- Home

- »

- Network Security

- »

-

Network Forensics Market Size, Share, Growth Report, 2030GVR Report cover

![Network Forensics Market Size, Share & Trends Report]()

Network Forensics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premises), By Organization Size (SME), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-460-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Network Forensics Market Summary

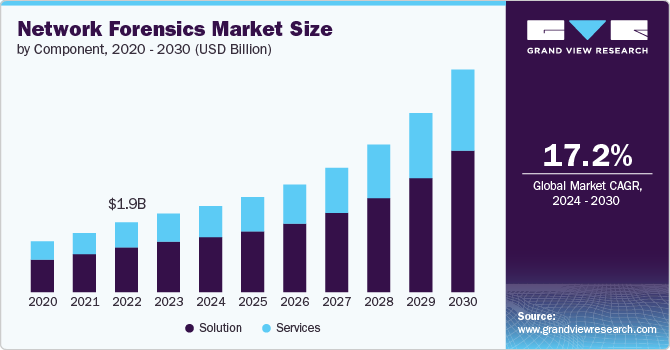

The global network forensics market size was estimated at USD 2.20 billion in 2023 and is projected to reach USD 6.23 billion by 2030, growing at a CAGR of 17.2% from 2024 to 2030. The rapid growth of IoT devices and connected infrastructures across various industries has introduced new security vulnerabilities, as these devices often lack robust security measures.

Key Market Trends & Insights

- The North America held the largest revenue share of over 36% in the market in 2023.

- The U.S. is growing significantly at a CAGR of 16.5% from 2024 to 2030.

- Based on component, solution segment accounted for the largest market share of over 63% in 2023.

- Based on deployment, on-premises segment held a market share of over 64% in 2023 and is expected to dominate the market by 2030.

- Based on organization size, large enterprises segment held a market share of over 69% in 2023 and is expected to dominate the market by 2030.

Market Size & Forecast

- 2023 Market Size: USD 2.20 Billion

- 2030 Projected Market Size: USD 6.23 Billion

- CAGR (2024-2030): 17.2%

- North America: Largest market in 2023

Network forensics solutions play a critical role in monitoring traffic within IoT ecosystems, helping organizations detect and analyze unusual or malicious activities. By capturing and analyzing network data from IoT devices, these tools can identify threats such as unauthorized access, data tampering, or malware. This proactive monitoring is essential for securing IoT networks, mitigating risks, and ensuring the integrity of connected systems, which are becoming increasingly vital to modern business operations.

The network forensics market refers to the solutions and services used to monitor, capture, store, and analyze network traffic to detect and investigate cybersecurity incidents, anomalies, and data breaches. Network forensics tools and technologies help organizations trace the origins of cyberattacks, mitigate risks, and meet regulatory compliance requirements. These solutions provide deep visibility into network traffic, aiding in detecting insider threats, external cyberattacks, and breaches in real-time.

The rising frequency and sophistication of cyberattacks, including ransomware, advanced persistent threats (APTs), and data breaches, have significantly increased the demand for network forensics tools. These attacks pose severe risks to organizations by compromising sensitive data and disrupting operations. Network forensics solutions enable security teams to monitor, capture, and analyze network traffic to trace the origin of attacks, identify vulnerabilities, and uncover malicious activities. By providing detailed insights into how breaches occur, these tools help organizations not only respond to incidents quickly but also implement proactive measures to prevent future security threats and ensure compliance with regulatory standards.

Regulatory frameworks like GDPR, HIPAA, and PCI DSS require organizations to implement strict data security protocols and maintain detailed incident reporting and investigation capabilities. Network forensics solutions help companies meet these requirements by monitoring and analyzing network traffic to detect security breaches, ensure data integrity, and document cyber incidents. These tools provide insights into the nature of attacks, enabling organizations to respond quickly and maintain comprehensive audit trails for regulatory compliance. By securing sensitive data and ensuring prompt breach detection, network forensics helps businesses avoid legal penalties and ensure compliance with industry-specific security standards.

Component Insights

The solution segment accounted for the largest market share of over 63% in 2023. Rising cybersecurity threats, including data breaches, ransomware attacks, and advanced persistent threats (APTs), are driving the demand for advanced network forensics solutions. As these threats grow in complexity and frequency, organizations require robust tools to detect, analyze, and respond to potential vulnerabilities and incidents. Network forensics solutions enable real-time monitoring of network traffic, helping to identify suspicious activities and mitigate attacks before they escalate. Simultaneously, the growing adoption of cloud infrastructures is transforming the security landscape. As businesses move to cloud and hybrid environments, traditional security solutions struggle to keep up with the scale and complexity. Cloud-native network forensics tools offer scalable and efficient threat detection, providing visibility across cloud networks and ensuring data security in multi-cloud and hybrid ecosystems.

