- Home

- »

- Medical Devices

- »

-

Nasal Packing Devices Market Size, Industry Report, 2030GVR Report cover

![Nasal Packing Devices Market Size, Share & Trends Report]()

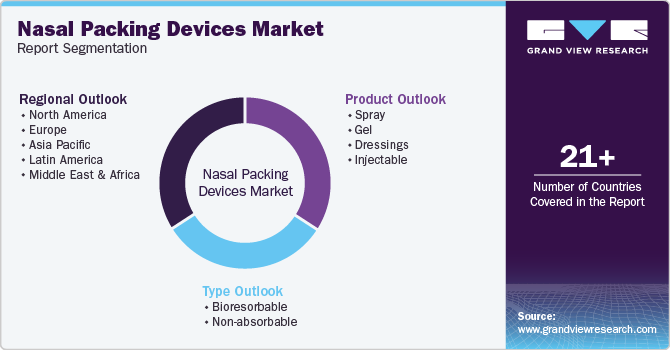

Nasal Packing Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Injectable, Gel, Sprays, Dressings), By Type (Bioresorbable, Non-absorbable), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-943-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nasal Packing Devices Market Summary

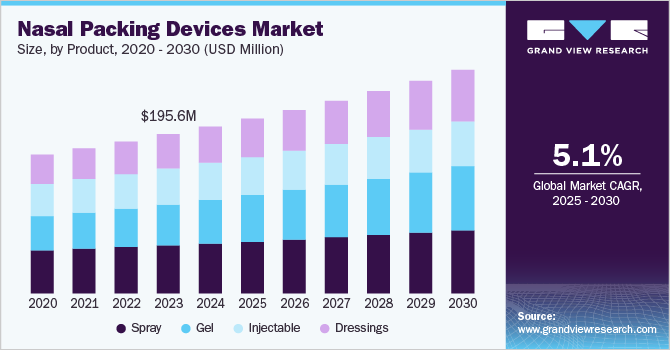

The global nasal packing devices market size was estimated at USD 205.2 million in 2024 and is projected to reach USD 276.8 million by 2030, growing at a CAGR of 5.1% from 2025 to 2030. The global industry is driven by the rising incidence of nasal surgeries, including septoplasty and sinus surgeries, as well as increasing cases of nasal injuries.

Key Market Trends & Insights

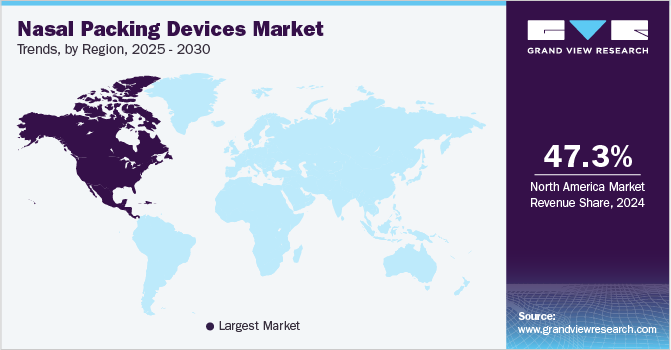

- The North America nasal packing devices market dominated the global market and accounted for 47.3% of revenue share in 2024.

- The U.S. held a significant share of the North American market in 2024.

- Based on product, the spray segment held the largest market share of around 29.3% in 2024, driven by innovations like the approval of a nasal spray for severe allergic reactions.

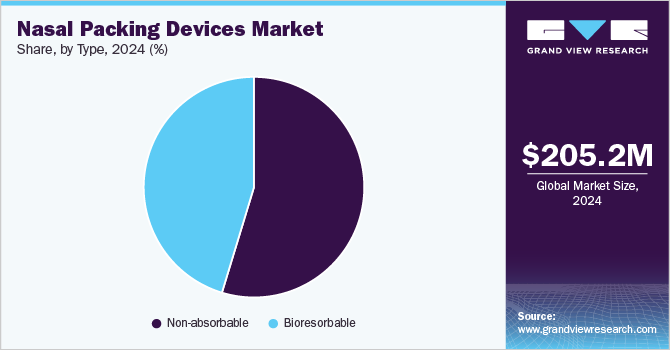

- Based on type, the non-absorbable segment accounted for the largest revenue share of 54.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 205.2 Million

- 2030 Projected Market Size: USD 276.8 Million

- CAGR (2025-2030): 5.1%

- North America: Largest market in 2024

The rising prevalence of epistaxis, also known as nosebleeds, is the primary factor majorly responsible for the growing demand for the market. Advancements in nasal packing materials, such as bioabsorbable and hemostatic products, are enhancing patient comfort and recovery.

