- Home

- »

- Clinical Diagnostics

- »

-

Multi Cancer Early Detection Market, Industry Report, 2030GVR Report cover

![Multi Cancer Early Detection Market Size, Share & Trends Report]()

Multi Cancer Early Detection Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Liquid Biopsy, Gene Panel, LDT & Others), By End Use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-966-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Multi Cancer Early Detection Market Summary

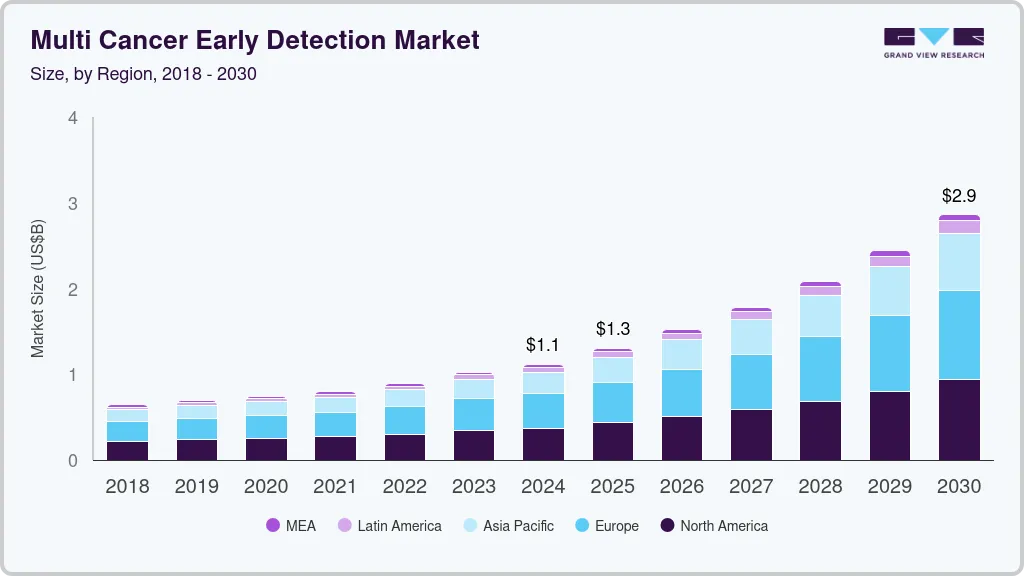

The global multi cancer early detection market size was estimated at USD 1.12 billion in 2024 and is projected to reach USD 2.86 billion by 2030, growing at a CAGR of 17% from 2025 to 2030. This market growth is attributed to an increase in the prevalence of multiple cancers aided by the growing need to provide efficient methods to detect them at early stages to enable timely appropriate treatment.

Key Market Trends & Insights

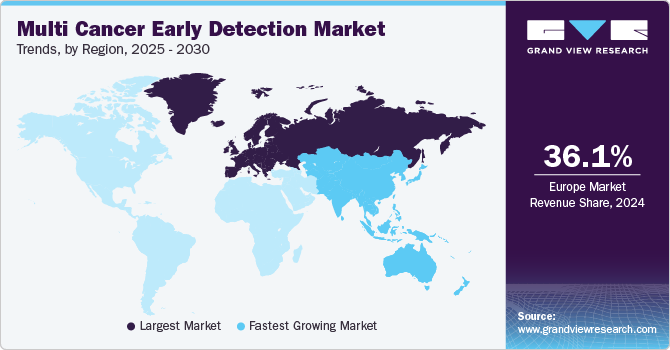

- Europe multi cancer early detection market dominated and accounted for a 36.05% share in 2024.

- France multi cancer early detection market is expected to grow over the forecast period.

- By type, gene Panel, LDT, & others segment led the MCED market, accounting for 91.28% of the global revenue in 2024.