The services segment is expected to grow at a CAGR of 17.4% during the forecast period. The demand for Managed Services is increasing as many organizations, especially SMEs, lack the in-house expertise to manage network forensics. These services offer continuous monitoring, threat detection, and analysis, providing a cost-effective solution for managing cybersecurity risks without needing internal teams. Additionally, the need for expertise and consulting services is growing due to stricter regulatory requirements like GDPR and HIPAA. Companies require professional services for implementing network forensics solutions, integrating them into their existing infrastructure, and managing compliance. These services ensure data security, regulatory adherence, and effective incident response, making external expertise crucial for robust cybersecurity.

Deployment Insights

The on-premises segment held a market share of over 64% in 2023 and is expected to dominate the market by 2030. On-premises solutions provide organizations with greater customization and control over their network security infrastructure, allowing them to tailor forensic tools to address specific security needs and respond to unique threats more effectively. This flexibility is particularly valuable for industries with specialized requirements or strict security protocols. Additionally, large enterprises with established on-premises infrastructure or legacy systems prefer integrating network forensics solutions locally, as it offers a more seamless and secure implementation compared to cloud alternatives. This preference for maintaining internal control and ensuring compatibility with existing systems contributes to the growth of the on-premises segment.

The cloud segment is expected to grow at a CAGR of 18.0% over the forecast period. As businesses increasingly adopt cloud-based infrastructures, the demand for cloud-native network forensics solutions is rising. These solutions are crucial for providing real-time monitoring and threat detection across complex and distributed cloud environments, ensuring robust security. Additionally, cloud-based network forensics offers significant scalability and flexibility, enabling organizations to expand their security capabilities without the need for substantial upfront investment in hardware or infrastructure. This scalability makes cloud solutions particularly appealing to growing businesses, as they can adjust resources based on needs and access advanced security features without significant capital expenditure.

Organization Size Insights

The large enterprises held a market share of over 69% in 2023 and is expected to dominate the market by 2030. Large enterprises typically manage intricate and expansive network infrastructures, involving numerous systems, applications, and locations. This complexity necessitates sophisticated network forensics solutions to effectively monitor, analyze, and secure high volumes of diverse network traffic. Such solutions are essential for detecting anomalies, understanding traffic patterns, and identifying potential security threats across the enterprise. They enable comprehensive visibility into various network segments and interactions, facilitating robust security measures and incident response. By providing deep insights and detailed analysis, these tools help large organizations maintain effective control over their intricate network environments and safeguard against advanced cyber threats.

The SMEs segment is expected to grow at a CAGR of 18.0% over the forecast period. SMEs are facing a surge in cyber threats, including ransomware and phishing attacks, making network forensics solutions essential for effective security management. These tools help SMEs detect, analyze, and respond to incidents promptly, safeguarding against the growing range of cyber risks. Additionally, as SMEs increasingly adopt cloud-based infrastructures, the need for cloud-native network forensics solutions has become more pronounced. These solutions are designed to secure data and applications in cloud environments, providing the visibility and control necessary to protect against threats and ensure the integrity of cloud-based systems, thus addressing the evolving security needs of SMEs.

Application Insights

The endpoint security segment held a market share of over 33% in 2023 and is expected to dominate the market by 2030. The surge in cyber threats, including sophisticated attacks targeting endpoints such as laptops, smartphones, and workstations, is driving the demand for advanced endpoint security solutions. As cyberattacks become more frequent and complex, traditional security measures are often insufficient to protect against threats like malware, ransomware, and phishing. Advanced endpoint security tools are crucial for detecting and responding to these threats in real-time, providing essential protection for critical devices and data. By offering features such as threat detection, behavior analysis, and automated response, these solutions help organizations defend against evolving security challenges and safeguard their endpoints effectively.

The data center security segment is expected to grow at a CAGR of 18.2% over the forecast period. As organizations generate and store increasingly vast amounts of data, securing data centers becomes critically important. The sheer volume and complexity of data necessitate advanced network forensics solutions to effectively monitor, analyze, and safeguard against breaches and cyberattacks. Data centers are prime targets for sophisticated threats, such as DDoS attacks and ransomware, due to the sensitive nature of the information they house. The rising frequency and complexity of these attacks drive the need for enhanced security measures. Network forensics solutions are essential for providing real-time visibility, detecting anomalies, and implementing protective measures to ensure the integrity and security of data center infrastructures.

