- Home

- »

- Automotive & Transportation

- »

-

Mountain E-bikes Market Size, Share, Industry Report, 2030GVR Report cover

![Mountain E-bikes Market Size, Share & Trends Report]()

Mountain E-bikes Market (2025 - 2030) Size, Share & Trends Analysis Report By Drive (Belt Drive, Chain Drive), By Battery (Lead-acid Battery, Lithium-ion Battery), By Propulsion (Pedal-assisted, Throttle-assisted), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-452-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mountain E-bikes Market Summary

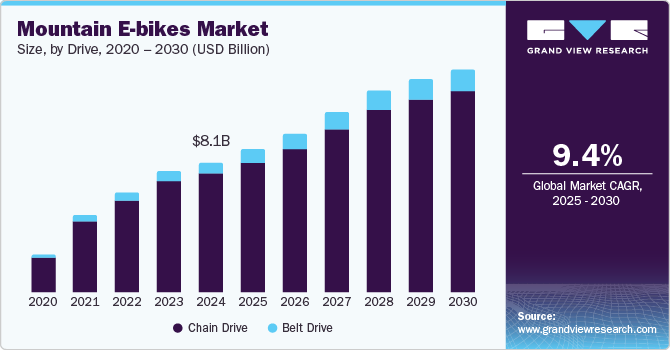

The global mountain e-bikes market size was estimated at USD 8,077.2 million in 2024 and is projected to reach USD 13,885.0 million by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The rising popularity of outdoor recreation and adventure sports is a major factor contributing to the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, U.S. is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, chain drive accounted for a revenue of USD 8,100.4 million in 2024.

- Belt Drive is the most lucrative drive segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8,077.2 Million

- 2030 Projected Market Size: USD 13,885.0 Million

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

Mountain e-bikes, with their electric assist features, allow riders of various skill levels to tackle challenging terrains and explore new trails with ease. This accessibility is attracting a broader demographic, including older riders and those new to mountain biking. The trend of combining exercise with adventure is driving demand for mountain e-bikes, contributing to the market's expansion.

Technological advancements in e-bike components, such as motors, batteries, and drivetrains, are a major driving force in the industry. High-performance mid-drive motors and efficient battery systems now offer increased torque, extended range, and smoother power delivery, making mountain e-bikes more capable on rugged terrains. Innovations such as smart sensors and integrated displays enhance rider experience by providing real-time data and ride customization options. These advancements are pushing the boundaries of what mountain e-bikes can achieve, making them more appealing to both novice and experienced riders. As technology continues to evolve, it is expected to further fuel the market growth.

The increasing emphasis on sustainability and eco-friendly transportation options is positively impacting the industry. Mountain e-bikes offer a greener alternative to traditional off-road vehicles, such as dirt bikes and ATVs, by producing no emissions and reducing the environmental footprint of outdoor activities. As environmental awareness grows, consumers are more inclined to choose sustainable transportation solutions, including e-bikes, for both commuting and recreational purposes. This shift is further supported by government policies and incentives promoting the use of electric vehicles, including e-bikes, to reduce carbon emissions. Consequently, the mountain e-bike market is benefiting from the broader trend towards sustainable and eco-friendly mobility solutions.

The expansion of e-bike infrastructure and increased access to trails suitable for e-bikes are also key drivers of the mountain e-bike market. Many regions are investing in dedicated e-bike trails, bike parks, and charging stations, making it easier for riders to explore new areas and enjoy longer rides without range anxiety. Additionally, changes in regulations allowing e-bikes on certain trails previously restricted to non-motorized bikes are opening up more riding opportunities. This enhanced infrastructure not only attracts local riders but also boosts e-bike tourism, as riders seek out new destinations and experiences. The improved accessibility and infrastructure are making mountain e-bikes a more viable option for adventure enthusiasts, driving industry growth.

The demand for customization and specialized mountain e-bike models is another significant trend influencing the market. Riders are increasingly seeking e-bikes tailored to their specific needs, whether for cross-country, downhill, or all-mountain riding styles. Manufacturers are responding by offering a wider range of models with various frame designs, suspension systems, and power options to cater to different preferences and terrains. Additionally, the trend of customization extends to components, with riders opting for upgrades in brakes, tires, and other accessories to enhance performance. This focus on personalized riding experiences is not only enhancing customer satisfaction but also further driving the market growth.