The rising incidence of chronic nasal conditions such as sinusitis, nasal polyps, and nosebleeds has fueled the demand for nasal packing solutions. Epistaxis results from the cooperation of various elements that harm the nasal mucosal covering, influence the vessel walls, or disturb the coagulability of the blood. Nasal packing is the second line of treatment for epistaxis, after the failure of cauterization. According to a study on nosebleeds conducted in the U.S., the occurrence is most common among children between the ages of 2 to 10 and adults and elders between the ages of 50 to 80, and this age group also contributes to the majority. Hence, the increasing number of the elderly population is also contributing to market growth. According to the American Academy of Otolaryngology, chronic sinusitis affects approximately 12% of the global population, which leads to a growing need for surgeries like septoplasty, rhinoplasty, and other corrective nasal procedures. Nasal packing devices are essential in these surgeries to control bleeding, support the healing process, and prevent complications.

Nasal packing can be classified according to the type of epistaxis, which is anterior, and posterior based on the location of the site of bleeding. Anterior nasal packing has more demand as anterior bleeding is more common among patients. Patients need to be admitted to the hospital for the application of posterior nasal packing. Nasal packing is suggested to be applied only when the site of bleeding is clearly identified. Nasal packing traditionally included a ribbon gauze applied with antibiotics, lubricant, or ointments. But the industry has significantly developed, the recent launches include foam-based nasal packing that can absorb liquid more than 30 times its weight. Once absorbed, the packing expands, imposing pressure on the nasal walls, which helps control the bleeding.

Over time, nasal packing devices have evolved from simple gauze-based solutions to more advanced materials such as absorbable hemostatic agents, and synthetic and bio-resorbable materials. These new innovations improve the patient's comfort and reduce the need for removal and the risk of infection. Products like Merocel, a commonly used nasal packing material, and Cutanplast, a bioabsorbable packing, offer ease of use and reduced complication rates. Such developments are contributing to the rapid growth of the market.

As the field of rhinoplasty and nasal surgeries advances, more sophisticated techniques are being used, leading to an increased focus on post-operative care. The growing demand for minimally invasive surgeries, which often require effective nasal packing to prevent bleeding and minimize complications, is also influencing the market. Devices that are easy to insert, reduce patient discomfort, and promote faster recovery are increasingly in demand.

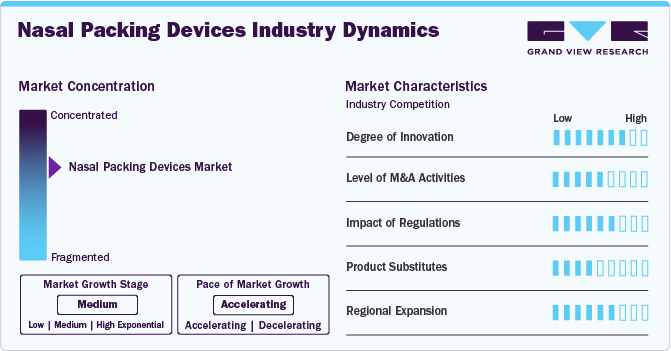

Market Concentration & Characteristics

The industry is characterized by moderate industry concentration, with a few key players dominating the market, including companies like Medtronic, Smith & Nephew, and Medi-Tech. These devices are primarily used in ENT surgeries, trauma care, and to manage conditions like epistaxis (nosebleeds) and chronic sinusitis. The industry is marked by a focus on innovative, patient-friendly solutions, such as absorbable materials, non-invasive designs, and easy-to-use systems. Increasing demand for minimally invasive procedures and advancements in biodegradable materials are driving innovation, while regulatory compliance and cost pressures remain ongoing challenges.

