- Home

- »

- Biotechnology

- »

-

Next Generation Sequencing Sample Preparation Market Report, 2030GVR Report cover

![Next Generation Sequencing Sample Preparation Market Size, Share & Trends Report]()

Next Generation Sequencing Sample Preparation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Service, By Workflow, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-051-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Next Generation Sequencing Sample Preparation Market Summary

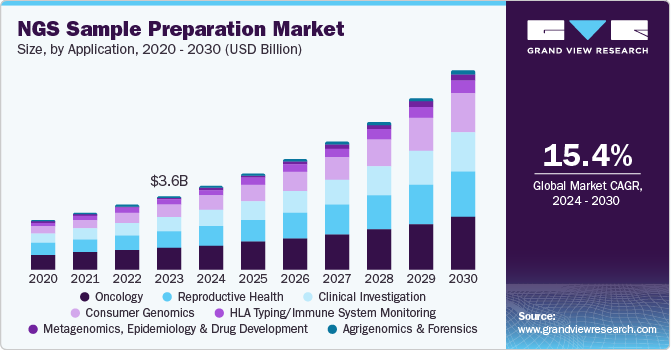

The global next generation sequencing sample preparation market size was estimated at USD 3.58 billion in 2023 and is projected to reach USD 9.66 billion by 2030, growing at a CAGR of 15.4% from 2024 to 2030. The next generation sequencing (NGS) sample preparation process transforms nucleic acids from biological samples ready for sequencing.

Key Market Trends & Insights

- The North America dominated the global market in 2023 with a revenue share of 41.5%.

- The U.S. next generation sequencing sample preparation market dominated the North American region with a substantial share in 2023 due to a strong healthcare system.

- Based on product & service, the consumables accounted for the largest market revenue share in 2023.

- Based on workflow, the library preparation & amplification dominated the market in 2023.

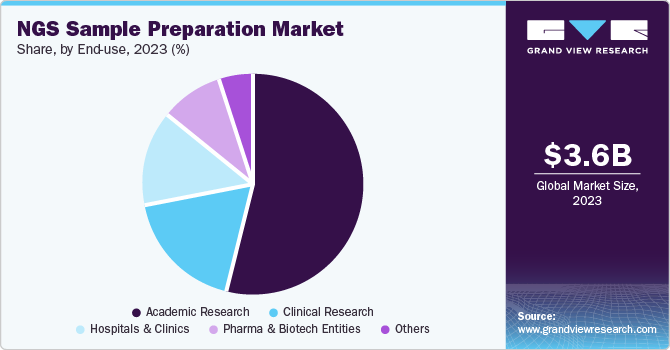

- Based on end-use, the academic research accounted for the largest revenue share of 53.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.58 Billion

- 2030 Projected Market USD 9.66 Billion

- CAGR (2024-2030): 15.4%

- North America: Largest market in 2023

The major steps in this process include library preparation, extraction, purification and quality control, sequencing, and data analysis. The rise in sequencing platforms, awareness about infectious diseases, and decreasing sequencing costs are the growth factors driving the market growth.

NGS sample preparation involves the DNA or RNA samples for sequencing with nanoscale technologies and methods. Next generation sequencing enables researchers to gain valuable information about the genetic makeup and operation of biological samples by high-throughput sequencing. The preparation of next generation sequencing samples is essential for data sequencing and clinical precision. Furthermore, the progress in nanotechnology has resulted in the creation of novel and effective methods of sample preparation.

The increase in global market revenue is driven by key factors such as the increasing use of next generation sequencing in diagnostics due to lower costs and affordable sequencing methods. The rising occurrence of genetic disorders in infectious and chronic diseases, and the implementation of next generation sequencing in cancer diagnosis and treatment are key factors propelling the growth of NGS sample preparation market.

Application Insights

Oncology dominated the market and accounted for a share of 29.3% in 2023 due to multiple players engaged in the development of oncology-targeted panels. For instance, Illumina offers a wide range of cancer-specific next-generation sequencing panels for various application fields. These panels cater to the need for solutions for preparing samples. The top biotech companies are collaborating with other players to create oncology companion diagnostics products.