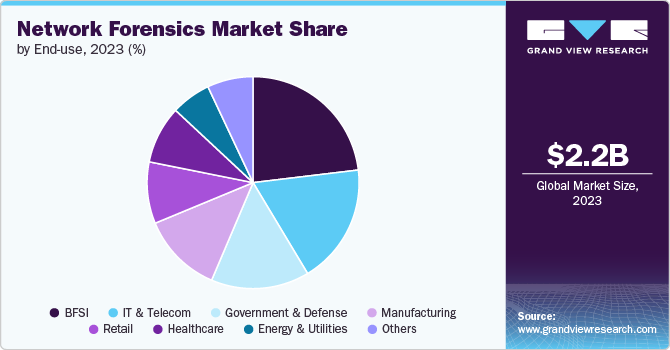

End Use Insights

The BFSI segment accounted for the largest market share of over 23% in 2023. The BFSI sector is a prime target for cyberattacks, including phishing, ransomware, and financial fraud, due to its handling of sensitive financial and personal data. Network forensics solutions are essential for detecting, analyzing, and mitigating these threats to protect against breaches and unauthorized access. Financial institutions manage highly valuable data, making the security of this information paramount. Advanced network forensics tools are crucial for safeguarding against sophisticated attacks, ensuring the integrity of transactions, and maintaining the confidentiality and security of sensitive data. These solutions help prevent financial losses and regulatory non-compliance by providing robust threat detection and incident response capabilities.

The IT and Telecom segment is expected to grow at a CAGR of 18.6% over the forecast period. The rapid expansion of IT and telecom networks, including advancements like 5G and fiber optics, significantly increases the complexity and volume of network traffic. This growth necessitates advanced network forensics solutions to effectively monitor, analyze, and secure these extensive infrastructures, ensuring robust performance and protection against threats. Additionally, the convergence of IT and telecom services, such as integrated communication and cloud solutions, results in a unified network environment that demands comprehensive forensics tools. These solutions are vital for monitoring and securing all components of the converged network, providing a holistic approach to managing and protecting complex, interconnected systems.

Regional Insights

The North America held the largest revenue share of over 36% in the market in 2023. North America, especially the U.S., experiences a high volume of sophisticated cyberattacks such as ransomware, advanced persistent threats (APTs), and data breaches. The frequent and severe nature of these threats drives the demand for advanced network forensics solutions. Organizations require these tools to effectively detect, analyze, and respond to complex security incidents. Network forensics solutions provide critical visibility into network traffic, helping identify attack vectors, trace the origins of breaches, and implement effective mitigation strategies. This heightened threat landscape necessitates robust network forensics capabilities to protect sensitive data and maintain cybersecurity resilience.

U.S. Network Forensics Market Trends

The network forensics market in the U.S. is growing significantly at a CAGR of 16.5% from 2024 to 2030. U.S. is home to many leading network forensics vendors and solution providers, which fosters significant innovation and market growth. These companies offer a diverse array of cutting-edge solutions and services, including advanced analytics, AI-driven tools, and comprehensive threat detection capabilities. The competitive environment encourages continuous advancements in technology, enhancing the effectiveness of network forensics in addressing evolving security challenges. The presence of these vendors not only drives the development of more sophisticated tools but also ensures that organizations have access to a wide range of options to meet their specific security needs and stay ahead of emerging threats.

Asia Pacific Network Forensics Market Trends

The network forensics market in Asia Pacific is growing significantly at a CAGR of 18.3% from 2024 to 2030. As businesses in Asia Pacific increasingly transition to cloud-based solutions, the need for cloud-native network forensics tools has surged. These tools are essential for monitoring and protecting complex multi-cloud and hybrid environments, where traditional security solutions may fall short. Cloud-native network forensics provide real-time visibility into network traffic, enabling organizations to detect, analyze, and respond to security incidents across diverse cloud platforms. This capability is crucial for safeguarding data, ensuring compliance with regulations, and maintaining security in dynamic and rapidly evolving cloud infrastructures, thus addressing the growing cybersecurity challenges associated with cloud adoption.

Europe Network Forensics Market Trends

The network forensics market in Europe is growing significantly at a CAGR of 17.1% from 2024 to 2030. Europe’s stringent data protection regulations, notably GDPR, require organizations to implement robust data protection and incident response measures, driving a heightened demand for network forensics solutions to ensure compliance and avoid substantial fines. Concurrently, the rapid digital transformation across various industries, including finance, healthcare, and retail, has increased the complexity of network environments. This digital expansion necessitates comprehensive network forensics solutions to effectively monitor and secure these intricate systems, address emerging security threats, and manage vast amounts of data. The combination of regulatory pressures and evolving digital landscapes fuels the need for advanced network forensics capabilities in the region.

