- Home

- »

- Biotechnology

- »

-

Next Generation Cancer Diagnostics Market Size Report 2033GVR Report cover

![Next Generation Cancer Diagnostics Market Size, Share & Trends Report]()

Next Generation Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Next Generation Sequencing, qPCR & Multiplexing, DNA Microarrays), By Application, By Cancer Type, By Function, By Region, And Segment Forecasts

- Report ID: 978-1-68038-738-4

- Number of Report Pages: 138

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Next Generation Cancer Diagnostics Market Summary

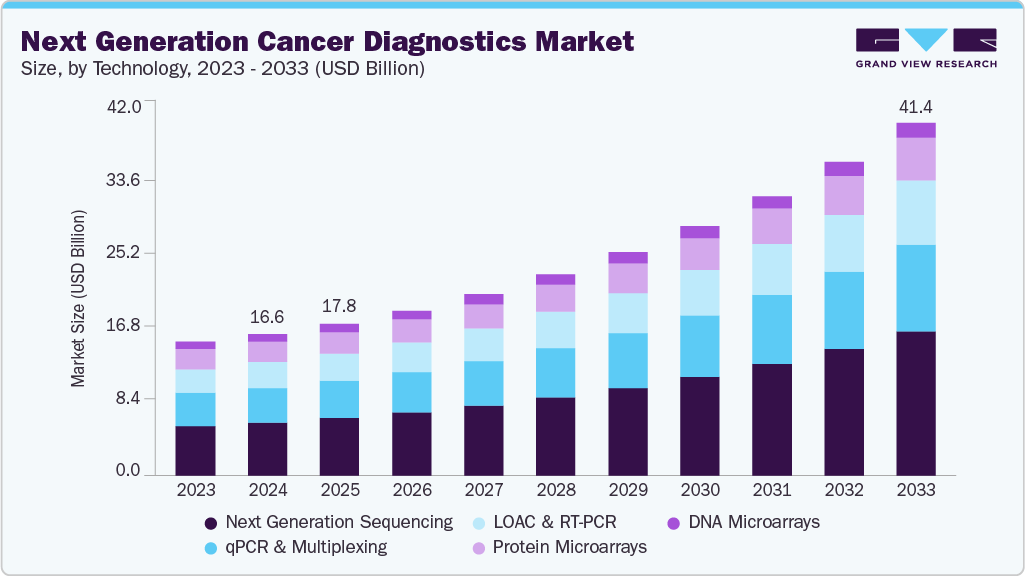

The global next generation cancer diagnostics market size was valued at USD 16.61 billion in 2024 and is expected to reach USD 41.44 billion by 2033, growing at a CAGR of 11.15% from 2025 to 2033. The growth of the industry is anticipated to be driven by the rising incidence of oncology diseases, the need for efficient prognosis and early diagnosis of various forms of cancer, and rising initiatives by key players in the development of innovative solutions to meet the rising demand for efficient diagnostics.

Key Market Trends & Insights

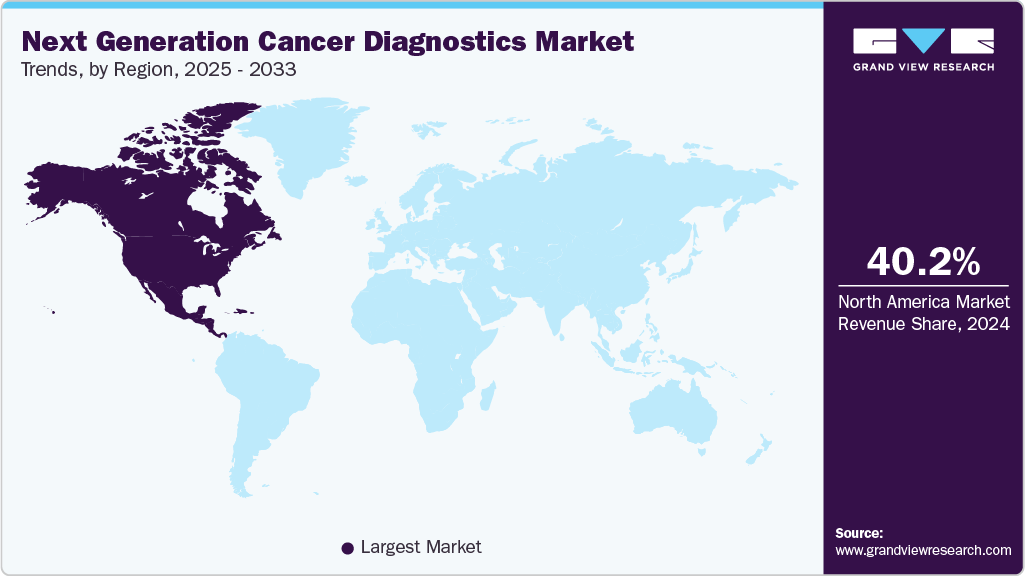

- North America next-generation cancer diagnostics market dominated with a revenue share of 40.17% in 2024.

