- Home

- »

- Electronic Devices

- »

-

Noise, Vibration, And Harshness Testing Market Report, 2030GVR Report cover

![Noise, Vibration, And Harshness Testing Market Size, Share & Trends Report]()

Noise, Vibration, And Harshness Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Application, By End-use (Aerospace & Defense, Automotive, Consumer Electronics, Construction, Energy & Utility), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-309-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Noise Vibration And Harshness Testing Market Summary

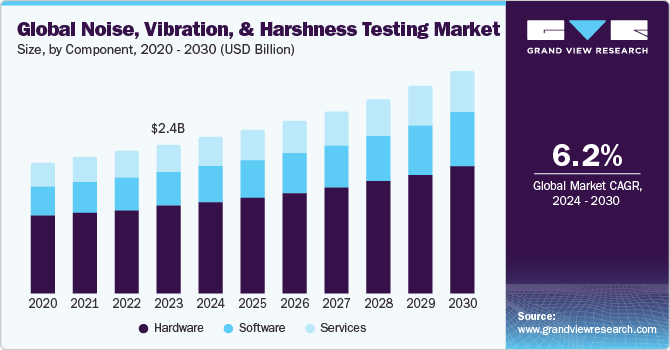

The global noise, vibration, and harshness testing market size was estimated at USD 2.37 billion in 2023 and is projected to reach USD 3.55 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The Noise, Vibration, and Harshness (NVH) testing market is driven by various factors, such as the need to meet noise and vibration standards, comply with regulations, and meet consumer expectations for comfort and quality.

Key Market Trends & Insights

- The Asia Pacific Noise, Vibration, and Harshness (NVH) Testing market dominated the NVH testing market and accounted for over 37.0% of the revenue share in 2023.

- The U.S. Noise, Vibration, and Harshness (NVH) testing market is projected to grow at a CAGR of 5.3% from 2024 to 2030.

- Based on component, the hardware segment dominated the target market with a share of over 58.6% in 2023.

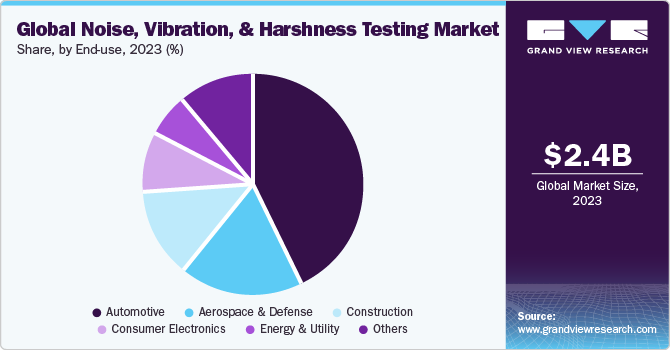

- Based on end-use, the automotive segment held the largest market share of over 43.4% in 2023.

- Based on application, the sound intensity and quality analysis segment dominated the target market with a share of over 51.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.37 Billion

- 2030 Projected Market USD 3.55 Billion

- CAGR (2024-2030): 6.2%

- Asia Pacific: Largest market in 2023

NVH testing is an evaluation process designed to measure and analyze the noise, vibration, and harshness properties of a product or system. It aims to identify and reduce unwanted sounds and vibrations that can impact the product's performance, comfort, and perceived quality.

Noise, Vibration, and Harshness (NVH) testing offers numerous benefits to various industries, including enhanced product quality, improved user experience and comfort, and ensured regulatory compliance. Noise, Vibration, and Harshness (NVH) testing helps identify and mitigate unwanted noise and vibrations, ensuring products operate more efficiently and reliably. Lowering vibrations can minimize wear and tear on components, extending the lifespan of the product. Moreover, lower noise levels lead to a more pleasant and comfortable experience for users, particularly in vehicles, consumer electronics, and household appliances.

Businesses of various industries need to ensure that their products meet health and safety standards and prevent any hearing damage, stress, or physical harm to consumers. Governments and regulatory bodies have established stringent noise and vibration standards that products must meet to be legally sold in many markets. For instance, the Scottish Environment Protection Agency (SEPA), the U.K. government’s Environment Agency, Northern Ireland Environment Agency (NIEA), and Natural Resources Wales have provided guidelines to control noise and vibration generated from industrial processes. Noise, Vibration, and Harshness (NVH) testing is essential to ensure compliance with these regulations, avoiding legal penalties and sales restrictions. This is having a positive impact on the adoption of target market solutions and services among various industries.