Key Network Forensics Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Palo Alto Networks and IBM partnered to deliver AI-powered cybersecurity solutions. IBM will integrate Palo Alto Networks’ security platforms into its consulting services and train over 1,000 security consultants. The collaboration focuses on AI-driven threat detection and security operations, with Palo Alto Networks incorporating IBM's watsonx large language models into its offerings. Additionally, Palo Alto Networks plans to acquire IBM’s QRadar SaaS assets to enhance their AI capabilities. Together, they aim to streamline security operations, support digital transformation, and drive innovation in AI-powered cybersecurity.

-

In June 2024, Cisco introduced new capabilities in its Security Cloud to enhance enterprise defenses, powered by AI and industry partnerships. Key innovations include Cisco Hypershield for improved security in modern data centers, a next-generation firewall series for better performance, and AI-driven management through Security Cloud Control. These solutions aim to streamline security management across hybrid environments, improve threat detection, and foster collaboration with major partners like Google to strengthen zero trust security frameworks. The Security Cloud platform also integrates advanced telemetry for superior security operations.

-

In May 2024, Palo Alto Networks has introduced AI-powered security solutions infused with their proprietary Precision AI to counter advanced cyber threats and secure AI adoption. The new solutions include AI Access Security, AI Security Posture Management (AI-SPM), and AI Runtime Security, helping organizations protect AI-driven infrastructures. These tools utilize machine learning, deep learning, and generative AI to proactively safeguard against sophisticated attacks, such as zero-day threats and DNS hijacking. The solutions aim to enhance compliance, minimize data exposure, and streamline security for businesses adopting AI technologies.

Key Network Forensics Companies:

The following are the leading companies in the network forensics market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- IBM Corporation

- Symantec Corporation (Broadcom Inc.)

- Trellix

- RSA Security LLC

- Palo Alto Networks, Inc.

- LogRhythm, Inc.

- Viavi Solutions Inc.

- NIKSUN

- Fortinet, Inc.

Network Forensics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.40 billion

Revenue forecast in 2030

USD 6.23 billion

Growth Rate

CAGR of 17.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, Deployment, Organization Size, Application, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Cisco Systems, Inc.; IBM Corporation; Symantec Corporation (Broadcom Inc.); Trellix; RSA Security LLC; Palo Alto Networks, Inc.; LogRhythm, Inc.; Viavi Solutions Inc.; NIKSUN; Fortinet, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Forensics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global network forensics market report based on component, deployment, organization size, application, end use and region:

-

Network Forensics Component Outlook (Revenue; USD Billion; 2018 - 2030)

-

Solution

-

Hardware

-

Software

-

-

Services

-

-

Network Forensics Deployment Outlook (Revenue; USD Billion; 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Network Forensics Organization Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Network Forensics Application Outlook (Revenue; USD Billion; 2018 - 2030)

-

Data Center Security

-

Endpoint Security

-

Network Security

-

Application Security

-

Others

-

-

Network Forensics End Use Outlook (Revenue; USD Billion; 2018 - 2030)

-

IT and Telecom

-

Government and Defense

-

Banking, Financial Services, and Insurance (BFSI)

-

Healthcare

-

Retail

-

Manufacturing

-

Energy & Utilities

-

Others

-

-

Network Forensics Regional Outlook (Revenue: USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global network forensics market was valued at USD 2.20 billion in 2023 and is expected to reach USD 2.40 billion in 2024.

b. The global network forensics market is expected to grow at a compound annual growth rate of 17.2% from 2024 to 2030 to reach USD 6.23 billion by 2030.

b. The solution segment accounted for the largest market share of over 63% in 2023. Rising cybersecurity threats, including data breaches, ransomware attacks, and advanced persistent threats (APTs), are driving the demand for advanced network forensics solutions. As these threats grow in complexity and frequency, organizations require robust tools to detect, analyze, and respond to potential vulnerabilities and incidents.

b. Key players in the network forensics market include Cisco Systems, Inc., IBM Corporation, Symantec Corporation (Broadcom Inc.), Trellix, RSA Security LLC, Palo Alto Networks, Inc., LogRhythm, Inc., Viavi Solutions Inc., NIKSUN, and Fortinet, Inc.

b. The network forensics market refers to the solutions and services used to monitor, capture, store, and analyze network traffic to detect and investigate cybersecurity incidents, anomalies, and data breaches. Network forensics tools and technologies help organizations trace the origins of cyberattacks, mitigate risks, and meet regulatory compliance requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.