- U.S. is expected to register the highest CAGR from 2025 to 2033.

- By technology, the next-generation sequencing segment held the highest market share of 37.26% in 2024.

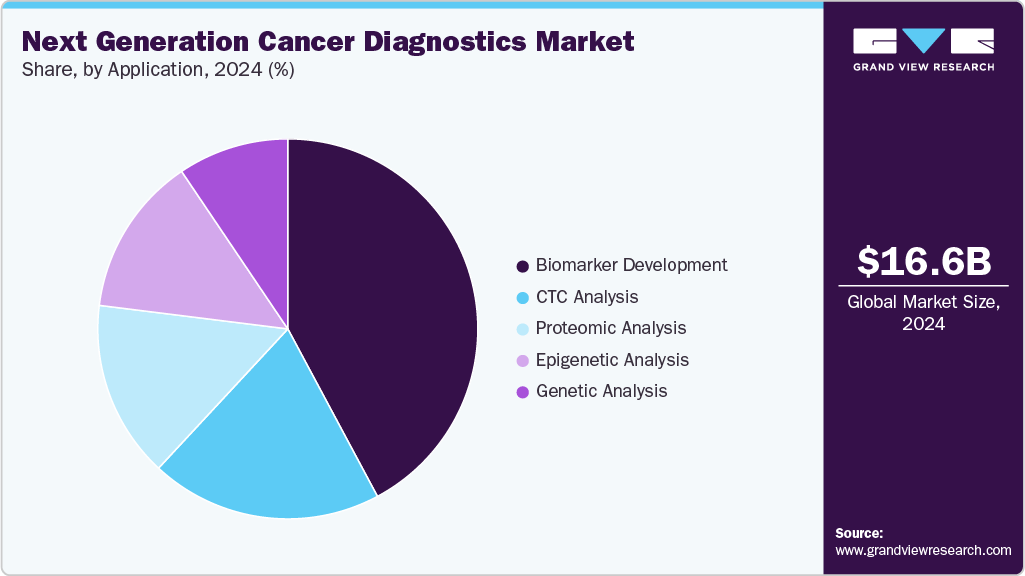

- By application, the biomarker development segment held the highest market share of 42.18% in 2024.

- Based on function, the therapeutic monitoring segment held the highest market share of 25.84% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.61 Billion

- 2033 Projected Market Size: USD 41.44 Billion

- CAGR (2025-2033): 11.15%

- North America: Largest market in 2024

Several tests, including physical examination, laboratory tests, imaging tests, and biopsy, have traditionally been performed in cancer diagnosis. Each step of the usual diagnostic procedure, with the prognosis and therapeutic decision made by oncologists, comes with a well-defined approach to avoid potential complications. This highlights the crucial importance of diagnosis throughout the entire oncology lifecycle, surpassing the therapeutic regimen's significance.Next-generation sequencing (NGS) has become a transformative force in oncology diagnostics, enabling comprehensive genomic profiling of tumors to match patients with targeted therapies. By identifying actionable mutations and molecular alterations, NGS supports personalized medicine strategies that improve clinical outcomes. However, the impact of sequencing in routine care still requires clearer evidence stratification, as not all patients with actionable mutations ultimately receive targeted therapies. Barriers such as the timing of sequencing within the care pathway, physician interpretation, limited accessibility, and cost-effectiveness continue to restrict broader adoption.

Large-scale initiatives such as the TAPUR Study and the NCI MATCH Study aim to generate robust real-world evidence on the impact of sequencing-driven treatment selection. While CMS’s National Coverage Determination expanded access by approving tests like FoundationOne CDx (F1CDx), the removal of the “coverage with evidence development” requirement has amplified calls for continuous outcome tracking, including metrics such as overall survival, progression-free survival, and response rates. Critics argue that broader panels (such as F1CDx) may add costs without always providing proportional clinical benefit, as illustrated by modest response rates in certain targeted therapy arms of NCI MATCH. This underscores the need for more evidence-based validation of sequencing-guided treatment approaches.