Drive Insights

The chain drive segment accounted for the largest share of 91.5% in 2024. The chain drive segment remains the dominant force in the industry due to its proven durability, strength, and cost-effectiveness. Chain drives have long been favored by riders for their ability to handle the rigorous demands of off-road cycling, including steep climbs, rocky paths, and muddy conditions. Their widespread availability and compatibility with most bike components make chain drives a versatile choice, appealing to a broad range of riders from beginners to seasoned mountain bikers. Additionally, the relatively simple design of chain drives facilitates easy maintenance and repairs, further enhancing their popularity. As a result, chain drives continue to be the preferred drivetrain for mountain e-bikes, supporting their leading position in the industry.

The belt drive segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment can be attributed to its unique benefits and growing appeal among riders seeking a quieter, low-maintenance alternative. Unlike traditional chain drives, belt drives do not require lubrication, making them cleaner and more convenient for riders who prioritize low upkeep. Belt drives are also highly durable and resistant to rust and wear, which is especially beneficial in wet or muddy riding conditions often encountered in mountain biking. Furthermore, the smooth and quiet operation of belt drives enhances the riding experience, attracting a new segment of e-bike enthusiasts looking for innovative drivetrain solutions. As awareness of these benefits increases, the belt drive segment is poised for significant growth, positioning itself as a modern, efficient alternative to the traditional chain drive.

Battery Insights

Lithium-ion battery segment held the largest market share in 2024. The lithium-ion battery segment continues to dominate the mountain e-bikes market due to its superior performance characteristics, including higher energy density, longer lifespan, and lighter weight compared to other battery types. Riders prefer lithium-ion batteries because they offer a longer range and quicker charging times, which are crucial for extended mountain biking adventures. These batteries also support the increasing demand for high-performance e-bikes capable of handling challenging terrains and long-distance rides without frequent recharging. Moreover, advancements in lithium-ion technology have led to improved safety features, such as thermal management systems, making them a more reliable choice for manufacturers and consumers alike.

The lead-acid battery segment is expected to grow at a significant CAGR during the forecast period. Recent advancements in lead-acid battery technology have improved their energy efficiency and reduced their weight, making them more viable for use in e-bikes. These batteries are also known for their reliability and ability to perform well in extreme weather conditions, which appeals to riders in regions with harsh climates. Additionally, lead-acid batteries are relatively easy to recycle, aligning with the growing consumer demand for more sustainable and environmentally friendly options. As the market expands to include more budget-conscious consumers and regions with varying climate conditions, the lead-acid battery segment is gaining traction as an accessible and durable alternative, contributing to its emerging status.

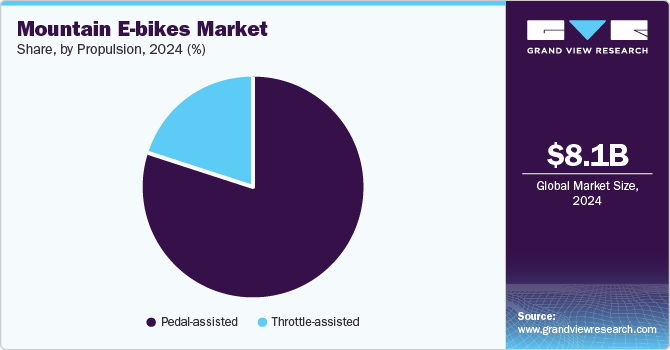

Propulsion Insights

The pedal-assisted segment dominated the market in 2024. The growth of the segment can be attributed to its ability to provide a more natural biking experience while offering the benefits of electric assistance. Pedal-assisted e-bikes are favored by riders who seek the thrill and exercise benefits of traditional mountain biking but with added support to conquer steep inclines and challenging trails. This segment appeals to a wide range of consumers, from fitness enthusiasts to casual riders, as it promotes active pedaling while reducing the physical strain associated with difficult terrain. The growing popularity of pedal-assisted mountain e-bikes is further bolstered by regulations in various regions that classify them similarly to regular bicycles, allowing access to a broader range of trails.