Moreover, the growing adoption of electronic devices and household appliances and consumer expectations for quieter devices are driving the need for target market solutions to minimize the noise, vibration, and harshness of these devices. The growing production and consumption of vehicles and electronic devices in emerging economies is positively impacting the market’s growth.

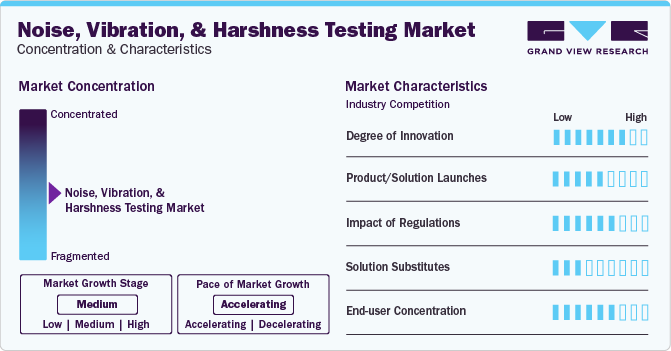

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market is competitive, with the presence of numerous target market solutions and service providers. The target market is characterized by a high degree of innovation, with market players adopting advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), to improve the analysis of NVH testing data by utilizing advanced techniques such as pattern recognition and anomaly detection.

The target market is also characterized by a high number of product launches by the leading players. For instance, in April 2023, GRAS Sound & Vibration, a part of U.S.-based Axiometrix Solutions, announced the launch of the GRAS 46BC multifield microphone, designed for automotive in-cabin and NVH testing. This innovative microphone is ideal for capturing high-quality data in various sound fields.

Companies in the target market are subject to various regulations that ensure products meet specific noise, vibration, and harshness standards. These regulations are often industry-specific and vary by region. For instance, Regulation (EU) No 540/2014 of the European Union (EU) is a law regarding the noise levels and standards for motor vehicles in the EU.

The substitutes for Noise, Vibration, and Harshness (NVH) testing solutions and services are less and generally used in combination with traditional NVH testing methods. For instance, simulation and modeling software has become a part of the NVH testing and helps in predicting and eliminating unwanted noise and vibrations, minimizing costly late changes in the designs of products.

Many industries, including aerospace & defense, automotive, construction, and consumer electronics, among others, are utilizing NVH testing solutions and services to improve their product quality and minimize noise and vibrations. For instance, in the aerospace & defense industry, NVH testing helps ensure the performance, reliability, and safety of spacecraft, aircraft, and defense systems.

Component Insights

The hardware segment dominated the target market with a share of over 58.6% in 2023. The hardware segment’s growth can be attributed to various factors, including the use of a high number of equipment, including sensors and transducers, data acquisition systems, analyzers, and excitation devices, among others, for capturing noise and vibration levels. Moreover, the launch of new and innovative hardware solutions by companies drives the segment’s growth. For instance, in June 2023, imc Test & Measurement GmbH of Axiometrix Solutions announced the launch of imc ARGUSfit, a modular data acquisition system.

The software segment is expected to register the fastest CAGR of 6.9% over the forecast period. The segment’s growth can be attributed to the growing adoption of simulation and optimization software and the use of advanced technologies, such as AI and ML, in software NVH solutions. The software is critical in interpreting the data collected by NVH sensors. Hence, the use of advanced technologies in NVH testing software is improving the data analysis and interpretation capabilities.

End-use Insights

The automotive segment held the largest market share of over 43.4% in 2023. The need to improve vehicle comfort and consumer experience and meet stringent noise emission regulations are driving the adoption of Noise, Vibration, and Harshness (NVH) testing solutions and services among automotive manufacturers. NVH testing is usually done during vehicle development and is done for exterior and interior vehicle noise and vibration reduction and quality assurance.

The consumer electronics segment is expected to register a significant CAGR of 6.4% over the forecast period. The growth of the consumer electronics segment is attributed to the growing demand for quieter consumer electronic devices. Moreover, the growing disposable incomes, especially in the developing nations is driving the demand for consumer electronic devices, driving the need for Noise, Vibration, and Harshness (NVH) testing solutions and services for these products. Sounds and vibrations of heating systems and refrigerators is an important factor for user acceptance.

Application Insights

The sound intensity and quality analysis segment dominated the target market with a share of over 51.6% in 2023. The segment’s growth can be attributed to the growing need to provide consumers with quieter products, including consumer electronic devices such as home appliances and vehicles in the automotive industry. Sound intensity and quality analysis involve the analysis of metrics such as tonality, loudness, and sharpness of sound. Moreover, sound intensity and quality analysis are applicable to most industries as they provide in-depth insights into overall acoustic performance.