Beyond genomics, the field is rapidly expanding toward multi-omics integration. While DNA provides a static blueprint, complementary approaches such as RNA sequencing (transcriptomics) and proteomics (mass spectrometry) offer dynamic insights into gene expression and protein signaling pathways. Combined with metabolomics, these data layers create a holistic picture of tumor biology. Projects like TCGA have highlighted the promise of integrated-omics, though challenges remain in harmonizing these datasets into clinically actionable outputs.

At the same time, companies are accelerating the clinical deployment of such technologies. In May 2025, Illumina expanded its oncology portfolio with the launch of TruSight Oncology (TSO) Comprehensive, the first FDA-approved distributable CGP IVD kit with pan-cancer CDx claims, which is now reimbursed under Medicare and most commercial plans. The test, covering more than 500 genes, has also gained regulatory approval in Japan and is being integrated into clinical practice across community hospitals and academic centers. Illumina also deepened its partnership with Pillar Biosciences, adding the oncoReveal® CDx panel on the MiSeq Dx System, further democratizing access to in-house tumor profiling. Similarly, in June 2025, QIAGEN and Incyte entered a collaboration to develop a multimodal NGS companion diagnostic for myeloproliferative neoplasms, validated on the Illumina NextSeq 550Dx platform. The test will detect mutCALR mutations, supporting Incyte’s innovative antibody program (INCA033989) for essential thrombocythemia and myelofibrosis. In March 2025, GenomOncology partnered with Chronetyx Laboratories to streamline clinical adoption by integrating its Pathology Workbench software with Chronetyx’s FDA-cleared and CE-IVD-marked Cyx Solid Tumor 505 test, automating tertiary analysis and significantly reducing turnaround times for NGS results. Collectively, these initiatives highlight how leading players are addressing bottlenecks in reimbursement, workflow automation, and biomarker expansion to accelerate precision oncology adoption.

NGS also plays a central role in immuno-oncology diagnostics. Tumor mutational burden (TMB), PD-L1 expression, and neoantigen profiling are increasingly used as biomarkers for response to immune checkpoint inhibitors. Evidence from advanced hepatocellular carcinoma (HCC) shows that TP53 mutations correlate with improved survival, while TERT and BRD4 mutations signal poor prognosis. Exome sequencing combined with proteomics helps identify which neoantigens are presented by the major histocompatibility complex (MHC), guiding personalized immunotherapy strategies.

Emerging diagnostic modalities such as liquid biopsy and single-cell sequencing are further reshaping the market. Liquid biopsy offers a non-invasive method to detect circulating tumor DNA (ctDNA) and monitor treatment resistance in real-time. Meanwhile, single-cell sequencing reveals intratumoral heterogeneity, identifying subclones that may drive resistance or metastasis. Together, these technologies address key limitations of conventional tissue biopsies and are poised to drive faster adoption of precision oncology.

A powerful enabler of these advancements is the integration of artificial intelligence (AI) and machine learning (ML). These tools can mine vast NGS and multi-omics datasets, uncovering hidden correlations that inform predictive modeling, treatment selection, and resistance mechanisms. AI-enhanced bioinformatics pipelines are expected to improve diagnostic accuracy, reduce turnaround times, and optimize clinical decision-making, making them a critical growth driver for the next generation cancer diagnostics market.

Nevertheless, significant challenges remain. Not all mutations detected are actionable, and many fall into a gray zone with uncertain clinical utility. Ethical considerations around incidental findings, patient consent, and data privacy further complicate adoption. To maximize the potential of NGS and related technologies, standardized guidelines, stronger evidence frameworks, and multidisciplinary collaboration across oncologists, geneticists, bioinformaticians, and ethicists are essential.

Overall, the market is evolving from single-modality genomic profiling to integrated, AI-powered, multi-omics solutions. With advances such as Illumina’s FDA-approved CGP assays, QIAGEN’s hematology-focused companion diagnostics, and GenomOncology’s workflow automation partnerships, alongside the broader adoption of liquid biopsy and immuno-oncology biomarkers, the sector is positioned for substantial growth. However, its long-term trajectory will hinge on demonstrating clear clinical utility, cost-effectiveness, and improved patient outcomes in real-world practice.

