- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Natural Food Color Market Size, Share, Growth Report, 2030GVR Report cover

![Natural Food Color Market Size, Share & Trends Report]()

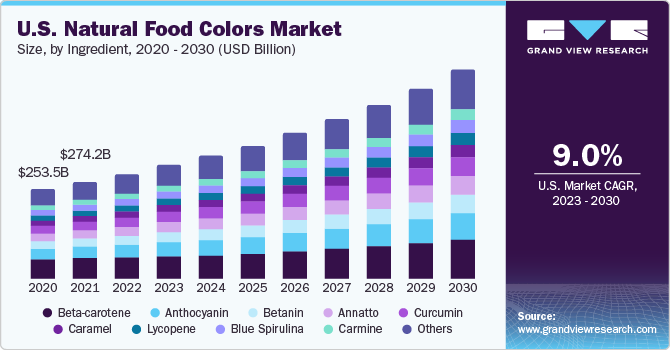

Natural Food Color Market Size, Share & Trends Analysis Report By Ingredient (Beta-carotene, Blue Spirulina, Carmine, Lycopene), By Application (Bakery & Confectionery, Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-740-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Natural Food Color Market Size & Trends

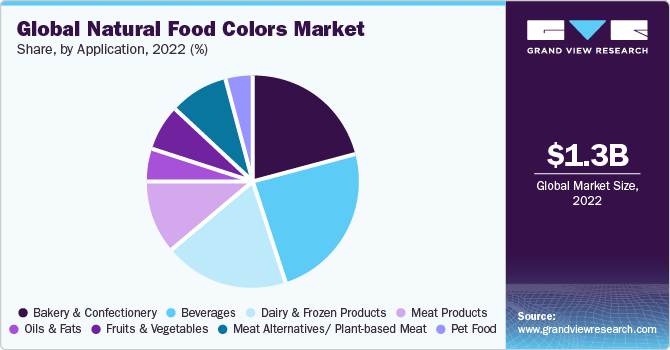

The global natural food color market size was estimated to be USD 1.33 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030. The demand for natural food colors is predominantly driven by several factors that enhance the overall appeal and consumption of these products. One of the primary drivers is the growing emphasis on visual allure in the food industry. Natural food colors are used to make food and beverages visually more appealing to consumers. As people often rely on their eyes to judge food, vibrant and visually captivating products are perceived as more valuable and are more likely to be chosen for purchase.

The rising awareness and demand for clean-label products are further propelling the growth of the natural food colors market. Today's consumers are more conscious about the ingredients present in their food and beverages, favoring natural alternatives over artificial additives. Consequently, there is a surge in demand for natural food colors derived from fruits, vegetables, and other botanicals. Manufacturers are keenly responding to this trend by offering a wide range of natural food color options, thereby significantly boosting the market for these products.

Furthermore, the expansion of the global food and beverage industry, particularly in developing countries, has contributed to the escalating demand for natural food colors. As economies grow and disposable incomes increase, consumers in these regions seek a broader array of food choices. This has led food manufacturers to embrace natural food colors to cater to the evolving preferences and demands of these emerging markets.

The increasing influence of social media and food photography has significantly impacted the natural food colors market. Platforms like Instagram and Facebook have fostered a culture of displaying food experiences, placing a higher emphasis on the aesthetics of food, including its colors. As a result, food manufacturers and chefs are turning to natural food colors, both from fruits and vegetables, and other botanical sources, to create visually stunning and Instagram-worthy dishes.

Ingredient Insights

The beta-carotene segment held the largest share of 20.21% in terms of revenue. The growth of beta-carotene is credited to its natural derivation, which makes this ingredient a safer choice as compared to synthetic alternatives. Beta-carotene is a natural pigment and antioxidant found in various fruits & vegetables, algae, and yeast. It belongs to the carotenoid family, which includes other pigments like lycopene and lutein.

Beta-carotene has gained popularity in the food industry as a natural food colorant and nutritional supplement. It occurs naturally in fruits and vegetables such as cantaloupe, carrots, sweet potatoes, and apricots, lending them their characteristic yellow or orange hue. The attractive color additive properties of beta-carotene make it suitable for use in dairy goods, margarine, salad dressings, cheese, soft drinks, and energy drinks.

Additionally, as consumer awareness regarding the potential health impact of artificial colorants rises, the demand for additive-free foods and beverages is experiencing a significant boost. Several consumers are actively seeking more natural alternatives in their food choices. To address this demand, several players in the market are investing in extraction and stabilization technologies to offer naturally sourced food colors.