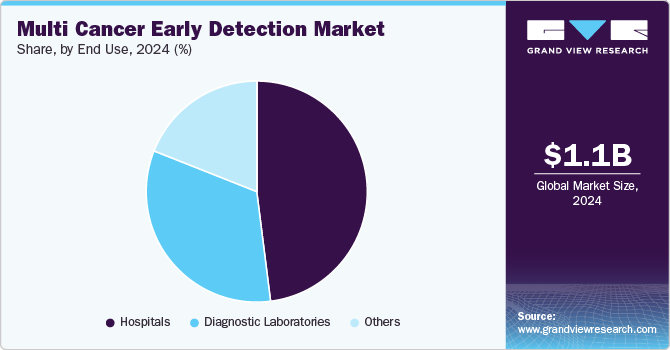

- By end use, hospitals segment led the MCED market with a share of 48.44% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2030 Projected Market Size: USD 2.86 Billion

- CAGR (2025-2030): 17%

- Europe: Largest market in 2024

For instance, according to the International Agency for Research on Cancer (IARC), over 20.7 million new cases are expected in 2023, and over 35 million cases are predicted to occur by 2050. Moreover, early detection of cancer, particularly when it is localized and has not metastasized, significantly enhances the effectiveness and efficiency of treatment. This further enhances the need for advanced diagnostic solutions, which drives market growth. Emerging biological and informational technologies, including nanotechnology, big data analytics, artificial intelligence (AI), machine learning (ML), and genome sequencing, are revolutionizing diagnosis and therapy. These innovations drive breakthroughs in precision medicine, enabling early detection, personalized treatment plans, and improved patient outcomes.For instance, AI/ML algorithms are employed by companies like Google Health to enhance imaging diagnostics, while genome sequencing technologies by firms like Illumina facilitate the identification of genetic predispositions. Multi-cancer early detection (MCED) screening aims to expand the range of cancers detectable through screening methods and identify cancer in asymptomatic individuals. For instance, GRAIL's Galleri test makes it possible to screen for multiple types through a single blood test, targeting early-stage where treatment is most effective. These advancements hold the potential to significantly improve survival rates and reduce healthcare costs by identifying tumors at a stage where interventions can have the greatest impact.

Moreover, the impact of early detection on survival rates becomes evident when examining outcomes for specific types. For instance, over 90% of women diagnosed with breast cancer at its earliest stages survive for at least five years, compared to only 15% of women diagnosed at the most advanced stages, which constitute approximately 15% of cases. Similarly, more than 80% of lung cancer patients survive for a minimum of one year if diagnosed and treated in the earliest stages. This is in stark contrast to a mere 15% survival rate for those identified at the disease's most advanced stages. These statistics highlight the life-saving potential of early diagnosis and timely intervention.

Furthermore, rising awareness about early diagnosis, available treatment options, and advancements in medical therapies have significantly improved patient outcomes. According to the OECD, approximately 2.7 million people in the European Union were projected to receive a cancer diagnosis in 2020, with countries such as Ireland, Belgium, Denmark, and the Netherlands reporting higher incidence rates. Cancer remains the second leading cause of mortality in Europe, following cardiovascular diseases, with an estimated 1.3 million deaths attributed to cancer in 2020.

Early detection plays a major role in reducing cancer-related mortality, particularly through the implementation of effective screening programs. Evidence demonstrates that early detection can improve patient survival rates by five to ten times compared to late-stage detection. For instance, the five-year survival rate is only 21% for patients diagnosed after cancer has metastasized, compared to 89% when the disease is identified early while still localized. These statistics underscore the critical importance of early diagnosis in improving survival outcomes and enhancing the quality of life for cancer patients.

However, high costs associated with advanced diagnostic technologies, such as liquid biopsy tests, genome sequencing, and AI-driven analytics, limit accessibility for a significant portion of the population, restrain market growth. In addition, the regulatory environment poses challenges, as gaining approval for new MCED technologies often requires extensive clinical trials and validation processes, delaying market entry. Limited awareness and uncertainty regarding the accuracy and reliability of MCED tests among healthcare providers and patients further hinder adoption. Moreover, inadequate healthcare infrastructure in some regions delays the implementation of comprehensive screening programs, while ethical concerns around false positives, overdiagnosis, and patient anxiety create resistance.