The powertrain performance testing segment is expected to register the fastest CAGR of 7.2% over the forecast period. The segment’s growth is attributed to the growing transition to EVs and the need to ensure safety and regulatory compliance. The primary noise sources in EVs are different from those in traditional vehicles, requiring specialized Noise, Vibration, and Harshness (NVH) testing. Moreover, NVH testing ensures that vehicle powertrain noise and vibrations do not negatively impact the vehicle experience, enhancing the driver experience.

Regional Insights

The Noise, Vibration, and Harshness (NVH) testing market in North America is expected to grow at a significant CAGR of 5.8% over the forecast period. The growth of the market in the region is attributable to the stringent government regulations pertaining to noise emissions and the presence of advanced Research and Development (R&D) facilities in the region, driving the development of innovative NVH testing equipment and software.

U.S. Noise, Vibration, and Harshness Testing Market Trends

The U.S. Noise, Vibration, and Harshness (NVH) testing market is projected to grow at a CAGR of 5.3% from 2024 to 2030. The growth of the market in the country can be attributed to the presence of prominent NVH testing companies, such as NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.) and Data Physics Corporation. Moreover, the large automotive industry in the country drives the demand for NVH testing solutions in the country. According to the Alliance for Automotive Innovation, auto production is the largest manufacturing sector in the U.S. with the presence of 20 automakers.

Europe Noise, Vibration, and Harshness Testing Market Trends

The Noise, Vibration, and Harshness (NVH) testing market in Europe was valued at USD 528.4 million in 2023. The market’s growth in the region is driven by the region’s development of technological infrastructure, especially the countries in Western Europe. Moreover, government initiatives to boost manufacturing and R&D are likely to impact the market’s growth positively. For instance, in March 2024, the U.K. government announced an investment of nearly USD 92.7 million in joint government and industry funding for advanced automotive R&D initiatives. This investment aims to bolster electric vehicle technology, create skilled employment opportunities, and improve electric vehicle manufacturing in the U.K.

Germany Noise, Vibration, and Harshness Testing market is expected to grow at a CAGR of 6.8% from 2024 to 2030. The target market's growth in the region can be attributed to the country's strong automotive sector and the presence of prominent NVH testing companies. The country is home to leading automotive manufacturers, including Volkswagen Group and Mercedes-Benz Group AG. The country's high automotive manufacturing activities drive the demand for NVH testing solutions and services.

Asia Pacific Noise, Vibration, and Harshness Testing Market Trends

Asia Pacific Noise, Vibration, and Harshness (NVH) Testing market dominated the NVH testing market and accounted for over 37.0% of the revenue share in 2023. The target market’s growth in the region can be attributed to the high demand for consumer electronic devices in the region. This is attributed to the growing disposable income among the Asia Pacific population. The consumer demand for high-quality consumer electronic products drives the demand for NVH testing solutions and services during the manufacturing of these products.

China Noise, Vibration, and Harshness (NVH) Testing market is projected to grow at a CAGR of 7.3% from 2024 to 2030. This growth is driven by the country's high automobile production and consumer electronic manufacturing activities. According to the International Organization of Motor Vehicle Manufacturers, in 2023, China produced over 30 million motor vehicles. Hence, manufacturers adopt NVH testing solutions and services to ensure the safety and quality of these vehicles.

Key Noise, Vibration, And Harshness Testing Company Insights

Some of the key companies operating in the market include Siemens, Bertrandt, NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.), and Schaeffler AG, among others.

-

Siemens is a Germany-based multinational technology company. The company operates in six business segments, namely, Digital Industries, Mobility, Smart Infrastructure, Siemens Healthineers, Siemens Financial Services, and Portfolio Companies. It provides a broad spectrum of NVH testing products and solutions, primarily through its Simcenter portfolio, which integrates various tools and technologies to facilitate efficient NVH analysis and optimization.

-

Bertrandt is a Germany-based engineering service provider for various industries, including automotive and aerospace. The company has over 14,000 employees in over 50 locations worldwide. It has been providing NVH testing services for over 20 years.

Dewesoft d.o.o. and Signal.X Technologies, LLC are some of the emerging companies in the target market.

-

Dewesoft d.o.o. is a Slovenia-based company that provides data acquisition systems. The company offers a broad range of hardware and software solutions for NVH testing applications. The company’s data acquisition systems fully support microphones and accelerometers for measuring and analyzing NVH data. They comply with international standards and are backed by comprehensive calibration services.

