- Home

- »

- Medical Devices

- »

-

Neurovascular Devices Market Size, Industry Report, 2033GVR Report cover

![Neurovascular Devices Market Size, Share & Trends Report]()

Neurovascular Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Device (Cerebral Embolization & Aneurysm Coiling Devices, Neurothrombectomy Devices, Support Devices), By Therapeutic Applications, By Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-851-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Neurovascular Devices Market Summary

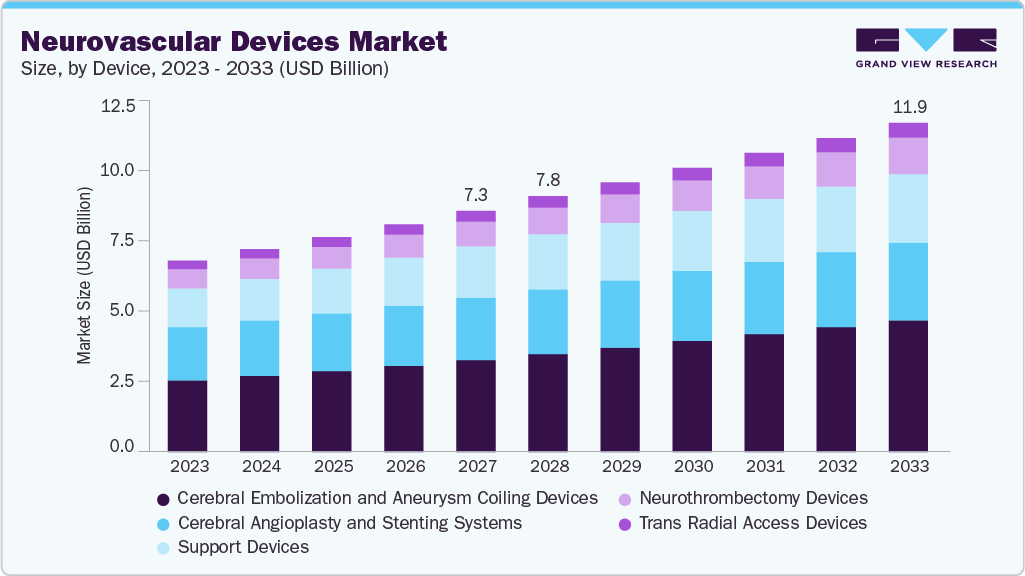

The global neurovascular devices market size was estimated at USD 7.34 billion in 2024 and is projected to reach USD 11.91 billion by 2033, growing at a CAGR of 5.48% from 2025 to 2033. The market is driven by the rising prevalence of neurovascular disorders, advancements in medical technology, and an increasing focus on minimally invasive procedures.

Key Market Trends & Insights

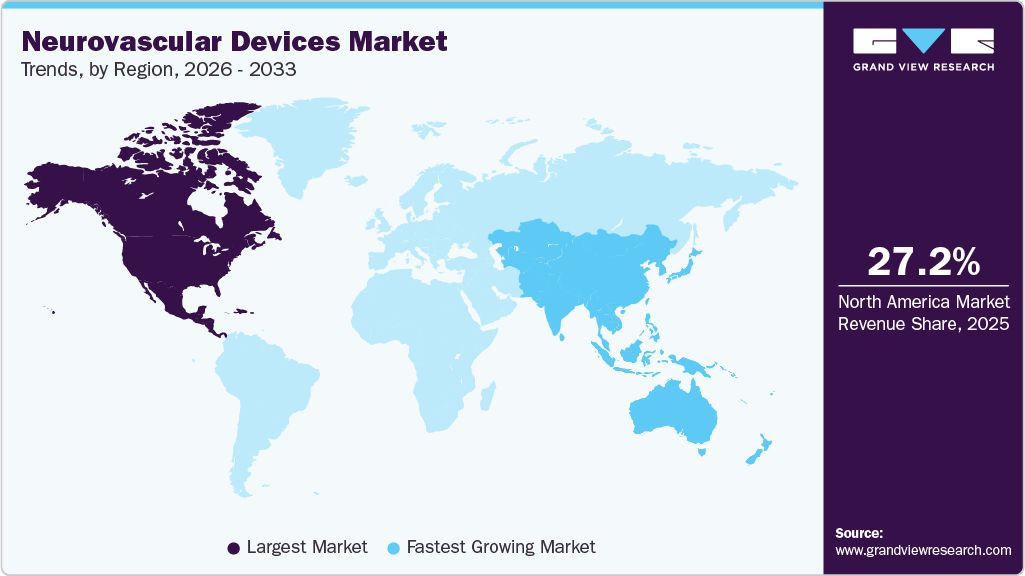

- North America dominated the neurovascular devices market with the largest revenue share of 27.40% in 2024.