Type Insights

Gene Panel, LDT, & others led the MCED market, accounting for 91.28% of the global revenue in 2024. The growth of this segment is largely driven by the non-requirement of FDA approval requirements for laboratory-developed tests (LDTs) in diagnostic laboratories, allowing for faster deployment and adoption. Advancements in next-generation sequencing (NGS), or massively parallel sequencing, have transformed the landscape of genetic testing for risk assessment. These technologies enable comprehensive and efficient genetic profiling, enhancing the scope of detection. Moreover, panel-based tests, compared to traditional BRCA1/2 genetic testing, offer broader insights into inherited risks of breast and ovarian cancers while providing higher clinical value for detecting hereditary risks associated with other malignancies, such as pheochromocytoma-paraganglioma and colorectal cancer.

Liquid biopsy is anticipated to grow fastest over the forecast period. The segment's growth is attributed to the increasing number of players receiving funding from investors to develop new tests. Liquid biopsy is an advanced testing technology for detecting tumor-related genetic alterations. It has also been used to stratify tumors to enable appropriate treatment through precision oncology. For instance, in July 2024, Guardant Health, Inc. announced an upgrade to its industry-leading Guardant360 liquid biopsy test. The enhanced version now analyzes biomarkers across 739 genes, ten times more cancer biomarkers than the previous duplication. This upgraded test provides the capability to detect a broad range of emerging biomarkers, allowing for a more precise characterization of cancer and offering much higher sensitivity in quantifying disease burden. The biomarkers, or gene alterations, identified by the test empower oncologists to tailor targeted treatment strategies most effective for patients with advanced cancer, ultimately improving treatment outcomes.

End Use Insights

Hospitals led the MCED market with a share of 48.44% in 2024. The growth of this segment can be attributed to the increasing preference for hospitals that offer a comprehensive range of services under one roof. One of the key advantages of hospitals conducting multi-cancer diagnostics is the ability to provide test results even in emergencies. Advances in hospital laboratories are essential to meet the evolving needs of patients, and many hospitals are expanding their service offerings to include a broader array of diagnostic and treatment options. For instance, in May 2024, University Hospitals announced the availability of a new detecting test, the GRAIL Galleri test, that can detect 50 different types of tumors.

Diagnostic laboratories is projected to grow significantly over the forecast period. Several factors, including increased awareness of personalized medicine, technological advancements, and the growing demand for affordable healthcare services, drive the growth of the diagnostic laboratory segment. In addition, government initiatives to provide support, such as compensation for diagnostic tests, are expected to fuel market expansion further. Many healthcare institutions are also partnering with laboratories to integrate a variety of clinical tests into their services. For example, in June 2023, the Baylor Scott & White Research Institute, in collaboration with Exact Sciences Corporation, launched a multi-cancer early detection program to improve cancer interception rates in Texas.

Regional Insights

Europe Multi Cancer Early Detection Market Trends

Europe multi cancer early detection market dominated and accounted for a 36.05% share in 2024, owing to rising awareness of cancer prevention, advancements in diagnostic technologies, and increased healthcare investments. Growing government-funded screening programs, such as those focusing on breast, colorectal, and cervical cancers, have enhanced the adoption of innovative diagnostic solutions. Furthermore, the growing demand for personalized medicine and precision oncology, which depend on advanced tests like MCED, further accelerates market growth. The introduction of cutting-edge technologies, including liquid biopsy and next-generation sequencing, is enhancing the accuracy and effectiveness of detection.

The multi cancer early detection market in the UK is expected to grow over the forecast period due to the presence of complex healthcare infrastructure, the launch of novel products, and collaborations between key market players.

France multi cancer early detection market is expected to grow over the forecast period due to increased government investments in healthcare and cancer prevention programs, aided byrising demand for advanced diagnostic solutions. The country's focus on enhancing early detection and personalized medicine is driving the adoption of these technologies.

The multi cancer early detection market in Germany is expected to grow over the forecast period due to the growing integration of innovative diagnostic technologies, such as liquid biopsy and next-generation sequencing, which is driving widespread adoption of multi-cancer screening solutions.