The throttle-assisted segment is projected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by its convenience and appeal to riders seeking a less strenuous option. Throttle-assisted e-bikes allow riders to engage the electric motor independently of pedaling, making them ideal for those who want to enjoy the outdoors without the physical demands of continuous pedaling. This feature is particularly attractive to older riders, individuals with physical limitations, and those looking for an easier ride on steep or uneven terrain. Additionally, throttle-assisted e-bikes offer a more accessible entry point for beginners and casual users who are less familiar with mountain biking techniques.

Regional Insights

North America mountain e-bikes market held the largest share of 33.76% in 2024. The growth is driven by its convenience and appeal to riders seeking a less strenuous option. Throttle-assisted e-bikes allow riders to engage the electric motor independently of pedaling, making them ideal for those who want to enjoy the outdoors without the physical demands of continuous pedaling. This feature is particularly attractive to older riders, individuals with physical limitations, and those looking for an easier ride on steep or uneven terrain. Additionally, throttle-assisted e-bikes offer a more accessible entry point for beginners and casual users who are less familiar with mountain biking techniques.

U.S. Mountain E-bikes Industry Trends

The mountain e-bikes industry in the U.S. is anticipated to register significant growth from 2025 to 2030. As a pioneer in technological advancements, the U.S. is at the forefront of developing high-performance e-bikes that cater to both recreational riders and fitness enthusiasts. The expansion of pedal-assisted bike-sharing programs and the establishment of more extensive off-road biking trails are contributing to the market's expansion. Additionally, government incentives and rebates for electric bike purchases are encouraging wider adoption.

Europe Mountain E-bikes Industry Trends

The mountain e-bikes market in Europe was identified as a lucrative region in 2024. Europe’s strong emphasis on sustainability and the rising trend of eco-friendly transportation are significant factors contributing to the growth of the market. European countries, particularly Germany, France, and the Netherlands, are actively promoting cycling as a green alternative to traditional vehicles, with mountain e-bikes gaining popularity for both pedal-assisted commuting and leisure activities. The region’s commitment to reducing carbon emissions and advancing green technologies is fostering innovation in e-bike design and functionality. Enhanced battery life, improved motor efficiency, and supportive regulatory frameworks are key factors driving market expansion.

The U.K. mountain e-bikes market is expected to grow rapidly in the coming years due to the rising awareness of the importance of physical fitness has significantly contributed to the popularity of mountain biking in the U.K. As more individuals prioritize exercise to combat sedentary lifestyles, mountain biking offers an appealing way to improve cardiovascular health, build muscle strength, and reduce stress.

The mountain e-bike market in Germany held a substantial market share in 2024 owing to the established cycling culture, which supports the growth of the mountain biking segment. The country is known for its extensive network of cycling paths and trails, many of which cater to mountain bikers. Regions like the Bavarian Alps, the Black Forest, and the Harz Mountains offer diverse and challenging terrains, attracting both domestic and international riders. This established culture of cycling serves as a strong foundation for the continued rise in mountain biking.

Asia Pacific Mountain E-bikes Industry Trends

The mountain e-bikes market in Asia Pacific is anticipated to grow significantly during the forecast period. Major economies such as China, Japan, and South Korea are witnessing increased adoption of mountain e-bikes, supported by government policies promoting green transportation and reduced reliance on fossil fuels. The rising popularity of outdoor activities and the expansion of dedicated cycling paths in pedal-assisted areas are further stimulating market growth. Technological advancements in battery systems and lightweight materials are making mountain e-bikes more accessible and attractive to a broader range of consumers. As the region continues to embrace sustainable transportation options, the market is expected to expand rapidly, underpinned by innovation and favorable economic conditions.

Japan mountain e-bike market is expected to grow rapidly in the coming years due to a significant surge in interest in outdoor activities, particularly post-pandemic. People are seeking opportunities to engage with nature to rejuvenate both physically and mentally. Mountain biking offers an appealing mix of adventure, exploration, and fitness, making it a popular choice among outdoor enthusiasts.