In September 2021, India-based Divi’s Nutraceuticals announced the launch of CaroNat, an all-natural food ingredient designed to impart a dark yellow to orange color to a wide range of food and beverage products. CaroNat is derived from concentrated carrot juice, rich in beta-carotene, which is its inherent component.

The blue spirulina segment is expected to showcase the fastest CAGR of 10.4% during the forecast period. Blue spirulina is a vibrant blue pigment extracted from the blue-green algae Arthrospira platensis. It has gained significant popularity in the food and beverage industry as a safe and natural alternative to synthetic food dyes. A favorable regulatory scenario and a rising demand for plant-based diets are key factors that are driving the market for blue spirulina.

In November 2022, GNT, a leading color supplier, obtained official approval from the U.S. Food and Drug Administration (FDA) to utilize spirulina extract as a natural food colorant in beverages. This regulatory endorsement opens up exciting opportunities for manufacturers, allowing them to create vibrant blue shades in their products while maintaining their clean-label status.

This approval paves the way for the use of spirulina extract in various beverage applications, including sports drinks, juice beverages, and alcoholic drinks. GNT has also developed an innovative and patented formulation technology that ensures the stability of the extract, further enhancing its appeal among food and beverage manufacturers.

Application Insights

The beverages segment held the largest share of 24.01% in terms of revenue. The increasing consumer preference for healthier and natural products is driving the adoption of natural food colors in beverages. Consumers are now more conscious of the potential health risks associated with artificial food colors, which have been linked to allergies, hyperactivity in children, and other negative effects. Consequently, there is a growing demand for beverages that use natural and safe food colors.

To cater to this demand, prominent players in the natural food colors market are actively pursuing product launches and employing various strategies. For instance, in September 2022, Sun Chemical unveiled SUNFOODS Natural Colorants, a range of natural colorants for food and beverages, during the Supply Side West event in Las Vegas. These colorants are derived from vegetables, algae, and fruits, making them suitable for use in various applications such as bakery, dairy, pet food, and confectionery. This move reflects the industry's commitment to providing natural and clean-label products to meet the changing preferences of consumers.

The meat alternative/plant-based meat showcased a CAGR of 9.1% during the forecast period. Consumers seek healthier and sustainable food choices, and plant-based meats offer a compelling alternative to traditional meat products. Natural food colors derived from plant sources, such as fruits, vegetables, and algae, are used to mimic the appearance of real meat, making plant-based meats visually more appealing and appetizing.

In May 2023, GNT launched Exberry Compound Red. It is a new plant-based natural food concentrate that gives red meat alternatives a brownish appearance when grilled or fried. It is made from carrots and vegetable oil, which makes it a clean-label ingredient. The Exberry Compound Red range includes two shades, Autumn Red and Fall Forest Red. These shades can be used to create a variety of browned meat colors. The compound is easy to use and transforms the color of meat analogs when heated.

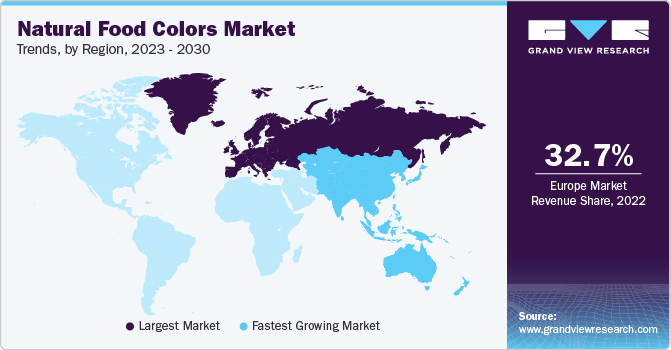

Regional Insights

The Europe market held a dominant revenue share of 32.7% in 2022. The shift in European consumers' preferences toward natural, simple, and recognizable ingredients is a major driver behind the growth of the natural food colors industry in the continent. As consumers become more conscious of what they eat, they are actively seeking healthier snack options with all-natural ingredients, particularly in the snack industry. The demand for products labeled as "no additives or preservatives," "GMO-free," "whole grain," or "all-natural" is on the rise as consumers look for reassurance about the quality and healthiness of their food choices.

Food manufacturers are responding by introducing natural food colors sourced from fruits, vegetables, and plant extracts to meet consumer demands, resulting in significant market growth. Market players are adopting various strategies to strengthen their position in the market. For instance, in October 2021, Givaudan announced its acquisition of DDW, The Color House, a prominent natural color company based in the U.S. This acquisition helps Givaudan cater to the growing demand for natural and sustainable ingredients in the food industry. Such strategic initiatives by market players drive growth and innovation in the Europe natural food colors market.

