodate these specific demands gain a competitive edge. The unexplored opportunities within these developing areas signify a substantial market share poised for exploration by providers of monitoring tools. By establishing a foothold in these regions and delivering customized solutions tailored to the needs of local enterprises, vendors of monitoring tools can access untapped customer segments and catalyze revenue expansion.

Component Insights

The software segment led the market in 2022, accounting for over 76% share of the global revenue. The complexity of modern IT environments necessitates robust software tools that can efficiently monitor a diverse range of infrastructure components, applications, and services. As businesses increasingly rely on intricate networks, cloud platforms, and hybrid setups, monitoring software ensures seamless operations, identifies bottlenecks, and preemptively addresses potential issues. Furthermore, the advancements in software technologies have facilitated the development of sophisticated monitoring solutions that provide real-time insights, predictive analytics, and automation capabilities. This empowers organizations to address problems reactively and optimize their systems for better performance and user experience proactively.

The services segment is estimated to grow significantly over the forecast period. The monitoring tools market is notably influenced by the substantial contributions of professional and managed services, which offer businesses an array of invaluable offerings. Professional services providers help configure, implement, and customize monitoring tools, providing optimal alignment and functionality with specific enterprise requirements. They provide consulting and advisory services, guiding enterprises to choose the right monitoring tools and create effective monitoring strategies. Managed services providers, on the other hand, provide continuous monitoring and management of applications and infrastructure, relieving enterprises of the burden of optimizing and maintaining their monitoring environment.

Deployment Insights

The on-premises segment led the market in 2022, accounting for over 59% share of the global revenue. Organizations that rely on legacy systems or uphold strict compliance and security standards often find favor in on-premises solutions. The attraction stems from their capacity to personalize and oversee the monitoring environment, reduce latency for real-time applications, and adeptly handle hybrid environments. These attributes collectively drive the continued demand for on-premises tools.

The cloud segment is estimated to grow significantly over the forecast period owing to the growing significance and widespread adoption of cloud-based monitoring solutions. The rapid proliferation of cloud computing and the increasing migration of businesses' IT infrastructure and applications to cloud environments have fueled the demand for monitoring tools. Moreover, the cloud-based solutions' swiftness and ease of deployment make them appealing to companies striving to swiftly integrate monitoring capabilities into their existing workflows without complex setup processes.

Type Insights

The security monitoring tools segment held the largest revenue share of over 37% in 2022. Cyber threats' escalating frequency and sophistication have prompted companies to prioritize security measures. Security monitoring tools offer essential capabilities for detecting and responding to threats, bolstering organizations' defenses against malicious activities. Moreover, integrating AI and machine learning into security monitoring tools has enhanced their ability to identify patterns and anomalies indicative of potential security breaches, contributing to the increased trust in these solutions.

The infrastructure monitoring tools segment is predicted to foresee significant growth in the forecast period. As modern business operations increasingly rely on complex and diverse IT infrastructure components, the need for robust monitoring tools to ensure their seamless functioning has become important. Infrastructure monitoring tools provide essential insights into the health, performance, and availability of servers, networks, databases, and other foundational elements. Moreover, the complexity of managing IT infrastructure has grown as technology evolves. For instance, in May 2023, New Relic, Inc. announced a new, powerfully incorporated experience for its infrastructure monitoring and APM capabilities. DevOps, engineers, and ITOps can swiftly diagnose performance problems, avoiding context-changing or missing critical insights.

Vertical Insights

The IT & telecom segment held the largest revenue share of over 22% in 2022. The rapid expansion of digital services and the increasing reliance on technology-driven communication platforms have elevated the importance of monitoring tools. These tools enable IT and Telecom companies to detect and address real-time issues, ensuring uninterrupted services and optimal user experiences. The IT and telecom industry operates in a highly dynamic and competitive landscape where digital systems' performance, availability, and security are critical. Monitoring tools ensure the seamless operation of critical IT infrastructure, networks, and services in this fast-paced environment.