The mountain e-bike market in China held a substantial market share in 2024 owing to the country’s ongoing efforts to promote eco-friendly lifestyles aligned with the principles of cycling. Mountain biking is a low-impact activity that promotes environmental stewardship and appeals to younger generations and eco-conscious consumers.

Key Mountain E-bikes Company Insights

Some of the key companies in the mountain e-bikes market include Bulls Bikes USA, Accell Group, Heybike Inc., Husqvarna E-Bicycles, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Husqvarna E-Bicycles, a division of Husqvarna Motorcycles known for its innovative approach to e-mobility, particularly in the electric mountain bike (eMTB) segment. The company's product lineup includes the Mountain Cross (MC) series, designed to enhance the riding experience for all skill levels with high-quality components and a minimalist Scandinavian design. Husqvarna E-Bicycles aims to combine performance with user-friendly features, allowing riders to push their limits while enjoying intuitive handling on challenging trails.

-

Bulls Bikes USA is an organization specializing in a diverse range of e-bikes, including eMTBs, eCity, and trekking models. Its product portfolio includes AMINGA EVA TR 1, COPPERHEAD EVO AM 1.5, COPPERHEAD EVO AM 1750, COPPERHEAD EVO AM 2 750, and others. Bulls Bikes USA aims to increase cycling participation by collaborating with advocacy groups and addressing common barriers to cycling mobility.

Key Mountain E-bikes Companies:

The following are the leading companies in the mountain e-bikes market. These companies collectively hold the largest market share and dictate industry trends.

- Bulls Bikes USA

- Accell Group

- Cycling Sports Group, Inc.

- Heybike Inc.

- Husqvarna E-Bicycles

- Magnum Electric Bikes

- RANDRIDE

- VAAN ELECTRIC MOTO PRIVATE LIMITED

- Pedego

- Polygon Bikes

Recent Developments

-

In May 2024, Audi expanded its e-mobility offerings with the launch of a limited-edition electric mountain bike (eMTB) designed in collaboration with Fantic. This new enduro-style eMTB features a robust aluminum frame and is equipped with a powerful Brose S-MAG 250-watt motor, providing up to 90 Newton meters of torque and four levels of electrical assistance: Tour, Eco, Sport, and Boost.

-

In July 2024, DJI entered the electric bike market with the Amflow PL, a carbon fiber electric mountain bike featuring their new Avinox drive system. The bike includes a mid-drive motor with smart assistance technology, offering four standard assist modes and a Boost mode, all customizable via the Avinox app. It comes with two battery options, 600Wh and 800Wh, with fast charging capabilities using GaN technology. The bike features a 2-inch OLED touchscreen display with advanced connectivity options and a range of smart features including bike security and real-time status updates.

Mountain E-bikes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.86 billion

Revenue forecast in 2030

USD 13.88 billion

Growth Rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Drive, battery, propulsion, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Bulls Bikes USA; Accell Group; Cycling Sports Group, Inc.; Heybike Inc.; Husqvarna E-Bicycles; Magnum Electric Bikes; RANDRIDE; VAAN ELECTRIC MOTO PRIVATE LIMITED; Pedego; Polygon Bikes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mountain E-bikes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mountain e-bikes market report based on drive, battery, propulsion, and region.

-

Drive Outlook (Revenue, USD Billion, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

-

Battery Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lead-acid Battery

-

Lithium-ion Battery

-

-

Propulsion Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pedal-assisted

-

Throttle-assisted

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mountain e-bikes market size was estimated at USD 8.08 billion in 2024 and is expected to reach USD 8.86 billion in 2025.

b. The global mountain e-bikes market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 13.88 billion by 2030.

b. North America dominated the mountain e-bikes market with a share of 33.76% in 2024. The growth of the region is driven by its convenience and appeal to riders seeking a less strenuous option.

b. Some key players operating in the mountain e-bikes market include Bulls Bikes USA; Accell Group; Cycling Sports Group, Inc.; Heybike Inc.; Husqvarna E-Bicycles; Magnum Electric Bikes; RANDRIDE; VAAN ELECTRIC MOTO PRIVATE LIMITED; Pedego; Polygon Bikes.

b. Key factors that are driving the market growth include the rising popularity of outdoor recreation and adventure sports and the increasing emphasis on sustainability and eco-friendly transportation options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.