The industry is highly innovative, driven by the demand for safer, more comfortable, and effective solutions in managing nasal surgeries and conditions like epistaxis. Key innovations include bioabsorbable materials, which eliminate the need for device removal, and advanced hemostatic agents that enhance bleeding control. Additionally, non-invasive designs and products that minimize patient discomfort are gaining popularity. There is also a focus on improving ease of use for healthcare providers with simpler application techniques. As minimally invasive surgeries rise in popularity, the industry continues to evolve, incorporating smart technologies and materials that promote faster healing and better outcomes.

Regulations have a significant impact on the nasal packing devices industry, ensuring safety, efficacy, and quality. In markets like the U.S. and Europe, devices must meet strict standards set by regulatory bodies such as the FDA and EMA, which can involve lengthy approval processes and rigorous testing. Compliance with these regulations is crucial for market entry and can affect product development timelines and costs. Additionally, biocompatibility, sterility, and patient safety are key regulatory concerns that influence design and manufacturing. As the industry innovates, meeting evolving regulatory requirements remains a challenge but also ensures that products deliver high-quality outcomes for patients.

Mergers and acquisitions (M&A) in the industry are rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, in June 2024, CoagCo LLC, a Cleveland-based medical device company, announced a partnership with CHAMPS Group Purchasing (GPO). The agreement will leverage CHAMPS' purchasing power across 20,000 U.S. member locations, enhancing the distribution of CoagCo's innovative nosebleed device while offering savings to CHAMPS members.

Alternatives or product substitutes include nasal sprays, cauterization techniques, and hemostatic agents. Nasal sprays, often used for mild nosebleeds or congestion, provide a non-invasive option, though they may not be as effective in severe cases. Cauterization, a medical procedure that uses heat to stop bleeding, serves as another substitute, especially in treating chronic epistaxis. Additionally, absorbable hemostatic agents, such as gelatin sponges or fibrin sealants, are gaining popularity for managing bleeding without the need for traditional nasal packing. These alternatives, while effective, may not fully replace traditional packing devices in more severe or surgical cases.

In November 2024, Aptar Pharma inaugurated a new manufacturing facility in Taloja, India, to enhance its production capabilities for drug delivery systems. The facility aims to meet the growing demand for innovative healthcare solutions in the region, reinforcing Aptar Pharma's commitment to providing advanced, high-quality solutions for pharmaceutical and biotechnology companies. In North America and Europe, demand for minimally invasive nasal packing devices is rising due to high rates of chronic sinusitis and nosebleeds. In Asia-Pacific and Latin America, improving healthcare infrastructure and growing nasal health awareness are boosting market growth. Regulatory support and strategic partnerships are driving the expansion and adoption of advanced solutions in these regions.

Product Insights

The spray segment held the largest market share of around 29.3% in 2024, driven by innovations like the approval of a nasal spray for severe allergic reactions. In August 2024, the FDA approved a needle-free nasal spray by ARS Pharmaceuticals as an emergency treatment for anaphylaxis in adults and older children. This spray offers an alternative to injectable treatments like EpiPen, providing a more convenient and effective solution for managing life-threatening allergic reactions, which include symptoms like hives, swelling, and difficulty breathing. The growing demand for non-invasive solutions further boosts the market.

The gel segment is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. Recent advancements in gel production, driven by their high patient comfort and hemostatic properties, are expected to boost segment growth. Gels and dressings are among the most effective treatments for nosebleeds, with various dressing brands available in the market. MeroGel, by Medtronic, is a leading nasal dressing. Additionally, injectable nasal packing is specifically used to prevent lateralization of the central turbinate and nasal adhesions during the post-surgery recovery period.