The BFSI segment is predicted to foresee significant growth in the forecast period. The increasing digitalization of banking and financial services has boosted the importance of monitoring tools. These tools are essential for maintaining the availability and performance of online banking systems, mobile applications, and electronic payment platforms. Furthermore, the BFSI sector is a prime target for cyberattacks and fraud due to high-value transactions and sensitive data. Monitoring tools provide real-time insights into potential security breaches, allowing organizations to promptly detect and respond to threats.

Regional Insights

North America dominated the market in 2022, accounting for over 37% share of the global revenue. North America is a major hub for cloud computing adoption, with many businesses moving their IT infrastructure to the cloud. This has led to a growing demand for monitoring tools to help businesses manage and optimize their cloud environments. The increasing threat of cyber-attacks has led to a growing need for security monitoring tools. North America is home to some of the world's largest and most valuable companies, making it a prime target for cyber-attacks. This has led to increased investment in security monitoring tools in the region.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The increasing adoption of digitalization and the growing importance of data-driven decision-making across various industries, such as telecommunications, IT, finance, healthcare, and manufacturing, have been key drivers of the monitoring tools market in the region. Several factors have contributed to the demand for monitoring tools in the region. The surging number of mobile phone subscribers, internet users, and connected devices has made an expansive pool of data that requires efficient monitoring and analysis. The rising cybersecurity threats have driven enterprises to invest in advanced monitoring solutions to protect their infrastructure, networks, and sensitive information.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in February 2023, Tech Mahindra Limited, an Indian multinational information technology services and consulting company, launched SANDSTORM, a powerful tool assisting businesses of all sizes to improve the customer experience by providing real-time insights into how their devices are performing. The next-gen solution allows service providers to remotely estimate customer experiences on any device, from tablets, smartphones, smart TVs, and VR headsets to connected cars. Some prominent players in the global monitoring tools market include:

-

Amazon Web Services, Inc.

-

Cisco Systems, Inc.

-

Dynatrace, Inc.

-

Google LLC

-

IBM Corporation

-

Microsoft

-

NETSCOUT Systems, Inc.

-

New Relic, Inc.

-

Riverbed Technology LLC

-

Splunk Inc.

Monitoring Tools Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 30.37 billion

Revenue forecast in 2030

USD 96.85 billion

Growth rate

CAGR of 18.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Amazon Web Services Inc.; Cisco Systems, Inc.; Dynatrace, Inc.; Google LLC; IBM Corporation; Microsoft; NETSCOUT Systems, Inc.; New Relic, Inc.; Riverbed Technology LLC; Splunk Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Monitoring Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global monitoring tools market report based on component, deployment, type, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Infrastructure Monitoring Tools

-

Network Monitoring

-

Storage Monitoring

-

Server Monitoring

-

Cloud Infrastructure Monitoring

-

Others

-

-

Application Performance Monitoring Tools

-

Database Monitoring

-

Web Application Monitoring

-

Mobile Application Monitoring

-

Code Level Monitoring

-

Others

-

-

Security Monitoring Tools

-

Intrusion Detection and Prevention Systems (IDPS)

-

Log Monitoring and Analysis

-

Vulnerability Assessment and Management

-

Others

-

-

End-user Experience Monitoring Tools

-

Synthetic Monitoring

-

Real User Monitoring

-

Others

-

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

IT & Telecom

-

Media & Entertainment

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global monitoring tools market size was estimated at USD 26.05 billion in 2022 and is expected to reach USD 30.37 billion in 2023.

b. The global monitoring tools market is expected to grow at a compound annual growth rate of 18.0% from 2023 to 2030 to reach USD 96.85 billion by 2030.

b. North America dominated the monitoring tools market with a share of 38.3% in 2022. North America is a major hub for cloud computing adoption, with many businesses moving their IT infrastructure to the cloud. This has led to a growing demand for monitoring tools to help businesses manage and optimize their cloud environments.

b. Some key players operating in the monitoring tools market include Amazon Web Services, Inc.; Cisco Systems, Inc.; Dynatrace, Inc.; Google LLC; IBM Corporation; Microsoft; NETSCOUT Systems, Inc.; New Relic, Inc.; Riverbed Technology LLC; Splunk Inc.

b. Key factors that are driving the monitoring tools market growth include rising demand for real-time monitoring and analytics and growing adoption of cloud-based monitoring solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.