- The neurovascular device market in the U.S. is expected to register significant CAGR over the forecast period.

- By device, the cerebral embolization and aneurysm coiling devices segment led the market with the largest revenue share of 37.56% in 2024.

- Based on therapeutic application, the cerebral aneurysm segment is anticipated to grow at the fastest CAGR over the forecast period.

- Based on size, the 0.021" segment led the market with the largest revenue share of 26.99% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.34 Billion

- 2033 Projected Market Size: USD 11.91 Billion

- CAGR (2025-2033): 5.48%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

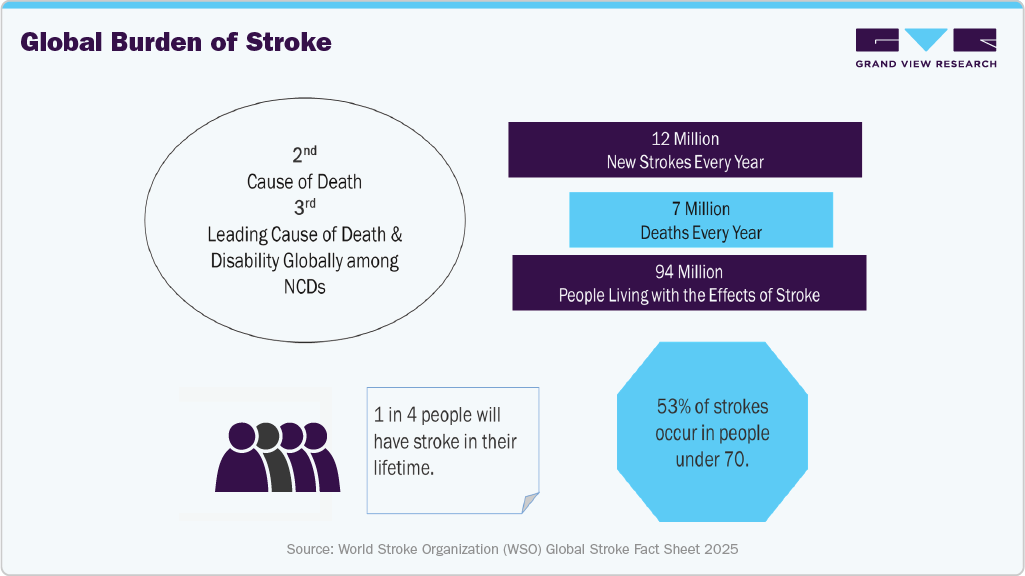

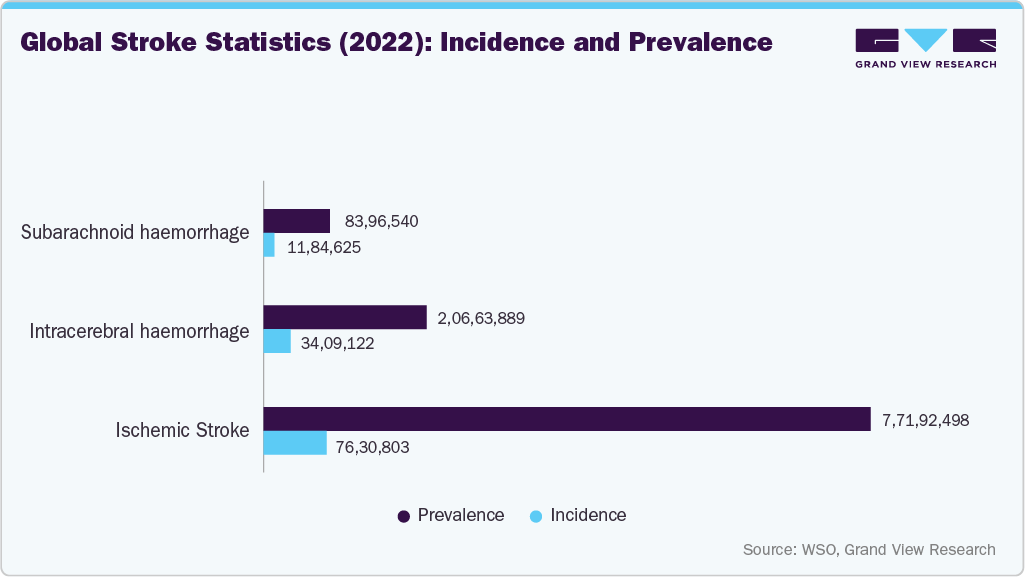

As conditions such as stroke, cerebral aneurysms, and Arteriovenous Malformations (AVM) become more common, the demand for effective treatment options also increases. The increasing prevalence of neurovascular diseases such as strokes and aneurysms is a major driving force behind the neurovascular devices industry. Various neurovascular devices, including clot retrieval devices, microcatheters, and flow diversion coils, are utilized to treat these conditions. According to the Global Stroke Fact Sheet 2024 published by the World Stroke Organization (WSO), more than 12 million new strokes occur annually, and about 25% of the global population will experience a stroke in their lifetime.