Type Insights

The non-absorbable segment accounted for the largest revenue share of 54.7% in 2024. These devices are preferred in various medical procedures due to their durability and ability to provide extended support in managing conditions like nosebleeds, chronic sinusitis, and post-surgical recovery. Non-absorbable nasal packing devices are effective in controlling bleeding and preventing complications without the need for frequent replacements. Their widespread use in hospitals and clinics, along with their cost-effectiveness, contributes to the segment's growth. Additionally, their ability to maintain optimal positioning for longer periods further drives their market dominance in nasal packing solutions.

The bioresorbable segment has experienced significant growth, with a notable compound annual growth rate (CAGR) during the forecast period, owing to the rapid technological advancements and the increasing introduction of newer brands into the market. Bioresorbable nasal packing devices are much more convenient to the patients as there is much less pain and have more advantages than their counterpart segment.

Regional Insights

North America nasal packing devices market dominated the global market and accounted for 47.3% of revenue share in 2024. due to the growing adoption of nasal packing solutions for treating the rising number of epistaxis (nosebleed) cases. Additionally, the presence of key market players and ongoing technological innovations in nasal packing products, such as bioabsorbable and minimally invasive devices, contribute to market growth. Strong healthcare infrastructure and a focus on patient comfort further reinforce North America's dominance in the global market.

U.S. Nasal Packing Devices Market Trends

The nasal packing devices market in the U.S. held a significant share of the North American market in 2024. Each year, up to 60 million people in the U.S. experience nosebleeds, with a higher frequency during the winter months due to cold weather and indoor heating, which dry out the nasal passages. This high incidence of epistaxis drives the demand for effective nasal packing solutions. Additionally, the growing adoption of advanced, patient-friendly devices and the presence of leading medical companies in the U.S. further contribute to the market's substantial share in North America.

Europe Nasal Packing Devices Market Trends

The nasal packing devices market in Europe is witnessing growth, fueled by increasing awareness of minimally invasive treatments and the adoption of advanced technologies, such as bioabsorbable materials, which are driving demand for more effective and comfortable nasal packing solutions. For example, Olympus offers a variety of Blu and Blu Glide products, including nasal packing strips for nose surgery. These bacteriostatic and biocompatible advanced polyvinyl alcohol (PVA) sponges address the issues associated with traditional laminated packing products.

The UK nasal packing devices market is projected to expand owing to its advanced healthcare system, partnerships among major stakeholders, and the launch of novel products. Furthermore, a heightened focus on research and development for nasal packing devices designed to address diverse conditions is anticipated to be a significant driver of market growth.

The nasal packing devices market in France is expected to grow over the forecast period, driven by increasing cases of chronic sinusitis, nosebleeds, and nasal surgeries. Advancements in minimally invasive treatments, coupled with rising awareness of bioabsorbable and patient-friendly packing solutions, are further contributing to market expansion.

Germany nasal packing devices market is expected to grow over the forecast period, fueled by the high volume of ENT procedures, which totaled 239,670 in 2022. The increasing prevalence of nasal conditions like epistaxis and sinusitis, along with advancements in minimally invasive treatments, is driving market growth.

Asia Pacific Nasal Packing Devices Market Trends

The nasal packing devices market in Asia Pacificis witnessing strong growth, fueled by several key factors. The rise in the number of nasal packing device manufacturers, coupled with high unmet healthcare needs, is driving market expansion. Additionally, the region's booming economy and improving healthcare infrastructure, particularly in rapidly developing countries like China and India, are contributing to this growth. Growing awareness about nasal packing devices and their applications in treating conditions like nosebleeds and sinus issues further supports the market's development, as both healthcare providers and patients increasingly recognize the benefits of these advanced solutions.

Japan nasal packing devices market is poised for substantial growth. Japan’s advanced healthcare infrastructure and high demand for innovative medical solutions further fuel market expansion. The market is also benefiting from the adoption of bioabsorbable materials and improved patient comfort in nasal packing products. With Japan's focus on technological advancements and rising healthcare expenditure, the market is expected to see steady growth, offering significant opportunities for both local and global players.

The nasal packing devices market in China is expected to grow, driven by technological advancements and heightened research and development in the field of nasal packing devices. The China National Medical Products Administration (NMPA) is responsible for overseeing medical devices, including injectables, to guarantee their safety, effectiveness, and adherence to regulatory requirements.