North America Multi Cancer Early Detection Market Trends

The multi cancer early detection market in North America was identified as a lucrative region in this industry owing to the high prevalence of cancer, rapid technological advancements, and increasing government initiatives supporting early detection. The U.S. leads the market, driven by significant investments and the presence of numerous biotechnology companies developing innovative MCED tests. Organizations like the American Society of Clinical Oncology (ASCO) support adopting early detection technologies, further fueling market growth. For example, in November 2023, GRAIL, LLC launched the REACH (Real-world Evidence to Advance Multi-Cancer Early Detection Health Equity) study to assess the clinical impact of the Galleri MCED test on the Medicare population, highlighting ongoing efforts to expand access and improve outcomes through advanced diagnostic solutions.

The U.S. multi cancer early detection market is expected to grow over the forecast period owing to significant investments in biotechnology and strong support from healthcare organizations like ASCO. The development and adoption of innovative tests, such as GRAIL’s Galleri, enhance early detection and improve public health outcomes.

Asia Pacific Multi Cancer Early Detection Market Trends

The multi cancer early detection market in Asia Pacific is anticipated to witness the fastest growth, driven by improving healthcare infrastructure, a large and growing population, and an increasing number of local companies entering the market. With a high prevalence, nearly half of all global cases, and 58.3% of cancer deaths occurring in Asia, according to Global Cancer Statistics 2020, the demand for early detection solutions is rising. Moreover, demographic changes such as urbanization, aging populations, and economic growth are increasing attention on cancer prevention. However, challenges such as low affordability, inadequate infrastructure, and a shortage of trained professionals may hinder the market's growth in some areas.

China multi cancer early detection market is expected to grow over the forecast period due to increasing incidence rates and rising awareness about early diagnosis. Government initiatives and collaborations with biotechnology firms are further accelerating the adoption of innovative diagnostic technologies across the country.

The multi cancer early detection market in Japan is expected to grow over the forecast period owing to increasing healthcare awareness and government initiatives aimed at enhancing cancer screening programs. Technological innovations and the integration of advanced diagnostic tools, such as liquid biopsy, are driving regional market expansion.

Latin America Multi Cancer Early Detection Market Trends

The multi cancer early detection market in Latin America was identified as a lucrative region in this industryowing to the growing adoption of innovative diagnostic technologies to address the rising cancer burden. Increasing awareness and government initiatives to improve screening are driving regional market expansion.

Brazil multi cancer early detection market is expected to grow over the forecast period. Government initiatives and partnerships with private sector players are driving the adoption of MCED solutions to enhance early cancer detection across the country.

MEA Multi Cancer Early Detection Market Trends

The multi cancer early detection market in MEA holds major growth opportunities, as most of it is untapped due to the unavailability of organized cancer screening programs in this region, especially in underdeveloped African economies.

Saudi Arabia multi cancer early detection market is expected to grow over the forecast. This market's growth is primarily attributed to the increasing government focus on healthcare innovation and cancer prevention programs. The country’s investment in advanced diagnostic technologies and collaboration with global players is driving the adoption of MCED solutions.

Key Multi Cancer Early Detection Company Insights

The multi-cancer early detection market is characterized by major players focusing on developing innovative diagnostic solutions. Key companies such as Illumina, Inc., Exact Sciences Corporation, FOUNDATION MEDICINE, INC., and Guardant Health are leading the market, leveraging advanced technologies like liquid biopsy and next-generation sequencing to detect multiple types of cancer early and accurately. These players are continuously investing in research and development to enhance the efficacy and reliability of their tests, while collaborations with healthcare providers and research institutions are aimed at expanding the reach and impact of MCED solutions. Their focus on offering high-quality, cost-effective diagnostic options has positioned them as pivotal contributors to the market's growth, enabling earlier intervention and improved patient outcomes.