The burden of neurovascular disorders, such as strokes, is increasing significantly, which is anticipated to propel the demand for neurovascular devices such as neurothrombectomy devices like clot retrievers and suction devices, among others.

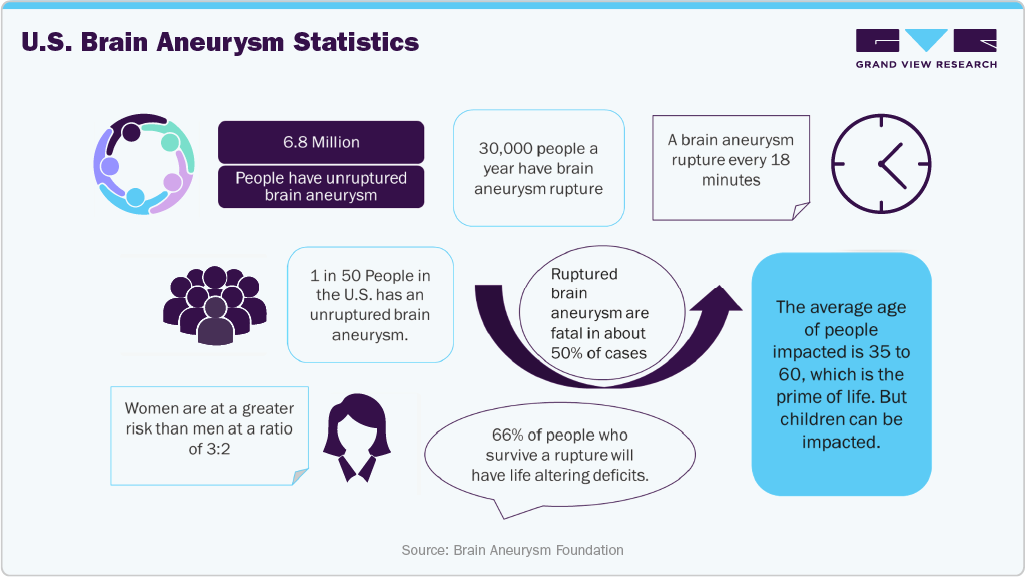

In addition, data released by the Brain Aneurysm Foundation in August 2024 indicates that an unruptured brain aneurysm affects an estimated 6.8 million people in the U.S., with around 30,000 individuals suffering a brain aneurysm rupture each year. As a result, the significant number of patients affected by neurovascular diseases and the increasing use of neurovascular devices in their treatment are expected to drive market growth in the coming years.

Moreover, companies are using innovative technologies to develop neurovascular devices. For instance, in June 2024, Penumbra launched BMX 81 and BMX 96 neuro access catheters in Europe. These catheters are manufactured utilizing laser-cut stainless steel hypo tube technology to provide trackability and stability. Such product developments incorporating advanced technology are expected to drive market growth over the forecast period.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Dr. Zaidat, Director of the Neuroscience and Stroke Center at Mercy Hospital in Toledo, Ohio.

“I’m privileged to be one of the first users of the new Cerepak detachable coils.The advancement of greater tools in neurology may improve patient outcomes, and my team looks forward to continuing the utilization of Cerepak coils in our treatment plans.”