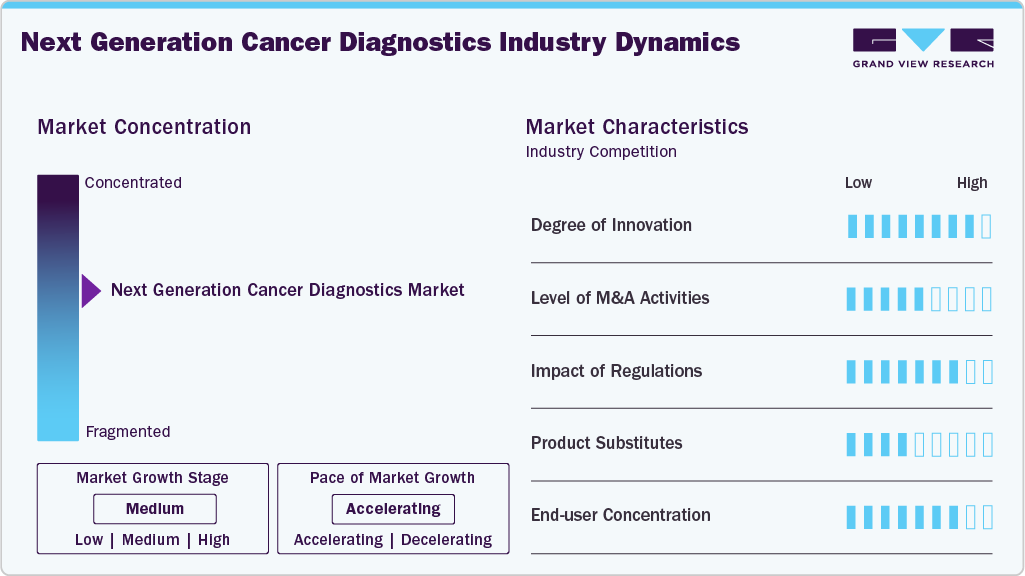

Market Concentration & Characteristics

The industry is highly innovation-driven, marked by advances in NGS, liquid biopsy, single-cell sequencing, and multi-omics integration. AI-enabled bioinformatics, spatial biology, and proteogenomics are expanding the clinical scope of diagnostics. Innovations in error suppression, rapid turnaround workflows, and distributable IVD kits are accelerating adoption beyond central labs into community oncology settings. Emerging applications like minimal residual disease monitoring, ctDNA methylation assays, and multi-cancer early detection (MCED) tests further highlight the disruptive potential. Overall, the market demonstrates strong innovation intensity, enabling broader precision oncology adoption and improving patient outcomes.

The market has seen strong M&A activity as major players consolidate capabilities in sequencing, informatics, and companion diagnostics. Large diagnostics companies and sequencing providers acquire smaller innovators to expand biomarker portfolios, integrate AI-driven reporting, and enhance regulatory-approved IVD pipelines. Partnerships between pharma and diagnostics firms drive the co-development of multi-modal companion diagnostics. Strategic acquisitions also target liquid biopsy firms and bioinformatics platforms to strengthen end-to-end offerings. Overall, M&A activity remains a critical growth lever, helping companies accelerate technology adoption, expand reimbursement reach, and achieve competitive advantage in precision oncology.

Regulation plays a central role in shaping the industry. FDA approvals of comprehensive genomic profiling assays (e.g., F1CDx, Illumina TSO Comprehensive) have accelerated adoption by securing payer coverage. CMS reimbursement decisions directly impact accessibility, particularly with Medicare patients. The shift from laboratory-developed tests toward distributable IVD kits reflects regulatory tightening. Global harmonization of standards across the US, EU, and Japan is driving broader adoption but also raises compliance burdens. Regulatory support for companion diagnostics strengthens pharma-diagnostic collaboration. Overall, regulation is both a catalyst and constraint, influencing adoption, pricing, and clinical integration.

While NGS-based diagnostics dominate, substitutes exist in targeted PCR assays, FISH, immunohistochemistry, and imaging. These alternatives remain relevant for single-gene mutations, cost-sensitive settings, or when rapid turnaround is needed. However, their limited breadth makes them less effective compared to CGP for multi-gene stratification. Liquid biopsy and emerging MCED tests also act as substitutes, offering non-invasive approaches. In some cases, substitute technologies may complement NGS rather than replace it, particularly in community oncology. Ultimately, substitutes present competition, but the trend favors NGS as the gold standard in comprehensive cancer diagnostics.

End-users in next-generation cancer diagnostics are diverse, spanning academic medical centers, community oncology networks, reference laboratories, and biopharmaceutical companies. Initially, adoption was concentrated in major cancer centers with advanced infrastructure. However, distributable IVD kits and payer coverage are decentralizing access to regional hospitals and local labs. Biopharma also represents a key customer segment for companion diagnostic development and clinical trial stratification. Despite this diversity, oncology care remains fragmented, limiting buyer power. Overall, end-user concentration is moderate, with expanding adoption across multiple healthcare tiers, driven by accessibility, reimbursement, and evolving clinical guidelines.