India nasal packing devices market is poised for substantial growth, fueled by increasing healthcare access, rising incidences of chronic sinusitis, nosebleeds, and nasal surgeries, and improving medical infrastructure. Additionally, the growing awareness of minimally invasive treatments and advancements in nasal packing technologies contribute to this growth. The rising healthcare spending and the adoption of advanced devices position India as a key emerging market for nasal packing solutions.

Latin America Nasal Packing Devices Market Trends

The nasal packing devices market in Latin Americais experiencing significant growth. Increasing efforts in research and development coupled with rapid technological advancements are predicted to drive market growth in the area. Domestic firms concentrate on cost-conscious market sectors by delivering economical inspection solutions. Their familiarity with local regulations and business practices could enable them to offer more customized support and services, thereby fueling market growth.

Saudi Arabia nasal packing devices market is anticipated to expand in the forecast period. This is attributed to the government's encouragement of private sector involvement in healthcare, as outlined in the National Transformation Plan (NTP). Additionally, the projected rise in disposable income from economic expansion and urban development is expected to generate favorable growth prospects.

Key Nasal Packing Devices Company Insights

The scenario in the industry is highly competitive, with key players such as Smith & Nephew, Stryker Corporation; and Medtronic plc. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Nasal Packing Devices Companies:

The following are the leading companies in the nasal packing devices market. These companies collectively hold the largest market share and dictate industry trends.

- Summit Health

- Smith & Nephew

- Stryker Corporation

- Medtronic plc.

- Network medical products ltd.

- Olympus

- Lohmann & Rauscher

- Meril Life Sciences Pvt Ltd.

- FABCO

- Aegis Lifesciences

Recent Developments

-

In April 2024,Aptar Pharma announced plans to expand its manufacturing facility in Congers, New York, with completion expected by the end of 2024. The expansion will enhance the production of Unidose nasal spray systems by adding moulds and assembly lines in cleanroom environments. The facility is set to be operational by 2025.

-

In September 2024, Phillips Medisize, a Molex subsidiary, announced its agreement to acquire Vectura Group, a UK-based CDMO specializing in inhalation drug delivery devices. Vectura's expertise includes the development of dry powder inhalers and metered dose inhalers, enhancing Phillips Medisize’s capabilities in inhalation drug delivery.

-

In October 2024, Aptar Pharma acquired SipNose Nasal Delivery Systems' device technology assets, strengthening its position in the intranasal drug delivery market. SipNose’s devices, designed for targeted delivery within the nasal cavity, will enhance Aptar Pharma's patent portfolio and aid in developing new drug delivery products.

Nasal Packing Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 215.4 million

Revenue forecast in 2030

USD 276.8 million

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Summit Health; Smith & Nephew; Stryker Corporation; Medtronic plc.; Network medical products ltd.; Olympus; Lohmann & Rauscher; Meril Life Sciences Pvt Ltd.; FABCO; Aegis Lifesciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nasal Packing Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nasal packing devices market report on the basis of product, type and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spray

-

Gel

-

Dressings

-

Injectable

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioresorbable

-

Non-absorbable

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the nasal packing devices market with the highest share of 47.3% in 2024. This is attributable to increased healthcare expenditure coupled with high disposable income and the presence of major manufacturers with enhanced product portfolio.

b. Some key players operating in the nasal packing devices market include Smith & Nephew, Lohmann & Rauscher, Network Medical Products Ltd., Olympus Corporation, Summit Medical Group, Entellus Medical, Inc., Medtronic, Stryker, Merocel Corp, Boston Scientific Corporation

b. Key factors driving the nasal packing devices market growth include an increasing number of nasal surgeries, the prevalence of epistaxis and chronic rhinosinusitis, growing geriatric population coupled with the prevalence of hypertension, favorable government initiatives along with rising per capita income.

b. The global nasal packing devices market size was estimated at USD 205.2 million in 2024 and is expected to reach USD 215.4 million in 2025.

b. The global nasal packing devices market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 276.8 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.