- Early adoption of innovative tools

- Growing demand for advanced neurology solutions

Joan Kristensen, head of the Europe, Middle East and Africa region for Penumbra, Inc.

“Physicians in Europe now have more options to serve their patients using our expanded portfolio. With five innovative devices introduced in Europe in a matter of months, our dedication to improving stroke care enables us to provide physicians with customised stroke solutions. IIn all modesty, Penumbra provides physicians with the widest aspiration thrombectomy stroke portfolio on the market.”

- Demand for customized devices

- Expansion in European markets

- Growth in thrombectomy adoption

Jeff Hopkins, CEO of FlowPhysix.

"Our game-changing technology has the potential to alter the current standard of care for thrombectomy. This partnership provides FlowPhysix expanded reach in delivering our unique solutions to patients worldwide. We strongly believe that 3comma's proven leadership and deep expertise will drive commercial success internationally and increase shareholder value for the company."

- Global expansion of thrombectomy solutions

- Increased access to innovative technologies worldwide

- Strengthened international market presence

Source: Grand View Research Analysis

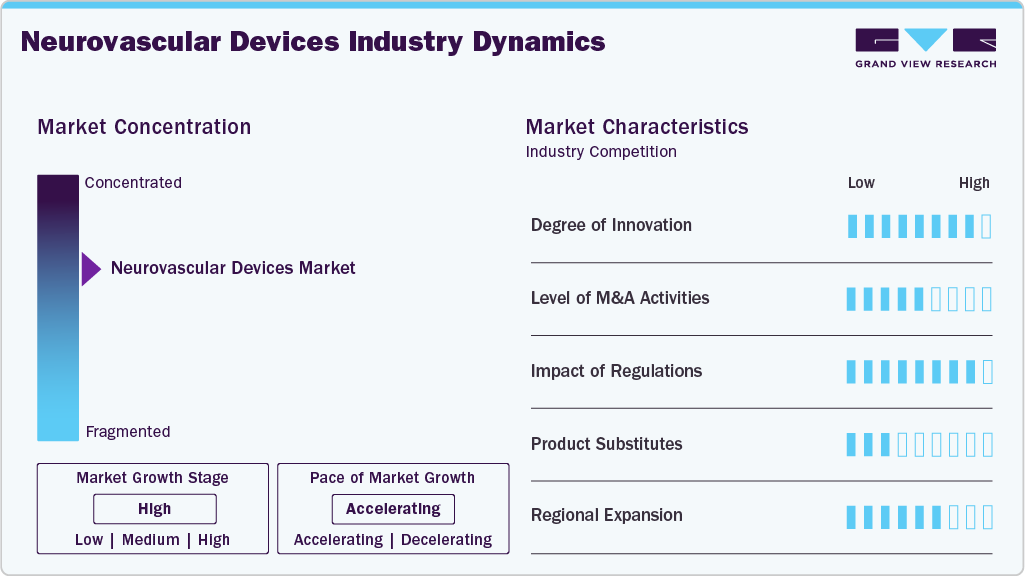

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by a high degree of growth due to the increasing prevalence of neurovascular diseases such as strokes and aneurysms.

Industry players and researchers are developing advanced neurovascular devices. They are focusing on differentiating products based on technology, designs and features. For instance, in May 2023, CERENOVUS, Inc., reported that its new CEREPAK Detachable Coils are now commercially available in the U.S. These coils come in three shapes and various sizes, giving physicians a wide range of options for embolizing brain aneurysms.

Regulatory bodies, such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA), play a crucial role in shaping the regulatory framework for the neurovascular devices industry. Stricter requirements for clinical trials and post-market surveillance ensure patient safety and product efficacy, but they can also pose challenges for companies seeking approvals.

U.S. FDA Classification for Neurovascular Devices

Classification

Product Category

Class II

Embolization Device

Class III

Intracranial Aneurysm Flow Diverter

Class III

Stent, carotid

Class II

Neurothrombectomy Devices

Source: U.S. Food and Drug Administration

The market is poised to experience robust mergers and acquisitions (M&A) activity as companies seek to expand their product portfolios, leverage synergies, and enter new markets. Established players are acquiring smaller innovators to gain access to advanced technologies. For example, in January 2025, Kaneka Corporation acquired 96.8% of shares in EndoStream Medical Ltd (ESM), a company developing the innovative Nautilus device for treating cerebral aneurysms.