Technology Insights

On the basis of technology, next-generation sequencing technology dominated the market with a share of 37.26% in 2024 and is anticipated to grow at the fastest rate over the forecast period. The technology enables the simultaneous analysis of multiple genes or genetic alterations, providing a comprehensive view of the genomic landscape, which allows the detection of various forms of genetic alterations, including gene mutations, amplifications, deletions, and rearrangements, which are crucial for accurate diagnosis and personalized treatment selection.

In January 2023, QIAGEN entered into an exclusive strategic partnership with Helix to advance hereditary diseases by developing companion diagnostics. The collaboration leverages the Helix Laboratory Platform, which is powered by QIAGEN's biopharma relationships, next-generation sequencing (NGS) capabilities, and global regulatory expertise. The combined offering of the partnership is anticipated to be accelerated by patient recruitment for the utilization of real-world evidence and the provision of diagnostic solutions using NGS and PCR technologies.

The usage rate of DNA and protein microarrays is expected to decrease due to a favorable shift in preference toward NGS-based technology. Technological advancements in NGS systems and the development of library preparation protocols and data interpretation tools have significantly driven the increased adoption of NGS among research entities. Market analysis conducted by prominent market entities has also indicated that DNA microarrays are projected to experience a substantial decline in market share as NGS-based diagnostics gain dominance over the next decade.

Cancer Type Insights

The others segment dominated the market, with a revenue share of 43.44% in 2024. The dominance of the segment is due to the rising advancements in next-generation technologies that have enabled more accurate and comprehensive detection and profiling of various types. This includes the identification of specific genetic mutations, biomarkers, and molecular signatures associated with these cancers. The ability to precisely diagnose and monitor these diverse cancer types using advanced diagnostic tools is propelling the market growth. Moreover, the increasing focus on personalized medicine and targeted therapies for specific cancer types within the other cancer type segment further drives the demand for advanced diagnostic solutions.

The breast cancer segment is anticipated to grow at the fastest CAGR rate of 12.30% over the forecast period. Breast cancer is one of the most prevalent types of cancer globally, affecting a large number of individuals. The rising prevalence of breast cancer, coupled with rising awareness and screening programs, contributes to the higher growth of the segment. Developments in diagnostic technologies and screening methods have led to improved detection and early diagnosis of breast cancer. This early detection enables timely intervention, more effective treatment, and improved patient outcomes. The adoption of advanced imaging techniques, such as mammography, ultrasound, and MRI, along with the development of biomarker-based tests, has enhanced the accuracy and efficiency of breast cancer diagnosis.

Function Insights

On the basis of function, the therapeutic monitoring segment dominated the market with a share of 25.84% in 2024. The increasing adoption of targeted therapies and immunotherapies in cancer treatment has strengthened the need for effective therapeutic monitoring. These advanced treatment modalities often require close monitoring to evaluate their impact on the tumor and ensure optimal patient outcomes. Next-generation cancer diagnostics offer the ability to detect specific genetic alterations or markers associated with the targeted therapy response, allowing for real-time monitoring of treatment efficacy. In addition, the ongoing advancements in next-generation sequencing (NGS), liquid biopsies, and molecular imaging technologies have significantly improved the sensitivity, accuracy, and efficiency of therapeutic monitoring. For instance, in March 2022, the FDA granted approval for Novartis' Pluvicto for the treatment of progressive, PSMA positive metastatic castration-resistant prostate cancer as the first targeted radioligand therapy.

The prognostic diagnostics segment is projected to grow at the fastest rate of 12.01% over the forecast period. The design of cancer therapies and protocols, such as chemotherapy, radiation-based treatment, and gene therapy, is influenced by the fact that the prognosis of cancer varies from patient to patient, which plays a crucial role in this process. For instance, in March 2023, Artera, a company that focuses on advanced predictive and prognostic cancer tests, received funding of USD 90 million for personalized cancer treatment with multimodal AI.

Application Insights

On the basis of application, biomarker development dominated the market with a revenue share of 42.18% in 2024, due to the high accuracy levels demonstrated by biomarker tests, reaching up to 90% in investigational studies, and their ability to enhance sensitivity in tumor screening. Moreover, the launch of innovative technologies to meet the rising demand for oncology diagnosis is further fueling the growth of the market. For instance, in July 2023, Quest Diagnostics entered into a collaboration with Envision Sciences and announced the launch of a novel prostate biomarker test, which helps in providing improved accuracy.