Emerging players in the multi-cancer early detection (MCED) market are making significant advances by introducing innovative technologies and approaches to cancer detection. Companies like ADELA, Inc., ClearNote Health, and SeekIn are leveraging artificial intelligence, machine learning, and genomics to create more efficient and accessible MCED tests. These emerging players focus on developing comprehensive, non-invasive screening tools that can detect a wide range of tumors at earlier stages, often through blood tests. Their ability to offer personalized solutions, integrate data analytics, and collaborate with academic and healthcare institutions is helping to expand the reach of MCED technologies. While they face competition from established market leaders, these new entrants are poised to drive innovation in cancer screening, particularly in underserved markets and populations.

Key Multi Cancer Early Detection Companies:

The following are the leading companies in the multi cancer early detection market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- GRAIL, Inc.

- Exact Sciences Corporation

- FOUNDATION MEDICINE, INC.

- AnchorDx

- Guardant Health

- Burning Rock Biotech Limited

- GENECAST

- Beijing Lyman Juntai International Medical Technology Development Co.

- Freenome Holdings, Inc

- Elypta AB

Recent Developments

- In October 2024, SeekIn Inc. revealed its innovative two-step multi-cancer screening strategy at the Early Detection of Cancer Conference in San Francisco. This approach aims to reduce the financial burden of population-wide screening, making Multi-Cancer Early Detection (MCED) tests more affordable and accessible.

- In August 2024, Exact Sciences announced the enrollment of the first patient in its MCED Falcon Registry Real-World Evidence study at Baylor Scott & White, Texas's largest non-profit health system. This multi-site study aims to enroll up to 25,000 patients and evaluate the clinical performance, patient and provider experiences, and psychological impact of MCED testing over five years.

- In February 2024, The NIH announced the Cancer Screening Research Network (CSRN) launch to evaluate new detection technologies and methods, supporting the Biden-Harris administration's Cancer Moonshot initiative. As part of this effort, the National Cancer Institute (NCI) has funded eight research groups to kick off the network.

Multi Cancer Early Detection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2030

USD 2.86 billion

Growth rate

CAGR of 17% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Illumina, Inc.; GRAIL, Inc.; Exact Sciences Corporation; FOUNDATION MEDICINE, INC.; AnchorDx; Guardant Health; Burning Rock Biotech Limited; GENECAST; Beijing Lyman Juntai International Medical Technology Development Co.; Freenome Holdings, Inc; Elypta AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

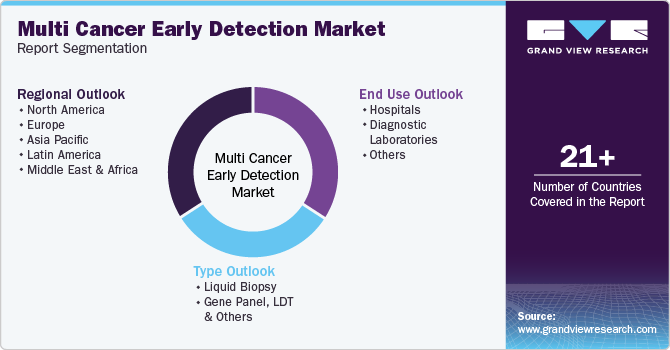

Global Multi Cancer Early Detection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multi cancer early detection market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liquid Biopsy

-

Gene Panel, LDT & Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global multi cancer early detection market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 1.30 billion in 2025.

b. The global multi cancer early detection market is expected to grow at a compound annual growth rate of 17.04% from 2025 to 2030 to reach USD 2.86 billion by 2030.

b. Europe dominated the market and accounted for 36.05% share in 2024, owing to rising awareness of cancer prevention, advancements in diagnostic technologies, and increased healthcare investments.

b. Key players operating in the multi cancer early detection market are Illumina, Inc., GRAIL, Inc., Exact Sciences Corporation, FOUNDATION MEDICINE, INC., AnchorDx, Guardant Health, Burning Rock Biotech Limited, GENECAST, Beijing Lyman Juntai International Medical Technology Development Co., Freenome Holdings, Inc, Elypta AB.

b. Key drivers driving the multi cancer early detection market are increasing prevalence of cancer, extensive R&D for the development of MCED and need to develop diagnostic options that can detect cancer at an early stage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.