Neurovascular device companies are increasingly focusing on regional expansion to meet growing demand. In September 2024, FlowPhysix Inc. collaborated with 3comma Medical GmbH to serve as the international commercial partner for the FLOWRUNNER Aspiration System. This collaboration will offer global access to advanced thrombectomy technology, allowing FlowPhysix to concentrate on U.S. commercialization while 3comma drives international market growth.

Device Insights

The cerebral embolization and aneurysm coiling devices segment led the market with the largest revenue share of 37.56% in 2024. These devices are further categorized into embolic coils, flow diversion coils, and liquid embolic agents. Ongoing research and development of advanced solutions, such as smart aneurysm coils, are expected to drive segment growth. For example, in November 2024, a study published by the National Library of Medicine evaluated the safety and efficacy of the SMART coil system for treating brain aneurysms. This next-generation embolic coil includes a detachment pusher, bare platinum coil, and detachment handle. The study found the SMART coil to be a safe and effective option for managing intracranial aneurysms, offering advantages over existing treatment methods. These promising clinical results are anticipated to fuel embolic device growth further.

Company Name

Product Name

Launch Date

Emboa Medical

Thrombus Retrieval Aspiration Platform (TRAP Catheter)

February 2025

CERENOVUS, Inc., part of Johnson & Johnson MedTech

CEREGLIDE 71 Intermediate Catheter

February 2024

MicroVention

Eric Retrieval Device

June 2023

Source: Grand View Research Analysis

The neurothrombectomy devices segment is expected to grow at the fastest CAGR during the forecast period. Industry players' increasing focus on expanding their product portfolios and the rising prevalence of acute ischemic stroke are expected to drive the segment's growth in the coming years. Some of the recently launched neurothrombectomy devices are mentioned below:

Therapeutic Application Insights

The stroke segment led the market with the largest revenue share of 56.85% in 2024. This dominance can be attributed to the growing prevalence of stroke across the globe. Moreover, healthcare facilities and industry players are focusing on developing innovative neurovascular devices that can help treat strokes. For instance, in November 2024, sixteen Indian hospitals, led by AIIMS Delhi, began testing a new stent-retriever for acute ischemic stroke, developed by U.S.-based Gravity Medical Technology. The GRASSROOT trial aims to evaluate this device, designed specifically for stroke clot characteristics in Indian patients, addressing a significant health burden in India. These developments of products for stroke treatment are anticipated to drive the segment growth.

The cerebral aneurysm segment is projected to experience at the fastest CAGR during the forecast period, driven by the rising prevalence of cerebral aneurysms. This growth is further supported by increasing clinical trials and the launch of advanced technologies. For example, in February 2023, EndoStream Medical-a company specializing in brain aneurysm solutions-initiated the TORNADO-US clinical study in the U.S. with the enrollment of its first patient. The study is evaluating the Nautilus intrasaccular system for treating cerebral aneurysms. Such advancements are expected to boost segment growth in the coming years.

Size Insights

The 0.021" size segment led the market with the largest revenue share of 26.99% in 2024. This dominance is attributed to various advantages provided by the 0.021" size devices, along with multiple product launches and approvals. For instance, in October 2021, Evasc Neurovascular introduced the eCLIPs Bifurcation Flow Diverter, the third version of their eCLIPs device. The latest generation of eCLIPs features a shapeable delivery wire, a reduced size suitable with 0.027" and 0.021" ID microcatheters, and electrolytic detachment for more effective treatment of bifurcation cerebral aneurysms.

The other segment is expected to grow at the fastest CAGR during the forecast period. The other segment includes devices sized at 0.015", 0.060", 0.84", 0.091", and 0.074". The availability and benefits offered by these products are projected to drive segment expansion. For example, the AVIGO 0.014" hydrophilic guidewire seamlessly supports tracking. crossing and maintaining catheter stability. Therefore, the abundance of products in this area is likely to promote market growth during the projection period.