Genetic analysis is anticipated to grow with the fastest CAGR of 13.20% over the forecast period. The advancements in genomic technologies and techniques have significantly improved genetic analysis's efficiency, speed, and affordability. This has made genetic analysis more accessible to a wider range of researchers, clinicians, and consumers. Moreover, the increasing prevalence of genetic oncology diseases and the rising demand for personalized medicine have created a strong need for comprehensive genetic analysis. Genetic analysis plays a crucial role in identifying genetic variations, mutations, and biomarkers associated with diseases, enabling accurate diagnosis, prognosis, and treatment selection. Moreover, the growth of genetic analysis for oncology diagnostics over the forecast period is expected to be significantly influenced by an increase in the number of research projects focused on developing innovative tools and solutions for the early detection of tumor-causing mutations.

Regional Insights

North America next-generation cancer diagnostics market dominated with a revenue share of 40.17% in 2024. The North American market is driven by rising cancer prevalence, technological advancements like AI, liquid biopsy, and imaging, and supportive regulatory frameworks. The liver cancer diagnostic market in North America has seen a shift towards non-invasive methods, including imaging techniques like MRI, CT scans, and ultrasound, which provide more accurate and earlier detection of liver tumors. Additionally,

U.S. Next-Generation Cancer Diagnostics Market Trends

The next-generation cancer diagnostics market in the U.S. is driven by strong reimbursement frameworks, FDA approvals for CGP assays like FoundationOne CDx and Illumina TSO Comprehensive, and large-scale initiatives such as NCI-MATCH and TAPUR. Community oncology networks increasingly adopt distributable IVD kits, decentralizing access beyond major academic centers. Liquid biopsy, MRD monitoring, and multi-cancer early detection are gaining traction with payer interest. Collaborations between pharma and diagnostics for companion diagnostics accelerate co-development. AI-enabled bioinformatics integration with EHRs is reducing turnaround times. Overall, the U.S. market benefits from robust innovation pipelines, strong payer coverage, and regulatory clarity, ensuring continued dominance in precision oncology.

Europe Next-Generation Cancer Diagnostics Market Trends

The next-generation cancer diagnostics market in Europe is expanding with strong policy focus on precision oncology, pan-European initiatives like Horizon Europe, and country-level genomics programs. CE-marked assays such as Illumina’s TSO Comprehensive are driving adoption across hospitals. Reimbursement varies by country, with Western Europe advancing faster than Central and Eastern Europe. Public-private partnerships enhance R&D in liquid biopsy and MRD surveillance. Regulatory harmonization under IVDR creates compliance pressure but strengthens clinical validation. Germany, France, and the UK lead adoption, while other countries are catching up via centralized genomic medicine initiatives. Growing demand for multi-omics and AI-enabled workflows underscores Europe’s strategic shift toward personalized oncology.

The UK next-generation cancer diagnostics market benefits from the NHS Genomic Medicine Service, which integrates NGS into routine oncology care. National genomic testing directories prioritize tumor profiling, with cancer patients gaining access to CGP under standardized frameworks. Pharma collaborations with diagnostic providers support companion diagnostic deployment in clinical trials and commercial launches. Investments in AI-driven bioinformatics, such as those by Genomics England, enhance data integration and interpretation. Liquid biopsy adoption is rising for non-invasive monitoring, supported by pilot programs. Despite cost-containment pressures, centralized NHS funding creates a favorable environment for equitable access, making the UK a frontrunner in precision oncology adoption.

The next-generation cancer diagnostics market in Germany is shaped by strong clinical infrastructure, large oncology centers, and favorable reimbursement for molecular diagnostics. The country’s early adoption of comprehensive genomic profiling has been boosted by regulatory frameworks under the Genomic Diagnostics Act. Pharma collaborations with German cancer research centers drive companion diagnostic development. Academic hospitals lead in integrating liquid biopsy and MRD monitoring into clinical workflows. Germany’s strong biotechnology sector contributes to innovation in multi-omics and AI-driven analytics. However, regional disparities in access and complex reimbursement pathways remain challenges. Overall, Germany is positioned as a leading European hub for next-generation precision oncology solutions.

Asia Pacific Next-Generation Cancer Diagnostics Market Trends

The next-generation cancer diagnostics market in Asia Pacific is projected to show significant growth over the forecast period, owing to a large and growing population, contributing to a higher prevalence of oncological conditions. The rising prevalence drives the demand for advanced diagnostic technologies and fuels market growth. Moreover, there is an increasing focus on improving healthcare infrastructure and expanding access to quality healthcare services in many countries across the region, which leads to the development of enhanced capabilities for cancer diagnosis and treatment, in turn propelling the adoption of next-generation cancer diagnostics.