Consumer genomics is expected to register the fastest CAGR of 18.9% during the forecast period. The continuous launch of new products from major companies is fueling expansion in the consumer genomics sector. The emergence of companies such as 23andMe offering the "Personal Genome Service" is expected to increase in the forecast period. In addition, Ancestry.com, Color Genomics, Cloud Health (which acquired a HiSeq X Ten), National Geographic, and various Japanese consumer companies are expected to increase market revenue share. Therefore, consumer genomics is largely driven by the next generation sequencing which is attributed to the swift expansion in paternity testing, personal health awareness, and genealogy.

Product & Service Insights

Consumables accounted for the largest market revenue share in 2023. The high share is attributed to the strong demand for consumables for commercial and research applications of NGS. These items include preparation kits for samples enriching specific targets. Many pharmaceutical companies and research institutes prefer NGS consumables for various diagnostic applications and cancer research. Another important aspect of the consumables industry is the participation of major companies in creating new products, prioritizing regulatory approvals, and implementing strategic efforts to guarantee a steady flow of consumables that cater to their need.

Services are projected to grow at the fastest CAGR over the forecast period. NGS sample preparation is a complex process that requires specialized knowledge. The growing complexity of next generation sequencing sample preparation, emphasis on core competencies, and the increasing demand for reliable and efficient services are driving the growth of the services segment.

Workflow Insights

Library preparation & amplification dominated the market in 2023. They assist in transforming DNA or RNA samples into libraries that have the essential adapters and indices for sequencing. As next generation sequencing technologies become increasingly popular in diverse research areas such as genomics, oncology, and personalized medicine. Automation reduces the need for manual intervention in complicated library preparation protocols. This is expected to assist the laboratories and increase their productivity with minimal manual intervention.

Library quantification/QC is expected to register the fastest CAGR during the forecast period. Accurate quantification and QC are essential for generating high-quality sequencing data. Increased sample throughput results in efficient and accurate QC methods. The range of next generation sequencing applications has created a demand for specific QC metrics. New technologies offer rapid quantification and QC. Automated systems improve efficiency and reduce human error. Therefore, these factors are driving the growth of the library quantification/QC workflow segment.

End-use Insights

Academic research accounted for the largest revenue share of 53.7% in 2023. The prevalence of next generation sequencing solutions in university and research center projects is primarily responsible for the segment's dominance. In addition, the scholarships available for PhD research in next generation sequencing are expected to augment the demand for next generation sequencing products and services. It is also anticipated that revenue from academic research increase in the future due to the on-site bioinformatics courses with workshops focusing on the practical use of next generation sequencing and data analysis.

Clinical research is projected to grow at the fastest CAGR of 16.6% over the forecast period. This can be attributed to the widespread use of NGS in cancer studies, notably in uncovering novel cancer-associated genes, exploring tumor diversity, and highlighting the changes that fuel tumor formation. The increase in government funding is projected to drive revenue growth by using NGS technology in labs. Moreover, the clinical research solutions from companies such as Illumina, Thermo Fisher Scientific Corporation, and Agilent Technologies for target enrichment and detection offer significant growth opportunities in the forecast period.

Regional Insights

North America dominated the global market in 2023 with a revenue share of 41.5%. Factors contributing to the growth include the increasing demand for diagnostic tools, public awareness, the high number of market participants in the U.S., and the growing prevalence of infectious and chronic diseases in the region. Substantial spending on research & development, advanced healthcare research framework, and participation of major companies encourage regional growth.

U.S. NGS Sample Preparation Market Trends

The U.S. next generation sequencing sample preparation market dominated the North American region with a substantial share in 2023 due to a strong healthcare system. The utilization of advanced sequencing techniques in large clinical labs is on the rise for studying disease progression and epidemiology, leading to a higher demand for various sample preparation products. Oncology is expected to depend on next generation sequencing sample preparation products. For instance, the key players are continuously developing next generation sequencing in vitro diagnostic solutions for cancer.