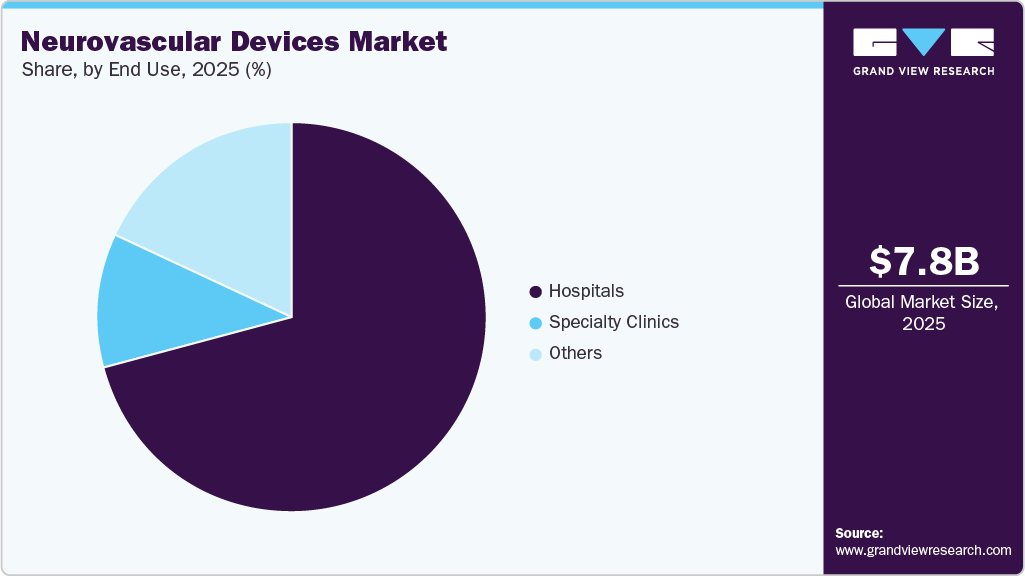

End-use Insights

The hospital segment led the market with the largest revenue share of 70.82% in 2024. This dominance is primarily driven by the high volume of neurovascular procedures performed in hospitals, the availability of advanced infrastructure, and the presence of skilled healthcare professionals. In addition, the growing number of hospital-based clinical trials and collaborations with medical device companies further strengthens the hospital segment's position in the market.

The other segment is expected to witness at the fastest CAGR from 2025 to 2033. The other segment includes ambulatory surgery centers (ASCs), emergency care centers, and long-term care centers. An increase in the number of ASCs and other modern healthcare facilities is expected to drive the segment. According to the report published by Medpac, in 2023, about 6,300 ASCs treated 3.4 million fee-for-service (FFS) Medicare beneficiaries. Thus, an increasing number of ASCs and growing awareness about the availability & advantages of other medical facilities are expected to help this segment grow over the forecast period.

Regional Insights

North America dominated the neurovascular devices market with the largest revenue share of 27.40% in 2024, driven by the presence of leading manufacturers such as Penumbra, Inc., Stryker Corporation, and Johnson & Johnson. In February 2023, Phenox Inc. announced FDA clearance for its pRESET Thrombectomy Device for treating acute ischemic stroke in the U.S. This device has been used in Europe for over a decade. This regulatory approval highlights the region's supportive environment for innovation. In addition, the rising prevalence of neurological disorders and the growing demand for minimally invasive surgical procedures are key factors fueling market growth in North America.

U.S. Neurovascular Devices Market Trends

The neurovascular device market in the U.S. is driven by several key factors, including the rising prevalence of stroke and other neurovascular disorders, advancements in minimally invasive treatment technologies, and increased awareness and diagnosis rates. The aging population, which is more susceptible to conditions like aneurysms and ischemic strokes, continues to fuel demand for effective neurointerventional devices. In addition, favorable reimbursement policies and growing adoption of mechanical thrombectomy procedures further support market growth. Continuous innovation in stent retrievers, embolic coils, and flow diverters enhances treatment outcomes, encouraging broader clinical adoption across healthcare settings.

The Canada neurovascular devices market is expected to grow at a significant CAGR during the forecast period. The country's healthcare coverage and compulsory insurance enable the adoption of advanced technologies. In addition, increasing awareness and the presence of organizations such as the Canadian Neurological Sciences Federation and the Canadian Neurovascular Health Society, which focuses on neurovascular research, are expected to support market growth in the future.

Europe Neurovascular Devices Market Trends

The neurovascular devices market in Europe is anticipated to witness at a substantial CAGR during the forecast period, fueled by a rising geriatric population and rapid advancements in neurovascular technology. The increasing adoption of innovative devices and a growing number of neurovascular surgeries across the region are further driving demand. In addition, supportive healthcare infrastructure and growing awareness of stroke management contribute to market expansion.