China next-generation cancer diagnostics market is rapidly expanding, driven by government-backed genomics programs, a growing cancer burden, and increasing investment from domestic sequencing companies like BGI and WuXi NextCODE. Liquid biopsy adoption is surging, particularly for lung cancer, supported by innovative local assays with faster turnaround. Regulatory reforms are improving IVD approval processes, though regional disparities in access remain. Partnerships with pharma for local CDx development are expanding, and domestic firms increasingly compete with global players like Illumina and Roche. AI-enabled bioinformatics, combined with large-scale patient datasets, strengthens predictive modeling. China is becoming a global innovation hub in NGCD commercialization.

The next-generation cancer diagnostics market in Japan is supported by government precision medicine initiatives and recent regulatory approvals, including Illumina’s TSO Comprehensive IVD kit. National health insurance coverage for certain NGS-based cancer diagnostics accelerates clinical adoption. Japanese hospitals are integrating CGP into standard care pathways, particularly for lung, colorectal, and gastric cancers. Partnerships between diagnostics firms and local academic centers drive biomarker discovery. Liquid biopsy adoption is growing, especially for patients unfit for invasive biopsies. Japan’s strong aging population drives demand, while its innovation ecosystem emphasizes integrating NGS with proteomics and metabolomics. Overall, Japan is emerging as a mature, insurance-supported precision oncology market.

Latin America Next-Generation Cancer Diagnostics Market Trends

The next-generation cancer diagnostics market in Latin America is in a growth phase, led by Brazil and Mexico, with increasing investment in genomic infrastructure and regional partnerships. Adoption remains uneven due to reimbursement challenges and disparities in healthcare access. Private hospitals and cancer centers are early adopters, while public systems lag in CGP integration. Pharma partnerships with diagnostic firms focus on clinical trial recruitment and companion diagnostic access. Liquid biopsy adoption is accelerating in urban centers due to its non-invasive nature. Regional growth is supported by international collaborations, though cost, access, and regulatory alignment remain key hurdles to broader adoption.

Brazil Next-Generation Cancer Diagnostics Market Trends

Brazil next-generation cancer diagnostics market represents Latin America’s largest NGCD market, with growing adoption of CGP and liquid biopsy in major private oncology centers. Government cancer programs increasingly explore NGS integration, but reimbursement in the public health system remains limited. Partnerships between global players like Roche and local labs help expand diagnostic access. Pharma companies are engaging Brazilian hospitals for clinical trials, supporting biomarker-based patient stratification. Rising cancer incidence and a large patient population drive demand. However, economic disparities and a fragmented healthcare infrastructure restrict equitable access. Brazil is becoming a regional leader in precision oncology despite systemic reimbursement and accessibility challenges.

Middle East And Africa Next-Generation Cancer Diagnostics Market Trends

The next-generation cancer diagnostics market in the Middle East and Africa (MEA) is at an early stage, with adoption concentrated in wealthier Gulf Cooperation Council (GCC) countries. Countries like the UAE and Saudi Arabia invest in genomic medicine centers, often in partnership with global players such as Illumina, AstraZeneca, and SOPHiA GENETICS. South Africa leads Sub-Saharan Africa in molecular diagnostics adoption but faces access and cost barriers. Limited reimbursement frameworks and infrastructure gaps restrict penetration across much of Africa. However, rising cancer incidence, government-backed precision medicine initiatives, and partnerships with international firms signal significant long-term growth potential in this emerging region.

Saudi Arabia next-generation cancer diagnostics market is rapidly emerging as a precision oncology hub in the Middle East. The country invests heavily in genomic medicine infrastructure, supported by Vision 2030 initiatives. Leading hospitals in Riyadh and Jeddah integrate CGP into oncology workflows, supported by collaborations with international players like Illumina and SOPHiA GENETICS. Government funding supports cancer genomics research, while private hospitals are early adopters of liquid biopsy and MRD assays. Pharma-diagnostics partnerships focus on companion diagnostic trials in the region. Despite cost and training barriers, Saudi Arabia’s strong investment trajectory positions it as a leading NGCD market in the Middle East.

Key Next Generation Cancer Diagnostics Companies Insights

Key players operating in the next generation cancer diagnostics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Next Generation Cancer Diagnostics Companies:

The following are the leading companies in the next generation cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Janssen Pharmaceuticals, Inc.