Europe NGS Sample Preparation Market Trends

Next generation sequencing sample preparation market in Europe is anticipated to witness the fastest CAGR of 15.2% in 2023 as research institutes develop novel methods for NGS sample preparation. Moreover, the partnerships between European healthcare companies are anticipated to drive the growth of the next generation sequencing market in the region. The market is expected rapid growth in the coming years due to the rise in companion diagnostics.

Asia Pacific NGS Sample Preparation Market Trends

Next generation sequencing sample preparation market in the Asia Pacific is anticipated to witness significant growth in the forecast period. The market's rapid growth is supported by rising investments in healthcare infrastructure, government efforts to promote precision medicine, and an increasing focus on genomics research. Furthermore, the region has many patients, with an increased need for advanced genetic testing and customized medical treatments.

India next generation sequencing sample preparation market is expected to proliferate in the coming years. Over the years, the healthcare industry in India has experienced significant developments with value-based care, smart healthcare, and advancing blockchain technology. Moreover, with the growing complexity of chronic and infectious diseases, the significance of next generation sequencing in diagnostics is prevalent.

Key Next Generation Sequencing Sample Preparation Company Insights

Some key companies in the next generation sequencing sample preparation market include Illumina, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., and others. Organizations are expanding their customer base to enhance competitiveness within the market. As a result, the key stakeholders are implementing various strategies, such as acquisitions and collaborations.

-

Illumina Inc. offers array-based solutions and genomic sequencing for translational and consumer genomics, genetic analysis in molecular diagnostics, and cancer. The company's product range includes sequencing tools, kits and reagents, microarray kits and reagents, molecular biology reagents, and arrays.

-

Eurofins Scientific SE offers analytical testing solutions to clients in multiple sectors. The company provides agriscience services, biopharma services, pharma central laboratory, food and feed testing, product testing, pharma early development, pharma discovery services, biopharma product testing, forensic services, and environmental testing.

Key Next Generation Sequencing Sample Preparation Companies:

The following are the leading companies in the next generation sequencing sample preparation market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- PerkinElmer Inc.

- F. Hoffmann-La Roche Ltd

- BGI Genomics

- Danaher Corporation (Beckman Coulter)

- Eurofins Scientific

Recent Developments

-

In June 2024, Illumina Inc. successfully incorporated its newest chemistry, XLEAP-SBS™, for all reagents including NextSeq 1000 and NextSeq 2000 NGS instruments. It has established a top player position in DNA sequencing and array-based technologies. NextSeq 1000/2000 allows labs to conduct larger NGS projects without increasing costs, helping in the wider use of multiomic strategies.

-

In June 2024, Beckman Coulter Life Sciences, expedited high-throughput genomic sample preparation workflows for instant results by introducing Biomek Echo One System. This solution offers flexible and integrated acoustic liquid handling for genomic workflows, such as NGS library sample preparation and high-throughput isothermal DNA assemblies.

Next Generation Sequencing Sample Preparation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.08 billion

Revenue forecast in 2030

USD 9.66 billion

Growth rate

CAGR of 15.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, workflow, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait, South Africa

Key companies profiled

Illumina; Inc.; Agilent Technologies; Inc.; Bio-Rad Laboratories; Inc.; Thermo Fisher Scientific Inc.; QIAGEN; PerkinElmer Inc.; F. Hoffmann-La Roche Ltd; BGI Genomics; Danaher Corporation (Beckman Coulter); Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global NGS Sample Preparation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global next generation sequencing sample preparation market report based on product & service, workflow, application, end-use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Services

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleic Acid Extraction

-

Library Preparation & Amplification

-

Target Enrichment

-

Library Quantification/QC

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Clinical Investigation

-

Reproductive Health

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Agrigenomics & Forensics

-

Consumer Genomics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.