The UK neurovascular devices market is expected to grow at a significant CAGR during the forecast period, driven by rising awareness about acute ischemic stroke treatment and the strong presence of key industry players. According to NHS England, stroke admissions in England increased to 111,137 in 2023/24, highlighting the growing demand for effective neurovascular interventions.

The neurovascular devices market in Germany is experiencing notable growth, primarily driven by the rising prevalence of acute ischemic stroke and the increasing number of mechanical thrombectomy procedures. High adoption of advanced neurovascular technologies further supports this trend. According to a study published by Springer Nature in April 2021, recanalization therapy rates for acute ischemic stroke in Germany have continued to rise, indicating growing demand for effective treatment solutions.

Asia Pacific Neurovascular Devices Market Trends

The neurovascular devices market in Asia Pacific is expected to register at the fastest CAGR during the forecast period, driven by the high prevalence of neurological disorders and rapid advancements in healthcare infrastructure. The availability of innovative products and a large patient population affected by brain aneurysms and strokes further contributes to this growth. In addition, the rising demand for advanced yet cost-effective healthcare solutions are creating substantial regional opportunities.

The China neurovascular devices market is anticipated to grow at a lucrative CAGR during the forecast period, owing to the presence of several local & key players in the market and an increase in the number of stroke cases. For instance, a study published in JAMA Network Open in March 2023 estimated the incidence and mortality of stroke in China. The study found that the overall stroke incidence was 500 per 100,000 person-years for individuals older than 40 years. Thus, the rising incidence of stroke in China is expected to boost the country's market in the coming years.

The neurovascular devices market in India is experiencing significant growth, driven by the increasing adoption of advanced technologies, rising clinical trials, and the development of innovative devices. In addition, an increase in domestic manufacturing is boosting the market. For instance, in March 2025, the Technology Development Board (TDB) authorized funding for S3V Vascular Technologies Limited, Mysuru, to establish India's first indigenous mechanical thrombectomy device manufacturing facility. This initiative marks a significant step toward strengthening the country's neurovascular capabilities.

Latin America Neurovascular Devices Market Trends

The neurovascular devices market in Latin America is driven by increasing government investments in healthcare infrastructure, rising awareness of neurological disorders, and growing demand for advanced medical technologies. Countries like Brazil are expanding healthcare budgets, improving access to high-cost neurovascular devices in public hospitals. In addition, the rising incidence of stroke and brain aneurysms, coupled with improvements in diagnostic capabilities and minimally invasive treatment options, are further accelerating market growth across the region.

Middle East and Africa Neurovascular Devices Market Trends

The neurovascular devices market in the Middle East and Africa (MEA) is experiencing steady growth, primarily driven by the rising incidence of neurovascular diseases such as strokes, aneurysms, and other cerebrovascular conditions. This surge is primarily attributed to the increasing prevalence of risk factors including hypertension, diabetes, obesity, and sedentary lifestyles. As these health challenges become more widespread across the region, the demand for effective neurovascular interventions and advanced medical devices continues to grow.

The UAE neurovascular devices market is growing rapidly, driven by rising stroke incidence and significant investments in advanced healthcare infrastructure. Annually, 8,000 to 10,000 people in the UAE suffer strokes, often resulting in long-term disability. Facilities like Sheikh Shakhbout Medical City (SSMC) are enhancing stroke care. In June 2022, SSMC launched a state-of-the-art Biplane Angio Suite for diagnosing and treating ischemic strokes. This service, part of its Interventional Neuroradiology division, is vital in improving stroke outcomes across Abu Dhabi.

Key Neurovascular Devices Company Insights

Medtronic, Stryker, Johnson & Johnson and its affiliates, Penumbra, Inc., MicroPort Scientific Corporation, Terumo Corporation, ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD., NeuroSafe Medical Co., Ltd., Rapid Medical, phenox GmbH, Lepu Medical Technology(Beijing) Co., Ltd, Evasc Neurovascular Enterprises, and Acandis GmbH are some of the major players in the neurovascular devices industry. Companies are launching novel products and also focusing on gaining regulatory approvals. Moreover, industry players are also forming distribution partnerships to gain a competitive advantage.