-

Axiometrix Solutions, a U.S.-based company, provides test and measurement solutions to various industries, including aerospace, electronics, and automotive. The company’s three major product lines are Audio Precision, Inc., GRAS Sound & Vibration, and imc Test & Measurement GmbH. It offers various NVH testing solutions, such as microphones, and has a global presence.

Key Noise, Vibration, And Harshness Testing Companies:

The following are the leading companies in the noise, vibration, and harshness (NVH) testing market. These companies collectively hold the largest market share and dictate industry trends.

- Hottinger Brüel & Kjær (Spectris)

- HEAD acoustics GmbH

- Dewesoft d.o.o.

- Siemens

- Data Physics Corporation

- NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.)

- Axiometrix Solutions

- IMV Corporation

- Prosig Ltd.

- Norsonic

- Signal.X Technologies, LLC

- Bertrandt

- Schaeffler AG

Recent Developments

-

In June 2023, Bertrandt announced the inauguration of its first North African site in Rabat, Morocco. This site concentrates on electrical and product development, electronic systems, and industrialization services for the local market. This facility is set to become a vital component of the company's transnational development network.

-

In April 2022, Dewesoft d.o.o. and Hottinger Brüel & Kjær (Spectris) announced a joint venture company called Blueberry (OpenDAQ), merging their expertise to set a new industry standard for data acquisition systems with a unified Software Development Kit (SDK) and common interfaces. This partnership will expedite the launch of next-generation DAQ platforms, while preserving the distinct identities and value propositions of each company's products.

-

In November 2021, Siemens Digital Industries Software of Siemens announced the introduction of a new Simcenter application named system NVH prediction, allowing engineers to precisely anticipate the NVH performance of vehicles, encompassing electric, hybrid, and internal combustion engine variants, prior to the availability of physical prototypes.

Noise, Vibration, And Harshness Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.48 billion

Revenue forecast in 2030

USD 3.55 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Hottinger Brüel & Kjær (Spectris); HEAD Acoustics GmbH; Dewesoft d.o.o.; Siemens; Data Physics Corporation; NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.); Axiometrix Solutions; IMV Corporation; Prosig Ltd.; Norsonic; Signal.X Technologies, LLC; Bertrandt; Schaeffler AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Noise, Vibration, And Harshness Testing Market Report Segmentation

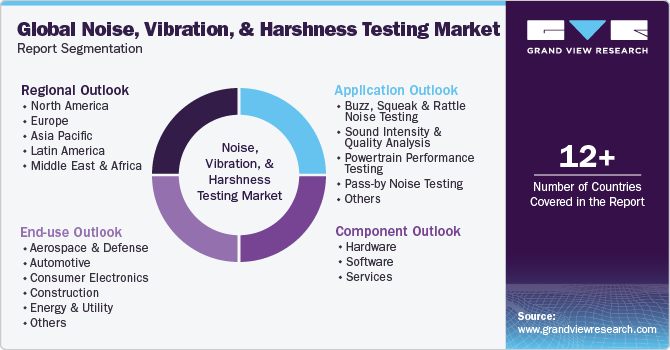

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global noise, vibration, and harshness (NVH) testing market report based on component, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Sensors and Transducers

-

Data Acquisition Systems

-

Analyzers

-

Excitation Devices

-

Others

-

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Buzz, Squeak and Rattle Noise Testing

-

Sound Intensity and Quality Analysis

-

Powertrain Performance Testing

-

Pass-by Noise Testing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Automotive

-

Consumer Electronics

-

Construction

-

Energy & Utility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global noise, vibration, and harshness testing market size was estimated at USD 2.37 billion in 2023 and is expected to reach USD 2.48 billion in 2024.

b. The global noise, vibration, and harshness testing market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 3.55 billion by 2030.

b. Asia Pacific dominated the noise, vibration, and harshness testing market with a share of over 37.0% in 2023. This is attributable to the high automobile manufacturing activity in the region.

b. Some key players operating in the noise, vibration, and harshness testing market include Hottinger Brüel & Kjær (Spectris), HEAD acoustics GmbH, Dewesoft d.o.o., Siemens, Data Physics Corporation, NATIONAL INSTRUMENTS CORP. (Emerson Electric Co.), Axiometrix Solutions, IMV Corporation, Prosig Ltd., Norsonic, Signal.X Technologies, LLC, Bertrandt, and Schaeffler AG.

b. Key factors driving market growth include the growing need to comply with stringent regulations and enhance consumer experience by providing quieter products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.