- Illumina, Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Koninklijke Philips N.V.

- QIAGEN

- Agilent Technologies, Inc. (Dako)

- Abbott

- Thermo Fisher Scientific Inc.

- GE HealthCare.

Recent Developments

-

In January 2025, Guardant Health announced the expansion of its Guardant Reveal™ MRD test into additional solid tumor indications, strengthening its liquid biopsy portfolio for recurrence monitoring.

-

In February 2025, Roche Diagnostics partnered with Genentech to co-develop companion diagnostics for novel immuno-oncology drugs, aligning NGS-based biomarker panels with upcoming therapy launches.

-

In March 2025, Natera expanded its clinical trial collaborations with global pharma companies to validate its Signatera™ MRD platform in colorectal and breast cancers.

-

In April 2025, Thermo Fisher Scientific introduced an upgraded Oncomine Precision Assay on the Genexus Dx System, enabling same-day turnaround for targeted genomic profiling.

-

In May 2025, Illumina expanded its oncology portfolio with the launch of TSO Comprehensive (FDA-approved) and Pillar oncoReveal CDx, gaining broad reimbursement coverage in the U.S. and Japan.

-

In June 2025, QIAGEN and Incyte announced a global collaboration to develop a multimodal NGS-based companion diagnostic panel for mutant CALR-driven myeloproliferative neoplasms (MPNs).

-

In July 2025, Foundation Medicine (Roche Group) launched an enhanced version of FoundationOne CDx, integrating multi-omics insights including RNA and proteomic biomarkers for better therapy matching.

-

In August 2025, Caris Life Sciences expanded its comprehensive molecular profiling service across Europe, partnering with academic cancer centers for clinical trial recruitment.

-

In September 2025, GenomOncology partnered with Chronetyx Laboratories to integrate its AI-driven Pathology Workbench, reducing turnaround times for NGS testing and enabling faster cancer care decisions.

-

In October 2025, Tempus Labs introduced an AI-enabled clinical decision support system that integrates NGS data with electronic health records to personalize oncology treatment recommendations.

-

In November 2025, SOPHiA GENETICS expanded its cloud-based platform to support liquid biopsy assays and partnered with Middle East oncology centers to scale precision oncology solutions.

-

In December 2025, Agilent Technologies launched a new line of NGS target enrichment kits designed for high-throughput cancer diagnostics, aimed at improving lab efficiency and clinical adoption.

Next Generation Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.79 billion

Revenue forecast in 2033

USD 41.44 billion

Growth rate

CAGR of 11.15% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, cancer type, function, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Janssen Pharmaceuticals, Inc.; Illumina, Inc.; Novartis AG; F. Hoffmann-La Roche Ltd; Koninklijke Philips N.V.; QIAGEN; Agilent Technologies, Inc. (Dako); Abbott; Thermo Fisher Scientific Inc.; GE HealthCare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Next Generation Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global next generation cancer diagnostics market report based on technology, application, cancer type, function, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Next Generation Sequencing

-

qPCR & Multiplexing

-

LOAC & RT-PCR

-

Protein Microarrays

-

DNA Microarrays

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biomarker Development

-

CTC Analysis

-

Proteomic Analysis

-

Epigenetic Analysis

-

Genetic Analysis

-

-

Cancer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Others

-

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Therapeutic Monitoring

-

Companion Diagnostics

-

Prognostics

-

Cancer Screening

-

Risk Analysis

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global next generation cancer diagnostics market size was estimated at USD 16.61 billion in 2024 and is expected to reach USD 17.79 billion in 2025.

b. The global next generation cancer diagnostics market is expected to grow at a compound annual growth rate of 11.15% from 2025 to 2033 to reach USD 41.44 billion by 2033.

b. Next generation sequencing dominated the next generation cancer diagnostics market with a share of 37.26% in 2024. This is attributable to declining sequencing price and technological advancements in ancillary protocols.

b. Some key players operating in the next generation cancer diagnostics market include Cepheid; Koninklijke Philips N.V.; F. Hoffmann-La Roche Ltd; Qiagen; Novartis AG; Abbott; Thermo Fisher Scientific, Inc.; Opko Health, Inc.; Myriad Genetics, Inc.; Agilent Technologies; GE Healthcare; PerkinElmer, Inc.; Genomic Health, Inc.; Illumina, Inc.

b. Key factors that are driving the next generation cancer diagnostics market growth include increasing implementation of NGS in clinical workflows coupled with rising cancer prevalence across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.