Key Opinion Leader

-

“The TRAP design demonstrated a greater than 200% increase in blockage removal force compared to a traditional catheter. Additionally, the TRAP catheter showed significant benefits in removing clots on the first attempt in a worst-case neurovascular model. It achieved a 40% success rate compared to 10% for conventional smooth inner diameter catheters.” Said CEO Ángel Enríquez of Emboa Medical

-

"I’ve really enjoyed getting to use and know EVO. With improved visibility and the ability to shelf the stent across the aneurysm neck, it’s become my tool-of-choice for stent-assisted coiling,"said Dr. Charles Matouk, Vice Chair of the Department of Neurosurgery at Yale University.

Key Neurovascular Devices Companies:

The following are the leading companies in the neurovascular devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- Johnson & Johnson and its affiliates

- Johnson & Johnson and its affiliates

- MicroPort Scientific Corporation

- Terumo Corporation

- ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.

- NeuroSafe Medical Co., Ltd.

- Rapid Medical

- Evasc Neurovascular Enterprises

- Lepu Medical Technology(Beijing)Co., Ltd.

- Acandis GmbH

- phenox GmbH

Recent Developments

-

In February 2025, Emboa Medical Inc., a medical device startup, introduced TRAP (Thrombus Retrieval Aspiration Platform), a biomimetic catheter inspired by a boa constrictor’s teeth. Designed to enhance clot retrieval without fragmentation, this innovative device has shown promising results in improving stroke treatment outcomes.

-

In June 2024, Terumo Corporation introduced the LVIS EVO Intraluminal Support Device for treating wide-neck intracranial aneurysms in the U.S. market.

-

In May 2024, Penumbra, Inc. reported the CE Mark authorization and the launch of three of its neurovascular catheters in Europe- Red 78, Red 43, and Red 72 with SENDit Technology -for treating acute ischemic strokes.

-

In April 2024, CERENOVUS, Inc. launched the CEREGLIDE 71 Aspiration Catheter in Europe. This catheter is useful for revascularizing patients suffering from acute ischemic stroke.

Neurovascular Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.78 billion

Revenue forecast in 2033

USD 11.91 billion

Growth rate

CAGR of 5.48% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, therapeutic application, size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; Johnson & Johnson and its affiliates; Penumbra, Inc.; MicroPort Scientific Corporation; Terumo Corporation; ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.; NeuroSafe Medical Co., Ltd.; Rapid Medical; phenox GmbH; Lepu Medical Technology (Beijing)Co.,Ltd.; Evasc Neurovascular Enterprises; Acandis GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neurovascular Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global neurovascular devices market report based on the device, therapeutic application, size, end-use, and region:

-

Device Outlook (Revenue, USD Million, 2021 - 2033)

-

Cerebral Embolization and Aneurysm Coiling Devices

-

Embolic coils

-

Flow diversion devices

-

Liquid embolic agents

-

-

Cerebral Angioplasty and Stenting Systems

-

Carotid artery stents

-

Embolic protection systems

-

-

Neurothrombectomy Devices

-

Clot retrieval devices

-

Suction devices/aspiration catheters

-

Vascular snares

-

-

Support Devices

-

Micro catheters

-

Micro guidewires

-

-

Trans Radial Access Devices

-

-

Therapeutic Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Stroke

-

Cerebral Artery

-

Cerebral Aneurysm

-

Aneurysmal Subarachnoid Hemorrhage

-

Others

-

-

Others

-

-

Size (in Inches) Outlook (Revenue, USD Million, 2021 - 2033)

-

0.027"

-

0.021"

-

0.071"

-

0.017"

-

0.019"

-

0.013"

-

0.058"

-

0.068"

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurovascular devices market size was estimated at USD 7.34 billion in 2024 and is expected to reach USD 7.78 billion in 2025.

b. The global neurovascular devices market is expected to grow at a compound annual growth rate of 5.48% from 2025 to 2033 to reach USD 11.91 billion by 2033.

b. The cerebral embolization and aneurysm coiling devices dominated the global neurovascular devices market and accounted for the largest revenue share of 37.56%.

b. The stroke segment dominated the global neurovascular devices market and accounted for the largest revenue share of 56.85% .

b. North America held the largest share of 27.40% in 2024 due to the presence of key manufacturers in the region, increased R&D investments, and a rise in government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.