The Asia Pacific market for natural food colors is expected to grow at a CAGR of 9.5% from 2023 to 2030. In the Asia Pacific region, the food and beverage industry has been actively embracing innovation as companies seek to set themselves apart in the competitive market. Natural food colors have become a valuable tool for manufacturers in this pursuit of differentiation and have been well-established in the food and beverage industry.

Moreover, standards like the T/CNFIA 101-2017 on Coloring Foods issued by China National Food Industry Association significantly impacted the market for natural food colors in the country. The strict criteria outlined in the standard require that colorants used in food products must be derived only from natural and edible raw materials, such as plants, fruits, vegetables, and algae. Furthermore, the extraction of pigments through organic solvent extraction is not permitted, and the colorants should be obtained solely through physical processes.

This standard aligns with the increasing demand for clean-label and transparent ingredients in China's food industry. As consumers become more health-conscious and seek safer and more natural food options, the demand for natural food colors has surged. By adhering to this standard, food manufacturers in China can offer products with cleaner labels, free from synthetic additives and artificial colorants, which are perceived as healthier and more trustworthy by consumers.

Key Companies & Market Share Insights

The global natural food colors market is characterized by intense competition, mainly attributed to several players operating in the market. Various companies are providing innovative products to cater to consumer demand. In April 2023, Sensient Colors, a division of Sensient Technologies, developed Vertafine, a new natural green color for pet foods. It enables pet food manufacturers to meet the increasing consumer demand for natural colors. This solution offers bright green shades and is cost-effective, making it suitable for high-heat pet food applications. Some prominent players in the global natural food color market include:

-

NATUREX

-

Givaudan

-

BASF SE

-

Sensient Technologies Corporation

-

ADM

-

Spring TopCo DK ApS (Oterra)

-

Allied Biotech Corporation

-

ROHA Group

-

Kalsec Inc.

-

Döhler GmbH

-

San-Ei Gen F.F.I., Inc.

-

AROMATAGROUP SRL

-

Ingredion

-

Vivify

-

Roquette Frères

-

INCOLTEC

-

IFC Solutions

-

Australian Food Ingredient Suppliers

Natural Food Color Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.42 billion

Revenue forecast in 2030

USD 2.52 billion

Growth rate

CAGR of 8.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, volume in kilo tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, application, region

Regional scope

North America; Europe; Asia-Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Argentina; Brazil; South Africa

Key companies profiled

NATUREX; Givaudan; BASF SE; Sensient Technologies Corporation; ADM; Spring TopCo DK ApS (Oterra); Allied Biotech Corporation; ROHA Group; Kalsec Inc.; Döhler GmbH; San-Ei Gen F.F.I., Inc.; AROMATAGROUP SRL; Ingredion; Vivify; Roquette Frères; INCOLTEC; IFC Solutions; Australian Food Ingredient Suppliers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Natural Food Color Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global natural food color market report based on ingredient, application, and region:

-

Ingredient Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Beta-carotene

-

Lycopene

-

Curcumin

-

Anthocyanin

-

Carmine

-

Copper Chlorophyllin

-

Paprika

-

Betanin

-

Riboflavin

-

Blue Spirulina

-

Caramel

-

Annatto

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Bakery & Confectionery

-

Beverages

-

Dairy & Frozen Products

-

Meat Products

-

Oils & Fats

-

Fruits & Vegetables

-

Meat Alternatives/ Plant-based Meat

-

Pet Food

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global natural food color market size was estimated at USD 1.32 billion in 2022 and is expected to reach USD 1.42 billion in 2023.

b. The global natural food color market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 2.52 billion by 2030.

b. Europe dominated the natural food color market with a share of 32% in 2022. This is attributable to adoption of the products such as carotenoids, carmines, curcumin, and anthocyanin in applications such as bakery & confectionery, beverages, and meat, among others.

b. Some key players operating in the natural food color market NATUREX, Givaudan, BASF SE, Sensient Technologies Corporation, ADM, Spring TopCo DK ApS (Oterra), Allied Biotech Corporation, ROHA Group, Kalsec Inc, Döhler GmbH, San-Ei Gen F.F.I., Inc., AROMATAGROUP SRL, Ingredion, Vivify, Roquette Frères, INCOLTEC, IFC Solutions, and Australian Food Ingredient Suppliers.

b. Key factors that are driving the market growth include rapid growth over the forecast period owing to high demand in confectionery and bakery goods. In addition, stringent regulations pertaining to the use of synthetic and identical colors is likely to emerge as the major driver for the industry growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."